Deck 19: Government Bonds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/84

Play

Full screen (f)

Deck 19: Government Bonds

1

Which one of the following is the Treasury program allowing interest and principal payments from Treasury notes or bonds to be sold separately?

A) EDGAR

B) TRSTRP

C) TRIPS

D) TZEROES

E) STRIPS

A) EDGAR

B) TRSTRP

C) TRIPS

D) TZEROES

E) STRIPS

E

2

Bonds issued by a city which is using a commercial insurance company to guarantee the principal and interest payments are called which one of the following?

A) general revenue bonds

B) general obligation bonds

C) insured dual bonds

D) insured municipal bonds

E) commercial agency bonds

A) general revenue bonds

B) general obligation bonds

C) insured dual bonds

D) insured municipal bonds

E) commercial agency bonds

D

3

What is the lowest accepted competitive bid in a U.S. Treasury auction called?

A) selected price

B) base price

C) stop-out bid

D) imputed bid

E) set bid

A) selected price

B) base price

C) stop-out bid

D) imputed bid

E) set bid

C

4

Which of the following are securities issued by the U. S. Treasury?

I) Government Account Series

II) T-bills

III) U.S. Savings Bonds

IV) T-notes

A) I and III only

B) II and IV only

C) II, III, and IV only

D) I, II, and IV only

E) I, II, III, and IV

I) Government Account Series

II) T-bills

III) U.S. Savings Bonds

IV) T-notes

A) I and III only

B) II and IV only

C) II, III, and IV only

D) I, II, and IV only

E) I, II, III, and IV

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

5

Which one of the following is the difference between the price a bond dealer is willing to pay to buy and the price at which he or she is willing to sell?

A) commission

B) imputed cost

C) imputed interest

D) bid-ask spread

E) ask price

A) commission

B) imputed cost

C) imputed interest

D) bid-ask spread

E) ask price

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

6

What are bonds called when the entire bond issue matures on the same date?

A) term bonds

B) uniform bonds

C) serial bonds

D) vanilla bonds

E) sinking fund bonds

A) term bonds

B) uniform bonds

C) serial bonds

D) vanilla bonds

E) sinking fund bonds

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

7

What is the method of selling Treasury bills at less than face value called?

A) imputed basis

B) par value method

C) discount basis

D) STRIP basis

E) face value method

A) imputed basis

B) par value method

C) discount basis

D) STRIP basis

E) face value method

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

8

What is the interest on a Treasury bill called when it is determined by the size of the bill's discount from face value?

A) assumed interest

B) imputed interest

C) imaginary interest

D) convergent interest

E) original-issue interest

A) assumed interest

B) imputed interest

C) imaginary interest

D) convergent interest

E) original-issue interest

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

9

What is a note that pays an interest rate based on current market rates called?

A) discount note

B) market note

C) serial note

D) flexible note

E) variable-rate note

A) discount note

B) market note

C) serial note

D) flexible note

E) variable-rate note

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

10

What are bonds called when they are issued such that a portion of the bonds mature each year over a multi-year period?

A) sinking bonds

B) serial bonds

C) sectioned bonds

D) discount bonds

E) term bonds

A) sinking bonds

B) serial bonds

C) sectioned bonds

D) discount bonds

E) term bonds

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

11

Which one of the following is the principal value of a bond at its maturity?

A) discount value

B) face value

C) STRIP value

D) imputed value

E) premium value

A) discount value

B) face value

C) STRIP value

D) imputed value

E) premium value

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

12

Municipal bonds that are secured by the full faith and credit of the issuer are referred to as which one of the following?

A) general obligation bonds

B) local taxation bonds

C) fully funded bonds

D) revenue bonds

E) private activity bonds

A) general obligation bonds

B) local taxation bonds

C) fully funded bonds

D) revenue bonds

E) private activity bonds

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

13

Which one of the following is a municipal bond that is secured by the income collected from a specific project?

A) agency bond

B) general obligation bond

C) development bond

D) contingency bond

E) revenue bond

A) agency bond

B) general obligation bond

C) development bond

D) contingency bond

E) revenue bond

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

14

Which one of the following is the risk that a bond issuer will cease paying the interest and principal payments as scheduled?

A) interest rate risk

B) default risk

C) market risk

D) conversion risk

E) earnings risk

A) interest rate risk

B) default risk

C) market risk

D) conversion risk

E) earnings risk

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

15

Which one of the following is the feature of a municipal bond that specifies when the bond may be called and the call price?

A) put provision

B) conversion provision

C) close-out clause

D) payment clause

E) call provision

A) put provision

B) conversion provision

C) close-out clause

D) payment clause

E) call provision

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

16

The yield to call is the interest rate on a bond assuming the bond is:

A) never called.

B) called on the latest possible date.

C) called on the middle day of the call period.

D) called at the earliest possible date.

E) called today.

A) never called.

B) called on the latest possible date.

C) called on the middle day of the call period.

D) called at the earliest possible date.

E) called today.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

17

What are bonds called when the bondholder can tender the bonds on regularly scheduled dates?

A) term bonds

B) callable bonds

C) dated bonds

D) put bonds

E) serial bonds

A) term bonds

B) callable bonds

C) dated bonds

D) put bonds

E) serial bonds

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of the following is a municipal bond that is secured by both the revenues from a project and also by the taxing authority of the municipality?

A) mixed bond

B) general obligation bond

C) hybrid bond

D) dual bond

E) multiple bond

A) mixed bond

B) general obligation bond

C) hybrid bond

D) dual bond

E) multiple bond

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

19

Which one of the following descriptors is used to identify a bond that pays one single payment at maturity?

A) zero coupon

B) imputed value

C) solo

D) STRIP

E) term

A) zero coupon

B) imputed value

C) solo

D) STRIP

E) term

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

20

Which one of the following is a taxable municipal bond used to finance a facility used by a private business?

A) private activity bond

B) private revenue bond

C) private corporate bond

D) private agency bond

E) private income bond

A) private activity bond

B) private revenue bond

C) private corporate bond

D) private agency bond

E) private income bond

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

21

What price will a noncompetitive bidder pay for a security being purchased through a U. S. Treasury auction?

A) highest competitive bid price

B) highest noncompetitive bid price

C) stop-out bid price

D) average of all bid prices

E) lowest competitive bid price

A) highest competitive bid price

B) highest noncompetitive bid price

C) stop-out bid price

D) average of all bid prices

E) lowest competitive bid price

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements are correct regarding Series EE savings bonds?

I) Interest is accrued monthly and compounded semiannually.

II) The minimum holding period is 3 months.

III) A penalty of 3-months interest is applied to all bonds redeemed prior to maturity.

IV) Bonds held to maturity are guaranteed to double in value regardless of the interest rate.

A) I and III only

B) I and IV only

C) II and III only

D) II and IV only

E) II, III, and IV only

I) Interest is accrued monthly and compounded semiannually.

II) The minimum holding period is 3 months.

III) A penalty of 3-months interest is applied to all bonds redeemed prior to maturity.

IV) Bonds held to maturity are guaranteed to double in value regardless of the interest rate.

A) I and III only

B) I and IV only

C) II and III only

D) II and IV only

E) II, III, and IV only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

23

Which one of the following statements is correct regarding Series EE savings bonds?

A) The face value amounts range from $100 to $10,000.

B) The bonds sell at face value and pay interest semiannually.

C) The bonds accrue interest monthly.

D) The bonds pay an adjustable-rate of interest.

E) The bonds sell at par value.

A) The face value amounts range from $100 to $10,000.

B) The bonds sell at face value and pay interest semiannually.

C) The bonds accrue interest monthly.

D) The bonds pay an adjustable-rate of interest.

E) The bonds sell at par value.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following features apply to T-bills?

I) zero-coupon security

II) original maturities of 1 to 12 months

III) sold at face value

IV) minimum face value of $1,000

A) I and II only

B) I and IV only

C) II and III only

D) I, II, and IV only

E) I, II, III, and IV

I) zero-coupon security

II) original maturities of 1 to 12 months

III) sold at face value

IV) minimum face value of $1,000

A) I and II only

B) I and IV only

C) II and III only

D) I, II, and IV only

E) I, II, III, and IV

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

25

You just purchased a 5-year STRIPS security that was created from a 30-year T-bond. How many payments will you receive?

A) 1

B) 10

C) 11

D) 60

E) 61

A) 1

B) 10

C) 11

D) 60

E) 61

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

26

You purchased a Series I saving bonds 4 years ago. Which one of the following applies if you redeem that bond today?

A) You have to wait one more year to receive your cash.

B) You will only be able to redeem 50 percent of your holdings.

C) You will incur a 3-month earnings penalty.

D) You will be paid the fixed interest rate but will forfeit any inflation adjustment.

E) You will forfeit 6 months of interest.

A) You have to wait one more year to receive your cash.

B) You will only be able to redeem 50 percent of your holdings.

C) You will incur a 3-month earnings penalty.

D) You will be paid the fixed interest rate but will forfeit any inflation adjustment.

E) You will forfeit 6 months of interest.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

27

When a callable T-bond is selling at a premium, the reported yield is which one of the following?

A) current yield

B) yield-to-maturity

C) yield-to-discount

D) yield-to-call

E) premium yield

A) current yield

B) yield-to-maturity

C) yield-to-discount

D) yield-to-call

E) premium yield

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements correctly apply to TIPS?

I) They are quoted as a percentage of the current accrued principal.

II) They pay a variable interest rate that responds to movements in the inflation rate.

III) They are backed by the full faith and credit of the U.S. government.

IV) They adjust for inflation on an annual basis.

A) I and III only

B) II and IV only

C) III and IV only

D) I, II, and III only

E) II, III, and IV only

I) They are quoted as a percentage of the current accrued principal.

II) They pay a variable interest rate that responds to movements in the inflation rate.

III) They are backed by the full faith and credit of the U.S. government.

IV) They adjust for inflation on an annual basis.

A) I and III only

B) II and IV only

C) III and IV only

D) I, II, and III only

E) II, III, and IV only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

29

Which one of the following applies to U.S. Treasury auctions?

A) Every bidder has a choice of submitting either a competitive or a noncompetitive bid.

B) The purchase price paid by all bidders is the highest bid price.

C) Each bidder with an accepted bid will pay the individual price he or she bid.

D) All noncompetitive bids are accepted automatically.

E) Noncompetitive bids are ignored unless there are not enough competitive bids to buy the entire issue.

A) Every bidder has a choice of submitting either a competitive or a noncompetitive bid.

B) The purchase price paid by all bidders is the highest bid price.

C) Each bidder with an accepted bid will pay the individual price he or she bid.

D) All noncompetitive bids are accepted automatically.

E) Noncompetitive bids are ignored unless there are not enough competitive bids to buy the entire issue.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

30

Which one of the following statements related to TIPS is correct assuming an inflationary environment?

A) TIPS have a maturity value of $1,000.

B) TIPS pay an interest payment based on the latest T-bill rate.

C) TIPS pay a fixed coupon rate.

D) The principal amount of a TIPS is adjusted annually for inflation.

E) The interest rate is adjusted semiannually for inflation.

A) TIPS have a maturity value of $1,000.

B) TIPS pay an interest payment based on the latest T-bill rate.

C) TIPS pay a fixed coupon rate.

D) The principal amount of a TIPS is adjusted annually for inflation.

E) The interest rate is adjusted semiannually for inflation.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

31

Which one of the following features applies to all Treasury bonds currently being offered?

A) noncallable

B) sold at a deep discount

C) zero-coupon

D) mature in 10 years or less

E) callable within 5 years of issue

A) noncallable

B) sold at a deep discount

C) zero-coupon

D) mature in 10 years or less

E) callable within 5 years of issue

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

32

Which one of the following do Series I savings bonds offer?

A) monthly interest payments

B) guaranteed real rate of return

C) interest for an unlimited period of time

D) monthly interest compounding

E) immediate redemption with no penalty

A) monthly interest payments

B) guaranteed real rate of return

C) interest for an unlimited period of time

D) monthly interest compounding

E) immediate redemption with no penalty

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

33

U.S. government agency bonds pay interest which is subject to which of the following taxes?

A) federal only

B) state only

C) state and local only

D) state and federal only

E) state, local, and federal

A) federal only

B) state only

C) state and local only

D) state and federal only

E) state, local, and federal

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following features apply to T-bills?

I) original maturities of 4, 13, or 26 weeks

II) minimum face value of $10,000

III) sold at a discount

IV) semiannual interest payments

A) IV only

B) I and III only

C) I and IV only

D) II and III only

E) II and IV only

I) original maturities of 4, 13, or 26 weeks

II) minimum face value of $10,000

III) sold at a discount

IV) semiannual interest payments

A) IV only

B) I and III only

C) I and IV only

D) II and III only

E) II and IV only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

35

Which one of the following statements correctly applies to STRIPS?

A) STRIPS securities pay a fixed-rate, semiannual interest payment.

B) A 10-year T-bond is broken into 20 STRIPS securities.

C) Treasury securities are broken into STRIPS securities by brokers.

D) STRIPS securities pay a variable-rate, semiannual interest payment.

E) All STRIPS securities taken from the same Treasury security must be registered to the same owner.

A) STRIPS securities pay a fixed-rate, semiannual interest payment.

B) A 10-year T-bond is broken into 20 STRIPS securities.

C) Treasury securities are broken into STRIPS securities by brokers.

D) STRIPS securities pay a variable-rate, semiannual interest payment.

E) All STRIPS securities taken from the same Treasury security must be registered to the same owner.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

36

A TIPS is quoted at 101:17. How should this quote be interpreted in relation to a $1,000 face value bond?

A) The current yield on this security is 1.17 percent.

B) The bond is currently selling at the discounted price of $101.17.

C) The bond will mature at a price equal to 101.17 percent of $1,000.

D) A $1,000 bond is currently selling for 101 and 17/32nds percent of $1,000.

E) A $1,000 bond will mature at a price equal to 101 and 17/32nds percent of $1,000.

A) The current yield on this security is 1.17 percent.

B) The bond is currently selling at the discounted price of $101.17.

C) The bond will mature at a price equal to 101.17 percent of $1,000.

D) A $1,000 bond is currently selling for 101 and 17/32nds percent of $1,000.

E) A $1,000 bond will mature at a price equal to 101 and 17/32nds percent of $1,000.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

37

Which one of the following statements applies to U.S. Treasury bonds?

A) They have original maturities of 1 to 10 years.

B) They have a minimum face value of $100,000.

C) They are zero-coupon securities.

D) They pay a fixed coupon payment semiannually.

E) They are adjusted semiannually for inflation.

A) They have original maturities of 1 to 10 years.

B) They have a minimum face value of $100,000.

C) They are zero-coupon securities.

D) They pay a fixed coupon payment semiannually.

E) They are adjusted semiannually for inflation.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

38

Which one of the following statements applies to U.S. Treasury notes?

A) They are zero coupon securities.

B) They have a minimum face value of $10,000.

C) They have original maturities of 2 to 10 years.

D) They are variable-rate securities.

E) They are sold on a non-marketable basis only.

A) They are zero coupon securities.

B) They have a minimum face value of $10,000.

C) They have original maturities of 2 to 10 years.

D) They are variable-rate securities.

E) They are sold on a non-marketable basis only.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

39

U.S. government agency debt does which one of the following?

A) has a larger bid-ask spread than U.S. Treasury debt

B) provides more liquidity than U.S. Treasury debt

C) provides security in the form of the full faith and credit of the U.S. government

D) provides triple tax-free income

E) pays a lower yield than comparable U.S. Treasury debt

A) has a larger bid-ask spread than U.S. Treasury debt

B) provides more liquidity than U.S. Treasury debt

C) provides security in the form of the full faith and credit of the U.S. government

D) provides triple tax-free income

E) pays a lower yield than comparable U.S. Treasury debt

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

40

Which one of the following applies to Series I savings bonds?

A) redemption any time after 6 months

B) fixed portion of the interest rate is adjusted each May and November over the bond's life

C) semiannual inflation rate adjustment

D) minimum face value of $100

E) maximum 20-year life

A) redemption any time after 6 months

B) fixed portion of the interest rate is adjusted each May and November over the bond's life

C) semiannual inflation rate adjustment

D) minimum face value of $100

E) maximum 20-year life

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

41

Which one of the following statements is true in regards to municipal bond insurance?

A) The insurance premium is paid by the bondholders.

B) The insurance can be cancelled with 30 days notice to the bond issuer.

C) The financial strength of the bond issuer can affect the bond's credit rating.

D) Insured bonds tend to sell at lower prices than uninsured bonds.

E) To date, bond insurers have not had to pay any payments for bond defaults.

A) The insurance premium is paid by the bondholders.

B) The insurance can be cancelled with 30 days notice to the bond issuer.

C) The financial strength of the bond issuer can affect the bond's credit rating.

D) Insured bonds tend to sell at lower prices than uninsured bonds.

E) To date, bond insurers have not had to pay any payments for bond defaults.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

42

Variable-rate demand obligations frequently carry a provision which allows the issuer to do which one of the following?

A) limit the amount of upward adjustment to a maximum increase of 2 percent

B) convert the issue from GO bonds to revenue bonds

C) void the put provision if the coupon rate increases

D) eliminate the call premium if the entire issue is called

E) convert the entire issue into a fixed-rate issue

A) limit the amount of upward adjustment to a maximum increase of 2 percent

B) convert the issue from GO bonds to revenue bonds

C) void the put provision if the coupon rate increases

D) eliminate the call premium if the entire issue is called

E) convert the entire issue into a fixed-rate issue

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

43

A Treasury bond has a dollar price of $1,015.63. What would you expect the bond quote to be?

A) 101:05

B) 101:15

C) 101:16

D) 101:18

E) 101:22

A) 101:05

B) 101:15

C) 101:16

D) 101:18

E) 101:22

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

44

Which one of the following generally applies to municipal bonds?

A) issued as term bonds without a sinking fund

B) $5,000 par value

C) trading based on price quotes

D) highly liquid market

E) callable at any time at par value

A) issued as term bonds without a sinking fund

B) $5,000 par value

C) trading based on price quotes

D) highly liquid market

E) callable at any time at par value

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

45

A Treasury note has 2.5 years left to maturity, a yield to maturity of 3.6 percent, and a coupon rate of 4.40 percent. What is the price of the bond?

A) $1,015.41

B) $1,015.53

C) $1,016.56

D) $1,017.58

E) $1,018.96

A) $1,015.41

B) $1,015.53

C) $1,016.56

D) $1,017.58

E) $1,018.96

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

46

Which one of the following generally applies to municipal bonds?

A) noncallable

B) risk-free

C) high credit rating

D) zero coupon

E) par value of $1,000

A) noncallable

B) risk-free

C) high credit rating

D) zero coupon

E) par value of $1,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

47

A Treasury bond has a face value of $30,000 and a quoted price of 102:20. What is the bond's dollar price?

A) $30,002.80

B) $30,102.18

C) $30,654.00

D) $30,787.50

E) $47,475.00

A) $30,002.80

B) $30,102.18

C) $30,654.00

D) $30,787.50

E) $47,475.00

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

48

You wish to purchase a bond for your tax-exempt retirement account. Which one of the following should you prefer if you only consider the tax aspects of your selection?

A) corporate bond

B) Treasury bond

C) qualified private activity bond

D) municipal insured bond

E) municipal GO bond

A) corporate bond

B) Treasury bond

C) qualified private activity bond

D) municipal insured bond

E) municipal GO bond

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

49

Which one of the following statements is correct concerning municipal bonds?

A) Municipal put bonds are less valuable than comparable nonputable bonds.

B) Highway bonds are generally issued as GO bonds.

C) College dormitories are frequently financed by revenue bonds.

D) Revenue bonds are risk-free.

E) A hybrid bond is joint debt of a state and the federal government.

A) Municipal put bonds are less valuable than comparable nonputable bonds.

B) Highway bonds are generally issued as GO bonds.

C) College dormitories are frequently financed by revenue bonds.

D) Revenue bonds are risk-free.

E) A hybrid bond is joint debt of a state and the federal government.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

50

A Treasury bond has a yield to maturity of 6.2 percent, a time to maturity of 9 years, and a coupon rate of 7 percent. What is the bond price?

A) $940.65

B) $946.95

C) $1,054.55

D) $1,061.63

E) $1,069.56

A) $940.65

B) $946.95

C) $1,054.55

D) $1,061.63

E) $1,069.56

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

51

A STRIPS matures in 6 years, has a face value of $17,000, and has a yield to maturity of 4.8 percent. What is the price?

A) $10,854.59

B) $11,010.43

C) $11,284.75

D) $11,322.01

E) $12,789.38

A) $10,854.59

B) $11,010.43

C) $11,284.75

D) $11,322.01

E) $12,789.38

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

52

Kathy lives in State A and owns a municipal bond issued by State B. The interest earned on this bond is most apt to be exempt from taxation at which of the following levels?

A) local only

B) The interest earned on this bond is most apt to be exempt from taxation at which of the following levels?

C) federal only

D) local and state only

E) federal, state, and local

A) local only

B) The interest earned on this bond is most apt to be exempt from taxation at which of the following levels?

C) federal only

D) local and state only

E) federal, state, and local

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

53

Which one of the following has the highest level of default risk?

A) U.S. Treasury bond

B) municipal bond

C) Series I bond

D) T-bill

E) Series EE bond

A) U.S. Treasury bond

B) municipal bond

C) Series I bond

D) T-bill

E) Series EE bond

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

54

A Treasury bond has a quoted bid price of 100:10 and a quoted ask price of 100:11. What is the amount you will receive if you sell your bond that has a par value of $20,000?

A) $20,016.00

B) $20,050.00

C) $20,062.60

D) $20,100.08

E) $21,600.00

A) $20,016.00

B) $20,050.00

C) $20,062.60

D) $20,100.08

E) $21,600.00

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

55

Which two of the following are the principle means by which a municipality can avoid a lump-sum principal repayment on a single maturity date?

I) issue only zero-coupon bonds

II) issue serial bonds

III) issue term bonds with a sinking fund provision

IV) issue only variable-rate notes

A) I and II only

B) I and III only

C) II and III only

D) II and IV only

E) III and IV only

I) issue only zero-coupon bonds

II) issue serial bonds

III) issue term bonds with a sinking fund provision

IV) issue only variable-rate notes

A) I and II only

B) I and III only

C) II and III only

D) II and IV only

E) III and IV only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

56

A Treasury bond has a 4.2 percent coupon, a quoted price of 101:06, and 8 years to maturity. What is the yield to maturity?

A) 3.78 percent

B) 3.93 percent

C) 4.03 percent

D) 4.90 percent

E) 5.92 percent

A) 3.78 percent

B) 3.93 percent

C) 4.03 percent

D) 4.90 percent

E) 5.92 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

57

A Treasury bond matures in 13 years, has a 5.25 percent coupon, and a quoted price of 98:01. What is the yield to maturity?

A) 5.25 percent

B) 5.34 percent

C) 5.46 percent

D) 5.55 percent

E) 5.68 percent

A) 5.25 percent

B) 5.34 percent

C) 5.46 percent

D) 5.55 percent

E) 5.68 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

58

Leslie has a marginal tax rate of 33 percent and Bill has a marginal tax rate of 37 percent. The critical marginal tax rate for a municipal bond is 35.2 percent. For their taxable investment accounts, Leslie will prefer _____ and Bill will prefer ____. Ignore any risk considerations.

A) corporate bonds; corporate bonds

B) municipal bonds; corporate bonds

C) corporate bonds; municipal bonds

D) municipal bonds; municipal bonds

E) Neither Leslie nor Bill will have a preference for either corporate or municipal bonds.

A) corporate bonds; corporate bonds

B) municipal bonds; corporate bonds

C) corporate bonds; municipal bonds

D) municipal bonds; municipal bonds

E) Neither Leslie nor Bill will have a preference for either corporate or municipal bonds.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

59

A moral obligation bond is which type of a bond?

A) municipal revenue

B) municipal GO

C) municipal hybrid

D) U.S. Treasury

E) U.S. agency

A) municipal revenue

B) municipal GO

C) municipal hybrid

D) U.S. Treasury

E) U.S. agency

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following uses of proceeds from private activity bonds will most likely qualify those bonds as federally tax-exempt?

I) public airport runway

II) baseball stadium

III) multifamily housing project

IV) mass rail transit

A) I and II only

B) I and III only

C) II and III only

D) II and IV only

E) I, III, and IV only

I) public airport runway

II) baseball stadium

III) multifamily housing project

IV) mass rail transit

A) I and II only

B) I and III only

C) II and III only

D) II and IV only

E) I, III, and IV only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

61

Municipal bonds are yielding 4.6 percent if they are insured and 4.9 percent if they are uninsured. Your marginal tax rate is 31 percent. Your equivalent taxable yield on the insured bonds is _____ percent and on the uninsured bonds is _____ percent.

A) 5.89; 6.27

B) 6.39; 6.76

C) 6.39; 6.81

D) 6.67; 7.10

E) 6.76; 7.10

A) 5.89; 6.27

B) 6.39; 6.76

C) 6.39; 6.81

D) 6.67; 7.10

E) 6.76; 7.10

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

62

A $5,000 face value municipal bond matures in 14 years and is priced at $4,862. The coupon rate is 4.5 percent with interest paid semiannually. What is the yield to maturity on the bond?

A) 4.77 percent

B) 5.14 percent

C) 5.40 percent

D) 5.61 percent

E) 5.97 percent

A) 4.77 percent

B) 5.14 percent

C) 5.40 percent

D) 5.61 percent

E) 5.97 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

63

A municipal bond is yielding 4.8 percent. Jeremy has a marginal tax rate of 24 percent. What is his equivalent taxable yield?

A) 2.18 percent

B) 4.58 percent

C) 6.15 percent

D) 6.32 percent

E) 7.18 percent

A) 2.18 percent

B) 4.58 percent

C) 6.15 percent

D) 6.32 percent

E) 7.18 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

64

Sonya has a marginal tax rate of 36 percent. A corporate bond is yielding 7.4 percent and a municipal bond is yielding 3.6 percent. Sonya should invest in the _____ bond because the critical marginal tax rate is _____ percent.

A) corporate; 17

B) corporate; 34

C) corporate; 51

D) municipal; 43

E) municipal; 51

A) corporate; 17

B) corporate; 34

C) corporate; 51

D) municipal; 43

E) municipal; 51

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

65

You own a corporate bond which is yielding 8.2 percent. What is your after-tax yield if your marginal tax rate is 28 percent?

A) 5.90 percent

B) 7.52 percent

C) 8.20 percent

D) 10.58 percent

E) 11.55 percent

A) 5.90 percent

B) 7.52 percent

C) 8.20 percent

D) 10.58 percent

E) 11.55 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

66

A corporate bond is yielding 6.9 percent and a municipal bond is yielding 4.8 percent. What is the critical marginal tax rate?

A) 28 percent

B) 30 percent

C) 33 percent

D) 35 percent

E) 38 percent

A) 28 percent

B) 30 percent

C) 33 percent

D) 35 percent

E) 38 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

67

An investor has a critical marginal tax rate of 28.5 percent when municipal bonds are yielding 5.1 percent. What is the corporate bond yield?

A) 4.38 percent

B) 5.81 percent

C) 6.51 percent

D) 7.13 percent

E) 10.26 percent

A) 4.38 percent

B) 5.81 percent

C) 6.51 percent

D) 7.13 percent

E) 10.26 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

68

A $5,000 face value municipal bond with a coupon rate of 3.5 percent has 13 years to maturity and a current price of $4,812. Interest is paid semiannually. What is the bond's yield to maturity?

A) 2.10 percent

B) 3.61 percent

C) 3.87 percent

D) 3.95 percent

E) 4.23 percent

A) 2.10 percent

B) 3.61 percent

C) 3.87 percent

D) 3.95 percent

E) 4.23 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

69

Laura has an average tax rate of 21 percent and a marginal tax rate of 28 percent. What is her after-tax yield on a corporate bond which has a 7.6 percent yield?

A) 2.51 percent

B) 5.09 percent

C) 5.47 percent

D) 6.00 percent

E) 11.34 percent

A) 2.51 percent

B) 5.09 percent

C) 5.47 percent

D) 6.00 percent

E) 11.34 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

70

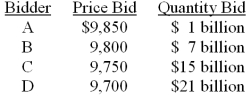

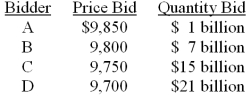

The Federal Reserve is offering Treasury bills with a par value of $18 billion for sale. They have received $7 billion of noncompetitive bids. The competitive bids for a $10,000 par value bond are:  What price will Bidder A pay per bond, assuming that bid is accepted?

What price will Bidder A pay per bond, assuming that bid is accepted?

A) $9,600

B) $9,650

C) $9,675

D) $9,700

E) $9,750

What price will Bidder A pay per bond, assuming that bid is accepted?

What price will Bidder A pay per bond, assuming that bid is accepted?A) $9,600

B) $9,650

C) $9,675

D) $9,700

E) $9,750

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

71

You own a principal STRIPS which is based on a 4.5 percent coupon Treasury bond that matures in 20 years. The STRIPS is priced at $22,868 and has a par value of $50,000. What is the yield to maturity on the STRIPS?

A) 3.79 percent

B) 3.90 percent

C) 3.93 percent

D) 3.95 percent

E) 3.99 percent

A) 3.79 percent

B) 3.90 percent

C) 3.93 percent

D) 3.95 percent

E) 3.99 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

72

A STRIPS that matures in 6 years is selling for $11,369. The par value is $15,000. What is the yield to maturity?

A) 3.17 percent

B) 4.67 percent

C) 5.25 percent

D) 6.54 percent

E) 6.75 percent

A) 3.17 percent

B) 4.67 percent

C) 5.25 percent

D) 6.54 percent

E) 6.75 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

73

Lester is considering a municipal bond yielding 4.4 percent and a corporate bond yielding 7.2 percent. His marginal tax rate is 36 percent. He should invest in the _____ bond because the critical marginal tax rate is _____ percent.

A) corporate; 35

B) corporate; 37

C) corporate; 39

D) municipal; 37

E) municipal; 39

A) corporate; 35

B) corporate; 37

C) corporate; 39

D) municipal; 37

E) municipal; 39

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

74

You have a marginal tax rate of 31 percent and an average tax rate of 28 percent. Municipal bonds in your area are yielding 3.6 percent. What is your equivalent taxable yield?

A) 4.16 percent

B) 4.93 percent

C) 5.13 percent

D) 5.22 percent

E) 5.27 percent

A) 4.16 percent

B) 4.93 percent

C) 5.13 percent

D) 5.22 percent

E) 5.27 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

75

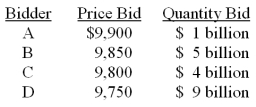

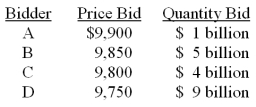

The Federal Reserve is offering Treasury bills with a par value of $30 billion for sale. They have received $11 billion of noncompetitive bids. The competitive bids for a $10,000 par value bond are:  How much money will the Federal Reserve raise from this offering?

How much money will the Federal Reserve raise from this offering?

A) $29.55 billion

B) $29.40 billion

C) $29.10 billion D. $29.33 billion

E) $29.25 billion

D) $29.33 billion

E) $29.25 billion

How much money will the Federal Reserve raise from this offering?

How much money will the Federal Reserve raise from this offering?A) $29.55 billion

B) $29.40 billion

C) $29.10 billion D. $29.33 billion

E) $29.25 billion

D) $29.33 billion

E) $29.25 billion

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

76

A STRIPS has a $9,000 par value and a market value of $7,050. The time to maturity is 5 years. What is the yield to maturity?

A) 2.07 percent

B) 3.00 percent

C) 4.94 percent

D) 5.00 percent

E) 5.07 percent

A) 2.07 percent

B) 3.00 percent

C) 4.94 percent

D) 5.00 percent

E) 5.07 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

77

The Federal Reserve is offering Treasury bills with a par value of $8 billion for sale. They have received $2 billion of noncompetitive bids. The competitive bids for a $10,000 par value bond are:  How much money will the Federal Reserve raise from this offering?

How much money will the Federal Reserve raise from this offering?

A) $7.92 billion

B) $7.88 billion

C) $7.86 billion

D) $7.84 billion

E) $7.80 billion

How much money will the Federal Reserve raise from this offering?

How much money will the Federal Reserve raise from this offering?A) $7.92 billion

B) $7.88 billion

C) $7.86 billion

D) $7.84 billion

E) $7.80 billion

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

78

Municipal bonds are yielding 4.8 percent currently. Alicia has a marginal tax rate of 35 percent and Yvonne has a marginal tax rate of 22 percent. Alicia's equivalent taxable yield is _____ percent and Yvonne's is _____ percent.

A) 7.50; 5.86

B) 7.39; 6.15

C) 6.53; 5.86

D) 6.53; 6.15

E) 8.29; 5.07

A) 7.50; 5.86

B) 7.39; 6.15

C) 6.53; 5.86

D) 6.53; 6.15

E) 8.29; 5.07

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

79

Jeff owns a taxable bond portfolio which is yielding 8.76 percent. His after-tax yield is 6.57 percent. What is his marginal tax rate?

A) 25 percent

B) 28 percent

C) 31 percent

D) 32 percent

E) 34 percent

A) 25 percent

B) 28 percent

C) 31 percent

D) 32 percent

E) 34 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

80

A STRIPS has a yield to maturity of 7.2 percent, a par value of $25,000, and a time to maturity of 12 years. What is the price?

A) $4,100.87

B) $5,792.80

C) $9,967.50

D) $10,698.08

E) $15,785.68

A) $4,100.87

B) $5,792.80

C) $9,967.50

D) $10,698.08

E) $15,785.68

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck