Deck 12: The Design of the Tax System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/51

Play

Full screen (f)

Deck 12: The Design of the Tax System

1

Zoe,Chloe,and Brody each like to read novels.The current mystery thriller costs 10 dinars.Zoe values it at 15 dinars,Chloe at 13 dinars,and Brody at 11 dinars.Suppose that if the government taxes books at 0.50dinarseach,the selling price rises to 10.50 dinars.A consequence of the tax is that

A)consumer surplus shrinks by 1.50 and tax revenues increase by 1.50,so there is no deadweight loss.

B)consumer surplus shrinks by 9.00 and tax revenues increase by 1.50,so there is a deadweight loss of 7.50.

C)consumer surplus shrinks by 7.50 and tax revenues increase by 7.50,so there is no deadweight loss.

D)consumer surplus shrinks by 7.50 and tax revenues increase by 1.50,so there is a deadweight loss of 6.

A)consumer surplus shrinks by 1.50 and tax revenues increase by 1.50,so there is no deadweight loss.

B)consumer surplus shrinks by 9.00 and tax revenues increase by 1.50,so there is a deadweight loss of 7.50.

C)consumer surplus shrinks by 7.50 and tax revenues increase by 7.50,so there is no deadweight loss.

D)consumer surplus shrinks by 7.50 and tax revenues increase by 1.50,so there is a deadweight loss of 6.

A

2

Which of the following statements is correct?

A)Equity is more important than efficiency as a goal of the tax system.

B)Efficiency is more important than equity as a goal of the tax system.

C)Both equity and efficiency are important goals of the tax system.

D)Neither equity nor efficiency is an important goal of the tax system.

A)Equity is more important than efficiency as a goal of the tax system.

B)Efficiency is more important than equity as a goal of the tax system.

C)Both equity and efficiency are important goals of the tax system.

D)Neither equity nor efficiency is an important goal of the tax system.

C

3

Changing the basis of taxation from income earned to amount spent will

A)necessarily reduce tax revenues.

B)lower effective interest rates on savings.

C)distort incentives to earn income.

D)eliminate disincentives to save.

A)necessarily reduce tax revenues.

B)lower effective interest rates on savings.

C)distort incentives to earn income.

D)eliminate disincentives to save.

D

4

An efficient tax system is one that imposes small

A)deadweight losses and administrative burdens.

B)marginal rates and deadweight losses.

C)administrative burdens and transfers of money.

D)marginal rates and transfers of money.

A)deadweight losses and administrative burdens.

B)marginal rates and deadweight losses.

C)administrative burdens and transfers of money.

D)marginal rates and transfers of money.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

5

In designing a tax system,policymakers have two objectives that are often conflicting.They are

A)maximizing revenue and minimizing costs to taxpayers.

B)efficiency and minimizing costs to taxpayers.

C)efficiency and equity.

D)maximizing revenue and reducing the national debt.

A)maximizing revenue and minimizing costs to taxpayers.

B)efficiency and minimizing costs to taxpayers.

C)efficiency and equity.

D)maximizing revenue and reducing the national debt.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

6

The resources that a taxpayer devotes to complying with the tax laws are a type of

A)consumption tax.

B)value-added tax.

C)deadweight loss.

D)producer surplus.

A)consumption tax.

B)value-added tax.

C)deadweight loss.

D)producer surplus.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

7

Why do some policymakers support a consumption tax rather than an earnings tax?

A)The average tax rate would be lower under a consumption tax.

B)A consumption tax would encourage people to save earned income.

C)A consumption tax would raise more revenues than an income tax.

D)The marginal tax rate would be higher under an earnings tax.

A)The average tax rate would be lower under a consumption tax.

B)A consumption tax would encourage people to save earned income.

C)A consumption tax would raise more revenues than an income tax.

D)The marginal tax rate would be higher under an earnings tax.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

8

A tax levied on the total amount spent in retail stores is called

A)a sales tax.

B)an excise tax.

C)a retail tax.

D)an income tax.

A)a sales tax.

B)an excise tax.

C)a retail tax.

D)an income tax.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

9

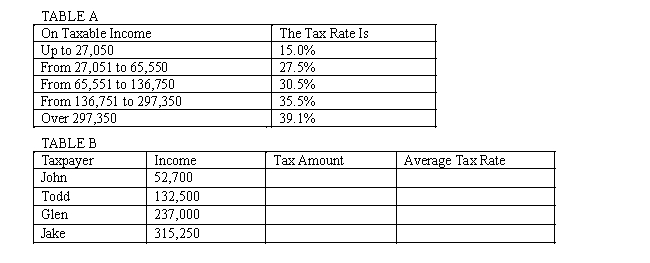

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Mateo has taxable income of 165,000 dinar,his marginal tax rate is

A)16%.

B)24%.

C)34%.

D)36%.

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Mateo has taxable income of 165,000 dinar,his marginal tax rate is

A)16%.

B)24%.

C)34%.

D)36%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is correct?

A)The average tax rate gauges the sacrifice made by a taxpayer,whereas the marginal tax rate gauges the distortion of taxes on consumer decisions.

B)The marginal tax rate gauges the sacrifice made by a taxpayer,whereas the average tax rate gauges the distortion of taxes on consumer decisions.

C)The average tax rate measures how much the tax system discourages people from working.

D)The marginal tax rate measures total taxes paid divided by total income.

A)The average tax rate gauges the sacrifice made by a taxpayer,whereas the marginal tax rate gauges the distortion of taxes on consumer decisions.

B)The marginal tax rate gauges the sacrifice made by a taxpayer,whereas the average tax rate gauges the distortion of taxes on consumer decisions.

C)The average tax rate measures how much the tax system discourages people from working.

D)The marginal tax rate measures total taxes paid divided by total income.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

11

A consumption tax is a tax on

A)goods but not on services.

B)the amount of income that people spend.

C)the amount of income that people earn.

D)the amount of income that people save.

A)goods but not on services.

B)the amount of income that people spend.

C)the amount of income that people earn.

D)the amount of income that people save.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

12

A person's marginal tax rate equals

A)her tax obligation divided by her average tax rate.

B)the increase in taxes she would pay as a percentage of the rise in her income.

C)her tax obligation divided by her income.

D)the increase in taxes if her average tax rate were to rise by 1%.

A)her tax obligation divided by her average tax rate.

B)the increase in taxes she would pay as a percentage of the rise in her income.

C)her tax obligation divided by her income.

D)the increase in taxes if her average tax rate were to rise by 1%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

13

In addition to tax payments,the two other primary costs that a tax system inevitably imposes on taxpayers are

A)deadweight losses and administrative burdens.

B)deadweight losses and frustration with the political system.

C)administrative burdens and tax-preparation costs.

D)administrative burdens and the risk of punishment for failure to comply with tax laws.

A)deadweight losses and administrative burdens.

B)deadweight losses and frustration with the political system.

C)administrative burdens and tax-preparation costs.

D)administrative burdens and the risk of punishment for failure to comply with tax laws.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is correct?

A)Both tax avoidance and tax evasion are legal.

B)Both tax avoidance and tax evasion are illegal.

C)Tax avoidance is legal,whereas tax evasion is illegal.

D)Tax avoidance is illegal,whereas tax evasion is legal.

A)Both tax avoidance and tax evasion are legal.

B)Both tax avoidance and tax evasion are illegal.

C)Tax avoidance is legal,whereas tax evasion is illegal.

D)Tax avoidance is illegal,whereas tax evasion is legal.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

15

If your income is 40,000 dinars and your income tax liability is 5,000 dinars,your marginal tax rate is

A)8 percent.

B)12.5 percent.

C)20 percent.

D)unknown.We do not have enough information to answer this question.

A)8 percent.

B)12.5 percent.

C)20 percent.

D)unknown.We do not have enough information to answer this question.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

16

Tim earns income of 60,000 dinars per year and pays 21,000 per year in taxes.Tim paid 20 percent in taxes on the first 30,000 he earned.What was the marginal tax rate on the second 30,000 he earned?

A)20 percent

B)30 percent

C)50 percent

D)70 percent

A)20 percent

B)30 percent

C)50 percent

D)70 percent

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

17

A person's tax obligation divided by her income is called her

A)marginal social tax rate.

B)marginal private tax rate.

C)marginal tax rate.

D)average tax rate.

A)marginal social tax rate.

B)marginal private tax rate.

C)marginal tax rate.

D)average tax rate.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

18

Deadweight losses occur in markets in which

A)firms decide to downsize.

B)the government imposes a tax.

C)profits fall because of low consumer demand.

D)equilibrium prices fall.

A)firms decide to downsize.

B)the government imposes a tax.

C)profits fall because of low consumer demand.

D)equilibrium prices fall.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

19

Special tax treatment given to specific types of behavior are called

A)tax avoidance.

B)tax evasion.

C)tax loopholes.

D)tax burden.

A)tax avoidance.

B)tax evasion.

C)tax loopholes.

D)tax burden.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

20

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Mateo has taxable income of 165,000 dinar,his tax liability is

A)23,800.

B)36,000.

C)45,000.

D)47,698.

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Mateo has taxable income of 165,000 dinar,his tax liability is

A)23,800.

B)36,000.

C)45,000.

D)47,698.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

21

Vertical equity in taxation refers to the idea that people

A)in unequal conditions should be treated differently.

B)in equal conditions should pay equal taxes.

C)should pay taxes based on the benefits they receive from the government.

D)should pay a proportional tax rather than a progressive tax.

A)in unequal conditions should be treated differently.

B)in equal conditions should pay equal taxes.

C)should pay taxes based on the benefits they receive from the government.

D)should pay a proportional tax rather than a progressive tax.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

22

Corporate income taxes are based on the amount of revenue a corporation earns.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

23

Horizontal equity in taxation refers to the idea that people

A)in unequal conditions should be treated differently.

B)in equal conditions should pay equal taxes.

C)should be taxed according to their ability to pay.

D)should receive government benefits according to how much they have been taxed.

A)in unequal conditions should be treated differently.

B)in equal conditions should pay equal taxes.

C)should be taxed according to their ability to pay.

D)should receive government benefits according to how much they have been taxed.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

24

If a government simplified its tax system the likeliest result would be

A)a decrease in consumer surplus.

B)a decrease in producer surplus.

C)a decrease in deadweight loss.

D)a decrease in tax revenues.

A)a decrease in consumer surplus.

B)a decrease in producer surplus.

C)a decrease in deadweight loss.

D)a decrease in tax revenues.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

25

When the government levies a tax on a corporation,

A)all the burden of the tax ultimately falls on the corporation's owners.

B)the corporation is more like a tax collector than a taxpayer.

C)output must increase to compensate for reduced profits.

D)less deadweight loss will occur since corporations are entities and not people who respond to incentives.

A)all the burden of the tax ultimately falls on the corporation's owners.

B)the corporation is more like a tax collector than a taxpayer.

C)output must increase to compensate for reduced profits.

D)less deadweight loss will occur since corporations are entities and not people who respond to incentives.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

26

A family's tax liability is the amount of money it owes in taxes.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

27

The most efficient tax possible is a

A)marginal income tax.

B)lump-sum tax.

C)consumption tax.

D)corporate profit tax.

A)marginal income tax.

B)lump-sum tax.

C)consumption tax.

D)corporate profit tax.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

28

With a lump-sum tax,

A)the average tax rate for high income taxpayers will be the same as the average tax rate for low income taxpayers.

B)the average tax rate for high income taxpayers will be lower than the average tax rate for low income taxpayers.

C)the average tax rate for high income taxpayers will be higher than the average tax rate for high income taxpayers.

D)Any of the above could be true under a regressive tax system.

A)the average tax rate for high income taxpayers will be the same as the average tax rate for low income taxpayers.

B)the average tax rate for high income taxpayers will be lower than the average tax rate for low income taxpayers.

C)the average tax rate for high income taxpayers will be higher than the average tax rate for high income taxpayers.

D)Any of the above could be true under a regressive tax system.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

29

Economists play an important role in the complex debates over tax policy by

A)identifying efficiency as the most important goal of tax policy.

B)identifying equity as the most important goal of tax policy.

C)shedding light on the tradeoff between efficiency and equity in tax policy.

D)None of the above is correct.

A)identifying efficiency as the most important goal of tax policy.

B)identifying equity as the most important goal of tax policy.

C)shedding light on the tradeoff between efficiency and equity in tax policy.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

30

One advantage of a lump-sum tax over other taxes is that it

A)is both equitable and efficient.

B)doesn't cause deadweight loss.

C)would place a larger tax burden on the rich.

D)would raise more revenues.

A)is both equitable and efficient.

B)doesn't cause deadweight loss.

C)would place a larger tax burden on the rich.

D)would raise more revenues.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

31

The benefits principle of taxation can be used to argue that wealthy citizens should pay higher taxes than poorer ones on the basis that

A)police services are more frequently used in poor neighborhoods.

B)the wealthy benefit more from services provided by government than the poor.

C)the poor are more active in political processes.

D)the poor receive welfare payments.

A)police services are more frequently used in poor neighborhoods.

B)the wealthy benefit more from services provided by government than the poor.

C)the poor are more active in political processes.

D)the poor receive welfare payments.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

32

With a lump-sum tax,the

A)marginal tax rate is always less than the average tax rate.

B)average tax rate is always less than the marginal tax rate.

C)marginal tax rate falls as income rises.

D)marginal tax rate rises as income rises.

A)marginal tax rate is always less than the average tax rate.

B)average tax rate is always less than the marginal tax rate.

C)marginal tax rate falls as income rises.

D)marginal tax rate rises as income rises.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

33

Under a progressive tax system,the marginal tax rate could be equal to the average tax rate only when a taxpayer

A)has a very high income.

B)has a very low income.

C)is self-employed.

D)invests in a retirement plan.

A)has a very high income.

B)has a very low income.

C)is self-employed.

D)invests in a retirement plan.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

34

A budget surplus occurs when government receipts fall short of government spending.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

35

Which tax system requires higher-income taxpayers to have lower tax rates,even though they pay a larger amount of tax when compared to lower-income taxpayers?

A)a proportional tax

B)a progressive tax

C)a regressive tax

D)a lump-sum tax

A)a proportional tax

B)a progressive tax

C)a regressive tax

D)a lump-sum tax

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

36

In order to construct a more complete picture of the economic burden of government across income classes,economists usually

A)include tax payments as well as transfer payments received.

B)focus only on the tax payments of wealthy tax payers.

C)limit their analysis to taxes based on the ability-to-pay principle.

D)focus their analysis on issues of tax efficiency.

A)include tax payments as well as transfer payments received.

B)focus only on the tax payments of wealthy tax payers.

C)limit their analysis to taxes based on the ability-to-pay principle.

D)focus their analysis on issues of tax efficiency.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

37

You are trying to design a tax system that will simultaneously achieve both of the following goals: 1)a person with no income would pay no taxes,and 2)a high-income person would pay a higher fraction of income in taxes than a low-income person.Which of the following statements is correct?

A)A lump-sum tax would achieve the second goal but not the first.

B)A regressive tax would achieve the second goal but not the first.

C)A progressive tax could achieve both goals.

D)A proportional tax could achieve the second goal but not the first.

A)A lump-sum tax would achieve the second goal but not the first.

B)A regressive tax would achieve the second goal but not the first.

C)A progressive tax could achieve both goals.

D)A proportional tax could achieve the second goal but not the first.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

38

Tax incidence refers to

A)what product or service the tax is levied on.

B)who bears the tax burden.

C)what sector of the economy is most affected by the tax.

D)the dollar value of the tax revenues.

A)what product or service the tax is levied on.

B)who bears the tax burden.

C)what sector of the economy is most affected by the tax.

D)the dollar value of the tax revenues.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

39

The government raises revenue through taxation to pay for the services it provides.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

40

The concept that people should pay taxes based on the benefits they receive from government services is called

A)the ability-to-pay principle.

B)the benefits principle.

C)horizontal equity.

D)vertical equity.

A)the ability-to-pay principle.

B)the benefits principle.

C)horizontal equity.

D)vertical equity.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

41

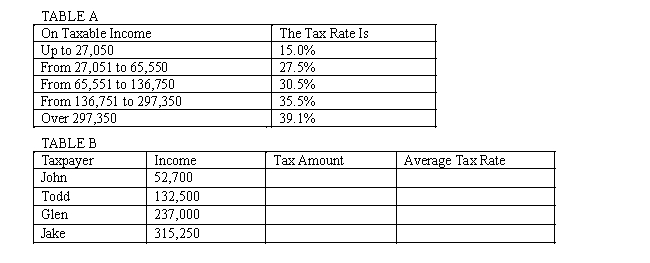

Use Table A to complete Table B.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

42

A lump sum tax can never have horizontal equity.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

43

Deadweight losses arise because a tax causes some individuals to change their behavior.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

44

The marginal tax rate serves as a measure of the extent to which the tax system discourages people from working.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

45

If all taxpayers pay the same percentage of income in taxes,the tax system is progressive.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

46

One characteristic of an efficient tax system is that it minimizes the costs associated with revenue collection.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

47

When the total surplus lost as a result of a tax is less than the amount of tax revenue collected by the government there is a deadweight loss.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

48

Many people consider lump-sum taxes to be unfair to low-income taxpayers.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

49

If a tax generates a reduction in surplus that is exactly offset by the tax revenue collected by the government,the tax does not have a deadweight loss.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

50

A recent increase in federal gasoline taxes was estimated to cause a $150 million reduction in the total surplus (consumer plus producer surplus)in the gasoline market.If tax revenues increased by $100 million,what is the deadweight loss associated with the tax?

As a result of the tax,10,000 people sold their cars and started riding their bicycles to work.How much of the burden of the deadweight loss is incurred by the bicycle riders?

As a result of the tax,10,000 people sold their cars and started riding their bicycles to work.How much of the burden of the deadweight loss is incurred by the bicycle riders?

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

51

According to the benefits principle,it is fair for people to pay taxes based on their ability to shoulder the tax burden.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck