Deck 4: Job Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

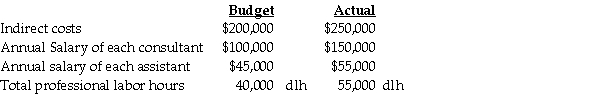

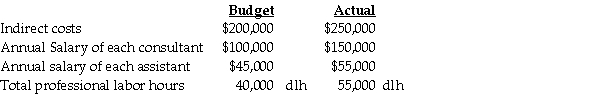

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

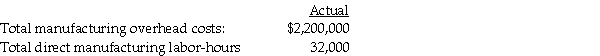

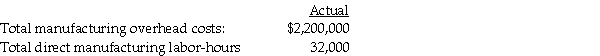

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/127

Play

Full screen (f)

Deck 4: Job Costing

1

The manager at Printing Solutions Company reported that a machine used 1,000 machine-hours.The cost allocation rate is $75 per machine-hour.

Required:

How should the manager allocate this cost?

A)$13.33.

B)$130.

C)$1,000.

D)$1,075.

E)$75,000.

Required:

How should the manager allocate this cost?

A)$13.33.

B)$130.

C)$1,000.

D)$1,075.

E)$75,000.

E

Explanation: E)[($75 × 1,000)] = $75,000

Explanation: E)[($75 × 1,000)] = $75,000

2

A cost allocation base can be either financial or nonfinancial.

True

3

The assignment of indirect costs is:

A)cost allocation.

B)cost tracing.

C)cost assignment.

D)job-costing system.

E)cost allocation base.

A)cost allocation.

B)cost tracing.

C)cost assignment.

D)job-costing system.

E)cost allocation base.

A

4

The cost-application base is referred to as the cost-allocation base when a cost object is a job,product,or customer.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

5

The iMac computer,or the service cost of repairing an iMac computer,are examples of:

A)cost objects.

B)cost assignments.

C)direct costs of a cost object.

D)indirect costs of a cost object.

E)semi-direct costs of a cost object.

A)cost objects.

B)cost assignments.

C)direct costs of a cost object.

D)indirect costs of a cost object.

E)semi-direct costs of a cost object.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

6

The ideal cost-allocation base is:

A)the cost driver of indirect costs.

B)the cost driver of direct costs.

C)the cost driver of variable costs.

D)the cost driver of mixed costs.

E)the cost driver of fixed,mixed,and direct costs.

A)the cost driver of indirect costs.

B)the cost driver of direct costs.

C)the cost driver of variable costs.

D)the cost driver of mixed costs.

E)the cost driver of fixed,mixed,and direct costs.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

7

Managers cost products to guide them in their long-term strategic planning process.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

8

A cost pool is a grouping of individual direct cost items.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

9

A criterion for allocating some costs is the cost object's ________ ________ ________ costs allocated to it.

A)ability to find

B)ability to bear

C)cost-allocation rate

D)direct-costing system

E)indirect-costing system

A)ability to find

B)ability to bear

C)cost-allocation rate

D)direct-costing system

E)indirect-costing system

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

10

Most managers believe that the ideal cost-allocation base is the ________ ________ of the indirect costs,since there is a cause-and-effect relationship between the cost allocation base and the indirect costs.

A)cost base

B)cost driver

C)cost period

D)cost analysis

E)costing systems

A)cost base

B)cost driver

C)cost period

D)cost analysis

E)costing systems

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

11

A systematic way that managers link an indirect cost or group of indirect costs to cost objects is known as:

A)cost period.

B)direct costing.

C)cost management.

D)cost-alteration base.

E)cost-allocation base.

A)cost period.

B)direct costing.

C)cost management.

D)cost-alteration base.

E)cost-allocation base.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

12

Cost pools can range from broad,such as all manufacturing-plant costs,to narrow,such as the costs of operating metal-cutting machines.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

13

Cost pools:

A)are single direct costs.

B)are groups of individual direct cost items.

C)are groups of multiple direct cost items.

D)are groups of multiple indirect cost items.

E)are groups of individual indirect cost items.

A)are single direct costs.

B)are groups of individual direct cost items.

C)are groups of multiple direct cost items.

D)are groups of multiple indirect cost items.

E)are groups of individual indirect cost items.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

14

Costs related to a particular cost object that cannot be traced to that cost object in an economically feasible way is:

A)cost assignment.

B)cost-allocation base.

C)job-costing system.

D)process-costing system.

E)indirect costs of a cost object.

A)cost assignment.

B)cost-allocation base.

C)job-costing system.

D)process-costing system.

E)indirect costs of a cost object.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

15

What are the two types of costing systems that managers use to assign costs to the products or services they offer their consumers?

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

16

The ideal part of a manager's long-term strategic plan is to have revenues exceed:

A)total costs.

B)direct costs.

C)variable costs.

D)indirect costs.

E)preliminary costs.

A)total costs.

B)direct costs.

C)variable costs.

D)indirect costs.

E)preliminary costs.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

17

Anything for which a measurement of costs is desired is a:

A)cost object.

B)cost assignment.

C)cost tracing.

D)cost pooling.

E)cost allocation.

A)cost object.

B)cost assignment.

C)cost tracing.

D)cost pooling.

E)cost allocation.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

18

The specific term for assigning direct costs is:

A)cost pool.

B)cost tracing.

C)cost assignment.

D)job-costing system.

E)cost allocation base.

A)cost pool.

B)cost tracing.

C)cost assignment.

D)job-costing system.

E)cost allocation base.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

19

The Pine Tree Service provides tree services to consumers in the community.The manager reported that the indirect costs were $800,000 to run the log-cutting machine for 15,000 hours.

Required:

Compute the cost allocation rate.

A)$53.33 per machine-hour.

B)$63.33 per machine-hour.

C)$78.50 per machine-hour.

D)$81.50 per machine-hour.

E)$120.00 per machine-hour.

Required:

Compute the cost allocation rate.

A)$53.33 per machine-hour.

B)$63.33 per machine-hour.

C)$78.50 per machine-hour.

D)$81.50 per machine-hour.

E)$120.00 per machine-hour.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

20

The term cost assignment is used to assign only direct costs.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

21

Managers that compare the predicted cost amounts against actual costs to evaluate how well they did on a specific job is an example of which step in the five-step decision-making process?

A)Step 1: Identify the problems with uncertainties.

B)Step 2: Obtain information.

C)Step 3: Make predictions about the future.

D)Step 4: Make decisions by choosing among alternatives.

E)Step 5: Implement the decision,evaluate performance,and learn.

A)Step 1: Identify the problems with uncertainties.

B)Step 2: Obtain information.

C)Step 3: Make predictions about the future.

D)Step 4: Make decisions by choosing among alternatives.

E)Step 5: Implement the decision,evaluate performance,and learn.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

22

Managers that decide on whether or not to bid on a project or how much to bid on a project is an example of which step in the five-step decision-making process?

A)Step 1: Identify the problems with uncertainties.

B)Step 2: Obtain information.

C)Step 3: Make predictions about the future.

D)Step 4: Make decisions by choosing among the alternatives.

E)Step 5: Implement the decision,evaluate performance,and learn.

A)Step 1: Identify the problems with uncertainties.

B)Step 2: Obtain information.

C)Step 3: Make predictions about the future.

D)Step 4: Make decisions by choosing among the alternatives.

E)Step 5: Implement the decision,evaluate performance,and learn.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

23

In the service sector,an example of the job-costing method is movies produced by Universal Studios.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

24

The two underlying reasons that managers use longer time periods,such as a year,to calculate indirect-cost rates are:

A)ability;capability.

B)process systems;evaluation.

C)quality of cost base;systems.

D)job-costing systems;job pools.

E)numerator reason;denominator reason.

A)ability;capability.

B)process systems;evaluation.

C)quality of cost base;systems.

D)job-costing systems;job pools.

E)numerator reason;denominator reason.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

25

In the merchandising sector,an example of an organization that utilizes job costing is a company that sends individual items by mail order.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

26

Per-unit cost is the ________ unit cost.

A)one

B)only

C)simple

D)complex

E)average

A)one

B)only

C)simple

D)complex

E)average

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

27

The benefit of ongoing cost information to manager about jobs is that the information helps managers when they bid on new job opportunities while old jobs are in process.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

28

In the manufacturing sector,the construction of ships at a company is an example of a company that utilizes job costing.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

29

The system that managers do not use too much in organizations today because managers cannot compute costs in a timely manner is:

A)direct costing system.

B)actual costing system.

C)annual costing system.

D)diversified costing system.

E)predetermined costing system.

A)direct costing system.

B)actual costing system.

C)annual costing system.

D)diversified costing system.

E)predetermined costing system.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

30

What are the differences of job-costing compared to process-costing systems?

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

31

Managers use job costing to cost multiple identical units of ________ products.

A)similar

B)unusual

C)identical

D)distinct

E)proprietary

A)similar

B)unusual

C)identical

D)distinct

E)proprietary

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

32

The system that calculates the actual costs of jobs is:

A)direct costing system.

B)actual costing system.

C)annual costing system.

D)diversified costing system.

E)predetermined costing system.

A)direct costing system.

B)actual costing system.

C)annual costing system.

D)diversified costing system.

E)predetermined costing system.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

33

In the service sector,an example of an organization that uses the process-costing method is a bank that uses bank-check clearing systems.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

34

Managers calculate the actual indirect-cost rate by dividing actual annual indirect costs by the actual annual quantity of the cost-allocation base.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

35

Managers that study drawings and engineering specifications provided by a company to make decisions about technical details is an example of which step in the five-step decision-making process?

A)Step 1: Identify the problems with uncertainties.

B)Step 2: Obtain information.

C)Step 3: Make predictions about the future.

D)Step 4: Make decisions by choosing among alternatives.

E)Step 5: Implement the decision,evaluate performance,and learn.

A)Step 1: Identify the problems with uncertainties.

B)Step 2: Obtain information.

C)Step 3: Make predictions about the future.

D)Step 4: Make decisions by choosing among alternatives.

E)Step 5: Implement the decision,evaluate performance,and learn.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

36

Managers never have a problem when they calculate the actual indirect-cost rates on a timely basis,for example each week.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is not a concern to a manager that utilizes the process-costing system?

A)Per-unit cost is average unit cost applied to similar product.

B)Allocates all of the product costs,including materials and labor.

C)The cost object is known as a unit or multiple units of a distinct product.

D)Cost object is masses of identical or similar units of a product or service.

E)To obtain per-unit cost,divide total product costs of identical products by total number or units produced.

A)Per-unit cost is average unit cost applied to similar product.

B)Allocates all of the product costs,including materials and labor.

C)The cost object is known as a unit or multiple units of a distinct product.

D)Cost object is masses of identical or similar units of a product or service.

E)To obtain per-unit cost,divide total product costs of identical products by total number or units produced.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

38

What are the differences associated with the cost pool and the cost-allocation base?

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

39

In job-costing systems,the cost-object is a unit or multiple units of a distinct product or service called a:

A)job.

B)cost.

C)method.

D)process.

E)service.

A)job.

B)cost.

C)method.

D)process.

E)service.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

40

The process costing system is useful to managers when there are masses of identical or similar units of a product or service.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

41

The original record that supports journal entries in an accounting system is the:

A)job sheet.

B)direct costs.

C)indirect costs.

D)source document.

E)direct materials.

A)job sheet.

B)direct costs.

C)indirect costs.

D)source document.

E)direct materials.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

42

Direct material usage can be reported hourly - if the benefits exceed the cost of such frequent reporting.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

43

Westinghouse Company has an opportunity to bid on a new job.The manufacturing cost estimate to bid on the job is $25,000,which yields a markup of 50% over the manufacturing cost.How much should they bid on this project?

A)$12,500

B)$25,000

C)$37,500

D)$50,000

E)$75,000

A)$12,500

B)$25,000

C)$37,500

D)$50,000

E)$75,000

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

44

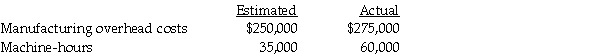

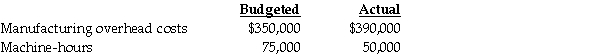

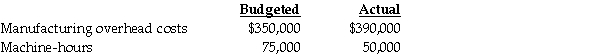

Rachel's Yarn Supply Manufacturing uses machine-hours as the only overhead cost allocation base.In 2012,the accountant reported the following information:

Required:

Using job costing,compute the 2012 budgeted manufacturing overhead rate.

A)$7.14

B)$14.28

C)$28.56

D)$57.12

E)$114.24

Required:

Using job costing,compute the 2012 budgeted manufacturing overhead rate.

A)$7.14

B)$14.28

C)$28.56

D)$57.12

E)$114.24

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

45

Managers order materials with a basic source document called a ________ ________ ________,which contains information about the cost of direct materials used on a specific job and in a specific department.

A)job-cost sheet

B)job-cost record

C)labor-time sheet

D)indirect-cost record

E)materials-requisition record

A)job-cost sheet

B)job-cost record

C)labor-time sheet

D)indirect-cost record

E)materials-requisition record

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

46

Modern information technology provides managers with quick and accurate information,making it easier to manage and control jobs.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

47

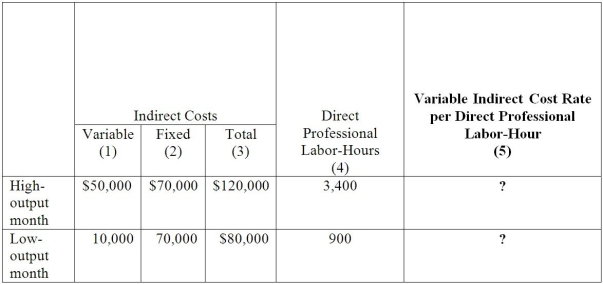

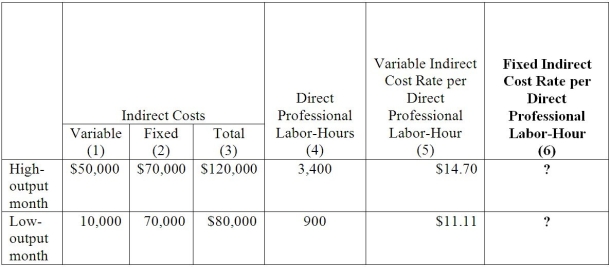

The Meredith Company reported the following information.

Required:

Compute the Variable Indirect Cost Rate per Direct Professional Labor-Hour.

A)$2.00;$.80

B)$14.70;$1.11

C)$147;$111

D)$53,400;$1,111

E)$60,000;1,111.11

Required:

Compute the Variable Indirect Cost Rate per Direct Professional Labor-Hour.

A)$2.00;$.80

B)$14.70;$1.11

C)$147;$111

D)$53,400;$1,111

E)$60,000;1,111.11

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

48

The source document that managers use for direct manufacturing labor,which contains information about the amount of labor time used for a specific job in a specific department is a:

A)job-cost sheet.

B)job-cost record.

C)labor-time sheet.

D)indirect-cost record.

E)material-requisition record.

A)job-cost sheet.

B)job-cost record.

C)labor-time sheet.

D)indirect-cost record.

E)material-requisition record.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

49

The Operations Manager at Mary's Pastry Shoppe requested a machine shop to build a special pastry machine to add extra jellies and sprinkles on their pastries.Mary estimated that the actual annual indirect-costs to make pastries in the new machine are $6,000 and the actual annual quantity of the cost-allocation base is 2,000.Compute the actual indirect-cost rate.

A)$1

B)$2

C)$3

D)$4

E)$5

A)$1

B)$2

C)$3

D)$4

E)$5

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

50

Why do managers have problems when they compute the actual indirect-cost rates when they use the normal costing system on a weekly or monthly basis?

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following describes how managers compute the actual indirect-cost rate?

A)Add actual total indirect costs in the pool to the actual total quantity of the cost-allocation base.

B)Divide actual total indirect costs in the pool by the actual total quantity of the cost-allocation base.

C)Multiply actual indirect costs in the pool by the actual total quantity of the cost-allocation base

D)Subtract actual direct costs in the pool from the actual total quality of the cost-allocation base

E)Subtract actual indirect costs in the pool from the actual quantity of the cost-allocation base

A)Add actual total indirect costs in the pool to the actual total quantity of the cost-allocation base.

B)Divide actual total indirect costs in the pool by the actual total quantity of the cost-allocation base.

C)Multiply actual indirect costs in the pool by the actual total quantity of the cost-allocation base

D)Subtract actual direct costs in the pool from the actual total quality of the cost-allocation base

E)Subtract actual indirect costs in the pool from the actual quantity of the cost-allocation base

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

52

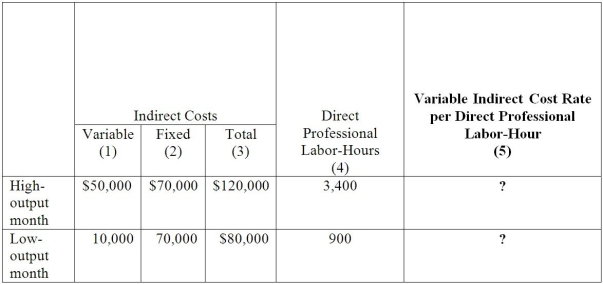

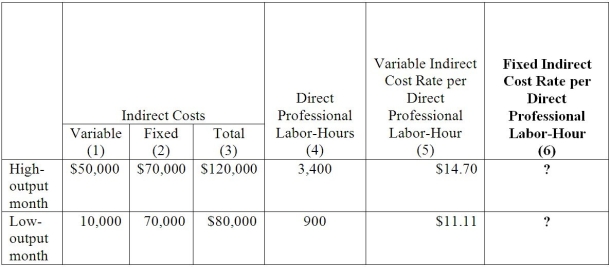

The Meredith Company reported the following information:

Required:

Compute the Fixed Indirect Cost rate per Direct Professional-Labor Hour.

A)$2.58;$.70.

B)$20.58;$77.77

C)$200.58;$79.77

D)$2,000.58;$777.77

E)$2,058.00;$779.77

Required:

Compute the Fixed Indirect Cost rate per Direct Professional-Labor Hour.

A)$2.58;$.70.

B)$20.58;$77.77

C)$200.58;$79.77

D)$2,000.58;$777.77

E)$2,058.00;$779.77

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

53

Managers use the job-cost record (job-cost sheet)to:

A)indicate the type of each product received.

B)record raw material purchases from suppliers.

C)indicate the quantity of each product received.

D)record only manufacturing costs accrued on the job.

E)record and accumulate all costs assigned to a specific job.

A)indicate the type of each product received.

B)record raw material purchases from suppliers.

C)indicate the quantity of each product received.

D)record only manufacturing costs accrued on the job.

E)record and accumulate all costs assigned to a specific job.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

54

Explain why the time-frame is important to managers that implement decisions about indirect-cost rates.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

55

In U.S.government contracting firms,errors in accounting for costs can then lead to overcharging the government and penalties and fines for the companies.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

56

The Frame Shoppe reported that fixed costs remain constant at $450,000 per month.During high-output months variable costs are $315,000,and during the low-output months variable costs are $60,000.What are the high and low indirect-cost rates if budgeted professional labor-hours are 15,000 for high-output months and 1,857 for low-output months?

Required:

Compute the budgeted indirect cost rate for the high-output month and the low-output month.

A)$51 per hour ;$201 per hour

B)$60 per hour;$206 per hour

C)$80 per hour;$210 per hour

D)$85 per hour;$215 per hour

E)$90 per hour;$220 per hour

Required:

Compute the budgeted indirect cost rate for the high-output month and the low-output month.

A)$51 per hour ;$201 per hour

B)$60 per hour;$206 per hour

C)$80 per hour;$210 per hour

D)$85 per hour;$215 per hour

E)$90 per hour;$220 per hour

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

57

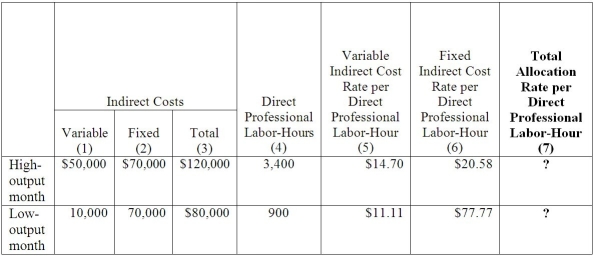

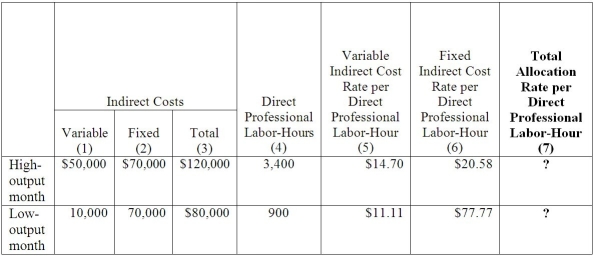

The Meredith Company reported the following information:

Required: Compute the Total Allocation Rate per Direct Professional Labor-Hour.

A)$3.52;$8.88

B)-$35.29;$88.88

C)$352.90;888.88

D)$3,529.90;$8,888.88

E)$35,299.90;$88,888.88

Required: Compute the Total Allocation Rate per Direct Professional Labor-Hour.

A)$3.52;$8.88

B)-$35.29;$88.88

C)$352.90;888.88

D)$3,529.90;$8,888.88

E)$35,299.90;$88,888.88

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

58

What is a challenge to managers when they implement job-costing systems?

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

59

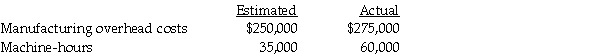

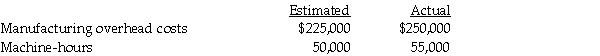

In 2012,Jim's Renovation Services used machine-hours as the only overhead cost-allocation base.According to his accountant,the following information was reported:

Under the actual-costing system,what was the 2012 budgeted manufacturing rate?

A)$4.00 per machine hour

B)$4.66 per machine hour

C)$4.75 per machine hour

D)$4.95 per machine hour

E)$5.10 per machine hour

Under the actual-costing system,what was the 2012 budgeted manufacturing rate?

A)$4.00 per machine hour

B)$4.66 per machine hour

C)$4.75 per machine hour

D)$4.95 per machine hour

E)$5.10 per machine hour

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

60

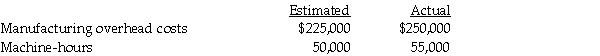

In 2012,Alan's Seafood Supply Manufacturing uses machine-hours as the only overhead cost-allocation base.The accountant reported the following information:

Using job costing,compute the 2012 actual indirect cost rate.

A)$3.85 per machine hour

B)$3.95 per machine hour

C)$4.45 per machine hour

D)$4.54 per machine hour

E)$4.85 per machine hour

Using job costing,compute the 2012 actual indirect cost rate.

A)$3.85 per machine hour

B)$3.95 per machine hour

C)$4.45 per machine hour

D)$4.54 per machine hour

E)$4.85 per machine hour

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

61

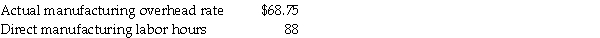

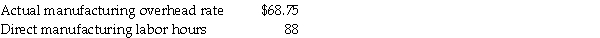

The following data was reported by the manager at Cost Less Manufacturing:

Required:

Compute the actual manufacturing overhead rate for the single manufacturing overhead cost pool.

A)$25.62 per direct manufacturing labor-hour

B)$50.25 per direct manufacturing labor-hour

C)$68.75 per direct manufacturing labor-hour

D)$72.50 per direct manufacturing labor-hour

E)$78.62 per direct manufacturing labor-hour

Required:

Compute the actual manufacturing overhead rate for the single manufacturing overhead cost pool.

A)$25.62 per direct manufacturing labor-hour

B)$50.25 per direct manufacturing labor-hour

C)$68.75 per direct manufacturing labor-hour

D)$72.50 per direct manufacturing labor-hour

E)$78.62 per direct manufacturing labor-hour

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following explains how managers compute the actual manufacturing overhead rate?

A)Add actual annual manufacturing overhead costs to the actual annual quantity of the cost-allocation base.

B)Divide actual annual manufacturing overhead costs by the actual annual quantity of the cost-allocation base.

C)Multiply actual annual manufacturing overhead costs by the actual annual quantity of the cost-allocation base.

D)Subtract actual manufacturing overhead costs by the actual annual quantity of the cost-allocation base.

E)Subtract forecasted manufacturing overhead costs from the actual annual quantity of the cost-allocation base.

A)Add actual annual manufacturing overhead costs to the actual annual quantity of the cost-allocation base.

B)Divide actual annual manufacturing overhead costs by the actual annual quantity of the cost-allocation base.

C)Multiply actual annual manufacturing overhead costs by the actual annual quantity of the cost-allocation base.

D)Subtract actual manufacturing overhead costs by the actual annual quantity of the cost-allocation base.

E)Subtract forecasted manufacturing overhead costs from the actual annual quantity of the cost-allocation base.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

63

Christian's Consulting Service employs 10 full-time consultants and 5 assistants.The direct and indirect costs are applied on a consultant labor-hour basis that includes both the consultants and assistant hours.The following information was reported by the accountant in 2012.

Compute the actual direct-cost rate and the actual indirect-cost rate per professional labor-hour.

A)$15.56;$2.25

B)$18.94;$2.75

C)$21.52;$2.95

D)$32.27;$4.54

E)$35.96;$4.95

Compute the actual direct-cost rate and the actual indirect-cost rate per professional labor-hour.

A)$15.56;$2.25

B)$18.94;$2.75

C)$21.52;$2.95

D)$32.27;$4.54

E)$35.96;$4.95

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

64

When do managers compute the budgeted indirect-cost rate?

A)Daily.

B)Monthly.

C)Annually.

D)Quarterly.

E)Semi-annually.

A)Daily.

B)Monthly.

C)Annually.

D)Quarterly.

E)Semi-annually.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

65

The Chandelier Shoppe's actual manufacturing overhead costs are $3,000,000.Overhead allocated on the basis of direct labor hours.The direct labor hours were 55,000 for the period.What is the manufacturing overhead rate?

A)$45.00

B)$48.16

C)$54.54

D)$60.18

E)$75.12

A)$45.00

B)$48.16

C)$54.54

D)$60.18

E)$75.12

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

66

How do managers use information technology to control costs and gather cost information to help them in their decision-making processes?

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

67

The following data was reported by the manager at Cost Less Manufacturing:

Required:

Compute the actual allocated manufacturing overhead costs.

A)$6,050

B)$6,075

C)$6,098

D)$7,025

E)$7,050

Required:

Compute the actual allocated manufacturing overhead costs.

A)$6,050

B)$6,075

C)$6,098

D)$7,025

E)$7,050

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

68

What are the circumstances why managers use actual costing rather than normal costing? Be specific.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

69

Sara's Accounting Service provides assistance to individuals and groups in the community to help them with their accounting needs.For each item listed below,identify the type category of source documents that her individual clients use to authorize a journal entry in the job-costing system.

a.direct materials purchased

b.direct materials used

c.direct manufacturing labor

d.indirect manufacturing labor

e.finished goods control

f.cost of good sold

a.direct materials purchased

b.direct materials used

c.direct manufacturing labor

d.indirect manufacturing labor

e.finished goods control

f.cost of good sold

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

70

Actual costing uses actual indirect cost rates calculated annually at the end of the year.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

71

Actual overhead costs incurred throughout the month are ________ to the Manufacturing Overhead Control account.

A)added

B)divided

C)multiplied

D)subtracted

E)cancelled

A)added

B)divided

C)multiplied

D)subtracted

E)cancelled

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

72

Casio Company manufactures stereos.For each unit,$3,500 of direct material is used and there is $2,500 of direct manufacturing labor at $25 per hour.Manufacturing overhead is applied at $40 per direct manufacturing labor hour.Compute the cost of each unit.

A)$2,500

B)$4,845

C)$6,045

D)$7,750

E)$9,500

A)$2,500

B)$4,845

C)$6,045

D)$7,750

E)$9,500

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

73

List the seven steps that managers in manufacturing,merchandising,and service sectors use to assign costs to individual jobs.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

74

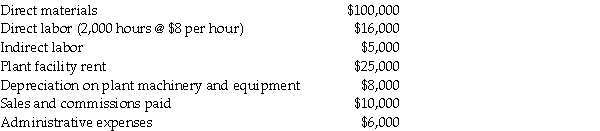

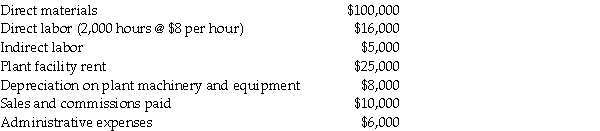

Tia's Tea Manufacturing manufactures organic tea and applies manufacturing overhead costs to production at a budgeted indirect-cost rate of $8.00 per direct labor hour.The following data was obtained from the accountant's records for December 2012:

Compute the actual amount of manufacturing overhead cost occurred in December 2012.

A)$35,000

B)$38,000

C)$42,000

D)$50,000

E)$55,000

Compute the actual amount of manufacturing overhead cost occurred in December 2012.

A)$35,000

B)$38,000

C)$42,000

D)$50,000

E)$55,000

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

75

Under normal costing,managers compute the amount of manufacturing overhead costs allocated to individual jobs based on the budgeted rate multiplied by the actual quantity used of the allocation base.This is known as:

A)account payable control.

B)work-in-process control.

C)manufacturing overhead allocated.

D)budgeted manufacturing overhead rate.

E)manufacturing overhead underallocated.

A)account payable control.

B)work-in-process control.

C)manufacturing overhead allocated.

D)budgeted manufacturing overhead rate.

E)manufacturing overhead underallocated.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is not a benefit of the normal-costing system?

A)Managers take corrective actions sooner.

B)Manufacturing costs of jobs are reported later.

C)Manufacturing costs of jobs are reported earlier.

D)Job pricing data is available soon after jobs are completed.

E)Sales managers evaluate profitability and efficiency of jobs faster.

A)Managers take corrective actions sooner.

B)Manufacturing costs of jobs are reported later.

C)Manufacturing costs of jobs are reported earlier.

D)Job pricing data is available soon after jobs are completed.

E)Sales managers evaluate profitability and efficiency of jobs faster.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

77

A difference between costing a job with normal costing and actual costing is that normal costing uses which of the following cost rates?

A)Budgeted real-cost rates.

B)Budgeted direct-cost rates.

C)Budgeted actual-cost rates.

D)Budgeted indirect-cost rates.

E)Budgeted preferred-cost rates.

A)Budgeted real-cost rates.

B)Budgeted direct-cost rates.

C)Budgeted actual-cost rates.

D)Budgeted indirect-cost rates.

E)Budgeted preferred-cost rates.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

78

Write a short essay and discuss how managers track direct manufacturing labor and control manufacturing overhead costs with enhancements in information technology.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

79

In the normal-costing system,managers understand that manufacturing costs of a job are available much later compared to the actual-costing system.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

80

An advantage of the actual-costing system is that at the end of the year,actual costs incurred equal the allocated costs in normal-costing systems.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck