Deck 8: Risk and Rates of Return

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 8: Risk and Rates of Return

1

The standard deviation is the weighted average of all the deviations from the expected value,and it indicates how far above or below the expected value the actual value is expected to be.

True

2

The only condition under which risk can be reduced to zero is to find securities that are perfectly negatively correlated (r = -1.0)with each other.

False

3

Combining stocks with perfectly correlated stock returns into a portfolio is less risky than holding an individual stock since the portfolio will benefit from diversification.

False

4

The tighter the probability distribution,the less variability there is and the less likely it is that the actual outcome will be close to the expected value; consequently the more likely it is that the actual return will be much different from the expected return.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

The expected rate of return of an asset will always equal one of the possible rates of return for that asset.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

Because of differences in the expected returns of different securities,the standard deviation is not always an adequate measure of risk.However,the coefficient of variation always will allow an investor to properly compare the relative risks of any two securities.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

Risk is defined as the chance (probability)of actually observing outcomes that are greater than expected,or favorable.Such outcomes are more desirable than observing less-than-expected events,so the possibility that positive outcomes will occur must be emphasized when evaluating risk.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

Market risk refers to the tendency of a stock to move with the general stock market.A stock with above-average market risk will tend to be more volatile than an average stock,and it will have a beta which is greater than 1.0.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

Assume Stock A has a standard deviation of 0.21 while Stock B has a standard deviation of 0.10.If both Stock A and Stock B must be held in isolation,and if investors are risk averse,we can conclude that Stock A will have a greater required return.However,if the assets could be held in portfolios,it is conceivable that the required return could be higher on the low standard deviation stock.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

A firm cannot change its beta through any managerial decision because betas are completely market determined.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements is correct?

A) Risk refers to the chance that some unfavorable event will occur, and a probability distribution is completely described by a listing of the likelihood of unfavorable events.

B) Portfolio diversification reduces the variability of returns on an individual stock.

C) When company specific risk has been diversified, the inherent risk that remains is market risk which is constant for all securities in the market.

D) A stock with a beta of -1.0 has zero systematic (or market) risk.

E) The SML relates required returns to firms' systematic (or market) risk. The slope and intercept of this line cannot be controlled by the financial manager.

A) Risk refers to the chance that some unfavorable event will occur, and a probability distribution is completely described by a listing of the likelihood of unfavorable events.

B) Portfolio diversification reduces the variability of returns on an individual stock.

C) When company specific risk has been diversified, the inherent risk that remains is market risk which is constant for all securities in the market.

D) A stock with a beta of -1.0 has zero systematic (or market) risk.

E) The SML relates required returns to firms' systematic (or market) risk. The slope and intercept of this line cannot be controlled by the financial manager.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

12

Risk is defined as the chance (probability)of actually observing outcomes that are less than expected,or unfavorable.Outcomes that are greater than expected are not considered when evaluating risk because such occurrences are desirable.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

13

Risk is indicated by variability,whether the variability is considered positive or negative.Both the positive and negative outcomes must be evaluated when considering risk because all unexpected possibilities should be examined,even the positive ones.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

The Y-axis intercept of the SML indicates the return on the individual asset when the realized return on an average stock (beta = 1.0)is zero.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

In the real world,the type of security that generates a return that is nearest to a risk-free rate of return is a Treasury bill.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

If we develop a weighted average of the possible return outcomes,multiplying each outcome or "state" by its respective probability of occurrence for a particular stock,we can construct a payoff matrix of expected returns.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

Risk really should not be a significant factor when making financial decision because all business decisions involve predictions about the future,which is unknown.As a result,all decisions automatically include some consideration of risk.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

A listing of all possible outcomes,or events,with a probability assigned to each is called a probability distribution.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

If I know for sure that the market will have a positive return over the next year,to maximize my rate of return,I should increase the beta of my portfolio.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

While the portfolio return is a weighted average of realized security returns,portfolio risk is not necessarily a weighted average of the standard deviations of the securities in the portfolio.It is this aspect of portfolios that allows investors to combine stocks and actually reduce the riskiness of a portfolio.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

For markets to be in equilibrium,that is,for there to be no strong pressure for prices to depart from their current levels,

A) The expected rate of return must be equal to the required rate of return; that is,

B) The past realized rate of return must be equal to the expected rate of return; that is

C) The required rate of return must equal the realized rate of return; that is

D) All three of the above statements must hold for equilibrium to exist; that is,

E) None of the above statements are correct.

A) The expected rate of return must be equal to the required rate of return; that is,

B) The past realized rate of return must be equal to the expected rate of return; that is

C) The required rate of return must equal the realized rate of return; that is

D) All three of the above statements must hold for equilibrium to exist; that is,

E) None of the above statements are correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

Other things held constant,(1)if the expected inflation rate decreases,and (2)investors become more risk averse,the Security Market Line would shift

A) Down and have steeper slope.

B) Up and have less steep slope.

C) Up and keep same slope.

D) Down and keep same slope.

E) Down and have less steep slope.

A) Down and have steeper slope.

B) Up and have less steep slope.

C) Up and keep same slope.

D) Down and keep same slope.

E) Down and have less steep slope.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

According to the following information,which of the stocks would be considered riskiest in a diversified portfolio of investments?

A) Stock MNO, because it has the highest standard deviation.

B) Stock TUV, because it has the highest beta.

C) Stock FGH, because it has the highest s/b ratio

D) Stock ABC, because its beta is the same as the market beta (1.0) and the market is always very, very risky.

A) Stock MNO, because it has the highest standard deviation.

B) Stock TUV, because it has the highest beta.

C) Stock FGH, because it has the highest s/b ratio

D) Stock ABC, because its beta is the same as the market beta (1.0) and the market is always very, very risky.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

According to the capital asset pricing model,which of the following stocks should have the highest required rate of return?

A) Beta Electronics because its standard deviation is highest.

B) Alpha Automobiles because its beta coefficient is highest.

C) Omega foods because the ration of standard deviation/beta is the lowest.

D) Not enough information is given to answer this question.

A) Beta Electronics because its standard deviation is highest.

B) Alpha Automobiles because its beta coefficient is highest.

C) Omega foods because the ration of standard deviation/beta is the lowest.

D) Not enough information is given to answer this question.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

Stock A has a beta of 1.5 and Stock B has a beta of 0.5.Which of the following statements must be true about these securities? (Assume the market is in equilibrium.)

A) When held in isolation, Stock A has greater risk than Stock B.

B) Stock B would be a more desirable addition to a portfolio than Stock A.

C) Stock A would be a more desirable addition to a portfolio than Stock B.

D) The expected return on Stock A will be greater than that on Stock B.

E) The expected return on Stock B will be greater than that on Stock A.

A) When held in isolation, Stock A has greater risk than Stock B.

B) Stock B would be a more desirable addition to a portfolio than Stock A.

C) Stock A would be a more desirable addition to a portfolio than Stock B.

D) The expected return on Stock A will be greater than that on Stock B.

E) The expected return on Stock B will be greater than that on Stock A.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements is most correct?

A) An increase in expected inflation could be expected to increase the required return on a riskless asset and on an average stock by the same amount, other things held constant.

B) A graph of the SML would show required rates of return on the vertical axis and standard deviations of returns on the horizontal axis.

C) If two "normal" or "typical" stocks were combined to form a 2-stock portfolio, the portfolio's expected return would be a weighted average of the stocks' expected returns, but the portfolio's standard deviation would probably be greater than the average of the stocks' standard deviations.

D) If investors became more averse to risk, then (1) the slope of the SML would increase and (2) the required rate of return on low-beta stocks would increase by more than the required return on high-beta stocks.

E) The CAPM has been thoroughly tested, and the theory has been confirmed beyond any reasonable doubt.

A) An increase in expected inflation could be expected to increase the required return on a riskless asset and on an average stock by the same amount, other things held constant.

B) A graph of the SML would show required rates of return on the vertical axis and standard deviations of returns on the horizontal axis.

C) If two "normal" or "typical" stocks were combined to form a 2-stock portfolio, the portfolio's expected return would be a weighted average of the stocks' expected returns, but the portfolio's standard deviation would probably be greater than the average of the stocks' standard deviations.

D) If investors became more averse to risk, then (1) the slope of the SML would increase and (2) the required rate of return on low-beta stocks would increase by more than the required return on high-beta stocks.

E) The CAPM has been thoroughly tested, and the theory has been confirmed beyond any reasonable doubt.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

In a portfolio of three different stocks,which of the following could not be true?

A) The riskiness of the portfolio is less than the riskiness of each of the stocks if they were held in isolation.

B) The riskiness of the portfolio is greater than the riskiness of one or two of the stocks.

C) The beta of the portfolio is less than the beta of each of the individual stocks.

D) The beta of the portfolio is greater than the beta of one or two of the individual stock's betas.

E) None of the above (i.e., they all could be true, but not necessarily at the same time).

A) The riskiness of the portfolio is less than the riskiness of each of the stocks if they were held in isolation.

B) The riskiness of the portfolio is greater than the riskiness of one or two of the stocks.

C) The beta of the portfolio is less than the beta of each of the individual stocks.

D) The beta of the portfolio is greater than the beta of one or two of the individual stock's betas.

E) None of the above (i.e., they all could be true, but not necessarily at the same time).

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements is most correct?

A) A portfolio with a beta of minus 2 has the same degree of risk to the holder, relative to the market, as a portfolio with a beta of plus 2. However the holder of either portfolio could lower his or her exposure by buying some "normal" stocks.

B) A stock with a beta of -1.0 has zero systematic (or market) risk.

C) It is possible for a stock to have a positive beta even in situations where the correlation between the returns on it and those on another stock are negative.

D) Diversifiable risk, which is measured by beta, can be lowered by adding more stocks to a portfolio.

E) Statements a and c are both correct.

A) A portfolio with a beta of minus 2 has the same degree of risk to the holder, relative to the market, as a portfolio with a beta of plus 2. However the holder of either portfolio could lower his or her exposure by buying some "normal" stocks.

B) A stock with a beta of -1.0 has zero systematic (or market) risk.

C) It is possible for a stock to have a positive beta even in situations where the correlation between the returns on it and those on another stock are negative.

D) Diversifiable risk, which is measured by beta, can be lowered by adding more stocks to a portfolio.

E) Statements a and c are both correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is correct?

A) If the returns from two stocks are perfectly positively correlated and the two stocks have equal variance, an equally weighted portfolio of the two stocks will have a variance whish is less than that of the individual stocks.

B) If a stock has a negative beta, its expected return must be negative.

C) According to the CAPM, stocks with higher standard deviations of returns will have higher expected returns.

D) A portfolio with a large number of randomly selected stocks will have less market risk than a single stock with has a beta equal to 0.5.

E) None of the above statements are correct.

A) If the returns from two stocks are perfectly positively correlated and the two stocks have equal variance, an equally weighted portfolio of the two stocks will have a variance whish is less than that of the individual stocks.

B) If a stock has a negative beta, its expected return must be negative.

C) According to the CAPM, stocks with higher standard deviations of returns will have higher expected returns.

D) A portfolio with a large number of randomly selected stocks will have less market risk than a single stock with has a beta equal to 0.5.

E) None of the above statements are correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

All else equal,risk averse investors generally require __________ returns to purchase investments with __________ risks.

A) higher; lower

B) lower; higher

C) higher; higher

D) None of the above is correct.

A) higher; lower

B) lower; higher

C) higher; higher

D) None of the above is correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

The Security Market Line (SML)relates risk to return,for a given set of financial market conditions.If investors conclude that the inflation rate is going to increase,which of the following changes would be most likely to occur?

A) The market risk premium would increase.

B) Beta would increase.

C) The slope of the SML would increase.

D) The required return of an average stock, rA = rM, would increase.

E) None of the indicated changes would be likely to occur.

A) The market risk premium would increase.

B) Beta would increase.

C) The slope of the SML would increase.

D) The required return of an average stock, rA = rM, would increase.

E) None of the indicated changes would be likely to occur.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the statements is most correct?

A) Suppose the returns on two stocks are negatively correlated. One has a beta of 1.2 as determined in a regression analysis, while the other has a beta of -0.6. The returns on the stock with the negative beta will be negatively correlated with returns on most other stocks in the market.

B) Suppose you are managing a stock portfolio, and you have information which leads you to believe that the stock market is likely to be very strong in the immediate future, i.e., you are confident that the market is about to rise sharply. You should sell your high beta stocks and buy low beta stocks in order to take advantage of the expected market move.

C) In a recent issue, The Wall Street Journal ran a story on a company named Collections Inc., which is in the business of collecting past due accounts for other companies, i.e., it is a collections agency. According to the Journal, Collections' revenues, profits, and stock price tend to rise during recessions. This suggests that Collection Inc.'s beta should be quite high, say 2.0, because it does so much better than most companies when the economy is weak.

D) Statements a and b are both true.

E) Statements a and c are both true.

A) Suppose the returns on two stocks are negatively correlated. One has a beta of 1.2 as determined in a regression analysis, while the other has a beta of -0.6. The returns on the stock with the negative beta will be negatively correlated with returns on most other stocks in the market.

B) Suppose you are managing a stock portfolio, and you have information which leads you to believe that the stock market is likely to be very strong in the immediate future, i.e., you are confident that the market is about to rise sharply. You should sell your high beta stocks and buy low beta stocks in order to take advantage of the expected market move.

C) In a recent issue, The Wall Street Journal ran a story on a company named Collections Inc., which is in the business of collecting past due accounts for other companies, i.e., it is a collections agency. According to the Journal, Collections' revenues, profits, and stock price tend to rise during recessions. This suggests that Collection Inc.'s beta should be quite high, say 2.0, because it does so much better than most companies when the economy is weak.

D) Statements a and b are both true.

E) Statements a and c are both true.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

Choose the correct answer for the following: (1)Which is the best measure of risk for choosing an asset which is to be held in isolation? (2)Which is the best measure for choosing an asset to be held as part of a diversified portfolio?

A) Variance; correlation coefficient.

B) Standard deviation; correlation coefficient.

C) Beta; variance.

D) Coefficient of variation; beta.

E) Beta; beta.

A) Variance; correlation coefficient.

B) Standard deviation; correlation coefficient.

C) Beta; variance.

D) Coefficient of variation; beta.

E) Beta; beta.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

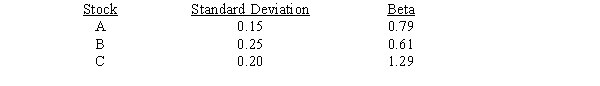

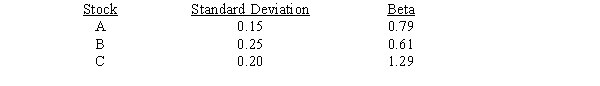

You have developed the following data on three stocks:  If you are a risk minimizer,you should choose Stock __________ if it is to be held in isolation and Stock __________ if it is to be held as part of a well-diversified portfolio.

If you are a risk minimizer,you should choose Stock __________ if it is to be held in isolation and Stock __________ if it is to be held as part of a well-diversified portfolio.

A) A; A

B) A; B

C) B; A

D) C; A

E) C; B

If you are a risk minimizer,you should choose Stock __________ if it is to be held in isolation and Stock __________ if it is to be held as part of a well-diversified portfolio.

If you are a risk minimizer,you should choose Stock __________ if it is to be held in isolation and Stock __________ if it is to be held as part of a well-diversified portfolio.A) A; A

B) A; B

C) B; A

D) C; A

E) C; B

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements is false?

A) The coefficient of variation is a better measure of risk than the standard deviation if the expected returns of the securities being compared differ significantly.

B) Managers cannot act in the best interests of their shareholders unless they know their shareholders' average time preference for receiving their money and what risks a typical shareholder is prepared to assume.

C) Companies should deliberately increase their risk relative to the market only if the actions that increase the risk also increase the expected rate of return on the firm's assets by enough to completely compensate for the higher risk.

D) If the expected rate of return for a particular investment, as seen by the marginal investor, exceeds its required rate of return, we should soon observe an increase in demand for the investment, and the price will likely increase until a price is established that equates the expected return with the required return.

E) All of the above statements are correct.

A) The coefficient of variation is a better measure of risk than the standard deviation if the expected returns of the securities being compared differ significantly.

B) Managers cannot act in the best interests of their shareholders unless they know their shareholders' average time preference for receiving their money and what risks a typical shareholder is prepared to assume.

C) Companies should deliberately increase their risk relative to the market only if the actions that increase the risk also increase the expected rate of return on the firm's assets by enough to completely compensate for the higher risk.

D) If the expected rate of return for a particular investment, as seen by the marginal investor, exceeds its required rate of return, we should soon observe an increase in demand for the investment, and the price will likely increase until a price is established that equates the expected return with the required return.

E) All of the above statements are correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is most correct?

A) If you add enough randomly selected stocks to a portfolio, you can completely eliminate all the market risk from the portfolio

B) If you formed a portfolio which included a large number of low beta stocks (stocks with betas less than 1.0 but greater than -1.0), the portfolio would itself have a beta coefficient that is equal to the weighted average beta of the stocks in the portfolio, so the portfolio would have a relatively low degree of risk.

C) If you were restricted to investing in publicly traded common stocks, yet you wanted to minimize the riskiness of your portfolio as measure by its beta, then, according to the CAPM theory, you should invest some of your money in each stock in the market, i.e., if there were 10,000 traded stocks in the world, the least risky portfolio would include some shares in each of them.

D) Company specific (or unsystematic) risk can be eliminated by forming a large portfolio, but normally even highly diversified portfolios are subject to market (or systematic) risk.

E) Statements b and d are both correct.

A) If you add enough randomly selected stocks to a portfolio, you can completely eliminate all the market risk from the portfolio

B) If you formed a portfolio which included a large number of low beta stocks (stocks with betas less than 1.0 but greater than -1.0), the portfolio would itself have a beta coefficient that is equal to the weighted average beta of the stocks in the portfolio, so the portfolio would have a relatively low degree of risk.

C) If you were restricted to investing in publicly traded common stocks, yet you wanted to minimize the riskiness of your portfolio as measure by its beta, then, according to the CAPM theory, you should invest some of your money in each stock in the market, i.e., if there were 10,000 traded stocks in the world, the least risky portfolio would include some shares in each of them.

D) Company specific (or unsystematic) risk can be eliminated by forming a large portfolio, but normally even highly diversified portfolios are subject to market (or systematic) risk.

E) Statements b and d are both correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is most correct?

A) The required return on a firm's common stock is determined by the firm's systematic (or market) risk. If its systematic risk is known, and if it is expected to remain constant, the analyst has sufficient information to specify the firm's required return.

B) A security's beta measures its nondiversifiable (systematic, or market) risk relative to that of most other securities.

C) If the returns of two firms are negatively correlated, one of them must have a negative beta.

D) A stock's beta is less relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only one stock.

E) Statements b and c are both correct.

A) The required return on a firm's common stock is determined by the firm's systematic (or market) risk. If its systematic risk is known, and if it is expected to remain constant, the analyst has sufficient information to specify the firm's required return.

B) A security's beta measures its nondiversifiable (systematic, or market) risk relative to that of most other securities.

C) If the returns of two firms are negatively correlated, one of them must have a negative beta.

D) A stock's beta is less relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only one stock.

E) Statements b and c are both correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is not a difficulty concerning beta and its estimation?

A) Sometimes a security or project does not have a past history which can be used as a basis for calculating beta.

B) Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different than the "true" or "expected future" beta.

C) The beta of an "average stock," or "the market," can change over time, sometimes drastically.

D) Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for the future because conditions have changed.

E) All of the above are potentially serious difficulties.

A) Sometimes a security or project does not have a past history which can be used as a basis for calculating beta.

B) Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different than the "true" or "expected future" beta.

C) The beta of an "average stock," or "the market," can change over time, sometimes drastically.

D) Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for the future because conditions have changed.

E) All of the above are potentially serious difficulties.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is most correct?

A) If beta doubles, the required return doubles.

B) If a stock has a negative beta, its required return is negative.

C) Higher beta stocks have more company-specific risk, but do not necessarily have more market risk.

D) If a portfolio's beta increases from 1.2 to 1.5, its required rate of return will increase by an amount equal to its market risk premium.

E) If two stocks have the same standard deviation and the correlation coefficient between the returns of two stocks equals zero, an equally weighted portfolio of the two stocks will have a standard deviation lower than that of individual stocks.

A) If beta doubles, the required return doubles.

B) If a stock has a negative beta, its required return is negative.

C) Higher beta stocks have more company-specific risk, but do not necessarily have more market risk.

D) If a portfolio's beta increases from 1.2 to 1.5, its required rate of return will increase by an amount equal to its market risk premium.

E) If two stocks have the same standard deviation and the correlation coefficient between the returns of two stocks equals zero, an equally weighted portfolio of the two stocks will have a standard deviation lower than that of individual stocks.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is correct?

A) If the returns on a stock could vary widely, and its standard deviation is large, then the stock will necessarily have a large beta coefficient.

B) A stock that is more highly positively correlated with "The Market" than most stocks would not necessarily have a beta coefficient that is greater than 1.0.

C) A stock's standard deviation of returns is a measure of the stock's "stand-alone" risk, while its coefficient of variation measures its risk if the stock is held in a portfolio.

D) A portfolio that contained 100 low-beta stocks would be riskier than a portfolio containing 100 high-beta stocks.

E) Negative betas cannot exist; if you calculate one, you made an error.

A) If the returns on a stock could vary widely, and its standard deviation is large, then the stock will necessarily have a large beta coefficient.

B) A stock that is more highly positively correlated with "The Market" than most stocks would not necessarily have a beta coefficient that is greater than 1.0.

C) A stock's standard deviation of returns is a measure of the stock's "stand-alone" risk, while its coefficient of variation measures its risk if the stock is held in a portfolio.

D) A portfolio that contained 100 low-beta stocks would be riskier than a portfolio containing 100 high-beta stocks.

E) Negative betas cannot exist; if you calculate one, you made an error.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

Assume you are considering combining two investments to form a portfolio and you are very concerned with the risk that will result from the combination.If you want to attain the greatest effect from diversification,you would prefer that the assets are __________ related.

A) negatively

B) positively

C) not

D) The relationship between the two investments gives no indication of the diversification effect that will result by combining them to form a portfolio.

E) Diversification is not an important factor in investment decisions.

A) negatively

B) positively

C) not

D) The relationship between the two investments gives no indication of the diversification effect that will result by combining them to form a portfolio.

E) Diversification is not an important factor in investment decisions.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements is most correct?

A) If investors become more risk averse, but rRF remains constant, the required rate of return on high beta stocks will rise, the required return on low beta stocks will decline, but the required return on an average risk stock will not change.

B) If Mutual Fund A held equal amounts of 100 stocks, each of which had a beta of 1.0, and Mutual Fund B held equal amounts of 10 stocks with betas of 1.0, then the two mutual funds would have betas of 1.0 and thus would be equally risky from an investor's standpoint.

C) An investor who holds just one stock will be exposed to more risk than an investor who holds a portfolio of stocks, assuming the stocks are all equally risky. Since the holder of the 1-stock portfolio is exposed to more risk, he or she can expect to earn a higher rate of return to compensate for the greater risk.

D) Assume that the required rate of return on the market , rM, is given and fixed. If the yield curve were upward-sloping, then the Security Market Line (SML) would have a steeper slope if 1-year Treasury securities were used as the risk-free rate than if 30-year Treasury bonds were used for rRF.

E) Statements a, b, c, and d are all false.

A) If investors become more risk averse, but rRF remains constant, the required rate of return on high beta stocks will rise, the required return on low beta stocks will decline, but the required return on an average risk stock will not change.

B) If Mutual Fund A held equal amounts of 100 stocks, each of which had a beta of 1.0, and Mutual Fund B held equal amounts of 10 stocks with betas of 1.0, then the two mutual funds would have betas of 1.0 and thus would be equally risky from an investor's standpoint.

C) An investor who holds just one stock will be exposed to more risk than an investor who holds a portfolio of stocks, assuming the stocks are all equally risky. Since the holder of the 1-stock portfolio is exposed to more risk, he or she can expect to earn a higher rate of return to compensate for the greater risk.

D) Assume that the required rate of return on the market , rM, is given and fixed. If the yield curve were upward-sloping, then the Security Market Line (SML) would have a steeper slope if 1-year Treasury securities were used as the risk-free rate than if 30-year Treasury bonds were used for rRF.

E) Statements a, b, c, and d are all false.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

__________ is a measure of total risk,whereas __________ is a measure of systematic risk.

A) Standard deviation; beta

B) Beta; standard deviation

C) Standard deviation; variance

D) Coefficient of variation; standard deviation

E) None of the above is correct.

A) Standard deviation; beta

B) Beta; standard deviation

C) Standard deviation; variance

D) Coefficient of variation; standard deviation

E) None of the above is correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

Steve Brickson currently has an investment portfolio that contains four stocks with a total value equal to $80,000.The portfolio has a beta (?)equal to 1.4.Steve wants to invest an additional $20,000 in a stock that has ? = 2.4.After Steve adds the new stock to his portfolio,what will be the portfolio's beta?

A) 1.6

B) 1.9

C) 2.0

D) Not enough information is given to compute the portfolio's beta (?).

E) None of the above is correct.

A) 1.6

B) 1.9

C) 2.0

D) Not enough information is given to compute the portfolio's beta (?).

E) None of the above is correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

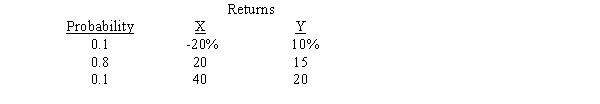

Given the following information,compute the standard deviation for Investment A:

A) 85.0%

B) 5.0%

C) 9.0%

D)17.%

E) None of the above are correct.

A) 85.0%

B) 5.0%

C) 9.0%

D)17.%

E) None of the above are correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

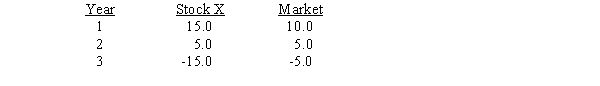

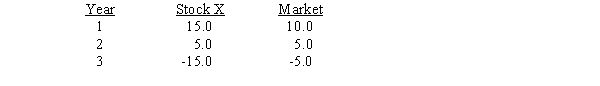

Stock X and the "market" had the following returns during the last three years,and the same relative volatility is expected to exist in the future:  The riskless rate is rRF = 8%,and the expected return on the market is 12 percent.If equilibrium exists,what is the expected return on Stock X?

The riskless rate is rRF = 8%,and the expected return on the market is 12 percent.If equilibrium exists,what is the expected return on Stock X?

A) -4%

B) 8%

C) 12%

D) 14%

E) 16%

The riskless rate is rRF = 8%,and the expected return on the market is 12 percent.If equilibrium exists,what is the expected return on Stock X?

The riskless rate is rRF = 8%,and the expected return on the market is 12 percent.If equilibrium exists,what is the expected return on Stock X?A) -4%

B) 8%

C) 12%

D) 14%

E) 16%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

Calculate the standard deviation of the expected dollar returns for Ditto Copier Center,given the following distribution of returns:

A) $36.0

B) $23.0

C) $18.0

D) $13.0

E) $30.0

A) $36.0

B) $23.0

C) $18.0

D) $13.0

E) $30.0

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

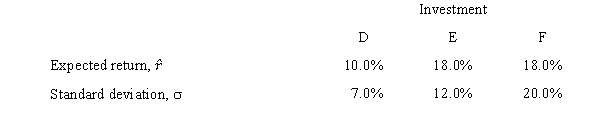

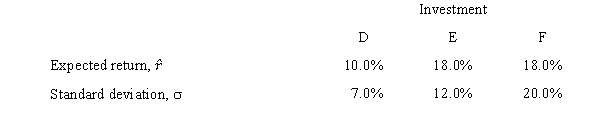

Based on the information given below,which of the following statements is incorrect?

A) Based on both risk and return, Investment D and Investment E should be considered equally risky.

B) If Investment F is negatively related to both Investment D and Investment E, then combining Investment F with both Investment D and Investment E would always produce a portfolio with lower risk than a portfolio of Investment F and either one of the other investments combined.

C) Investment F is the most desirable security for investors who are risk averse and who want to hold a one-security portfolio.

D) An investor can purchase positive amounts of Investment D and Investment F and form a two-security portfolio with a return greater than 18 percent and a standard deviation less than 10 percent.

E) None of the above statements is correct.

A) Based on both risk and return, Investment D and Investment E should be considered equally risky.

B) If Investment F is negatively related to both Investment D and Investment E, then combining Investment F with both Investment D and Investment E would always produce a portfolio with lower risk than a portfolio of Investment F and either one of the other investments combined.

C) Investment F is the most desirable security for investors who are risk averse and who want to hold a one-security portfolio.

D) An investor can purchase positive amounts of Investment D and Investment F and form a two-security portfolio with a return greater than 18 percent and a standard deviation less than 10 percent.

E) None of the above statements is correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

Assume the risk-free rate of return (rRF)is 5 percent,the market risk premium (RPM)is 8 percent,and an investment exists that has a beta (β)equal to 1.5.According to the Capital Asset Pricing Model (CAPM),which of the following statements is correct?

A) The risk premium associated with the investment would be 12 percent.

B) The appropriate rate of return for the investment is 9.5 percent.

C) All investments that have betas less than 1.0 must earn a total rate of return less than 8 percent.

D) There is not enough information to answer this question.

E) None of the above is a correct statement.

A) The risk premium associated with the investment would be 12 percent.

B) The appropriate rate of return for the investment is 9.5 percent.

C) All investments that have betas less than 1.0 must earn a total rate of return less than 8 percent.

D) There is not enough information to answer this question.

E) None of the above is a correct statement.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

Stock X has ? = 4.0,which means that it is considered four times riskier than the average stock,or the stock market as a whole.According to the capital asset pricing model,Stock X should earn

A) a total return that is four times greater than the market return, that is, rX = 4 * rM.

B) a risk premium that is four times greater than the market risk premium-that is, RPX = 4 * RPM, which means that rX B kRF = 4 * (rM B kRF).

C) a return that is less than the market return (rM) because, all else equal, the high risk associated with Stock X will cause its value to decrease.

D) the risk-free rate of return (rRF).

E) None of the above is correct.

A) a total return that is four times greater than the market return, that is, rX = 4 * rM.

B) a risk premium that is four times greater than the market risk premium-that is, RPX = 4 * RPM, which means that rX B kRF = 4 * (rM B kRF).

C) a return that is less than the market return (rM) because, all else equal, the high risk associated with Stock X will cause its value to decrease.

D) the risk-free rate of return (rRF).

E) None of the above is correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

If the risk-free rate is 7 percent,the expected return on the market is 10 percent,and the expected return on Security J is 13 percent,what is the beta of Security J?

A) 1.0

B) 1.5

C) 2.0

D) 2.5

E) 3.0

A) 1.0

B) 1.5

C) 2.0

D) 2.5

E) 3.0

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

Stock Q has a beta (β)equal to 1.6 and Stock P has a beta equal to 0.8.Based on this information,according to the capital asset pricing model (CAPM),which of the following statements is correct?

A) The required rate of return for Stock Q, rQ, should be 1.6 times greater than the required rate of return for Stock P, rP.

B) The risk premium associated with Stock Q, RPQ, should be 1.6 times greater than the risk premium associated with Stock P, RPP.

C) The required rate of return for Stock Q, rQ, should be two times greater than the required rate of return for Stock P, rP.

D) The risk premium associated with Stock Q, RPQ, should be two times greater than the risk premium associated with Stock P, RPP.

E) None of the above is a correct answer.

A) The required rate of return for Stock Q, rQ, should be 1.6 times greater than the required rate of return for Stock P, rP.

B) The risk premium associated with Stock Q, RPQ, should be 1.6 times greater than the risk premium associated with Stock P, RPP.

C) The required rate of return for Stock Q, rQ, should be two times greater than the required rate of return for Stock P, rP.

D) The risk premium associated with Stock Q, RPQ, should be two times greater than the risk premium associated with Stock P, RPP.

E) None of the above is a correct answer.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

Sharon Stonewall currently has an investment portfolio that contains 10 stocks that have a total value equal to $160,000.The portfolio has a beta (?)equal to 1.0.Sharon wants to invest an additional $40,000 in a stock with ? = 2.0.After Sharon adds the new stock to her portfolio,what will be the portfolio's beta?

A) 1.2

B) 1.5

C) 2.0

D) Not enough information is given to compute the portfolio's beta (?).

E) None of the above is correct.

A) 1.2

B) 1.5

C) 2.0

D) Not enough information is given to compute the portfolio's beta (?).

E) None of the above is correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

Based on the information given below,which of the investments would be considered best based on its risk and return relationship? Assume all investors are risk-averse and the investments will be held in isolation,not in a portfolio.

A) D, because its total risk is lowest.

B) E, because its coefficient of variation is lowest.

C) F, because its standard deviation, , is highest.

D) E and F, because the have the same expected return,.

E) None of the above.

A) D, because its total risk is lowest.

B) E, because its coefficient of variation is lowest.

C) F, because its standard deviation, , is highest.

D) E and F, because the have the same expected return,.

E) None of the above.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

HR Corporation has a beta of 2.0,while LR Corporation's beta is 0.5.The risk-free rate is 10%,and the required rate of return on an average stock is 15%.Now the expected rate of inflation built into kRF falls by 3 percentage points,the real risk-free rate remains constant,the required return on the market falls to 11%,and the betas remain constant.When all of these changes are made,what will be the difference in required returns on HR's and LR's stocks?

A) 1.0%

B) 2.5%

C) 4.5%

D) 5.4%

E) 6.0%

A) 1.0%

B) 2.5%

C) 4.5%

D) 5.4%

E) 6.0%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

Given the following information,compute the coefficient of variation for Cyber Soda,Inc.:  Expected return:

Expected return:

A) 3.78

B) 0.58

C) 0.00

D) 1.72

E) None of the above is correct.

Expected return:

Expected return:A) 3.78

B) 0.58

C) 0.00

D) 1.72

E) None of the above is correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements is most correct?

A) According to CAPM theory, the required rate of return on a given stock can be found by use of the SML equation:

Ri = rRF + (rM - rRF) i

Expectations for inflation are not reflected anywhere in this equation, even indirectly, and because of that the text notes that the CAPM may not be strictly correct.

B) If the required rate of return is given by the SML equation as set forth in Answer a, there is nothing a financial manager can do to changer his or her company's cost of capital, because each of the elements in the equation is determined exclusively by the market, not by the type of actions a company's management can take, even in the long run.

C) Assume that the required rate of return on the market is currently rM = 15%, and that rM remains fixed at that level. If the yield curve has a steep upward slope, the calculated market risk premium would be larger if the 30-day T-bill rate were used as the risk-free rate than if the 30-year T-bond rate were used as rRF.

D) Statements a and b are both true.

E) Statements a and c are both true.

A) According to CAPM theory, the required rate of return on a given stock can be found by use of the SML equation:

Ri = rRF + (rM - rRF) i

Expectations for inflation are not reflected anywhere in this equation, even indirectly, and because of that the text notes that the CAPM may not be strictly correct.

B) If the required rate of return is given by the SML equation as set forth in Answer a, there is nothing a financial manager can do to changer his or her company's cost of capital, because each of the elements in the equation is determined exclusively by the market, not by the type of actions a company's management can take, even in the long run.

C) Assume that the required rate of return on the market is currently rM = 15%, and that rM remains fixed at that level. If the yield curve has a steep upward slope, the calculated market risk premium would be larger if the 30-day T-bill rate were used as the risk-free rate than if the 30-year T-bond rate were used as rRF.

D) Statements a and b are both true.

E) Statements a and c are both true.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58

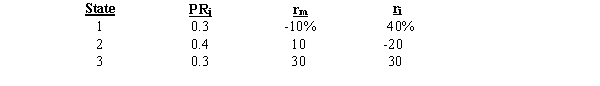

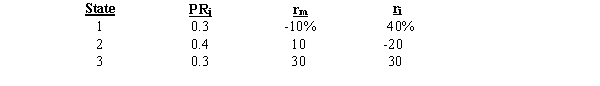

Given the following probability distributions,what are the expected returns for the Market and for Security J?

A) 10.0%; 11.3%

B) 9.5%; 13.0%

C) 10.0%; 9.5%

D) 10.0%; 13.0%

E) 13.0%; 10.0%

A) 10.0%; 11.3%

B) 9.5%; 13.0%

C) 10.0%; 9.5%

D) 10.0%; 13.0%

E) 13.0%; 10.0%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

59

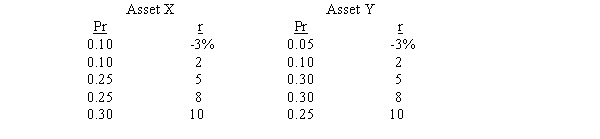

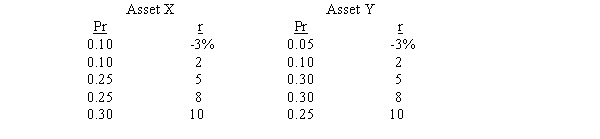

Assume that a new law is passed which restricts investors to holding only one asset.A risk-averse investor is considering two possible assets as the asset to be held in isolation.The assets' possible returns and related probabilities (i.e.,the probability distributions)are as follows:  Which asset should be preferred?

Which asset should be preferred?

A) Asset X, since its expected return is higher.

B) Asset Y, since its beta is probably lower.

C) Either one, since the expected returns are the same.

D) Asset X, since its standard deviation is lower.

E) Asset Y, since its coefficient of variation is lower and its expected return is higher.

Which asset should be preferred?

Which asset should be preferred?A) Asset X, since its expected return is higher.

B) Asset Y, since its beta is probably lower.

C) Either one, since the expected returns are the same.

D) Asset X, since its standard deviation is lower.

E) Asset Y, since its coefficient of variation is lower and its expected return is higher.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

60

If a stock has a beta coefficient,β,equal to 1.20,the risk premium associated with the market is 9 percent,and the risk-free rate is 5 percent,application of the capital asset pricing model indicates the appropriate return should be __________.

A) 9.8%

B) 14%

C) 5%

D) 15.8%

E) None of the above is correct.

A) 9.8%

B) 14%

C) 5%

D) 15.8%

E) None of the above is correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

61

You are managing a portfolio of 10 stocks which are held in equal amounts.The current beta of the portfolio is 1.64,and the beta of Stock A is 2.0.If Stock A is sold,what would the beta of the replacement stock have to be to produce a new portfolio beta of 1.55?

A) 1.10

B) 1.00

C) 0.90

D) 0.75

E) 0.50

A) 1.10

B) 1.00

C) 0.90

D) 0.75

E) 0.50

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

62

Company X has beta = 1.6,while Company Y's beta = 0.7.The risk-free rate is 7%,and the required rate of return on an average stock is 12%.Now the expected rate of inflation built into rRF rises by 1 percentage point,the real risk-free rate remains constant,the required return on the market rises to 14%,and betas remain constant.After all of these changes have been reflected in the data,by how much will the required return on Stock X exceed that on Stock Y?

A) 3.75%

B) 4.20%

C) 4.82%

D) 5.40%

E) 5.75%

A) 3.75%

B) 4.20%

C) 4.82%

D) 5.40%

E) 5.75%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

63

Oakdale Furniture Inc.has a beta coefficient of 0.7 and a required rate of return of 15 percent.The market risk premium is currently 5 percent.If the inflation premium increases by 2 percentage points,and Oakdale acquires new assets which increase its beta by 50 percent,what will be Oakdale's new required rate of return?

A) 13.5%

B) 22.8%

C) 18.75%

D) 15.25%

E) 17.00%

A) 13.5%

B) 22.8%

C) 18.75%

D) 15.25%

E) 17.00%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

64

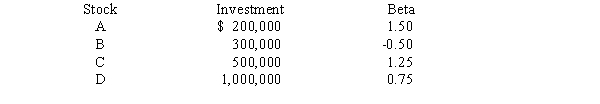

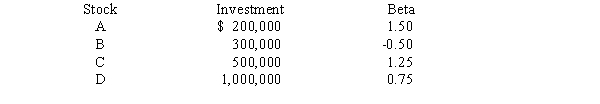

Consider the following information,and then calculate the required rate of return for the Scientific Investment Fund.The total investment in the fund is $2 million.The market required rate of return is 15 percent,and the risk-free rate is 7 percent.

A) 14.3%

B) 15.0%

C) 13.1%

D) 12.7%

E) 10.3%

A) 14.3%

B) 15.0%

C) 13.1%

D) 12.7%

E) 10.3%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

65

Here are the expected returns on two stocks:  If you form a 50-50 portfolio of the two stocks,what is the portfolio's standard deviation?

If you form a 50-50 portfolio of the two stocks,what is the portfolio's standard deviation?

A) 8.1%

B) 10.5%

C) 13.4%

D) 16.5%

E) 20.0%

If you form a 50-50 portfolio of the two stocks,what is the portfolio's standard deviation?

If you form a 50-50 portfolio of the two stocks,what is the portfolio's standard deviation?A) 8.1%

B) 10.5%

C) 13.4%

D) 16.5%

E) 20.0%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

66

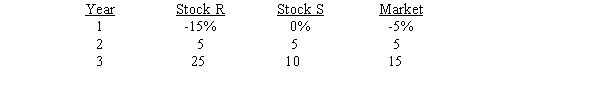

CAPM Analysis

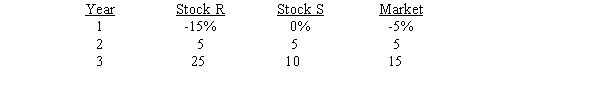

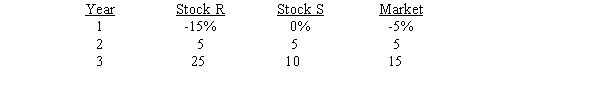

You have been asked to use a CAPM analysis to choose between stocks R and s, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin. The risk-free rate is 6%, and the required return on an average stock (or "the market") is 10%. Your security analyst tells you that Stock S's expected rate of return is = 11%, while Stock R's expected rate of return in = 13%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

Refer to CAPM Analysis.Calculate both stocks' betas.What is the difference between the betas,i.e.,what is the value of betaR - betaS? (Hint: The graphical method of calculating the rise over run,or (Y2 - Y1)divided by (X2 - X1)may aid you.)

A) 0.0

B) 1.0

C) 1.5

D) 2.0

E) 2.5

You have been asked to use a CAPM analysis to choose between stocks R and s, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin. The risk-free rate is 6%, and the required return on an average stock (or "the market") is 10%. Your security analyst tells you that Stock S's expected rate of return is = 11%, while Stock R's expected rate of return in = 13%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.Refer to CAPM Analysis.Calculate both stocks' betas.What is the difference between the betas,i.e.,what is the value of betaR - betaS? (Hint: The graphical method of calculating the rise over run,or (Y2 - Y1)divided by (X2 - X1)may aid you.)

A) 0.0

B) 1.0

C) 1.5

D) 2.0

E) 2.5

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

67

CAPM Analysis

You have been asked to use a CAPM analysis to choose between stocks R and s, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin. The risk-free rate is 6%, and the required return on an average stock (or "the market") is 10%. Your security analyst tells you that Stock S's expected rate of return is = 11%, while Stock R's expected rate of return in = 13%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

Refer to CAPM Analysis.Set up the SML equation and use it to calculate both stocks' required rates of return,and compare those required returns with the expected returns given above.You should invest in the stock whose expected return exceeds its required return by the widest margin.What is the widest margin,or greatest excess return r-r?

A) 0.0%

B) 0.5%

C) 1.0%

D) 2.0%

E) 3.0%

You have been asked to use a CAPM analysis to choose between stocks R and s, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin. The risk-free rate is 6%, and the required return on an average stock (or "the market") is 10%. Your security analyst tells you that Stock S's expected rate of return is = 11%, while Stock R's expected rate of return in = 13%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.Refer to CAPM Analysis.Set up the SML equation and use it to calculate both stocks' required rates of return,and compare those required returns with the expected returns given above.You should invest in the stock whose expected return exceeds its required return by the widest margin.What is the widest margin,or greatest excess return r-r?

A) 0.0%

B) 0.5%

C) 1.0%

D) 2.0%

E) 3.0%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

68

You hold a diversified portfolio consisting of a $5,000 investment in each of 20 different common stocks.The portfolio beta is equal to 1.15.You have decided to sell one of your stocks,a lead mining stock whose β = 1.0,for $5,000 net and to use the proceeds to buy $5,000 of stock in a steel company whose β = 2.0.What will be the new beta of the portfolio?

A) 1.12

B) 1.20

C) 1.22

D) 1.10

E) 1.15

A) 1.12

B) 1.20

C) 1.22

D) 1.10

E) 1.15

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck