Deck 11: Capital Investments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/109

Play

Full screen (f)

Deck 11: Capital Investments

1

In what stage of the capital budgeting process do managers determine the investment that yields the best and worse returns to the organization?

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among the alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among the alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

D

2

Working capital refers to the difference between current assets and current liabilities.

True

3

In what stage of the capital-budgeting process do top managers ask marketing managers for potential revenue numbers,plant managers for assembly times,and suppliers for prices and the availability of key components.

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among the alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among the alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

B

4

________ is the process of making long-run planning decisions for investments in projects.

A)Payback

B)Predictions

C)Capital budgeting

D)Initial investment

E)Obtain information

A)Payback

B)Predictions

C)Capital budgeting

D)Initial investment

E)Obtain information

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

5

What is working capital?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

6

Making capital investments is often an arduous task,laden with the purchase of many different goods and services.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

7

When managers make predictions,they forecast all potential cash flows attributable to the alternative projects.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

8

________ measure all expected future cash inflows and outflows of a project discounted back to the present point in time.

A)Income tax

B)Payback period

C)Net present value

D)Internal rate of return

E)Discounted cash flow methods

A)Income tax

B)Payback period

C)Net present value

D)Internal rate of return

E)Discounted cash flow methods

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following terms is not a capital budget method implemented to analyze financial information?

A)IRPN

B)NBV

C)IRR

D)Payback

E)AARR

A)IRPN

B)NBV

C)IRR

D)Payback

E)AARR

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

10

Cutting Edge Concrete (CEC)set the industry standard for high-performance concrete from the company's conception in 2008 until 2012.New environmentally beneficial innovations opened a new marketing arena for concrete manufacturers in 2008,with concrete mixes that reduced pollution caused by traffic.

In Stage I,the project-identification stage,CEC determined that green construction ensured the company remained competitive in industry.

In Stage II,the information-gathering stage,CEC contracted a cost-benefit analysis and cost-effectiveness analysis to measure the effect that adoption of new technology would have on revenue.CEC finds that the after-tax initial investment for the machine is $410,000 and the machines have a useful life of 8 years.Cash inflows are estimated to cost $11,000 and $21,000 from the disposal of old machine is $21,000.

Required

Compute the net initial investment for the machine.

A)$300,000

B)$400,000

C)$500,000

D)$600,000

E)$700,000

In Stage I,the project-identification stage,CEC determined that green construction ensured the company remained competitive in industry.

In Stage II,the information-gathering stage,CEC contracted a cost-benefit analysis and cost-effectiveness analysis to measure the effect that adoption of new technology would have on revenue.CEC finds that the after-tax initial investment for the machine is $410,000 and the machines have a useful life of 8 years.Cash inflows are estimated to cost $11,000 and $21,000 from the disposal of old machine is $21,000.

Required

Compute the net initial investment for the machine.

A)$300,000

B)$400,000

C)$500,000

D)$600,000

E)$700,000

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

11

The ________ calculates the discount rate at which an investment's present value of all expected cash inflows equals the present value of its expected cash outflows.

A)income tax

B)payback period

C)required rate-of-return

D)internal rate-of-return

E)discounted cash flow methods

A)income tax

B)payback period

C)required rate-of-return

D)internal rate-of-return

E)discounted cash flow methods

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

12

The net present value criterion (NPV)specifies that a manager should choose a project if ________.

A)the annuity factor for five periods is positive

B)the sum of its discounted cash flow is negative

C)the costs are in line with expectations

D)the sum of its discounted cash flow is positive

E)the rate of return equals or exceeds the sum of its discounted cash flow

A)the annuity factor for five periods is positive

B)the sum of its discounted cash flow is negative

C)the costs are in line with expectations

D)the sum of its discounted cash flow is positive

E)the rate of return equals or exceeds the sum of its discounted cash flow

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

13

In what stage of the capital-budgeting process do managers make the investment and track realized cash flows?

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among the alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among the alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

14

Exclusive Golfing Supplies (EGS),an outdoor golfing equipment producer that specializes in personalized,precision golf clubs,engaged in a laboratory analysis to test the newest metallic compounds on the market.In Stage I,the project-identification stage,EGS learned of a new compound that is expected to increase the precision and improve the quality of golf clubs.In Stage II,the information-gathering stage,the cost of new machinery and training is computed to produce materials associated with the new technology.The results of the analysis revealed $580,000 the cost of new machinery and $16,000 total training gear to run the new machines.The managerial accountant reported that the cash flow from the disposal of the current equipment is $42,000.

Required

Compute the net initial investment of the new machine.

A)$560,000

B)$554,000

C)$610,00

D)$570,000

E)$590,000

Required

Compute the net initial investment of the new machine.

A)$560,000

B)$554,000

C)$610,00

D)$570,000

E)$590,000

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

15

In what stage of the capital budgeting process do managers forecast all potential cash flows attributable to the alternative projects?

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

16

What is the first step of the internal rate-of-return (IRR)method?

A)Compute a sensitivity analysis.

B)Ignore the discount rate in the NPV computation.

C)Calculate the net initial investment.

D)Use a discount rate and calculate the project's NPV.

E)Calculate the payback period.

A)Compute a sensitivity analysis.

B)Ignore the discount rate in the NPV computation.

C)Calculate the net initial investment.

D)Use a discount rate and calculate the project's NPV.

E)Calculate the payback period.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

17

In what stage of the capital budgeting process do managers identify potential capital investments that agree with the organization's strategy?

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

18

The minimum acceptable annual rate of return on an investment is referred to as the _________.

A)income tax

B)payback period

C)required rate-of-return

D)internal rate-of-return

E)discounted cash flow methods

A)income tax

B)payback period

C)required rate-of-return

D)internal rate-of-return

E)discounted cash flow methods

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

19

Managers use capital budgeting as a decision-making and a control tool.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

20

A key feature of the discounted cash flow (DCF)method is ________.

A)operating income as determined by accrual accounting

B)investment in working capital

C)the time value of money

D)net after-tax initial investments

E)equity and debt securities

A)operating income as determined by accrual accounting

B)investment in working capital

C)the time value of money

D)net after-tax initial investments

E)equity and debt securities

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

21

Projects with longer payback periods provide managers more flexibility because funds for other projects become available later.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

22

The ________ calculates the amount of time required for the discounted expected future cash flows to recoup the net initial investment in a project.

A)internal rate of return

B)discounted payback method

C)opportunity cost of capital

D)net present value method

E)accrual accounting rate-or-return

A)internal rate of return

B)discounted payback method

C)opportunity cost of capital

D)net present value method

E)accrual accounting rate-or-return

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

23

What values are necessary in order to calculate a payback period with a project that has uniform cash flows?

A)Net initial investment and non-uniform cash inflows.

B)Net initial investment and uniform increase in annual future cash flows.

C)Net initial investment and cutoff period.

D)Net initial investment and discounted expected future cash flows.

E)Net initial investment and non-uniform cash outflows.

A)Net initial investment and non-uniform cash inflows.

B)Net initial investment and uniform increase in annual future cash flows.

C)Net initial investment and cutoff period.

D)Net initial investment and discounted expected future cash flows.

E)Net initial investment and non-uniform cash outflows.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

24

The two DCF methods used to describe are the net present value (NPV)method and the internal rate-of-return method (IRR).

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

25

In accrual-accounting,sales made on credit cards,or other noncash expenses,are not included in NPV.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

26

When computing the payback method,cash flows are ________,with no adjustment to compensate the time value of money.

A)added

B)divided

C)multiplied

D)subtracted

E)disregarded

A)added

B)divided

C)multiplied

D)subtracted

E)disregarded

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

27

Similar to the NPV and IRR,the payback method does not distinguish among the sources of cash flows from operations,purchase and sale of equipment,or in the investment or recovery of working capital.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

28

What are the weaknesses of the payback method?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is not true about the discounted payback method?

A)Incorporates the time value of money.

B)Does not incorporate the time value of money.

C)Cash flows beyond the discounted payback period are ignored.

D)A bias toward projects with high short-run cash flows occur.

E)Companies value it because they believe long-run cash flows are unpredictable in high-growth industries.

A)Incorporates the time value of money.

B)Does not incorporate the time value of money.

C)Cash flows beyond the discounted payback period are ignored.

D)A bias toward projects with high short-run cash flows occur.

E)Companies value it because they believe long-run cash flows are unpredictable in high-growth industries.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

30

Managers solving capital budgeting problems typically use a calculator,or a computer program,to provide the internal rate of return.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

31

The manager at Shriver Industrial,a laundry detergent manufacturer,needs to purchase a new machine.The net initial investment of the plan is $291,000.The machine is expected to generate $80,000 in uniform cash flow each year and it has a five-year expected useful life.

Required

Compute the payback period.

A)4.8 years

B)2.5 years

C)3.6 years

D)4.0 years

E)3.5 years

Required

Compute the payback period.

A)4.8 years

B)2.5 years

C)3.6 years

D)4.0 years

E)3.5 years

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

32

Managers prefer projects with ________ payback periods.

A)equal

B)shorter

C)longer

D)infinite

E)solvent

A)equal

B)shorter

C)longer

D)infinite

E)solvent

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

33

Is the payback method affected by accrual accounting methods,for example,depreciation?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

34

The ________ measures the time it will take to recoup,in the form of expected future cash flows,the net initial investment in a project.

A)income tax

B)payback method

C)net present value

D)internal rate of return

E)external rate of return

A)income tax

B)payback method

C)net present value

D)internal rate of return

E)external rate of return

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

35

The managerial accountant at Insider Technology Organization,a medical imaging company,considers the purchase of a new machine to increase the efficiency in the image division.The existing machine is operable for 4 more years and it will have a disposal price of $0.If the current machine is sold now it will be worth $75,000.The cost of the new machine is $250,000 and an additional cash investment of working capital of $25,000 is needed.

The manager expects the new machine to reduce the time needed to take each image,and it will improve the green energy environmental initiatives because it is more efficient.The new machine is expected to net $50,000 in additional cash inflows during the year of acquisition and $75,000 each additional year of use.

The new machine has a five-year life and $0 disposal value.The cash flows will be recognized at the end of each year.The income taxes are not considered,and the investment in working capital is not expected to be recovered at the end of the machine's useful years.

Required

Compute the net present value of the investment,assuming the required rate of return is 12%.Would the manager at the company want to purchase the new machine?

A)($21,116);No.

B)($42,184);No.

C)$42,184;Yes.

D)$48,362;Yes.

E)$96,742;Yes.

The manager expects the new machine to reduce the time needed to take each image,and it will improve the green energy environmental initiatives because it is more efficient.The new machine is expected to net $50,000 in additional cash inflows during the year of acquisition and $75,000 each additional year of use.

The new machine has a five-year life and $0 disposal value.The cash flows will be recognized at the end of each year.The income taxes are not considered,and the investment in working capital is not expected to be recovered at the end of the machine's useful years.

Required

Compute the net present value of the investment,assuming the required rate of return is 12%.Would the manager at the company want to purchase the new machine?

A)($21,116);No.

B)($42,184);No.

C)$42,184;Yes.

D)$48,362;Yes.

E)$96,742;Yes.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

36

Is the IRR method always accurate?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is not an advantage of the NPV method?

A)Expresses computations in dollars.

B)Expresses computations in percentages.

C)The NPV of a project is expressed as a unique number.

D)Can be used when the IRR varies over the life of a project.

E)The manager makes accurate assessments of final decision to accept or reject project.

A)Expresses computations in dollars.

B)Expresses computations in percentages.

C)The NPV of a project is expressed as a unique number.

D)Can be used when the IRR varies over the life of a project.

E)The manager makes accurate assessments of final decision to accept or reject project.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

38

How do managers compensate for the time value of money when they use the payback method?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

39

In-a-Jiff Tire Service owner,Jeffery Haberton,has the opportunity to invest $360,000 at 8% interest during a one-year period.After the first year,the value of the investment is expected to be $28,800.According to the time value of money,how much would the same $360,000 be worth in one year if it is not invested at 8%?

A)$300,000

B)$308,000

C)$333,333

D)$346,800

E)$360,000

A)$300,000

B)$308,000

C)$333,333

D)$346,800

E)$360,000

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

40

Why do managers use the net present value (NPV)method?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

41

The manager at the Key Factory purchased a new key-fitting machine at the plant in Delaware.The net investment is $450,000 and the expected average annual after-tax operating cash inflows of $122,000.The new machine results in depreciation deductions of $80,000 per year ($100,000 in annual depreciation for the new machine relative to $20,000 per year on the existing machine).The increase in expected annual after-tax income?

Required

Compute the AARR.

A)9%

B)11%

C)13%

D)15%

E)17%

Required

Compute the AARR.

A)9%

B)11%

C)13%

D)15%

E)17%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

42

The ________ divides the average annual income of a project by a measure of the investment in it.

A)real rate of return

B)nominal rate of return

C)discounted payback method

D)discounted cash flow method

E)accrual accounting rate of return (AARR)

A)real rate of return

B)nominal rate of return

C)discounted payback method

D)discounted cash flow method

E)accrual accounting rate of return (AARR)

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

43

The manager at Nielson's Paper purchased a new upgraded machine with an initial investment of $409,000 and forecasted an increase in expected average annual after-tax operating income of $34,400.

Required

Compute the accrual accounting rate of return (AARR).

A)AARR=0.065,or 6.5% per year

B)AARR=0.074,or 7.4%per year

C)AARR=0.056,or 5.6% per year

D)AARR=0.084,or 8.4% per year

E)AARR=0.102,or 10.2% per year

Required

Compute the accrual accounting rate of return (AARR).

A)AARR=0.065,or 6.5% per year

B)AARR=0.074,or 7.4%per year

C)AARR=0.056,or 5.6% per year

D)AARR=0.084,or 8.4% per year

E)AARR=0.102,or 10.2% per year

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

44

The managerial accountant at Reverse Manufacturing needs to evaluate two machines and use the payback period.The cash inflows per year are $120,000.

Required

Use the payback Method to compute the useful life for Machine 1 and Machine 2.What is the problem with the payback period method if the cutoff point is 3 years? Show all work.

Required

Use the payback Method to compute the useful life for Machine 1 and Machine 2.What is the problem with the payback period method if the cutoff point is 3 years? Show all work.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

45

The ________ method calculates return using operating-income numbers after considering accruals and taxes.

A)IR

B)IRR

C)AARR

D)hurdle rate

E)cost of capital

A)IR

B)IRR

C)AARR

D)hurdle rate

E)cost of capital

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

46

The manager at Northern Neck Manufacturing reported a need to purchase a new machine to clean and process fresh shrimp.In its simple form,the average investment is calculated as the arithmetic mean of the net initial investment at $650,000 and a net terminal cash flow of $24,000.The managerial accountant reports that the net terminal value of the new machine is $0,plus the net terminal amount of working capital is $24,000.The increase in expected annual after-tax income is expected at $34,000.

Required

Compute the average investment over 5 years.Compute the AARR on average investment.

Required

Compute the average investment over 5 years.Compute the AARR on average investment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

47

The AARR method considers income earned ________ a project's expected useful life.

A)before

B)during

C)throughout

D)forecasted

E)predicted

A)before

B)during

C)throughout

D)forecasted

E)predicted

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

48

How is the AARR method different,compared to the payback method?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

49

The manager at Starfish Manufacturing purchased a new machine with an upgraded feature with an investment of $285,000.The manager forecasted an increase in expected average annual after-tax operating income of $46,000.

Required

Compute the accrual accounting rate of return (AARR).

A)15.14%

B)16.14%

C)17.14%

D)18.14%

E)19.14%

Required

Compute the accrual accounting rate of return (AARR).

A)15.14%

B)16.14%

C)17.14%

D)18.14%

E)19.14%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

50

The ________ method calculates return using after-tax cash flows and the time value of money.

A)IR

B)IRR

C)AARR

D)hurdle rate

E)cost of capital

A)IR

B)IRR

C)AARR

D)hurdle rate

E)cost of capital

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

51

Jim's Renovation Services need to purchase a new super hydraulic machine to complete a new job.The initial investment on the machine is $250,000.The machine is expected to generate $130,000 in uniform cash flow each year and it has a five-year expected life.

Required

Compute the payback period.

A)1 year

B)1.25 years

C)1.68 years

D)1.92 years

E)1.98 years

Required

Compute the payback period.

A)1 year

B)1.25 years

C)1.68 years

D)1.92 years

E)1.98 years

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

52

Because cash flows and time value of money are central to capital budgeting decisions,managers regard the AARR method as better than the IRR method.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

53

The payback method ignores cash flows after the payback period.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

54

Managers consider projects acceptable if the AARR exceeds a specified hurdle required rate of return.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

55

Unlike the payback method,which ignores cash flows after the payback period,the AARR method considers income earned throughout a project's expected useful life.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

56

When managers calculate the accrual accounting rate of return (AARR),what values should be used?

A)The initial investment and the project's expected useful life.

B)The discount rate and the net initial investment.

C)The NPV and the IRR.

D)The non-uniform cash flows and the net initial investment.

E)The after-tax operating income and the net initial investment.

A)The initial investment and the project's expected useful life.

B)The discount rate and the net initial investment.

C)The NPV and the IRR.

D)The non-uniform cash flows and the net initial investment.

E)The after-tax operating income and the net initial investment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

57

Bridgett's Beauty Spa needs to purchase a new extra deluxe machine to implement spa services.The initial investment on this new ultra jacuzzi is $85,000.The machine is expected to generate $65,000 in uniform cash flow each year and it has a five-year expected useful life.

Required

Compute the payback period.

A)1 year

B)1.31 years

C)1.51 years

D)1.61 years

E)1.71 years

Required

Compute the payback period.

A)1 year

B)1.31 years

C)1.51 years

D)1.61 years

E)1.71 years

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is not true about the AARR method?

A)Managers at companies vary in how they compute AARR.

B)There is no uniformed approach to compute the AARR.

C)Managers believe AARR is acceptable if it exceeds the hurdle rate of the AARR.

D)Managers believe AARR is unacceptable if it exceeds the hurdle rate of the AARR.

E)Managers use it to compute the rate-of-return percentage.

A)Managers at companies vary in how they compute AARR.

B)There is no uniformed approach to compute the AARR.

C)Managers believe AARR is acceptable if it exceeds the hurdle rate of the AARR.

D)Managers believe AARR is unacceptable if it exceeds the hurdle rate of the AARR.

E)Managers use it to compute the rate-of-return percentage.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

59

Relevant cash flow in discounted cash analysis:

A)are not used in discounted cash flow analysis.

B)is not a challenge in capital budgeting decisions.

C)are obtained when managers identify only the past costs.

D)are the similarities of the past costs of products and services.

E)are the differences in expected future cash flows between continuing to use an old machine or the decision to use an updated or new machine.

A)are not used in discounted cash flow analysis.

B)is not a challenge in capital budgeting decisions.

C)are obtained when managers identify only the past costs.

D)are the similarities of the past costs of products and services.

E)are the differences in expected future cash flows between continuing to use an old machine or the decision to use an updated or new machine.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

60

Why is the finance theory important when managers use different methods that lead to different ranking of projects?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

61

The manager at Home Manufacturing Center needs to compute the effect of cash operating flows on the net income tax after the investment of a new home repair and design machine.The operating cost inflows from investment in the machine equal $150,000 with a 40% tax rate that resulted in $60,000 income taxes,excluding the effect of depreciation.

Required

Compute the after-tax cash flow from operations.What is the company's net income tax and cash flow from operations if the manager claims an additional deprecation deduction of $50,000 at the 40% tax rate?

A)$75,000;$95,000

B)$65,000;$90,000

C)$50,000;$72,000

D)$80,000;$108,000

E)$90,000;$110,000

Required

Compute the after-tax cash flow from operations.What is the company's net income tax and cash flow from operations if the manager claims an additional deprecation deduction of $50,000 at the 40% tax rate?

A)$75,000;$95,000

B)$65,000;$90,000

C)$50,000;$72,000

D)$80,000;$108,000

E)$90,000;$110,000

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

62

The manager at Harrison's Paper Service needs to assess the net increase in income the company should experience after the investment in a new machine.The operating cash inflows from the investment of $185,000,with an additional depreciation deduction of $111,000.The company is taxed at 40%.

Required

Compute the increase in net income.

A)$56,200

B)$14,300

C)$44,400

D)$32,300

E)$23,500

Required

Compute the increase in net income.

A)$56,200

B)$14,300

C)$44,400

D)$32,300

E)$23,500

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is true about net initial investments?

A)Cash outflows used to purchase plant only.

B)Cash outflows used to purchase equipment only.

C)Cash outflows occur at the end of a project's life.

D)Cash outflows occur at the beginning of a project's life.

E)Excludes the cash outflows to transport and install equipment.

A)Cash outflows used to purchase plant only.

B)Cash outflows used to purchase equipment only.

C)Cash outflows occur at the end of a project's life.

D)Cash outflows occur at the beginning of a project's life.

E)Excludes the cash outflows to transport and install equipment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

64

Gains or losses on the sale of depreciable assets can be taxed at the same rate as ordinary income.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is not an example of an asset related to initial working-capital investments?

A)Inventories.

B)Current asset.

C)Current liability.

D)Accounts receivable.

E)Minus current liability.

A)Inventories.

B)Current asset.

C)Current liability.

D)Accounts receivable.

E)Minus current liability.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

66

In which stage of the capital budgeting process begins the choice to manage the project?

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among the alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

A)Stage 1: Identify projects.

B)Stage 2: Obtain information.

C)Stage 3: Make predictions.

D)Stage 4: Make decisions by choosing among the alternatives.

E)Stage 5: Implement the decision,evaluate performance,and learn.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

67

What do managers need to consider about the after-tax cash flow from the current disposal of an old machine?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

68

The Meredith Organization has an annual cash inflow from operations from its investment in a capital asset of $25,000 each for five years.The corporation's income tax rate is 25%.

Required

Compute the five years total after-tax cash inflow from operations.

A)$90,000

B)$91,450

C)$92,250

D)$93,750

E)$94,250

Required

Compute the five years total after-tax cash inflow from operations.

A)$90,000

B)$91,450

C)$92,250

D)$93,750

E)$94,250

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

69

The Hopewell Factory disposes a capital asset with an original cost of $195,000 and accumulated depreciation of $115,000 for $55,000.The managerial accountant has a tax rate of 40%.

Required

Compute the after-tax cash inflow from the disposal of the capital asset (include proceeds).

A)$45,000

B)$55,000

C)$60,000

D)$65,000

E)$67,200

Required

Compute the after-tax cash inflow from the disposal of the capital asset (include proceeds).

A)$45,000

B)$55,000

C)$60,000

D)$65,000

E)$67,200

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

70

Initial investments in plant and equipment are usually accompanied by additional investments in working capital.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

71

Depreciation costs directly affect cash flows because depreciation is a cash cost.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

72

What is the impact on taxes when the manager sells an asset at a loss?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

73

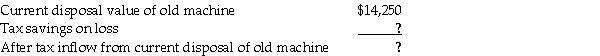

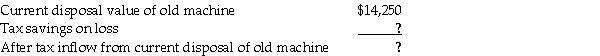

The manager at the Alexandria Environmental Services reported $14,250 as the current disposal value of an old machine.The loss on the disposal of the old machine is $50,000.The tax rate is 42%.The managerial accountant provided the following information:

Alexandria Environmental Service

Required

Compute the tax savings on the loss and the after tax inflow from current disposal of the old machine.Show all work.

Alexandria Environmental Service

Required

Compute the tax savings on the loss and the after tax inflow from current disposal of the old machine.Show all work.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

74

The manager at the Chesapeake Bay Crab House reported a current disposal value of an old fish processing machine at $8,200.The current book value on the old machine is $43,500.

Required

Compute the loss on disposal of the old machine.

A)($22,000)

B)($26,000)

C)($28,500)

D)($31,480)

E)($35,300)

Required

Compute the loss on disposal of the old machine.

A)($22,000)

B)($26,000)

C)($28,500)

D)($31,480)

E)($35,300)

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

75

In performance evaluations,it is important for managers to ensure that the method of evaluation does not conflict with the ________ method for making capital-budgeting decisions.

A)IR

B)IRR

C)NPV

D)AARR

E)IRRR

A)IR

B)IRR

C)NPV

D)AARR

E)IRRR

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is true about initial working-capital investment?

A)Initial investments in plant and equipment are usually accompanied by additional investments in working capital.

B)Initial investments in plant and equipment are never accompanied by additional investments in working capital.

C)Additional investments in working-capital investments are never in the form of a current asset.

D)Investments in initial machines occur at the end of the product's life.

E)Initial investments exclude cash assets.

A)Initial investments in plant and equipment are usually accompanied by additional investments in working capital.

B)Initial investments in plant and equipment are never accompanied by additional investments in working capital.

C)Additional investments in working-capital investments are never in the form of a current asset.

D)Investments in initial machines occur at the end of the product's life.

E)Initial investments exclude cash assets.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

77

The managerial accountant at Fort Story Manufacturing plant reported an annual cash inflow from its investment in a capital asset of $30,000 each year for five years.The corporation's income tax rate is 40%.

Required

Compute the five years total after-tax cash inflow from operations.

A)$70,000

B)$80,000

C)$90,000

D)$100,000

E)$110,000

Required

Compute the five years total after-tax cash inflow from operations.

A)$70,000

B)$80,000

C)$90,000

D)$100,000

E)$110,000

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is not true about postinvestment audits?

A)Postinvestment audit provides managers with feedback about the performance of a project.

B)Managers can compare actual results to the costs and benefits expected at the time of project selection.

C)Optimistic estimates may cause managers to accept a project that they should reject.

D)Optimistic estimates prevent managers from accepting a project that they should reject.

E)Postinvestment audits prevent senior management from identifying problems that could be quickly corrected.

A)Postinvestment audit provides managers with feedback about the performance of a project.

B)Managers can compare actual results to the costs and benefits expected at the time of project selection.

C)Optimistic estimates may cause managers to accept a project that they should reject.

D)Optimistic estimates prevent managers from accepting a project that they should reject.

E)Postinvestment audits prevent senior management from identifying problems that could be quickly corrected.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

79

What is a challenge to managers that implement discounted cash flow (DCF)analysis?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is not true about capital budgeting projects?

A)The building projects in capital-budget projects are less complex.

B)The building projects are more complex in capital-budget projects.

C)The managers engage in postinvestment audits when they implement capital-budget projects.

D)Building projects that involve the purchase of equipment are more complex.

E)Monitoring investment schedules and budgets is critical to success.

A)The building projects in capital-budget projects are less complex.

B)The building projects are more complex in capital-budget projects.

C)The managers engage in postinvestment audits when they implement capital-budget projects.

D)Building projects that involve the purchase of equipment are more complex.

E)Monitoring investment schedules and budgets is critical to success.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck