Deck 21: Corporate Stocks

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/66

Play

Full screen (f)

Deck 21: Corporate Stocks

1

Columbia Corporation stock has a par value of $47. If the corporation pays a 7% dividend, compute the amount of the dividend paid to the owner of 1,400 shares.

$4,606

2

George Fuji bought 600 shares of TTV stock at $28. Commission charges were $0.20 per share. A dividend of $1.50 per share was paid this year. Compute the rate of yield. (Round answer to two decimal places.)

5.32%

3

Ralph bought 100 shares of Meredian stock at $86; 100 shares of Lawson stock at 30.25; and 100 shares of Puritan stock at 22.50. Commission charges were $0.20 per share. Compute the total cost of the purchase.

$13,935

4

Jorge sold 200 shares of Pacific stock at $21; 300 shares of Atlantic stock at $32; and 100 shares of Inland stock at $42. Commission charges were $0.20 per share. Compute the proceeds of the sale.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

5

Assume a differential rate 12.5 cents for odd lot sales and purchases. Brian purchased 160 shares of PTG stock at $20. Commission charges were $0.20 per share. Compute the total purchase costs.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

6

Jason bought 300 shares of Robot stock at $38. Commission charges were $0.20 per share. Compute the total cost of the purchase.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

7

Stock of the ABC Corporation has a par value of $30. If the corporation pays a 6% dividend, compute the amount of the dividend per share.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

8

Kevin sold 250 shares of Mountain stock at $23; 325 shares of ADS stock at $30; and 95 shares of Liberty stock at $43. Commission charges were $0.20 per share. Compute the proceeds of the sale.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

9

Margaret Jones bought 1,000 shares of DVG stock at $26. Commission charges were $0.20 per share. A dividend of $1.10 per share was paid this year. Compute the rate of yield. (Round answer to two decimal places.)

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

10

Fern sold 800 shares of Atlantic stock at $14.25. Commission charges were $0.20 per share. Compute the proceeds of the sale.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

11

Alan Jackson bought 300 shares of MTY stock at $47. Commission charges were $0.20 per share. A dividend of $1.70 per share was paid this year. Compute the rate of yield. (Round answer to two decimal places.)

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

12

Assume a differential rate of 12.5 cents for odd lot sales and purchases. Mark sold 250 shares of PFB stock at $62. Commission charges were $0.20 per share. Compute the proceeds of the sale.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

13

Cynthia bought 200 shares of Atlantic stock at $14.70 and 100 shares of ITT stock at $18.25. Commission charges were $0.20 per share. Compute the total cost of the purchase.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

14

Marge Nelson bought 400 shares of BRN stock at $34. Commission charges were $0.20 per share. A dividend of $2.20 per share was paid this year. Compute the rate of yield. (Round answer to two decimal places.)

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

15

Assume a differential rate 12.5 cents for odd lot sales and purchases. June purchased 150 shares of UNF stock at $23. Commission charges were $0.20 per share. Compute the total purchase costs.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

16

Robot, Inc. closed Thursday at $37. The daily stock report in the local newspaper showed that on Friday Robot, Inc. had a high of 42.64, a low of 36.72, and closed at $39.12. Compute the amount that the net change column for Friday will show.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

17

Jim bought 300 shares of Nelson stock at $14.25. Commission charges were $0.20 per share. Compute the total cost of the purchase.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

18

McDonald's stock closed Wednesday at $26.75. The daily stock report in the local newspaper showed that on Thursday McDonalds had a high of 27, a low of 24, and closed at $26.15. Compute the amount that the net change column for Thursday will show.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

19

Stock of the XYZ Corporation has a par value of $50. If the corporation pays a 5% dividend, compute the amount of the dividend paid to the owner of 160 shares.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

20

Stock of the Boston Corporation has a par value of $20. If the corporation pays a 7% dividend, compute the amount of the dividend paid to the owner of 762 shares.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

21

Channing Company

The Channing Company earned $64,000 last year. The capital stock of the company consists of $500,000 of 8% preferred stock and $200,000 of common stock. The directors declare a dividend of the entire earnings.

Refer to Channing Company. Compute the total amount that will be paid to the holders of preferred stock.

The Channing Company earned $64,000 last year. The capital stock of the company consists of $500,000 of 8% preferred stock and $200,000 of common stock. The directors declare a dividend of the entire earnings.

Refer to Channing Company. Compute the total amount that will be paid to the holders of preferred stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

22

Fuller Company

The Fuller Company earned $106,000 last year. The capital stock of the company consists of $500,000 of 6% preferred stock and $1,200,000 of common stock. The directors declare a dividend of the entire earnings.

Refer to Fuller Company. Compute the total amount that will be paid to the holders of preferred stock.

The Fuller Company earned $106,000 last year. The capital stock of the company consists of $500,000 of 6% preferred stock and $1,200,000 of common stock. The directors declare a dividend of the entire earnings.

Refer to Fuller Company. Compute the total amount that will be paid to the holders of preferred stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

23

George Fuji bought 400 shares of TTV stock at $28. He sold the stock at $34. Commission charges were $0.20 per share. Compute the dollar amount of gain or loss.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

24

Scott Company

The Scott Company earned $120,000 last year. The capital stock of the company consists of $400,000 of 7% preferred stock and $200,000 of common stock. The directors declared a dividend of 60% of the earnings.

Refer to Scott Company. Compute the total amount that will be paid to the holders of common stock.

The Scott Company earned $120,000 last year. The capital stock of the company consists of $400,000 of 7% preferred stock and $200,000 of common stock. The directors declared a dividend of 60% of the earnings.

Refer to Scott Company. Compute the total amount that will be paid to the holders of common stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

25

Scott Company

The Scott Company earned $120,000 last year. The capital stock of the company consists of $400,000 of 7% preferred stock and $200,000 of common stock. The directors declared a dividend of 60% of the earnings.

Refer to Scott Company. Compute the total amount that will be paid to the holders of preferred stock.

The Scott Company earned $120,000 last year. The capital stock of the company consists of $400,000 of 7% preferred stock and $200,000 of common stock. The directors declared a dividend of 60% of the earnings.

Refer to Scott Company. Compute the total amount that will be paid to the holders of preferred stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

26

Blue Well Company

The Blue Well Company earned $48,000 last year. The capital stock of the company consists of $300,000 of 7.5% preferred stock and $150,000 of common stock. The directors declare a dividend of half of the entire earnings.

Refer to Blue Well Company. Compute the total amount that will be paid to the holders of common stock.

The Blue Well Company earned $48,000 last year. The capital stock of the company consists of $300,000 of 7.5% preferred stock and $150,000 of common stock. The directors declare a dividend of half of the entire earnings.

Refer to Blue Well Company. Compute the total amount that will be paid to the holders of common stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

27

Fuller Company

The Fuller Company earned $106,000 last year. The capital stock of the company consists of $500,000 of 6% preferred stock and $1,200,000 of common stock. The directors declare a dividend of the entire earnings.

Refer to Fuller Company. Compute the total amount that will be paid to the holders of common stock.

The Fuller Company earned $106,000 last year. The capital stock of the company consists of $500,000 of 6% preferred stock and $1,200,000 of common stock. The directors declare a dividend of the entire earnings.

Refer to Fuller Company. Compute the total amount that will be paid to the holders of common stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

28

Marge Nelson bought 300 shares of BRN stock at $34. She sold the stock at $35. Commission charges were $0.20 per share. Compute the dollar amount of gain or loss.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

29

Channing Company

The Channing Company earned $64,000 last year. The capital stock of the company consists of $500,000 of 8% preferred stock and $200,000 of common stock. The directors declare a dividend of the entire earnings.

Refer to Channing Company. Compute the total amount that will be paid to the holders of common stock.

The Channing Company earned $64,000 last year. The capital stock of the company consists of $500,000 of 8% preferred stock and $200,000 of common stock. The directors declare a dividend of the entire earnings.

Refer to Channing Company. Compute the total amount that will be paid to the holders of common stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

30

Pratt Company

The Pratt Company earned $140,000 last year. The capital stock of the company consists of $600,000 of 8% cumulative preferred stock and $600,000 of common stock. The directors declared a dividend of half of the earnings. During the previous year, the company earned only enough to pay a 6% dividend on preferred stock.

Refer to Pratt Company. Compute the total amount that will be paid to the holders of common stock?

The Pratt Company earned $140,000 last year. The capital stock of the company consists of $600,000 of 8% cumulative preferred stock and $600,000 of common stock. The directors declared a dividend of half of the earnings. During the previous year, the company earned only enough to pay a 6% dividend on preferred stock.

Refer to Pratt Company. Compute the total amount that will be paid to the holders of common stock?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

31

Hybrid Company

The Hybrid Company earned $52,000 last year. The capital stock of the company consists of $300,000 of 7% cumulative preferred stock and $200,000 of common stock. The directors declared a dividend of the entire earnings. During the previous year, the company earned only enough to pay a 2% dividend on preferred stock.

Refer to Hybrid Company. What is the total amount that will be paid to the holders of preferred stock?

The Hybrid Company earned $52,000 last year. The capital stock of the company consists of $300,000 of 7% cumulative preferred stock and $200,000 of common stock. The directors declared a dividend of the entire earnings. During the previous year, the company earned only enough to pay a 2% dividend on preferred stock.

Refer to Hybrid Company. What is the total amount that will be paid to the holders of preferred stock?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

32

Columbia Company

The Columbia Company earned $1,400,000 last year. The capital stock of the company consists of $8,000,000 of 6% cumulative preferred stock and $15,000,000 of common stock. The directors declared a dividend of the entire earnings. During the previous year, the company earned $240,000 and the directors declared a dividend of the entire earnings.

Refer to Columbia Company. What is the total amount that will be paid to the holders of common stock?

The Columbia Company earned $1,400,000 last year. The capital stock of the company consists of $8,000,000 of 6% cumulative preferred stock and $15,000,000 of common stock. The directors declared a dividend of the entire earnings. During the previous year, the company earned $240,000 and the directors declared a dividend of the entire earnings.

Refer to Columbia Company. What is the total amount that will be paid to the holders of common stock?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

33

Hybrid Company

The Hybrid Company earned $52,000 last year. The capital stock of the company consists of $300,000 of 7% cumulative preferred stock and $200,000 of common stock. The directors declared a dividend of the entire earnings. During the previous year, the company earned only enough to pay a 2% dividend on preferred stock.

Refer to Hybrid Company. What is the total amount that will be paid to the holders of common stock?

The Hybrid Company earned $52,000 last year. The capital stock of the company consists of $300,000 of 7% cumulative preferred stock and $200,000 of common stock. The directors declared a dividend of the entire earnings. During the previous year, the company earned only enough to pay a 2% dividend on preferred stock.

Refer to Hybrid Company. What is the total amount that will be paid to the holders of common stock?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

34

Sam Cooper bought 200 shares of MTV stock at $54. He sold the stock at $52. Commission charges were $0.20 per share. Compute the dollar amount of gain or loss.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

35

Pratt Company

The Pratt Company earned $140,000 last year. The capital stock of the company consists of $600,000 of 8% cumulative preferred stock and $600,000 of common stock. The directors declared a dividend of half of the earnings. During the previous year, the company earned only enough to pay a 6% dividend on preferred stock.

Refer to Pratt Company. What is the total amount that will be paid to the holders of preferred stock?

The Pratt Company earned $140,000 last year. The capital stock of the company consists of $600,000 of 8% cumulative preferred stock and $600,000 of common stock. The directors declared a dividend of half of the earnings. During the previous year, the company earned only enough to pay a 6% dividend on preferred stock.

Refer to Pratt Company. What is the total amount that will be paid to the holders of preferred stock?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

36

Sam Hanson bought 600 shares of DVG stock at $27. He sold the stock at $32. Commission charges were $0.20 per share. Compute the dollar amount of gain or loss.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

37

Blue Well Company

The Blue Well Company earned $48,000 last year. The capital stock of the company consists of $300,000 of 7.5% preferred stock and $150,000 of common stock. The directors declare a dividend of half of the entire earnings.

Refer to Blue Well Company. Compute the total amount that will be paid to the holders of preferred stock.

The Blue Well Company earned $48,000 last year. The capital stock of the company consists of $300,000 of 7.5% preferred stock and $150,000 of common stock. The directors declare a dividend of half of the entire earnings.

Refer to Blue Well Company. Compute the total amount that will be paid to the holders of preferred stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

38

Columbia Company

The Columbia Company earned $1,400,000 last year. The capital stock of the company consists of $8,000,000 of 6% cumulative preferred stock and $15,000,000 of common stock. The directors declared a dividend of the entire earnings. During the previous year, the company earned $240,000 and the directors declared a dividend of the entire earnings.

Refer to Columbia Company. What is the total amount that will be paid to the holders of preferred stock?

The Columbia Company earned $1,400,000 last year. The capital stock of the company consists of $8,000,000 of 6% cumulative preferred stock and $15,000,000 of common stock. The directors declared a dividend of the entire earnings. During the previous year, the company earned $240,000 and the directors declared a dividend of the entire earnings.

Refer to Columbia Company. What is the total amount that will be paid to the holders of preferred stock?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

39

Swartz Company

The Swartz Company earned $30,000 last year. The capital stock of the company consists of $200,000 of 7% preferred stock and $100,000 of common stock. The directors declare a dividend of half of the entire earnings.

Refer to Swartz Company. Compute the total amount that will be paid to the holders of preferred stock.

The Swartz Company earned $30,000 last year. The capital stock of the company consists of $200,000 of 7% preferred stock and $100,000 of common stock. The directors declare a dividend of half of the entire earnings.

Refer to Swartz Company. Compute the total amount that will be paid to the holders of preferred stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

40

Swartz Company

The Swartz Company earned $30,000 last year. The capital stock of the company consists of $200,000 of 7% preferred stock and $100,000 of common stock. The directors declare a dividend of half of the entire earnings.

Refer to Swartz Company. Compute the total amount that will be paid to the holders of common stock.

The Swartz Company earned $30,000 last year. The capital stock of the company consists of $200,000 of 7% preferred stock and $100,000 of common stock. The directors declare a dividend of half of the entire earnings.

Refer to Swartz Company. Compute the total amount that will be paid to the holders of common stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

41

Bob Wright

Bob Wright owned 100 shares of Lawson Company's convertible preferred stock at $10 par value. He converted each share of preferred stock into three shares of common stock.

Refer to Bob Wright. If common stock was selling at $4 per share on the date of conversion, compute Bob Wright's common stock worth.

Bob Wright owned 100 shares of Lawson Company's convertible preferred stock at $10 par value. He converted each share of preferred stock into three shares of common stock.

Refer to Bob Wright. If common stock was selling at $4 per share on the date of conversion, compute Bob Wright's common stock worth.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

42

John purchased 400 shares of MMM stock at 78. One year later he sold all 400 shares at 82. He paid a transaction fee of $19.95 for each transaction. What was his gain or loss on the sale?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

43

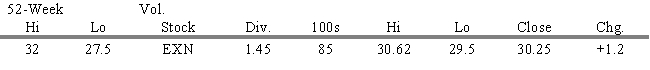

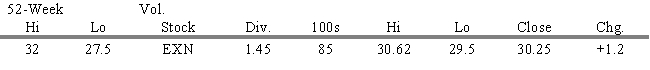

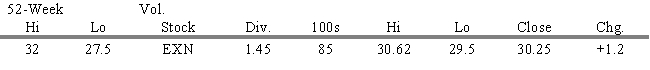

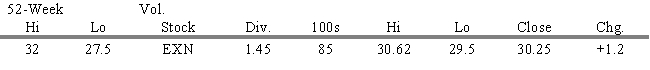

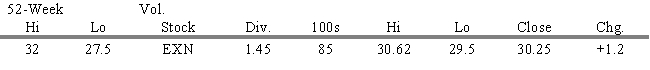

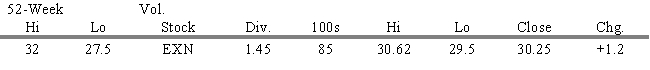

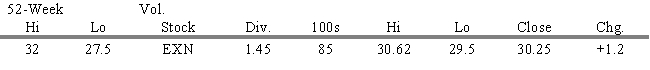

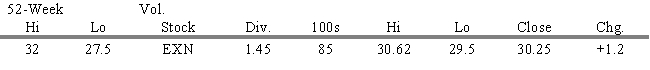

Stock Listing

Use the following stock listing to answer the questions.

Refer to Stock Listing. What is the PE ratio if EXN has earnings per share of $1.89?

Use the following stock listing to answer the questions.

Refer to Stock Listing. What is the PE ratio if EXN has earnings per share of $1.89?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

44

Bob Wright

Bob Wright owned 100 shares of Lawson Company's convertible preferred stock at $10 par value. He converted each share of preferred stock into three shares of common stock.

Refer to Bob Wright. Compute the number of shares of common stock Bob Wright received when he converted the shares.

Bob Wright owned 100 shares of Lawson Company's convertible preferred stock at $10 par value. He converted each share of preferred stock into three shares of common stock.

Refer to Bob Wright. Compute the number of shares of common stock Bob Wright received when he converted the shares.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

45

Bob Wright

Bob Wright owned 100 shares of Lawson Company's convertible preferred stock at $10 par value. He converted each share of preferred stock into three shares of common stock.

Refer to Bob Wright. If the convertible preferred stock paid 7% annually and the common stock pays $0.40 a share this year, how much more dividend will Bob Wright receive this year because of his conversion?

Bob Wright owned 100 shares of Lawson Company's convertible preferred stock at $10 par value. He converted each share of preferred stock into three shares of common stock.

Refer to Bob Wright. If the convertible preferred stock paid 7% annually and the common stock pays $0.40 a share this year, how much more dividend will Bob Wright receive this year because of his conversion?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

46

Buckley Company

The Buckley Company earned $110,000 last year. The capital stock of the company consists of $300,000 of 9% cumulative preferred stock and $200,000 of common stock. The directors declared a dividend of 60% of the earnings. For the previous year, the directors did not declare a dividend at all.

Refer to Buckley Company. Compute the total amount that will be paid to the holders of preferred stock.

The Buckley Company earned $110,000 last year. The capital stock of the company consists of $300,000 of 9% cumulative preferred stock and $200,000 of common stock. The directors declared a dividend of 60% of the earnings. For the previous year, the directors did not declare a dividend at all.

Refer to Buckley Company. Compute the total amount that will be paid to the holders of preferred stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

47

Mary Lee

Mary Lee owned 500 shares of Dugan Company's convertible preferred stock at $20 par value. She converted each share of preferred stock into four shares of common stock.

Refer to Mary Lee. If the convertible preferred stock paid 9% annually and the common stock pays $1.00 a share this year, how much more dividend will Mary Lee receive this year because of her conversion?

Mary Lee owned 500 shares of Dugan Company's convertible preferred stock at $20 par value. She converted each share of preferred stock into four shares of common stock.

Refer to Mary Lee. If the convertible preferred stock paid 9% annually and the common stock pays $1.00 a share this year, how much more dividend will Mary Lee receive this year because of her conversion?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

48

Mary Lee

Mary Lee owned 500 shares of Dugan Company's convertible preferred stock at $20 par value. She converted each share of preferred stock into four shares of common stock.

Refer to Mary Lee. If Mary Lee paid $20 per share for her preferred stock, and if common stock was selling at $50 per share on the date of conversion, compute the amount that Mary Lee's investment increased in value.

Mary Lee owned 500 shares of Dugan Company's convertible preferred stock at $20 par value. She converted each share of preferred stock into four shares of common stock.

Refer to Mary Lee. If Mary Lee paid $20 per share for her preferred stock, and if common stock was selling at $50 per share on the date of conversion, compute the amount that Mary Lee's investment increased in value.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

49

Buckley Company

The Buckley Company earned $110,000 last year. The capital stock of the company consists of $300,000 of 9% cumulative preferred stock and $200,000 of common stock. The directors declared a dividend of 60% of the earnings. For the previous year, the directors did not declare a dividend at all.

Refer to Buckley Company. Compute the total amount that will be paid to the holders of common stock.

The Buckley Company earned $110,000 last year. The capital stock of the company consists of $300,000 of 9% cumulative preferred stock and $200,000 of common stock. The directors declared a dividend of 60% of the earnings. For the previous year, the directors did not declare a dividend at all.

Refer to Buckley Company. Compute the total amount that will be paid to the holders of common stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

50

Kelly Jordan

Kelly Jordan owned 220 shares of Diego Company's convertible preferred stock at $50 par value. He converted each share of preferred stock into two shares of common stock.

Refer to Kelly Jordan. Compute the number of shares of common stock Kelly Jordan received when he converted.

Kelly Jordan owned 220 shares of Diego Company's convertible preferred stock at $50 par value. He converted each share of preferred stock into two shares of common stock.

Refer to Kelly Jordan. Compute the number of shares of common stock Kelly Jordan received when he converted.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

51

Mary Lee

Mary Lee owned 500 shares of Dugan Company's convertible preferred stock at $20 par value. She converted each share of preferred stock into four shares of common stock.

Refer to Mary Lee. Compute the number of shares of common stock that Mary Lee received when she converted.

Mary Lee owned 500 shares of Dugan Company's convertible preferred stock at $20 par value. She converted each share of preferred stock into four shares of common stock.

Refer to Mary Lee. Compute the number of shares of common stock that Mary Lee received when she converted.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

52

May purchased 500 shares of XYZ stock at $31.45. One year later she sold the 500 shares at $26.97. She paid a transaction fee of $19.95 for each transaction. What was her gain or loss on the sale?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

53

Stock Listing

Use the following stock listing to answer the questions.

Refer to Stock Listing. What is the rate of yield for the EXN stock? (Round to nearest tenth of a percent.)

Use the following stock listing to answer the questions.

Refer to Stock Listing. What is the rate of yield for the EXN stock? (Round to nearest tenth of a percent.)

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

54

Stock Listing

Use the following stock listing to answer the questions.

Refer to Stock Listing. What was the closing price of the previous day?

Use the following stock listing to answer the questions.

Refer to Stock Listing. What was the closing price of the previous day?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

55

Bob Wright

Bob Wright owned 100 shares of Lawson Company's convertible preferred stock at $10 par value. He converted each share of preferred stock into three shares of common stock.

Refer to Bob Wright. If Bob Wright paid $10 per share for his preferred stock, and if common stock was selling at $4 per share on the date of conversion, compute the amount that Bob Wright's investment increased in value.

Bob Wright owned 100 shares of Lawson Company's convertible preferred stock at $10 par value. He converted each share of preferred stock into three shares of common stock.

Refer to Bob Wright. If Bob Wright paid $10 per share for his preferred stock, and if common stock was selling at $4 per share on the date of conversion, compute the amount that Bob Wright's investment increased in value.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

56

Kelly Jordan

Kelly Jordan owned 220 shares of Diego Company's convertible preferred stock at $50 par value. He converted each share of preferred stock into two shares of common stock.

Refer to Kelly Jordan. If Kelly Jordan paid $50 per share for his preferred stock, and if common stock was selling at $31 per share on the date of conversion, compute the amount that Kelly Jordan's investment increased in value.

Kelly Jordan owned 220 shares of Diego Company's convertible preferred stock at $50 par value. He converted each share of preferred stock into two shares of common stock.

Refer to Kelly Jordan. If Kelly Jordan paid $50 per share for his preferred stock, and if common stock was selling at $31 per share on the date of conversion, compute the amount that Kelly Jordan's investment increased in value.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

57

Kelly Jordan

Kelly Jordan owned 220 shares of Diego Company's convertible preferred stock at $50 par value. He converted each share of preferred stock into two shares of common stock.

Refer to Kelly Jordan. If common stock was selling at $31 per share on the date of conversion, compute Kelly Jordan's common stock worth.

Kelly Jordan owned 220 shares of Diego Company's convertible preferred stock at $50 par value. He converted each share of preferred stock into two shares of common stock.

Refer to Kelly Jordan. If common stock was selling at $31 per share on the date of conversion, compute Kelly Jordan's common stock worth.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

58

Stock Listing

Use the following stock listing to answer the questions.

Refer to Stock Listing. How many shares were sold?

Use the following stock listing to answer the questions.

Refer to Stock Listing. How many shares were sold?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

59

Kelly Jordan

Kelly Jordan owned 220 shares of Diego Company's convertible preferred stock at $50 par value. He converted each share of preferred stock into two shares of common stock.

Patrick Harrigan owned 200 shares of Marsh Company's convertible preferred stock at $12 par value. He converted each share of preferred stock into two shares of common stock. If the convertible preferred stock paid 8% annually and the common stock pays $0.60 a share this year, how much more dividend will Patrick Harrigan receive this year because of his conversion.

Kelly Jordan owned 220 shares of Diego Company's convertible preferred stock at $50 par value. He converted each share of preferred stock into two shares of common stock.

Patrick Harrigan owned 200 shares of Marsh Company's convertible preferred stock at $12 par value. He converted each share of preferred stock into two shares of common stock. If the convertible preferred stock paid 8% annually and the common stock pays $0.60 a share this year, how much more dividend will Patrick Harrigan receive this year because of his conversion.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

60

Mary Lee

Mary Lee owned 500 shares of Dugan Company's convertible preferred stock at $20 par value. She converted each share of preferred stock into four shares of common stock.

Refer to Mary Lee. If common stock was selling at $50 per share on the date of conversion, compute Mary Lee's common stock worth.

Mary Lee owned 500 shares of Dugan Company's convertible preferred stock at $20 par value. She converted each share of preferred stock into four shares of common stock.

Refer to Mary Lee. If common stock was selling at $50 per share on the date of conversion, compute Mary Lee's common stock worth.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

61

John purchased 400 shares of MTC stock at 30.50. One year later she sold the 400 shares at 25.75. She paid a transaction fee of $19.95 for each transaction. What was her gain or loss on the sale?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

62

Marge Brown bought 200 shares of Kenworth $50 par 7% preferred stock at the current market price of $58 per share. What is her rate of yield if Kenworth pays the regular dividend for the year?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

63

Parliament Corporation

Parliament Corporation's capital consists of 25,000 shares of $100 par 8% preferred stock and 75,000 shares of no-par common stock. The board of directors declared a dividend of $293,750.

Refer to Parliament Corporation. Calculate the dividend per share for preferred stock.

Parliament Corporation's capital consists of 25,000 shares of $100 par 8% preferred stock and 75,000 shares of no-par common stock. The board of directors declared a dividend of $293,750.

Refer to Parliament Corporation. Calculate the dividend per share for preferred stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

64

Parliament Corporation

Parliament Corporation's capital consists of 25,000 shares of $100 par 8% preferred stock and 75,000 shares of no-par common stock. The board of directors declared a dividend of $293,750.

Refer to Parliament Corporation. Calculate the dividend per share for common stock.

Parliament Corporation's capital consists of 25,000 shares of $100 par 8% preferred stock and 75,000 shares of no-par common stock. The board of directors declared a dividend of $293,750.

Refer to Parliament Corporation. Calculate the dividend per share for common stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

65

Beth Martin bought 300 shares of Alpha $50 par 6% preferred stock at the current market price of $59 per share. What is her rate of yield if Alpha pays the regular dividend for the year?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

66

Paula Jones bought 400 shares of Smartlook $55 par 7% preferred stock at the current market price of $60 per share. What is her rate of yield if Smartlook pays the regular dividend for the year?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck