Deck 7: Corporate Acquisitions and Reorganizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/108

Play

Full screen (f)

Deck 7: Corporate Acquisitions and Reorganizations

1

Pacific Corporation acquires 80% of the stock of Jackson Corporation for $3,000,000 in the current year.Jackson's assets have a basis of $2,000,000 and its liabilities are $800,000.The assets are worth $3,500,000.What gain is recognized by Jackson Corporation on the deemed sale of its assets if a Sec.338 election is made?

FMV of $3,500,000 less basis of $2,000,000 equals a recognized gain of $1,500,000.

2

Parent Corporation purchases all of Target Corporation's stock for $200,000 and makes a deemed liquidation election.Target Corporation has Class I assets with an adjusted basis of $55,000 and an FMV of $55,000; Class II assets with an adjusted basis of $40,000 and an FMV of $60,000; and Class V assets with an adjusted basis of $70,000 and an FMV of $100,000.The Class V assets are subject to a $20,000 liability.Assume a 34% corporate tax rate.What is the adjusted grossed-up basis of Target Corporation's stock?

ADSP = [$200,000 + $20,000 - (0.34 × $165,000)]/(1 - 0.34)

=($220,000 - $56,000)/0.66

= $248,333

![ADSP = [$200,000 + $20,000 - (0.34 × $165,000)]/(1 - 0.34) =($220,000 - $56,000)/0.66 = $248,333](https://d2lvgg3v3hfg70.cloudfront.net/TB1258/11ea7cb8_54f2_3ef9_928c_25a3e2c91506_TB1258_00.jpg)

=($220,000 - $56,000)/0.66

= $248,333

![ADSP = [$200,000 + $20,000 - (0.34 × $165,000)]/(1 - 0.34) =($220,000 - $56,000)/0.66 = $248,333](https://d2lvgg3v3hfg70.cloudfront.net/TB1258/11ea7cb8_54f2_3ef9_928c_25a3e2c91506_TB1258_00.jpg)

3

Tax attributes of the target corporation are lost when a Sec.338 deemed liquidation election is made.

True

4

Jersey Corporation purchased 50% of Target Corporation's single class of stock on June 1 of this year.They purchased an additional 40% on November 20 of this year.The Sec.338 election must be made on or before

A)June 30 of this year.

B)November 30 of this year.

C)August 15 of next year.

D)June 30 of next year.

A)June 30 of this year.

B)November 30 of this year.

C)August 15 of next year.

D)June 30 of next year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

5

Identify which of the following statements is false.

A)A taxable acquisition of the assets of a target corporation that is subsequently liquidated,results in a loss of the target corporation's tax attributes.

B)A taxable acquisition of the assets of a target corporation,that is subsequently liquidated,results in the target corporation's shareholders recognizing gain or loss on the surrender of their target stock.

C)An acquiring corporation in a tax-free or a taxable acquisition transaction does not recognize gain or loss when its stock is issued in exchange for property.

D)An acquiring corporation in a taxable acquisition transaction must acquire all of the assets and liabilities of the target corporation.

A)A taxable acquisition of the assets of a target corporation that is subsequently liquidated,results in a loss of the target corporation's tax attributes.

B)A taxable acquisition of the assets of a target corporation,that is subsequently liquidated,results in the target corporation's shareholders recognizing gain or loss on the surrender of their target stock.

C)An acquiring corporation in a tax-free or a taxable acquisition transaction does not recognize gain or loss when its stock is issued in exchange for property.

D)An acquiring corporation in a taxable acquisition transaction must acquire all of the assets and liabilities of the target corporation.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

6

A stock acquisition that is not treated as a purchase for purposes of meeting the Sec.338 rules is

A)stock whose adjusted basis is determined by its basis in the hands of the person from whom it was acquired.

B)stock acquired from a decedent.

C)stock acquired in a tax-free reorganization.

D)All of the above are correct.

A)stock whose adjusted basis is determined by its basis in the hands of the person from whom it was acquired.

B)stock acquired from a decedent.

C)stock acquired in a tax-free reorganization.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

7

Identify which of the following statements is true.

A)Acquisition of the stock of a target corporation in a taxable acquisition transaction is reflected in an increased basis for the target corporation's assets on its books.

B)Acquisition of 100% of the stock of a target corporation in a taxable transaction followed by a tax-free liquidation of the target corporation permits a step-up in the basis of the target corporation's assets to their FMV.

C)Usually when 100% of the stock of a target corporation is purchased by an acquiring corporation,the basis of the assets of the target corporation reflects the purchase price of the target stock.

D)All of the above are false.

A)Acquisition of the stock of a target corporation in a taxable acquisition transaction is reflected in an increased basis for the target corporation's assets on its books.

B)Acquisition of 100% of the stock of a target corporation in a taxable transaction followed by a tax-free liquidation of the target corporation permits a step-up in the basis of the target corporation's assets to their FMV.

C)Usually when 100% of the stock of a target corporation is purchased by an acquiring corporation,the basis of the assets of the target corporation reflects the purchase price of the target stock.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

8

In a taxable asset acquisition,the purchaser does not acquire unknown and contingent liabilities.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

9

The Sec.338 deemed sale rules require that 70% of the target corporation's stock be owned.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following definitions of Sec.338 property classes is not correct?

A)Class I: cash,demand deposits,and similar accounts in banks,savings and loan associations,etc.

B)Class II: actively traded personal property such as publicly traded securities

C)Class III: covenants not to compete,similar restrictions on trade,etc.

D)Class IV: inventory or other property held primarily for sale to customers

A)Class I: cash,demand deposits,and similar accounts in banks,savings and loan associations,etc.

B)Class II: actively traded personal property such as publicly traded securities

C)Class III: covenants not to compete,similar restrictions on trade,etc.

D)Class IV: inventory or other property held primarily for sale to customers

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

11

Identify which of the following statements is false.

A)A Sec.338 election usually triggers taxation to the target corporation.

B)A Sec.338 election must be made not later than the fifteenth day of the ninth month following the first stock acquisition in a series of acquisitions that leads to 80% or more stock ownership.

C)When a Sec.338 election is made,the target corporation is treated as having sold all of its assets at their FMV at the close of the acquisition date.

D)In a Sec.338 deemed sale election,the shareholders of the target corporation sell their stock to the acquiring corporation.

A)A Sec.338 election usually triggers taxation to the target corporation.

B)A Sec.338 election must be made not later than the fifteenth day of the ninth month following the first stock acquisition in a series of acquisitions that leads to 80% or more stock ownership.

C)When a Sec.338 election is made,the target corporation is treated as having sold all of its assets at their FMV at the close of the acquisition date.

D)In a Sec.338 deemed sale election,the shareholders of the target corporation sell their stock to the acquiring corporation.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

12

Identify which of the following statements is true.

A)When the acquiring corporation makes the Sec.338 election,the target corporation is treated in many respects as a new corporation.

B)A Sec.338 election requires the adoption of the old target corporation's tax year by the new target corporation.

C)Tax attributes of the target corporation are not lost when a Sec.338 deemed liquidation election is made.

D)All of the above are false.

A)When the acquiring corporation makes the Sec.338 election,the target corporation is treated in many respects as a new corporation.

B)A Sec.338 election requires the adoption of the old target corporation's tax year by the new target corporation.

C)Tax attributes of the target corporation are not lost when a Sec.338 deemed liquidation election is made.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

13

Dreyer Corporation purchased 5% of Willy Corporation's stock five years ago for $100,000.Dreyer then decides to purchase an additional 80% of the Willy stock for $1,000,000 on April 15 of the current year.On the acquisition date,Willy Corporation's liabilities are $150,000.A $300,000 tax liability is incurred by Willy on the Sec.338 deemed sale.What is the total basis of Willy Corporation's assets for Sec.338 basis allocation purposes?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

14

Taxable acquisition transactions can either be a purchase of assets or a purchase of stock.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

15

Melon Corporation makes its first purchase of 30% of Hill Corporation stock on July 31 of this year.Melon Corporation uses a calendar tax year.To use the Sec.338 election,Melon Corporation must purchase

A)an additional 50% of Hill Corporation stock by December 31 of this year.

B)an additional 50% of Hill Corporation stock by July 30 of next year.

C)an additional 51% of Hill Corporation stock by December 31 of this year.

D)an additional 51% of Hill Corporation stock by July 30 of next year.

A)an additional 50% of Hill Corporation stock by December 31 of this year.

B)an additional 50% of Hill Corporation stock by July 30 of next year.

C)an additional 51% of Hill Corporation stock by December 31 of this year.

D)an additional 51% of Hill Corporation stock by July 30 of next year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

16

Identify which of the following statements is true.

A)A deemed liquidation election is available when a target corporation is liquidated into its parent corporation.

B)Corporate purchasers generally prefer Sec.338 treatment because of the significant tax savings originating from the step-up in basis.

C)The Sec.338 deemed liquidation rules require that 100% of the target corporation's stock be purchased.

D)All of the above are false.

A)A deemed liquidation election is available when a target corporation is liquidated into its parent corporation.

B)Corporate purchasers generally prefer Sec.338 treatment because of the significant tax savings originating from the step-up in basis.

C)The Sec.338 deemed liquidation rules require that 100% of the target corporation's stock be purchased.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

17

Brown Corporation has assets with a $650,000 basis and an $800,000 FMV.The assets are subject to $250,000 in liabilities.Clark Corporation acquires all of Brown's assets and liabilities for $600,000 in cash.Brown Corporation then liquidates.What is Clark Corporation's basis in the acquired assets?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

18

Identify which of the following statements is false.

A)Taxable acquisition transactions can either be a purchase of assets or a purchase of stock.

B)The tax-free reorganization rules are an example of the wherewithal to pay concept.

C)A taxable acquisition of a target corporation's assets results in the nonrecognition of gain or loss on the disposition of each individual asset.

D)Sales of depreciable assets as part of a taxable acquisition result in depreciation recapture.

A)Taxable acquisition transactions can either be a purchase of assets or a purchase of stock.

B)The tax-free reorganization rules are an example of the wherewithal to pay concept.

C)A taxable acquisition of a target corporation's assets results in the nonrecognition of gain or loss on the disposition of each individual asset.

D)Sales of depreciable assets as part of a taxable acquisition result in depreciation recapture.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

19

Axle Corporation acquires 100% of Drexel Corporation's stock from Drexel's shareholders for $500,000 cash.Drexel Corporation has assets with a $600,000 adjusted basis and an $800,000 FMV.The assets are subject to $200,000 in liabilities.Drexel Corporation shareholders purchased their stock eight years ago for $300,000.Axle Corporation's basis in the Drexel Corporation stock is

A)$800,000.

B)$600,000.

C)$500,000.

D)$300,000.

A)$800,000.

B)$600,000.

C)$500,000.

D)$300,000.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

20

Identify which of the following statements is true.

A)The total basis of the target corporation's assets following a Sec.338 election in general equals the amount paid for the target corporation's stock minus the target corporation's liabilities.

B)The residual method ensures that any premium paid for the target stock is reflected in depreciable assets.

C)The allocation of the total basis of the target corporation's assets to the individual assets following a Sec.338 election occurs under the residual method.

D)All of the above are false.

A)The total basis of the target corporation's assets following a Sec.338 election in general equals the amount paid for the target corporation's stock minus the target corporation's liabilities.

B)The residual method ensures that any premium paid for the target stock is reflected in depreciable assets.

C)The allocation of the total basis of the target corporation's assets to the individual assets following a Sec.338 election occurs under the residual method.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

21

The assets of Bold Corporation have a $1,000,000 basis and a $3,000,000 FMV.Its liabilities are $500,000.Tidel Corporation acquires 80% of the Bold Corporation stock for $2,000,000.What gain is recognized by Bold Corporation if a timely Sec.338 election is made by Tidel Corporation? What is the total basis of the assets to Bold Corporation following the deemed sale? Assume a 34% corporate tax rate.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

22

Paper Corporation adopts a plan of reorganization and exchanges 1,000 shares of its voting stock and $50,000 in cash for Chase Corporation's assets having a $200,000 adjusted basis and a $275,000 FMV.Chase Corporation is subsequently liquidated.What is Paper Corporation's basis in the assets acquired in the exchange?

A)$200,000

B)$250,000

C)$275,000

D)$50,000

A)$200,000

B)$250,000

C)$275,000

D)$50,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

23

Parent Corporation purchases all of Target Corporation's stock for $200,000 and makes a deemed liquidation election.Target Corporation has Class I assets with an adjusted basis of $55,000 and an FMV of $55,000; Class II assets with an adjusted basis of $40,000 and an FMV of $60,000; and Class V assets with an adjusted basis of $70,000 and an FMV of $100,000.The Class V assets are subject to a $20,000 liability.Assume a 34% corporate tax rate.

Assuming that the adjusted grossed-up basis is $237,000 ($200,000 + $20,000 + $17,000 federal income taxes),what is the allocation of adjusted grossed-up basis to Class VI assets?

Assuming that the adjusted grossed-up basis is $237,000 ($200,000 + $20,000 + $17,000 federal income taxes),what is the allocation of adjusted grossed-up basis to Class VI assets?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

24

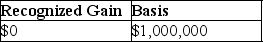

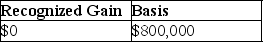

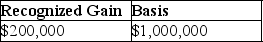

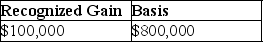

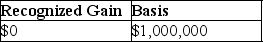

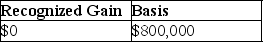

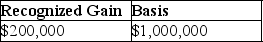

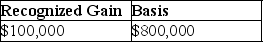

Bob exchanges 4,000 shares of Beetle Corporation stock that he had purchased for $800,000 for 6,000 shares of Butterfly Corporation common stock with a fair market value of $1,000,000.What is Bob's recognized gain on the exchange and his basis in the Butterfly stock?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

25

Identify which of the following statements is true.

A)Depreciation recapture rules do not override the nonrecognition of gain or loss rules.

B)The acquisition of liabilities by an acquiring corporation will trigger a gain.

C)A target corporation will recognize a gain when it distributes stock to its shareholders.

D)The basis of property acquired in a reorganization is its FMV.

A)Depreciation recapture rules do not override the nonrecognition of gain or loss rules.

B)The acquisition of liabilities by an acquiring corporation will trigger a gain.

C)A target corporation will recognize a gain when it distributes stock to its shareholders.

D)The basis of property acquired in a reorganization is its FMV.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

26

Acquiring Corporation acquires all of the assets of Target Corporation in exchange for $3,000,000 of Acquiring common stock and the assumption of $2,000,000 of Target's liabilities.The assets had a $2,300,000 adjusted basis to Target.Target's sole shareholder,Paula,had a $1,000,000 adjusted basis for her stock.Target Corporation had $600,000 of E&P on the acquisition date.Paula receives all of the Acquiring common stock in the liquidation of Target.What are the tax consequences of the acquisition to: Acquiring,Target,and Paula?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

27

What are the two steps of a Sec.338 deemed liquidation election?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

28

Identify which of the following statements is false.

A)The acquiring corporation does not recognize gains or losses under Sec.1001 when it transfers noncash boot property to the target corporation or its shareholders.

B)Gain recognized by a shareholder in a tax-free reorganization may be characterized as a dividend.

C)If no gain or loss is recognized by a stock or security holder in a tax-free reorganization,the stock or securities received take a substituted basis equal to the basis of the shares or securities surrendered.

D)Tax-free reorganizations generally do not involve actual redemptions of the stock of the target corporation's shareholders.

A)The acquiring corporation does not recognize gains or losses under Sec.1001 when it transfers noncash boot property to the target corporation or its shareholders.

B)Gain recognized by a shareholder in a tax-free reorganization may be characterized as a dividend.

C)If no gain or loss is recognized by a stock or security holder in a tax-free reorganization,the stock or securities received take a substituted basis equal to the basis of the shares or securities surrendered.

D)Tax-free reorganizations generally do not involve actual redemptions of the stock of the target corporation's shareholders.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

29

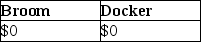

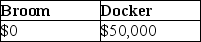

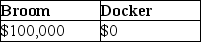

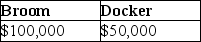

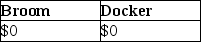

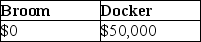

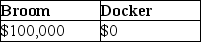

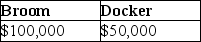

Broom Corporation transfers assets with an adjusted basis of $300,000 and an FMV of $400,000 to Docker Corporation in exchange for $400,000 of Docker Corporation stock as part of a tax-free reorganization.The Docker stock had been purchased from its shareholders one year earlier for $350,000.How much gain do Broom and Docker Corporations recognize on the asset transfer?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

30

In a nontaxable reorganization,shareholders of the target corporation recognize gain or loss.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

31

In a Sec.338 election,the target corporation

A)will have a holding period for assets beginning on the day after the acquisition date.

B)must use the preacquisition tax year.

C)will no longer file a separate return.

D)is considered to be a continuation of the old target corporation for purposes of the tax attribute carryover rules.

A)will have a holding period for assets beginning on the day after the acquisition date.

B)must use the preacquisition tax year.

C)will no longer file a separate return.

D)is considered to be a continuation of the old target corporation for purposes of the tax attribute carryover rules.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

32

The acquiring corporation does not recognize gain or loss in a reorganization where it receives boot.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

33

Identify which of the following statements is true.

A)The target corporation in a tax-free reorganization generally recognizes no gain or loss when boot property is received in exchange for assets because such property is usually distributed to its shareholders and creditors when the target corporation is liquidated.

B)In tax-free reorganizations,one transaction cannot qualify for more than one type of tax-free reorganization.

C)The Sec.1245 recapture rules override the nonrecognition of gain or loss rules for an asset-for-stock tax-free reorganization.

D)All of the above are false.

A)The target corporation in a tax-free reorganization generally recognizes no gain or loss when boot property is received in exchange for assets because such property is usually distributed to its shareholders and creditors when the target corporation is liquidated.

B)In tax-free reorganizations,one transaction cannot qualify for more than one type of tax-free reorganization.

C)The Sec.1245 recapture rules override the nonrecognition of gain or loss rules for an asset-for-stock tax-free reorganization.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

34

Rocky is a party to a tax-free asset-for-stock reorganization.As part of the transaction,Rocky exchanges 100% of the Hope Corporation stock with a $40,000 basis and a $50,000 FMV for Moth Corporation stock worth $40,000 and $10,000 cash.Hope Corporation is subsequently liquidated as part of the reorganization,with Moth receiving the Hope assets and liabilities.Rocky is

A)not required to recognize any gain or loss.

B)required to recognize capital gain or dividend income of $10,000,depending on Hope Corporation's current and accumulated E&P and Rocky's postacquisition interest in Moth Corporation.

C)required to recognize dividend income of $10,000 if Hope Corporation's current and accumulated E&P is at least $10,000.

D)able to recognize capital gain income of $10,000 without regard to his post-acquisition interest in Moth Corporation.

A)not required to recognize any gain or loss.

B)required to recognize capital gain or dividend income of $10,000,depending on Hope Corporation's current and accumulated E&P and Rocky's postacquisition interest in Moth Corporation.

C)required to recognize dividend income of $10,000 if Hope Corporation's current and accumulated E&P is at least $10,000.

D)able to recognize capital gain income of $10,000 without regard to his post-acquisition interest in Moth Corporation.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

35

When gain is realized by a target corporation from disposing of its assets in a tax-free reorganization,the gain is

A)recognized if boot is received and immediately distributed to its shareholders.

B)recognized without exception.

C)recognized if boot is received and retained.

D)never recognized.

A)recognized if boot is received and immediately distributed to its shareholders.

B)recognized without exception.

C)recognized if boot is received and retained.

D)never recognized.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

36

Define the seven classes of assets used in allocating basis when using the residual method.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

37

Why would an acquiring corporation want an acquisition to be tax-free if it gets only a substituted basis rather than a step-up basis for the acquired assets?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

38

In a nontaxable reorganization,the holding period for the stock received by the target shareholders includes the holding period of the stock surrendered.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

39

In a nontaxable reorganization,the acquiring corporation has a holding period for the acquired assets that begins on the day after the transaction date.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

40

John Van Kirk owns all the stock of Monmouth Restaurant Corporation in Pittsburgh.John would like to sell his business and retire to sunny Florida now that he has turned 65.Pam,a long-time bartender at Monmouth Restaurant,offers to purchase all the business's noncash assets in exchange for a 25% down payment,with the remaining 75% being paid in five equal annual installments.Interest will be charged at a 10% rate on the unpaid installments.John plans to liquidate the corporation that has operated the restaurant and have Monmouth Restaurant distribute the installment notes and any remaining assets.What tax issues should Monmouth Restaurant,John,and Pam consider with respect to the purchase transaction?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

41

Brad exchanges 1,000 shares of Goodyear Corporation stock having a $15,000 basis for Atlas Corporation stock having a $25,000 FMV as part of a Type A tax-free reorganization.Brad also receives $6,000 cash as part of the reorganization.How much gain must Brad recognize?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

42

In a Type B reorganization,the acquiring corporation obtains substantially all of the target corporation's assets in exchange for its voting stock and a limited amount of other consideration.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

43

Acme Corporation acquires Fisher Corporation's assets in a Type A reorganization for $800,000 of Acme's nonvoting preferred stock and $200,000 (face amount and FMV)of securities.The assets have an adjusted basis of $600,000 and an FMV of $1,500,000.In addition,Acme Corporation assumes $500,000 of Fisher's liabilities.At the time of the transfer,Acme's E&P is $400,000.Fisher distributes the stock and securities to its sole shareholder Barbara for all of her Fisher stock.After the reorganization,Barbara owns 25% of Acme's stock.Barbara has an adjusted basis of $400,000 in her Fisher stock.Barbara's basis for her Acme securities is

A)0)

B)$200,000.

C)$350,000.

D)$400,000.

A)0)

B)$200,000.

C)$350,000.

D)$400,000.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

44

Acme Corporation acquires Fisher Corporation's assets in a Type A reorganization for $800,000 of Acme's nonvoting preferred stock and $200,000 (face amount and FMV)of securities.The assets have an adjusted basis of $600,000 and an FMV of $1,500,000.In addition,Acme Corporation assumes $500,000 of Fisher's liabilities.At the time of the transfer,Acme's E&P is $400,000.Fisher distributes the stock and securities to its sole shareholder Barbara for all of her Fisher stock.After the reorganization,Barbara owns 25% of Acme's stock.Barbara has an adjusted basis of $400,000 in her Fisher stock.Barbara must recognize a gain of

A)$0.

B)$200,000 dividend income.

C)$200,000 capital gain.

D)$650,000 capital gain.

A)$0.

B)$200,000 dividend income.

C)$200,000 capital gain.

D)$650,000 capital gain.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

45

Type A reorganizations include mergers and consolidations.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

46

Identify which of the following statements is true.

A)The acquired corporation in a Type C reorganization may retain its corporation charter.

B)Alpha Corporation acquires 100% of the assets of Beta Corporation in exchange for $75,000 of Alpha stock and $25,000 in cash.Beta is subsequently liquidated.This exchange qualifies as a Type C reorganization.

C)Alpha Corporation acquires 100% of the assets of Beta Corporation in exchange for $75,000 of Alpha stock and the assumption of $25,000 of Beta liabilities.Beta is subsequently liquidated.This exchange does not qualify as a Type C reorganization.

D)All of the above are false.

A)The acquired corporation in a Type C reorganization may retain its corporation charter.

B)Alpha Corporation acquires 100% of the assets of Beta Corporation in exchange for $75,000 of Alpha stock and $25,000 in cash.Beta is subsequently liquidated.This exchange qualifies as a Type C reorganization.

C)Alpha Corporation acquires 100% of the assets of Beta Corporation in exchange for $75,000 of Alpha stock and the assumption of $25,000 of Beta liabilities.Beta is subsequently liquidated.This exchange does not qualify as a Type C reorganization.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

47

Acme Corporation acquires Fisher Corporation's assets in a Type A reorganization for $800,000 of Acme's nonvoting preferred stock and $200,000 (face amount and FMV)of securities.The assets have an adjusted basis of $600,000 and an FMV of $1,500,000.In addition,Acme Corporation assumes $500,000 of Fisher's liabilities.At the time of the transfer,Acme's E&P is $400,000.Fisher distributes the stock and securities to its sole shareholder Barbara for all of her Fisher stock.After the reorganization,Barbara owns 25% of Acme's stock.Barbara has an adjusted basis of $400,000 in her Fisher stock.What is Barbara's basis for her Acme stock?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

48

Identify which of the following statements is true.

A)Per IRS Treasury Regulations,to qualify as a Type A reorganization,at least 40% of the total consideration used must be acquiring corporation stock.

B)A Type A reorganization has the advantage of avoiding the acquisition of unknown and contingent liabilities.

C)A merger usually involves the approval of all of the shareholders of both corporations.

D)All of the above are false.

A)Per IRS Treasury Regulations,to qualify as a Type A reorganization,at least 40% of the total consideration used must be acquiring corporation stock.

B)A Type A reorganization has the advantage of avoiding the acquisition of unknown and contingent liabilities.

C)A merger usually involves the approval of all of the shareholders of both corporations.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

49

Identify which of the following statements is true.

A)In a tax-free reorganization,the acquiring corporation's holding period for the acquired properties includes the period of time the target corporation held the properties.

B)In a tax-free reorganization,if the acquiring corporation uses nonmonetary boot property,gains or losses will be recognized by the acquiring corporation.

C)The receipt of cash by a shareholder results in the recognition of all of his or her realized gain even if the transaction qualifies as a tax-free reorganization.

D)All of the above are false.

A)In a tax-free reorganization,the acquiring corporation's holding period for the acquired properties includes the period of time the target corporation held the properties.

B)In a tax-free reorganization,if the acquiring corporation uses nonmonetary boot property,gains or losses will be recognized by the acquiring corporation.

C)The receipt of cash by a shareholder results in the recognition of all of his or her realized gain even if the transaction qualifies as a tax-free reorganization.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

50

In a Type B reorganization,the target corporation exchange their stock for the acquiring corporation's voting stock,and the target corporation remains in existence as the acquiring corporation's subsidiary.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

51

Marty is a party to a tax-free reorganization.He has a basis of $22,000 in his Van Corporation stock that has an FMV of $35,000.Marty exchanges the Van stock for Young Corporation stock worth $29,000 and Young securities with a face amount of $7,000 and an FMV of $6,000.What is Marty's basis in the Young securities?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

52

American Corporation acquires the noncash assets of Utech Corporation in exchange for $700,000 of its voting stock plus $50,000 of cash.Utech Corporation assets are worth $750,000.Utech Corporation does not distribute the stock and cash but instead holds the stock as an investment.Utech will use the American cash along with the cash it retained to start a new business.The transaction can be classified as a

A)Type A reorganization.

B)Type B reorganization.

C)Type C reorganization.

D)The transaction does not qualify as a tax-free reorganization.

A)Type A reorganization.

B)Type B reorganization.

C)Type C reorganization.

D)The transaction does not qualify as a tax-free reorganization.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

53

In a Type B reorganization,the 1.stock of the target corporation is acquired solely for the voting stock of either the acquiring corporation or its parent.

2)acquiring corporation must have control of the target corporation immediately after the acquisition.

A)Only statement 1 is correct.

B)Only statement 2 is correct.

C)Both statements are correct.

D)Neither statement is correct.

2)acquiring corporation must have control of the target corporation immediately after the acquisition.

A)Only statement 1 is correct.

B)Only statement 2 is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

54

Zebra Corporation transfers assets with a $120,000 basis and a $250,000 FMV to Hat Corporation for common stock worth $200,000 and cash of $50,000.The exchange qualifies as a tax-free reorganization.Zebra Corporation distributes the stock and cash to its shareholders pursuant to its liquidation.How much gain must Zebra Corporation recognize?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

55

Identify which of the following statements is false.

A)In a Type C reorganization,the acquired corporation must distribute stock,securities,and other property it receives to its shareholders.

B)A Type C reorganization is less flexible than a Type A reorganization because of the solely-for-voting stock requirement of a Type C.

C)To qualify as a Type C reorganization,the target corporation must be formally dissolved.

D)In a Type C reorganization,shareholders of the acquiring corporation generally do not have to approve the acquisition.

A)In a Type C reorganization,the acquired corporation must distribute stock,securities,and other property it receives to its shareholders.

B)A Type C reorganization is less flexible than a Type A reorganization because of the solely-for-voting stock requirement of a Type C.

C)To qualify as a Type C reorganization,the target corporation must be formally dissolved.

D)In a Type C reorganization,shareholders of the acquiring corporation generally do not have to approve the acquisition.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

56

In a triangular Type A merger,the acquiring subsidiary corporation must obtain substantially all of the target corporation's assets.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

57

Martha owns Gator Corporation stock having an adjusted basis of $21,000.As part of a tax-free reorganization involving Gator and Baker Corporations,Martha exchanges her Gator stock for $18,000 of Baker stock and $6,000 (face amount and FMV)of Baker securities.What is Martha's basis in the Baker stock?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

58

Briefly describe A,B,C,D,and G reorganization types.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

59

Rock Corporation acquires all of the assets of Stone Corporation using only its voting stock.Stone Corporation distributes the Rock stock to its shareholders pursuant to its liquidation.After the acquisition,Stone Corporation's shareholders own 20% of the Rock stock (by voting power and value).The transaction is classified as a

A)Type B reorganization.

B)Type C reorganization.

C)Type D reorganization.

D)The transaction does not qualify as a tax-free reorganization.

A)Type B reorganization.

B)Type C reorganization.

C)Type D reorganization.

D)The transaction does not qualify as a tax-free reorganization.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

60

Buddy owns 100 of the outstanding shares of Binder Corporation stock.Buddy's basis in his Binder Corporation stock is $100,000.Binder Corporation is merged with Clipper Corporation in a tax-free reorganization.Buddy receives 50 shares of Clipper stock worth $150,000 and $150,000 cash.The remaining 100 shares of Binder stock were owned by Bruce who received the same consideration for his Binder stock.Binder and Clipper have E&P balances of $250,000 and $500,000,respectively.Buddy and Bruce each own 25% of Clipper Corporation's 200 shares of stock after the reorganization.Which of the following is correct?

A)Buddy recognizes $200,000 as dividend income.

B)Buddy recognizes $200,000 as a capital gain.

C)Buddy recognizes $150,000 as dividend income.

D)Buddy recognizes $150,000 as a capital gain.

A)Buddy recognizes $200,000 as dividend income.

B)Buddy recognizes $200,000 as a capital gain.

C)Buddy recognizes $150,000 as dividend income.

D)Buddy recognizes $150,000 as a capital gain.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

61

As part of a plan of corporate reorganization,Sally exchanged 1,000 shares of Tone Corporation common stock that she had purchased for $85,000,for 3,000 shares of Fade Corporation voting common stock having an $87,000 FMV.What is the amount and character of Sally's recognized gain and her basis in the Tone stock as a result of the exchange?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

62

After the stock acquisition,MCI transferred its assets to TC Investments Corporation in a liquidation transaction,after which TC Investments Corporation held MCI assets instead of MCI stock.TC Investments Corporation then changed its name to MCI Communications Corporation,and WorldCom changed its name to MCI WorldCom.

After these three steps,MCI Communications Corporation,which held the acquired MCI assets,ended up as a subsidiary of MCI WorldCom.Total assets of MCI WorldCom after the merger were $86 billion,including the stock of its subsidiary,MCI Communications Corporation.

On December 31,1997,prior to the acquisition,MCI had $576 million of U.S.NOL carryovers and $179 million of minimum tax credit carryovers.MCI WorldCom incurred expenses of $127 million in connection with the acquisition.MCI WorldCom recorded the transaction as a purchase for financial accounting purposes with the excess of cost over FMV being recorded as a combination of goodwill,in-process R&D costs,and other intangible assets.In addition,MCI WorldCom incurred $21 million in employee severance pay outlays.MCI stock options were converted into MCI WorldCom stock options.What type of reorganization did WorldCom and MCI engage in? What tax issues should the parties to the reorganization (MCI,BT,TC Investments Corporation,WorldCom,and the MCI and WorldCom shareholders)consider when evaluating the acquisition?

After these three steps,MCI Communications Corporation,which held the acquired MCI assets,ended up as a subsidiary of MCI WorldCom.Total assets of MCI WorldCom after the merger were $86 billion,including the stock of its subsidiary,MCI Communications Corporation.

On December 31,1997,prior to the acquisition,MCI had $576 million of U.S.NOL carryovers and $179 million of minimum tax credit carryovers.MCI WorldCom incurred expenses of $127 million in connection with the acquisition.MCI WorldCom recorded the transaction as a purchase for financial accounting purposes with the excess of cost over FMV being recorded as a combination of goodwill,in-process R&D costs,and other intangible assets.In addition,MCI WorldCom incurred $21 million in employee severance pay outlays.MCI stock options were converted into MCI WorldCom stock options.What type of reorganization did WorldCom and MCI engage in? What tax issues should the parties to the reorganization (MCI,BT,TC Investments Corporation,WorldCom,and the MCI and WorldCom shareholders)consider when evaluating the acquisition?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

63

Table Corporation transfers one-half of its assets to Chair Corporation in exchange for 100% of Chair Corporation's single class of stock.Following the exchange,Table Corporation distributes the Chair stock ratably to its shareholders.This transaction will constitute a

A)Type A reorganization.

B)Type C reorganization.

C)divisive Type D reorganization.

D)acquisitive Type D reorganization.

A)Type A reorganization.

B)Type C reorganization.

C)divisive Type D reorganization.

D)acquisitive Type D reorganization.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

64

TC Investments Corporation used cash to purchase all the outstanding MCI Class A common stock from British Telecommunications (BT)for $51 per share.BT had acquired the MCI Class A common stock two years earlier in a failed merger attempt involving BT and MCI.In addition,TC Investments Corporation used WorldCom stock to acquire all outstanding shares of regular MCI common stock from other MCI shareholders.In this exchange,MCI shareholders received 1.2439 shares of WorldCom stock for each share of regular MCI common stock surrendered.TC Investments Corporation paid cash in lieu of issuing fractional WorldCom shares to MCI shareholders who were entitled to such fractional shares.More than 50% of the consideration used to acquire MCI was composed of WorldCom stock.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

65

What are the advantages of a triangular merger?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

66

What are the advantages and disadvantages of a Type C reorganization?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

67

Identify which of the following statements is true.

A)A split-off Type D reorganization occurs when part of the assets of one corporation are transferred to a controlled corporation in exchange for its stock,and shares of the controlled corporation's stock are distributed to all of the distributing corporation's shareholders without having them surrender any of their stock in the distributing corporation.

B)In a Type D reorganization,the existence of a good corporate business purpose is necessary before the stock of a controlled subsidiary can be distributed to the shareholders of the distributing corporation.

C)A distribution of a controlled corporation's stock can be a tax-free Type D reorganization,even if none of the distributing corporation's assets are transferred to the controlled corporation.

D)All of the above are false.

A)A split-off Type D reorganization occurs when part of the assets of one corporation are transferred to a controlled corporation in exchange for its stock,and shares of the controlled corporation's stock are distributed to all of the distributing corporation's shareholders without having them surrender any of their stock in the distributing corporation.

B)In a Type D reorganization,the existence of a good corporate business purpose is necessary before the stock of a controlled subsidiary can be distributed to the shareholders of the distributing corporation.

C)A distribution of a controlled corporation's stock can be a tax-free Type D reorganization,even if none of the distributing corporation's assets are transferred to the controlled corporation.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

68

Midnight Corporation transferred part of its assets to Noon Corporation in exchange for all of Noon's stock.Midnight distributed all of Noon's stock pro rate to Midnight's shareholders.What is this type of reorganization?

A)split-off

B)spin-off

C)split-up

D)dividend distribution

A)split-off

B)spin-off

C)split-up

D)dividend distribution

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

69

Carol owns Target Corporation stock having an adjusted basis of $41,000.As part of a Type C tax-free reorganization involving Revbo and Target Corporations,Carol exchanges her Target stock for $42,000 of Revbo stock and Revbo securities having a face amount and FMV of $8,000.What is Carol's basis in the Revbo stock?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

70

What are the advantages and disadvantages of a Type B reorganization?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

71

WorldCom created an acquisitions subsidiary (TC Investments Corporation)by transferring WorldCom stock and cash to TC Investments Corporation in exchange for newly issued TC Investments Corporation stock.TC Investments Corporation then used the WorldCom stock and cash to acquire MCI as described in the next two steps.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

72

In which of the following reorganizations does the distributing corporation transfer all of its assets to two controlled corporations before the distributing corporation dissolves?

A)split-off

B)spin-off

C)split-up

D)Type C reorganization

A)split-off

B)spin-off

C)split-up

D)Type C reorganization

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

73

Gulf Corporation wants to acquire all of Beamer Corporation's assets and liabilities in a Type C reorganization.The FMV of Beamer's assets is $500,000.Beamer's liabilities are $70,000.How much cash can Gulf Corporation use to pay for Beamer's assets without violating the Type C reorganization requirements?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

74

Acquiring Corporation acquires all of the stock of Target Corporation in a Type B (stock-for-stock)reorganization.Both corporations have always filed separate tax returns.Which one of the following statements regarding the acquisition is correct?

A)Acquiring and Target Corporations can elect to file a consolidated tax return.

B)Acquiring and Target Corporations must file a consolidated tax return.

C)Acquiring Corporation assumes all of the tax attributes of Target Corporation.

D)Acquiring Corporation must step up or step down the basis of the Target Corporation's assets to their FMV on the acquisition date?

A)Acquiring and Target Corporations can elect to file a consolidated tax return.

B)Acquiring and Target Corporations must file a consolidated tax return.

C)Acquiring Corporation assumes all of the tax attributes of Target Corporation.

D)Acquiring Corporation must step up or step down the basis of the Target Corporation's assets to their FMV on the acquisition date?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

75

Town Corporation acquires all of the stock of Country Corporation in June in exchange for Town voting common stock.Both Town and Country use a calendar year as their tax year.In the following January,Country pays all of its liabilities and distributes its remaining assets to Town pursuant to its liquidation.These assets consist of $50,000 in cash and land having a $30,000 FMV and a $10,000 basis to Country.Upon distribution of Country's assets to Town,all of Country's capital stock is canceled.Town's basis for the Country stock prior to the liquidation was $57,000.What is the amount and character of Town's recognized gain on receipt of Country's assets pursuant to the liquidation?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

76

Identify which of the following statements is true.

A)Both a Type B reorganization or a reverse triangular merger will not allow the target corporation to remain in existence.

B)Andrews Corporation gives 10% of its stock worth $200,000 and Andrews notes worth $10,000 in exchange for 80% of Baxter Corporation's stock.The exchange qualifies as a Type B reorganization.

C)In a Type B reorganization,with minor exceptions only voting stock can be used by the acquiring corporation to acquire the target corporation's stock.

D)All of the above are false.

A)Both a Type B reorganization or a reverse triangular merger will not allow the target corporation to remain in existence.

B)Andrews Corporation gives 10% of its stock worth $200,000 and Andrews notes worth $10,000 in exchange for 80% of Baxter Corporation's stock.The exchange qualifies as a Type B reorganization.

C)In a Type B reorganization,with minor exceptions only voting stock can be used by the acquiring corporation to acquire the target corporation's stock.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

77

WorldCom is a telecommunications company that provides national and international service to local and long-distance customers.On September 14,1998,WorldCom acquired MCI Communications Corporation (MCI)pursuant to a merger agreement.The acquisition can be divided into three stages:

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

78

Identify which of the following statements is true.

A)A Type B reorganization must be accomplished in one transaction.

B)"Creeping acquisitions" are not allowed in a Type B reorganization.

C)Boxer Corporation acquires 81% of Excel Corporation's stock in a Type B reorganization.When Boxer Corporation acquires an additional 11% of Excel Corporation's stock two years later in exchange for Boxer stock,the second acquisition is also treated as a Type B reorganization.

D)All of the above are false.

A)A Type B reorganization must be accomplished in one transaction.

B)"Creeping acquisitions" are not allowed in a Type B reorganization.

C)Boxer Corporation acquires 81% of Excel Corporation's stock in a Type B reorganization.When Boxer Corporation acquires an additional 11% of Excel Corporation's stock two years later in exchange for Boxer stock,the second acquisition is also treated as a Type B reorganization.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

79

What are the advantages and disadvantages of a merger transaction?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

80

Identify which of the following statements is true.

A)Ann,Dewey Corporation's sole shareholder,exchanges her Dewey stock having a $400,000 FMV and a $175,000 adjusted basis for $350,000 of Heider Corporation stock and $50,000 cash.Ann realizes a $225,000 gain on the stock transfer,none of which is recognized.

B)A Type B reorganization can be accomplished without formal shareholder approval.

C)The target corporation's tax attributes are lost in a Type B reorganization.

D)All of the above are false.

A)Ann,Dewey Corporation's sole shareholder,exchanges her Dewey stock having a $400,000 FMV and a $175,000 adjusted basis for $350,000 of Heider Corporation stock and $50,000 cash.Ann realizes a $225,000 gain on the stock transfer,none of which is recognized.

B)A Type B reorganization can be accomplished without formal shareholder approval.

C)The target corporation's tax attributes are lost in a Type B reorganization.

D)All of the above are false.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck