Deck 13: Share Capital and Reserves

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/85

Play

Full screen (f)

Deck 13: Share Capital and Reserves

1

The AASB Framework defines equity as the remedial interest in the assets of the entity after the deduction of its liabilities.

False

2

Retained earnings can be used (reduced)for the purpose of a bonus issue of shares.

True

3

If a partly paid share issue is oversubscribed and the shares are allocated on a pro rata basis,the excess application monies must be refunded to all subscribers.

False

4

If an entity performs a share split on a partly paid share,the split must be done in such a way as to divide the uncalled portion equally among the shares issued.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

5

It used to be normal practice to issue shares at below par value.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

6

TheCorporations Act 2001 requires that where a company redeems preference shares it must do so out of profits that would otherwise be available for dividends or out of the proceeds of a fresh issue of shares made for the purpose of the redemption.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

7

As a residual interest,equity ranks after liabilities in terms of a claim against the assets of a reporting entity.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

8

Companies undertake share splits in order to increase their shareholders' funds.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

9

If a company is listed in the Australian Securities Exchange and shareholders fail to pay the amount due on allotment,the shares forfeited must be refunded in full to defaulting investors.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

10

The owners' equity of an organisation is the same as the shareholders' funds of a company.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

11

Reserves form part of the shareholders' funds.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

12

As a consequence of recent changes to the Corporations Act 2001 (s.254C),shares of a company are no longer considered to be issued at a premium or a discount.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

13

Ordinary shares receive low dividends because they do not perform very well.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

14

An individual's views on measurement techniques for assets and liabilities will have a direct impact on the amount recorded in shareholders' funds.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

15

A share split is usually funded through retained earnings.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

16

It is a requirement of the Corporations Act 2001 that companies hold capital contributed on the issue of shares in trust until the application is made.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

17

In a public issue of shares,the procedure to be adopted in the case of an oversubscription is normally specified in the prospectus.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

18

Where new investors are offered the opportunity to buy new shares this will have the effect of diluting the existing shareholders' interest in the company.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

19

When shares were issued at amounts greater than par value this was called a share premium.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

20

An allotment account,being a receivable account from the subscribers in a share issue,is presented under current assets in the statement of financial position.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

21

The Corporations Law was amended in 1998 in relation to the par value of shares.That amendment has the effect of:

A) making the use of par values optional for companies.

B) requiring companies not to issue shares with a par value.

C) requiring the calculation of the share premium or discounts to be based on an average of the market price for the share over the current reporting period.

D) making the use of par values optional for companies and requiring the calculation of the share premium or discounts to be based on an average of the market price for the share over the current reporting period.

A) making the use of par values optional for companies.

B) requiring companies not to issue shares with a par value.

C) requiring the calculation of the share premium or discounts to be based on an average of the market price for the share over the current reporting period.

D) making the use of par values optional for companies and requiring the calculation of the share premium or discounts to be based on an average of the market price for the share over the current reporting period.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

22

Under The Corporations Law as amended in 1998 companies now issue shares at:

A) any price they determine is appropriate in the market.

B) the price determined by the Australian Stock Exchange as the appropriate issue price for the shares.

C) the ASIC-specified level of price relative to a moving average of sales over the preceding 6 months.

D) the average price at which shares have been issued over the last 5 years.

A) any price they determine is appropriate in the market.

B) the price determined by the Australian Stock Exchange as the appropriate issue price for the shares.

C) the ASIC-specified level of price relative to a moving average of sales over the preceding 6 months.

D) the average price at which shares have been issued over the last 5 years.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

23

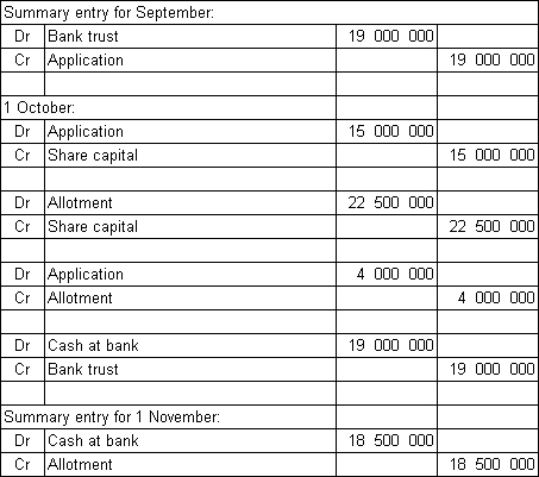

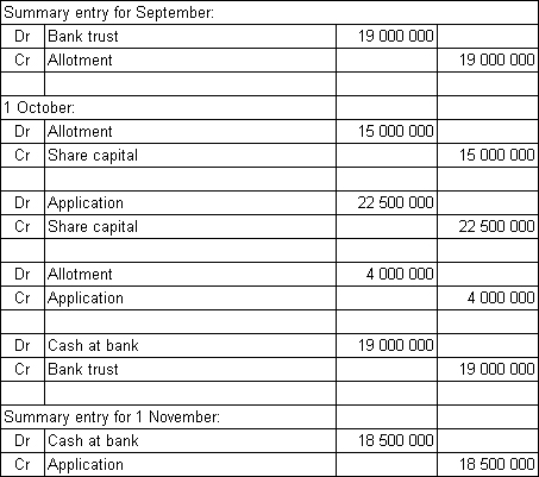

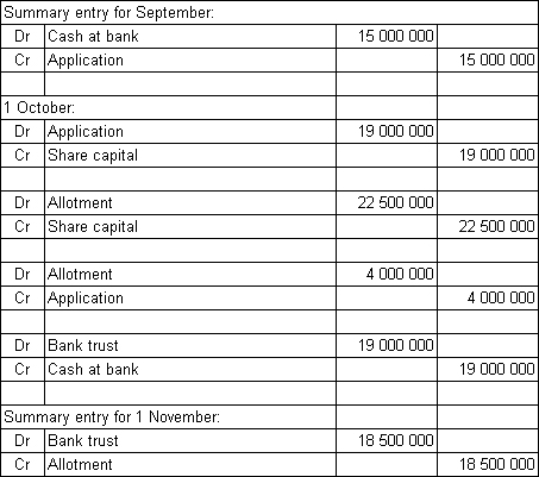

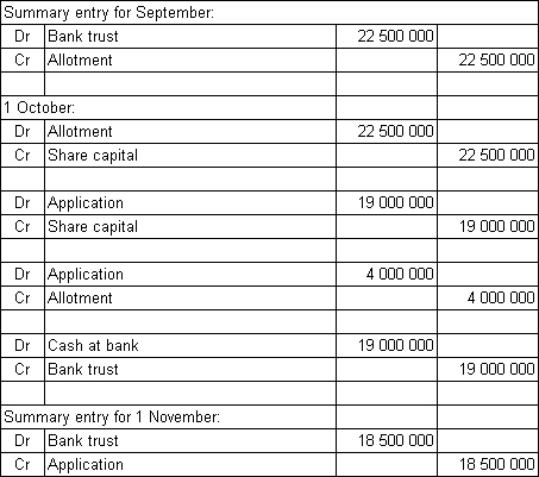

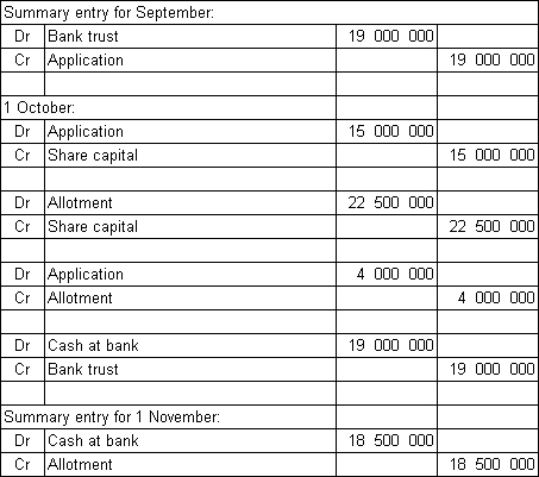

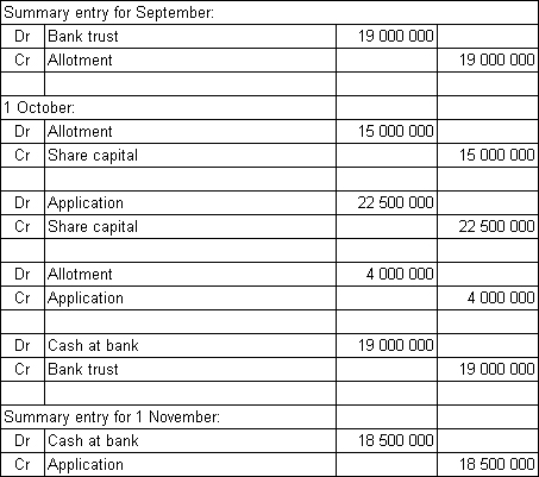

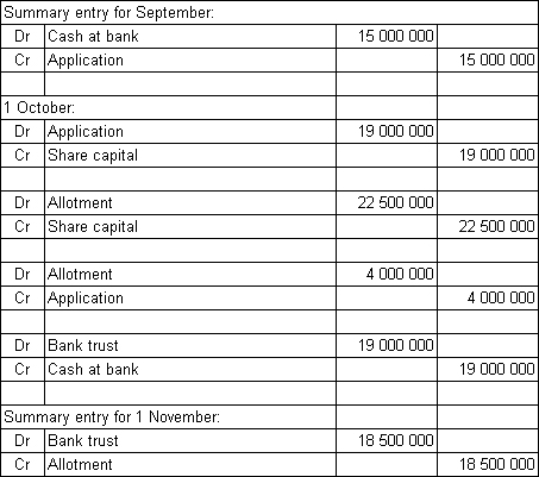

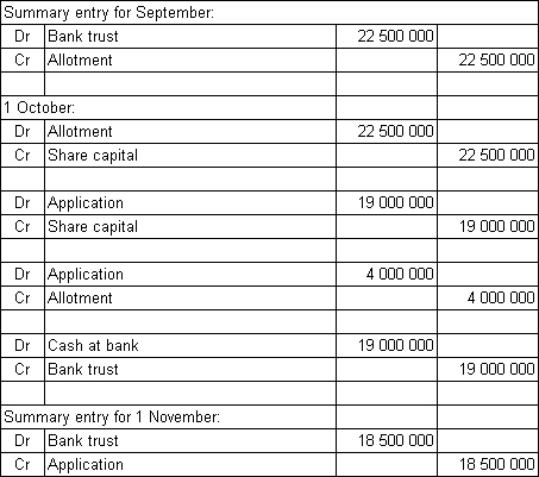

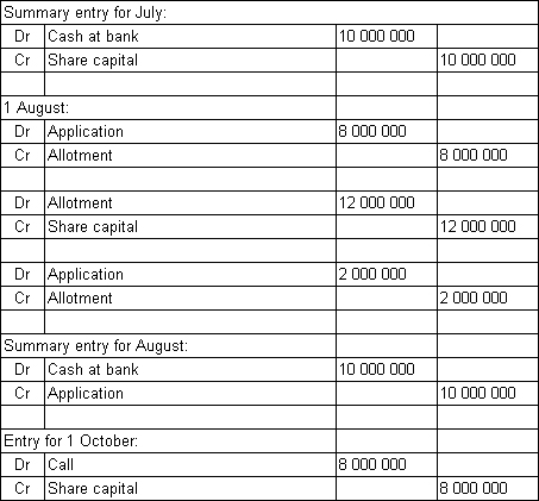

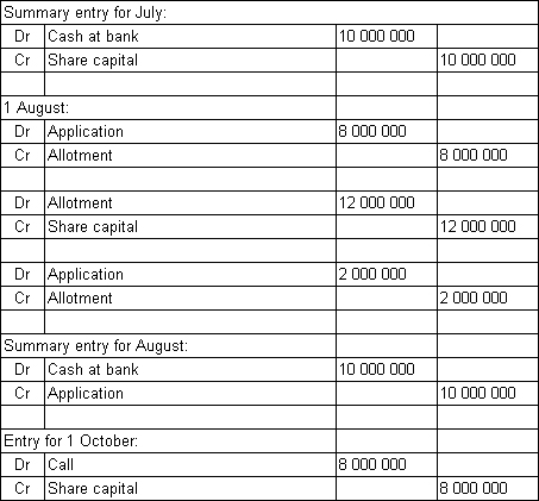

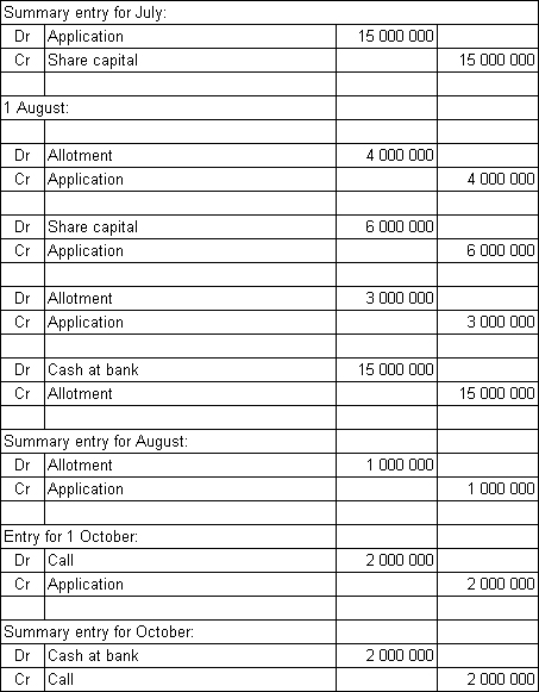

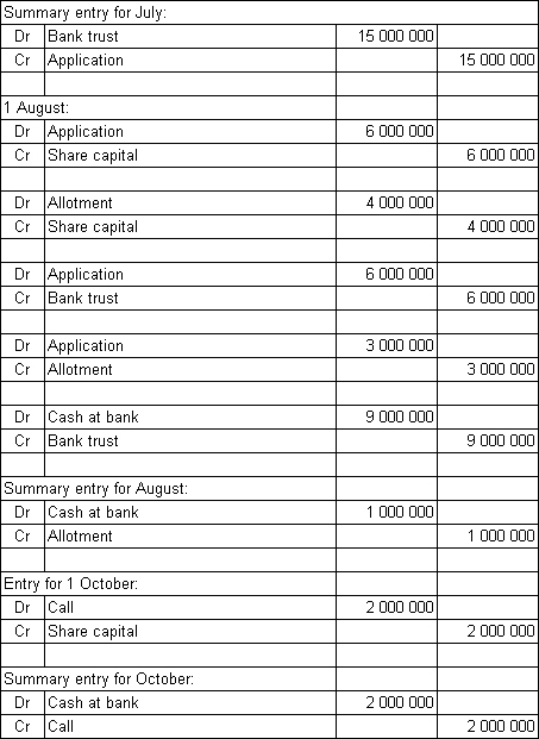

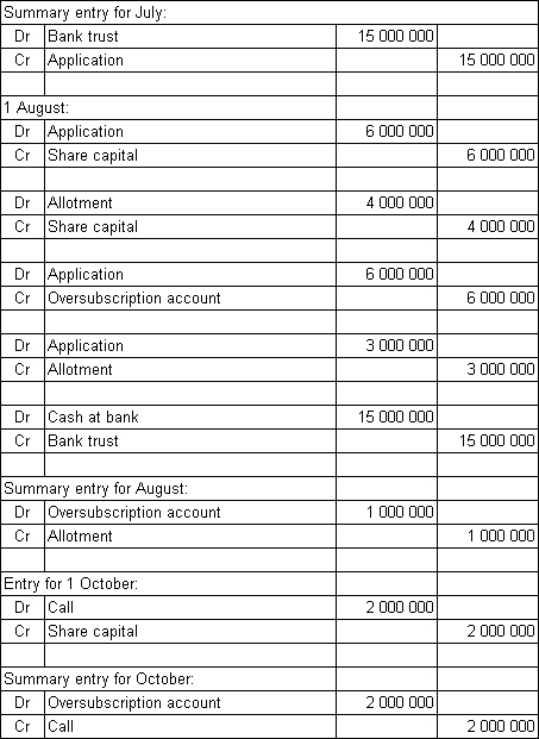

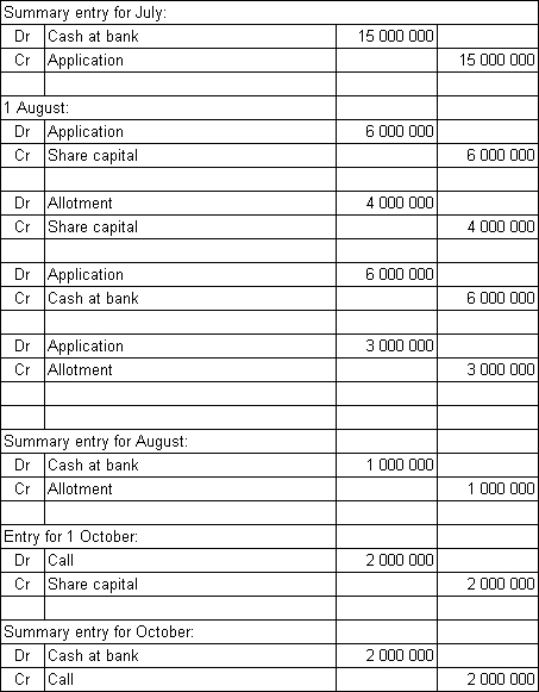

Semaphore Ltd called for subscriptions for 15 million shares.The issue price per share is $2.50 to be paid in two parts: the first payment of $1.00 is to be made on application and the remaining $1.50 is to be paid within 1 month of allotment.At the end of September,when applications close,applications for 19 million shares have been received.The shares are allotted on 1 October on a pro rata basis with the excess application money to be applied against the amount due on allotment.All amounts on allotment are paid by the due date.What are the accounting entries to record these events?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

24

In the case of a share issue being oversubscribed,the common approaches include:

A) Issue additional shares to meet the excess demand.

B) Allocate the shares on a pro rata basis.

C) Increase the issue price of the shares.

D) Issue additional shares to meet the excess demand and increase the issue price of the shares.

A) Issue additional shares to meet the excess demand.

B) Allocate the shares on a pro rata basis.

C) Increase the issue price of the shares.

D) Issue additional shares to meet the excess demand and increase the issue price of the shares.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

25

Double entry accounting requires that:

A) the claims held by external parties equal the claims held by the owners.

B) the total assets of an entity equal the total of the claims held by external parties plus those claims held by the owners.

C) the liabilities of the entity equal its total assets plus the claims held by the owners.

D) the recognition of the claims held by owners will match the entity's total assets.

A) the claims held by external parties equal the claims held by the owners.

B) the total assets of an entity equal the total of the claims held by external parties plus those claims held by the owners.

C) the liabilities of the entity equal its total assets plus the claims held by the owners.

D) the recognition of the claims held by owners will match the entity's total assets.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

26

A residual interest is:

A) a claim to a fixed percentage return on the amount invested.

B) a priority claim over the assets of the entity as the right of an owner.

C) a claim or right to the net assets of the reporting entity.

D) the minimum entitlement of the holder of the interest.

A) a claim to a fixed percentage return on the amount invested.

B) a priority claim over the assets of the entity as the right of an owner.

C) a claim or right to the net assets of the reporting entity.

D) the minimum entitlement of the holder of the interest.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

27

Equity's claim against the assets of the entity:

A) takes priority as owners.

B) is ranked before employee entitlements.

C) is equal to the value of cash reserves held in equity.

D) ranks after liabilities in terms of priority.

A) takes priority as owners.

B) is ranked before employee entitlements.

C) is equal to the value of cash reserves held in equity.

D) ranks after liabilities in terms of priority.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

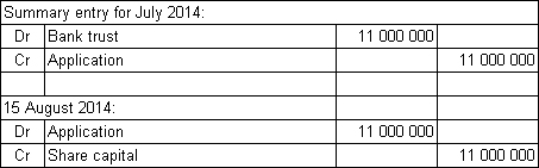

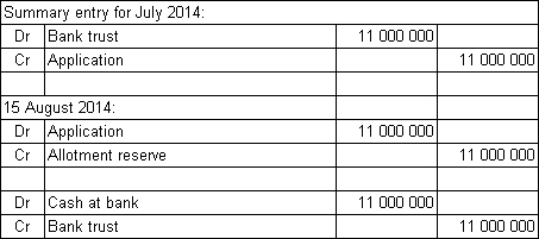

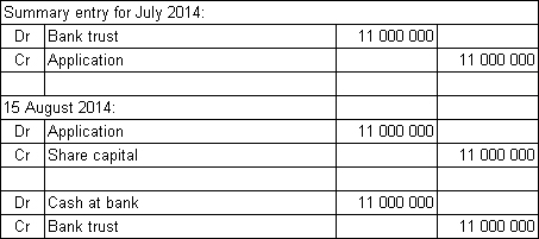

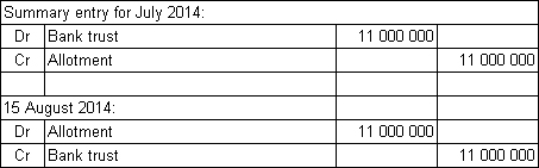

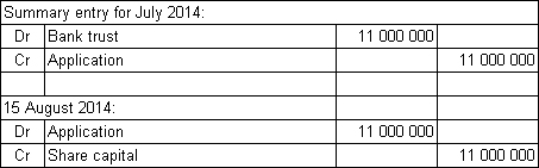

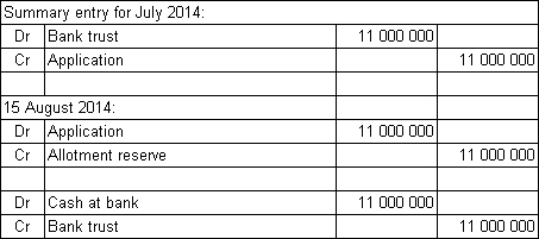

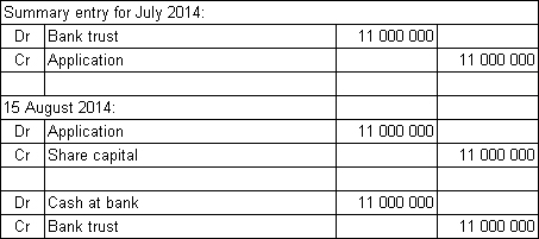

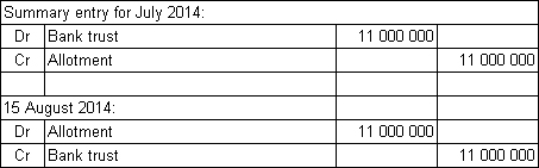

28

Flag Ltd has received applications for 4 million shares during July 2014.The shares are to be issued at a price of $2.75 per share.The 4 million shares are allotted on 15 August 2014.What are the accounting entries required to record these events?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

29

Holders of ordinary shares:

A) are assured of dividends each year.

B) may not receive a cash dividend each year but the dividend will accrue and eventually be paid.

C) will always receive a dividend if the company has made a profit in that financial year.

D) receive dividends at the discretion of the board.

A) are assured of dividends each year.

B) may not receive a cash dividend each year but the dividend will accrue and eventually be paid.

C) will always receive a dividend if the company has made a profit in that financial year.

D) receive dividends at the discretion of the board.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

30

Accounts that make up owners' equity may include:

A) preference shares.

B) debentures.

C) general reserves.

D) preference shares and general reserves.

A) preference shares.

B) debentures.

C) general reserves.

D) preference shares and general reserves.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

31

The process for issuing shares is that:

A) They are offered for sale, allotments are received and an assignment made. Monies received on allotment must be held in trust until the assignment is made.

B) They are offered for sale, applications are received and an allotment made. Monies received on application must be held in trust until the allotment is made.

C) Applications are received for the issue of shares and an offer of shares is made. Applicants contribute capital that is returned to them if their application is unsuccessful when the shares are assigned.

D) A notice of intention to purchase shares is registered with the stock exchange, which the company receives. The company then offers shares. The applicant may then be allotted shares and at that point must make the cash contribution.

A) They are offered for sale, allotments are received and an assignment made. Monies received on allotment must be held in trust until the assignment is made.

B) They are offered for sale, applications are received and an allotment made. Monies received on application must be held in trust until the allotment is made.

C) Applications are received for the issue of shares and an offer of shares is made. Applicants contribute capital that is returned to them if their application is unsuccessful when the shares are assigned.

D) A notice of intention to purchase shares is registered with the stock exchange, which the company receives. The company then offers shares. The applicant may then be allotted shares and at that point must make the cash contribution.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

32

When shares are allotted,or a call made on them,allotment and call accounts are created respectively.What is the nature of these accounts and how are they to be disclosed in the financial statements?

A) The accounts are similar in nature to an account receivable and are to be disclosed in the statement of financial position as a current asset.

B) The accounts are similar to a future income benefit and are to be separately disclosed as assets in the statement of financial position.

C) The accounts are similar to an account receivable and are disclosed in the statement of financial position as a reduction against share capital.

D) The accounts are in the nature of a deferred income and are disclosed as a provision for future cash inflows in the statement of financial position.

A) The accounts are similar in nature to an account receivable and are to be disclosed in the statement of financial position as a current asset.

B) The accounts are similar to a future income benefit and are to be separately disclosed as assets in the statement of financial position.

C) The accounts are similar to an account receivable and are disclosed in the statement of financial position as a reduction against share capital.

D) The accounts are in the nature of a deferred income and are disclosed as a provision for future cash inflows in the statement of financial position.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

33

Normal features of ordinary shares include:

A) They entitle the holder to receive his/her proportion of any ordinary dividends declared.

B) They ensure the holder has priority over unsecured creditors in the case of the company going into liquidation.

C) They confer voting rights.

D) They entitle the holder to receive his/her proportion of any ordinary dividends declared and they confer voting rights.

A) They entitle the holder to receive his/her proportion of any ordinary dividends declared.

B) They ensure the holder has priority over unsecured creditors in the case of the company going into liquidation.

C) They confer voting rights.

D) They entitle the holder to receive his/her proportion of any ordinary dividends declared and they confer voting rights.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

34

In the case of a share issue being oversubscribed,excess application monies:

A) will always be refunded to applicants.

B) may be used to reduce future amounts owing on allotment if the shares are issued on a pro rata basis.

C) must be recorded as revenue in the current financial period.

D) must be placed in a trust account until a refund is requested by applicants.

A) will always be refunded to applicants.

B) may be used to reduce future amounts owing on allotment if the shares are issued on a pro rata basis.

C) must be recorded as revenue in the current financial period.

D) must be placed in a trust account until a refund is requested by applicants.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

35

Share capital:

A) relates to one class of shares, with the remaining equity recorded as reserves or retained profits.

B) represents the amount shareholders are guaranteed to receive if the company is wound up.

C) may relate to one or several classes of shares.

D) may be calculated by subtracting liabilities from assets.

A) relates to one class of shares, with the remaining equity recorded as reserves or retained profits.

B) represents the amount shareholders are guaranteed to receive if the company is wound up.

C) may relate to one or several classes of shares.

D) may be calculated by subtracting liabilities from assets.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

36

A public issue of shares involves:

A) compiling and then issuing a prospectus that outlines the details of the share issue so those interested can make an informed decision.

B) making the general public aware that shares are available for sale at a set price.

C) only issuing a limited number of shares to ensure there is sufficient demand for a full subscription.

D) issuing ordinary shares to all members of the public who are interested.

A) compiling and then issuing a prospectus that outlines the details of the share issue so those interested can make an informed decision.

B) making the general public aware that shares are available for sale at a set price.

C) only issuing a limited number of shares to ensure there is sufficient demand for a full subscription.

D) issuing ordinary shares to all members of the public who are interested.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

37

A company may elect to issues its shares at any price,which will depend on:

A) the last sales price for the company's shares before the new issue.

B) the market demand.

C) the minimum price that has been paid for the shares over the last reporting period. .

D) the amount specified in legislation at which all Australian companies were required to issue shares.

A) the last sales price for the company's shares before the new issue.

B) the market demand.

C) the minimum price that has been paid for the shares over the last reporting period. .

D) the amount specified in legislation at which all Australian companies were required to issue shares.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

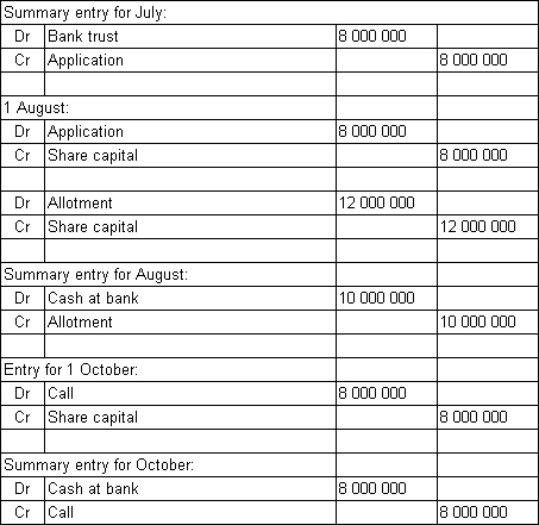

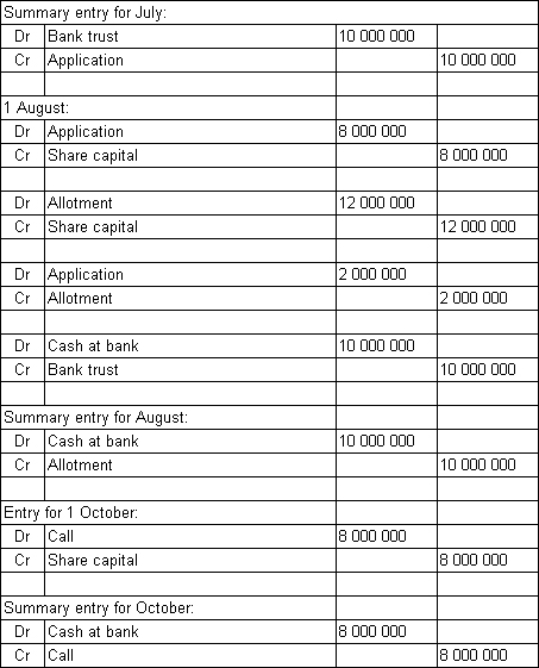

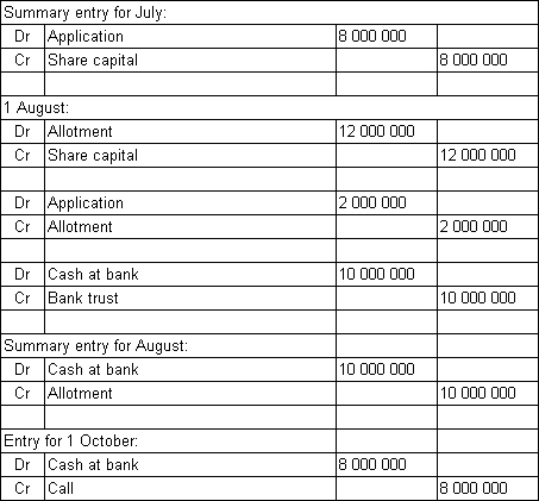

38

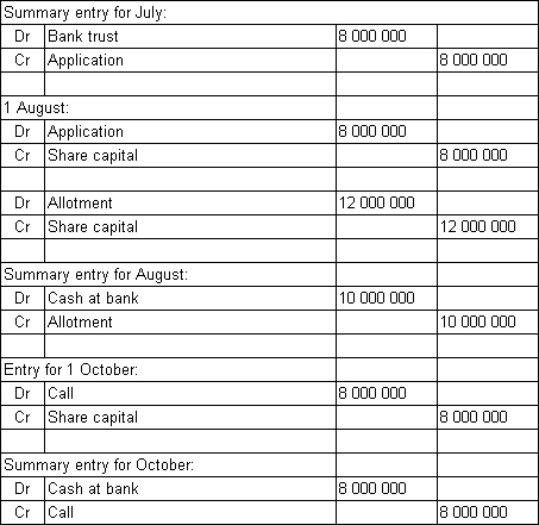

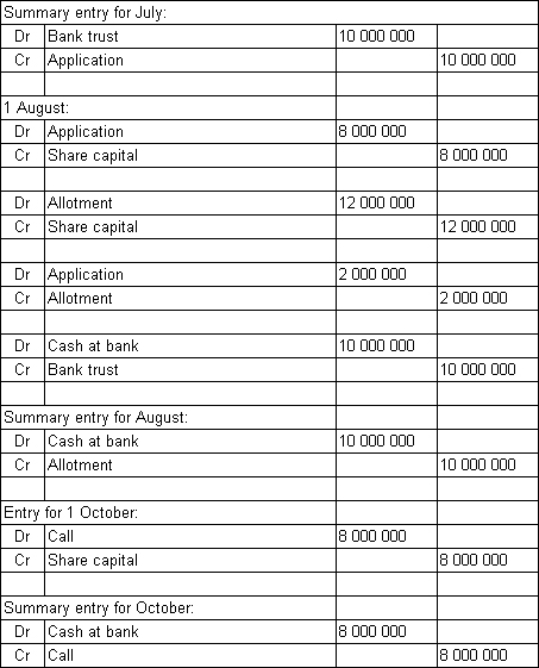

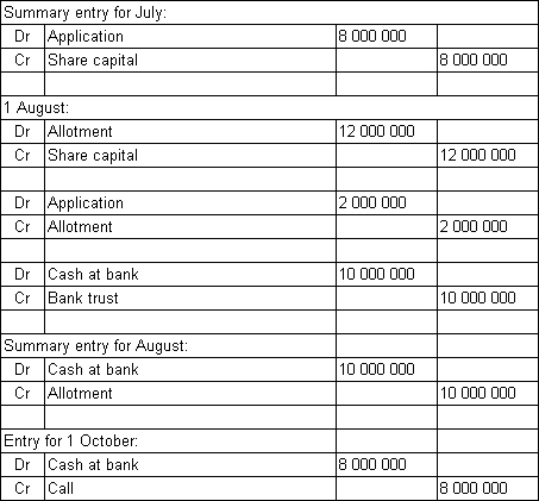

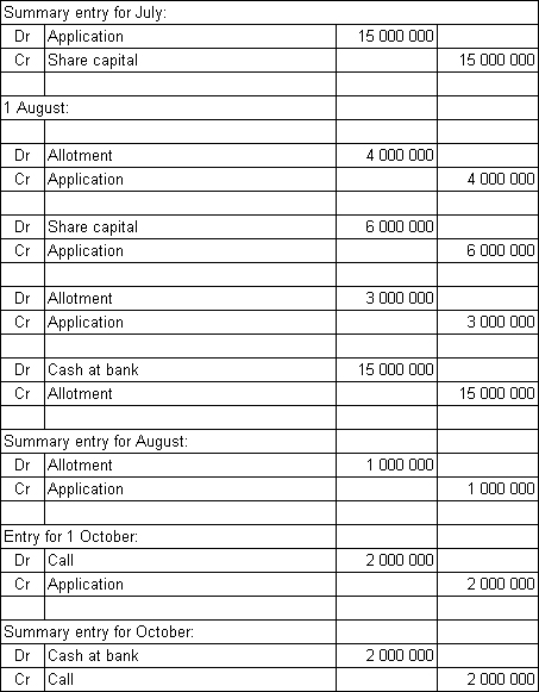

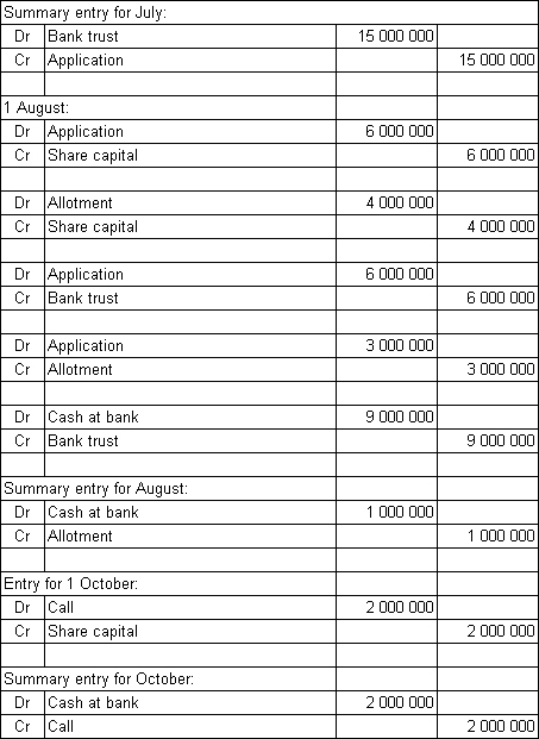

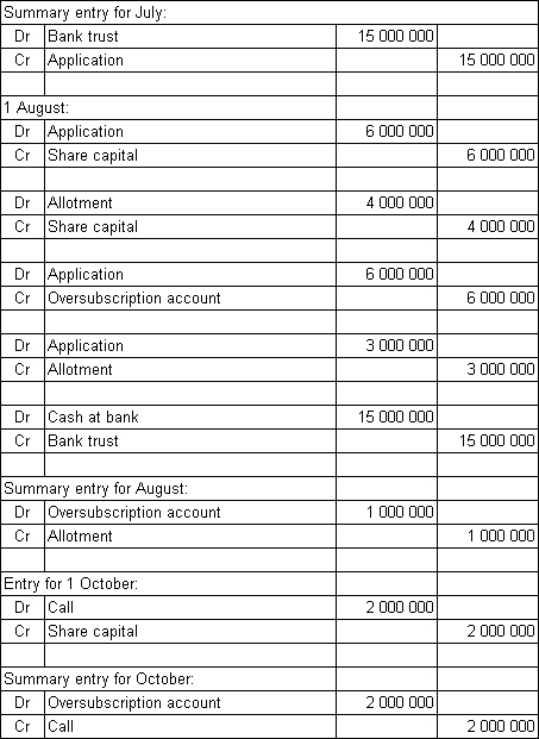

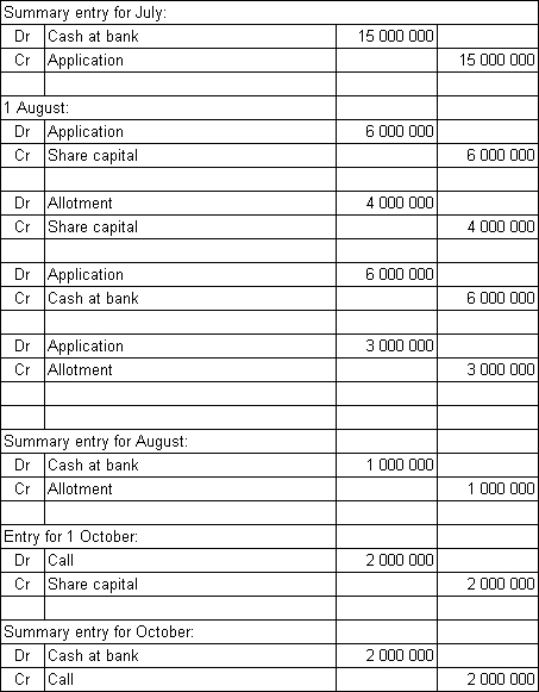

Signal Ltd called for subscriptions for 8 million shares.The issue price per share is $3.50 to be paid in three parts: the first payment of $1.00 is to be made on application,$1.50 is to be paid within 1 month of allotment and the remaining $1.00 is to be paid within 3 months of allotment.At the end of July,when applications close,applications for 10 million shares have been received.The shares are allotted on 1 August on a pro rata basis with the excess application money to be applied against the amount due on allotment.The first and final call on the shares is made on 1October.Assume all amounts on allotment and call are paid by the due date.What are the accounting entries to record these events?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

39

Sundowner Ltd called for subscriptions for 2 million shares.The issue price per share is $6.00 to be paid in three parts: the first payment of $3.00 is to be made on application,$2.00 is to be paid within 1 month of allotment and the remaining $1.00 is to be paid within 6 months of allotment.At the end of July,when applications close,applications for 5 million shares have been received.Two million share applicants were unsuccessful,while the remaining 3 million applicants were allotted shares on 1 August on a pro rata basis with the excess application money to be applied against the amount due on allotment.The first and final call on the shares is made on 1October.Assume all amounts on allotment and call are paid by the due date.What are the accounting entries to record these events?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

40

AASB 101 Presentation of Financial Statements requires an entity to disclose a description of the nature and purpose of each reserve within equity.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

41

When a rights issue is tradeable it is often referred to as:

A) reducable.

B) rightful.

C) redeemable.

D) renounceable.

A) reducable.

B) rightful.

C) redeemable.

D) renounceable.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

42

An effect of a bonus issue to all shareholders is to:

A) increase the total amount of shareholders' funds.

B) make the amount that was previously recorded as retained earnings no longer available for the payment of cash dividends.

C) alter the current shareholders' proportionate share of the company's net assets.

D) increase the total assets of the company.

A) increase the total amount of shareholders' funds.

B) make the amount that was previously recorded as retained earnings no longer available for the payment of cash dividends.

C) alter the current shareholders' proportionate share of the company's net assets.

D) increase the total assets of the company.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

43

A statement of changes in equity includes:

A) each item of income and expense for the period that, as required by other Australian Accounting Standards, is recognised directly in equity.

B) profit or loss for the period.

C) total income and expense for the period showing separately the total amounts attributable to equity holders of the parent and to minority interest.

D) each item of income and expense for the period that, as required by other Australian Accounting Standards, is recognised directly in equity, profit or loss for the period, and total income and expense for the period showing separately the total amounts attributable to equity holders of the parent and to minority interest.

A) each item of income and expense for the period that, as required by other Australian Accounting Standards, is recognised directly in equity.

B) profit or loss for the period.

C) total income and expense for the period showing separately the total amounts attributable to equity holders of the parent and to minority interest.

D) each item of income and expense for the period that, as required by other Australian Accounting Standards, is recognised directly in equity, profit or loss for the period, and total income and expense for the period showing separately the total amounts attributable to equity holders of the parent and to minority interest.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

44

The total market capitalisation of a company after a bonus issue is likely to:

A) be lower than it was before the bonus issue.

B) be greater than it was before the bonus issue.

C) be less than it was before the bonus issue.

D) There will be no change.

A) be lower than it was before the bonus issue.

B) be greater than it was before the bonus issue.

C) be less than it was before the bonus issue.

D) There will be no change.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

45

The 'participating' in participating preference shares means that the shareholders may:

A) vote at annual meetings.

B) vote at annual meetings if preference dividends have not been paid.

C) participate in a conversion of preference shares into ordinary shares.

D) receive a share of any further profits that are to be distributed to ordinary shareholders after the payment of the preference dividend.

A) vote at annual meetings.

B) vote at annual meetings if preference dividends have not been paid.

C) participate in a conversion of preference shares into ordinary shares.

D) receive a share of any further profits that are to be distributed to ordinary shareholders after the payment of the preference dividend.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

46

If a company has created a forfeited shares reserve,this means that:

A) The company is not a member of the Australian Stock Exchange and its constitution does not require it to refund amounts already paid by defaulting investors.

B) The company is expecting that the amounts unpaid will be collected in the next period.

C) The company is a member of the Australian Stock Exchange and is required to refund amounts already paid by defaulting investors.

D) The company is holding the amounts already paid by defaulting investors in trust in order to repay them on the request of the investor.

A) The company is not a member of the Australian Stock Exchange and its constitution does not require it to refund amounts already paid by defaulting investors.

B) The company is expecting that the amounts unpaid will be collected in the next period.

C) The company is a member of the Australian Stock Exchange and is required to refund amounts already paid by defaulting investors.

D) The company is holding the amounts already paid by defaulting investors in trust in order to repay them on the request of the investor.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

47

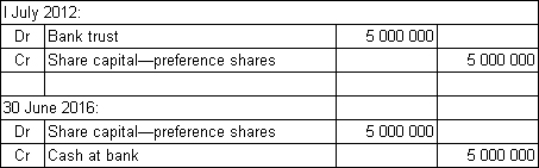

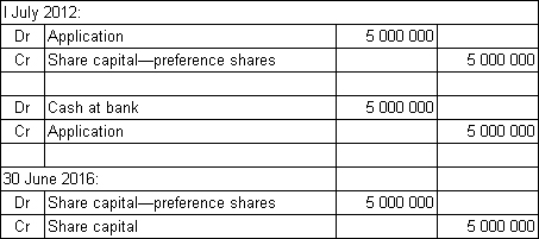

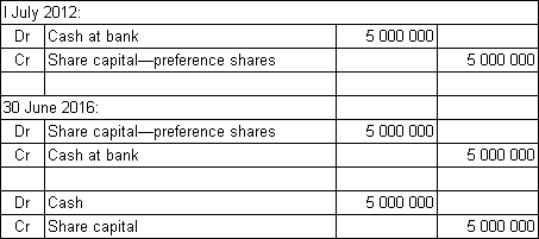

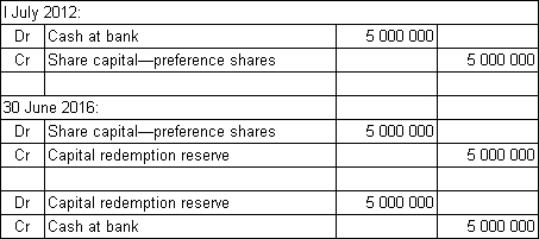

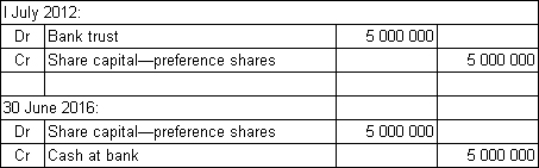

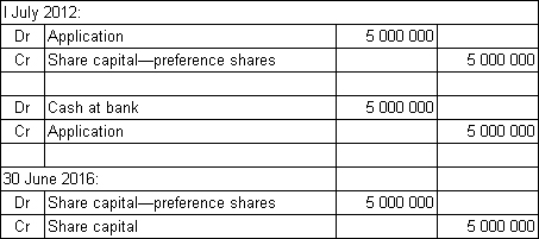

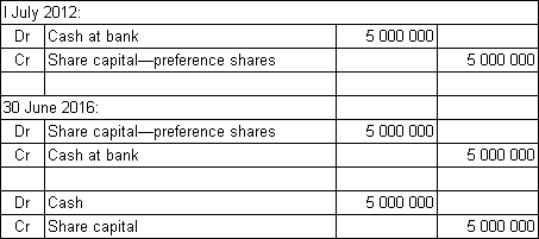

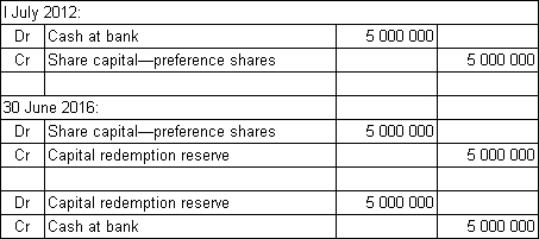

Motion Ltd issued $5 million in redeemable preference shares in a private placement on 1 July 2012.The shares are redeemable on 30 June 2016,have no voting rights and offer a fixed rate of return to the holder.The shares are redeemed as expected with a fresh issue of shares.What are the accounting entries and note disclosures to record the transactions on 1 July 2012and 30 June 2016?

A)

Note disclosure: redeemable preference shares have characteristics different to ordinary shares and so have been disclosed separately in the shareholders' funds section of the statement of financial position.

Note disclosure: redeemable preference shares have characteristics different to ordinary shares and so have been disclosed separately in the shareholders' funds section of the statement of financial position.

B)

Note disclosure: redeemable preference shares have characteristics different to ordinary shares and so have been disclosed separately in the shareholders' funds section of the statement of financial position.

Note disclosure: redeemable preference shares have characteristics different to ordinary shares and so have been disclosed separately in the shareholders' funds section of the statement of financial position.

C)

Note disclosure: redeemable preference shares have the characteristics of debt and so have been classified as liabilities in the statement of financial position.

Note disclosure: redeemable preference shares have the characteristics of debt and so have been classified as liabilities in the statement of financial position.

D)

Note disclosure: redeemable preference shares are to be redeemed on 30 June 2008.

Note disclosure: redeemable preference shares are to be redeemed on 30 June 2008.

A)

Note disclosure: redeemable preference shares have characteristics different to ordinary shares and so have been disclosed separately in the shareholders' funds section of the statement of financial position.

Note disclosure: redeemable preference shares have characteristics different to ordinary shares and so have been disclosed separately in the shareholders' funds section of the statement of financial position.B)

Note disclosure: redeemable preference shares have characteristics different to ordinary shares and so have been disclosed separately in the shareholders' funds section of the statement of financial position.

Note disclosure: redeemable preference shares have characteristics different to ordinary shares and so have been disclosed separately in the shareholders' funds section of the statement of financial position.C)

Note disclosure: redeemable preference shares have the characteristics of debt and so have been classified as liabilities in the statement of financial position.

Note disclosure: redeemable preference shares have the characteristics of debt and so have been classified as liabilities in the statement of financial position.D)

Note disclosure: redeemable preference shares are to be redeemed on 30 June 2008.

Note disclosure: redeemable preference shares are to be redeemed on 30 June 2008.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

48

Giggles Ltd has 2 million shares issued.The directors have elected,with the support of a resolution passed at a general meeting,to undertake a 1: 2 share split so that there will be 4 million issued shares.The shares were originally issued at a price of $2 each.What is the summary entry to record the share split?

A)

B)

C)

D) None of the given answers are correct.

A)

B)

C)

D) None of the given answers are correct.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

49

Share splits are conducted because it is believed that:

A) Excess capital leads to reduced return ratios, which the market does not view favourably.

B) Increasing the number of shares issued makes the company appear larger and more stable.

C) Decreasing the price per share makes them more marketable.

D) Investors view this as a bonus because they now have more shares than they previously held.

A) Excess capital leads to reduced return ratios, which the market does not view favourably.

B) Increasing the number of shares issued makes the company appear larger and more stable.

C) Decreasing the price per share makes them more marketable.

D) Investors view this as a bonus because they now have more shares than they previously held.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

50

A statement of changes in equity:

A) is identical to a statement of comprehensive income.

B) is required to include only the components listed in paragraph 106 of AASB 101.

C) includes the effects of changes in accounting policies recognised in accordance with AASB 108.

D) is required to include only the components listed in paragraph 106 of AASB 101 and includes the effects of changes in accounting policies recognised in accordance with AASB 108.

A) is identical to a statement of comprehensive income.

B) is required to include only the components listed in paragraph 106 of AASB 101.

C) includes the effects of changes in accounting policies recognised in accordance with AASB 108.

D) is required to include only the components listed in paragraph 106 of AASB 101 and includes the effects of changes in accounting policies recognised in accordance with AASB 108.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

51

When a share split occurs:

A) Current shareholders receive more shares thus increasing their stake in the company.

B) Accounting entries are required to record the increase in the number of shares on hand.

C) It must be done so that any uncalled amounts are divided equally when the shares are issued.

D) More shares are available to be purchased by the general public, allowing the company to raise more funds.

A) Current shareholders receive more shares thus increasing their stake in the company.

B) Accounting entries are required to record the increase in the number of shares on hand.

C) It must be done so that any uncalled amounts are divided equally when the shares are issued.

D) More shares are available to be purchased by the general public, allowing the company to raise more funds.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

52

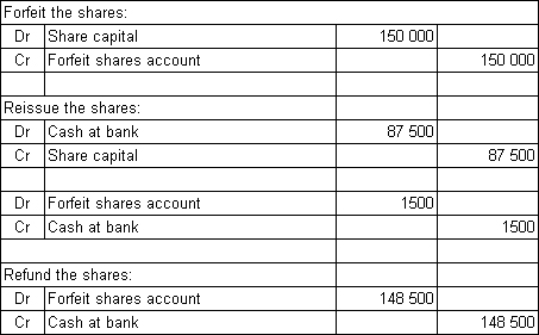

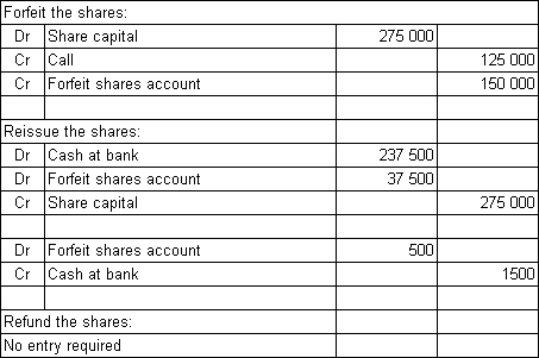

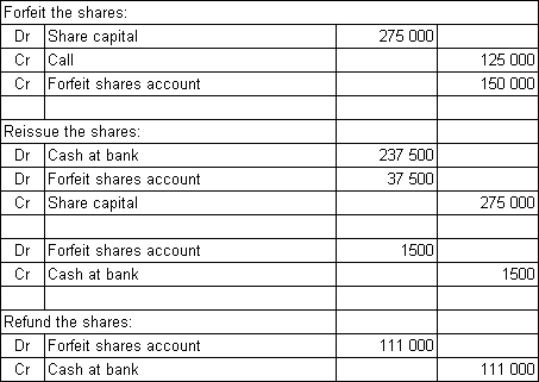

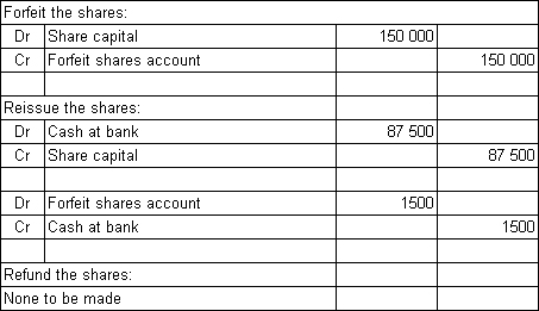

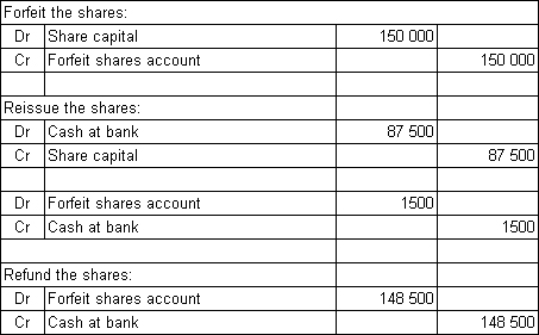

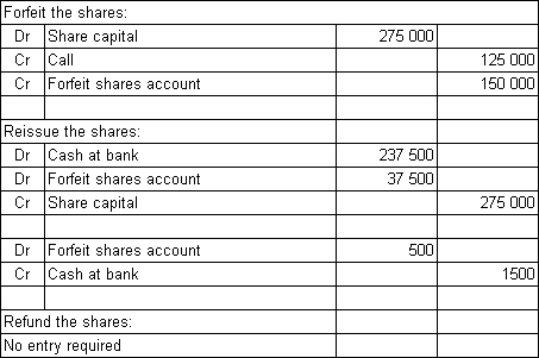

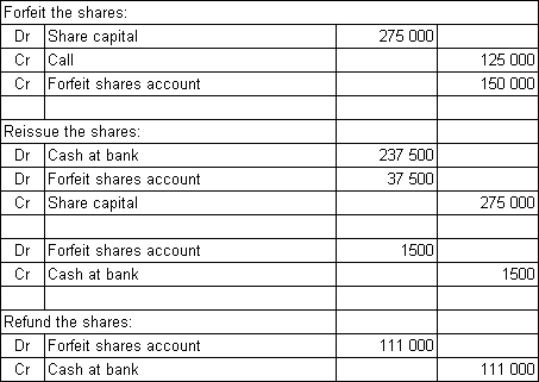

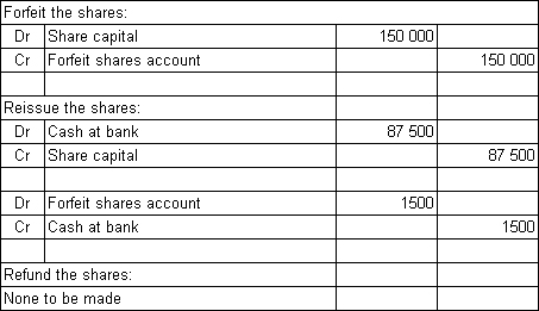

Cartoon Ltd is listed on the Australian Stock Exchange.It has 3 million shares issued at a price of $5.50 per share.The investors were required to pay $2.00 on application and $1.00 on allotment.Both these amounts were paid in full.A first and final call of $2.50 was made and was due on 30 August 2013.At the end of November the directors of the company elect to forfeit 50 000 shares on which the holders have failed to pay the call.Cartoon Ltd reissues the shares fully paid up for a price of $4.75 and incurred costs of $1500.What are the entries required to forfeit the shares,reissue the shares,and make a refund if appropriate?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

53

Goggle Ltd has 1 million shares issued.The directors have elected to make a '1 for 5' bonus issue.The current market price of the shares is $10 each.What is the summary entry to record the bonus issue?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

54

The statement of changes in equity:

A) presents, either on the face of the statement or in the notes, the amounts of dividends recognised as distributions to owners during the period and the related amount per share.

B) is identical to the statement of recognised income and expense.

C) is the same as that required under the former AASB 1018.

D) provides a reconciliation between the expenses outstanding at the start of the period and those outstanding at the end of the period.

A) presents, either on the face of the statement or in the notes, the amounts of dividends recognised as distributions to owners during the period and the related amount per share.

B) is identical to the statement of recognised income and expense.

C) is the same as that required under the former AASB 1018.

D) provides a reconciliation between the expenses outstanding at the start of the period and those outstanding at the end of the period.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

55

A redeemable preference share is one that may be:

A) converted into debt at the option of the shareholder.

B) converted into cash at the option of either the company or the shareholder.

C) forgiven any future calls where the company has profits in excess of specified levels.

D) have any dividends converted into further preference shares rather than receiving them in cash.

A) converted into debt at the option of the shareholder.

B) converted into cash at the option of either the company or the shareholder.

C) forgiven any future calls where the company has profits in excess of specified levels.

D) have any dividends converted into further preference shares rather than receiving them in cash.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

56

Reserves recorded in the equity section of the statement of financial position:

A) represent an amount of cash put aside for future projects.

B) are created from excess profits that are not available for distribution as dividends.

C) may be established by transferring amounts from retained profits.

D) will not have an impact on the total equity reported in the equity section of the statement of financial position when created.

A) represent an amount of cash put aside for future projects.

B) are created from excess profits that are not available for distribution as dividends.

C) may be established by transferring amounts from retained profits.

D) will not have an impact on the total equity reported in the equity section of the statement of financial position when created.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

57

When a company redeems preference shares:

A) It must ensure it has sufficient cash reserves to do so.

B) It must do so out of profits other than those available for the issuing of dividends.

C) It must issue fresh shares to fund the redemption.

D) None of the given answers are correct.

A) It must ensure it has sufficient cash reserves to do so.

B) It must do so out of profits other than those available for the issuing of dividends.

C) It must issue fresh shares to fund the redemption.

D) None of the given answers are correct.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

58

The effect of a bonus issue to all shareholders on (a)net asset backing per share,(b)each shareholder's share of net assets and (c)market capitalisation is:

A) (a) The net asset backing per share will decrease; (b) each shareholder's share of net assets will remain the same; (c) evidence suggests that on average the market capitalisation will increase.

B) (a) The net asset backing per share will increase; (b) each shareholder's share of net assets will increase; (c) evidence suggests that on average the market capitalisation will remain the same.

C) (a) The net asset backing per share will decrease; (b) each shareholder's share of net assets will decrease; (c) evidence suggests that on average the market capitalisation will remain the same.

D) (a) The net asset backing per share will remain the same; (b) each shareholder's share of net assets will decrease; (c) evidence suggests that on average the market capitalisation will decrease.

A) (a) The net asset backing per share will decrease; (b) each shareholder's share of net assets will remain the same; (c) evidence suggests that on average the market capitalisation will increase.

B) (a) The net asset backing per share will increase; (b) each shareholder's share of net assets will increase; (c) evidence suggests that on average the market capitalisation will remain the same.

C) (a) The net asset backing per share will decrease; (b) each shareholder's share of net assets will decrease; (c) evidence suggests that on average the market capitalisation will remain the same.

D) (a) The net asset backing per share will remain the same; (b) each shareholder's share of net assets will decrease; (c) evidence suggests that on average the market capitalisation will decrease.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

59

Preference shares are often considered to be closer to debt as they:

A) may be issued with the condition that they are redeemable by the company in the future.

B) may guarantee a regular or cumulative payment, similar to interest.

C) may be able to be converted into ordinary shares at a specific date in the future, indicating they are a liability until that time.

D) may guarantee a regular or cumulative payment, similar to interest and may be able to be converted into ordinary shares at a specific date in the future, indicating they are a liability until that time.

A) may be issued with the condition that they are redeemable by the company in the future.

B) may guarantee a regular or cumulative payment, similar to interest.

C) may be able to be converted into ordinary shares at a specific date in the future, indicating they are a liability until that time.

D) may guarantee a regular or cumulative payment, similar to interest and may be able to be converted into ordinary shares at a specific date in the future, indicating they are a liability until that time.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

60

If a company is listed on the Australian Stock Exchange and a shareholder fails to pay amounts owing on shares,the company will:

A) transfer the unpaid amount to a forfeited share reserve that remains part of equity after the cost to reissue the shares has been deducted.

B) transfer the unpaid amount to a forfeited share reserve and refund the amount remaining after the cost of reissuing the shares has been deducted.

C) take action to collect the unpaid amount through the courts.

D) transfer the unpaid amount to a forfeited share account and refund the amount remaining after the cost of reissuing the shares has been deducted.

A) transfer the unpaid amount to a forfeited share reserve that remains part of equity after the cost to reissue the shares has been deducted.

B) transfer the unpaid amount to a forfeited share reserve and refund the amount remaining after the cost of reissuing the shares has been deducted.

C) take action to collect the unpaid amount through the courts.

D) transfer the unpaid amount to a forfeited share account and refund the amount remaining after the cost of reissuing the shares has been deducted.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

61

A forfeited shares account is:

A) a revenue account.

B) an expense account.

C) a liability account.

D) an asset account.

A) a revenue account.

B) an expense account.

C) a liability account.

D) an asset account.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

62

Discuss,with examples,how the recognition criteria for assets and liabilities provide the criteria for the recognition of equity.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

63

For each class of share capital,an entity shall disclose either on the face of the statement of financial position or in the notes:

A) shares in the entity held by the entity or its subsidiaries or associates.

B) the number of shares authorised.

C) the number of shares issued but not fully paid.

D) all of the given answers.

A) shares in the entity held by the entity or its subsidiaries or associates.

B) the number of shares authorised.

C) the number of shares issued but not fully paid.

D) all of the given answers.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

64

Share capital is also referred to as:

A) equity

B) contributed equity

C) owners contribution

D) shareholder equity

A) equity

B) contributed equity

C) owners contribution

D) shareholder equity

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

65

The term 'reserves' in the statement of financial position is used to identify:

A) a decline in the fair value of a non-current asset.

B) an amount of retained earnings that is allocated for a specific purpose.

C) the allowance for uncollectible receivables.

D) an amount that is being accumulated to reduce the financial effect of a litigation lawsuit.

A) a decline in the fair value of a non-current asset.

B) an amount of retained earnings that is allocated for a specific purpose.

C) the allowance for uncollectible receivables.

D) an amount that is being accumulated to reduce the financial effect of a litigation lawsuit.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

66

The forfeited shares account is used to make up any shortfall:

A) to the forfeiting shareholder.

B) the forfeited share reserve.

C) on the issue of the shares.

D) on the cash at bank account .

A) to the forfeiting shareholder.

B) the forfeited share reserve.

C) on the issue of the shares.

D) on the cash at bank account .

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

67

Where there is a redemption of preference shares 'out of profit':

A) The redemption is recorded in the appropriations section of the profit and loss account.

B) The redemption is recorded as an expense.

C) The redemption is recorded as a liability and is amortised over a maximum of five years.

D) The redemption is not recorded in the current period.

A) The redemption is recorded in the appropriations section of the profit and loss account.

B) The redemption is recorded as an expense.

C) The redemption is recorded as a liability and is amortised over a maximum of five years.

D) The redemption is not recorded in the current period.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

68

Preference shares may be classified as a liability,an equity item,or have features of both.Explain with examples,how to determine such a classification.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements correctly describes this journal entry:

A) The issue of options, costing $3.50 each.

B) The issue of options, costing $30 each.

C) The exercise of options, with a current market value per share of $3.50.

D) The exercise of options, initially costing $3 500 000 to issue and with an exercise price for each option of $30.

A) The issue of options, costing $3.50 each.

B) The issue of options, costing $30 each.

C) The exercise of options, with a current market value per share of $3.50.

D) The exercise of options, initially costing $3 500 000 to issue and with an exercise price for each option of $30.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

70

What is the effect of a share split on earnings per share and the number of shares outstanding,respectively?

A) increase; decrease

B) decrease; increase

C) increase; increase

D) no effect; increase

A) increase; decrease

B) decrease; increase

C) increase; increase

D) no effect; increase

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

71

AASB 110 Events After the Reporting Period specifically prohibits the recognition of dividends as a liability at the end of the reporting period if:

A) the dividends have been declared before the end of the reporting period.

B) the dividends have been declared after the end of the reporting period.

C) the dividends have been declared during the reporting period.

D) the dividends have not been declared after the end of the reporting period.

A) the dividends have been declared before the end of the reporting period.

B) the dividends have been declared after the end of the reporting period.

C) the dividends have been declared during the reporting period.

D) the dividends have not been declared after the end of the reporting period.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

72

When an entity issues shares,until such time as the shares are allotted,the amount received must be held in trust.It remains in trust (refer s.722 of the Corporations Act)until:

A) so directed by ASIC.

B) the shares are issued or transferred; or the money is returned to the applicants.

C) options are issued over the shares.

D) the Board of Directors indicate that the received monies are required by the entity.

A) so directed by ASIC.

B) the shares are issued or transferred; or the money is returned to the applicants.

C) options are issued over the shares.

D) the Board of Directors indicate that the received monies are required by the entity.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

73

What is meant by an oversubscription of a share offer?

Explain the two approaches that could be adopted in the case of an oversubscription.

Explain the two approaches that could be adopted in the case of an oversubscription.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

74

Discuss the primary role of the statement of changes in equity,and what is included in such a statement.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is not a required disclosure to be made in relation to each class of share capital?

A) number of shares authorised

B) number of shares issued and fully paid and issued but not fully paid

C) par value per share or that the shares have no par value

D) None of the given answers are correct.

A) number of shares authorised

B) number of shares issued and fully paid and issued but not fully paid

C) par value per share or that the shares have no par value

D) None of the given answers are correct.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

76

Shares may be issued for consideration other than cash including:

A) promissory notes.

B) contracts for future services.

C) real or personal property.

D) all of the given answers.

A) promissory notes.

B) contracts for future services.

C) real or personal property.

D) all of the given answers.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

77

Fraser Ltd issued 10 million shares at a price of $3 on 1 July 2012.The subscribers are required to pay $1 on application,$1 on allotment and the balance on call to be announced at a later date.The share issue was oversubscribed by 2 million shares.On 1 August 2012 the shares were allotted to all subscribers on a pro rata basis.What is the balance of the 'allotment account' and 'share capital' for this share issue on 1 August 2012,respectively?

A) $8 million; $20 million

B) $8 million; $30 million

C) $10 million; $20 million

D) $10 million; $30 million

A) $8 million; $20 million

B) $8 million; $30 million

C) $10 million; $20 million

D) $10 million; $30 million

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following statements correctly describes this journal entry:

A) The entry is for an entity not listed on the Australian Stock exchange and shows the buy back of shares as a result of a resolution of the Board.

B) The entry is for an entity listed on the Australian Stock exchange and shows the buy back of shares as a result of a resolution of the Board.

C) The entry is for an entity not listed on the Australian Stock exchange and shows the forfeiture of shares as a result of a failure by some shareholders to meet a call on the shares.

D) The entry is for an entity listed on the Australian Stock exchange and shows the forfeiture of shares as a result of a failure by some shareholders to meet a call on the shares.

A) The entry is for an entity not listed on the Australian Stock exchange and shows the buy back of shares as a result of a resolution of the Board.

B) The entry is for an entity listed on the Australian Stock exchange and shows the buy back of shares as a result of a resolution of the Board.

C) The entry is for an entity not listed on the Australian Stock exchange and shows the forfeiture of shares as a result of a failure by some shareholders to meet a call on the shares.

D) The entry is for an entity listed on the Australian Stock exchange and shows the forfeiture of shares as a result of a failure by some shareholders to meet a call on the shares.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following share issue costs does not qualify as a deduction from share capital?

A) advertising of share issue

B) costs of prospectus issue

C) administration overheads

D) audit expenses associated with the issue of a prospectus

A) advertising of share issue

B) costs of prospectus issue

C) administration overheads

D) audit expenses associated with the issue of a prospectus

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following would not apply to a preference shares?

A) higher order of ranking in relation to asset distributions on the winding up of the company

B) redeemable at a set date in the future

C) can be classified as an expense

D) can be converted to ordinary shares

A) higher order of ranking in relation to asset distributions on the winding up of the company

B) redeemable at a set date in the future

C) can be classified as an expense

D) can be converted to ordinary shares

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck