Deck 17: Accounting for Share-Based Payments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/77

Play

Full screen (f)

Deck 17: Accounting for Share-Based Payments

1

AASB 2 requires that goods and services received in an equity-settled share-based transaction be measured in reference to fair value of equity instruments granted.

True

2

AASB 2 requires the remeasurement of cash-settled transactions at fair value at reporting date.

True

3

In a cash-settled share-based payment transaction,the entity shall remeasure the fair value of the liability at each reporting date and at the date of settlement,with any changes in fair value recognised in profit or loss for the period.

True

4

If share appreciation rights vest immediately,the entity shall presume that the services rendered by the employees in exchange for the share appreciation rights have been received.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

5

AASB 2 requires the remeasurement of equity-settled transactions at fair value at reporting date.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

6

Equity instruments granted to employees of the acquiree,in their capacity as employees in a business combination,is within the scope of AASB 2.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

7

When a good or service is acquired in a share-based payment transaction and it does qualify as an asset,the transaction must be expensed.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

8

In share-based payment transactions with cash alternatives,the entity shall measure the equity component of the compound financial instrument as the difference between the fair value of the goods or services received and the fair value of the debt component,measured at vesting date.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

9

If an entity alters the conditions of the options after issue,AASB 2 requires the effects of such modifications to be recognised.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

10

If the fair value of the equity instruments granted in a share-based payment transaction cannot be estimated,the entity shall measure the fair value of the goods received.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

11

If a grant of equity instruments is conditional upon satisfying specified vesting conditions,the vesting conditions shall be taken into account in estimating the fair value of the instruments at measurement date.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

12

AASB 2 requires some share-based payments to be recognised in an entity's financial statements.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

13

AASB 2 requires all share-based payment transactions to be measured at grant date.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

14

AASB 2 also applies to transactions where an entity issues equity instruments to purchase the net assets of another entity in a business combination.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

15

AASB 2 requires all share-based payment transactions to be expensed on grant date and the credit is equity.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

16

A share-based payment is a transaction that entitles another party to receive a cash payment with the amount paid dependent on the price of the entity's shares or other equity instruments.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

17

Issue of shares in exchange for shares of another entity in a purchase transaction of the net assets of an entity in a business combination is within the scope of AASB 2 Share-based Payment.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

18

AASB 2 requires all equity-settled share-based payment transactions be measured at fair value of goods and services received.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

19

Where equity instruments are issued with a vesting period,the transactions must be recognised over the vesting period.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

20

AASB 2 does not require expensing of cash-settled share-based payment transactions until settlement date.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

21

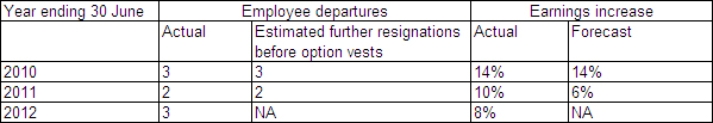

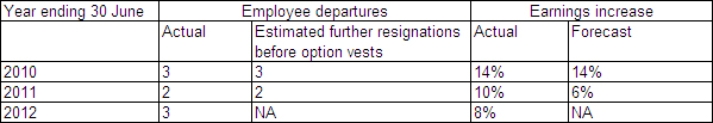

Blackburn Ltd grants 50 share options to each of its 150 employees on 1 July 2009.Each grant is conditional upon the employee working for the company for 3 years following the grant date.On grant date,the fair value of each option is estimated to be $12. Estimated value of the option for the year ending 2010,2011 and 2012 is $10,$13,$14 respectively.

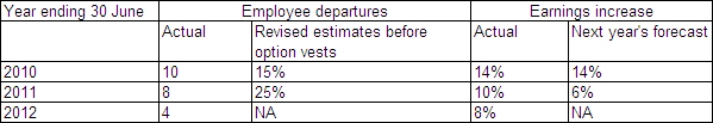

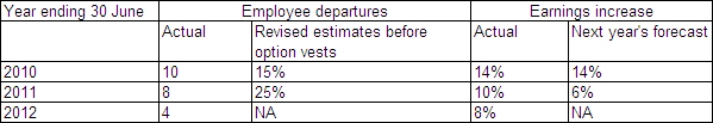

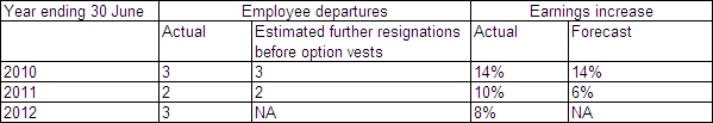

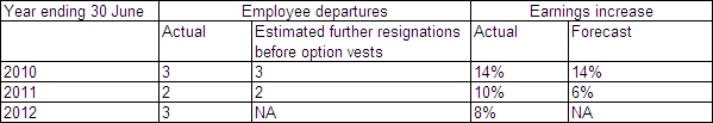

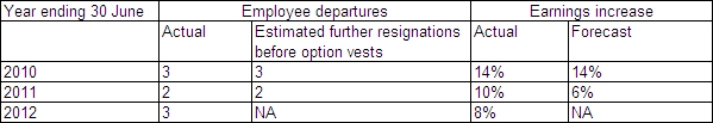

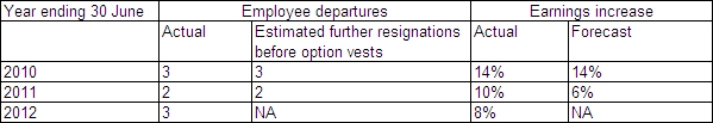

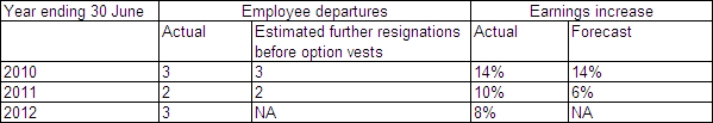

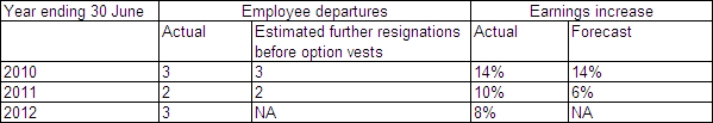

Information on employee departures at the end of each year follows:

What would be the appropriate journal entry to account for the share-based payment transaction for the year ending 30 June 2011?

A)

B)

C)

D)

Information on employee departures at the end of each year follows:

What would be the appropriate journal entry to account for the share-based payment transaction for the year ending 30 June 2011?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

22

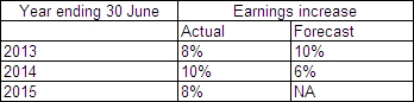

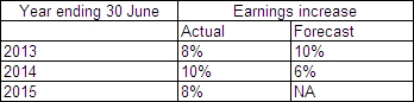

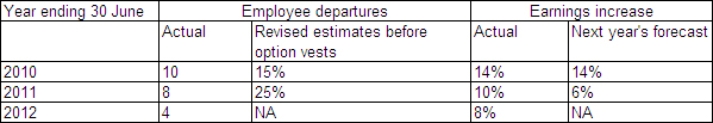

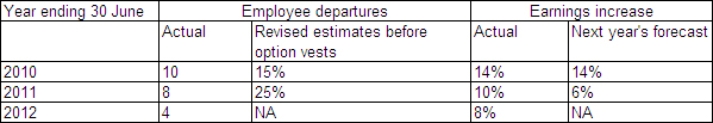

On 1 July 2012,Manchester Ltd granted 50 000 share options to its Chief Executive Officer with an exercise price of $40 per share,conditional upon the entity achieving the following non-market vesting conditions:

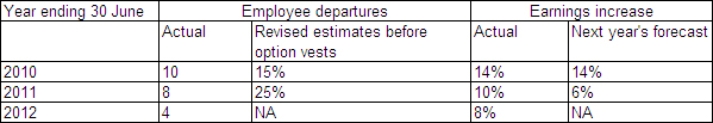

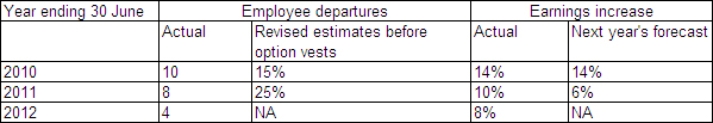

Earnings information available follows:

In accordance with AASB 2,when will this share option vest?

A) 1 July 2012

B) 30 June 2013

C) 30 June 2014

D) 30 June 2015

Earnings information available follows:

In accordance with AASB 2,when will this share option vest?

A) 1 July 2012

B) 30 June 2013

C) 30 June 2014

D) 30 June 2015

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following items are not considered share-based payment transactions within the scope of AASB 2?

A) options issued to employees in exchange for services rendered

B) shares issued to employees for services rendered

C) shares issued to consultants for services rendered

D) bonus shares issued to employees as a shareholder of the entity

A) options issued to employees in exchange for services rendered

B) shares issued to employees for services rendered

C) shares issued to consultants for services rendered

D) bonus shares issued to employees as a shareholder of the entity

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

24

In a share-based payment transaction like an option,which of the following accounting treatments is incorrect?

A) An entity shall recognise the goods or services received or acquired in a share-based payment transaction when it obtains the goods or as the services are received.

B) The entity shall recognise a corresponding increase in equity if the goods or services were received in an equity-settled share-based payment transaction.

C) The entity shall recognise a corresponding increase in liability if the goods or services were acquired in a cash-settled share-based payment transaction.

D) Goods or services received or acquired in a share-based payment transaction shall be recognised as expenses.

A) An entity shall recognise the goods or services received or acquired in a share-based payment transaction when it obtains the goods or as the services are received.

B) The entity shall recognise a corresponding increase in equity if the goods or services were received in an equity-settled share-based payment transaction.

C) The entity shall recognise a corresponding increase in liability if the goods or services were acquired in a cash-settled share-based payment transaction.

D) Goods or services received or acquired in a share-based payment transaction shall be recognised as expenses.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following share-based payment transactions are considered equity-settled transactions within the scope of AASB 2?

A) Company A grants 5000 options each to its directors in return for services to be received over two years.

B) Company B purchases machinery in exchange for shares.

C) Company C incurs a liability based on the price of the entity's share options to pay for the services of its sales executives.

D) Company A grants 5000 options each to its directors in return for services to be received over two years; Company B purchases machinery in exchange for shares.

A) Company A grants 5000 options each to its directors in return for services to be received over two years.

B) Company B purchases machinery in exchange for shares.

C) Company C incurs a liability based on the price of the entity's share options to pay for the services of its sales executives.

D) Company A grants 5000 options each to its directors in return for services to be received over two years; Company B purchases machinery in exchange for shares.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following items are considered share-based payment transactions within the scope of AASB 2?

A) share dividends to employees who are shareholders of the entity

B) goods acquired from a supplier on credit to be settled in cash

C) services provided by an employee to be settled in equity instruments

D) purchase of non-current assets on credit to be settled in cash

A) share dividends to employees who are shareholders of the entity

B) goods acquired from a supplier on credit to be settled in cash

C) services provided by an employee to be settled in equity instruments

D) purchase of non-current assets on credit to be settled in cash

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

27

Blackburn Ltd grants 50 share options to each of its 150 employees on 1 July 2009.Each grant is conditional upon the employee working for the company for 3 years following the grant date.On grant date,the fair value of each option is estimated to be $12. Estimated value of the option for the year ending 2010,2011 and 2012 is $10,$13,$14 respectively.

Information on employee departures at the end of each year follows:

In accordance with AASB 2,how much remuneration expense related to the share option issue should Blackburn Ltd recognise for the year ended 30 June 2010,30 June 2011 and 30 June 2012 respectively?

A) $19 500; $33 800; $39 800

B) $23 400; $25 800; $30 600

C) $23 400; $29 900; $39 800

D) $23 833; $35 534; $33 733

Information on employee departures at the end of each year follows:

In accordance with AASB 2,how much remuneration expense related to the share option issue should Blackburn Ltd recognise for the year ended 30 June 2010,30 June 2011 and 30 June 2012 respectively?

A) $19 500; $33 800; $39 800

B) $23 400; $25 800; $30 600

C) $23 400; $29 900; $39 800

D) $23 833; $35 534; $33 733

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

28

AASB 2 has reduced the discretion that reporting entities have when accounting for options and other share-based payments.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following share-based payment transactions are considered cash-settled transactions within the scope of AASB 2?

A) Company A grants 5000 options each to its directors in return for services to be received over two years.

B) Company B purchases machinery in exchange for shares.

C) Company C incurs a liability based on the price of the entity's share options to pay for the services of its sales executives.

D) Company A grants 5000 options each to its directors in return for services to be received over two years; Company B purchases machinery in exchange for shares.

A) Company A grants 5000 options each to its directors in return for services to be received over two years.

B) Company B purchases machinery in exchange for shares.

C) Company C incurs a liability based on the price of the entity's share options to pay for the services of its sales executives.

D) Company A grants 5000 options each to its directors in return for services to be received over two years; Company B purchases machinery in exchange for shares.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

30

Blackburn Ltd grants 50 share options to each of its 150 employees on 1 July 2009.Each grant is conditional upon the employee working for the company for 3 years following the grant date.On grant date,the fair value of each option is estimated to be $12. Estimated value of the option for the year ending 2010,2011 and 2012 is $10,$13,$14 respectively.

Information on employee departures at the end of each year follows:

What would be the appropriate journal entry to account for the share-based payment transaction for the year ending 30 June 2012?

A)

B)

C)

D)

Information on employee departures at the end of each year follows:

What would be the appropriate journal entry to account for the share-based payment transaction for the year ending 30 June 2012?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

31

Blackburn Ltd grants 50 share options to each of its 150 employees on 1 July 2009.Each grant is conditional upon the employee working for the company for 3 years following the grant date.On grant date,the fair value of each option is estimated to be $12. Estimated value of the option for the year ending 2010,2011 and 2012 is $10,$13,$14 respectively.

Information on employee departures at the end of each year follows:

What would be the appropriate journal entry to account for the share-based payment transaction for the year ending 30 June 2010?

A)

B)

C)

D)

Information on employee departures at the end of each year follows:

What would be the appropriate journal entry to account for the share-based payment transaction for the year ending 30 June 2010?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is incorrect of cash-settled share-based payment transactions?

A) The entity acquires goods and services by incurring a liability to transfer cash or other assets that are based on the price or value of the entity's shares or other equity instruments of the entity.

B) Share appreciation rights (SARs) is one example of a cash-settled share-based payment transaction.

C) Cash-settled share-based payment transactions are required to be re-measured at fair value at each reporting date until settlement date.

D) The equity shall be measured, initially and at each reporting date until settled, at the fair value of the share appreciation rights, by applying an option pricing model, taking into account the terms and conditions on which the share appreciation rights were granted, and the extent to which the employees have rendered service to date.

A) The entity acquires goods and services by incurring a liability to transfer cash or other assets that are based on the price or value of the entity's shares or other equity instruments of the entity.

B) Share appreciation rights (SARs) is one example of a cash-settled share-based payment transaction.

C) Cash-settled share-based payment transactions are required to be re-measured at fair value at each reporting date until settlement date.

D) The equity shall be measured, initially and at each reporting date until settled, at the fair value of the share appreciation rights, by applying an option pricing model, taking into account the terms and conditions on which the share appreciation rights were granted, and the extent to which the employees have rendered service to date.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

33

To assist users of financial statements an entity must provide the effect of expenses arising from share-based transactions on the entity's profit or loss for the period.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

34

AASB 2 requires all share-based payment transactions to be recognised at:

A) grant date.

B) balance date.

C) exercise date.

D) settlement date.

A) grant date.

B) balance date.

C) exercise date.

D) settlement date.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following items are considered cash-settled share-based payment transactions within the scope of AASB 2?

A) An entity grants 200 share options to all employees.

B) An entity grants 200 share options to all employees but requires employees to work at least 3 years.

C) An entity acquires a piece of equipment from another entity in exchange for shares of the entity.

D) An entity issues share appreciation rights to its employees.

A) An entity grants 200 share options to all employees.

B) An entity grants 200 share options to all employees but requires employees to work at least 3 years.

C) An entity acquires a piece of equipment from another entity in exchange for shares of the entity.

D) An entity issues share appreciation rights to its employees.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

36

Market prices for share options granted to employees are typically not available because:

A) Options granted to employees are subject to terms and conditions that do not apply to traded options.

B) It is difficult to obtain the fair value of these options using option pricing models.

C) Employee options have long lives and are usually exercised early.

D) Options granted to employees are subject to terms and conditions that do not apply to traded options and it is difficult to obtain the fair value of these options using option pricing models

A) Options granted to employees are subject to terms and conditions that do not apply to traded options.

B) It is difficult to obtain the fair value of these options using option pricing models.

C) Employee options have long lives and are usually exercised early.

D) Options granted to employees are subject to terms and conditions that do not apply to traded options and it is difficult to obtain the fair value of these options using option pricing models

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is incorrect of equity-settled share-based payment transactions?

A) These are transactions in which the entity receives goods and services as consideration for shares or share options issued by the entity.

B) There is a presumption that the fair value of the transactions with other parties (other than employees) can be measured reliably.

C) The fair value of equity-settled instruments is required to be re-estimated at balance date.

D) The entity shall recognise a corresponding increase in equity if the goods or services were received in an equity-settled share-based payment transaction.

A) These are transactions in which the entity receives goods and services as consideration for shares or share options issued by the entity.

B) There is a presumption that the fair value of the transactions with other parties (other than employees) can be measured reliably.

C) The fair value of equity-settled instruments is required to be re-estimated at balance date.

D) The entity shall recognise a corresponding increase in equity if the goods or services were received in an equity-settled share-based payment transaction.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

38

On 1 July 2012 Lancaster Ltd grants 100 share options to each of its 50 employees conditional upon the employee working for the entity for the next 3 years.The entity estimates the fair value of each share option at $13.Based on probability estimates,25 employees are expected to leave the entity before the options vest.In accordance with AASB 2,how much remuneration expense related to the share option issue should Lancaster Ltd recognise for the year ended 30 June 2013?

A) zero

B) $10 833

C) $32 500

D) $65 000

A) zero

B) $10 833

C) $32 500

D) $65 000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

39

In a share-based payment transaction like an option,vesting date is:

A) grant date.

B) expiry date of option.

C) date when all vesting conditions are satisfied.

D) balance date.

A) grant date.

B) expiry date of option.

C) date when all vesting conditions are satisfied.

D) balance date.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

40

On 1 July 2012 Lancashire Ltd grants 100 share options to each of its 50 employees conditional upon the employee working for the entity for the next 3 years.On the same date,the entity estimates the fair value of each share option at $15.Based on probability estimates,15 employees are expected to leave the entity in one year and another 5 employees in two years.Actual resignation for the year ending 2013 was 12 employees and the fair value of the option is $12 on 30 June 2014. In accordance with AASB 2,what is the cumulative remuneration expense (related to the share option issue)as at 30 June 2011?

A) $24 000

B) $26 400

C) $33 000

D) $45 000

A) $24 000

B) $26 400

C) $33 000

D) $45 000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

41

Wigan Ltd grants 100 options to each of its 80 employees on 1 July 2009.The fair value of each option at grant date is $20.The vesting conditions allow shares to vest if the following performance targets are achieved:

The following information is available:

What action must Wigan Ltd take that is in compliance with AASB 2,if the option does not vest on 30 June 2012?

A) No action is necessary.

B) It must modify the terms and conditions of the option to allow the employees to benefit from the share-based payment transaction in future.

C) The equity account arising from the share-based payment transaction shall be reversed and credited to revenue.

D) The equity account arising from the share-based payment transaction shall be reversed and credited to liability.

The following information is available:

What action must Wigan Ltd take that is in compliance with AASB 2,if the option does not vest on 30 June 2012?

A) No action is necessary.

B) It must modify the terms and conditions of the option to allow the employees to benefit from the share-based payment transaction in future.

C) The equity account arising from the share-based payment transaction shall be reversed and credited to revenue.

D) The equity account arising from the share-based payment transaction shall be reversed and credited to liability.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

42

Southport Ltd grants 100 share appreciation rights (SARs)to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for the next 3 years.All SARs held by employees will vest at the end of 3 years.The intrinsic value (equals cash actually paid out)and estimates of the fair value of the SARs at the end of each year are as follows:

Summary of actual and estimated employee departures and number of options exercised follow:

What is/are the journal entry/ies to recognise salary expense for Southport Ltd related to the share appreciation rights issued 1 July 2009 for the year ended 30 June 2012?

A)

B)

C)

D)

Summary of actual and estimated employee departures and number of options exercised follow:

What is/are the journal entry/ies to recognise salary expense for Southport Ltd related to the share appreciation rights issued 1 July 2009 for the year ended 30 June 2012?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

43

On 1 July 2009,Windermere Ltd grants 200 share options to each of its 100 employees.The share option is conditional upon the employee working for the entity when the share option vests and the entity achieving the following non-market vesting conditions:

If the employee resigns before the share option vests,the share option is forfeited.

On 30 June 2010,based on probability estimates how many employees are expected to be employed by Windermere Ltd when the share option vests?

A) 75

B) 78

C) 85

D) 88

If the employee resigns before the share option vests,the share option is forfeited.

On 30 June 2010,based on probability estimates how many employees are expected to be employed by Windermere Ltd when the share option vests?

A) 75

B) 78

C) 85

D) 88

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

44

Liverpool Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for the next 3 years.The fair value of each option at grant date is $15.Liverpool Ltd estimates that 15% of its employees will leave during the vesting period.The following table summarises the actual employee departures and revised estimates of employee departures across the vesting period.

By the end of year 2011 the company's share price had fallen and it decides to re-price the options.At this time the fair value of the original options is estimated to be $5 and the fair value of the re-priced options is estimated to be $8.

What is the employee benefits expense of Liverpool Ltd related to this share option for the year ended 30 June 2010?

A) $19 500

B) $25 000

C) $58 500

D) $75 000

By the end of year 2011 the company's share price had fallen and it decides to re-price the options.At this time the fair value of the original options is estimated to be $5 and the fair value of the re-priced options is estimated to be $8.

What is the employee benefits expense of Liverpool Ltd related to this share option for the year ended 30 June 2010?

A) $19 500

B) $25 000

C) $58 500

D) $75 000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

45

Southport Ltd grants 100 share appreciation rights (SARs)to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for the next 3 years.All SARs held by employees will vest at the end of 3 years.The intrinsic value (equals cash actually paid out)and estimates of the fair value of the SARs at the end of each year are as follows:

Summary of actual and estimated employee departures and number of options exercised follow:

What is the journal entry to recognise salary expense for Southport Ltd related to the share appreciation rights issued 1 July 2009 for the year ended 30 June 2011?

A)

B)

C)

D)

Summary of actual and estimated employee departures and number of options exercised follow:

What is the journal entry to recognise salary expense for Southport Ltd related to the share appreciation rights issued 1 July 2009 for the year ended 30 June 2011?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

46

On 1 July 2012 Chester Ltd granted an executive director a choice between receiving a cash payment equivalent to 5000 shares or receiving 6000 shares.The grant is conditional upon the director being under the employ of the entity for 3 years.What is the accounting treatment for this share-based payment arrangement that is consistent with AASB 2?

A) similar treatment with cash-settled transactions

B) similar treatment with equity-settled transactions

C) similar to a compound financial instrument

D) recognise salaries benefit expense at vesting date

A) similar treatment with cash-settled transactions

B) similar treatment with equity-settled transactions

C) similar to a compound financial instrument

D) recognise salaries benefit expense at vesting date

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

47

On 1 July 2012 York Ltd (a start-up biotech company)grants its senior manager a choice of receiving cash equivalent of 100 000 shares or 120000 shares.The grant is conditional upon the senior manager working for the entity for 3 years but if the share alternative is chosen,the grant vests after two years.At grant date the entity's share price is $12.50.The entity does not expect to pay dividends in the next 3 years.After taking into account the effects of post-vesting transfer restrictions,the entity estimates the grant-date fair value of the share alternative to be $12. What is the fair value of the equity component of the compound instrument?

A) $10 000

B) $20 000

C) $190 000

D) $300 000

A) $10 000

B) $20 000

C) $190 000

D) $300 000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

48

On 1 July 2009,Windermere Ltd grants 200 share options to each of its 100 employees.The share option is conditional upon the employee working for the entity when the share option vests and the entity achieving the following non-market vesting conditions:

If the employee resigns before the share option vests,the share option is forfeited.

On 30 June 2011,based on probability estimates how many employees are expected to be employed by Windermere Ltd when the share option vests?

A) 72

B) 75

C) 78

D) 82

If the employee resigns before the share option vests,the share option is forfeited.

On 30 June 2011,based on probability estimates how many employees are expected to be employed by Windermere Ltd when the share option vests?

A) 72

B) 75

C) 78

D) 82

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

49

Wigan Ltd grants 100 options to each of its 80 employees on 1 July 2009.The fair value of each option at grant date is $20.The vesting conditions allow shares to vest if the following performance targets are achieved:

The following information is available:

In accordance with AASB 2,how much employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2012?

A) $36 667

B) $44 667

C) $46 667

D) $48 000

The following information is available:

In accordance with AASB 2,how much employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2012?

A) $36 667

B) $44 667

C) $46 667

D) $48 000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

50

Wigan Ltd grants 100 options to each of its 80 employees on 1 July 2009.The fair value of each option at grant date is $20.The vesting conditions allow shares to vest if the following performance targets are achieved:

The following information is available:

In accordance with AASB 2,how much employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2011?

A) $22 000

B) $23 333

C) $76 000

D) $97 333

The following information is available:

In accordance with AASB 2,how much employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2011?

A) $22 000

B) $23 333

C) $76 000

D) $97 333

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is an acceptable measure of fair value of the equity instruments granted?

A) cost of the equity instrument at initial recognition

B) valuation technique used to estimate what the price of the equity instruments would have been on the measurement date in an arm's length transaction between knowledgeable, willing parties.

C) fair value of a similar equity instrument

D) net realisable value of the equity instrument

A) cost of the equity instrument at initial recognition

B) valuation technique used to estimate what the price of the equity instruments would have been on the measurement date in an arm's length transaction between knowledgeable, willing parties.

C) fair value of a similar equity instrument

D) net realisable value of the equity instrument

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

52

North Terraces Ltd issued share options to its executives two years ago.The options did not vest and have now expired.The cumulative salary benefits expense related to this option issue before its expiry amounts to $150 000.What is the appropriate course of action to take for North Terraces Ltd that is in accordance with AASB 2?

A) Reverse the expense previously recognised in equity.

B) Reclassify equity to accrued salaries expense.

C) Leave this in equity for transfer to retained earnings.

D) Recognise a gain of $150 000.

A) Reverse the expense previously recognised in equity.

B) Reclassify equity to accrued salaries expense.

C) Leave this in equity for transfer to retained earnings.

D) Recognise a gain of $150 000.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

53

If the arrangement in a share-based transaction provides either the entity or the counter party with the choice of cash settlement or issuance of the equity instruments,what is the accounting treatment required in AASB 2?

A) similar treatment with cash-settled transactions if the entity has incurred a liability to settle in cash or other assets

B) similar treatment with equity-settled transactions if the entity has not incurred a liability

C) Where the other party has the right to choose the settlement basis then it should be accounted for simular to a compound financial instrument.

D) All of the given answers are correct.

A) similar treatment with cash-settled transactions if the entity has incurred a liability to settle in cash or other assets

B) similar treatment with equity-settled transactions if the entity has not incurred a liability

C) Where the other party has the right to choose the settlement basis then it should be accounted for simular to a compound financial instrument.

D) All of the given answers are correct.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

54

Southport Ltd grants 100 share appreciation rights (SARs)to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for the next 3 years.All SARs held by employees will vest at the end of 3 years.The intrinsic value (equals cash actually paid out)and estimates of the fair value of the SARs at the end of each year are as follows:

Summary of actual and estimated employee departures and number of options exercised follow:

What is the journal entry to recognise salary expense for Southport Ltd related to the share appreciation rights issued 1 July 2009 for the year ended 30 June 2014?

A)

B)

C)

D)

Summary of actual and estimated employee departures and number of options exercised follow:

What is the journal entry to recognise salary expense for Southport Ltd related to the share appreciation rights issued 1 July 2009 for the year ended 30 June 2014?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

55

Southport Ltd grants 100 share appreciation rights (SARs)to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for the next 3 years.All SARs held by employees will vest at the end of 3 years.The intrinsic value (equals cash actually paid out)and estimates of the fair value of the SARs at the end of each year are as follows:

Summary of actual and estimated employee departures and number of options exercised follow:

What is/are the journal entry/ies to recognise salary expense for Southport Ltd related to the share appreciation rights issued 1 July 2009 for the year ended 30 June 2013?

A)

B)

C)

D)

Summary of actual and estimated employee departures and number of options exercised follow:

What is/are the journal entry/ies to recognise salary expense for Southport Ltd related to the share appreciation rights issued 1 July 2009 for the year ended 30 June 2013?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

56

Southport Ltd grants 100 share appreciation rights (SARs)to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for the next 3 years.All SARs held by employees will vest at the end of 3 years.The intrinsic value (equals cash actually paid out)and estimates of the fair value of the SARs at the end of each year are as follows:

Summary of actual and estimated employee departures and number of options exercised follow:

In accordance with AASB 2,how much employee benefits expense related to the share option issue should Southport Ltd recognise for the year ended 30 June 2010?

A) $9840

B) $12 000

C) $29 520

D) $36 000

Summary of actual and estimated employee departures and number of options exercised follow:

In accordance with AASB 2,how much employee benefits expense related to the share option issue should Southport Ltd recognise for the year ended 30 June 2010?

A) $9840

B) $12 000

C) $29 520

D) $36 000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

57

Liverpool Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for the next 3 years.The fair value of each option at grant date is $15.Liverpool Ltd estimates that 15% of its employees will leave during the vesting period.The following table summarises the actual employee departures and revised estimates of employee departures across the vesting period.

By the end of year 2011 the company's share price had fallen and it decides to re-price the options.At this time the fair value of the original options is estimated to be $5 and the fair value of the re-priced options is estimated to be $8.

What is the employee benefits expense of Liverpool Ltd related to this share option for the year ended 30 June 2011?

A) $19 500

B) $24 200

C) $43 700

D) $57 000

By the end of year 2011 the company's share price had fallen and it decides to re-price the options.At this time the fair value of the original options is estimated to be $5 and the fair value of the re-priced options is estimated to be $8.

What is the employee benefits expense of Liverpool Ltd related to this share option for the year ended 30 June 2011?

A) $19 500

B) $24 200

C) $43 700

D) $57 000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

58

Liverpool limited grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for the next 3 years.The fair value of each option at grant date is $15.Liverpool Ltd estimates that 15% of its employees will leave during the vesting period.The following table summarises the actual employee departures and revised estimates of employee departures across the vesting period.

By the end of year 2011 the company's share price had fallen and it decides to re-price the options.At this time the fair value of the original options is estimated to be $5 and the fair value of the re-priced options is estimated to be $8.

What is the employee benefits expense of Liverpool Ltd related to this share option for the year ended 30 June 2012?

A) $19 500

B) $22 750

C) $26 500

D) $70 200

By the end of year 2011 the company's share price had fallen and it decides to re-price the options.At this time the fair value of the original options is estimated to be $5 and the fair value of the re-priced options is estimated to be $8.

What is the employee benefits expense of Liverpool Ltd related to this share option for the year ended 30 June 2012?

A) $19 500

B) $22 750

C) $26 500

D) $70 200

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

59

Wigan Ltd grants 100 options to each of its 80 employees on 1 July 2009.The fair value of each option at grant date is $20.The vesting conditions allow shares to vest if the following performance targets are achieved:

The following information is available:

In accordance with AASB 2,how much employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2010?

A) $48 000

B) $49 333

C) $72 000

D) $74 000

The following information is available:

In accordance with AASB 2,how much employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2010?

A) $48 000

B) $49 333

C) $72 000

D) $74 000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

60

On 1 July 2009,Windermere Ltd grants 200 share options to each of its 100 employees.The share option is conditional upon the employee working for the entity when the share option vests and the entity achieving the following non-market vesting conditions:

If the employee resigns before the share option vests,the share option is forfeited.

On 30 June 2012,based on probability estimates how many employees are expected to be employed by Windermere Ltd when the share vests?

A) 78

B) 82

C) 88

D) 90

If the employee resigns before the share option vests,the share option is forfeited.

On 30 June 2012,based on probability estimates how many employees are expected to be employed by Windermere Ltd when the share vests?

A) 78

B) 82

C) 88

D) 90

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

61

Winton Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for 3 years.The fair value of each option at grant date is $15. The following information is available:

What is the employee benefits expense of Winton Ltd related to this share option for the year ended 30 June 2010,2011 and 2012 respectively?

A) $18 667; 26 933; 26 400

B) $20 000; 20 000; 20 000

C) $20 000, $18 000; $16,000

D) $26 667; $24 000; $21 333

What is the employee benefits expense of Winton Ltd related to this share option for the year ended 30 June 2010,2011 and 2012 respectively?

A) $18 667; 26 933; 26 400

B) $20 000; 20 000; 20 000

C) $20 000, $18 000; $16,000

D) $26 667; $24 000; $21 333

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

62

Discuss the accounting treatment required in AASB 2 with respect to share-based payment transactions with cash alternatives.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

63

Are there parties that would benefit from the accounting requirements of AASB 2?

Discuss.

Discuss.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

64

Penneshaw Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for 3 years.The fair value of each option at grant date is $15. The following information is available:

What is the employee benefits expense of Penneshaw Ltd related to this share option for the year ended 30 June 2012?

A) $16 000

B) $20 000

C) $21 333

D) $26 400

What is the employee benefits expense of Penneshaw Ltd related to this share option for the year ended 30 June 2012?

A) $16 000

B) $20 000

C) $21 333

D) $26 400

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

65

Briefly describe the keys points of AASB 2.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

66

AASB 2 requires entities to disclose information relating to:

A) measurement details of options.

B) details of share-based payment arrangements that were modified during the period.

C) measurement details of other equity instruments (excluding options).

D) all of the given answers.

A) measurement details of options.

B) details of share-based payment arrangements that were modified during the period.

C) measurement details of other equity instruments (excluding options).

D) all of the given answers.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

67

Mission Beach Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for 3 years.The fair value of each option at grant date is $15. The following information is available:

What is the employee benefits expense of Mission Beach Ltd related to this share option for the year ended 30 June 2011?

A) $18 000

B) $20 000

C) $24 000

D) $26 933

What is the employee benefits expense of Mission Beach Ltd related to this share option for the year ended 30 June 2011?

A) $18 000

B) $20 000

C) $24 000

D) $26 933

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

68

Discuss the hierarchy to follow in determining which fair values to use in a share-based payment transaction that is consistent with AASB 2.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

69

Explain why senior managers or executives have share options as part of their remuneration.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is not a main heading for AASB 2 disclosures?

A) the nature and extent of share-based payment arrangements

B) how the fair value of goods or services received or equity instruments granted were determined

C) fair value of a similar equity instrument

D) effect from shared-based transactions on the profit or loss for the period

A) the nature and extent of share-based payment arrangements

B) how the fair value of goods or services received or equity instruments granted were determined

C) fair value of a similar equity instrument

D) effect from shared-based transactions on the profit or loss for the period

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

71

Discuss the three main headings required to be disclosed by AASB 2 with respect to share-based payments.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

72

When options are issued,the amount that must be paid to acquire the shares is referred to as:

A) the current share price.

B) the strike price.

C) the fair value of the share price.

D) net realisable value of the share price.

A) the current share price.

B) the strike price.

C) the fair value of the share price.

D) net realisable value of the share price.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

73

Why are equity instruments in a share-based payment transactions modified?

What is the accounting treatment for such modifications that is consistent with AASB 2?

What is the accounting treatment for such modifications that is consistent with AASB 2?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

74

Longreach Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for 3 years.The fair value of each option at grant date is $15. The following information is available:

What is the employee benefits expense of Longreach Ltd related to this share option for the year ended 30 June 2010?

A) $18 667

B) $20 000

C) $26 667

D) $56 000

What is the employee benefits expense of Longreach Ltd related to this share option for the year ended 30 June 2010?

A) $18 667

B) $20 000

C) $26 667

D) $56 000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

75

Discuss why equity-settled share-based payments may also be issued with market conditions.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

76

Discuss the recognition principles required in AASB 2 when an entity issues a share-based transaction instrument that has vesting conditions?

According to AASB 2,if something vests it has become an unconditional entitlement.Specifically,AASB defines to 'vest' as:

To become an entitlement.Under a share-based payment arrangement,a counterparty's right to receive cash,other assets,or equity instruments of the entity vests when the counterparty's entitlement is no longer conditional on the satisfaction of any vesting conditions.

The 'counterparty',as referred to in this definition,is the party providing the goods or services to the reporting entity.

Vesting conditions are:

the conditions that determine whether the entity receives the services that entitle the counterparty to receive cash,other assets or equity instruments of the entity,under a share-based payment arrangement.Vesting conditions are either service conditions or performance conditions.Service conditions require the counterparty to complete a specified period of service.Performance conditions require the counterparty to complete a specified period of service and specified performance targets to be met (such as a specified increase in the entity's profit over a specified period of time).A performance condition might include a market condition.

For more information refer to 'Have the entitlements vested?

'

According to AASB 2,if something vests it has become an unconditional entitlement.Specifically,AASB defines to 'vest' as:

To become an entitlement.Under a share-based payment arrangement,a counterparty's right to receive cash,other assets,or equity instruments of the entity vests when the counterparty's entitlement is no longer conditional on the satisfaction of any vesting conditions.

The 'counterparty',as referred to in this definition,is the party providing the goods or services to the reporting entity.

Vesting conditions are:

the conditions that determine whether the entity receives the services that entitle the counterparty to receive cash,other assets or equity instruments of the entity,under a share-based payment arrangement.Vesting conditions are either service conditions or performance conditions.Service conditions require the counterparty to complete a specified period of service.Performance conditions require the counterparty to complete a specified period of service and specified performance targets to be met (such as a specified increase in the entity's profit over a specified period of time).A performance condition might include a market condition.

For more information refer to 'Have the entitlements vested?

'

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

77

AASB 2 states that when goods or services received or acquired in a share-based payment transaction do not qualify for recognition as assets,they shall be recognised as:

A) liabilities.

B) equity.

C) income.

D) expenses.

A) liabilities.

B) equity.

C) income.

D) expenses.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck