Deck 11: Dividends: Past, present, and Future

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/39

Play

Full screen (f)

Deck 11: Dividends: Past, present, and Future

1

The liquidation of a corporation is not subject to federal capital gains taxation.

False

2

The price of a stock generally adjusts downward for the distribution of dividends.

True

3

The payout ratio is dividends divided by earnings.

True

4

Managements are often reluctant to reduce dividends because reductions may be viewed as indicating financial weakness.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

5

A two-for-one stock split doubles the number of shares and their price.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

6

Dividend increases usually occur prior to an increase in earnings.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

7

Earnings retention facilitates the firm's growth in assets.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

8

Stock dividends reduce the firm's total equity.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

9

A higher payout ratio implies a lower growth rate.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

10

The ex-dividend date follows the date of record.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

11

A major advantage associated with dividend reinvestment plans is forced saving.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

12

Cash dividends are subject to federal income taxes.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

13

Academic studies often suggest that stock splits do not increase the value of the firm.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

14

A one-for-two reverse split increases the price of the stock.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

15

Dividend reinvestment plans are a means to postpone federal income tax on dividends.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

16

Stock dividends increase the firm's cash.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

17

Firms in cyclical industries may supplement regular dividends with extra dividends.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

18

If an investor buys stock on the ex-dividend date,that individual will not receive the dividend.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

19

Repurchases of shares may be viewed as an alternative to paying cash dividends.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

20

Stock splits and stock dividends increase the earning capacity of the firm.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

21

Cash dividends

1)are paid from earnings

2)increase the capacity of the firm to grow

3)reduce the firm's assets

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

1)are paid from earnings

2)increase the capacity of the firm to grow

3)reduce the firm's assets

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following occurs when a 10 percent stock dividend is paid?

A) the firm's retained earnings decrease

B) the firm's equity is increased

C) the stock's par value is decreased

D) the stock's price is increased

A) the firm's retained earnings decrease

B) the firm's equity is increased

C) the stock's par value is decreased

D) the stock's price is increased

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

23

If a firm has substantial excess cash,it may

1)repurchase some of its shares

2)increase its cash dividends

3)increase its liabilities

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) only 2

1)repurchase some of its shares

2)increase its cash dividends

3)increase its liabilities

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) only 2

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

24

A firm's stock sells for $100 a share.What will be the price after a

a.two-for-one split

b.four-for-one split

c.one-for-two reverse split?

a.two-for-one split

b.four-for-one split

c.one-for-two reverse split?

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

25

Dividend policy depends on

1)the firm's earnings

2)investment opportunities available to the firm

3)corporate income taxes

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

1)the firm's earnings

2)investment opportunities available to the firm

3)corporate income taxes

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

26

If a firm's dividend has grown from $1 to $2 in ten years,the annual rate of growth is 10 percent.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

27

Dividend reinvestment plans offer which advantages?

1)deferment of federal income taxes

2)a convenient means to accumulate shares

3)dollar-cost averaging

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) only 2

1)deferment of federal income taxes

2)a convenient means to accumulate shares

3)dollar-cost averaging

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) only 2

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

28

Stock dividends increase

A) the number of shares outstanding

B) the firm's assets

C) the firm's equity

D) the stock's price

A) the number of shares outstanding

B) the firm's assets

C) the firm's equity

D) the stock's price

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

29

The procedure for the distribution of dividends does not include

A) the ex-dividend date

B) the date of record

C) the settlement date

D) the date of announcement

A) the ex-dividend date

B) the date of record

C) the settlement date

D) the date of announcement

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following occurs when a stock is split two-for-one?

A) the price of the stock doubles

B) the firm's assets increase

C) the firm's liabilities decrease

D) the par value of the stock is reduced

A) the price of the stock doubles

B) the firm's assets increase

C) the firm's liabilities decrease

D) the par value of the stock is reduced

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

31

Stock dividends cause

A) the price of a share of stock to rise

B) the price of a share of stock to fall

C) the value of the firm to rise

D) the value of the firm to fall

A) the price of a share of stock to rise

B) the price of a share of stock to fall

C) the value of the firm to rise

D) the value of the firm to fall

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

32

If a firm is liquidated,

1)it ceases to exist

2)stockholders receive the firm's assets after liabilities are paid

3)stockholders pay any applicable capital gains taxes

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

1)it ceases to exist

2)stockholders receive the firm's assets after liabilities are paid

3)stockholders pay any applicable capital gains taxes

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

33

Historical growth rates are useful for stock valuation only to the extent they help forecast the future growth in dividends.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

34

Dividend growth rates may be estimated using

A) return on assets

B) the ratio of debt to assets

C) regression analysis

D) present value of an annuity interest factors

A) return on assets

B) the ratio of debt to assets

C) regression analysis

D) present value of an annuity interest factors

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

35

The future value of an annuity may be used to help estimate a firm's historical growth rate.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

36

Regression analysis estimates the rate of growth in dividends by considering the starting and ending dividend paid by the firm.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

37

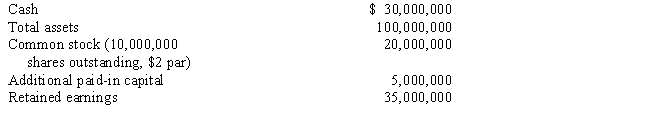

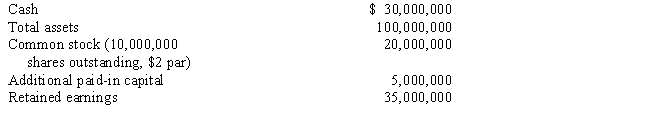

A firm's balance sheet has the following entries:

What will be each of these balance sheet entries after a

What will be each of these balance sheet entries after a

What will be each of these balance sheet entries after a

What will be each of these balance sheet entries after a

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

38

Averaging positive and negative percentage changes biases the rate of return the investor earns.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

39

If a firm repurchases its stock,

A) selling stockholders avoid capital gains taxes

B) the firm's holdings of cash are increased

C) earnings per share are increased

D) debt financing decreases

A) selling stockholders avoid capital gains taxes

B) the firm's holdings of cash are increased

C) earnings per share are increased

D) debt financing decreases

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck