Deck 6: Bonds Debt-Characteristics and Valuation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

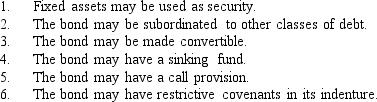

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/104

Play

Full screen (f)

Deck 6: Bonds Debt-Characteristics and Valuation

1

A 20-year original maturity bond with 1 year left to maturity has more interest rate price risk than a 10-year original maturity bond with 1 year left to maturity.(Assume that the bonds have equal default risk and equal coupon rates.)

False

2

There is an inverse relationship between bond ratings and the required return on a bond.The required return is lowest for AAA rated bonds,and required returns increase as the ratings get lower (worse).

True

3

Foreign debt is a debt instrument sold by a foreign borrower but denominated in the currency of the country in which it is sold.

True

4

The motivation for floating rate bonds arose out of the costly experience of the early 1980s when inflation pushed interest rates to very high levels causing sharp declines in the prices of long-term bonds.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

5

Regardless of the size of the coupon payment,the price of a bond moves in the opposite direction from interest rate movements.For example,if interest rates rise,bond prices fall.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

6

One of the disadvantages to a firm in issuing zero coupon bonds is that the tax shield associated with the bonds' appreciation cannot be claimed until the bond matures.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

7

Issuing zero coupon bonds might appeal to a company that is considering investing in a long-term project that will not generate positive cash flows for several years.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

8

If a firm raises capital by selling new bonds,the buyer is called the "issuing firm," and the coupon rate is generally set equal to the required rate.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

9

Restrictive covenants are designed so as to protect both the bondholder and the issuer even though they may constrain the actions of the firm's managers.Such covenants are contained in the bond's indenture.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

10

Because junk bonds are such high-risk instruments,the returns on such bonds aren't very high and the existence of this market detracts from social welfare.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

11

Eurocredits are bank loans that are denominated in the currency of a country other than where the lending bank is located.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

12

A call provision gives bondholders the right to demand,or "call for," repayment of a bond.Typically,calls are exercised if interest rates rise,because when rates rise the bondholder can get the principal amount back and reinvest it elsewhere at higher rates.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

13

Foreign debt is debt sold in a country other than the one in whose currency the debt is denominated.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

14

Eurobonds have a higher level of required disclosure than normally is found for bonds issued in domestic markets,particularly the United States.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

15

Floating rate debt is advantageous to investors because the interest rate moves up if market rates rise.Floating rate debt shifts interest rate risk to companies and thus has no advantages for issuers.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

16

Typically,debentures have higher interest rates than mortgage bonds primarily because the mortgage bonds are backed by assets while debentures are unsecured.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

17

LIBOR is an acronym for London Interbank Offer Rate,which is an average of interest rates offered by London banks to U.S.corporations.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

18

Although common stock represents a riskier investment to an individual than do bonds,in the sense of exposing the firm to the risk of bankruptcy,bonds represent a riskier method of financing to a corporation than does common stock.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

19

Eurobonds are typically issued as registered bonds rather than bearer bonds.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

20

In general,long-term unsecured debt is less costly than long-term secured for a particular firm.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

21

If a bond is callable,and if interest rates in the economy decline,then the company can sell a new issue of low-interest-rate bonds and use the proceeds to "call" the old bonds in and have effectively refinanced at a lower rate.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

22

The longer the maturity of a bond,the more its price will change in response to a given change in interest rates; this is called interest rate price risk.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

23

A bond that has a claim on assets only after the senior debt has been paid off in the event of liquidation is called what?

A) Debenture.

B) Income bond.

C) Indenture.

D) Subordinated debenture.

E) Mortgage bond.

A) Debenture.

B) Income bond.

C) Indenture.

D) Subordinated debenture.

E) Mortgage bond.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

24

All else equal,a zero-coupon bond's price is more sensitive to changes interest rates than a bond with a 10% annual coupon.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

25

A bond differs from term in loans in that

A) a bond issue is generally advertised.

B) a bond is sold to many investors.

C) a bond is offered to the public.

D) All of the above.

E) None of the above.

A) a bond issue is generally advertised.

B) a bond is sold to many investors.

C) a bond is offered to the public.

D) All of the above.

E) None of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

26

Because short-term interest rates are much more volatile than long-term rates,you would,in the real world,be subject to much more interest rate price risk if you purchased a 30-day bond than if you bought a 30-year bond.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

27

If two bonds have the same maturity and the same expected rate of return,but one has a higher coupon,the price of the low coupon bond will be more affected by a given change in interest rates.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

28

A contract negotiated directly with a bank in which the borrower agrees to make a series of interest and principal payments on specific dates to the bank is called

A) preferred stock.

B) commercial paper.

C) convertible debt.

D) a term loan.

E) a bond issue.

A) preferred stock.

B) commercial paper.

C) convertible debt.

D) a term loan.

E) a bond issue.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

29

Call provisions on corporate bonds are generally included to protect the issuer against large declines in interest rates.They affect the actual maturity of the bond but not its price.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

30

A bond's value will increase as interest rates rise over time.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following are generally considered advantages of term loans over publicly issued bonds?

A) Lower flotation costs.

B) Speed, or how long it takes to bring the issue to market.

C) Flexibility, or the ability to adjust the bond's terms after it has been issued.

D) All of the above.

E) Only answers b and c above.

A) Lower flotation costs.

B) Speed, or how long it takes to bring the issue to market.

C) Flexibility, or the ability to adjust the bond's terms after it has been issued.

D) All of the above.

E) Only answers b and c above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

32

If we have two bonds with a simple interest rate yield of 9% where one bond is compounded quarterly and the other bond is compounded monthly,the bond compounded quarterly will have a higher effective annual yield.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

33

If the yield to maturity (the market rate of return)of a bond is less than its coupon rate,the bond should be selling at a discount; i.e.,the bond's market price should be less than its face (maturity)value.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

34

If you buy a bond that is selling for less than its face,or maturity,value then the price (value)of the bond will increase the maturity date nears if market interest rates do not change during the life of the bond.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following types of debt are backed by some form of specific property?

A) Debenture.

B) Mortgage bond.

C) Subordinated debt.

D) All of the above.

E) None of the above.

A) Debenture.

B) Mortgage bond.

C) Subordinated debt.

D) All of the above.

E) None of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

36

Bonds with long maturities expose the investor to high interest rate reinvestment risk,which is the risk that income will differ from what is expected because the cash flows received from bonds will have to be reinvested at different interest rates.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

37

Bonds issued by BB&C Communications that have a coupon rate of interest equal to 10 percent currently have a yield to maturity (YTM)equal to 8 percent.Based on this information,BB&C's bonds must currently be selling at a premium in the financial markets.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

38

The terms and conditions to which a bond is subject are set forth in its

A) Debenture.

B) Underwriting agreement.

C) Indenture.

D) Restrictive covenants.

E) Call provision.

A) Debenture.

B) Underwriting agreement.

C) Indenture.

D) Restrictive covenants.

E) Call provision.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

39

Other things held constant,if a bond indenture contains a call provision,the yield to maturity that would exist without such a call provision will generally be __________ the YTM with it.

A) Higher than

B) Lower than

C) The same as

D) Either higher or lower, depending on the level of call premium, than

E) Unrelated to

A) Higher than

B) Lower than

C) The same as

D) Either higher or lower, depending on the level of call premium, than

E) Unrelated to

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

40

A bond with a $100 annual interest payment and $1,000 face value with five years to maturity (not expected to default)would sell for a premium if interest rates were below 9% and would sell for a discount if interest rates were greater than 11%.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

41

If the yield to maturity (the market rate of return)of a bond is less than its coupon rate,the bond should be

A) selling at a discount; i.e., the bond's market price should be less than its face (maturity) value.

B) selling at a premium; i.e., the bond's market price should be greater than its face value.

C) selling at par; i.e., the bond's market price should be the same as its face value.

D) purchased because it is a good deal.

A) selling at a discount; i.e., the bond's market price should be less than its face (maturity) value.

B) selling at a premium; i.e., the bond's market price should be greater than its face value.

C) selling at par; i.e., the bond's market price should be the same as its face value.

D) purchased because it is a good deal.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following securities is the riskiest to investors?

A) Floating rate notes.

B) Income bonds.

C) Treasury bills.

D) First mortgage bonds.

E) Common stock.

A) Floating rate notes.

B) Income bonds.

C) Treasury bills.

D) First mortgage bonds.

E) Common stock.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

43

A 12-year bond that has a 12 percent coupon rate is currently selling for $1,000,which equals the bond's face value.If interest is paid semiannually,the bond's yield to maturity is

A) equal to 12 percent.

B) greater than 12 percent.

C) less than 12 percent.

D) More information is needed to answer this question.

E) None of the above is correct.

A) equal to 12 percent.

B) greater than 12 percent.

C) less than 12 percent.

D) More information is needed to answer this question.

E) None of the above is correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

44

Bonds that can be exchanged for shares of equity at the owner's discretion are called what?

A) Debenture.

B) Indenture.

C) Callable bond

D) Convertible bond.

E) Putable bond.

A) Debenture.

B) Indenture.

C) Callable bond

D) Convertible bond.

E) Putable bond.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

45

Bonds issued by BB&C Communications that have a coupon rate of interest equal to 10.65 percent currently have a yield to maturity (YTM)equal to 15.25 percent.Based on this information,BB&C's bonds must currently be selling at __________ in the financial markets.

A) par value

B) a discount

C) a premium

D) Not enough information is given to answer this question.

E) None of the above is a correct answer.

A) par value

B) a discount

C) a premium

D) Not enough information is given to answer this question.

E) None of the above is a correct answer.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

46

S.Claus & Company is planning a zero coupon bond issue.The bond has a par value of $1,000,matures in 2 years,and will be sold at a price of $826.45.The firm's marginal tax rate is 40 percent.What is the annual after-tax cost of debt to the company on this issue?

A) 4.0%

B) 6.0%

C) 8.0%

D) 10.0%

E) 12.0%

A) 4.0%

B) 6.0%

C) 8.0%

D) 10.0%

E) 12.0%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

47

A bond that can be redeemed for cash at the bondholder's option is called what?

A) Convertible bond.

B) Putable bond.

C) Callable bond.

D) Debenture.

E) Income bond.

A) Convertible bond.

B) Putable bond.

C) Callable bond.

D) Debenture.

E) Income bond.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

48

Which type of investor would be most likely to purchase zero coupon bonds?

A) Retired individuals seeking income for current consumption.

B) Individuals in high tax brackets.

C) Tax free investors such as pension funds.

D) Risk averse individuals anticipating increases in interest rates.

E) None of the above.

A) Retired individuals seeking income for current consumption.

B) Individuals in high tax brackets.

C) Tax free investors such as pension funds.

D) Risk averse individuals anticipating increases in interest rates.

E) None of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

49

__________ are high-risk,high-yield bonds used to finance mergers,leveraged buyouts,and troubled companies.

A) Callable bonds

B) Junk bonds

C) Convertible bonds

D) Floating rate bonds

E) Putable bonds

A) Callable bonds

B) Junk bonds

C) Convertible bonds

D) Floating rate bonds

E) Putable bonds

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following events would make it less likely that a company would choose to call its outstanding callable bonds?

A) Increase in interest rates.

B) Decrease in interest rates.

C) Increase in price of outstanding convertible bonds.

D) A decrease in call premium.

E) Answers b and c only.

A) Increase in interest rates.

B) Decrease in interest rates.

C) Increase in price of outstanding convertible bonds.

D) A decrease in call premium.

E) Answers b and c only.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following ratings by Moody's represent bonds that are at least investment grade?

A) Caa

B) Baa

C) B

D) Ba

E) None of the above.

A) Caa

B) Baa

C) B

D) Ba

E) None of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following types of debt protect a bondholder against an increase in interest rates?

A) Floating rate debt.

B) Bonds that are redeemable ("putable") at par at the bondholders' option.

C) Bonds with call provisions.

D) All of the above.

E) Only answers a and b above.

A) Floating rate debt.

B) Bonds that are redeemable ("putable") at par at the bondholders' option.

C) Bonds with call provisions.

D) All of the above.

E) Only answers a and b above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

53

GP&L sold $1,000,000 of 12 percent,30-year,semiannual payment bonds 15 years ago.The bonds are not callable,but they do have a sinking fund which requires GP&L to redeem 5 percent of the original face value of the issue each year ($50,000),beginning in Year 11.To date,25 percent of the issue has been retired.The company can either call bonds at par for sinking fund purposes or purchase bonds on the open market,spending sufficient money to redeem 5 percent of the original face value each year.If the yield to maturity (15 years remaining)on the bonds is currently 14 percent,what is the least amount of money GP&L must put up to satisfy the sinking fund provision?

A) $43,856

B) $50,000

C) $37,500

D) $43,796

E) $39,422

A) $43,856

B) $50,000

C) $37,500

D) $43,796

E) $39,422

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is false?

A) Any bond sold outside the country of the borrower is called an international bond.

B) Foreign bonds and Eurobonds are two important types of international bonds.

C) Foreign bonds are bonds sold by a foreign borrower but denominated in the currency of the country in which the issue is sold.

D) The term Eurobond specifically applies to any foreign bonds denominated in U.S. currency.

E) None of the above.

A) Any bond sold outside the country of the borrower is called an international bond.

B) Foreign bonds and Eurobonds are two important types of international bonds.

C) Foreign bonds are bonds sold by a foreign borrower but denominated in the currency of the country in which the issue is sold.

D) The term Eurobond specifically applies to any foreign bonds denominated in U.S. currency.

E) None of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is correct?

A) A zero coupon bond provides no interest payments during the life of the bond, but it provides its owner with a capital gain when the bond matures. In the United States, these bonds appeal to high-income investors because the tax on capital gains income is deferred until the bond matures or is sold.

B) The "penalty" for having a low bond rating is more severe when the Security Market Line (SML) is relatively steep than when it is not so steep.

C) A bond that is callable has a chance of being retired earlier than its stated term to maturity. Therefore, if the yield curve is upward sloping, an outstanding callable bond should have a lower yield to maturity than an otherwise identical noncallable bond.

D) A zero coupon bond is a bond that pays no interest and is offered (and subsequently sells) at par, therefore providing compensation to investors in the form of capital appreciation.

E) None of the above is a correct statement.

A) A zero coupon bond provides no interest payments during the life of the bond, but it provides its owner with a capital gain when the bond matures. In the United States, these bonds appeal to high-income investors because the tax on capital gains income is deferred until the bond matures or is sold.

B) The "penalty" for having a low bond rating is more severe when the Security Market Line (SML) is relatively steep than when it is not so steep.

C) A bond that is callable has a chance of being retired earlier than its stated term to maturity. Therefore, if the yield curve is upward sloping, an outstanding callable bond should have a lower yield to maturity than an otherwise identical noncallable bond.

D) A zero coupon bond is a bond that pays no interest and is offered (and subsequently sells) at par, therefore providing compensation to investors in the form of capital appreciation.

E) None of the above is a correct statement.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

56

Listed below are some provisions that are often contained in bond indentures:  Which of the above provisions,each viewed alone,would tend to reduce the yield to maturity investors would otherwise require on a newly issued bond?

Which of the above provisions,each viewed alone,would tend to reduce the yield to maturity investors would otherwise require on a newly issued bond?

A) 1, 2, 3, 4, 5, 6

B) 1, 2, 3, 4, 6

C) 1, 3, 4, 5, 6

D) 1, 3, 4, 6

E) 1, 4, 6

Which of the above provisions,each viewed alone,would tend to reduce the yield to maturity investors would otherwise require on a newly issued bond?

Which of the above provisions,each viewed alone,would tend to reduce the yield to maturity investors would otherwise require on a newly issued bond?A) 1, 2, 3, 4, 5, 6

B) 1, 2, 3, 4, 6

C) 1, 3, 4, 5, 6

D) 1, 3, 4, 6

E) 1, 4, 6

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

57

A bond that only pays interest if the firm has sufficient earnings to cover the interest payments is called what?

A) Callable bond.

B) Putable bond.

C) Convertible bond.

D) Income bond.

E) Indexed bond.

A) Callable bond.

B) Putable bond.

C) Convertible bond.

D) Income bond.

E) Indexed bond.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following ratings by Standard & Poor's represent speculative grade debt?

A) A

B) B

C) BB

D) BBB

E) None of the above.

A) A

B) B

C) BB

D) BBB

E) None of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

59

A bond that pays no annual interest but is sold at a discount below its par value is called what?

A) Mortgage bond.

B) Callable bond.

C) Convertible bond.

D) Putable bond.

E) Zero coupon bond.

A) Mortgage bond.

B) Callable bond.

C) Convertible bond.

D) Putable bond.

E) Zero coupon bond.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

60

Rollincoast Incorporated issued BBB bonds two years ago that provided a yield to maturity of 11.5 percent.Long-term risk-free government bonds were yielding 8.7 percent at that time.The current risk premium on BBB bonds versus government bonds is half what it was two years ago.If the risk-free long-term governments are currently yielding 7.8 percent,then at what rate should Rollincoast expect to issue new bonds?

A) 7.8%

B) 8.7%

C) 9.2%

D) 10.2%

E) 12.9%

A) 7.8%

B) 8.7%

C) 9.2%

D) 10.2%

E) 12.9%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

61

A $1,000 par value bond pays interest of $35 each quarter and will mature in 10 years.If your simple annual required rate of return is 12 percent with quarterly compounding,how much should you be willing to pay for this bond?

A) $941.36

B) $1,051.25

C) $1,115.57

D) $1,391.00

E) $825.49

A) $941.36

B) $1,051.25

C) $1,115.57

D) $1,391.00

E) $825.49

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is most correct?

A) All else equal, an increase in interest rates will have a greater effect on the prices of long-term bonds than it will on the prices of short-term bonds.

B) All else equal, and increase in interest rate will have a greater effect on higher-coupon bonds than it will have on lower-coupon bonds.

C) An increase in interest rates will have a greater effect on a zero-coupon bond with 10 years maturity than it will have on a 9-year bond with a 10 percent annual coupon.

D) All of the above are correct.

E) Answers a and c are both correct.

A) All else equal, an increase in interest rates will have a greater effect on the prices of long-term bonds than it will on the prices of short-term bonds.

B) All else equal, and increase in interest rate will have a greater effect on higher-coupon bonds than it will have on lower-coupon bonds.

C) An increase in interest rates will have a greater effect on a zero-coupon bond with 10 years maturity than it will have on a 9-year bond with a 10 percent annual coupon.

D) All of the above are correct.

E) Answers a and c are both correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements is correct?

A) A 10-year bond would have more interest rate price risk than a 5-year bond, but all 10-year bonds have the same interest rate price risk.

B) A 10-year bond would have more reinvestment rate risk than a 5-year bond, but all 10-year bonds have the same reinvestment rate risk.

C) If their maturities were the same, a 5 percent coupon bond would have more interest rate price risk than a 10 percent coupon bond.

D) If their maturities were the same, a 5 percent coupon bond would have less interest rate price risk than a 10 percent coupon bond.

E) Zero-coupon bonds have more interest rate price risk than any other type bond, even perpetuities.

A) A 10-year bond would have more interest rate price risk than a 5-year bond, but all 10-year bonds have the same interest rate price risk.

B) A 10-year bond would have more reinvestment rate risk than a 5-year bond, but all 10-year bonds have the same reinvestment rate risk.

C) If their maturities were the same, a 5 percent coupon bond would have more interest rate price risk than a 10 percent coupon bond.

D) If their maturities were the same, a 5 percent coupon bond would have less interest rate price risk than a 10 percent coupon bond.

E) Zero-coupon bonds have more interest rate price risk than any other type bond, even perpetuities.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

64

Stephanie just purchased a corporate bond that matures in three years.The bond has a coupon interest rate equal to 9 percent and its yield to maturity is 6 percent.If market conditions do not change-that is market interest rates remain constant-and Stephanie sells the bond in 12 months,what will be her capital gain from holding the bond?

A) Positive; because she bought the bond for a discount, which means its price has to increase as the maturity date nears.

B) Negative; because she bought the bond for a premium, which means its price has to decrease as the maturity date nears.

C) Zero, because she must have bought the bond for par, which means its price will not change as the maturity date nears.

D) This question cannot be answered, because the face (maturity) value of the bond is not given.

E) None of the above is correct.

A) Positive; because she bought the bond for a discount, which means its price has to increase as the maturity date nears.

B) Negative; because she bought the bond for a premium, which means its price has to decrease as the maturity date nears.

C) Zero, because she must have bought the bond for par, which means its price will not change as the maturity date nears.

D) This question cannot be answered, because the face (maturity) value of the bond is not given.

E) None of the above is correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following statements is correct?

A) Rising inflation makes the actual yield to maturity on a bond greater than the quoted yield to maturity which is based on market prices.

B) The yield to maturity for a coupon bond that sells at its par value consists entirely of an interest yield; it has a zero expected capital gains yield.

C) On an expected yield basis, the expected capital gains yield will always be positive because an investor would not purchase a bond with an expected capital loss.

D) The market value of a bond will always approach its par value as its maturity date approaches. This holds true even if the firm enters bankruptcy.

E) All of the above statements are false.

A) Rising inflation makes the actual yield to maturity on a bond greater than the quoted yield to maturity which is based on market prices.

B) The yield to maturity for a coupon bond that sells at its par value consists entirely of an interest yield; it has a zero expected capital gains yield.

C) On an expected yield basis, the expected capital gains yield will always be positive because an investor would not purchase a bond with an expected capital loss.

D) The market value of a bond will always approach its par value as its maturity date approaches. This holds true even if the firm enters bankruptcy.

E) All of the above statements are false.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

66

You are the owner of 100 bonds issued by Euler,Ltd.These bonds have 8 years remaining to maturity,an annual coupon payment of $80,and a par value of $1,000.Unfortunately,Euler is on the brink of bankruptcy.The creditors,including yourself,have agreed to a postponement of the next 4 interest payments (otherwise,the next interest payment would have been due in 1 year).The remaining interest payments,for Years 5 through 8,will be made as scheduled.The postponed payments will accrue interest at an annual rate of 6 percent,and they will then be paid as a lump sum at maturity 8 years hence.The required rate of return on these bonds,considering their substantial risk,is now 28 percent.What is the present value of each bond?

A) $538.21

B) $426.73

C) $384.84

D) $266.88

E) $249.98

A) $538.21

B) $426.73

C) $384.84

D) $266.88

E) $249.98

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

67

You are contemplating the purchase of a 20-year bond that pays $50 in interest each six months.You plan to hold this bond for only 10 years,at which time you will sell it in the marketplace.You require a 12 percent annual return,but you believe the market will require only an 8 percent return when you sell the bond 10 years hence.Assuming you are a rational investor,how much should you be willing to pay for the bond today?

A) $1,126.85

B) $1,081.43

C) $737.50

D) $927.68

E) $856.91

A) $1,126.85

B) $1,081.43

C) $737.50

D) $927.68

E) $856.91

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

68

JRJ Corporation recently issued 10-year bonds at a price of $1,000.These bonds pay $60 in interest each six months.Their price has remained stable since they were issued,i.e.,they still sell for $1,000.Due to additional financing needs,the firm wishes to issue new bonds that would have a maturity of 10 years,a par value of $1,000,and pay $40 in interest every six months.If both bonds have the same yield,how many new bonds must JRJ issue to raise $2,000,000 cash?

A) 2,400

B) 2,596

C) 3,000

D) 5,000

E) 4,275

A) 2,400

B) 2,596

C) 3,000

D) 5,000

E) 4,275

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

69

You have just purchased a 10-year,$1,000 par value bond.The coupon rate on this bond is 8 percent annually,with interest being paid each 6 months.If you expect to earn a 10 percent simple rate of return on this bond,how much did you pay for it?

A) $1,122.87

B) $1,003.42

C) $875.38

D) $950.75

E) $812.15

A) $1,122.87

B) $1,003.42

C) $875.38

D) $950.75

E) $812.15

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

70

Omega Software Corporation's bond is currently selling at a discount in the financial markets.If the bond's yield to maturity is 11.5 percent,what is its coupon rate of interest?

A) greater than 11.5 percent

B) less than 11.5 percent

C) equal to 11.5 percent

D) There is not enough information to answer this question.

E) None of the above is a correct answer.

A) greater than 11.5 percent

B) less than 11.5 percent

C) equal to 11.5 percent

D) There is not enough information to answer this question.

E) None of the above is a correct answer.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

71

Assume that you are considering the purchase of a $1,000 par value bond that pays interest of $70 each six months and has 10 years to go before it matures.If you buy this bond,you expect to hold it for 5 years and then to sell it in the market.You (and other investors)currently require a simple annual rate of 16 percent,but you expect the market to require a rate of only 12 percent when you sell the bond due to a general decline in interest rates.How much should you be willing to pay for this bond?

A) $842.00

B) $1,115.81

C) $1,359.26

D) $966.99

E) $731.85

A) $842.00

B) $1,115.81

C) $1,359.26

D) $966.99

E) $731.85

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

72

Due to a number of lawsuits related to toxic wastes,a major chemical manufacturer has recently experienced a market reevaluation.The firm has a bond issue outstanding with 15 years to maturity and a coupon rate of 8 percent,with interest being paid semiannually.The required simple rate on this debt has now risen to 16 percent.What is the current value of this bond?

A) $1,273

B) $1,000

C) $7,783

D) $550

E) $450

A) $1,273

B) $1,000

C) $7,783

D) $550

E) $450

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements is correct?

A) Other things held constant, a callable bond would have a lower required rate of return than a noncallable bond.

B) Other things held constant, a corporation would rather issue noncallable bonds than callable bonds.

C) Reinvestment rate risk is worse from a typical investor's standpoint than interest rate price risk.

D) If a 10-year, $1,000 par, zero coupon bond were issued at a price which gave investors a 10 percent rate of return, and if interest rates then dropped to the point where rd = YTM = 5%, we could be sure that the bond would sell at a premium over its $1,000 par value.

E) If a 10-year, $1,000 par, zero coupon bond were issued at a price which gave investors a 10 percent rate of return, and if interest rates then dropped to the point where rd = YTM = 5%, we could be sure that the bond would sell at a discount below its $1,000 par value.

A) Other things held constant, a callable bond would have a lower required rate of return than a noncallable bond.

B) Other things held constant, a corporation would rather issue noncallable bonds than callable bonds.

C) Reinvestment rate risk is worse from a typical investor's standpoint than interest rate price risk.

D) If a 10-year, $1,000 par, zero coupon bond were issued at a price which gave investors a 10 percent rate of return, and if interest rates then dropped to the point where rd = YTM = 5%, we could be sure that the bond would sell at a premium over its $1,000 par value.

E) If a 10-year, $1,000 par, zero coupon bond were issued at a price which gave investors a 10 percent rate of return, and if interest rates then dropped to the point where rd = YTM = 5%, we could be sure that the bond would sell at a discount below its $1,000 par value.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following statements is most correct?

A) If a bond's yield to maturity exceeds its coupon rate, the bond's current yield must also exceed its coupon rate.

B) If a bond's yield to maturity exceeds its coupon rate, the bond's price must be less than its maturity value.

C) If two bonds have the same maturity, the same yield to maturity, and the same level of risk, the bonds should sell for the same price regardless of the bond's coupon rate.

D) Answers b and c are both correct.

E) None of the above answers are correct.

A) If a bond's yield to maturity exceeds its coupon rate, the bond's current yield must also exceed its coupon rate.

B) If a bond's yield to maturity exceeds its coupon rate, the bond's price must be less than its maturity value.

C) If two bonds have the same maturity, the same yield to maturity, and the same level of risk, the bonds should sell for the same price regardless of the bond's coupon rate.

D) Answers b and c are both correct.

E) None of the above answers are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

75

Assume that you wish to purchase a 20-year bond that has a maturity value of $1,000 and makes semiannual interest payments of $40.If you require a 10 percent simple yield to maturity on this investment,what is the maximum price you should be willing to pay for the bond?

A) $619

B) $674

C) $761

D) $828

E) $902

A) $619

B) $674

C) $761

D) $828

E) $902

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

76

If you buy a bond that is selling for less than its face,or maturity,value what will happen to the price (value)of the bond as the maturity date nears if market interest rates do not change during the life of the bond?

A) Because interest rates remain constant, nothing happens to the market value of the bond.

B) The price of the bond should decrease even further below the bond's face value because the rates in the market are too high.

C) The price of the bond will increase as the bond gets closer to its maturity because the bond's value has to equal its face value at maturity.

D) This question cannot be answered without additional information.

E) None of the above is a correct answer.

A) Because interest rates remain constant, nothing happens to the market value of the bond.

B) The price of the bond should decrease even further below the bond's face value because the rates in the market are too high.

C) The price of the bond will increase as the bond gets closer to its maturity because the bond's value has to equal its face value at maturity.

D) This question cannot be answered without additional information.

E) None of the above is a correct answer.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is not true about bonds? In all of the statements,assume other things are held constant?

A) Price sensitivity, that is, the change in price due to a given change in the required rate of return, increases as a bond's maturity increases.

B) For a given bond of any maturity, a given percentage point increase in the interest rate (rd) causes a larger dollar capital loss than the capital gain stemming from an identical decrease in the interest rate.

C) For any given maturity, a given percentage point increase in the interest rate causes a smaller dollar capital loss than the capital gain stemming from an identical decrease in the interest rate.

D) From a borrower's point of view, interest paid on bonds is tax-deductible.

E) A 20-year zero-coupon bond has less reinvestment rate risk than a 20-year coupon bond.

A) Price sensitivity, that is, the change in price due to a given change in the required rate of return, increases as a bond's maturity increases.

B) For a given bond of any maturity, a given percentage point increase in the interest rate (rd) causes a larger dollar capital loss than the capital gain stemming from an identical decrease in the interest rate.

C) For any given maturity, a given percentage point increase in the interest rate causes a smaller dollar capital loss than the capital gain stemming from an identical decrease in the interest rate.

D) From a borrower's point of view, interest paid on bonds is tax-deductible.

E) A 20-year zero-coupon bond has less reinvestment rate risk than a 20-year coupon bond.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following statements is correct?

A) The discount or premium on a bond can be expressed as the difference between the coupon payment on an old bond which originally sold at par and the coupon payment on a new bond, selling at par, where the difference in payments is discounted at the new market rate.

B) The price of a coupon bond is determined primarily by the number of years to maturity.

C) On a coupon paying bond, the final interest payment is made one period before maturity and then, at maturity, the bond's face value is paid as the final payment.

D) The actual capital gains yield for a one-year holding period on a bond can never be greater than the current yield on the bond.

E) All of the above statements are false.

A) The discount or premium on a bond can be expressed as the difference between the coupon payment on an old bond which originally sold at par and the coupon payment on a new bond, selling at par, where the difference in payments is discounted at the new market rate.

B) The price of a coupon bond is determined primarily by the number of years to maturity.

C) On a coupon paying bond, the final interest payment is made one period before maturity and then, at maturity, the bond's face value is paid as the final payment.

D) The actual capital gains yield for a one-year holding period on a bond can never be greater than the current yield on the bond.

E) All of the above statements are false.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

79

Assume that a 15-year,$1,000 face value bond pays interest of $37.50 every 3 months.If you require a simple annual rate of return of 12 percent,with quarterly compounding,how much should you be willing to pay for this bond?

A) $821.92

B) $1,207.57

C) $986.43

D) $1,120.71

E) $1,358.24

A) $821.92

B) $1,207.57

C) $986.43

D) $1,120.71

E) $1,358.24

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

80

If interest rates fall from 8 percent to 7 percent,which of the following bonds will have the largest percentage increase in its value?

A) A 10-year zero-coupon bond.

B) A 10-year bond with a 10 percent semiannual coupon.

C) A 10-year bond with a 10 percent annual coupon.

D) A 5-year zero-coupon bond.

E) A 5-year bond with a 12 percent annual coupon.

A) A 10-year zero-coupon bond.

B) A 10-year bond with a 10 percent semiannual coupon.

C) A 10-year bond with a 10 percent annual coupon.

D) A 5-year zero-coupon bond.

E) A 5-year bond with a 12 percent annual coupon.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck