Deck 8: Making Investment Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/74

Play

Full screen (f)

Deck 8: Making Investment Decisions

1

List the five steps of the decision-making framework outlined in chapter 8 and briefly explain the process and importance of each step.

1.Define the decision to be made and any related issues 2.Determine the criteria to be used when evaluating alternatives 3.Generate alternatives 4.Analyze and assess the alternatives 5.Decide on an alternative and begin implementation Section one discusses each of the steps and I refer you to those paragraphs.

2

The ________ method provides the number of years required for a project to repay its initial investment.

A)modified internal rate of return

B)internal rate of return

C)net present value

D)payback

A)modified internal rate of return

B)internal rate of return

C)net present value

D)payback

D

3

The ________ rule states that a firm should accept any project with a present value of cash inflows greater than the present value of cash outflows.

A)internal rate of return

B)payback

C)modified internal rate of return

D)net present value

A)internal rate of return

B)payback

C)modified internal rate of return

D)net present value

D

4

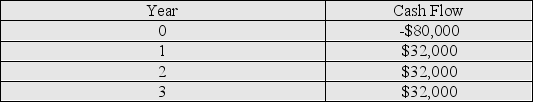

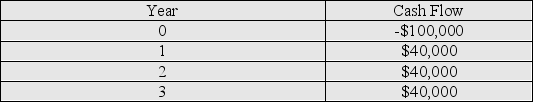

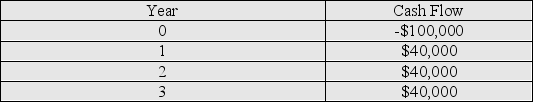

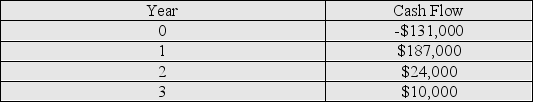

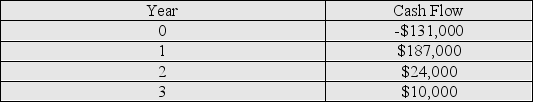

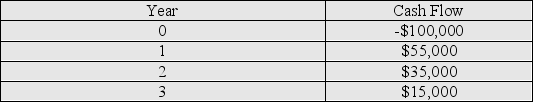

Based strictly on the payback method,which project is preferred?

A)Project A because the payback for A of 1.92 years is less than the payback for B of 2.23 years.

B)Project A because the payback for A of 2.23 years is greater than the payback for B of 1.92 years.

C)Project B because the payback for B of 2.23 years is greater than the payback for A of 1.92 years.

D)Project B because the sum of the total cash inflows less the outflows = $20,000 for B but only $14,000 for A.

A)Project A because the payback for A of 1.92 years is less than the payback for B of 2.23 years.

B)Project A because the payback for A of 2.23 years is greater than the payback for B of 1.92 years.

C)Project B because the payback for B of 2.23 years is greater than the payback for A of 1.92 years.

D)Project B because the sum of the total cash inflows less the outflows = $20,000 for B but only $14,000 for A.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

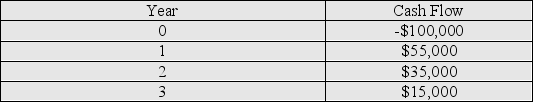

5

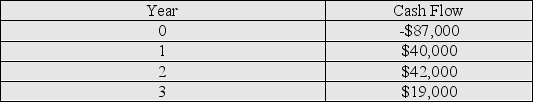

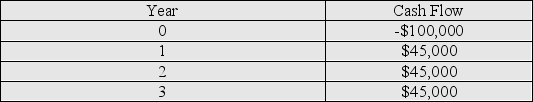

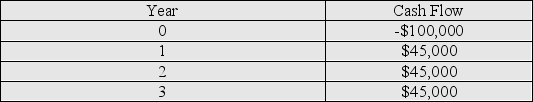

What is the Net Present Value (NPV)for the cash flows provided in the table below? Note: The negative cash flow for year 0 is the initial investment for the project.The required rate of return is 10% and the internal rate of return is 8.80%.

A)$3,275.98

B)-$1,650.64

C)$0

D)-$83,724.02

A)$3,275.98

B)-$1,650.64

C)$0

D)-$83,724.02

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

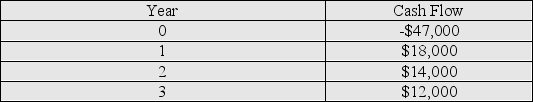

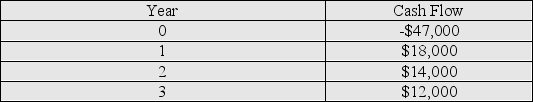

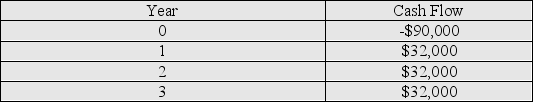

6

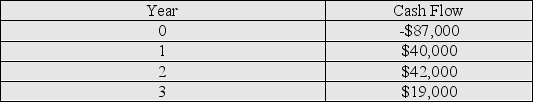

Calculate the payback period (PP)for the cash flows provided in the table below.Note: The negative cash flow for year 0 is the initial investment for the project.

A)3 years

B)2.50 years

C)1.75 years

D)1 year

A)3 years

B)2.50 years

C)1.75 years

D)1 year

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

7

Capital budgeting techniques are ________ assessment tools to determine whether a firm should proceed with an investment in ________.

A)qualitative; a project.

B)qualitative; working capital.

C)quantitative; a project.

D)quantitative; working capital.

A)qualitative; a project.

B)qualitative; working capital.

C)quantitative; a project.

D)quantitative; working capital.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

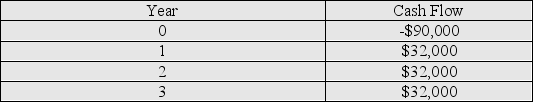

8

What is the Net Present Value (NPV)for the cash flows provided in the table below? Note: The negative cash flow for year 0 is the initial investment for the project.The required rate of return is 8% and the internal rate of return is 9.70%.

A)$0.00

B)$100,000.00

C)$3,083.88

D)-$103,083.88

A)$0.00

B)$100,000.00

C)$3,083.88

D)-$103,083.88

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

9

Calculate the payback period (PP)for the cash flows provided in the table below.Note: The negative cash flow for year 0 is the initial investment for the project.

A)2.61 years

B)3.00 years

C)4.50 years anticipated

D)This project never fully repays its initial investment based on the information provided.

A)2.61 years

B)3.00 years

C)4.50 years anticipated

D)This project never fully repays its initial investment based on the information provided.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

10

A firm's cost of capital may also be known as:

A)the cost of financing.

B)the internal rate of return.

C)modified internal rate of return.

D)the prime rate.

A)the cost of financing.

B)the internal rate of return.

C)modified internal rate of return.

D)the prime rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is considered an advantage of the net present value method of capital budgeting over the payback method?

A)The NPV considers all cash flows.

B)The NPV uses the firm's required rate of return to discount cash flows.

C)The NPV method considers opportunity costs in its calculations.

D)All of the above are considered advantages for the NPV method.

A)The NPV considers all cash flows.

B)The NPV uses the firm's required rate of return to discount cash flows.

C)The NPV method considers opportunity costs in its calculations.

D)All of the above are considered advantages for the NPV method.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following capital budgeting techniques does not specifically use time value of money analysis?

A)payback period

B)net present value

C)internal rate of return

D)modified internal rate of return

A)payback period

B)net present value

C)internal rate of return

D)modified internal rate of return

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

13

The ________ method of capital budgeting provides an answer in dollar terms whereas the ________ method provides answers in percentage terms.

A)IRR; payback

B)NPV; payback

C)MIRR; IRR

D)NPV; IRR

A)IRR; payback

B)NPV; payback

C)MIRR; IRR

D)NPV; IRR

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

14

Highland Construction works primarily on new home construction but has become aware of new and potentially profitable construction activities in multi-home structures such as 20-unit apartment buildings.This type of construction would be a new activity for the firm.The President of the firm believes the firm could do a number of things related to this opportunity: 1.Do nothing,2.Purchase new equipment to efficiently construct the larger buildings,3.Lend their name to sub-contractors who would in turn do all of the construction but pay a royalty fee,or 4.Hire a larger work force to undertake the new projects in addition to their existing projects.If no additional work has been done regarding this new opportunity,what stage of the decision-making framework has been reached by the firm?

A)Define the decision to be made and any related issues

B)Determine the criteria to be used when evaluating alternatives

C)Generate alternatives

D)Decide on an alternative and begin implementation

A)Define the decision to be made and any related issues

B)Determine the criteria to be used when evaluating alternatives

C)Generate alternatives

D)Decide on an alternative and begin implementation

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is NOT a strength of the payback method of capital budgeting?

A)The payback values are relatively simple to calculate.

B)When comparing projects the payback method decision is intuitive.

C)The payback method uses all project cash flows in establishing the project payback period.

D)It is a quick measure of the inherent risk of a project.

A)The payback values are relatively simple to calculate.

B)When comparing projects the payback method decision is intuitive.

C)The payback method uses all project cash flows in establishing the project payback period.

D)It is a quick measure of the inherent risk of a project.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

16

Calculate the payback period (PP)for the cash flows provided in the table below.Note: The negative cash flow for year 0 is the initial investment for the project.

A)0.70 years

B)1 year

C)1.25 years

D)2.75 years

A)0.70 years

B)1 year

C)1.25 years

D)2.75 years

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

17

The ________ method is the most intuitive but least sophisticated capital budgeting technique presented by the author.

A)net present value

B)internal rate of return

C)payback

D)modified internal rate of return

A)net present value

B)internal rate of return

C)payback

D)modified internal rate of return

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

18

The ________ method of capital budgeting finds the present value of cash inflows and subtracts the initial cash outflow.

A)payback

B)net present value

C)internal rate of return

D)modified internal rate of return

A)payback

B)net present value

C)internal rate of return

D)modified internal rate of return

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is NOT a weakness of the payback method of capital budgeting?

A)There is no EXPLICIT time value of money calculation.

B)There is no attempt to distinguish between cash flows in the earlier years and cash flows in the later years.

C)It does not given any consideration to cash flows expected to occur beyond the payback period.

D)All of the above are weaknesses with the payback period method.

A)There is no EXPLICIT time value of money calculation.

B)There is no attempt to distinguish between cash flows in the earlier years and cash flows in the later years.

C)It does not given any consideration to cash flows expected to occur beyond the payback period.

D)All of the above are weaknesses with the payback period method.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

20

The decision rule for net present value declares that a project is acceptable if:

A)it pays back within a specified time period.

B)the rate of return is greater than the firm's cost of capital.

C)the present value of the cash inflows exceeds the initial cash outflow.

D)all of the statements above are true.

A)it pays back within a specified time period.

B)the rate of return is greater than the firm's cost of capital.

C)the present value of the cash inflows exceeds the initial cash outflow.

D)all of the statements above are true.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

21

One weakness of the net present value method is that it provides an answer in dollar terms while many managers focus on percentage returns when assessing projects.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

22

The payback method of capital budgeting does NOT incorporate opportunity costs.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is a major problem with the IRR method of capital budgeting?

A)The IRR cutoff interest rate is arbitrary.

B)The IRR is denominated as an interest rate.

C)For projects with typical cash flows the IRR method agrees with the NPV accept/reject decision.

D)A mix of positive and negative cash flows may result in multiple IRRs.

A)The IRR cutoff interest rate is arbitrary.

B)The IRR is denominated as an interest rate.

C)For projects with typical cash flows the IRR method agrees with the NPV accept/reject decision.

D)A mix of positive and negative cash flows may result in multiple IRRs.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

24

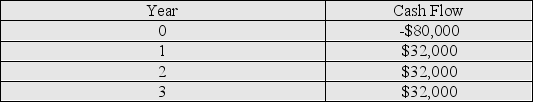

What is the Internal Rate of Return (IRR)for the cash flows provided in the table below? Note: The negative cash flow for year 0 is the initial investment for the project.The required rate of return is 8%.

A)8.00%

B)9.70%

C)12.41%

D)16.65%

A)8.00%

B)9.70%

C)12.41%

D)16.65%

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

25

The net present value method of capital budgeting fails to incorporate opportunity costs.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

26

The ________ measure is similar to the yield to maturity measure for bonds.

A)NPV

B)IRR

C)MIRR

D)payback

A)NPV

B)IRR

C)MIRR

D)payback

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

27

The capital budgeting techniques presented by the author in chapter 8 are quantitative assessment tools to determine whether a firm should proceed with an investment in a project

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

28

The MIRR eliminates the following statements regarding the IRR and how it solves problems with the IRR is not accurate?

A)The MIRR eliminates the problem of multiple IRRs.

B)The MIRR eliminates the problem of the assumption of always reinvesting at the IRR.

C)The MIRR eliminates the problem of arbitrarily choosing a required rate of return (AKA the hurdle rate).

D)All of the above are accurate.

A)The MIRR eliminates the problem of multiple IRRs.

B)The MIRR eliminates the problem of the assumption of always reinvesting at the IRR.

C)The MIRR eliminates the problem of arbitrarily choosing a required rate of return (AKA the hurdle rate).

D)All of the above are accurate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

29

The IRR method of capital budgeting tells us what particular discount rate will result in a ________ NPV project.

A)positive

B)negative

C)zero

D)none of the above

A)positive

B)negative

C)zero

D)none of the above

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

30

Your firm is considering a new investment.The initial cost (today)is $25,000.The project generates year-end annuity cash flows of $15,000 per year for the next two years.If the hurdle rate for the project is 12% and the reinvestment rate is 9%,calculate the MIRR.Is this an acceptable project?

A)8.00%; no,the MIRR is less than the hurdle rate

B)10.10%; yes,the MIRR is greater than the reinvestment rate

C)13.10%; yes,the MIRR is greater than the reinvestment rate

D)10.10%; no,the MIRR is less than the hurdle rate

A)8.00%; no,the MIRR is less than the hurdle rate

B)10.10%; yes,the MIRR is greater than the reinvestment rate

C)13.10%; yes,the MIRR is greater than the reinvestment rate

D)10.10%; no,the MIRR is less than the hurdle rate

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

31

The single most important and desirable of aspect of the payback method is the fact that the maximum acceptable length of the payback period is arbitrary

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is NOT a major strength of the IRR method of capital budgeting?

A)For straight forward projects of negative cash flows followed by positive cash flows,it is consistent with the NPV method of establishing if a project is acceptable or not.

B)The IRR method uses time value of money techniques.

C)The IRR cutoff interest rate is arbitrary.

D)The IRR considers opportunity costs.

A)For straight forward projects of negative cash flows followed by positive cash flows,it is consistent with the NPV method of establishing if a project is acceptable or not.

B)The IRR method uses time value of money techniques.

C)The IRR cutoff interest rate is arbitrary.

D)The IRR considers opportunity costs.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

33

The IRR method gives a ________ to assess the viability of a project.

A)percentage return

B)dollar figure

C)time period

D)ratio

A)percentage return

B)dollar figure

C)time period

D)ratio

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

34

By allowing partial year values,the payback method is implying that cash flows occur evenly throughout the year.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

35

The payback method of capital budgeting may be applied to either annuity cash flows or uneven cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

36

________ is the right but not the obligation to make a particular business decision.

A)Net present value

B)Real option analysis

C)Internal rate of return

D)Modified internal rate of return

A)Net present value

B)Real option analysis

C)Internal rate of return

D)Modified internal rate of return

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

37

For a project with ordinary cash flows (defined as negative initial cash flows followed by positive cash flows)and a positive NPV,which of the following statements is NOT necessarily true?

A)The internal rate of return will be greater than the required rate of return.

B)The modified internal rate of return will be greater than the required rate of return.

C)The payback period will be less than the required amount of time.

D)All of the statements above must be true.

A)The internal rate of return will be greater than the required rate of return.

B)The modified internal rate of return will be greater than the required rate of return.

C)The payback period will be less than the required amount of time.

D)All of the statements above must be true.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

38

If a project has a ________ NPV,it should also have an IRR ________ the hurdle rate.

A)positive; greater than

B)positive; less than

C)negative; greater than

D)negative; equal to

A)positive; greater than

B)positive; less than

C)negative; greater than

D)negative; equal to

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

39

What is the Internal Rate of Return (IRR)for the cash flows provided in the table below? Note: The negative cash flow for year 0 is the initial investment for the project.The required rate of return is 12.0%

A)0.00%

B)3.07%

C)8.00%

D)9.70%

A)0.00%

B)3.07%

C)8.00%

D)9.70%

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following capital budgeting evaluation techniques does NOT have an available Excel function?

A)NPV

B)IRR

C)MIRR

D)Excel contains each of these functions.

A)NPV

B)IRR

C)MIRR

D)Excel contains each of these functions.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

41

If capital projects are ________ the NPV and IRR methods should result in ________ "accept" or "reject" decisions.If the projects are ________ this may no longer be the case.

A)independent,inconsistent,mutually exclusive

B)independent,consistent,mutually exclusive

C)mutually exclusive,consistent,independent

D)None of the above are true statements.

A)independent,inconsistent,mutually exclusive

B)independent,consistent,mutually exclusive

C)mutually exclusive,consistent,independent

D)None of the above are true statements.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

42

An implicit assumption of the IRR method is that any cash inflows generated in the earlier years can be reinvested at the rate of the IRR.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

43

Calculate the profitability index for the cash flows provided in the table below.Note: The negative cash flow for year 0 is the initial investment for the project.Assume a required rate of return of 9.00%

A)0.85

B)0.90

C)1.00

D)1.11

A)0.85

B)0.90

C)1.00

D)1.11

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

44

The appropriate hurdle rate for a particular project reflects the perceived riskiness of the project.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

45

The value of real option analysis comes from the value of time (to wait and make a decision)and from the riskiness of the project.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

46

Identify at least two major problems with the internal rate of return method of capital budgeting.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

47

For projects with typical cash flows the IRR method agrees with the NPV accept/reject decision.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

48

How is the profitability index calculated?

A)The present value of the net cash flows minus the initial investment.

B)The present value of the net cash flows /plus the initial investment.

C)The present value of the net cash flows divided by the initial investment.

D)The initial investment divided by the present value of the net cash flows.

A)The present value of the net cash flows minus the initial investment.

B)The present value of the net cash flows /plus the initial investment.

C)The present value of the net cash flows divided by the initial investment.

D)The initial investment divided by the present value of the net cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

49

Survey data indicates that the profitability index method of project evaluation is preferred to:

A)NPV.

B)IRR.

C)MIRR.

D)None of the above.

A)NPV.

B)IRR.

C)MIRR.

D)None of the above.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

50

If a project has a positive NPV,it should also have an IRR less than the hurdle rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

51

The profitability index method of project evaluation provides an answer that is a:

A)rate of interest.

B)dollar value.

C)time period.

D)ratio.

A)rate of interest.

B)dollar value.

C)time period.

D)ratio.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

52

The decision rule for the profitability index is that any project with ________ is an acceptable project.

A)a ratio less than one

B)a ratio greater than one

C)a ratio greater than zero

D)a ratio less than zero

A)a ratio less than one

B)a ratio greater than one

C)a ratio greater than zero

D)a ratio less than zero

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

53

The modified internal rate of return method of capital budgeting was developed to overcome shortfalls in the net present value method.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

54

The IRR rule states that a firm should accept any project with an internal rate of return greater than or equal to a pre-specified hurdle rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

55

The ________ method is a capital budgeting technique for evaluating projects of unequal lives.

A)equivalent annual cost

B)equal amortization

C)straight-line annuity

D)none of the above

A)equivalent annual cost

B)equal amortization

C)straight-line annuity

D)none of the above

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

56

The net present value method implicitly makes the reasonable assumption that any interim cash flows from the project are reinvested at the firm's internal rate of return.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

57

What are the primary strengths and weaknesses of the Net Present Value method of capital budgeting?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

58

If capital projects are mutually exclusive,which of the following statements is TRUE?

A)Acceptance of one project means the firm will reject the other mutually exclusive projects.

B)The NPV rule still applies as a decision-making process.

C)The IRR rule may be inconsistent in rank order with the NPV rule when choosing among mutually exclusive projects.

D)All of the above.

A)Acceptance of one project means the firm will reject the other mutually exclusive projects.

B)The NPV rule still applies as a decision-making process.

C)The IRR rule may be inconsistent in rank order with the NPV rule when choosing among mutually exclusive projects.

D)All of the above.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

59

The profitability index is the right but not the obligation to make a business decision.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

60

The MIRR method requires the specification of two interest rates,the hurdle rate and the reinvestment rate.These rates may or may not be identical.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

61

The brew master at Appalachian Ale has asked you to help choose between two alternatives for a plant expansion.The first choice is a new brew system that costs $180,000 with annual maintenance costs of $17,000,an expected life of 15 years and a required rate of return of 12%.the alternative brew system costs only $98,000,requires $9,000 per year in maintenance,will last only 9 years and has a required return of 10%.Calculate the equivalent annual cost of each system.Based on your results only,which system would you recommend?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

62

There are limitations to using the net present value method.Note that a very small project might have a net present value,but in dollar terms,it might add only a small amount of value compared with a larger project with a lower net present value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

63

The profitability index measure is useful for ranking a series of projects based on the notion of getting "bang for your buck," or receiving as much value added as possible in excess of each dollar of investment.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

64

If capital projects are mutually exclusive,which of the following statements is TRUE?

A)Acceptance of one project means the firm will NOT reject the other mutually exclusive projects.

B)The IRR rule still applies as a decision-making process.

C)The profitability index rule will Be inconsistent with the NPV rule when choosing among mutually exclusive projects.

D)All of the above.

A)Acceptance of one project means the firm will NOT reject the other mutually exclusive projects.

B)The IRR rule still applies as a decision-making process.

C)The profitability index rule will Be inconsistent with the NPV rule when choosing among mutually exclusive projects.

D)All of the above.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

65

Crater Lake Diagnostics Inc.is considering the purchase of a new piece of equipment that has an initial investment of $75,000,has annual expenses associated with its operation of $10,000 per year and has a six year life.What is the equivalent annual cost of this investment if the firms considers the appropriate discount rate to be 11%?

A)$17,728

B)$19,551

C)$22,500

D)$27,728

A)$17,728

B)$19,551

C)$22,500

D)$27,728

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

66

________ occurs when a firm puts a limit on the amount of its investments.

A)Capital structure

B)Capital rationing

C)Working capital management

D)Marginal structure

A)Capital structure

B)Capital rationing

C)Working capital management

D)Marginal structure

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

67

Any project with a profitability index below 1.0 should be accepted as this implies that the benefits exceed the costs.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

68

What are the two most popular forms of capital budgeting decision rules in practice?

A)IRR and payback period

B)profitability index and payback period

C)IRR and NPV

D)NPV and profitability index

A)IRR and payback period

B)profitability index and payback period

C)IRR and NPV

D)NPV and profitability index

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

69

There are no adequate methods for comparing projects of unequal lives.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is NOT a common reason for capital rationing?

A)The firm puts a limit on the amount of its investments.

B)Creditors impose capital rationing on firms due to poor performance.

C)Senior executives may be reluctant to issue additional debt,thus limiting capital expenditures.

D)All of the above are reasons in impose capital rationing.

A)The firm puts a limit on the amount of its investments.

B)Creditors impose capital rationing on firms due to poor performance.

C)Senior executives may be reluctant to issue additional debt,thus limiting capital expenditures.

D)All of the above are reasons in impose capital rationing.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

71

Managers wishing to add value to the firm can do this by adding projects with a ________ net present value.

A)positive

B)negative

C)zero

D)none of the above

A)positive

B)negative

C)zero

D)none of the above

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

72

A firm has three independent projects under consideration each with a required rate of return of 10%/ The total projects budget is only $2,000.Project X has an initial investment of $2,000 and a single cash flow in year one of $2,360.Project Y has an initial investment of $1,000 and a single cash flow in year one of $1,200.Project Z has an initial investment of $1,000 and a single cash flow in year one of $1,170.Calculate the IRR and NPV for each of these projects.If we assume that we cannot "repeat" these projects (i.e.,we cannot do project Z twice)which project or combination of projects should the firm undertake? Why?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

73

Capital budgeting decisions are more complex when:

A)projects are mutually exclusive.

B)comparison projects are not of equal length.

C)capital is rationed.

D)All of the above are true.

A)projects are mutually exclusive.

B)comparison projects are not of equal length.

C)capital is rationed.

D)All of the above are true.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

74

Ultimately,when faced with capital rationing,firms should choose the combination of capital projects that maximizes the NPV subject to the capital constraints.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck