Deck 11: Accounting for Leases

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/81

Play

Full screen (f)

Deck 11: Accounting for Leases

1

The initial direct costs of a sales-type lease,borne by the lessor,are to be accounted for by the lessor as part of the lease receivable.

False

2

If the lease arrangement contains a bargain purchase option,it is reasonable to assume that the risks and rewards of ownership are transferred to the lessee.

True

3

In the situation where there is an unguaranteed residual in a finance lease agreement,the leased asset will be recorded in the books of the lessee at an amount less than its fair value at the inception of the lease.

True

4

An owner of an asset may sell it and then lease it back from the new owner.Where this lease meets the conditions to be classified as a finance lease,the profit or loss on the sale of the asset recorded by the lessee should be classified as a finance item in the statement of comprehensive income in the year of the sale.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

5

The discount rate to be used in calculating the present value of the minimum lease payments is the interest rate implicit to the lease,or if this is not practicable to do so,the lessor's incremental borrowing rate.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

6

If a lease transfers ownership of the property to the lessee,or contains a bargain purchase option,then this is consistent with the lease being an operating lease.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

7

A finance lease is one in which substantially all the risks and benefits of ownership pass to the lessee.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

8

Under a lease agreement,the lessee may have control of an asset even if the lessee does not have legal ownership.According to the AASB Framework this is not a sufficient basis for recording an asset.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

9

Over the term of the lease,the rental payments to the lessor represent a payment of principal plus interest.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

10

If there is reasonable assurance at the inception of the lease that the lessee will obtain ownership of the assets at the end of the lease term,then the leased asset should be depreciated over the lease term.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

11

In reference to the statement,'if the non-cancellable lease term is for the major part of the economic life of the asset,the lease is generally considered to be a finance lease',AASB 117 defines 'major part' as 75%.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

12

In a sale and leaseback transaction,if the risks and rewards incidental to ownership effectively pass to the lessor,this arrangement is classified as a finance lease.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

13

Contingent rent is included in the determination of minimum lease payments under AASB 117 Leases.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

14

AASB 117 applies to accounting for leases,including those that relate to lease arrangements to explore for or use natural resources.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

15

A leased asset under a finance lease should be amortised over the asset's expected useful life if there is a bargain purchase option in the lease agreement.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

16

A leased asset classified as a finance lease is not subject to depreciation or amortisation.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

17

A guaranteed residual value is that part of the residual value that is guaranteed by the lessee,or by a party related to the lessee.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

18

At the commencement of the lease term,lessees are to recognise finance leases as assets and liabilities in their statements of financial position measured at the lower of the fair value of the leased asset and the present value of minimum lease payment,determined at the inception of the lease.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

19

A non-cancellable lease,which transfers the risks and rewards associated with asset ownership,can still be terminated early with the permission of the lessor.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

20

Operating leases are capitalised for inclusion in the statement of financial position.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

21

AASB 117 defines the benefits of ownership to include:

A) those obtainable from the insurance claims associated with it.

B) those obtainable from gains in the realisable value of the asset.

C) those obtainable from the profitable use of the asset.

D) those obtainable from gains in the realisable value of the asset and those obtainable from the profitable use of the asset.

A) those obtainable from the insurance claims associated with it.

B) those obtainable from gains in the realisable value of the asset.

C) those obtainable from the profitable use of the asset.

D) those obtainable from gains in the realisable value of the asset and those obtainable from the profitable use of the asset.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

22

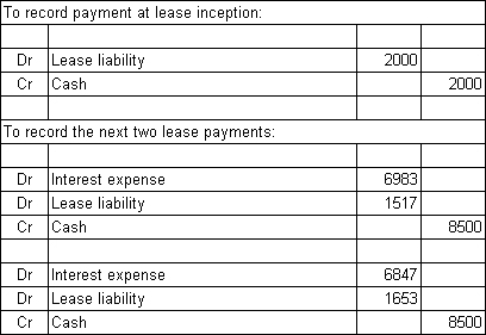

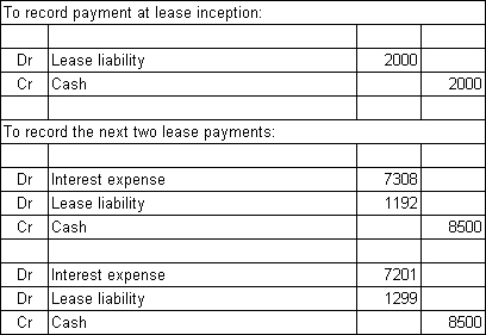

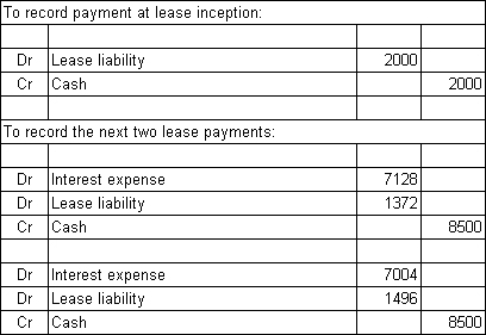

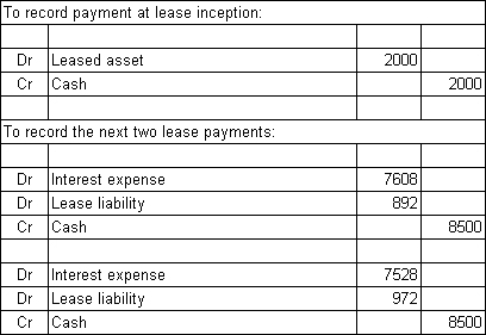

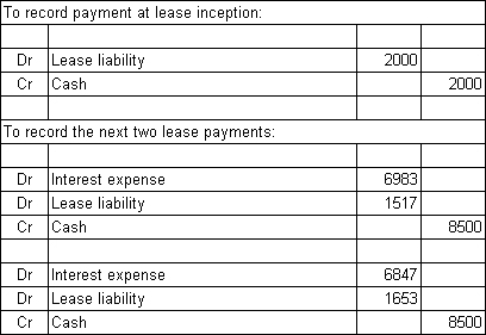

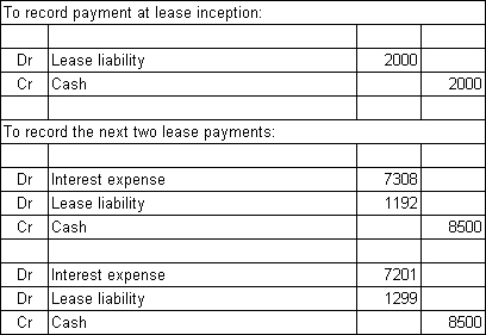

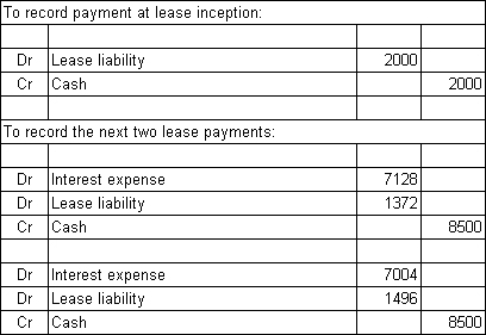

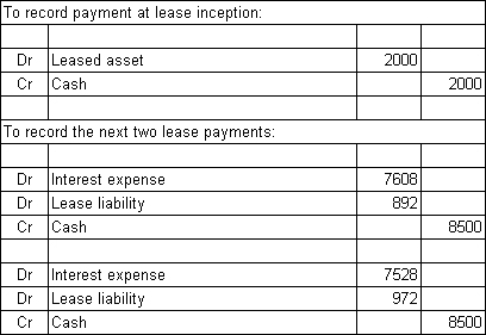

Fresco Ltd enters into a non-cancellable lease agreement with Meola Ltd to lease some equipment under the following conditions: The interest rate implicit in the lease is 9% and the fair value of the asset at the inception of the lease is $81 199.What are the journal entries to record the lease payment at inception of the lease and the next two lease payments in the books of the lessee (rounded to the nearest dollar)?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

23

In determining if the risk and rewards of ownership have been transferred,AASB 117 states the following would indicate a finance lease is in effect:

A) Ownership of the assets transfers at the end of the lease term for a variable payment equal to its then fair value.

B) Contingent rents exist.

C) The lease is non-cancellable by the lessor.

D) All of the given answers are correct.

A) Ownership of the assets transfers at the end of the lease term for a variable payment equal to its then fair value.

B) Contingent rents exist.

C) The lease is non-cancellable by the lessor.

D) All of the given answers are correct.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

24

An operating lease is one in which:

A) the lessee agrees to maintain the operating capability of the asset to a level specified by the lessor.

B) the risks and benefits of ownership reside with the lessor.

C) the lessee is required to maintain the leased asset according to an agreed maintenance schedule.

D) the risks and benefits of ownership reside with the lessor and the lessee is required to maintain the leased asset according to an agreed maintenance schedule.

A) the lessee agrees to maintain the operating capability of the asset to a level specified by the lessor.

B) the risks and benefits of ownership reside with the lessor.

C) the lessee is required to maintain the leased asset according to an agreed maintenance schedule.

D) the risks and benefits of ownership reside with the lessor and the lessee is required to maintain the leased asset according to an agreed maintenance schedule.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

25

Johnson Ltd enters into a lease agreement with Peterson Ltd under the following conditions: The lease may be cancelled only with the permission of the lessor.If the rate of interest implicit in the lease is 10%,what is the fair value of the asset at the inception of the lease,and is the lease a finance or operating lease?

A) $56 745, finance lease

B) $52 596, operating lease

C) $56 745, operating lease

D) $52 596, finance lease

A) $56 745, finance lease

B) $52 596, operating lease

C) $56 745, operating lease

D) $52 596, finance lease

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

26

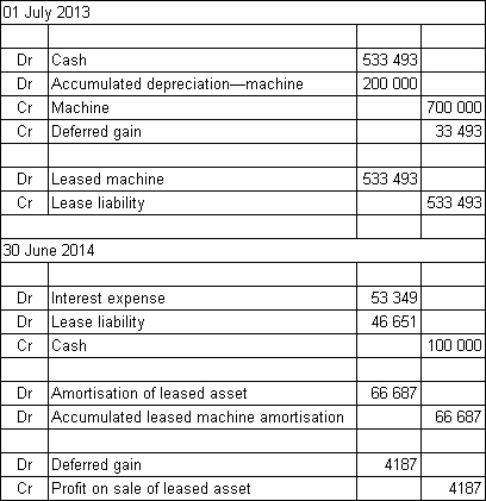

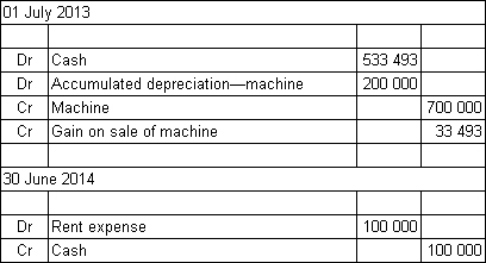

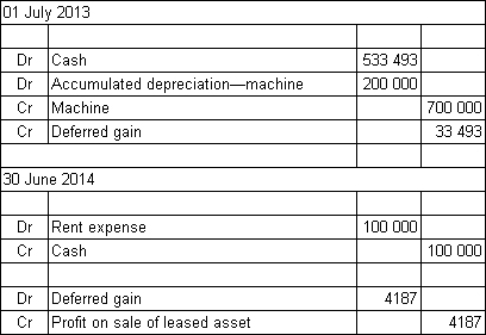

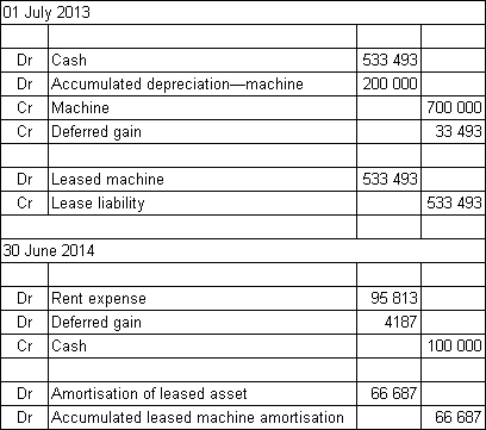

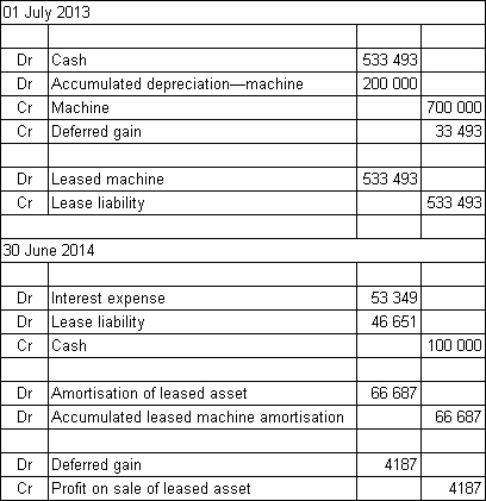

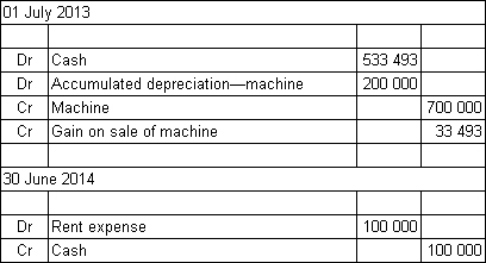

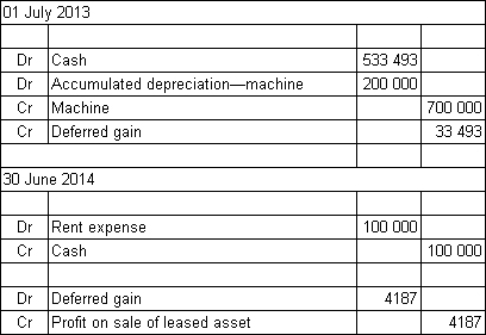

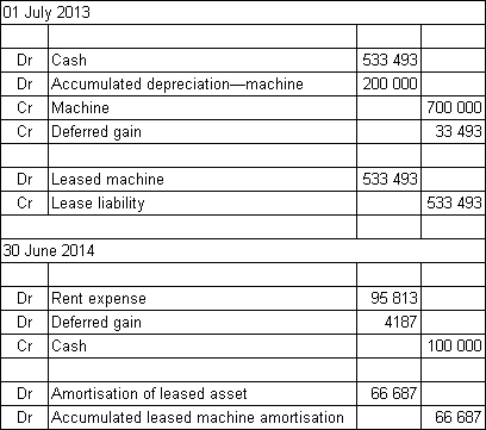

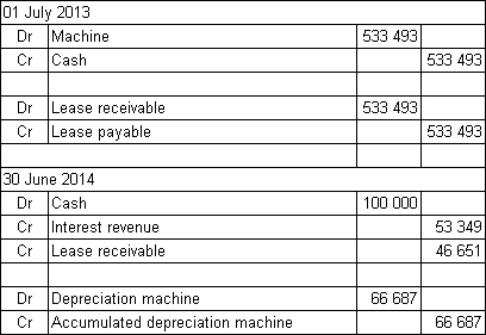

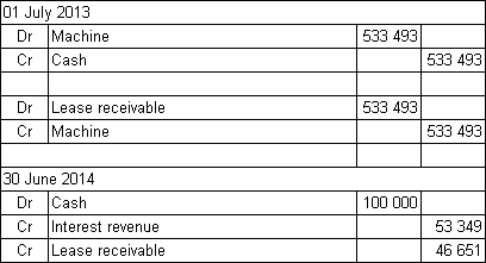

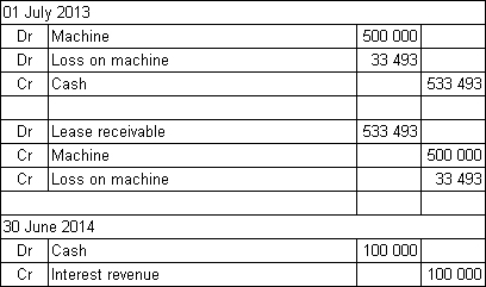

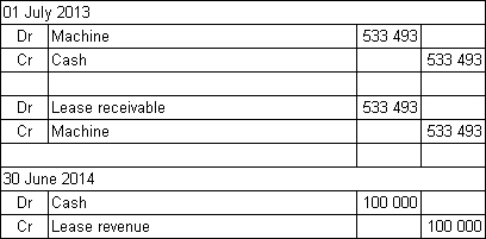

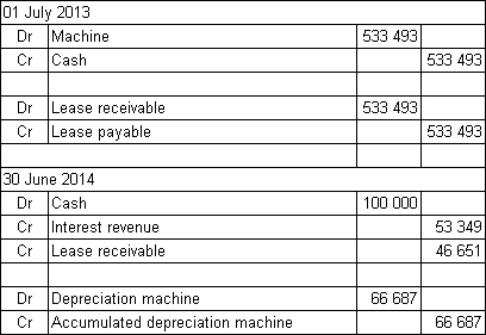

Cobalt Ltd owns an item of machinery that has a cost of $700 000 and accumulated depreciation of $200 000 as at 1 July 2013.On that date the machine is sold to Blue Ltd for $533 493,and then leased back over 8 years (the remaining life of the machine).The lease is non-cancellable.The lease payments are $100 000 per annum,payable in arrears on 30 June each year.The interest rate implicit in the lease is 10% and the economic benefits of the asset are expected to be realised evenly over its life.What are the entries to record the transactions in Cobalt's books on 1 July 2013 and 30 June 2014 (rounded to the nearest dollar)?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

27

Kensington Ltd decides to lease some equipment from Piccadilly Ltd on the following terms: If the interest rate implicit in the lease is 8%,what is the fair value of the equipment at the inception of the lease (rounded to the nearest dollar)?

A) $44 518

B) $46 094

C) $40 094

D) $48 399

A) $44 518

B) $46 094

C) $40 094

D) $48 399

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

28

In the case of a finance lease,the accounting treatment by the lessee could:

A) calculate the IRR implicit in the lease contract and disclose it in the notes to the accounts.

B) provide note disclosure to the accounts and recognise the lease payments in the same way as a rental expense.

C) accrue the lease payments and match them against revenues earned by using a unit of production method.

D) recognise an asset and associated liability equal in value to the present value of the minimum lease payments.

A) calculate the IRR implicit in the lease contract and disclose it in the notes to the accounts.

B) provide note disclosure to the accounts and recognise the lease payments in the same way as a rental expense.

C) accrue the lease payments and match them against revenues earned by using a unit of production method.

D) recognise an asset and associated liability equal in value to the present value of the minimum lease payments.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

29

In circumstances where the lessee is unable to determine the implicit interest rate in a lease agreement,AASB 117 requires the lessee to use:

A) the incremental lending rate of the lessor.

B) the weighted average cost of capital of the lessee.

C) the incremental borrowing rate of the lessee.

D) the internal rate of return on similar projects adopted by the lessor.

A) the incremental lending rate of the lessor.

B) the weighted average cost of capital of the lessee.

C) the incremental borrowing rate of the lessee.

D) the internal rate of return on similar projects adopted by the lessor.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

30

Where a sale and leaseback arrangement involves the benefits and risks of ownership being maintained by the lessee:

A) the lease back is classified as a finance lease.

B) the owner has effectively refinanced the asset.

C) any profit on the sale should be deferred in the statement of financial position and amortised.

D) All of the given answers are correct.

A) the lease back is classified as a finance lease.

B) the owner has effectively refinanced the asset.

C) any profit on the sale should be deferred in the statement of financial position and amortised.

D) All of the given answers are correct.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

31

Mitchum Ltd entered into a lease agreement on 1 July 2013 to lease equipment on the following terms: The interest rate implicit in the lease is 6% and the fair value of the leased asset is $13 316.The lease is cancellable at the option of the lessee.The economic benefits provided by the leased asset are expected to be consumed evenly over its life.What are the appropriate entries in the books of the lessee at the end of the reporting period 30 June 2014?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

32

The rental payments made during the term of a finance lease:

A) are reductions of the lease liability that should be debited to the liability account.

B) are an expense that should be recognised in the annual statements of comprehensive income.

C) need to be divided into an interest component and an expense component. The expense effectively shows the amortisation of the lease asset.

D) should be considered as a payment of principal (reduction in the lease liability) and interest (an annual expense).

A) are reductions of the lease liability that should be debited to the liability account.

B) are an expense that should be recognised in the annual statements of comprehensive income.

C) need to be divided into an interest component and an expense component. The expense effectively shows the amortisation of the lease asset.

D) should be considered as a payment of principal (reduction in the lease liability) and interest (an annual expense).

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

33

Minimum lease payments include:

A) any bargain purchase option amount.

B) any rentals paid to reimburse the lessor for executory costs.

C) contingent rentals.

D) unguaranteed residuals.

A) any bargain purchase option amount.

B) any rentals paid to reimburse the lessor for executory costs.

C) contingent rentals.

D) unguaranteed residuals.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

34

The central accounting issue associated with leases is:

A) the timing of the recognition of the lease payments.

B) whether or not the leased assets should be treated as assets of the lessee.

C) the treatment of provisions for the repairs and maintenance on leased assets.

D) the method of recording any commitment to guarantee the value of the asset at the end of the lease term.

A) the timing of the recognition of the lease payments.

B) whether or not the leased assets should be treated as assets of the lessee.

C) the treatment of provisions for the repairs and maintenance on leased assets.

D) the method of recording any commitment to guarantee the value of the asset at the end of the lease term.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

35

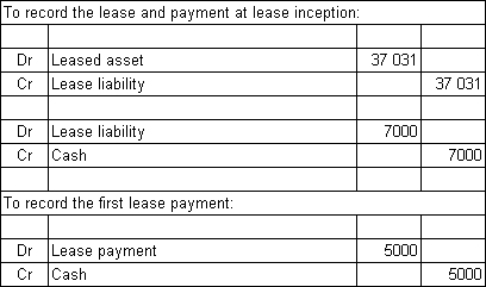

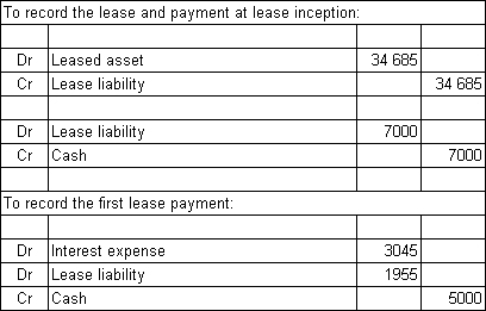

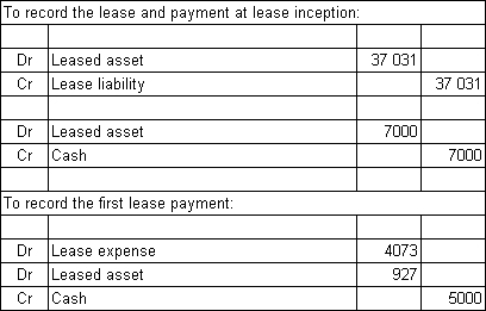

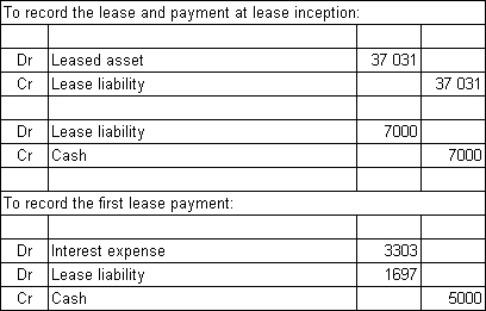

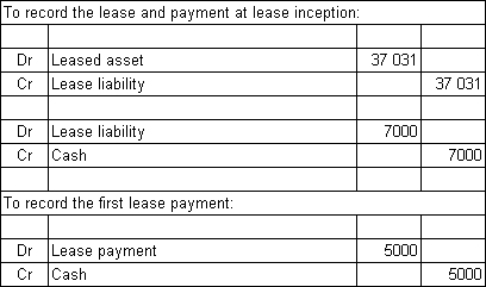

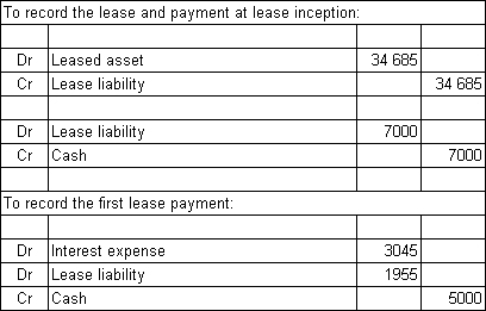

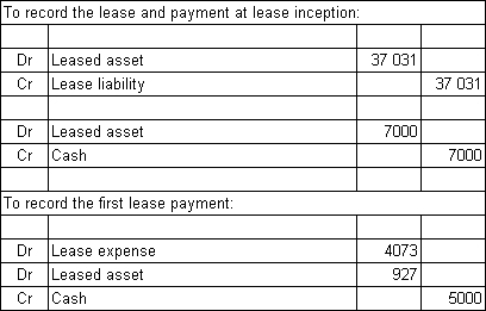

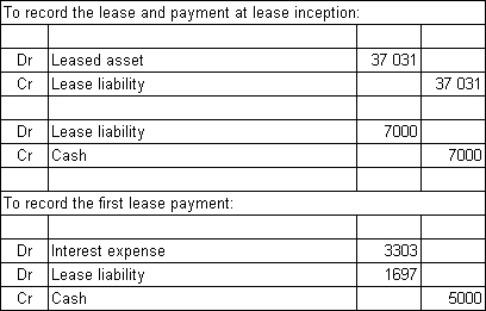

Hoof & Tail Ltd enters into a non-cancellable lease agreement with Equine Industries to lease some equipment under the following conditions: The interest rate implicit in the lease is 11% and the fair value of the asset at the inception of the lease is $37 031.What are the journal entries to record the lease,the payment at lease inception and the first lease payment in the books of the lessee (rounded to the nearest dollar)?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

36

Joplin Ltd entered into a lease agreement on 1 July 2012 with Thomas Ltd.The terms of the lease are as follows:

The interest rate implicit in the lease is 6% and the fair value of the leased asset at the inception of the lease is $20517.The lease is non-cancellable and at the end of the lease the asset is returned to the lessor.The economic benefits provided by the lease asset are expected to be consumed evenly over its life.What is the value of the lease asset and lease liability in the books of the lessee after adjusting entries made on 30 June 2013?

A) lease asset: $17908; lease liability: $18064

B) lease asset: $21352; lease liability: $21954

C) lease asset: $18465; lease liability: $18188

D) lease asset: $17460; lease liability: $17004

The interest rate implicit in the lease is 6% and the fair value of the leased asset at the inception of the lease is $20517.The lease is non-cancellable and at the end of the lease the asset is returned to the lessor.The economic benefits provided by the lease asset are expected to be consumed evenly over its life.What is the value of the lease asset and lease liability in the books of the lessee after adjusting entries made on 30 June 2013?

A) lease asset: $17908; lease liability: $18064

B) lease asset: $21352; lease liability: $21954

C) lease asset: $18465; lease liability: $18188

D) lease asset: $17460; lease liability: $17004

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

37

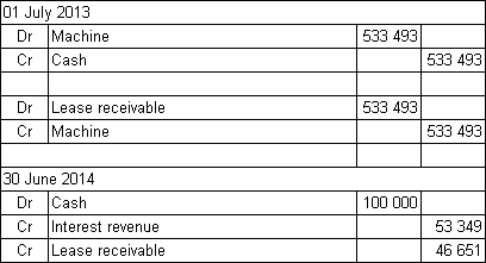

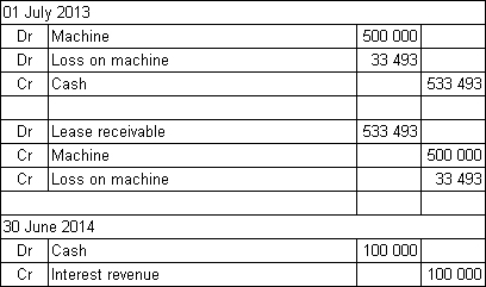

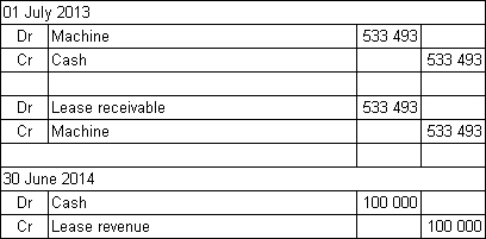

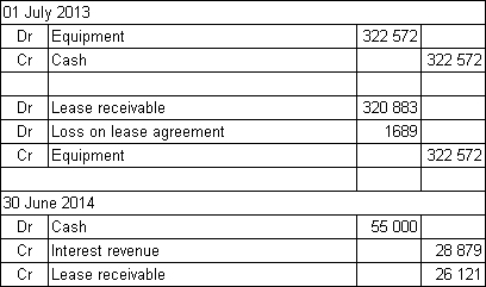

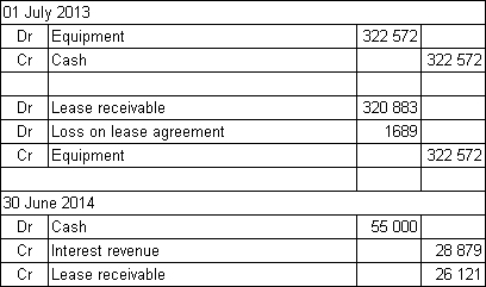

Cobalt Ltd owns an item of machinery that has a cost of $700 000 and accumulated depreciation of $200 000 as at 1 July 2013.On that date the machine is sold to Blue Ltd for $533 493,and then leased back over 8 years (the remaining life of the machine).The lease is non-cancellable.The lease payments are $100 000 per annum,payable in arrears on 30 June each year.The interest rate implicit in the lease is 10% and the economic benefits of the asset are expected to be realised evenly over its life.What are the entries to record the transactions in Blue's books on 1 July 2013 and 30 June 2014 (rounded to the nearest dollar)?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

38

A sale and leaseback arrangement may involve an operating lease where the benefits and risks of ownership have effectively passed to the lessor.In this situation if the sale is not made at the fair value of the asset,the appropriate treatment is to:

A) Write-down the asset to its fair value where the carrying value is greater than the fair value. Where the sale price is above fair value the excess of sales price over fair value must be deferred and amortised by the lessee in proportion to the rental payments over the lease term.

B) Revalue the asset to fair value and in the case that the sale price is less than the fair value write-off the loss to the statement of comprehensive income in the period of the sale. In the case that the sale price is greater than the fair value, the profit should be deferred and amortised against the future rental payments.

C) Write-down the asset to its fair value where the carrying value is greater than the fair value. Where the sale price is below fair value any profit or loss must be recognised immediately by the lessee except that, to the extent the loss is compensated by future rentals at below market price, it must be deferred and amortised in proportion to the rental payments over the lease term.

D) Write-down the asset to its fair value where the carrying value is greater than the fair value. Where the sale price is above fair value the excess of sales price over fair value must be deferred and amortised by the lessee in proportion to the rental payments over the lease term and write-down the asset to its fair value where the carrying value is greater than the fair value. Where the sale price is below fair value any profit or loss must be recognised immediately by the lessee except that, to the extent the loss is compensated by future rentals at below market price, it must be deferred and amortised in proportion to the rental payments over the lease term.

A) Write-down the asset to its fair value where the carrying value is greater than the fair value. Where the sale price is above fair value the excess of sales price over fair value must be deferred and amortised by the lessee in proportion to the rental payments over the lease term.

B) Revalue the asset to fair value and in the case that the sale price is less than the fair value write-off the loss to the statement of comprehensive income in the period of the sale. In the case that the sale price is greater than the fair value, the profit should be deferred and amortised against the future rental payments.

C) Write-down the asset to its fair value where the carrying value is greater than the fair value. Where the sale price is below fair value any profit or loss must be recognised immediately by the lessee except that, to the extent the loss is compensated by future rentals at below market price, it must be deferred and amortised in proportion to the rental payments over the lease term.

D) Write-down the asset to its fair value where the carrying value is greater than the fair value. Where the sale price is above fair value the excess of sales price over fair value must be deferred and amortised by the lessee in proportion to the rental payments over the lease term and write-down the asset to its fair value where the carrying value is greater than the fair value. Where the sale price is below fair value any profit or loss must be recognised immediately by the lessee except that, to the extent the loss is compensated by future rentals at below market price, it must be deferred and amortised in proportion to the rental payments over the lease term.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

39

Quaid Ltd entered into a lease agreement on 1 July 2012 to lease equipment on the following terms: The interest rate implicit in the lease is 8% and the fair value of the leased asset is $24 987.The lease is cancellable if the lessee immediately enters into a further lease for the same or equivalent asset.The economic benefits provided by the lease asset are expected to be consumed evenly over its life.The lease payment has not been made on 30 June before the adjusting entries are made for the year end.What are the appropriate entries in the books of the lessee at the end of the reporting period 30 June 2013?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

40

The term 'bargain purchase option' is not used explicitly in AASB 117 but is described as:

A) the option to purchase the leased asset for significantly less than its cost at the date the option becomes exercisable, for it to be reasonably certain at the inception of the lease, that the option will be exercised.

B) the option to purchase the asset at a price that is expected to be sufficiently lower that the fair value at the date the option becomes exercisable, for it to be reasonably certain at the inception of the lease, that the option will be exercised.

C) being in place when the lessee is guaranteed to undertake the option at the end of the lease.

D) the option to purchase the asset at a price that is expected to be sufficiently lower that the fair value at the date the option becomes exercisable, for it to be reasonably certain at the inception of the lease, that the option will be exercised and being in place when the lessee is guaranteed to undertake the option at the end of the lease.

A) the option to purchase the leased asset for significantly less than its cost at the date the option becomes exercisable, for it to be reasonably certain at the inception of the lease, that the option will be exercised.

B) the option to purchase the asset at a price that is expected to be sufficiently lower that the fair value at the date the option becomes exercisable, for it to be reasonably certain at the inception of the lease, that the option will be exercised.

C) being in place when the lessee is guaranteed to undertake the option at the end of the lease.

D) the option to purchase the asset at a price that is expected to be sufficiently lower that the fair value at the date the option becomes exercisable, for it to be reasonably certain at the inception of the lease, that the option will be exercised and being in place when the lessee is guaranteed to undertake the option at the end of the lease.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

41

Under AASB 117,operating leases require the following disclosures by lessees:

A) the total of future minimum sublease payments expected to be received under non-cancellable subleases at the statement of financial position date.

B) a general description of the lessee's significant leasing arrangements.

C) No disclosures are required as operating leases are expensed each year.

D) the total of future minimum sublease payments expected to be received under non-cancellable subleases at the statement of financial position date and a general description of the lessee's significant leasing arrangements.

A) the total of future minimum sublease payments expected to be received under non-cancellable subleases at the statement of financial position date.

B) a general description of the lessee's significant leasing arrangements.

C) No disclosures are required as operating leases are expensed each year.

D) the total of future minimum sublease payments expected to be received under non-cancellable subleases at the statement of financial position date and a general description of the lessee's significant leasing arrangements.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

42

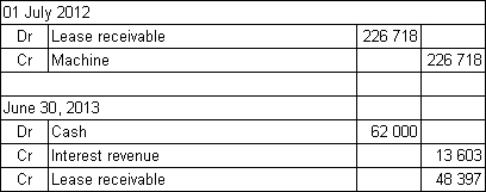

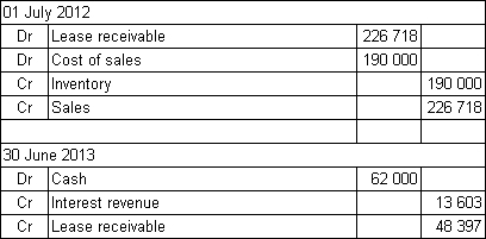

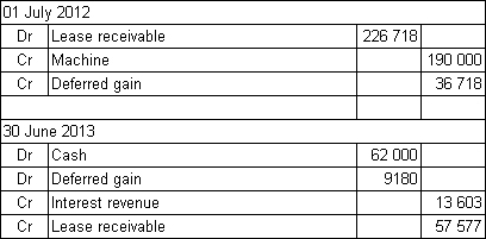

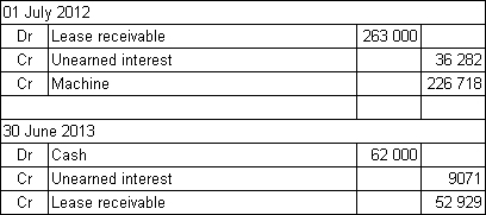

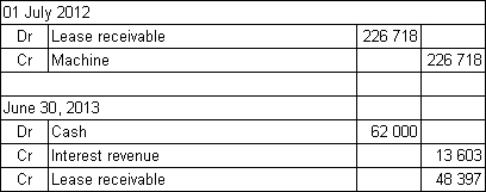

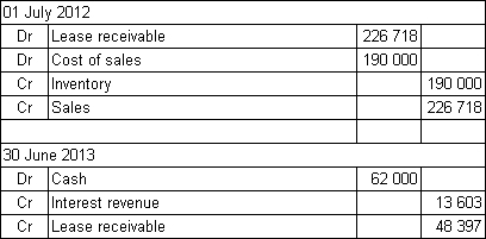

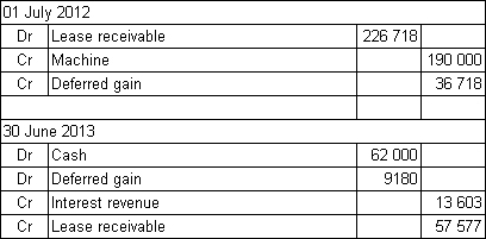

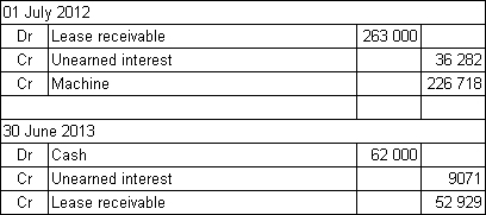

Gerbert Ltd enters into a finance lease with Hokiman Ltd on 1 July 2012 for an item of machinery that has a fair value at that date of $226 718.The lease is for a period of 4 years,with annual lease payments of $62 000 due on 30 June each year,the first payment to be made in 2013.There is a bargain purchase option of $15 000 available for Hokiman to exercise at the end of the lease period.The rate of interest implicit in the lease is 6%.It cost Gerbert Ltd $190 000 to manufacture the machine.What are the entries in the books of Gerbert Ltd for 1 July 2012 and 30 June 2013 (round amounts to the nearest dollar)?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

43

A finance lease in which the lessor provides the financial resources to acquire an asset and retains ownership while the control of the asset and the risks and benefits of ownership pass to the lessee,may be considered from the perspective of the lessor to be a(n):

A) sales-type lease.

B) operating lease.

C) direct finance lease.

D) executory lease.

A) sales-type lease.

B) operating lease.

C) direct finance lease.

D) executory lease.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

44

The following journal entry,in the books of Lessee Pty Limited,records the lease payment made at 30 June 2012.The actual lease payment,the present value of which was included in the calculation of minimum lease payments at the inception of the lease,is:

30 June 2012

A) 87000

B) 93000

C) 97000

D) 100000

30 June 2012

A) 87000

B) 93000

C) 97000

D) 100000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

45

The following journal entry,in the books of Lessee Pty Limited,records the entry for the depreciation expense at 30 June 2012.The lease term is of 5 years duration.Which of the following statements is correct?

30 June 2012 (to record depreciation expense [(739,648 - 120,000)/6]

A) The economic life of the asset is 6 years.

B) It is reasonably certain that the lessee will obtain ownership of the asset at the end of the lease term.

C) It is reasonably certain that the lessee will not obtain ownership of the asset at the end of the lease term.

D) The economic life of the asset is 6 years; and it is reasonably certain that the lessee will obtain ownership of the asset at the end of the lease term.

30 June 2012 (to record depreciation expense [(739,648 - 120,000)/6]

A) The economic life of the asset is 6 years.

B) It is reasonably certain that the lessee will obtain ownership of the asset at the end of the lease term.

C) It is reasonably certain that the lessee will not obtain ownership of the asset at the end of the lease term.

D) The economic life of the asset is 6 years; and it is reasonably certain that the lessee will obtain ownership of the asset at the end of the lease term.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

46

The following is an extract from a lease payment schedule for Lessee Pty Limited.What is the present value of the lease liability at 30 June 2012?

A) 18 006

B) 19 355

C) 25 006

D) 20 157

A) 18 006

B) 19 355

C) 25 006

D) 20 157

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

47

For a lessee entering into a finance lease,initial direct costs are:

A) expensed immediately.

B) expensed at the end of the lease term.

C) capitalised as part of the lease receivable.

D) capitalised as part of the cost of the leased asset.

A) expensed immediately.

B) expensed at the end of the lease term.

C) capitalised as part of the lease receivable.

D) capitalised as part of the cost of the leased asset.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

48

From the point of view of the lessor,any lease rentals that are a recovery of executory costs should be treated as:

A) a reduction in the lease receivable in the period in which they are received.

B) a reduction in interest revenue in the period that the costs are incurred.

C) an increase in unearned revenue in the period in which the lease rental is received.

D) revenue in the periods in which the related costs are incurred.

A) a reduction in the lease receivable in the period in which they are received.

B) a reduction in interest revenue in the period that the costs are incurred.

C) an increase in unearned revenue in the period in which the lease rental is received.

D) revenue in the periods in which the related costs are incurred.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

49

For a depreciable asset,the amount of depreciation recognised shall be in accordance with AASB 116.The asset shall be:

A) fully depreciated over the shorter of the lease term and its useful life, if there is a reasonable certainty that the lessee will obtain ownership by the end of the lease term.

B) fully depreciated over the shorter of the lease term and its useful life, if there is no reasonable certainty that the lessee will obtain ownership by the end of the lease term.

C) fully depreciated over the longer of the lease term and its useful life, if there is no reasonable certainty that the lessee will obtain ownership by the end of the lease term.

D) fully depreciated over the longer of the lease term and its useful life, if there is no reasonable certainty that the lessee will obtain ownership by the end of the lease term.

A) fully depreciated over the shorter of the lease term and its useful life, if there is a reasonable certainty that the lessee will obtain ownership by the end of the lease term.

B) fully depreciated over the shorter of the lease term and its useful life, if there is no reasonable certainty that the lessee will obtain ownership by the end of the lease term.

C) fully depreciated over the longer of the lease term and its useful life, if there is no reasonable certainty that the lessee will obtain ownership by the end of the lease term.

D) fully depreciated over the longer of the lease term and its useful life, if there is no reasonable certainty that the lessee will obtain ownership by the end of the lease term.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

50

Where a sale and leaseback results in the creation of an operating lease and the sales price varies from the fair value of the asset,the lessee:

A) either immediately recognises a profit or loss, or defers and amortises the profit or loss, depending upon the carrying amount of the asset (when sold) and whether any loss is compensated for by future lease payments.

B) immediately recognises a profit or loss.

C) defers and amortises the profit or loss.

D) either immediately recognises a profit or loss, or defers and amortises the profit or loss, depending upon the length of the lease term.

A) either immediately recognises a profit or loss, or defers and amortises the profit or loss, depending upon the carrying amount of the asset (when sold) and whether any loss is compensated for by future lease payments.

B) immediately recognises a profit or loss.

C) defers and amortises the profit or loss.

D) either immediately recognises a profit or loss, or defers and amortises the profit or loss, depending upon the length of the lease term.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

51

Lease incentives are:

A) not covered by AASB 117 and therefore may lead to divergent practices.

B) revenues for the lessees and may be recorded in the initial period of the lease contract.

C) designed to entice lessees to enter into non-cancellable operating leases.

D) not covered by AASB 117 and therefore may lead to divergent practices and designed to entice lessees to enter into non-cancellable operating leases.

A) not covered by AASB 117 and therefore may lead to divergent practices.

B) revenues for the lessees and may be recorded in the initial period of the lease contract.

C) designed to entice lessees to enter into non-cancellable operating leases.

D) not covered by AASB 117 and therefore may lead to divergent practices and designed to entice lessees to enter into non-cancellable operating leases.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

52

Where a lessor is involved in a finance lease (risk has passed to the lessee)the lessor must:

A) remove the asset in question from their statement of financial position as they no longer own it.

B) record a new asset on their statement of financial position, a lease receivable, to replace the leased asset.

C) only record the revenue earned from lease payments in the statement of comprehensive income as they are received.

D) record the sale of the asset to the lessee to ensure the accounting records accurately reflect control of the leased asset.

A) remove the asset in question from their statement of financial position as they no longer own it.

B) record a new asset on their statement of financial position, a lease receivable, to replace the leased asset.

C) only record the revenue earned from lease payments in the statement of comprehensive income as they are received.

D) record the sale of the asset to the lessee to ensure the accounting records accurately reflect control of the leased asset.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

53

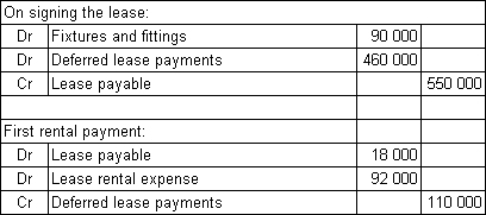

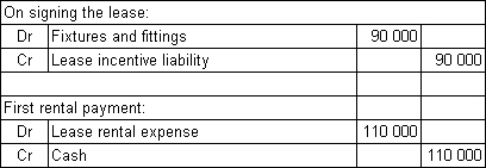

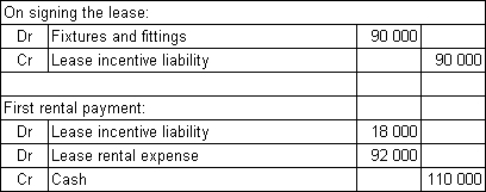

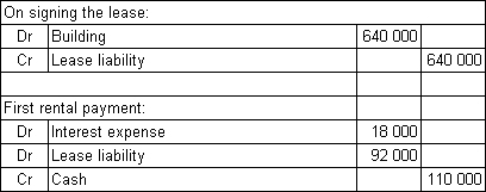

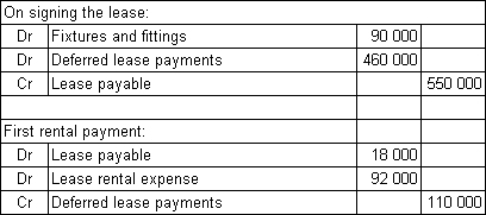

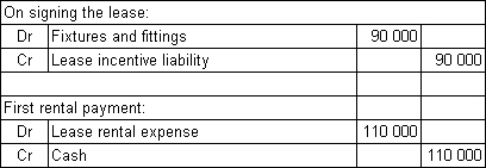

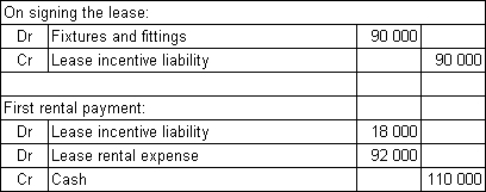

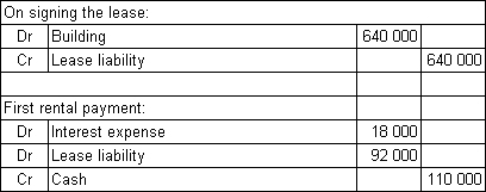

Schwann Ltd enters into a non-cancellable 5-year lease for office space in Bigtown's central business district.The building has an expected remaining life of 40 years.Schwann Ltd has been offered a free fit-out of the office as an incentive to take up the lease.The fit-out would have cost Schwann Ltd $90 000 to do itself.The benefits of the fit-out are to be recognised on a straight-line basis.The rental payments are $110 000 per annum.How would the signing of the lease and the first rental payment be recorded by Schwann Ltd?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

54

The following is an extract from a lease payment schedule for Lessee Pty Limited.Assuming Lessee Pty Limited uses the current/non-current dichotomy to disclose liabilities,what are the amounts of (a)current liabilities; and (b)non-current liabilities,relating to this lease,disclosed by Lessee Pty Limited at 30 June 2012?

A) (a) current 2601; (b) non-current 26 012

B) (a) current 1976; (b) non-current 13 268

C) (a) current 1796; (b) non-current 15 243

D) (a) current 1633; (b) non-current 17 039

A) (a) current 2601; (b) non-current 26 012

B) (a) current 1976; (b) non-current 13 268

C) (a) current 1796; (b) non-current 15 243

D) (a) current 1633; (b) non-current 17 039

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

55

A lease involving land and buildings:

A) must be recorded as an operating lease as land has an indefinite life.

B) requires two separate leases to be recorded, one for the land and another for the building.

C) will still require a determination to be made as to whether the lease constitutes a finance or operating lease.

D) requires the minimum lease repayments to be split evenly between the land and buildings.

A) must be recorded as an operating lease as land has an indefinite life.

B) requires two separate leases to be recorded, one for the land and another for the building.

C) will still require a determination to be made as to whether the lease constitutes a finance or operating lease.

D) requires the minimum lease repayments to be split evenly between the land and buildings.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

56

From the perspective of the lessor,finance leases can be further classified into:

A) leases involving agricultural products and direct-finance leases.

B) leases involving manufacturers or dealers and sales and leasebacks.

C) leases involving manufacturers or dealers and direct-finance leases.

D) leases involving land and buildings and direct-finance leases

A) leases involving agricultural products and direct-finance leases.

B) leases involving manufacturers or dealers and sales and leasebacks.

C) leases involving manufacturers or dealers and direct-finance leases.

D) leases involving land and buildings and direct-finance leases

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

57

Where there is a lease involving a manufacturer or dealer:

A) There are really two parts to the transaction.

B) There will be a difference between the cost of the asset to the lessor and its fair value at the inception of the lease.

C) The lessor's investment would be accounted for in the same way as a direct-financing lease.

D) There are really two parts to the transaction and there will be a difference between the cost of the asset to the lessor and its fair value at the inception of the lease.

A) There are really two parts to the transaction.

B) There will be a difference between the cost of the asset to the lessor and its fair value at the inception of the lease.

C) The lessor's investment would be accounted for in the same way as a direct-financing lease.

D) There are really two parts to the transaction and there will be a difference between the cost of the asset to the lessor and its fair value at the inception of the lease.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

58

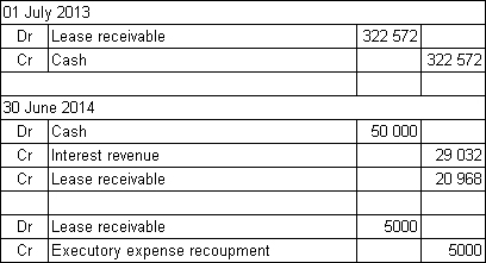

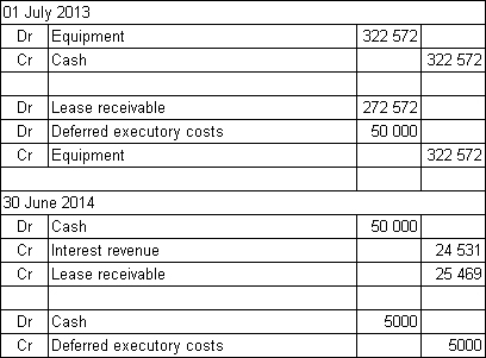

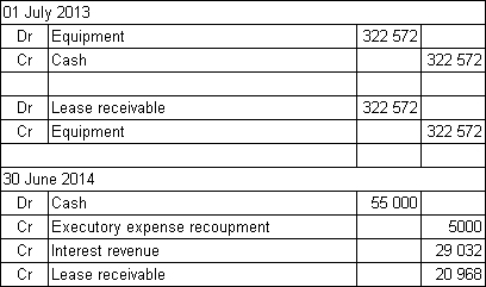

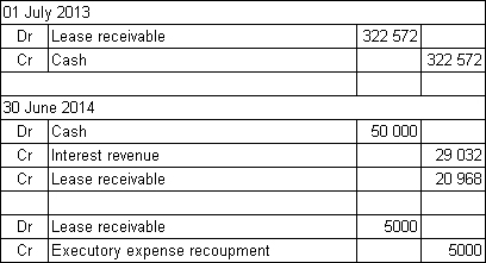

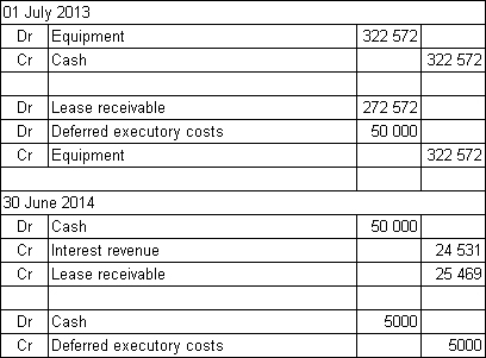

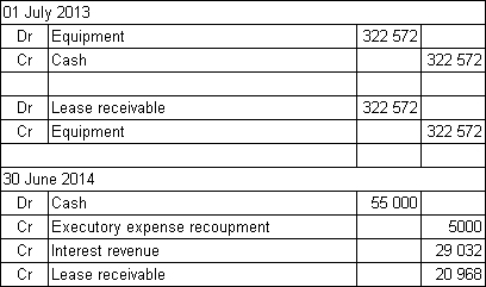

Medusa Ltd enters into a non-cancellable 10-year lease with Lennox Ltd on 1 July 2013.The lease is for an item of equipment that at the inception of the lease has a fair value of $322 572 (the amount that Medusa paid for the asset on 1 July 2013).The equipment is expected to have a useful life of 12 years and the lease term is for 10 years.The lease contract includes a bargain purchase option of $4000 that Lennox Ltd will be able to exercise at the end of the 10-year lease.The lease payments will be made on 30 June each year,beginning 30 June 2014.The payments are to be $55 000 each year with $5000 of this being for executory costs to cover maintenance of the equipment.The maintenance will be carried out annually.The interest rate implicit in the lease is 9%.What are the entries in the books of Medusa Ltd for 1 July 2013 and 30 June 2014 (round amounts to the nearest dollar)?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

59

A non-cancellable lease is a lease that is cancellable only:

A) upon the occurrence of some probable contingency.

B) with the permission of the lessee.

C) if the lessee enters into a new lease for the same or equivalent asset with the same lessor.

D) upon payment by the lessor of such an additional amount that, at inception of the lease, continuation of the lease is certain.

A) upon the occurrence of some probable contingency.

B) with the permission of the lessee.

C) if the lessee enters into a new lease for the same or equivalent asset with the same lessor.

D) upon payment by the lessor of such an additional amount that, at inception of the lease, continuation of the lease is certain.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

60

The amount of a lease receivable recorded by the lessor for a direct finance lease should equal at the beginning of the lease term:

A) the aggregate of the present value of the minimum lease and executory payments and the present value of any unguaranteed residual value expected to accrue to the benefit of the lessor at the end of the lease term.

B) the aggregate of the present value of the minimum lease payments and the present value of any unguaranteed residual value expected to accrue to the benefit of the lessor at the end of the lease term. Any initial direct costs should also be included in the lease receivable.

C) the aggregate of the present value of the total lease payments and the present value of any guaranteed residual value expected to accrue to the benefit of the lessor at the end of the lease term.

D) the aggregate of the present value of the minimum lease payments and the present value of any guaranteed residual value expected to accrue to the benefit of the lessor at the end of the lease term, plus any initial direct costs.

A) the aggregate of the present value of the minimum lease and executory payments and the present value of any unguaranteed residual value expected to accrue to the benefit of the lessor at the end of the lease term.

B) the aggregate of the present value of the minimum lease payments and the present value of any unguaranteed residual value expected to accrue to the benefit of the lessor at the end of the lease term. Any initial direct costs should also be included in the lease receivable.

C) the aggregate of the present value of the total lease payments and the present value of any guaranteed residual value expected to accrue to the benefit of the lessor at the end of the lease term.

D) the aggregate of the present value of the minimum lease payments and the present value of any guaranteed residual value expected to accrue to the benefit of the lessor at the end of the lease term, plus any initial direct costs.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

61

The following is an extract from a lease payment schedule for Lipton Pty Limited.What is the present value of the lease liability at 30 June 2012?

A) 13 539

B) 15 335

C) 15 243

D) 11 835

A) 13 539

B) 15 335

C) 15 243

D) 11 835

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

62

The depreciation policy for depreciable leased assets shall be consistent with:

A) the lessor's normal depreciation policy for similar assets.

B) the lessee's normal depreciation policy for similar assets.

C) the lessor's implicit rate of interest.

D) the lessee's implicit rate of interest

A) the lessor's normal depreciation policy for similar assets.

B) the lessee's normal depreciation policy for similar assets.

C) the lessor's implicit rate of interest.

D) the lessee's implicit rate of interest

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

63

Lease rentals representing a recovery of material executory costs are to be treated by the lessor as:

A) expenses of the financial years in which the related costs incurred.

B) expenses at inception when the related costs incurred.

C) revenue of the financial years in which the related costs incurred.

D) revenue at inception when the related costs incurred.

A) expenses of the financial years in which the related costs incurred.

B) expenses at inception when the related costs incurred.

C) revenue of the financial years in which the related costs incurred.

D) revenue at inception when the related costs incurred.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

64

Discuss how entities with debt-to-asset constraints are affected by the classification of leases as either finance or operating leases.What are the implications for lease accounting?

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

65

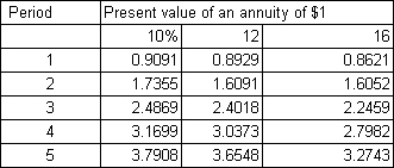

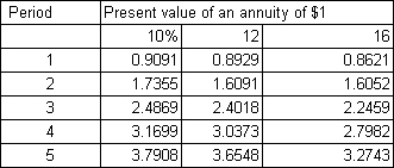

Kingslake Ltd signed a non-cancellable lease contract on 1 January 2012 for a machine that requires 5 annual payments of $200 000 at the start of each year.On the last annual payment,ownership will transfer from the lessor to Kingslake Ltd.The fair value of the asset if paid in cash is $75964.The following information is also available:  What is the implicit rate of this lease arrangement in accordance with AASB 117?

What is the implicit rate of this lease arrangement in accordance with AASB 117?

A) 10%

B) 12%

C) 16%

D) Between 10% and 12%

What is the implicit rate of this lease arrangement in accordance with AASB 117?

What is the implicit rate of this lease arrangement in accordance with AASB 117?A) 10%

B) 12%

C) 16%

D) Between 10% and 12%

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

66

Alpine Ltd signed a 10-year non-cancellable lease with Mt Buller Ltd for the use of high-tech equipment.No bargain purchase option is provided in the lease contract.The following information is available: What is the amount to be recorded as an asset and a liability in the books of the lessee that is in accordance with AASB 117 Leases?

A) $0

B) $120 000

C) $125 000

D) $200 000

A) $0

B) $120 000

C) $125 000

D) $200 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

67

What characteristic(s)of land means that the lessee does not normally receive substantially all of the risks and rewards incidental to ownership (in which case making a lease of land an operating lease)?

A) Land normally has an indefinite economic life.

B) Land being leased normally has a building on it.

C) Land is a tangible asset.

D) Land title must be transferred only by law.

A) Land normally has an indefinite economic life.

B) Land being leased normally has a building on it.

C) Land is a tangible asset.

D) Land title must be transferred only by law.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

68

Paragraph 47 of AASB 117 requires that for a finance lease,the lessor must disclose:

A) the unguaranteed residual values accruing to the lessor.

B) earned finance income.

C) contingent rents recognised as expenses in the period.

D) the guaranteed residual values accruing to the lessor and unearned finance income.

A) the unguaranteed residual values accruing to the lessor.

B) earned finance income.

C) contingent rents recognised as expenses in the period.

D) the guaranteed residual values accruing to the lessor and unearned finance income.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

69

Explain what is meant by a 'direct finance' lease,and how such leases should be accounted under AASB 117.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

70

If the gross method is adopted,the lease receivable is recorded as the sum of:

A) the undiscounted minimum lease payments and the guaranteed residual.

B) the undiscounted minimum lease payments and the unguaranteed residual.

C) the discounted minimum lease payments and the unguaranteed residual.

D) the discounted minimum lease payments and the guaranteed residual.

A) the undiscounted minimum lease payments and the guaranteed residual.

B) the undiscounted minimum lease payments and the unguaranteed residual.

C) the discounted minimum lease payments and the unguaranteed residual.

D) the discounted minimum lease payments and the guaranteed residual.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

71

Discuss the issues raised by the IASB and the US FASB on the accounting treatment for operating leases and how this arrangement gives rise to an asset and a liability to the lessee at inception of the lease.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

72

At inception of the lease,what is the cost basis of an asset acquired from a lease arrangement when the lease is classified as a finance lease?

A) The net realisable value of the asset plus present value of the minimum lease payments.

B) The fair value of the leased asset.

C) The lower of fair value of the leased asset or present value of the minimum lease payments.

D) The lower of fair value of the leased asset or present value of the minimum lease payments plus any initial indirect costs.

A) The net realisable value of the asset plus present value of the minimum lease payments.

B) The fair value of the leased asset.

C) The lower of fair value of the leased asset or present value of the minimum lease payments.

D) The lower of fair value of the leased asset or present value of the minimum lease payments plus any initial indirect costs.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

73

Snowy River Ltd is a lessee to two lease arrangements.Lease A is non-cancellable,contains a bargain purchase option and the lease term is equal to 75% of the economic life of the asset.Lease B is non-cancellable,lease term is less than 60% of the economic life of the asset and the minimum lease payment represents 75% of the fair value of the leased asset. How should Snowy River Ltd classify Lease A and Lease B respectively?

A) operating lease; operating lease

B) operating lease; finance lease

C) finance lease; finance lease

D) finance lease; operating lease

A) operating lease; operating lease

B) operating lease; finance lease

C) finance lease; finance lease

D) finance lease; operating lease

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

74

Describe how a lessee would account for the depreciation (amortisation)of a leased asset.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

75

Describe 'lease incentives' and discuss the suggested approach to 'lease incentives' in Interpretation 115.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

76

Discuss the presentation and disclosure requirements of operating leases under AASB 117.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

77

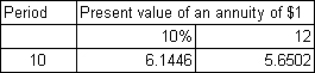

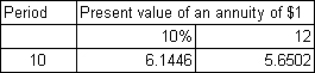

On 1 January 2012 Dobel Ltd signed a 10-year non-cancellable lease that requires a payment of $100 000 at the end of each year.Ownership of the leased asset remains with the lessor at expiry of the lease.The incremental borrowing rate of Dobel Ltd is 12% while the implicit rate of the lessor known to Dobel Ltd is 10%. The following information is also available:

At what amount should the leased property be recorded in the books of Dobel Ltd?

At what amount should the leased property be recorded in the books of Dobel Ltd?

A) $0

B) $565 020

C) $614 460

D) $1 000 000

At what amount should the leased property be recorded in the books of Dobel Ltd?

At what amount should the leased property be recorded in the books of Dobel Ltd?A) $0

B) $565 020

C) $614 460

D) $1 000 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

78

Paragraph 47 of AASB 117 requires that for a finance lease,the lessor must disclose:

A) the guaranteed residual values accruing to the lessor.

B) unearned finance income.

C) contingent rents recognised as expenses in the period.

D) the guaranteed residual values accruing to the lessor and unearned finance income.

A) the guaranteed residual values accruing to the lessor.

B) unearned finance income.

C) contingent rents recognised as expenses in the period.

D) the guaranteed residual values accruing to the lessor and unearned finance income.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

79

In a lease arrangement that is classified by the lessee as an operating lease,the lease payment should be:

A) allocated between depreciation expense and interest expense.

B) allocated between the reduction of liability for leased assets and interest expense.

C) recognised as a rental expense.

D) recognised as an interest expense.

A) allocated between depreciation expense and interest expense.

B) allocated between the reduction of liability for leased assets and interest expense.

C) recognised as a rental expense.

D) recognised as an interest expense.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

80

Explain the accounting treatment for a lease arrangement involving both land and building.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck