Deck 20: Investments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

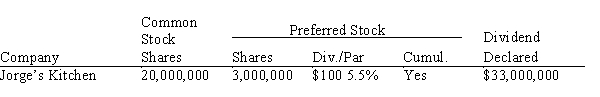

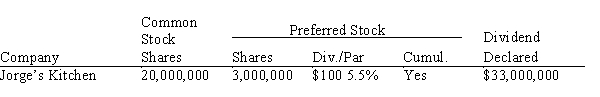

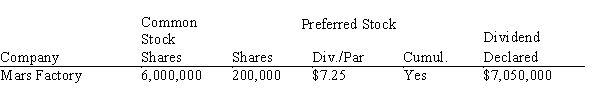

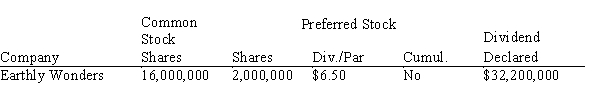

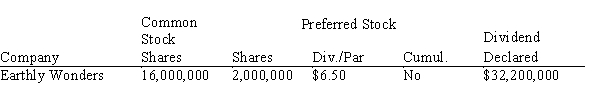

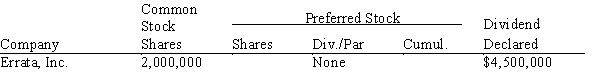

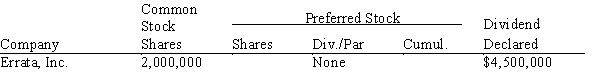

Question

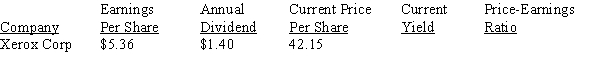

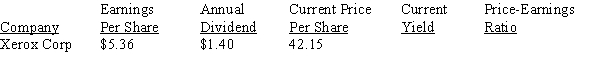

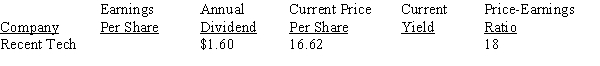

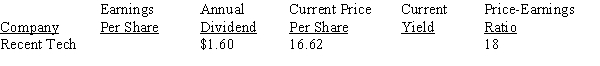

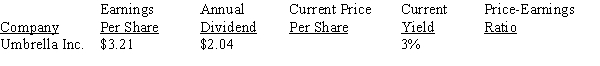

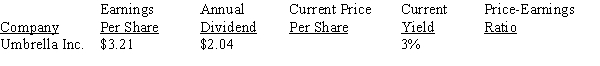

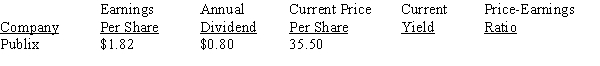

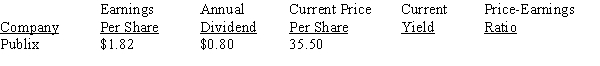

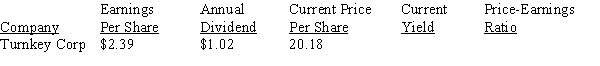

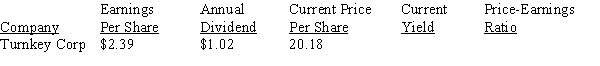

Question

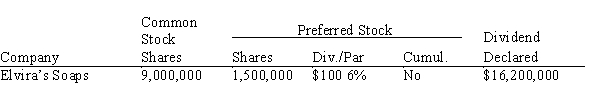

Question

Question

Question

Question

Question

Question

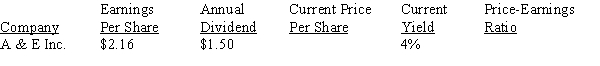

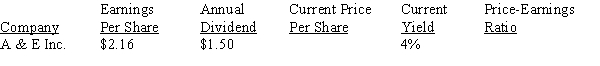

Question

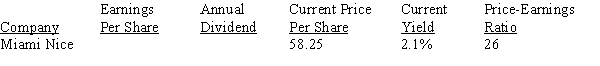

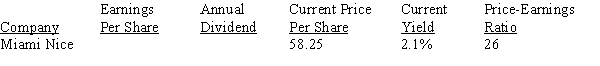

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/159

Play

Full screen (f)

Deck 20: Investments

1

____________________ are the amount of dividends that accumulate and are owed to cumulative preferred shareholders for past years in which no dividends were paid.

Dividends in arrears

2

Given the following stock quotation, find the lowest price during the last year.

A) 24.37

B) 17.81

C) 11

D) 135.05

A) 24.37

B) 17.81

C) 11

D) 135.05

17.81

3

____________________ bonds are those that the issuer has the right to repurchase before the maturity date.

Callable

4

Hopen Consulting has 310,000 shares of $100 par value, 8% cumulative preferred stock and 2,650,000 shares of common stock. Although no dividend was declared last year, a $6,500,000 dividend has been declared this year. After finding the amount of dividends due the preferred shareholders, calculate the dividend per share of common stock.

A) $0.58

B) $1.44

C) $0.62

D) $0.51

A) $0.58

B) $1.44

C) $0.62

D) $0.51

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

5

Given the following stock quotation, find the highest price during the last year.

A) 20.36

B) 15

C) 14

D) 38.227

A) 20.36

B) 15

C) 14

D) 38.227

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

6

A type of preferred stock that may be exchanged for a specified number of common shares in the future is called ____________________ preferred.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

7

The percentage measure of how well an investment is doing and is often used as the basis for comparison with other investments is the ____________________.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

8

An investment strategy that is a mixture of stocks, bonds, cash equivalents, and other types of investments is called a(n) ____________________ portfolio.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

9

When a bond is selling for more than its par value, it is said to be selling at a(n) ____________________.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

10

The dollar value of one share of a mutual fund's stock is called the ____________________ value.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

11

____________________ are a distribution of a company's profits to its shareholders.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

12

Given the following stock quotation, find the symbol for the stock.

A) BN

B) BNG

C) Boeing

D) BA

A) BN

B) BNG

C) Boeing

D) BA

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

13

The board of directors of Streamlined Airlines has declared a dividend of $4,300,000. The company has 400,000 shares of preferred stock that pay $0.70 per share and 2,750,000 shares of common stock. After finding the amount of dividends due the preferred shareholders, calculate the dividend per share of common stock. (Round your answer to the nearest cent if necessary)

A) $11.50

B) $1.46

C) $1.92

D) $1.79

A) $11.50

B) $1.46

C) $1.92

D) $1.79

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

14

Corporations that are investment pools of money with a wide variety of investment goals are called ____________________.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

15

____________________ are bonds that are backed only by the general credit of the issuing corporation.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

16

The board of directors of Midwest Foods has declared a dividend of $3,500,000. The company has 300,000 shares of preferred stock that pay $2.85 per share and 2,500,000 shares of common stock. After finding the amount of dividends due the preferred shareholders, calculate the dividend per share of common stock.

A) $1.06

B) $1.57

C) $13.50

D) $4.50

A) $1.06

B) $1.57

C) $13.50

D) $4.50

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

17

Given the following stock quotation, find the yield percent.

A) 2.88%

B) 9%

C) 3.84%

D) 8.75%

A) 2.88%

B) 9%

C) 3.84%

D) 8.75%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

18

A(n) ____________________ is one unit of stock or ownership in a corporation.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

19

Saunders and Flimsy Partnership paid dividends of $0.27 and $0.15 per share last year. If yesterday's closing price was $12.27, what is the current yield on the stock? (Round to the nearest tenth)

A) 3.4%

B) 2.6%

C) 18.6%

D) 2.9%

A) 3.4%

B) 2.6%

C) 18.6%

D) 2.9%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

20

The board of directors of Clear Communications has declared a dividend of $2,500,000. The company has 240,000 shares of preferred stock that pay $2.10 per share and 2,600,000 shares of common stock. After finding the amount of dividends due the preferred shareholders, calculate the dividend per share of common stock.

A) $0.37

B) $1.89

C) $0.69

D) $0.77

A) $0.37

B) $1.89

C) $0.69

D) $0.77

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

21

Suppose you own stock in Beach Front Resort Inc. which had earnings of $2.10 per share last year. If yesterday's closing price was $58.80, what is the price-earnings ratio of the stock? (Round to the nearest whole number)

A) 4

B) 0.04

C) 2.8

D) 28

A) 4

B) 0.04

C) 2.8

D) 28

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

22

You sell 30 bonds with a coupon rate of 8.125% and a current market price of . The commission charge is $10.00 per bond. The date of the transaction is 88 days since the last interest payment. What are your total proceeds?

A) $32,845.83

B) $32,896.50

C) $32,837.70

D) $32,887.50

A) $32,845.83

B) $32,896.50

C) $32,837.70

D) $32,887.50

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

23

Given the following bond quotation, find the closing price.

A) $505.00

B) $1,016.56

C) $1,013.92

D) $1,016.28

A) $505.00

B) $1,016.56

C) $1,013.92

D) $1,016.28

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

24

Great Fruit Inc. paid a dividend of $5.10 per share last year. If yesterday's closing price was $42.38, what is the current yield on the stock? (Round to nearest tenth)

A) 1.2%

B) 12.0%

C) 7.2%

D) 6.3%

A) 1.2%

B) 12.0%

C) 7.2%

D) 6.3%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

25

Bobby bought 550 shares of stock at $61.25 per share. His broker charges 4% commission for round lots and 5% for odd lots. Calculate the total cost of the stock purchase.

A) $35,065.63

B) $39,258.65

C) $33,710.00

D) $35,371.88

A) $35,065.63

B) $39,258.65

C) $33,710.00

D) $35,371.88

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

26

Given the following bond quotation, find the coupon rate.

A) 4.521%

B) 4.600%

C) 101.9%

D) 101.7%

A) 4.521%

B) 4.600%

C) 101.9%

D) 101.7%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose you own stock in National Advertising which had earnings of $2.50 per share last year. If yesterday's closing price was $41.50, what is the price-earnings ratio of the stock? (Round to the nearest whole number)

A) 6:1

B) 1:17

C) 4:1

D) 17:1

A) 6:1

B) 1:17

C) 4:1

D) 17:1

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

28

Shaylash bought 250 shares of stock at $31.38 per share. Several months later he sold the stock at $45.65 per share. His broker charges 4% commission for round lots and 5% for odd lots. Calculate the gain or loss on the transaction. (Show loss in parentheses)

A) $10,933.19

B) $8,174.49

C) $2,758.69

D) ($2,758.69)

A) $10,933.19

B) $8,174.49

C) $2,758.69

D) ($2,758.69)

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

29

Given the following bond quotation, find the coupon rate.

A) 6.948%

B) 7.000%

C) 96.096%

D) 2.000%

A) 6.948%

B) 7.000%

C) 96.096%

D) 2.000%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

30

Cornware Distributing paid a dividend of $0.08, $0.21, $0.11 and $0.17 per share respectively last year. If yesterday's closing price was $35.40, what is the current yield on the stock? (Round to the nearest tenth)

A) 3.4%

B) 1.6%

C) 4.5%

D) 5.2%

A) 3.4%

B) 1.6%

C) 4.5%

D) 5.2%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

31

You purchase 10 bonds with a coupon rate of 9% and a current market price of 101.125. The commission charge is $5.00 per bond. The date of the transaction is October 1, and the bond pays interest on January 1 and July 1. What is your total purchase price?

A) $10,392.50

B) $10,400.00

C) $10,395.10

D) $10,391.90

A) $10,392.50

B) $10,400.00

C) $10,395.10

D) $10,391.90

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

32

Shares of Lorne and Greene Manufacturing now sell for $64. If the company had earnings per share of $3.70 last year, calculate the price-earnings ratio of the stock. (Round to nearest whole number)

A) 51:1

B) 23:1

C) 25:1

D) 17:1

A) 51:1

B) 23:1

C) 25:1

D) 17:1

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

33

Light Fixtures Inc. paid a dividend of $7.20 per share last year. If yesterday's closing price was $88.24, what is the current yield on the stock? (Round to nearest tenth)

A) 8.2%

B) 11.0%

C) 5.2%

D) 2.3%

A) 8.2%

B) 11.0%

C) 5.2%

D) 2.3%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

34

You purchase 150 shares of stock at $40.88 per share. Several months later you sell the shares at $32.50. Your broker charges 4% commission for round lots and 5% for odd lots. Calculate the gain or loss on the transaction. (If loss, enclose in parenthesis)

A) ($1,924.69)

B) ($1,311.47)

C) ($1,733.97)

D) $2,145.87

A) ($1,924.69)

B) ($1,311.47)

C) ($1,733.97)

D) $2,145.87

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

35

Find the total purchase price of 35 bonds that have a coupon rate of 4.50% and a current market price of 102.375. The commission charge is $5.00 per bond. The date of the transaction is April 1, and the bond pays interest on January 1 and July 1.

A) $30,225

B) $36,400

C) $30,226

D) $30,426

A) $30,225

B) $36,400

C) $30,226

D) $30,426

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

36

Lakeesha bought 300 shares of stock at $48.25 per share. Her broker charges 3% commission for round lots and 4% for odd lots. Calculate the total cost of the stock purchase.

A) $15,025.63

B) $14,909.25

C) $13,820.00

D) $25,115.88

A) $15,025.63

B) $14,909.25

C) $13,820.00

D) $25,115.88

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose you own stock in the Golf Tour Corporation which had earnings of $0.90 per share last year. If yesterday's closing price was $33.13, what is the price-earnings ratio of the stock? (Round to nearest whole number)

A) 33:1

B) 37:1

C) 22:1

D) 38:1

A) 33:1

B) 37:1

C) 22:1

D) 38:1

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

38

Lance bought 120 shares of stock at $25.28 per share. Several months later he sold the stock at $24.70 per share. His broker charges 3% commission for round lots and 4% for odd lots. Calculate the gain or loss on the transaction. (Show loss in parentheses)

A) $3,139.66

B) $3,033.60

C) $259.52

D) ($259.52)

A) $3,139.66

B) $3,033.60

C) $259.52

D) ($259.52)

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

39

Helping Hand Industries paid a dividend of $0.40 per share last year. If yesterday's closing price was $19.05, what is the current yield on the stock? (Round to nearest tenth)

A) 17.2%

B) 6.3%

C) 2.1%

D) 1.6%

A) 17.2%

B) 6.3%

C) 2.1%

D) 1.6%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

40

You purchase 30 bonds with a coupon rate of 5.875% and a current market price of 89. The commission charge is $15.00 per bond. The date of the transaction is September 1, and the bond pays interest on January 1 and July 1. What is your total purchase price?

A) $27,200.00

B) $27,590.63

C) $27,800.00

D) $27,791.60

A) $27,200.00

B) $27,590.63

C) $27,800.00

D) $27,791.60

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

41

Suppose you own a mutual fund that has 10,500,525 shares outstanding. If its total assets are $37,500,020 and its liabilities are $12,375,375, find the net asset value of the fund.

A) $3.20

B) $2.39

C) $3.71

D) $3.05

A) $3.20

B) $2.39

C) $3.71

D) $3.05

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

42

A mutual fund has total assets of $60,500,005 and liabilities of $7,987,654. If there are 10,123,456 shares outstanding, what is the net asset value of the fund?

A) $4.60

B) $5.70

C) $5.19

D) $5.00

A) $4.60

B) $5.70

C) $5.19

D) $5.00

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

43

Suppose you own a mutual fund which has 11,326,555 shares outstanding. If its total assets are $70,111,050 and its liabilities are $12,444,100, find the net asset value of the fund.

A) $5.09

B) $5.13

C) $5.36

D) $5.98

A) $5.09

B) $5.13

C) $5.36

D) $5.98

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

44

Given the following mutual fund quotation, find the change in the net asset value.

A) 13.70%

B) ?4.8%

C) +0.03%

D) -15.8%

A) 13.70%

B) ?4.8%

C) +0.03%

D) -15.8%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

45

Find the current yield of a bond whose coupon rate is listed as 5.875% and currently selling at a discount of 92.375. (Round to the nearest tenth percent)

A) 7.1%

B) 6.6%

C) 6.3%

D) 6.4%

A) 7.1%

B) 6.6%

C) 6.3%

D) 6.4%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

46

Find the current yield of a bond whose coupon rate is listed as 9.375% and currently selling at a premium of 100.875. (Round to the nearest tenth percent)

A) 9.3%

B) 9.4%

C) 10.0%

D) 10.1%

A) 9.3%

B) 9.4%

C) 10.0%

D) 10.1%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

47

Ricardo invested a lump sum of $10,000 in a mutual fund with an offer price of $12.04. How many shares did he purchase? (Round to the nearest thousandth)

A) 1,204.000

B) 830.565

C) 955.874

D) 637.121

A) 1,204.000

B) 830.565

C) 955.874

D) 637.121

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

48

A mutual fund has total assets of $39,333,444 and liabilities of $6,753,789. If there are 11,521,000 shares outstanding, what is the net asset value of the fund?

A) $3.02

B) $3.85

C) $2.83

D) $2.16

A) $3.02

B) $3.85

C) $2.83

D) $2.16

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

49

Suppose that you own a bond with a coupon rate of 8% and currently selling at a premium of 101.75. What is the current yield? (Round to the nearest tenth percent)

A) 7.9%

B) 9.1%

C) 8.5%

D) 8.9%

A) 7.9%

B) 9.1%

C) 8.5%

D) 8.9%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

50

A mutual fund has an offer price of $14.32. If you invested a lump sum of $5,525, how many shares did you purchase? (Round to the nearest thousandth)

A) 518.266

B) 616.000

C) 489.651

D) 385.824

A) 518.266

B) 616.000

C) 489.651

D) 385.824

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

51

Find the current yield of a bond whose coupon rate is listed as 6.125% and currently selling at a discount of 87.50. (Round to the nearest tenth percent)

A) 7.8%

B) 7.0%

C) 9.3%

D) 10.2%

A) 7.8%

B) 7.0%

C) 9.3%

D) 10.2%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

52

Chloe invested a lump sum of $24,000 in a mutual fund with an offer price of $8.05. How many shares did she purchase? (Round to the nearest thousandth)

A) 1,600.500

B) 1,633.340

C) 3,690.342

D) 2,981.366

A) 1,600.500

B) 1,633.340

C) 3,690.342

D) 2,981.366

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

53

Given the following mutual fund quotation, find the net asset value (NAV).

A) FCNTX

B) 56.46

C) +0.07

D) -5.0

A) FCNTX

B) 56.46

C) +0.07

D) -5.0

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

54

You purchase a mutual fund at an offer price of $11.28 per share. If the net asset value is $10.74, find the sales charge percent. (Round to the nearest tenth)

A) 5.0%

B) 95.0%

C) 4.8%

D) 95.2%

A) 5.0%

B) 95.0%

C) 4.8%

D) 95.2%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

55

You purchase a mutual fund at an offer price of $10.43 per share. If the net asset value is $9.99, find the sales charge percent. (Round to nearest tenth)

A) 5.8%

B) 4.2%

C) 5.2%

D) 4.4%

A) 5.8%

B) 4.2%

C) 5.2%

D) 4.4%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

56

A mutual fund has an offer price of $11.98 per share and a net asset value of $11.29. What is the sales charge percent? (Round to the nearest tenth)

A) 5.8%

B) 6.1%

C) 93.9%

D) 94.2%

A) 5.8%

B) 6.1%

C) 93.9%

D) 94.2%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

57

A mutual fund has an offer price of $7.83 per share and a net asset value of $7.38. What is the sales charge percent? (Round to nearest tenth)

A) 5.7%

B) 6.1%

C) 4.9%

D) 7.4%

A) 5.7%

B) 6.1%

C) 4.9%

D) 7.4%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

58

Given the following mutual fund quotation, find the YTD percent return on investment:

A) 500

B) 96.95

C) -4.7

D) -8.7

A) 500

B) 96.95

C) -4.7

D) -8.7

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

59

Brian invested a lump sum of $10,000 in a mutual fund with an offer price of $6.03. How many shares did he purchase? (Round to the nearest thousandth)

A) 1,600.500

B) 1,658.375

C) 1,685.375

D) 6,300.000

A) 1,600.500

B) 1,658.375

C) 1,685.375

D) 6,300.000

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

60

Given the following mutual fund quotation, find the 3-year percent change on investment.

A) 49.26%

B) 0.69%

C) +16.3%

D) +17.7%

A) 49.26%

B) 0.69%

C) +16.3%

D) +17.7%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

61

Calculate the preferred and common dividend per share for the following.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

62

Calculate the missing information for the stocks, rounding to the nearest tenth of a percent for current yield and whole number for price-earnings ratio.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

63

Calculate the preferred and common dividend per share for the following.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

64

A mutual fund has an offer price of $9.42 per share and a net asset value of $9.04. What is the sales charge percent? (Round to nearest tenth)

A) 4.2%

B) 5.1%

C) 3.9%

D) 8.4%

A) 4.2%

B) 5.1%

C) 3.9%

D) 8.4%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

65

Calculate the preferred and common dividend per share for the following.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

66

The board of directors of Clarian Motels has declared a dividend of $3,000,000. The company has 150,000 shares of preferred stock that pay $1.20 per share and 1,800,000 shares of common stock. After finding the amount of dividends due the preferred shareholders, calculate the dividend per share of common stock. (Round your answer to the nearest cent if necessary)

A) $0.44

B) $2.99

C) $1.57

D) $0.75

A) $0.44

B) $2.99

C) $1.57

D) $0.75

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

67

Calculate the preferred and common dividend per share for the following.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

68

A mutual fund has an offer price of $7.75. If you invested a lump sum of $12,000, how many shares did you purchase? (Round to the nearest thousandth)

A) 1,548.387

B) 1,584.387

C) 9,300.000

D) 12,000.000

A) 1,548.387

B) 1,584.387

C) 9,300.000

D) 12,000.000

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

69

Calculate the missing information for the stocks, rounding to the nearest hundredth for earnings per ratio and nearest tenth of a percent for current yield.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

70

Calculate the missing information for the stocks, rounding to the whole number for price-earnings ratio.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

71

You purchased 3,000 shares of a mutual fund at an offer price of $7.10 per share. Several months later you sold the shares for $8.45 per share. During the time you owned the shares, the fund paid a dividend of $0.29 per share. What was your return on investment? (Round to the nearest tenth)

A) 16.0%

B) 19.0%

C) 23.1%

D) −16.0%

A) 16.0%

B) 19.0%

C) 23.1%

D) −16.0%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

72

Sabrine purchased 4,500 shares of a mutual fund at an offer price of $8.98 per share. Later, she sold the investment for $7.39 per share. During the time she owned the shares, the fund paid a dividend of $0.58 per share. What was her return on her investment? (Round to the nearest tenth)

A) −9.5%

B) −11.2%

C) −1.2%

D) 6.6%

A) −9.5%

B) −11.2%

C) −1.2%

D) 6.6%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

73

Calculate the missing information for the stocks, rounding to the nearest hundredth for earnings per share and annual dividend.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

74

Calculate the missing information for the stocks, rounding to the nearest tenth of a percent for current yield and whole number for price-earnings ratio.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

75

Calculate the missing information for the stocks, rounding to the nearest hundredth for current price per share and whole number for price-earnings ratio.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

76

A mutual fund has an offer price of $7.42 per share and a net asset value of $7.02. What is the sales charge percent? (Round to the nearest tenth)

A) 2.8%

B) 4.1%

C) 92.8%

D) 5.7%

A) 2.8%

B) 4.1%

C) 92.8%

D) 5.7%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

77

Calculate the preferred and common dividend per share for the following.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

78

Dane purchased 3,000 shares of a mutual fund at an offer price of $6.03 per share. Later, he sold the investment for $3.64 per share. During the time Dane owned the shares, the fund paid a dividend of $0.52 per share. What was his return on investment? (Round to nearest tenth percent)

A) −31.0%

B) −37.1%

C) +44.3%

D) +41.2%

A) −31.0%

B) −37.1%

C) +44.3%

D) +41.2%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

79

Tamara purchased 1,500 shares of a mutual fund at an offer price of $7.08 per share. Later she sold the investment for $10.02 per share. During the time Tamara owned the shares, the fund paid a dividend of $0.21 per share. What was her return on investment? (Round to nearest tenth percent)

A) 44.5%

B) 5.1%

C) 4.5%

D) 9.8%

A) 44.5%

B) 5.1%

C) 4.5%

D) 9.8%

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck

80

Calculate the missing information for the stocks, rounding to the nearest tenth of a percent for current yield and whole number for price-earnings ratio.

Unlock Deck

Unlock for access to all 159 flashcards in this deck.

Unlock Deck

k this deck