Deck 23: Investing in Nonfinancial Assets: Collectibles, resources, and Real Estate

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/62

Play

Full screen (f)

Deck 23: Investing in Nonfinancial Assets: Collectibles, resources, and Real Estate

1

The value of gold coins depends on their scarcity and their gold content.

True

2

Investing in collectibles avoids many of the costs (e.g.,commissions,the spread)associated with investing in stocks.

False

3

Anticipation of inflation is an important reason for investing in collectibles.

True

4

Collectibles may be sold by dealers on consignment.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

5

Gold options and futures offer investors a means to leverage positions in gold.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

6

The Canadian Maple Leaf is a pure silver coin.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

7

Investors should specialize in a type of collectible in order to know what may appreciate in value.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

8

The price of gold rises during inflationary periods.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

9

The elasticity of supply refers to the responsiveness of the quantity supplied to a change in price.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

10

Changes in the price of gold are often related to the anticipation of inflation.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

11

Collectibles are bought and sold in organized markets like the New York Stock Exchange.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

12

One reason for investing in gold and collectibles is their possible impact on the diversification of the investor's portfolio.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

13

Many commemorative gold coins initially are sold for a premium above from the value of their gold content.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

14

An investment in timber may be attractive if the quantity supplied is elastic with respect to a change in demand.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

15

Since collectibles may be traced,the investor does not have to be concerned with theft.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

16

Fakes of collectibles,such as rare stamps,are one possible source of risk.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

17

Commissions on art works at major auction houses are less than 5 percent of the value of the asset.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

18

Gold's general acceptability as a currency makes it a good store of value.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

19

Who previously owned a painting may affect its value.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

20

Investing in collectibles legally avoids paying capital gains taxes.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

21

People who rent do not receive the same federal income tax deductions as those who own homes.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

22

Individuals who own a home may deduct property taxes for the purposes of computing taxable income.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

23

An equity trust does not use financial leverage (i.e.,its financing is entirely equity).

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

24

The shares of hedge funds are often included in an individual investor's IRAs.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

25

A mortgage trust is a REIT that specializes in mortgage loans.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

26

FHA mortgages are insured by state governments.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

27

A hedge fund is a conservative type of mutual fund.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

28

A fixed interest rate mortgage exposes the homeowner to fluctuations in home prices.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

29

Real estate investment trusts (REITs)are illustrative of a closed-end investment company.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

30

Investments in properties,such as an apartment,may generate cash flow that is not subject to federal income tax.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

31

The cash flow generated by an investment in rental properties must be reinvested in the properties in order to receive favorable income tax treatment.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

32

The valuation of land depends on its potential for future use (e.g.,development).

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

33

The effective interest cost of home ownership depends on the individual's tax bracket.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

34

Fluctuations in interest rates have little impact on the value of REIT shares.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

35

The shares of hedge funds are registered with the SEC.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

36

While rental properties may operate at a loss,they may produce a positive cash flow.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

37

When rental property is depreciated,the cost basis of the property is reduced.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

38

The tax treatment of owners of condominiums is the same as the tax treatment applied to homeowners.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

39

The value of a REIT's shares depends on future dividends and the investor's required rate of return.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

40

The cash flow generated by REITs is taxed as income by the federal government.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is not a consideration for investing in real estate investment trusts (REITs)?

A) fluctuations in dividend payments

B) excessive use of debt financing by some REITs

C) fluctuating interest rates affecting securities valuations

D) the federal tax rate paid by the trust

A) fluctuations in dividend payments

B) excessive use of debt financing by some REITs

C) fluctuating interest rates affecting securities valuations

D) the federal tax rate paid by the trust

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

42

Sources of risk to investors purchasing collectibles include 1.fraud

2)theft

3)market fluctuations

4)Interest in collectibles as an investment increases during periods of

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

2)theft

3)market fluctuations

4)Interest in collectibles as an investment increases during periods of

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

43

Collectibles offer

A) potential price appreciation

B) monetary income

C) liquidity

D) safety of principal

A) potential price appreciation

B) monetary income

C) liquidity

D) safety of principal

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

44

If an investor expected the price of gold to fall,that individual should consider which of the following strategies? 1.sell a gold call

2)buy a gold call

3)sell a gold put

4)buy a gold put

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

2)buy a gold call

3)sell a gold put

4)buy a gold put

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

45

A hedge fund

A) is a public financial institution

B) has its shares registered with the Federal Reserve

C) is open to a select number of individual investors

D) has actively traded shares

A) is a public financial institution

B) has its shares registered with the Federal Reserve

C) is open to a select number of individual investors

D) has actively traded shares

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

46

The cost of investing in collectibles may include 1.insurance

2)the spread between the bid and ask

3)commissions

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

2)the spread between the bid and ask

3)commissions

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

47

If the supply of timber is inelastic that means

A) the quantity demanded does not respond to a change in supply

B) the quantity supplied responds to a change in demand

C) the quantity demanded responds to a change in supply

D) the quantity supplied does not respond to a change in price

A) the quantity demanded does not respond to a change in supply

B) the quantity supplied responds to a change in demand

C) the quantity demanded responds to a change in supply

D) the quantity supplied does not respond to a change in price

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

48

The true (effective)cost of a mortgage loan depends on the

A) individual's marginal tax rate

B) capital gains tax rate

C) individual's need to borrow

D) cost of the home

A) individual's marginal tax rate

B) capital gains tax rate

C) individual's need to borrow

D) cost of the home

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

49

Hedge funds follow investment strategies such as

A) acquiring shares in mutual funds

B) shorting "overvalued" stocks while buying "undervalued" stocks

C) limiting their portfolios to money market instruments

D) underwriting new issues (IPOs)

A) acquiring shares in mutual funds

B) shorting "overvalued" stocks while buying "undervalued" stocks

C) limiting their portfolios to money market instruments

D) underwriting new issues (IPOs)

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

50

Risks associated with home ownership may include 1.excessive use of financial leverage

2)fluctuations in home values

3)possible theft and fire

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

2)fluctuations in home values

3)possible theft and fire

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

51

Sources of risk to investments in rental properties include

1)increased vacancy rates

2)fluctuations in depreciation expenses

3)excessive use of debt financing

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

1)increased vacancy rates

2)fluctuations in depreciation expenses

3)excessive use of debt financing

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

52

Hedge funds are primarily open to high net worth investors and financial institutions such as pension plans.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

53

Purchasers of gold futures contracts

A) do not have to meet margin requirements

B) run the risk of government intervention altering the supply and demand for gold

C) are considered to be unleveraged positions

D) have less speculative positions

A) do not have to meet margin requirements

B) run the risk of government intervention altering the supply and demand for gold

C) are considered to be unleveraged positions

D) have less speculative positions

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

54

Hedge fund strategies may include buying one stock while shorting another.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

55

Condominiums may be preferred to homes because they

A) receive special tax treatment

B) have no maintenance costs

C) may be financed through the use of debt

D) offer the convenience of renting and the tax advantages of home ownership

A) receive special tax treatment

B) have no maintenance costs

C) may be financed through the use of debt

D) offer the convenience of renting and the tax advantages of home ownership

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

56

Deductible homeowner expenses include

A) improvements

B) fire insurance

C) sales tax on purchases for the home

D) property taxes

A) improvements

B) fire insurance

C) sales tax on purchases for the home

D) property taxes

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

57

Depreciation of real estate

A) allocates the cost of the real estate over time

B) is a cash expense covering required maintenance

C) reduces profits and cash flow

D) increases the property's value

A) allocates the cost of the real estate over time

B) is a cash expense covering required maintenance

C) reduces profits and cash flow

D) increases the property's value

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

58

A real estate investment trust

A) pays federal income taxes

B) retains all of its earnings

C) invests in mortgages or rental properties

D) cannot use debt financing

A) pays federal income taxes

B) retains all of its earnings

C) invests in mortgages or rental properties

D) cannot use debt financing

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

59

The value of a gold coin depends on its 1.rarity

2)gold content

3)tax advantages

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

2)gold content

3)tax advantages

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

60

Interest in collectibles as an investment increases during periods of

A) recession

B) economic growth

C) deflation

D) inflation

A) recession

B) economic growth

C) deflation

D) inflation

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

61

A newly married couple bought a house for $25,000 in 1975.They sold the house for $99,000 in 2000.What was the annual rate of growth in the value of the house? Did the house appreciate more rapidly than if they had invested $25,000 in a savings account that paid 5 percent?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

62

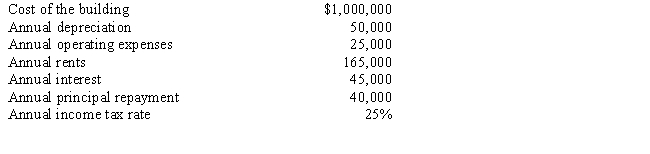

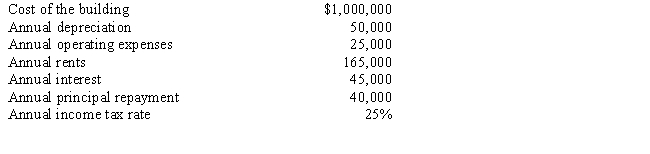

You are considering acquiring a building and have estimated the following data:

Based on this information,what are the estimated net income and funds from operations? Why are the two estimates different?

Based on this information,what are the estimated net income and funds from operations? Why are the two estimates different?

Based on this information,what are the estimated net income and funds from operations? Why are the two estimates different?

Based on this information,what are the estimated net income and funds from operations? Why are the two estimates different?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck