Deck 19: Insurance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

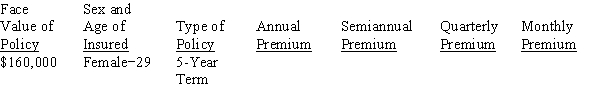

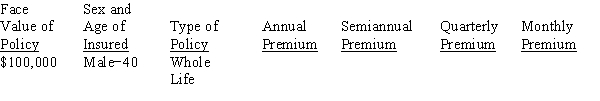

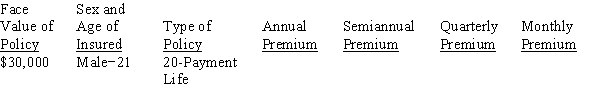

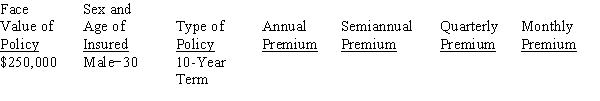

Question

Question

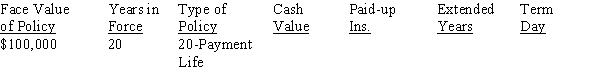

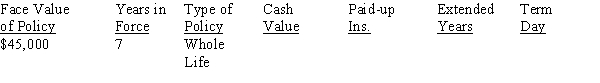

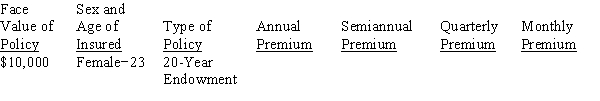

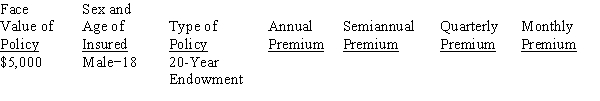

Question

Question

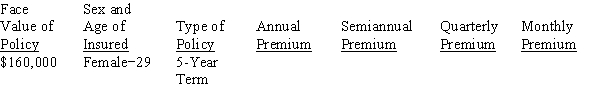

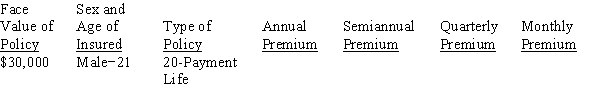

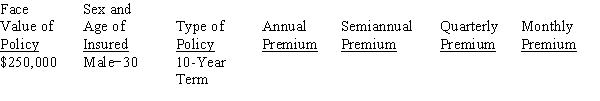

Question

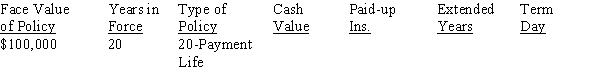

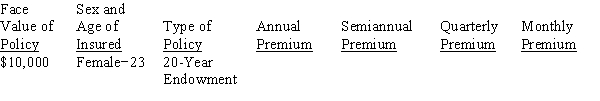

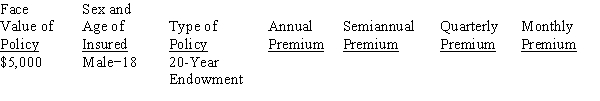

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/155

Play

Full screen (f)

Deck 19: Insurance

1

____________________ is the name given for that portion of motor vehicle insurance that includes payment for bodily injury to other persons and damages to the property of others resulting from the insured's negligence.

Liability

2

The amount paid at regular intervals to purchase insurance protection is called the ____________________.

premium

3

____________________ is the theory upon which insurance is based.

Shared risk

4

Leslie wishes to obtain a 20-year endowment insurance policy having a face value of $275,000. Based on Tables 19-1 and 19-2 from your text, what would be her semiannual premium if she were 60 years old? (Round your answer to the nearest cent)

A) $15,972.00

B) $21,162.00

C) $13,524.24

D) $8,305.44

A) $15,972.00

B) $21,162.00

C) $13,524.24

D) $8,305.44

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

5

Xavier wishes to obtain a 10-year term insurance policy having a face value of $375,250. Based on the tables in the book what would be his annual premium if he is 23 years old?

A) $1501.02

B) $1,763.68

C) $1250.51

D) $986.72

A) $1501.02

B) $1,763.68

C) $1250.51

D) $986.72

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

6

The document stipulating the terms of the contract between the insurer and the insured is called the ____________________.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

7

The amount of money that begins to build up in a permanent life insurance policy after the first two or three years is called the ____________________.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

8

____________________ are statisticians employed by insurance companies to calculate the probability or chance of a certain insurable event occurring.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

9

A type of insurance that offers pure insurance protection with no investment component is called ____________________ insurance.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

10

At age 29, Wendi purchased a 20-year endowment insurance policy with face value of $230,000. She is now 32 and wants to cancel her policy. Determine the amount of reduced paid-up insurance to which she is entitled.

A) $15,070

B) $19,879

C) $22,310

D) $17,338

A) $15,070

B) $19,879

C) $22,310

D) $17,338

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

11

At age 28, Kitty had decided to purchase a 10-year term insurance policy with a face value of $350,500. Use Tables 19-1 and 19-2 from your text to calculate her semiannual premium. (Round your answer to the nearest cent)

A) $1,135.00

B) $869.38

C) $1564.75

D) $693.67

A) $1,135.00

B) $869.38

C) $1564.75

D) $693.67

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

12

Donna purchased a 20-payment life insurance policy having a face value of $350,000 when she was 23 years old. What is the cash value of her policy if she is now 26 years old?

A) $10,150

B) $20,200

C) $10,820

D) $10,940

A) $10,150

B) $20,200

C) $10,820

D) $10,940

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

13

How much would Olga's semiannual premium be for a 5-year term insurance policy with a face value of $350,000, based on Tables 19-1 and 19-2 from your text? She turned 26 years old on her last birthday. (Round your answer to the nearest cent)

A) $450.00

B) $392.50

C) $456.82

D) $549.70

A) $450.00

B) $392.50

C) $456.82

D) $549.70

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

14

The insurance carrier used by Pinnacle Computer Systems specifies 65% coinsurance. The company recently incurred $420,000 in damages from flooding. The building was valued at $625,000, but was only insured for $320,000. What amount will be paid by the insurance company for the loss? (Round your answer to the nearest cent)

A) $626,000.00

B) $411,240.59

C) $330,830.77

D) $292,400.00

A) $626,000.00

B) $411,240.59

C) $330,830.77

D) $292,400.00

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

15

At age 40, Janice has decided to purchase a 20-payment life insurance policy with a face value of $390,000. Use Tables 19-1 and 19-2 from your text to calculate her quarterly premium. (Round your answer to the nearest cent)

A) $3,587.16

B) $10,258.30

C) $3679.81

D) $9,524.10

A) $3,587.16

B) $10,258.30

C) $3679.81

D) $9,524.10

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

16

At age 22, Valencia has decided to purchase a 5-year term insurance policy with face value of $165,000. Use the table in the book to calculate her semiannual premium.

A) $366.30

B) $190.48

C) $192.27

D) $351.90

A) $366.30

B) $190.48

C) $192.27

D) $351.90

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

17

The options available to the policyholder upon termination of a permanent life insurance policy with accumulated cash value are called ____________________ options.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

18

The ____________________ is the person or institution to whom the proceeds of the policy are paid in the event that a loss occurs.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

19

A portion of the motor vehicle insurance that covers damage sustained by the insured's vehicle in an accident is called ____________________.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

20

The clause in a property insurance policy stipulating a minimum amount of coverage required in order for a claim to be paid in full is called a(n) ____________________ clause.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

21

If Tanya's husband were to die, she and her children could live on $60,400 per year. Tanya makes $33,100 annually, and estimates additional income of $21,500 from other sources. How much insurance should she purchase on her husband to cover the shortfall, assuming a 16.7% prevailing interest rate? (Round your answer to the nearest $1,000)

A) $28,000

B) $36,000

C) $35,000

D) $30,000

A) $28,000

B) $36,000

C) $35,000

D) $30,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

22

Rudy needs temporary property insurance to cover his home for a period of 6 months. Based on Table 19-5 from your text, what would be his short-rate premium if the annual premium were $1,266.00? (Round your answer to the nearest cent)

A) $891.80

B) $519.80

C) $1,266.00

D) $886.20

A) $891.80

B) $519.80

C) $1,266.00

D) $886.20

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

23

Cheryl purchased a whole life insurance policy having a face value of $425,500 when she was 30 years old. Based on Table 19-3 from your text, what is the cash value of her policy if she is now 40 years old?

A) $42,257

B) $40,262

C) $41,699

D) $41,134

A) $42,257

B) $40,262

C) $41,699

D) $41,134

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

24

Sunshine was transferred to another city and must sell her home. She renewed her homeowner's policy effective 11 months ago, with an annual premium of $902.00. How much of a refund will she receive based on Table 19-5 in your text?

A) $45.10

B) $39.97

C) $87.41

D) $91.74

A) $45.10

B) $39.97

C) $87.41

D) $91.74

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

25

If Carly's husband were to die, she and her children could live on $50,100 per year. Carly makes $28,500 annually, and estimates additional income of $8,300 from other sources. How much insurance should she purchase on her husband to cover the shortfall, assuming a 17.7% prevailing interest rate? (Round to nearest $1,000)

A) $57,000

B) $84,000

C) $156,000

D) $75,000

A) $57,000

B) $84,000

C) $156,000

D) $75,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

26

What would be the total fire insurance premium for Best Hardware if their $625,000 building belongs in structural classification B? The contents are worth $850,250 and they received an area rating of 4. The rates per $100 are found in Table 19-4 from your text. (Round your answer to the nearest cent)

A) $14,525.00

B) $11,807.08

C) $17,123.58

D) $10,456.68

A) $14,525.00

B) $11,807.08

C) $17,123.58

D) $10,456.68

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

27

Jim wishes to obtain a 20-year endowment insurance policy having a face value of $335,000. Based on Tables 19-1 and 19-2 from your text, what would be his monthly premium if he were 35 years old?

A) $1,316.65

B) $2,262.45

C) $5,718.50

D) $1,484.67

A) $1,316.65

B) $2,262.45

C) $5,718.50

D) $1,484.67

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

28

Pete's wife earns $37,400 per year. If Pete dies, his family would require $56,700 to cover their living expenses. Some of the yearly expenses would be offset by $2,400 from stock dividends, but this is still not enough. How much insurance should Pete have to cover the shortfall, given a 13.1% prevailing interest rate? (Round to nearest $1,000)

A) $159,000

B) $129,000

C) $156,000

D) $147,000

A) $159,000

B) $129,000

C) $156,000

D) $147,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

29

Yolanda wishes to obtain fire insurance for a rental property she owns. The building is valued at $480,000 and the contents are worth $635,800. Based on Table 19-4 from your text, what would be her total premium if the building has a structural classification of C and area rating of 1? (Round your answer to the nearest cent)

A) $4,494.36

B) $4,444.00

C) $4,250.36

D) $4,649.36

A) $4,494.36

B) $4,444.00

C) $4,250.36

D) $4,649.36

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

30

At age 30, Ravonda purchased a whole life insurance policy with a face value of $115,325. She is now 40 and wants to cancel her policy. Use Table 19-3 from your text to calculate the amount of reduced paid-up insurance to which she is entitled.

A) $21,491.58

B) $21,450.45

C) $18,340.00

D) $26,222.22

A) $21,491.58

B) $21,450.45

C) $18,340.00

D) $26,222.22

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

31

As the owner of a business, Rodrigo needs fire insurance. His building is worth $984,000 and the contents are valued at $800,500. His agent placed the building in structural classification D and area rating 1. Use Table 19-4 in your text to calculate Rodrigo's total premium.

A) $8,005.00

B) $8172.00

C) $8,642.60

D) $8,760.30

A) $8,005.00

B) $8172.00

C) $8,642.60

D) $8,760.30

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

32

The Wings and Things owns a building valued at $2,154,000 but has decided to insure it for only $1,542,000. Their insurance policy stipulates coinsurance of 80%. If a fire were to cause $685,000 in damage, how much would the insurance company pay on the claim? (Round your answer to the nearest cent)

A) $612,970.06

B) $503,000.00

C) $635,403.86

D) $667,329.21

A) $612,970.06

B) $503,000.00

C) $635,403.86

D) $667,329.21

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

33

Ana Maria's family would need $35,500 for annual living expenses if she should pass away. Her husband earns $13,100 per year and the family has additional yearly income of $12,000 from investments. If the prevailing interest rate is 13.3%, how much life insurance is needed to cover the family's income shortfall? (Round your answer to the nearest $1,000)

A) $78,000

B) $267,000

C) $189,000

D) $2,000

A) $78,000

B) $267,000

C) $189,000

D) $2,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

34

As the owner of a business, Avery needs fire insurance. His building is worth $427,000 and the contents are valued at $325,600. His agent placed the building in structural classification A and area rating 4. Use Table 19-4 from your text to calculate his total premium. (Round your answer to the nearest cent)

A) $4,929.30

B) $4,534.08

C) $4,733.38

D) $4,463.83

A) $4,929.30

B) $4,534.08

C) $4,733.38

D) $4,463.83

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

35

What would be the total fire insurance premium for Best Seconds if their $837,500 building belongs in structural classification D? The contents are worth $421,300 and they received an area rating of 2. (The rates per $100 are found in the book)

A) $7,680.72

B) $5,126.34

C) $6,587.14

D) $7,255.49

A) $7,680.72

B) $5,126.34

C) $6,587.14

D) $7,255.49

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

36

Carlos's wife earns $11,600 per year. If Carlos dies, his family would require $57,900 to cover their living expenses. Some of the yearly expenses would be offset by $29,200 from stock dividends, but this is still not enough. How much insurance should Carlos have to cover the shortfall, given a 13.7% prevailing interest rate?

A) $298,000

B) $423,000

C) $3,000

D) $125,000

A) $298,000

B) $423,000

C) $3,000

D) $125,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

37

Michele's property insurance on her home was canceled by the insurance company after a period of 315 days. What would be her regular refund if the annual premium were $385.00? (Round your answer to the nearest cent)

A) $332.62

B) $332.26

C) $52.74

D) $385.00

A) $332.62

B) $332.26

C) $52.74

D) $385.00

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

38

Perón purchased a 20-year endowment insurance policy having a face value of $20,000 when she was 20 years old. Based on Table 19-3 from your text, what is the cash value of her policy if she is now 30 years old?

A) $2,191

B) $2,910

C) $3,324

D) $6,480

A) $2,191

B) $2,910

C) $3,324

D) $6,480

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

39

Find the premium refund due to Keona after she canceled a fire insurance policy that had been in force for only 2 months. Her annual premium was $427.00. Use the short-rate premium factors in Table 19-5 from your text. (Round your answer to the nearest cent)

A) $157.58

B) $225.00

C) $384.60

D) $298.90

A) $157.58

B) $225.00

C) $384.60

D) $298.90

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

40

At age 20, Zia purchased a 20-payment life insurance policy with face value of $415,000. She is now 40 and wants to cancel her policy. Use Table 19-3 from your text to calculate the amount of reduced paid-up insurance to which she is entitled.

A) $41,500

B) $354,665

C) $382,530

D) $415,000

A) $41,500

B) $354,665

C) $382,530

D) $415,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

41

All Season Gifts owns a building valued at $802,000, but has decided to insure it for only $552,000. Their insurance policy stipulates coinsurance of 85%. If a fire were to cause $208,000 in damage, how much would the insurance company pay on the claim? (Round your answer to the nearest cent)

A) $208,000.00

B) $16,190.05

C) $168,425.99

D) $191,800.00

A) $208,000.00

B) $16,190.05

C) $168,425.99

D) $191,800.00

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

42

A hurricane caused $179,000 in damages to a building owned by Universal Imports. The building was insured by several carriers for a total of $659,000, and all coinsurance requirements were met. If CNA Insurance is providing $197,700 of the total coverage, what is their share of the loss?

A) $53,700

B) $125,300

C) $59,310

D) $119,690

A) $53,700

B) $125,300

C) $59,310

D) $119,690

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

43

Jessie is happy with his 7-year old car, but he is thinking of switching auto insurance carriers. His agent said the car was in model class A and that he would be assigned to driver class 3. For comparison with his current policy, he wants a price quote for 50/100/50 liability coverage, $500 deductible collision and $100 deductible comprehensive. Based on the tables in the book, what would be his total premium if he lives in territory 2 and has a rating factor of 1.3?

A) $309.98

B) $306.00

C) $355.24

D) $397.80

A) $309.98

B) $306.00

C) $355.24

D) $397.80

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

44

Based on the information in Marcus's auto insurance application, his agent has assigned Marcus to driver class 1 and placed his 10-year old car in model class J. The state where he lives requires minimum liability coverage of 15/30/10, and he also wants $250 deductible collision and $100 deductible comprehensive. Using Tables 19-6 and 19-7 from your text, find his total premium, if his state is in territory 3, and he has received a rating factor of 2.1. (Round your answer to the nearest cent)

A) $300.00

B) $360.00

C) $630.00

D) $491.40

A) $300.00

B) $360.00

C) $630.00

D) $491.40

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

45

Halbrooke Warehouse Inc. recently incurred $263,000 in damages from an earthquake. Fireman's is responsible for $47,500 out of a total of $475,000 coverage provided by multiple carriers. If all coinsurance requirements have been met, how much of the loss will be paid by Fireman's?

A) $26,300

B) $236,700

C) $263,000

D) $47,500

A) $26,300

B) $236,700

C) $263,000

D) $47,500

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

46

Toby wishes to obtain auto insurance. He wants 50/100/50 liability coverage, $250 deductible collision and full coverage comprehensive. He lives in territory 2 and has been assigned to driver class 3 with a rating factor of 2.95. Based on Tables 19-6 and 19-7 from your text, what would be his total premium, if his 2-year old car were in model class H? (Round your answer to the nearest cent)

A) $349.00

B) $805.35

C) $680.55

D) $1,029.55

A) $349.00

B) $805.35

C) $680.55

D) $1,029.55

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

47

Vandome Pizzeria recently incurred $174,000 in damages from an earthquake. Massive Mutual is responsible for $240,800 out of a total of $688,000 coverage provided by multiple carriers. If all coinsurance requirements have been met, how much of the loss will be paid by Massive Mutual?

A) $60,900

B) $125,731

C) $174,000

D) $83,419

A) $60,900

B) $125,731

C) $174,000

D) $83,419

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

48

A flood caused $620,000 in damages to a building owned by Super Storage Inc. The building, valued at $1,035,000, was insured for $847,000 despite a coinsurance requirement of 90% in their policy. How much of the loss will be covered by the insurance company?

A) $558,000.00

B) $620,000.00

C) $507,381.64

D) $563,757.38

A) $558,000.00

B) $620,000.00

C) $507,381.64

D) $563,757.38

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

49

Oxdale Kennels has insured its building with multiple companies for a total of $1,149,000, of which $976,650 is with Nationwide. Assuming that all coinsurance requirements have been met, how much would Nationwide be responsible for in the event of a $205,000 fire?

A) $205,000

B) $172,350

C) $174,250

D) $30,750

A) $205,000

B) $172,350

C) $174,250

D) $30,750

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

50

A flood caused $602,000 in damages to a building owned by Garcia Engineering. The building, valued at $915,000, was insured for $686,000 despite a coinsurance requirement of 90% in their policy. How much of the loss will be covered by the insurance company? (Round your answer to the nearest cent)

A) $602,000.00

B) $606,938.65

C) $501,483.91

D) $596,000.00

A) $602,000.00

B) $606,938.65

C) $501,483.91

D) $596,000.00

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

51

Based on the information in Clarissa's auto insurance application, her agent has assigned Clarissa to driver class 3 and placed her 5-year-old car in model class N. The state where she lives requires minimum liability coverage of 50/100/50, and she also wants $250 deductible collision and full coverage comprehensive. Using Tables 19-6 and 19-7 from your text, find her total premium, if her state is in territory 2, and she has received a rating factor of 2.8. (Round your answer to the nearest cent)

A) $359.00

B) $646.20

C) $784.00

D) $1,005.20

A) $359.00

B) $646.20

C) $784.00

D) $1,005.20

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

52

The insurance carrier used by Wayne's Pool Service specifies 65% coinsurance. The company recently incurred $233,000 in damages from a tornado. The building was valued at $390,000, but was only insured for $209,000. What will the insurance company pay for the loss?

A) $144,460.00

B) $192,098.62

C) $209,000.00

D) $233,000.00

A) $144,460.00

B) $192,098.62

C) $209,000.00

D) $233,000.00

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

53

The insurance carrier used by Best Security Systems specifies 75% coinsurance. The company recently incurred $696,000 in damages from a tornado. The building was valued at $877,000, but was only insured for $606,000. What amount will be paid by the insurance company for the loss? (Round your answer to the nearest cent)

A) $696,000.00

B) $641,240.59

C) $578,495.07

D) $592,750.00

A) $696,000.00

B) $641,240.59

C) $578,495.07

D) $592,750.00

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

54

Based on the information in Jarred's auto insurance application, his agent has assigned Jarred to driver class 2 and placed his 1-year-old car in model class R. The state where he lives requires minimum liability coverage of 50/100/50, and he also wants $250 deductible collision and full coverage comprehensive. Using Tables 19-6 and 19-7 from your text, find his total premium, if his state is in territory 4, and he has received a rating factor of 2. (Round your answer to the nearest cent)

A) $250.00

B) $306.00

C) $397.00

D) $794.00

A) $250.00

B) $306.00

C) $397.00

D) $794.00

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

55

A hurricane caused $465,000 in damages to a building owned by Cane Consulting. The building was insured by several carriers for a total of $950,000 and all coinsurance requirements were met. If Supreme Insurance is providing $475,000 of the total coverage, what is their share of the loss?

A) $465,000

B) $455,211

C) $232,500

D) $387,962

A) $465,000

B) $455,211

C) $232,500

D) $387,962

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

56

Affordable Consulting has insured its building with multiple companies for a total of $688,000, of which $275,200 is with USF&G. Assuming that all coinsurance requirements have been met, how much would USF&G be responsible for in the event of a $565,000 fire?

A) $275,200

B) $412,800

C) $339,000

D) $226,000

A) $275,200

B) $412,800

C) $339,000

D) $226,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

57

Alana wishes to obtain auto insurance. She wants 100/300/100 liability coverage, $250 deductible collision and full coverage comprehensive. She lives in territory 2 and has been assigned to driver class 2 with a rating factor of 1.05. Based on Tables 19-6 and 19-7 from your text, what would be her total premium, if her 3-year old car were in model class L? (Round your answer to the nearest cent)

A) $355.00

B) $383.25

C) $389.00

D) $305.45

A) $355.00

B) $383.25

C) $389.00

D) $305.45

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

58

Based on the information in Karen's auto insurance application, her agent has assigned Karen to driver class 1 and placed her 7-year old car in model class G. The state where she lives requires minimum liability coverage of 100/300/100 and she also wants $500 deductible collision and $100 deductible comprehensive. Using Tables 19-6 and 19-7 in your text, find her total premium if her state is in territory 2 and she has received a rating factor of 1.1.

A) $317.00

B) $320.49

C) $320.17

D) $348.70

A) $317.00

B) $320.49

C) $320.17

D) $348.70

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

59

Maya was involved in an auto accident in which she was at fault. Her own car sustained $1,926 damages and the other vehicle cost $1,126 to repair. Maya was not injured, but the driver of the other car required medical treatment costing $3,448 and a passenger's injuries totaled $3,946. Maya's policy includes 10/20/5 liability, $250 deductible collision and full coverage comprehensive. How much of the damages must Maya pay?

A) $385

B) $250

C) $260

D) $955

A) $385

B) $250

C) $260

D) $955

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

60

Ignacio was involved in an auto accident in which he was at fault. His own car sustained $3,827 damages and the other vehicle cost $1,709 to repair. Ignacio was not injured, but the driver of the other car required medical treatment costing $34,550 and a passenger's injuries totaled $3,944. Ignacio's policy includes 15/30/10 liability, $250 deductible collision and $100 deductible comprehensive. How much of the damages must the insurance company pay?

A) $24,230

B) $30,000

C) $43,680

D) $21,840

A) $24,230

B) $30,000

C) $43,680

D) $21,840

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

61

Brian was involved in an auto accident in which he was at fault. His own car sustained $3,026 damages and the other vehicle cost $1,424 to repair. Brian was not injured, but the driver of the other car required medical treatment costing $32,375 and a passenger's injuries totaled $20,704. Brian's policy includes 50/100/50 liability, $500 deductible collision and $100 deductible comprehensive. How much of the damages must the insurance company pay?

A) $57,029

B) $2,526

C) $500

D) $1,424

A) $57,029

B) $2,526

C) $500

D) $1,424

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

62

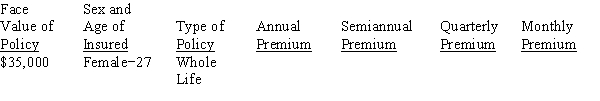

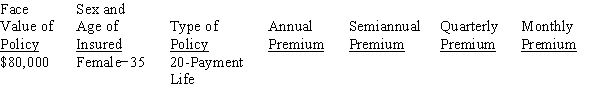

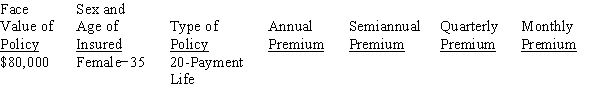

Calculate the annual, semiannual, quarterly, and monthly premiums for the following life insurance policy, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

63

Kevin was involved in an auto accident in which he was at fault. His own car sustained $3,696 damages and the other vehicle cost $2,083 to repair. Kevin was not injured, but the driver of the other car required medical treatment costing $32,103. There was additional property damage in the amount of $413. Kevin's policy includes 25/50/25 liability, $250 deductible collision, and full coverage comprehensive. How much of the damages must the insurance company pay?

A) $3,696.00

B) $3,446.00

C) $25,000.00

D) $30,942.00

A) $3,696.00

B) $3,446.00

C) $25,000.00

D) $30,942.00

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

64

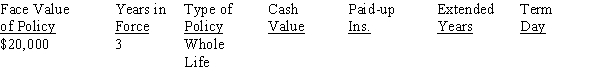

Calculate the value of the nonforfeiture options for the following life insurance policy issued to a female at age 20.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

65

Linda was involved in an auto accident in which she was at fault. Her own car sustained $3,293 damages and the other vehicle cost $982 to repair. Linda was not injured, but the driver of the other car required medical treatment costing $8,668 and a passenger's injuries totaled $22,035. There was additional property damage in the amount of $3,296. Linda's policy includes 50/100/50 liability, $500 deductible collision and full coverage comprehensive. How much of the damages must Linda pay?

A) $500

B) $2,793

C) $4,278

D) $37,774

A) $500

B) $2,793

C) $4,278

D) $37,774

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

66

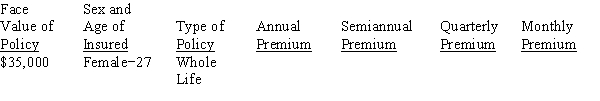

Calculate the annual, semiannual, quarterly, and monthly premiums for the following life insurance policy, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

67

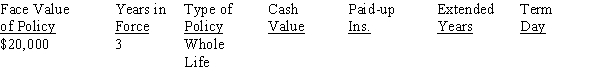

Calculate the value of the nonforfeiture options for the following life insurance policy issued to a female at age 20.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

68

Based on the information in Idalia's auto insurance application, her agent has assigned Idalia to driver class 4 and placed her 4-year-old car in model class J. The state where she lives requires minimum liability coverage of 50/100/100, and she also wants $500 deductible collision and full coverage comprehensive. Using Tables 19-6 and 19-7 from your text, find her total premium, if her state is in territory 1, and she has received a rating factor of 2.6. (Round your answer to the nearest cent)

A) $981.75

B) $721.25

C) $565.50

D) $860.60

A) $981.75

B) $721.25

C) $565.50

D) $860.60

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

69

Calculate the value of the nonforfeiture options for the following life insurance policy issued to a female at age 20.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

70

Calculate the annual, semiannual, quarterly, and monthly premiums for the following life insurance policy, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

71

Calculate the annual, semiannual, quarterly, and monthly premiums for the following life insurance policy, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

72

Calculate the annual, semiannual, quarterly, and monthly premiums for the following life insurance policy, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

73

Francesco's wife earns $14,250 per year. If Francesco dies, his family would require $88,200 to cover their living expenses. Some of the yearly expenses would be offset by $12,400 from stock dividends, but this is still not enough. How much insurance should Francesco have to cover the shortfall, given a 10.4% prevailing interest rate? (Round your answer to the nearest $1,000)

A) $328,000

B) $418,000

C) $592,000

D) $114,000

A) $328,000

B) $418,000

C) $592,000

D) $114,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

74

Asunción was involved in an auto accident in which she was at fault. Her own car sustained $2,503 damages and the other vehicle cost $396 to repair. Asunción was not injured, but the driver of the other car required medical treatment costing $2,298. There was additional property damage in the amount of $2,558. Asunción's policy includes 10/20/5 liability, $250 deductible collision, and $100 deductible comprehensive. How much of the damages must Asuncion pay?

A) $250

B) $396

C) $7,505

D) $7,755

A) $250

B) $396

C) $7,505

D) $7,755

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

75

Scott was involved in an auto accident in which he was at fault. His own car sustained $2,380 damages and the other vehicle cost $2,748 to repair. Scott was not injured, but the driver of the other car required medical treatment costing $32,180. Scott's policy includes 10/20/5 liability, $250 deductible collision, and full coverage comprehensive. How much of the damages must the insurance company pay?

A) $14,878

B) $22,430

C) $32,180

D) $37,308

A) $14,878

B) $22,430

C) $32,180

D) $37,308

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

76

At age 29, Akeem has decided to purchase a 10-year term insurance policy with face value of $240,000. Use Tables 19-1 and 19-2 in your text to calculate his quarterly premium.

A) $326.35

B) $290.44

C) $152.38

D) $751.90

A) $326.35

B) $290.44

C) $152.38

D) $751.90

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

77

Calculate the annual, semiannual, quarterly, and monthly premiums for the following life insurance policy, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

78

Valerie purchased a 20-year endowment insurance policy having a face value of $50,000 when she was 20 years old. Based on Table 19-3 from your text, what is the cash value of her policy if she is now 35 years old?

A) $12,190

B) $52,000

C) $32,350

D) $26,000

A) $12,190

B) $52,000

C) $32,350

D) $26,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

79

Calculate the annual, semiannual, quarterly, and monthly premiums for the following life insurance policy, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

80

Calculate the annual, semiannual, quarterly, and monthly premiums for the following life insurance policy, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck