Deck 10: Partnership Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/83

Play

Full screen (f)

Deck 10: Partnership Taxation

1

Because a partnership does not pay taxes, a partnership is not recognized as a legal entity under civil law.

False

2

Jack and Jill decided to pool their money and start a water delivery business.Since they trust each other so much, they did not draw up any legal documents for the business.During the first year of business, they earned $50,000 which was net of $10,000 paid to Jill as a guaranteed payment.During the second year of business, they decided to limit their liability exposure by forming an LLC.

a.Was a partnership formed during the first year?

b.If a partnership was formed, how much income will be taxed at the partnership level?

c.For the second year, do they need to file a partnership tax return?

a.Was a partnership formed during the first year?

b.If a partnership was formed, how much income will be taxed at the partnership level?

c.For the second year, do they need to file a partnership tax return?

a.Yes.

b.$0.There is no tax at the partnership level.The partnership income and other items are passed through to the partners

and taxed at the individual level.

c.Yes.An LLC is generally treated as a partnership for tax law purposes.

b.$0.There is no tax at the partnership level.The partnership income and other items are passed through to the partners

and taxed at the individual level.

c.Yes.An LLC is generally treated as a partnership for tax law purposes.

3

Leslie contributes a building worth $88,000, with an adjusted basis of $40,000, to a partnership in exchange for a 50 percent interest in the partnership's capital and profits.What is the amount of Leslie's basis in her partnership interest immediately after the contribution?

A)$20,000

B)$40,000

C)$44,000

D)$88,000

E)None of the above

A)$20,000

B)$40,000

C)$44,000

D)$88,000

E)None of the above

B

4

Sabrina contributes a building with an adjusted basis of $80,000 to a partnership.The fair market value of the building is $100,000 on the date of the contribution.What is Sabrina's basis in her partnership interest immediately after the contribution?

A)$0

B)$40,000

C)$80,000

D)$100,000

E)None of the above

A)$0

B)$40,000

C)$80,000

D)$100,000

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

5

The holding period of property contributed to a partnership includes the period of time that the contributor has held the property.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

6

Loretta contributes property to a partnership in exchange for a 25 percent partnership interest.The property contributed has a fair market value of $45,000 and a basis of $35,000 on the date of the contribution to the partnership.In addition, Loretta receives a 10 percent partnership interest, valued at $18,000, in exchange for services rendered to the partnership.What is Loretta's basis in her partnership interest, immediately after these transactions?

A)$35,000

B)$45,000

C)$53,000

D)$63,000

E)None of the above

A)$35,000

B)$45,000

C)$53,000

D)$63,000

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

7

The basis of a partner's interest in a partnership is increased by losses of the partnership allocated to the partner.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

8

A partner's interest in a partnership is decreased by:

A)Capital gains of the partnership.

B)Distributions from the partnership.

C)Taxable income of the partnership.

D)Additional contributions by the partner.

E)None of the above.

A)Capital gains of the partnership.

B)Distributions from the partnership.

C)Taxable income of the partnership.

D)Additional contributions by the partner.

E)None of the above.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

9

Which one of the following is not true about partnerships?

A)There must be two or more owners.

B)General partners assume more risk of legal liability than limited partners.

C)An LLC limits certain liability risks.

D)A partnership is taxed like a corporation.

E)All of the above are true.

A)There must be two or more owners.

B)General partners assume more risk of legal liability than limited partners.

C)An LLC limits certain liability risks.

D)A partnership is taxed like a corporation.

E)All of the above are true.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

10

An equal partnership is formed by Rita and Gerry.Rita contributes cash of $10,000 and a building with a fair market value of $150,000, adjusted basis of $55,000, and subject to a liability of $60,000.Gerry contributes cash of $100,000.What is Rita's basis in her partnership interest immediately after formation of the partnership?

A)$25,000

B)$35,000

C)$65,000

D)$70,000

E)None of the above

A)$25,000

B)$35,000

C)$65,000

D)$70,000

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

11

If Margo and Bruce purchase and operate an ice cream store, for tax purposes they have formed a partnership.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

12

An equal partnership is formed by Rita and Gerry.Rita contributes cash of $10,000 and a building with a fair market value of $150,000, adjusted basis of $55,000 and subject to a liability of $60,000.Gerry contributes cash of $100,000.What is the partnership's basis in the building contributed by Rita?

A)$55,000

B)$60,000

C)$90,000

D)$150,000

E)None of the above

A)$55,000

B)$60,000

C)$90,000

D)$150,000

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

13

On July 1 of the current year, Bertram acquired a 25 percent interest in Sycamore Company, a partnership, by contributing property with an adjusted basis of $7,000 and a fair market value of $12,000.The property was subject to a mortgage of $8,000, which was assumed by Sycamore Company.What is Bertram's basis in his partnership interest in Sycamore Company immediately after the partnership contribution?

A)$0

B)$1,000

C)$7,000

D)$12,000

E)None of the above

A)$0

B)$1,000

C)$7,000

D)$12,000

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

14

In general, income is recognized by the partner when a partnership interest is received in exchange for services rendered to the partnership.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

15

An equal partnership is formed by Rita and Gerry.Rita contributes cash of $10,000 and a building with a fair market value of $150,000, adjusted basis of $55,000, and subject to a liability of $60,000.Gerry contributes cash of $100,000.What amount of gain must Rita recognize as a result of this transaction?

A)$95,000

B)$35,000

C)$5,000

D)$0

E)None of the above

A)$95,000

B)$35,000

C)$5,000

D)$0

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

16

For the following separate, independent situations indicate with a "Yes" if a partnership return needs to be filed.Mark with a "No" if a partnership return is not required.

a.Tony and Gina form a joint venture to import goods from South Korea.

b.Nancy decided to start her own private investigative business.

c.Uncle Pennybag's estate assets are pooled together until they can be distributedto the beneficiaries.

d.Howie, Dewey, and Cheatem form an LLC.

e.Flora, Fauna, and Merryweather start a child care business.No official documentsare drawn up.

a.Tony and Gina form a joint venture to import goods from South Korea.

b.Nancy decided to start her own private investigative business.

c.Uncle Pennybag's estate assets are pooled together until they can be distributedto the beneficiaries.

d.Howie, Dewey, and Cheatem form an LLC.

e.Flora, Fauna, and Merryweather start a child care business.No official documentsare drawn up.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

17

On July 1 of the current year, Ambrose was admitted to the partnership of Ambrose and Nectar.His contribution to capital consisted of 500 shares of stock in Paniculata Corporation, which he bought in 2014 for $10,000 and which had a fair market value of $50,000 on July 1 of the current year.Ambrose's interest in the partnership's capital and profits is 25 percent.On July 1 of the current year, the fair market value of the partnership's net assets (after Ambrose was admitted)was $200,000.What is Ambrose's taxable gain in the current year on the exchange of stock for his partnership interest?

A)$0 gain or loss

B)$40,000 ordinary income

C)$40,000 long-term capital gain

D)$40,000 Section 1231 gain

E)None of the above

A)$0 gain or loss

B)$40,000 ordinary income

C)$40,000 long-term capital gain

D)$40,000 Section 1231 gain

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

18

Income from a partnership is taxed to the partner only if the partner receives the income as a distribution during the year.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is true about partnerships?

A)The formation of a partnership must be documented in writing.

B)An LLC is generally treated as a partnership for tax law purposes.

C)General partners have no liability for partnership obligations beyond their capital contributions.

D)When Sue and Billy Bob invest in land together, they are considered to have formed a partnership.

A)The formation of a partnership must be documented in writing.

B)An LLC is generally treated as a partnership for tax law purposes.

C)General partners have no liability for partnership obligations beyond their capital contributions.

D)When Sue and Billy Bob invest in land together, they are considered to have formed a partnership.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

20

During the current year, Norman contributed investment property held for over one year to the Mary Ann Partnership for a 40 percent interest in partnership capital and profits.His tax basis in the property contributed was $8,000, and the property had a fair market value of $10,000 on the date of the contribution to the partnership.What gain or loss should Norman report as a result of the contribution of the property to the partnership in exchange for the 40 percent partnership interest?

A)No gain or loss

B)$2,000 long-term capital gain

C)$2,000 ordinary income

D)$10,000 long-term capital gain

E)None of the above

A)No gain or loss

B)$2,000 long-term capital gain

C)$2,000 ordinary income

D)$10,000 long-term capital gain

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements about partnerships is true?

A)Partnerships must file their tax returns on a calendar year basis.

B)No gain or loss is ever recognized in transactions between partners and a partnership.

C)Gain is never recognized by a partner on a contribution of property to a partnership.

D)A partner's original basis in a partnership interest is equal to the basis of the property transferred (plus cash contributed) to the partnership, adjusted for any gain recognized on the transfer and reduced for liabilities assumed by the other partners.

E)The partnership's basis in property contributed by a partner is equal to the fair market value of the property on the date of the transfer.

A)Partnerships must file their tax returns on a calendar year basis.

B)No gain or loss is ever recognized in transactions between partners and a partnership.

C)Gain is never recognized by a partner on a contribution of property to a partnership.

D)A partner's original basis in a partnership interest is equal to the basis of the property transferred (plus cash contributed) to the partnership, adjusted for any gain recognized on the transfer and reduced for liabilities assumed by the other partners.

E)The partnership's basis in property contributed by a partner is equal to the fair market value of the property on the date of the transfer.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

22

For tax purposes, in computing the ordinary income of a partnership, a deduction is allowed for:

A)Payments to partners, determined without regard to the income of the partnership, for services provided to the partnership.

B)The net operating loss deduction.

C)Contributions to charitable organizations.

D)Personal exemptions of the partners.

E)None of the above.

A)Payments to partners, determined without regard to the income of the partnership, for services provided to the partnership.

B)The net operating loss deduction.

C)Contributions to charitable organizations.

D)Personal exemptions of the partners.

E)None of the above.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

23

A partnership may deduct a single personal exemption in calculating ordinary taxable income or loss.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

24

Please answer the following questions:

a.What form is used to report income and expenses from a partnership?

b.If a partner's basis at the beginning of the year is $1,000 and the partnership allocates $7,000 of loss to the partner: how much of the loss is deductible in the current year; what is his new basis in the partnership; and what happens to any excess loss not deducted?

c.What is the exemption amount for a partnership?

a.What form is used to report income and expenses from a partnership?

b.If a partner's basis at the beginning of the year is $1,000 and the partnership allocates $7,000 of loss to the partner: how much of the loss is deductible in the current year; what is his new basis in the partnership; and what happens to any excess loss not deducted?

c.What is the exemption amount for a partnership?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

25

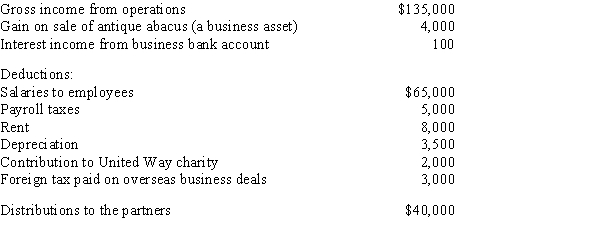

Nash and Ford are partners who share profits and losses equally.For the current tax year, the partnership had book income of $70,000 which included the following deductions: What amount should be reported as ordinary income on the partnership return for the current tax year?

A)$75,000

B)$85,000

C)$130,000

D)$135,000

E)None of the above

A)$75,000

B)$85,000

C)$130,000

D)$135,000

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

26

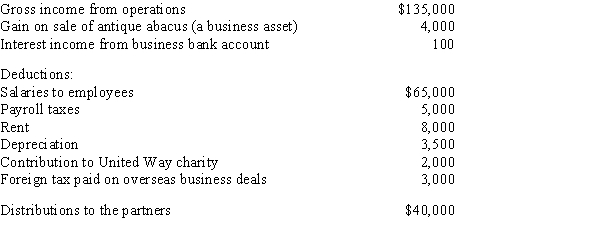

The partnership of Truman and Hanover realized the following items of income during the current tax year:

Both the partners are on a calendar year basis.What is the total income which should be reported as ordinary income from business activities of the partnership for the current tax year?

A)$0

B)$65,000

C)$69,000

D)$71,000

E)None of the above

Both the partners are on a calendar year basis.What is the total income which should be reported as ordinary income from business activities of the partnership for the current tax year?

A)$0

B)$65,000

C)$69,000

D)$71,000

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

27

Partnership losses that are not used because a partner's basis in the partnership interest is zero may not be carried forward and are lost by the partner.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

28

A partnership may not show a loss as a result of deducting guaranteed payments made to the partners.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

29

Jamie decides to contribute cash and property to a partnership she and her friends started.She contributes a building worth $260,000 that has an adjusted basis of $100,000 and she also contributes $40,000 in cash.What is her basis in the partnership?

A)$100,000

B)$140,000

C)$260,000

D)$300,000

E)None of the above is correct

A)$100,000

B)$140,000

C)$260,000

D)$300,000

E)None of the above is correct

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

30

A partnership must separately report Section 1231 gains and losses rather than including them in ordinary taxable income.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

31

The partnership of Felix and Oscar had the following items of income during the current tax year: What is the total ordinary income from business activities passed through by the partnership for the current tax year?

A)$156,000

B)$157,000

C)$165,000

D)$110,000

E)None of the above

A)$156,000

B)$157,000

C)$165,000

D)$110,000

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

32

Cooke and Thatcher form the C&T Partnership.Cooke contributes equipment with a fair market value of $70,000 and a basis of $35,000, in exchange for a 70 percent interest in the partnership capital and profits.Thatcher performs services worth $30,000 for the partnership in exchange for a 30 percent interest in capital and profits.

a.What is the amount of Cooke's recognized gain or loss (if any) as a result of the contribution to the partnership in exchange for the partnership interest?

b.What is Cooke's basis in his partnership interest immediately after the contribution?

c.What is the amount of Thatcher's recognized income or loss (if any) on the contribution to the partnership?

d.What is Thatcher's basis in her partnership interest immediately after the contribution?

e.What is C&T Partnership's basis in the equipment received from Cooke?

a.What is the amount of Cooke's recognized gain or loss (if any) as a result of the contribution to the partnership in exchange for the partnership interest?

b.What is Cooke's basis in his partnership interest immediately after the contribution?

c.What is the amount of Thatcher's recognized income or loss (if any) on the contribution to the partnership?

d.What is Thatcher's basis in her partnership interest immediately after the contribution?

e.What is C&T Partnership's basis in the equipment received from Cooke?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

33

Jennifer has a 25 percent interest in the Aspen Aircraft partnership.Her basis in her partnership interest is $10,000 at the beginning of the year.The partnership reported the following activity for the year:  What is Jennifer's basis in her partnership interest at the end of the year?

What is Jennifer's basis in her partnership interest at the end of the year?

What is Jennifer's basis in her partnership interest at the end of the year?

What is Jennifer's basis in her partnership interest at the end of the year?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

34

Partnership income is taxed at the same tax rates as the income of corporations.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following items must be reported separately from ordinary income or loss on a partnership return?

A)Capital losses

B)Miscellaneous income

C)Cost of goods sold

D)Sales income

E)None of the above

A)Capital losses

B)Miscellaneous income

C)Cost of goods sold

D)Sales income

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

36

J.Bean and D.Counter formed a partnership.During the current year, the partnership had the following income and expenses:

a.Calculate the net ordinary income.

b.List all of the other items that need to be separately reported.

c.If the partnership is on a calendar year tax basis, when is the partnership tax return due?

a.Calculate the net ordinary income.

b.List all of the other items that need to be separately reported.

c.If the partnership is on a calendar year tax basis, when is the partnership tax return due?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

37

A partner contributes assets with a basis of $50,000 and a fair market value of $80,000 to a partnership.What is the basis of the property to the partnership and what is the general rule for the basis of appreciated property contributed to a partnership?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

38

Which one of the following is not true about partnerships and their income-reporting process?

A)The partnership must file a Form 1065.

B)The partner's share of income/loss is presented on Schedule K-1.

C)A partner's deductible loss is limited to his basis in the partnership.

D)The partnership pays income tax.

E)All of the above are true.

A)The partnership must file a Form 1065.

B)The partner's share of income/loss is presented on Schedule K-1.

C)A partner's deductible loss is limited to his basis in the partnership.

D)The partnership pays income tax.

E)All of the above are true.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

39

A partnership reports its income on Form 1040.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

40

Oscar and Frank form an equal partnership, the O and F Partnership.Oscar contributes land with an adjusted basis of $45,000, subject to a mortgage of $100,000, in exchange for a partnership interest worth $250,000.Frank contributes cash of $100,000 and performs services for the partnership in exchange for a partnership interest worth $250,000.

a.What is the amount of Oscar's recognized gain or loss (if any) as a result of the contribution to the partnership in exchange for the partnership interest?

b.What is Oscar's basis in his partnership interest immediately after the contribution?

c.What is the amount of Frank's recognized income or loss (if any) as a result of the receipt of the partnership interest in exchange for the cash and services?

d.What is the partnership's basis in the land received from Oscar?

a.What is the amount of Oscar's recognized gain or loss (if any) as a result of the contribution to the partnership in exchange for the partnership interest?

b.What is Oscar's basis in his partnership interest immediately after the contribution?

c.What is the amount of Frank's recognized income or loss (if any) as a result of the receipt of the partnership interest in exchange for the cash and services?

d.What is the partnership's basis in the land received from Oscar?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

41

Guaranteed payments made by a partnership must be made to individuals other than partners in the partnership.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

42

Lilac Designs is a partnership with a tax year that ends November 30, 2018.During that year, William, a partner, received $4,000 per month as a guaranteed payment and his share of partnership income after guaranteed payments was $20,000.For December of 2018, William received a guaranteed payment of $10,000.Calculate the amount of income from the partnership that William should report for his tax year ended December 31, 2018.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

43

Jim's basis in his partnership is $200,000.His share of the current year partnership income is $60,000.The partnership paid him a $75,000 distribution in the current year.What is his new basis in the partnership at the end of the year and what is his taxable income from the partnership?

A)$200,000; $75,000

B)$260,000; $60,000

C)$140,000; $60,000

D)$185,000; $60,000

E)$185,000; $135,000

A)$200,000; $75,000

B)$260,000; $60,000

C)$140,000; $60,000

D)$185,000; $60,000

E)$185,000; $135,000

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

44

A partnership will terminate and its tax year will close if the partnership ceases to carry on any business activity.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

45

Ownership of a partnership interest by a taxpayer's brother is considered indirect ownership by the taxpayer.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

46

Jordan files his income tax return on a calendar-year basis.He is the principal partner of a partnership reporting on a June 30 fiscal year end basis.Jordan's share of the partnership's ordinary income was $24,000 for the fiscal year ended June 30, 2018, and $72,000 for the fiscal year ended June 30, 2019.How much should Jordan report on his 2018 individual income tax return as his share of taxable income from the partnership?

A)$24,000

B)$36,000

C)$48,000

D)$72,000

E)None of the above

A)$24,000

B)$36,000

C)$48,000

D)$72,000

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

47

Debbie and Betty operate the D & B partnership.Betty, a 50 percent partner, receives a guaranteed payment of $10,000 for her services in operating the partnership.The partnership has income before the guaranteed payment of $5,000.What is the taxable income Debbie and Betty must each report from the partnership for the year?Debbie should report income of $__________.Betty should report income of $__________.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

48

Assuming that a partnership normally has a calendar year-end, what should the tax year-end be in the following independent cases?

a.Jim, a 70 percent partner, sells his partnership interest to Fred on August 10.

b.On July 13, the partnership sells its office building and moves its business across town.

c.June buys a 15 percent interest in the partnership on May 14.

d.The partnership goes out of business on February 26.

a.Jim, a 70 percent partner, sells his partnership interest to Fred on August 10.

b.On July 13, the partnership sells its office building and moves its business across town.

c.June buys a 15 percent interest in the partnership on May 14.

d.The partnership goes out of business on February 26.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

49

The tax year of a partnership generally closes upon entry of a new 20% partner.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

50

Barbara receives a current distribution consisting of $2,000 cash plus other property with an adjusted basis to the partnership of $2,300 and a fair market value on the date of the distribution of $7,000.Barbara has a 10 percent interest in the partnership and her basis in her partnership interest, immediately prior to the distribution, is $5,000.What is Barbara's basis in the noncash property received in the current distribution?

A)$2,000

B)$2,300

C)$3,000

D)$7,000

E)None of the above

A)$2,000

B)$2,300

C)$3,000

D)$7,000

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

51

A partnership generally must adopt the same tax year as its majority partners.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

52

Jerry receives cash of $15,000 and a building with a fair market value of $50,000 (adjusted basis of $30,000)in a current distribution.

a.Assuming his basis in his partnership interest was $50,000, what amount of gain must Jerry recognize as a result of the current distribution?

b.Assuming his basis in his partnership interest was $10,000, what amount of gain must Jerry recognize as a result of the current distribution?

a.Assuming his basis in his partnership interest was $50,000, what amount of gain must Jerry recognize as a result of the current distribution?

b.Assuming his basis in his partnership interest was $10,000, what amount of gain must Jerry recognize as a result of the current distribution?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

53

In December of 2018, Ms.Havisham and Pip form a wedding planning business.Each of them own 50 percent of the partnership.The partnership establishes a September 30th year-end since most weddings are during the summer.Therefore, the partnership's initial year-end is September 30, 2019.For the month of December 2018, the partnership made $3,000 after Ms.Havisham's guaranteed payment of $1,000.From January through September of 2019, the partnership made a net income of $65,000 after a $1,500 per month guaranteed payment to Ms.Havisham.

a.How much income should Ms.Havisham report for 2018?

b.How much income should Ms.Havisham report for 2019?

a.How much income should Ms.Havisham report for 2018?

b.How much income should Ms.Havisham report for 2019?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

54

Under which of the following circumstances would a partnership terminate and close its tax year?

A)Divorce of a partner

B)Cessation of business activities by the partnership

C)Entry of a new partner

D)Distribution of property to a 10 percent partner in complete termination of the partner's interest in the partnership

E)None of the above

A)Divorce of a partner

B)Cessation of business activities by the partnership

C)Entry of a new partner

D)Distribution of property to a 10 percent partner in complete termination of the partner's interest in the partnership

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

55

Phil and Bill each own a 50 percent interest in P&B Interests.P&B Interests has ordinary income for the year of $35,000 before guaranteed payments to Phil.If Phil receives guaranteed payments of $20,000 during the tax year, what is the total income or loss that should be reported by Bill from the partnership for this tax year?

A)$5,000 income

B)$7,500 income

C)$25,000 income

D)$30,000 income

E)None of the above

A)$5,000 income

B)$7,500 income

C)$25,000 income

D)$30,000 income

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

56

Cypress Road is a partnership with two partners, Saul, a 60 percent partner, and Robbie, a 40 percent partner.The partnership has income for the year of $100,000 before guaranteed payments to Robbie.Guaranteed payments of $50,000 are paid to Robbie for his management services during the year.Calculate the amount of income that should be reported by Saul and Robbie from the partnership for the year.Saul should report income of $__________.Robbie should report income of $__________.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

57

Salix Associates is a partnership with an October 31 year-end.For the fiscal year ended October 31, 2018, Salix Associates reported ordinary income of $100,000, after deducting guaranteed payments.Max, a calendar year taxpayer, is a 30 percent partner in the partnership and received $2,000 monthly as a guaranteed payment for the calendar year 2017, and $2,100 monthly for the calendar year 2018.What is the total income from the partnership that Max should report on his 2018 individual income tax return?

A)$30,000

B)$54,200

C)$55,000

D)$55,200

E)None of the above

A)$30,000

B)$54,200

C)$55,000

D)$55,200

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

58

Lucky's original contribution to the Boxwood Partnership was land with a basis of $5,000 and a market value of $55,000.Her share of the taxable income from the partnership since her original contribution has been $95,000 and Lucky has received $45,000 in cash distributions from the partnership.Lucky did not recognize any gains as a result of the distributions.Calculate Lucky's current basis in her partnership interest.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

59

Guaranteed payments received from a partnership are included in the income of the partner receiving the payments on a cash basis, without regard to the partnership's tax year.Guaranteed payments received from a partnership are included in the income of the partner receiving the payments on a cash basis, without regard to the partnership's tax year.Guaranteed payments received from a partnership are included in the income of the partner receiving the payments on a cash basis, without regard to the partnership's tax year.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

60

A distribution of cash to a partner was greater than his basis in the partnership.How would this distribution be treated by the partner, assuming the distribution is not a liquidating distribution?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

61

Wallace and Pedersen have equal interests in the capital and profits of the partnership of Wallace and Pedersen.They are otherwise unrelated to each other.On August 1, 2018, Wallace sold 100 shares of Kalmia Mining Corporation to the partnership for its fair market value of $7,000.Wallace had bought the stock in 2009 at a cost of $10,000.What is Wallace's deductible loss for 2018 as a result of the sale of this stock?

A)$0

B)$1,500 long-term capital loss

C)$3,000 long-term capital loss

D)$3,000 ordinary loss

E)None of the above

A)$0

B)$1,500 long-term capital loss

C)$3,000 long-term capital loss

D)$3,000 ordinary loss

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

62

Kitty is a 60 percent partner of Tabby Associates.Kitty sells a building to the partnership for $75,000.If the building had an adjusted basis to Kitty of $95,000, how much gain or loss does Kitty recognize on this transaction?

A)$95,000 loss

B)$20,000 loss

C)$0 gain or loss

D)$20,000 gain

E)None of the above

A)$95,000 loss

B)$20,000 loss

C)$0 gain or loss

D)$20,000 gain

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

63

The "at-risk" rule acts to prevent tax shelters from generating large losses for their investors while exposing them to little personal risk.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

64

Owen owns 60 percent of the Big Time partnership.He sells to the partnership a machine for $70,000 that has a $45,000 basis.What would the taxable income be for Owen and what is the partnership's basis in the machine?

A)$25,000; $45,000

B)$0; $45,000

C)$25,000; $70,000

D)None of the above is correct

A)$25,000; $45,000

B)$0; $45,000

C)$25,000; $70,000

D)None of the above is correct

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

65

Michael invests in Buxus Interests, a partnership.Michael's capital contribution to the partnership consists of $10,000 cash and equipment with an adjusted basis of $120,000 (fair market value of $150,000)subject to a nonrecourse liability of $60,000.

a.Calculate the amount that Michael is at-risk in the activity after making the above contribution?

b.If Michael's share of the partnership loss in the year after he makes the contribution is$150,000, how much of the loss may be deducted in that year (before considering thelimitations on passive losses)? Assume the partnership had no other transactions.

c.If Michael has any nondeductible loss in part b, what may Michael do with thenondeductible loss?

a.Calculate the amount that Michael is at-risk in the activity after making the above contribution?

b.If Michael's share of the partnership loss in the year after he makes the contribution is$150,000, how much of the loss may be deducted in that year (before considering thelimitations on passive losses)? Assume the partnership had no other transactions.

c.If Michael has any nondeductible loss in part b, what may Michael do with thenondeductible loss?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

66

If a partner has a more than 50 percent interest in a partnership, a capital gain resulting from the sale of property by the partner to the partnership will be taxed as ordinary income to the partner, provided the property is not a capital asset to the partnership.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

67

Josh is a 30% partner in the Ghost Partnership.Ghost paid W-2 wages of $100,000 and also made a guaranteed payment to Josh of $20,000.The amount includable as wages in Josh's wage limitation on his QBI deduction is:

A)$0.

B)$30,000.

C)$50,000.

D)$100,000.

A)$0.

B)$30,000.

C)$50,000.

D)$100,000.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

68

The "at-risk" rule applies, with limited exceptions, to all taxable activities.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

69

Limited liability companies may operate in more than one state.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

70

Rochelle owns 40 percent of a partnership and her brother owns the remaining 60 percent interest.During the current tax year, Rochelle sold a building to the partnership for $180,000, to be used for the partnership's office.She had held the building for 3 years at the time of the sale.

a.Assuming Rochelle's basis in the building was $200,000, what is the amount and nature of her gain or loss?

b.Assuming Rochelle's basis in the building was $150,000, what is the amount and nature of her gain or loss?

a.Assuming Rochelle's basis in the building was $200,000, what is the amount and nature of her gain or loss?

b.Assuming Rochelle's basis in the building was $150,000, what is the amount and nature of her gain or loss?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

71

During the current year, Jay is a partner in an automobile dealership.Jay's amount at risk at the beginning of the year is $90,000, and during the current year Jay's share of the dealership's ordinary loss is $120,000.

a.What is the amount of the loss from the automobile dealership that Jay may deduct in the current year?

b.If the dealership has a profit of $63,000 in the subsequent year, how much of the subsequent year income is taxable to Jay?

a.What is the amount of the loss from the automobile dealership that Jay may deduct in the current year?

b.If the dealership has a profit of $63,000 in the subsequent year, how much of the subsequent year income is taxable to Jay?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

72

There is no general partner required in a limited liability company (LLC).

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

73

A partner's receipt of guaranteed payments is a form of qualified business income.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

74

Losses on transactions between a partnership and its partners are always disallowed.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

75

At the beginning of the year, Joe's basis in his partnership interest was $5,000.During the year, Joe contributed $10,000 in cash to the partnership and signed a bank loan to be personally liable for the partnership's debt of $25,000.For the current year, the partnership allocated a loss of $60,000 to Joe.In the following year, Joe's portion of the partnership income is $30,000.Which of the following is accurate?

A)In the following year, Joe's reportable taxable income from the partnership is $10,000.

B)Joe's basis in his partnership at the end of the current year is $15,000.

C)Joe may deduct all of the $60,000 loss in the current year.

D)Joe may carry over a $45,000 loss to the following year.

A)In the following year, Joe's reportable taxable income from the partnership is $10,000.

B)Joe's basis in his partnership at the end of the current year is $15,000.

C)Joe may deduct all of the $60,000 loss in the current year.

D)Joe may carry over a $45,000 loss to the following year.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

76

Mario and Luigi are brothers and they are equal partners in Pipes of Your Dreams Plumbing.Mario sells his fancy sports car to the business for $40,000.Mario's basis in the car is $45,000.

a.What is the amount of Mario's recognized gain or loss on this transaction, and what is the nature of the gain or loss?

b.If the partnership later sells the sports car for $55,000, how much of the gain is recognized?

a.What is the amount of Mario's recognized gain or loss on this transaction, and what is the nature of the gain or loss?

b.If the partnership later sells the sports car for $55,000, how much of the gain is recognized?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

77

Losses are disallowed for transactions between a partnership and a partner who has a 50 percent interest in the partnership.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following liabilities would be considered nonrecourse?

A)A bank loan for which the taxpayer is personally liable.

B)Credit card debt.

C)A $20,000 real estate loan which allows the bank to take the real estate if the taxpayer stops making payments on the loan.

D)All of the above are nonrecourse liabilities.

A)A bank loan for which the taxpayer is personally liable.

B)Credit card debt.

C)A $20,000 real estate loan which allows the bank to take the real estate if the taxpayer stops making payments on the loan.

D)All of the above are nonrecourse liabilities.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

79

The "at-risk" rule does not apply to activities involving real estate.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

80

Barry owns a 50 percent interest in B&B Interests, a partnership.His brother, Benny, owns a 35 percent interest in that same partnership, and the remaining 15 percent is owned by an unrelated individual.During the current year, Barry sells a rental property with a basis of $60,000 to B&B Interests for $100,000.The partnership intends to hold the rental as inventory for resale.What is the amount and nature of Barry's gain or loss on this transaction?

A)$40,000 long-term capital loss

B)$0 gain or loss

C)$40,000 long-term capital gain

D)$40,000 ordinary income

E)None of the above

A)$40,000 long-term capital loss

B)$0 gain or loss

C)$40,000 long-term capital gain

D)$40,000 ordinary income

E)None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck