Deck 12: Fiscal Policy and the National Debt

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/377

Play

Full screen (f)

Deck 12: Fiscal Policy and the National Debt

1

In the late 1970s and early 1980s the goals of fiscal policy were

A)completely attained.

B)largely attained.

C)largely unattained.

D)completely unattaineD.

A)completely attained.

B)largely attained.

C)largely unattained.

D)completely unattaineD.

C

2

Which statement is true?

A)On occasion we have inflationary gaps and recessionary gaps at the same time.

B)When we are at equilibrium GDP,we are generally at full employment.

C)Fiscal policy and the automatic stabilizers are identical terms.

D)None of the statements are true.

A)On occasion we have inflationary gaps and recessionary gaps at the same time.

B)When we are at equilibrium GDP,we are generally at full employment.

C)Fiscal policy and the automatic stabilizers are identical terms.

D)None of the statements are true.

D

3

Statement I: If equilibrium GDP is $6 trillion and full employment GDP is $6.5 trillion,we have a recessionary gap of $500 billion.

Statement II: In 1991 and 1992 we had recessionary gaps.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Statement II: In 1991 and 1992 we had recessionary gaps.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

B

4

Which statement is true about automatic stabilizers?

A)They have eliminated the business cycle.

B)They have helped smooth out the business cycle.

C)They have been completely ineffective.

D)None of the statements are true of automatic stabilizers.

A)They have eliminated the business cycle.

B)They have helped smooth out the business cycle.

C)They have been completely ineffective.

D)None of the statements are true of automatic stabilizers.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

5

To close a recessionary gap we should

A)raise G and raise taxes.

B)lower G and lower taxes.

C)raise G and lower taxes.

D)lower G and raise taxes.

A)raise G and raise taxes.

B)lower G and lower taxes.

C)raise G and lower taxes.

D)lower G and raise taxes.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

6

When there is a recession,the biggest percentage decline would be in

A)social Security tax receipts.

B)personal income tax receipts.

C)consumer spending.

D)corporate after-tax profits.

A)social Security tax receipts.

B)personal income tax receipts.

C)consumer spending.

D)corporate after-tax profits.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

7

If equilibrium GDP is $1 trillion greater than full employment GDP,and there is an inflationary gap of $250 billion,the multiplier is

A)zero.

B)1.

C)2.5.

D)4.

E)impossible to find.

A)zero.

B)1.

C)2.5.

D)4.

E)impossible to find.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

8

Statement I: The federal budget deficit more than doubled between 1987 and 1992.

Statement II: High federal budget deficits tend to push up real interest rates.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Statement II: High federal budget deficits tend to push up real interest rates.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

9

Most economists would agree that the national debt should be reduced

A)during both periods of recession and prosperity.

B)just during periods of recession.

C)just during periods of prosperity.

D)never.

A)during both periods of recession and prosperity.

B)just during periods of recession.

C)just during periods of prosperity.

D)never.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

10

If full employment GDP is $1 trillion greater than equilibrium GDP,and there is a recessionary gap of $400 billion,the multiplier is

A)1.

B)2.5.

C)4.

D)5.

E)This is impossible to find with the information given.

A)1.

B)2.5.

C)4.

D)5.

E)This is impossible to find with the information given.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

11

Budget deficits are appropriate during

A)recessions,but not inflations.

B)inflations,but not recessions.

C)recessions and inflations.

D)neither recessions nor inflations.

A)recessions,but not inflations.

B)inflations,but not recessions.

C)recessions and inflations.

D)neither recessions nor inflations.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

12

Over the last four decades we have had

A)only balanced budgets.

B)only surpluses.

C)only deficits.

D)both deficits and surpluses.

A)only balanced budgets.

B)only surpluses.

C)only deficits.

D)both deficits and surpluses.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

13

We have an inflationary gap when

A)equilibrium GDP is greater than full employment GDP.

B)full employment GDP is greater than equilibrium GDP.

C)equilibrium GDP is equal to full employment GDP.

D)None of the choices are correct.

A)equilibrium GDP is greater than full employment GDP.

B)full employment GDP is greater than equilibrium GDP.

C)equilibrium GDP is equal to full employment GDP.

D)None of the choices are correct.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

14

If full employment GDP is $500 billion greater than equilibrium GDP and the multiplier is 5,there is a recessionary gap

A)of $50 billion.

B)of $100 billion.

C)of $200 billion.

D)of $500 billion.

E)that is impossible to find.

A)of $50 billion.

B)of $100 billion.

C)of $200 billion.

D)of $500 billion.

E)that is impossible to find.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

15

The national debt passed the $2 trillion mark in

A)1980.

B)1982.

C)1984.

D)1986.

E)1988.

A)1980.

B)1982.

C)1984.

D)1986.

E)1988.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

16

Which statement is true about fiscal policy?

A)There really is no fiscal policy,but rather a series of political compromises.

B)Fiscal policy is legally vested in the President;congressional interference has prevented it from being effective.

C)Although fiscal policy hasn't always been right,it is quickly formulated and put into effect.

D)None of the statements are true of fiscal policy.

A)There really is no fiscal policy,but rather a series of political compromises.

B)Fiscal policy is legally vested in the President;congressional interference has prevented it from being effective.

C)Although fiscal policy hasn't always been right,it is quickly formulated and put into effect.

D)None of the statements are true of fiscal policy.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

17

If equilibrium GDP is $500 billion greater than full employment GDP and the multiplier is 2.5,there is an inflationary gap of

A)$100 billion.

B)$200 billion.

C)$250 billion.

D)$500 billion.

E)This is impossible to find with the information given.

A)$100 billion.

B)$200 billion.

C)$250 billion.

D)$500 billion.

E)This is impossible to find with the information given.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

18

If we passed a constitutional amendment requiring a balanced budget every year,this would probably

A)make our recessions into depressions.

B)prevent recessions.

C)create inflations.

D)raise interest rates.

A)make our recessions into depressions.

B)prevent recessions.

C)create inflations.

D)raise interest rates.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

19

There is a recessionary gap when

A)equilibrium GDP is equal to full employment GDP.

B)equilibrium GDP is smaller than full employment GDP.

C)equilibrium GDP is larger than full employment GDP.

D)None of the choices are correct.

A)equilibrium GDP is equal to full employment GDP.

B)equilibrium GDP is smaller than full employment GDP.

C)equilibrium GDP is larger than full employment GDP.

D)None of the choices are correct.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

20

Fiscal policy deals with each of the following,except

A)the money supply.

B)government spending.

C)taxation.

D)the federal budget.

A)the money supply.

B)government spending.

C)taxation.

D)the federal budget.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

21

Which statement is true?

A)When there is a recessionary gap,we are spending too much and taxes should be raised.

B)When there is a recessionary gap we are spending too little and taxes should be raised.

C)When there is a recessionary gap,we are spending too much and taxes should be lowered.

D)When there is a recessionary gap we are spending too little and taxes should be lowereD.

A)When there is a recessionary gap,we are spending too much and taxes should be raised.

B)When there is a recessionary gap we are spending too little and taxes should be raised.

C)When there is a recessionary gap,we are spending too much and taxes should be lowered.

D)When there is a recessionary gap we are spending too little and taxes should be lowereD.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

22

Fiscal policy includes each of the following except

A)the money supply.

B)taxes.

C)government spending.

D)the automatic stabilizers.

A)the money supply.

B)taxes.

C)government spending.

D)the automatic stabilizers.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

23

Which statement is false?

A)Foreigners are holding an increasing percentage of the national debt.

B)The national debt rises substantially during wartime.

C)Over the next 50 years we will have to pay off most of the national debt.

D)None of the statements are false.

A)Foreigners are holding an increasing percentage of the national debt.

B)The national debt rises substantially during wartime.

C)Over the next 50 years we will have to pay off most of the national debt.

D)None of the statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

24

Statement I: Fiscal policy was invented by John Maynard Keynes in the 1930s.

Statement II: Until the 1980s,virtually all economists thought that the federal government should balance its budget every year.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Statement II: Until the 1980s,virtually all economists thought that the federal government should balance its budget every year.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

25

Between fiscal years 2008 and 2010,our federal budget deficit as a percent of GDP

A)rose substantially.

B)rose slightly.

C)fell slightly.

D)fell substantially.

A)rose substantially.

B)rose slightly.

C)fell slightly.

D)fell substantially.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

26

Interest rates in the United States would have been higher in recent years had it not been for

A)the federal budget deficits.

B)the large federal budget surpluses.

C)the outflow of funds to foreigners.

D)the inflow of funds from foreigners.

A)the federal budget deficits.

B)the large federal budget surpluses.

C)the outflow of funds to foreigners.

D)the inflow of funds from foreigners.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

27

When there is an inflationary gap

A)we are spending too much and taxes should be raised.

B)we are spending too much and taxes should be lowered.

C)we are spending too little and taxes should be raised.

D)we are spending too little and taxes should be lowereD.

A)we are spending too much and taxes should be raised.

B)we are spending too much and taxes should be lowered.

C)we are spending too little and taxes should be raised.

D)we are spending too little and taxes should be lowereD.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

28

Large budget deficits tend to

A)raise interest rates.

B)lower interest rates.

C)have no effect on interest rates.

A)raise interest rates.

B)lower interest rates.

C)have no effect on interest rates.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

29

Since 1980,our national debt as a percentage of GDP has

A)risen.

B)fallen.

C)stayed about the same.

A)risen.

B)fallen.

C)stayed about the same.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

30

In the mid-1990s,the federal budget deficit

A)fell substantially.

B)fell slightly.

C)stayed about the same.

D)rose slightly.

E)rose substantially.

A)fell substantially.

B)fell slightly.

C)stayed about the same.

D)rose slightly.

E)rose substantially.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

31

Right now our national debt is

A)between $4 and $6 trillion.

B)between $6 and $8 trillion.

C)between $8 and $10 trillion.

D)between $10 and $12 trillion.

E)over $12 trillion.

A)between $4 and $6 trillion.

B)between $6 and $8 trillion.

C)between $8 and $10 trillion.

D)between $10 and $12 trillion.

E)over $12 trillion.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

32

Which statement is true?

A)The public debt is greater than our GDP.

B)The public debt has doubled over the past four years.

C)Over 50 percent of the outstanding public debt is owed by foreigners.

D)None of the statements are true.

A)The public debt is greater than our GDP.

B)The public debt has doubled over the past four years.

C)Over 50 percent of the outstanding public debt is owed by foreigners.

D)None of the statements are true.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

33

The national debt is ____ of the United States government and ___ of the people who hold it.

A)an asset;an asset

B)a liability;a liability

C)an asset;a liability

D)a liability;an asset

A)an asset;an asset

B)a liability;a liability

C)an asset;a liability

D)a liability;an asset

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

34

Two ways to lower the deficit are to

A)raise taxes and raise government spending.

B)lower taxes and lower government spending.

C)raise taxes and lower government spending.

D)lower taxes and raise government spending.

A)raise taxes and raise government spending.

B)lower taxes and lower government spending.

C)raise taxes and lower government spending.

D)lower taxes and raise government spending.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

35

For a short period in 2009,the Social Security trust ran a temporary deficit.As a result,the 2009 federal budget deficit

A)increased substantially.

B)increased slightly.

C)decreased slightly.

D)decreased substantially.

E)was not effected by this deficit.

A)increased substantially.

B)increased slightly.

C)decreased slightly.

D)decreased substantially.

E)was not effected by this deficit.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

36

Which statement is true?

A)The United States Treasury will probably go bankrupt within 10 years.

B)Because the national debt grows each year,we have to pay more and more interest on the debt;because interest payments keep rising,our deficits keep growing,further pushing up the debt.

C)The United States Treasury can never go bankrupt.

D)None of the choices/statements are true.

A)The United States Treasury will probably go bankrupt within 10 years.

B)Because the national debt grows each year,we have to pay more and more interest on the debt;because interest payments keep rising,our deficits keep growing,further pushing up the debt.

C)The United States Treasury can never go bankrupt.

D)None of the choices/statements are true.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

37

If G = $800 billion,tax receipts = $850 billion,and there is an inflationary gap of $100 billion,there is

A)a budget surplus.

B)a budget deficit.

C)not enough information to determine whether there is a budget surplus or a budget deficit.

A)a budget surplus.

B)a budget deficit.

C)not enough information to determine whether there is a budget surplus or a budget deficit.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

38

In the 1930s,John Maynard Keynes said that our main economic problem was

A)weak aggregate demand.

B)too much government spending.

C)big budget deficits.

D)high interest rates.

E)that taxes were too low.

A)weak aggregate demand.

B)too much government spending.

C)big budget deficits.

D)high interest rates.

E)that taxes were too low.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

39

If our unemployment rate were eight percent

A)there is definitely an inflationary gap.

B)there is probably an inflationary gap.

C)there is definitely a recessionary gap.

D)there is probably a recessionary gap.

A)there is definitely an inflationary gap.

B)there is probably an inflationary gap.

C)there is definitely a recessionary gap.

D)there is probably a recessionary gap.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

40

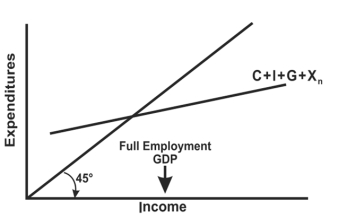

Which statement is true about the graph above?

A)Equilibrium GDP is too big.

B)Equilibrium GDP is too small.

C)Equilibrium GDP is just the right size.

D)There is not enough information to determine whether or not equilibrium GDP is the right size.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

41

Statement I: The national debt passed the $1 trillion mark in 1981.

Statement II: The national debt exceeded $12 trillion in 2010.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Statement II: The national debt exceeded $12 trillion in 2010.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

42

When government expenditures in a given year exceed tax receipts,there exists

A)a budget surplus.

B)a budget deficit.

C)public revenue.

D)full-employment taxation.

A)a budget surplus.

B)a budget deficit.

C)public revenue.

D)full-employment taxation.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

43

An illustration of the term "automatic stabilizer" is provided by

A)The tendency of tax collections to rise as the economy moves into a recession.

B)The tendency of tax collections to fall as the economy moves into a recession.

C)Increases in tax rates as the economy moves into a recession.

D)Decreases in tax rates as the economy moves into a recession.

E)Public works designed to get the economy out of a depression.

A)The tendency of tax collections to rise as the economy moves into a recession.

B)The tendency of tax collections to fall as the economy moves into a recession.

C)Increases in tax rates as the economy moves into a recession.

D)Decreases in tax rates as the economy moves into a recession.

E)Public works designed to get the economy out of a depression.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

44

In the 20th century,our federal budget deficits were,on average,largest in the

A)1960s.

B)1970s.

C)1980s.

D)1990s.

A)1960s.

B)1970s.

C)1980s.

D)1990s.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following would require reducing government expenditures and increasing tax rates during a recession?

A)An annually balanced budget policy

B)A countercyclical fiscal policy

C)A cyclically balanced budget policy

D)A policy employing built-in stability

A)An annually balanced budget policy

B)A countercyclical fiscal policy

C)A cyclically balanced budget policy

D)A policy employing built-in stability

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

46

The federal government deficit or surplus

A)is not affected by the level of GDP.

B)is not affected by discretionary fiscal policy.

C)may be more a symptom of economic distress than a result of intentional fiscal policy.

D)should be balanced at all times to prevent business cycles.

A)is not affected by the level of GDP.

B)is not affected by discretionary fiscal policy.

C)may be more a symptom of economic distress than a result of intentional fiscal policy.

D)should be balanced at all times to prevent business cycles.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

47

Statement I: If there were deflation,the national debt would become easier to pay off.

Statement II: Foreign investors own over 75 percent of our national debt.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Statement II: Foreign investors own over 75 percent of our national debt.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

48

If full employment GDP is $8 trillion and equilibrium GDP is $7 trillion

A)there is definitely an inflationary gap.

B)there is probably an inflationary gap.

C)there is definitely a recessionary gap.

D)there is probably a recessionary gap.

A)there is definitely an inflationary gap.

B)there is probably an inflationary gap.

C)there is definitely a recessionary gap.

D)there is probably a recessionary gap.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

49

The annual Social Security surplus has been _____ a year.

A)somewhat less than $100 billion

B)over $100 billion

C)somewhat less than $200 billion

D)over $200 billion

A)somewhat less than $100 billion

B)over $100 billion

C)somewhat less than $200 billion

D)over $200 billion

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

50

Even if the economy has considerable excess capacity,new government spending that creates new jobs involves opportunity costs because

A)goods other than those purchased by government could have been produced and consumed.

B)unemployed workers are unwilling to surrender leisure time to take paid jobs.

C)excess capacity implies that the capital stock exceeds equilibrium.

D)government employment is inefficient relative to jobs in the private sector.

E)expansionary monetary policy stimulates employment without growth of national debt.

A)goods other than those purchased by government could have been produced and consumed.

B)unemployed workers are unwilling to surrender leisure time to take paid jobs.

C)excess capacity implies that the capital stock exceeds equilibrium.

D)government employment is inefficient relative to jobs in the private sector.

E)expansionary monetary policy stimulates employment without growth of national debt.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

51

Expansionary fiscal policy involves

A)a decrease in government spending and/or an increase in taxes.

B)only an increase in taxes.

C)an increase in government spending and/or a decrease in taxes.

D)only a decrease in government spending.

A)a decrease in government spending and/or an increase in taxes.

B)only an increase in taxes.

C)an increase in government spending and/or a decrease in taxes.

D)only a decrease in government spending.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

52

The public debt is the sum of all of the previous

A)expenditures of the federal government.

B)budget deficits of the federal government.

C)budget deficits less the budget surpluses of the federal government.

D)budget surpluses less the budget deficits of the federal government.

A)expenditures of the federal government.

B)budget deficits of the federal government.

C)budget deficits less the budget surpluses of the federal government.

D)budget surpluses less the budget deficits of the federal government.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

53

If the federal budget deficit were lowered,then the national debt would

A)decline.

B)stay the same.

C)rise at an increasing rate.

D)rise at a decreasing rate.

A)decline.

B)stay the same.

C)rise at an increasing rate.

D)rise at a decreasing rate.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

54

Statement I: The national debt has risen every year since 1969.

Statement II: The national debt has declined every year since 1980.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Statement II: The national debt has declined every year since 1980.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

55

Nearly all of the budget deficits we had in the 1980s were

A)under $10 billion.

B)between $100 billion and $200 billion.

C)between $200 billion and $300 billion.

D)over $300 billion.

A)under $10 billion.

B)between $100 billion and $200 billion.

C)between $200 billion and $300 billion.

D)over $300 billion.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is an example of an automatic stabilizer?

A)The reduction in the money supply that occurs as banks become less willing to make loans during a recession

B)The reduction in real wages that occurs as the economy goes into a recession

C)The increase in government spending that occurs as the result of new spending bills passed by Congress

D)The rise in tax revenue that occurs as a result of growth in real GDP

E)All of the choices are examples of an automatic stabilizer.

A)The reduction in the money supply that occurs as banks become less willing to make loans during a recession

B)The reduction in real wages that occurs as the economy goes into a recession

C)The increase in government spending that occurs as the result of new spending bills passed by Congress

D)The rise in tax revenue that occurs as a result of growth in real GDP

E)All of the choices are examples of an automatic stabilizer.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

57

The multiplier effect occurs because

A)as saving levels increase,a greater pool of loanable funds is available for investment spending by businesses.

B)increases in income cause a chain reaction of spending by many businesses and individuals.

C)increases in income cause tax revenues to increase,thereby stimulating increases in government spending levels.

D)businesses copy the spending decisions of their competitors.

E)households tend to spend any increase in income.

A)as saving levels increase,a greater pool of loanable funds is available for investment spending by businesses.

B)increases in income cause a chain reaction of spending by many businesses and individuals.

C)increases in income cause tax revenues to increase,thereby stimulating increases in government spending levels.

D)businesses copy the spending decisions of their competitors.

E)households tend to spend any increase in income.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

58

Statement I: To lower a recessionary gap we would raise the C + I + G + Xn line.

Statement II: The best way to eliminate a recessionary gap is to balance the federal budget.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Statement II: The best way to eliminate a recessionary gap is to balance the federal budget.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

59

Which statement is false?

A)We had more budget surpluses in the 1990s than we did in the 1970s and 1980s.

B)We had no budget surpluses in the 1970s and 1980s.

C)We had bigger budget deficits in the 1980s than we did in the 1970s.

D)None of the choices/statements are false.

A)We had more budget surpluses in the 1990s than we did in the 1970s and 1980s.

B)We had no budget surpluses in the 1970s and 1980s.

C)We had bigger budget deficits in the 1980s than we did in the 1970s.

D)None of the choices/statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

60

Statement I: The federal budget deficit is the same thing as the national debt.

Statement II: The national debt will continue to rise even if the federal budget deficit is lowered.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Statement II: The national debt will continue to rise even if the federal budget deficit is lowered.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

61

If the government wishes to maintain a balanced budget during a recession,it must

A)increase taxes,decrease transfer payments,and/or decrease government spending.

B)decrease taxes,decrease government spending,and/or decrease transfer payments.

C)decrease taxes,increase transfer payments,and/or decrease government spending.

D)increase taxes,increase government spending,and/or increase transfer payments.

E)increase taxes,decrease transfer payments,and/or increase government spending.

A)increase taxes,decrease transfer payments,and/or decrease government spending.

B)decrease taxes,decrease government spending,and/or decrease transfer payments.

C)decrease taxes,increase transfer payments,and/or decrease government spending.

D)increase taxes,increase government spending,and/or increase transfer payments.

E)increase taxes,decrease transfer payments,and/or increase government spending.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

62

Statement I: To cut a federal budget deficit,we must raise taxes,cut government spending,or experience rapid economic growth.

Statement II: It would be a lot easier to cut Social Security benefits than to cut most other federal spending programs.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Statement II: It would be a lot easier to cut Social Security benefits than to cut most other federal spending programs.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

63

Suppose the deficit in the year 2010 is $500 billion;in the year 2011 it falls to $200 billion.If the national debt at the beginning of year 2010 is $10 trillion,how much will it be at the end of year 2011?

A)$10 trillion

B)$10.2 trillion

C)$10.5 trillion

D)$10.7 trillion

E)$11 trillion

A)$10 trillion

B)$10.2 trillion

C)$10.5 trillion

D)$10.7 trillion

E)$11 trillion

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

64

During the 1980s,

A)both the national debt and the deficit increased.

B)neither the national debt nor the deficit increased.

C)the national debt increased while the deficit decreased.

D)the national debt decreased while the deficit increaseD.

E)the national debt was the same thing as the deficit and it increased.

A)both the national debt and the deficit increased.

B)neither the national debt nor the deficit increased.

C)the national debt increased while the deficit decreased.

D)the national debt decreased while the deficit increaseD.

E)the national debt was the same thing as the deficit and it increased.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

65

In fiscal year 2010,the federal budget deficit was about

A)$300 billion.

B)$500 billion.

C)$800 billion.

D)$1,000 billion.

E)$1,600 billion.

A)$300 billion.

B)$500 billion.

C)$800 billion.

D)$1,000 billion.

E)$1,600 billion.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

66

Because automatic stabilizers exist in the United States economy

A)during a recession,transfer payments automatically rise and tax revenue drops;during a period of economic recovery,transfer payments fall and tax revenue rises.

B)real wages automatically adjust to keep the labor force fully employed at all stages of the business cycle.

C)monetary policy is designed to automatically respond to changes in money demand.

D)during a recession,the government's budget deficit automatically becomes smaller.

E)All of the choices/statements are true.

A)during a recession,transfer payments automatically rise and tax revenue drops;during a period of economic recovery,transfer payments fall and tax revenue rises.

B)real wages automatically adjust to keep the labor force fully employed at all stages of the business cycle.

C)monetary policy is designed to automatically respond to changes in money demand.

D)during a recession,the government's budget deficit automatically becomes smaller.

E)All of the choices/statements are true.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

67

Federal income tax rates for the rich were raised in

A)1981 and 1986.

B)1986 and 1990.

C)1990 and 1993.

D)1981 and 1990.

E)1986 and 1993.

A)1981 and 1986.

B)1986 and 1990.

C)1990 and 1993.

D)1981 and 1990.

E)1986 and 1993.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

68

The paradox of thrift refers to the idea that

A)people who save are usually those who cannot afford it.

B)as people become more thrifty,incomes may fall.

C)the thrift industry (banks and savings and loans)wants some people to save so that others may borrow.

D)saving is necessary for economic development.

E)equilibrium requires aggregate supply and total expenditures to be equal.

A)people who save are usually those who cannot afford it.

B)as people become more thrifty,incomes may fall.

C)the thrift industry (banks and savings and loans)wants some people to save so that others may borrow.

D)saving is necessary for economic development.

E)equilibrium requires aggregate supply and total expenditures to be equal.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

69

The 1990 deficit reduction legislation

A)contained no new taxes.

B)increased excise tax rates.

C)increased the personal income tax rates by 10%.

D)contained no reductions in non-defense spending.

A)contained no new taxes.

B)increased excise tax rates.

C)increased the personal income tax rates by 10%.

D)contained no reductions in non-defense spending.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

70

Statement I: The Tax Reform Act of 1986 was an attempt to reduce the federal budget deficit.

Statement II: The federal budget deficit is what the federal government owes to its creditors.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Statement II: The federal budget deficit is what the federal government owes to its creditors.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

71

The reason the multiplier is greater than 1 is that

A)income is re-spent.

B)workers are capable of increasing their production when they have to.

C)the marginal propensity to save is 1.

D)none of the choices are correct.

A)income is re-spent.

B)workers are capable of increasing their production when they have to.

C)the marginal propensity to save is 1.

D)none of the choices are correct.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

72

During recessionary periods

A)tax revenues fall proportionately faster than does national income.

B)budgetary surpluses are generated.

C)decreases in nominal income are accelerated as tax revenue decreases.

D)higher tax revenues are generated by progressive income taxes.

E)the Congress must lower taxes if full employment is to be achieved.

A)tax revenues fall proportionately faster than does national income.

B)budgetary surpluses are generated.

C)decreases in nominal income are accelerated as tax revenue decreases.

D)higher tax revenues are generated by progressive income taxes.

E)the Congress must lower taxes if full employment is to be achieved.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

73

Statement I: Our national debt is larger than our GDP.

Statement II: The national debt is much greater than the size of any of the annual federal budget deficits run during the 1990s.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Statement II: The national debt is much greater than the size of any of the annual federal budget deficits run during the 1990s.

A)Statement I is true and statement II is false.

B)Statement II is true and statement I is false.

C)Both statements are true.

D)Both statements are false.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

74

If the federal budget deficit declines,the national debt

A)will definitely go down.

B)may go down.

C)will definitely go up.

D)may go up.

A)will definitely go down.

B)may go down.

C)will definitely go up.

D)may go up.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

75

When government expenditures in a given year are less than tax receipts,there exists

A)a budget deficit.

B)public revenue.

C)full-employment taxation.

D)a budget surplus.

A)a budget deficit.

B)public revenue.

C)full-employment taxation.

D)a budget surplus.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

76

How large will the total change in income be from a change in investment of $15 if the marginal propensity to consume is .8?

A)$12

B)$20

C)$25

D)$75

E)$200

A)$12

B)$20

C)$25

D)$75

E)$200

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

77

John Maynard Keynes believed that

A)the market forces would soon cure the Great Depression.

B)the federal government should balance its budget every year.

C)we could spend our way out of the Great Depression.

D)we should scrap the capitalist system and have the government take over the ownership of the means of production.

A)the market forces would soon cure the Great Depression.

B)the federal government should balance its budget every year.

C)we could spend our way out of the Great Depression.

D)we should scrap the capitalist system and have the government take over the ownership of the means of production.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

78

As a result of the existence of automatic stabilizers

A)the government budget deficit will always increase during a period of economic recession.

B)the economy will always tend to move toward a full-employment equilibrium.

C)the government budget deficit will always increase during a period of economic expansion.

D)the business cycle will no longer exist.

E)None of the choices are correct.

A)the government budget deficit will always increase during a period of economic recession.

B)the economy will always tend to move toward a full-employment equilibrium.

C)the government budget deficit will always increase during a period of economic expansion.

D)the business cycle will no longer exist.

E)None of the choices are correct.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

79

The federal budget deficit was almost $_____ billion in fiscal year 1992.

A)100

B)200

C)300

D)400

E)500

A)100

B)200

C)300

D)400

E)500

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck

80

Automatic stabilizers

A)are probably insufficient to completely offset strong recessionary pressures.

B)tend to accelerate abrupt changes in economic activity and cause expenditures to move pro-cyclically.

C)give policy makers more time to formulate nondiscretionary policy.

D)are unimportant to those workers most likely to be laid off or otherwise harmed by recessions.

A)are probably insufficient to completely offset strong recessionary pressures.

B)tend to accelerate abrupt changes in economic activity and cause expenditures to move pro-cyclically.

C)give policy makers more time to formulate nondiscretionary policy.

D)are unimportant to those workers most likely to be laid off or otherwise harmed by recessions.

Unlock Deck

Unlock for access to all 377 flashcards in this deck.

Unlock Deck

k this deck