Deck 15: Bond Valuation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/87

Play

Full screen (f)

Deck 15: Bond Valuation

1

A $200 000 bond is redeemable at 108 in 14 years. If interest on the bond is 5.5% payable semi-annually, what is the purchase price to yield 4% compounded semi-annually?

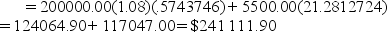

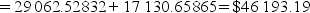

PP = 200000.00(1.08)(1.02)-28 + 5500.00

2

A $50 000 bond bears interest at 4.5% payable semi-annually and is redeemable at par on November 4, 2022. The bond is sold on March 20, 2013, to yield 5.5% compounded semi-annually. What is the cash price?

FV = 50 000; PMT = 50000(  ) = $1125.00; P/Y = C/Y = 2; i =

) = $1125.00; P/Y = C/Y = 2; i =  = 0.0275

= 0.0275

Since the maturity date is Nov.4, the semi-annual interest dates are May 4 and Nov. 4. The interest date preceding the date of purchase is November 4, 2012. The time period from Nov. 4, 2012 to November 4, 2022 is 10 years.

n = 10(2) = 20

The purchase price on the date preceding the date of purchase

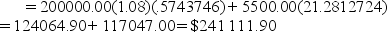

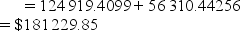

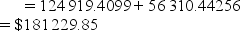

PP(Nov. 4, 2012) = 50000(1.0275)-20 + 1125

The purchase price is $46 193.19

The purchase price is $46 193.19

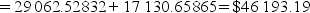

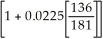

The number of days from Nov.4, 2012 to May 4, 2013 is 181 days.

The number of days from Nov.4, 2012 to March 20, 2013 is 136 days.

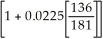

PV = $46 193.19; r = i = 0.0225; t = FV = $46 193.19

FV = $46 193.19  = $46 974.14

= $46 974.14

The cash price on March 20, 2013 is $46 974.14

) = $1125.00; P/Y = C/Y = 2; i =

) = $1125.00; P/Y = C/Y = 2; i =  = 0.0275

= 0.0275Since the maturity date is Nov.4, the semi-annual interest dates are May 4 and Nov. 4. The interest date preceding the date of purchase is November 4, 2012. The time period from Nov. 4, 2012 to November 4, 2022 is 10 years.

n = 10(2) = 20

The purchase price on the date preceding the date of purchase

PP(Nov. 4, 2012) = 50000(1.0275)-20 + 1125

The purchase price is $46 193.19

The purchase price is $46 193.19The number of days from Nov.4, 2012 to May 4, 2013 is 181 days.

The number of days from Nov.4, 2012 to March 20, 2013 is 136 days.

PV = $46 193.19; r = i = 0.0225; t =

FV = $46 193.19

FV = $46 193.19  = $46 974.14

= $46 974.14The cash price on March 20, 2013 is $46 974.14

3

A $200 000.00, 6% bond with semi-annual coupons is redeemable at par. What is the purchase price of the bond six years before maturity to yield 8% compounded semi-annually?

FV = $200 000; P/Y = C/Y = 2; PMT = 200 000(0.06/2) = $6 000; i =  = 0.04; n = 6(2) = 12.

= 0.04; n = 6(2) = 12.

PP = 200 000(1.04)-12 + 6000

= 0.04; n = 6(2) = 12.

= 0.04; n = 6(2) = 12.PP = 200 000(1.04)-12 + 6000

4

A $100 000, 8.75% bond with interest payable annually is redeemable at 103 in four years. What is the purchase price to yield 7% compounded quarterly?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

5

A $50 000 bond bearing interest at 6.5% bond payable semi-annually matures in 10 years. If it is bought to yield 5.7% compounded semi-annually, what is the purchase price of the bond?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

6

A $100 000 bond bearing interest at 8% payable semi-annually is bought five years before maturity to yield 6% compounded annually. If the bond is redeemable at par, what is the purchase price?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

7

A $1 000 000, 9% bond with interest payable annually is redeemable at 104 in 5 years. What is the purchase price to yield 8% compounded quarterly?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

8

A $100 000, 4% bond with semi-annual coupons is redeemable at 108. What is the purchase price to yield 5.5% compounded semi-annually seven years before maturity?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

9

A $50 000 bond bearing interest at 5.5% payable semi-annually is redeemable at par on August 10, 2033. The bond is sold on the primary market on December 10, 2013, to yield 5% compounded semi-annually. Determine

a) calculate the market price;

b) the accrued interest;

c) the cash price.

a) calculate the market price;

b) the accrued interest;

c) the cash price.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

10

A $150 000 bond redeemable at par on October 1, 2026, is purchased on January 15, 2014. Interest is 6% payable semi-annually and the yield is 7.5% compounded semi-annually.

a) What is the market price of the bond?

b) How much interest has accrued?

c) What is the cash price?

a) What is the market price of the bond?

b) How much interest has accrued?

c) What is the cash price?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

11

A $5000, 6.5% bond with semi-annual coupons redeemable at 108 is bought two years before maturity to yield 6% compounded semi-annually. What is the purchase price?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

12

A $5000 bond that pays 6% semi-annually is redeemable at par in 14 years. Calculate the purchase price if it is sold to yield 8% compounded semi-annually.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

13

Six $1500 bonds with 4.5% coupons payable semi-annually are bought to yield 5% compounded monthly. If the bonds are redeemable at par in eight years, what is the purchase price?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

14

What is the purchase price of a $10 000, 3.5% bond with semi-annual coupons redeemable at 104 in seven years if the bond is bought to yield 2.5% compounded semi-annually?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

15

A $100 000, 7.5% bond with semi-annual coupons redeemable at 106 is bought three years before maturity to yield 8% compounded semi-annually. What is the purchase price?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

16

A $25 000, 6% bond redeemable at par is purchased 11 years before maturity to yield 6.9% compounded semi-annually. If the bond interest is payable semi-annually, what is the purchase price of the bond?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

17

A $100 000 bond is redeemable at 105 in 20 years. If interest on the bond is 5% payable semi-annually, what is the purchase price to yield 6% compounded semi-annually?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

18

Bonds in denominations of $100 000 redeemable at 104 are offered for sale. If the bonds mature in ten years and six months and the coupon rate is 5.5% payable quarterly, what is the market price of the bonds to yield 7.2% compounded quarterly?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

19

Bonds in denominations of $10 000 redeemable at par in six years and four months are offered for sale. If the coupon rate is 6.5% payable quarterly and the expected yield is 8% compounded quarterly, determine

a) the market price;

b) the accrued interest;

c) the cash price.

a) the market price;

b) the accrued interest;

c) the cash price.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

20

A $150 000 bond bearing interest at 6% payable semi-annually is bought eight years before maturity to yield 4.5% compounded annually. If the bond is redeemable at par, what is the purchase price?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

21

A $50 000, 4% bond with semi-annual coupons is purchased three years before maturity. Calculate the discount or premium if the bond is sold to yield 6% compounded semi-annually.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

22

A $125 000 bond, redeemable at par in three years with 7.5% coupons payable quarterly, is bought to yield 6% compounded quarterly.

(i) Compute the premium or discount and the purchase price.

(ii) Construct a schedule for amortization of premium.

(i) Compute the premium or discount and the purchase price.

(ii) Construct a schedule for amortization of premium.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

23

A $5000, 6.25% bond with interest payable annually redeemable at par in eight years is purchased to yield 7.5% compounded annually. Find the premium or discount and the purchase price and construct the appropriate bond schedule.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

24

Find the gain or loss on the sale without constructing a bond schedule for a $50 000, 6% bond with semi-annual coupons redeemable at par purchased twelve years before maturity to yield 10% compounded semi-annually. The bond was sold five years later at 99.375.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

25

Three $25 000, 6% bonds with semi-annual coupons redeemable at par were bought eight years before maturity to yield 7% compounded semi-annually. Determine the gain or loss if the bonds are sold at 89.625 four years later.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

26

Find the gain or loss on the sale without constructing a bond schedule for six $5000, 9.5% bonds with interest payable semi-annually redeemable at par bought twenty-one years before maturity to yield 10.5% compounded semi-annually. The bonds were sold three years later at 103.625.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

27

A $1000, 7% bond redeemable at par in eight years bears coupons payable annually. Compute the premium or discount and the purchase price if the yield, compounded annually, is:

a) 6.5%

b) 7.5%

c) 8.5%

a) 6.5%

b) 7.5%

c) 8.5%

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

28

Ten $10 000, 4% bonds with interest payable semi-annually and redeemable at par are purchased 18.5 years before maturity. Find the premium or discount and the purchase price if the bonds are bought to yield 7%.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

29

A $10 000, 7.2% bond with semi-annual coupons is purchased 3 years before maturity. Calculate the discount or premium if the bond is sold to yield 6% compounded semi-annually.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

30

Twenty $5 000 bonds redeemable at par bearing 6% coupons payable quarterly are sold eight years before maturity to yield 5.5% compounded annually. What is the purchase price of the bonds?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

31

Nine $10 000, 4% bonds with interest payable semi-annually and redeemable at par are purchased 8.5 years before maturity. Find the premium or discount and the purchase price if the bonds are bought to yield 6%.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

32

A $250 000, 7% bond redeemable at par with interest payable semi-annually is bought 4 years before maturity. Determine the premium or discount and the purchase price if the bond is purchased to yield:

a) 6.5% compounded semi-annually

b) 8% compounded semi-annually

a) 6.5% compounded semi-annually

b) 8% compounded semi-annually

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

33

A $100 000.00, 7.2% bond with quarterly coupons redeemable at par is purchased 11 years before maturity to yield 6% compounded semi-annually. Determine the premium or discount.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

34

A $50 000.00, 8% bond with quarterly coupons redeemable at par is purchased five years before maturity to yield 4% compounded semi-annually. Determine the premium or discount.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

35

A $5000.00 6.5% bond redeemable at 109 with interest payable annually is purchased six years before maturity to yield 7% compounded annually. Construct the appropriate bond schedule.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

36

A $1000, 6% bond redeemable at par with semi-annual coupons was purchased 10 years before maturity to yield 5% compounded semi-annually. The bond was sold 3 years later at 102. Calculate the gain or loss on the sale of the bond.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

37

Bonds with a face value of $130 000 redeemable at par bearing 4.5% coupons payable quarterly are sold six years before maturity to yield 5.25% quarterly. Determine

a) the premium or discount;

b) the purchase price?

a) the premium or discount;

b) the purchase price?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

38

A $100 000 bond, redeemable at 110 in seven years with 6.75% coupons payable annually, is bought to yield 7.25% compounded annually.

(i) Determine the discount and the purchase price.

(ii) Construct a schedule of accumulation of discount.

(i) Determine the discount and the purchase price.

(ii) Construct a schedule of accumulation of discount.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

39

Find the gain or loss on the sale without constructing a bond schedule for a $100 000, 8% bond with semi-annual coupons redeemable at par purchased eleven-and-a-half years before maturity to yield 9% compounded semi-annually. The bond was sold five years later at 99.125.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

40

A $1000, 6.5% bond redeemable at par in four years bears coupons payable annually. Compute the premium or discount and the purchase price if the yield, compounded annually, is 7.5%.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

41

A $10 000 bond bearing interest at 6% payable semi-annually redeemable at par on March 1, 2002, was purchased on September 30, 1996, to yield 5% compounded semi-annually. Determine the purchase price.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

42

A $25 000, 8% bond with semi-annual coupons, redeemable at par in 12 years, is purchased to yield 6% compounded semi-annually. Determine the gain or loss if the bond is sold two years later at 107.25.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

43

A $200 000, 6% bond with semi-annual coupons redeemable at par March 1, 2009, was purchased on November 15, 1999, to yield 5% compounded semi-annually. What was the purchase price of the bond?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

44

A $50 000.00, 6% bond with semi-annual coupons redeemable at par in 14 years is purchased to yield 8% compounded semi-annually. What is the gain or loss if the bond is sold four years before maturity at 99.25?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

45

A $250 000, 6.5% bond with semi-annual coupons redeemable at par is bought 17.5 years before maturity at 78.25. What was the approximate yield rate?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

46

A 4.5% annuity bond of $500 000 with interest payable quarterly is to be redeemable at par in seven years.

a) What is the purchase price to yield 6% compounded quarterly?

b) What is the book value after 6 years?

c) What is the gain or loss if the bond is sold six years after the date of purchase at

a) What is the purchase price to yield 6% compounded quarterly?

b) What is the book value after 6 years?

c) What is the gain or loss if the bond is sold six years after the date of purchase at

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

47

A $100 000, 9.0% bond with semi-annual coupons redeemable at par on March 1, 2015, was purchased on September 22, 2007, to yield 10.00% compounded semi-annually. What was the purchase price?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

48

A $10 000, 8.5% bond with semi-annual coupons redeemable at par on March 1, 2005, was purchased on September 22, 1997, to yield 10.06% compounded semi-annually. What was the purchase price?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

49

What is the purchase price of a bond that has 4 years and 6 months until it matures? The face value of the bond is $3000 and the coupon rate is 5.2% compounded semi-annually. The yield rate is 7.5% compounded semi-annually.

A) $2740.53

B) $2440.53

C) $2770.53

D) $2447.53

E) $2547.53

A) $2740.53

B) $2440.53

C) $2770.53

D) $2447.53

E) $2547.53

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

50

A $50 000 bond that pays 5% semi-annually is redeemable at par on July 15, 2025.It is quoted at 97.5 on December 2, 2013. Determine the yield rate.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

51

Find the gain or loss on the sale without constructing a bond schedule for three $100 000, 5.5% bonds with quarterly coupons redeemable at par on September 1, 2017, bought on May 1, 2011, to yield 6% compounded quarterly. The bonds were sold on January 21, 2014, at 93.5.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

52

A $50 000, 6% bond with semi-annual coupons redeemable at par on April 25, 2018, was purchased on June 25, 2009, at 94.378. What was the approximate yield rate?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

53

A $100 000, 8% bond with semi-annual coupons redeemable at par on April 25, 2018, was purchased on June 25, 2009, at 94.125. What was the approximate yield rate?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

54

A $10 000.00, 5% bond with semi-annual coupons redeemable at 105 in 23 years is purchased at 102.5. What is the approximate yield rate?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

55

A $40 000 bond with semi-annual coupon payments at 5.5% compounded semi-annually is redeemable at par in 12 years. Calculate the yield rate if the bond is purchased at 102.5.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

56

A $100 000, 6.0% bond with semi-annual coupons redeemable at par is bought 17.5 years before maturity at 74.25. What was the approximate yield rate?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

57

A $25 000, 7% bond with semi-annual coupons redeemable at par in twenty-two years is purchased to yield 6% compounded semi-annually. Determine the gain or loss if the bond is sold seven years after the date of purchase at 98.25.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

58

A $100 000.00, 7% bond with semi-annual coupons redeemable at 105 on November 1, 2001, is purchased on July 23, 1999, to yield 8% compounded semi-annually. Determine the quoted price.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

59

A $40 000.00, 5% bond with semi-annual coupons redeemable at par in 14 years is purchased to yield 7% compounded semi-annually. What is the gain or loss if the bond is sold three years before maturity at 99.75?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

60

What is the purchase price of a bond that is issued on May 1, 2002 for 22 years at a coupon rate of 9.4% compounded semi-annually? The purchase date of the bond is May 11, 2007 and the yield rate is 8.5% compounded semi-annually. The bond has a face value of $5000 and is redeemable at par.

A) $4513.30

B) $5413.30

C) $5431.30

D) $4531.30

E) $4533.30

A) $4513.30

B) $5413.30

C) $5431.30

D) $4531.30

E) $4533.30

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

61

What is the quoted price of a bond that has 4.5 years until maturity? The face value of the bond is $5000 and it has a coupon rate of 8.1% compounded semi-annually and a yield rate of 8.6% compounded semi-annually.

A) $4809.32

B) $4998.32

C) $4908.32

D) $4888.32

E) $4898.32

A) $4809.32

B) $4998.32

C) $4908.32

D) $4888.32

E) $4898.32

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

62

A $63 000 bond bearing interest at 9.1% bond payable semi-annually matures in 20 years. If it is bought to yield 11.1% compounded semi-annually, what is the purchase price of the bond?

A) $7261.24

B) $2866.50

C) $45 695.74

D) $52 956.98

E) $74 510.72

A) $7261.24

B) $2866.50

C) $45 695.74

D) $52 956.98

E) $74 510.72

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

63

Nick buys a $25 000, 5.4% bond with quarterly interest coupons, 3 years before maturity, to yield 7% compounded quarterly. Determine the premium or discount.

A) $4698.55 premium

B) $4698.55 discount

C) $3624.60 discount

D) $1073.95 premium

E) $1073.95 discount

A) $4698.55 premium

B) $4698.55 discount

C) $3624.60 discount

D) $1073.95 premium

E) $1073.95 discount

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

64

From his retirement fund, Jack buys a $50 000, 5.4% bond with quarterly interest coupons at 104.1, redeemable at par in 15 years. What is the approximate yield rate?

A) 1.256%

B) 5.024%

C) 1.23%

D) 4.92%

E) 5.19%

A) 1.256%

B) 5.024%

C) 1.23%

D) 4.92%

E) 5.19%

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

65

A $1000 bond, with interest at 8% payable semi-annually on January 1 and July 1, was purchased on October 8 at 104 plus accrued interest. What is the purchase payment for the bond?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

66

Nick buys a $25 000, 5.4% bond with quarterly interest coupons, 3 years before maturity, to yield 7% compounded quarterly. Construct a schedule of accumulation of discount.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

67

Nick buys a $25 000, 5.4% bond with quarterly interest coupons, 3 years before maturity, to yield 3.5% compounded quarterly. Construct a schedule of amortization of premium.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

68

A $30 000, 3% bond redeemable at par is purchased 7 years before maturity to yield 5.5% compounded quarterly. If the bond interest is payable quarterly, what is the purchase price of the bond?

A) $20 467.13

B) $225.00

C) $5199.75

D) $25 666.88

E) $34 719.51

A) $20 467.13

B) $225.00

C) $5199.75

D) $25 666.88

E) $34 719.51

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

69

Six $20 000, 2% bonds with interest payable semi-annually and redeemable at par are purchased 18.5 years before maturity. Find the premium or discount and the purchase price if the bonds are bought to yield 5.9%.

A) $56 268.82 premium

B) $56 268.82 discount

C) $12 011.81 premium

D) $8711.47 discount

E) $12 011.81 discount

A) $56 268.82 premium

B) $56 268.82 discount

C) $12 011.81 premium

D) $8711.47 discount

E) $12 011.81 discount

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

70

What is the amount of premium/discount amortized or accumulated in the first payment interval for a bond that has a face value of $6000 and it sold for $5700? The coupon rate is 9% compounded semi-annually and the market rate is 10.1% compounded semi-annually.

A) $18.75

B) $17.85

C) $11.85

D) $15.75

E) $14.75

A) $18.75

B) $17.85

C) $11.85

D) $15.75

E) $14.75

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

71

Nick buys a $25 000, 5.4% bond with quarterly interest coupons, 3 years before maturity, to yield 3.5% compounded quarterly. Determine the premium or discount.

A) $2481 discount

B) $2481 premium

C) $1347 premium

D) $1347 discount

E) $3829 premium

A) $2481 discount

B) $2481 premium

C) $1347 premium

D) $1347 discount

E) $3829 premium

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

72

A $1000 bond, with interest at 8% payable semi-annually on January 1 and July 1, was purchased on February 8, 2012. The bond matures on July 1, 2015 and yields 2.2% compounded semi-annually. What is the purchase payment for the bond?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

73

What is the amount of premium/discount amortized or accumulated for the second payment interval of a $1500 bond that sold for $1627.32? The bond rate is 6.95% compounded semi-annually and the yield rate is 6% compounded semi-annually.

A) $4.30

B) $5.30

C) $1.40

D) $3.40

E) $2.30

A) $4.30

B) $5.30

C) $1.40

D) $3.40

E) $2.30

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

74

Clarington issued 15 year bonds in the amount of $500 000. Interest on the bonds is 2.2% payable annually. What is the issue price of the bonds, if the bonds are sold to yield 2.8% compounded quarterly?

A) $329 004

B) $132 950

C) $461 954

D) $330 425

E) $343 749

A) $329 004

B) $132 950

C) $461 954

D) $330 425

E) $343 749

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

75

Nine $2000, 9% bonds with interest payable semi-annually and redeemable at par are purchased 7 years before maturity. Find the premium or discount and the purchase price if the bonds are bought to yield 4%.

A) $5447.81 premium

B) $5447.81 discount

C) $4600.27 premium

D) $11.14 discount

E) $4600.27 discount

A) $5447.81 premium

B) $5447.81 discount

C) $4600.27 premium

D) $11.14 discount

E) $4600.27 discount

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

76

Nick buys a $25 000, 5.4% bond with quarterly interest coupons, 3 years before maturity, to yield 7% compounded quarterly. Calculate the shortage of the actual interest received compared to the required interest based on the yield rate.

A) $337.50

B) $437.50

C) $100

D) $1350

E) $1750

A) $337.50

B) $437.50

C) $100

D) $1350

E) $1750

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

77

Nick buys a $25 000, 5.4% bond with quarterly interest coupons, 3 years before maturity, to yield 7% compounded quarterly. The bond was sold a year later at 102. What is the gain or loss on the sale of the bond?

A) $740.51 gain

B) $740.51 loss

C) $1240.50 gain

D) $1240.50 loss

E) $500 gain

A) $740.51 gain

B) $740.51 loss

C) $1240.50 gain

D) $1240.50 loss

E) $500 gain

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

78

Clarington issued 15 year bonds in the amount of $500 000. Interest on the bonds is 2.2% payable annually. What is the promised payment at the end of each year?

A) $11 100

B) $693 000

C) $360 750

D) $374 675

E) $13 925

A) $11 100

B) $693 000

C) $360 750

D) $374 675

E) $13 925

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

79

A $20 000, 3.6% bond with semi-annual coupons is purchased 5 years before maturity. Calculate the discount or premium if the bond is sold to yield 3% compounded semi-annually.

A) $553.33 premium

B) $553.33 discount

C) $360 premium

D) $544.64 premium

E) $554.64 discount

A) $553.33 premium

B) $553.33 discount

C) $360 premium

D) $544.64 premium

E) $554.64 discount

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

80

What is the amount of premium/discount for a bond that has 4 years till it matures? The face value of the bond is $100 000 and it has a bond rate of 6.4% compounded semi-annually. The bond is sold to yield 7.4% compounded semi-annually.

A) $3084.47

B) $3840.47

C) $3048.47

D) $3408.47

E) $3184.47

A) $3084.47

B) $3840.47

C) $3048.47

D) $3408.47

E) $3184.47

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck