Deck 14: Mortgages

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

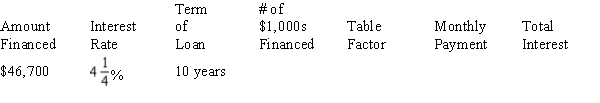

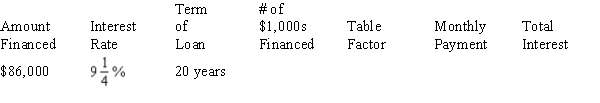

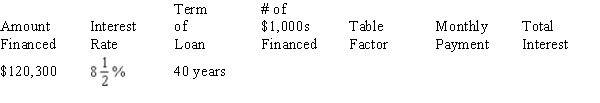

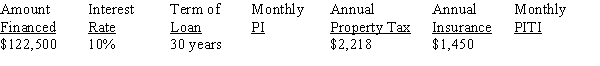

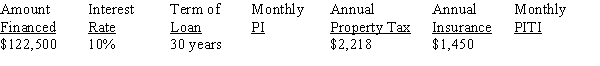

Question

Question

Question

Question

Question

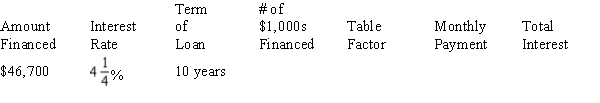

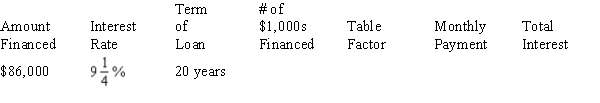

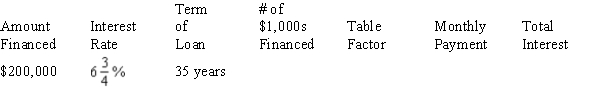

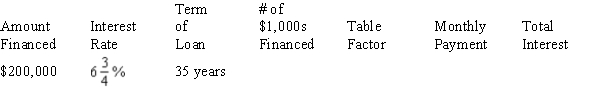

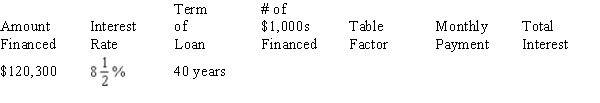

Question

Question

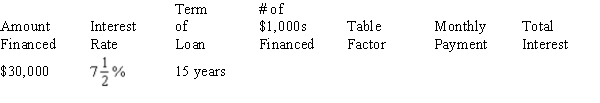

Question

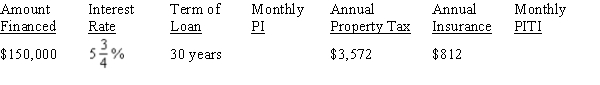

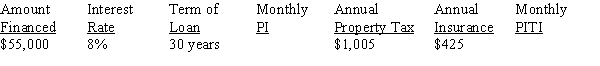

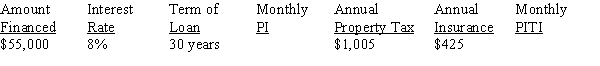

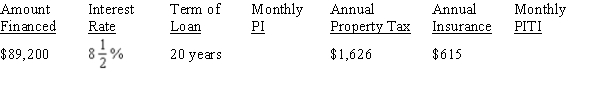

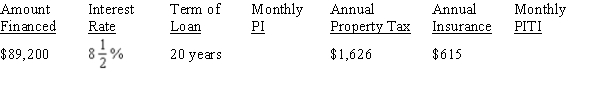

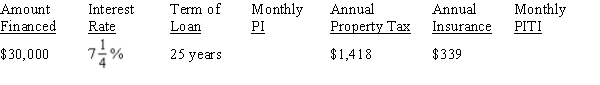

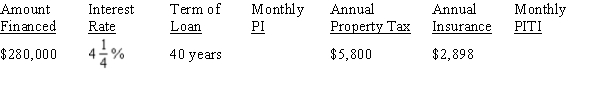

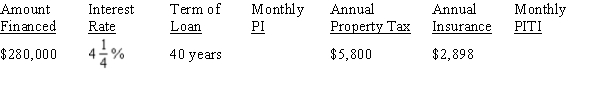

Question

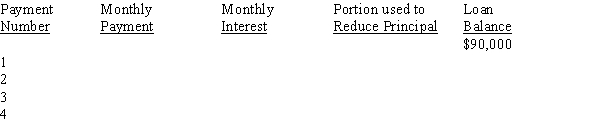

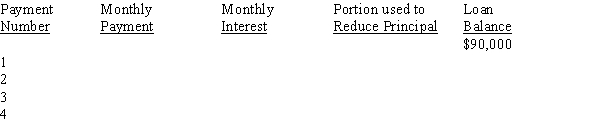

Question

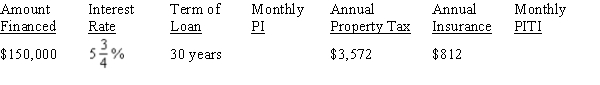

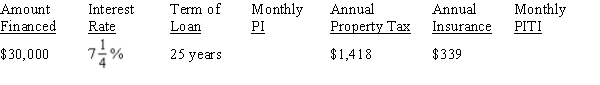

Question

Question

Question

Question

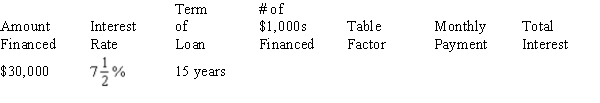

Question

Question

Question

Question

Question

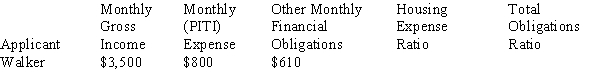

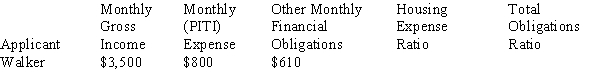

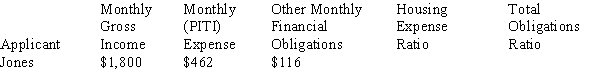

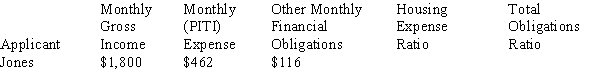

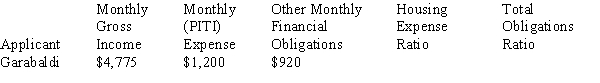

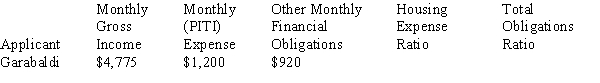

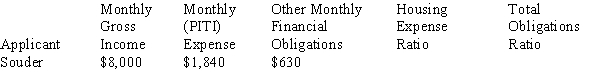

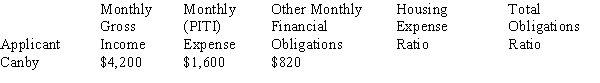

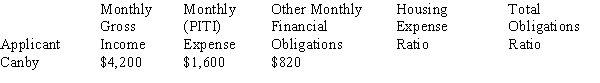

Question

Question

Question

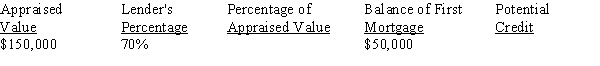

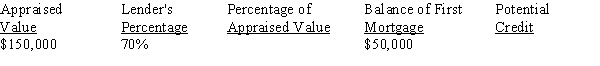

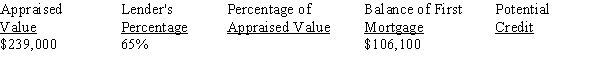

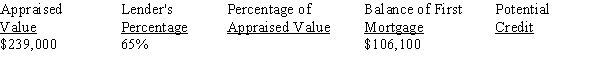

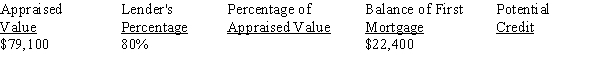

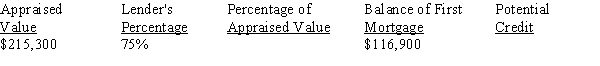

Question

Question

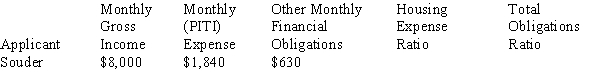

Question

Question

Question

Question

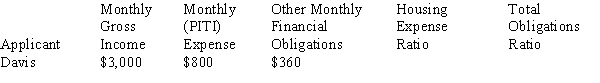

Question

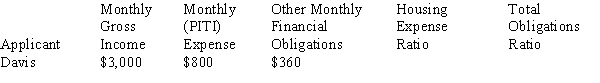

Question

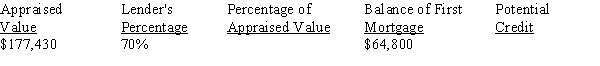

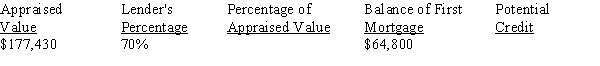

Question

Question

Question

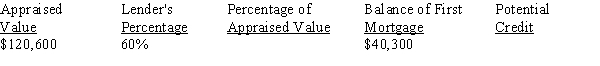

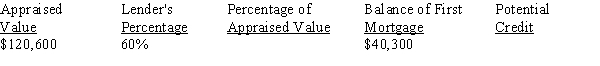

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/120

Play

Full screen (f)

Deck 14: Mortgages

1

Real estate loans made by private lenders that are not FHA-insured or VA-guaranteed are called ____________________ mortgages.

conventional

2

____________________ are the expenses incurred in conjunction with the sale of real estate.

Closing costs

3

A(n) ____________________ is any loan in which real property is used as security for a debt.

mortgage

4

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Prepare an amortization schedule for the first 3 payments of an $87,000 mortgage at for 30 years. Find the loan balance after 3 payments.

A) $83,855.24

B) $86,725.08

C) $86,274.99

D) $85,345.15

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Prepare an amortization schedule for the first 3 payments of an $87,000 mortgage at for 30 years. Find the loan balance after 3 payments.

A) $83,855.24

B) $86,725.08

C) $86,274.99

D) $85,345.15

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

5

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Leandro has a mortgage of $89,000 at for 25 years. Find the total interest.

A) $106,143.00

B) $136,085.80

C) $126,202.00

D) $191,961.60

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Leandro has a mortgage of $89,000 at for 25 years. Find the total interest.

A) $106,143.00

B) $136,085.80

C) $126,202.00

D) $191,961.60

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

6

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Roberto has a mortgage of $89,500 at for 20 years. Find the total interest.

A) $99,502.31

B) $103,201.28

C) $96,946.40

D) $97,855.68

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Roberto has a mortgage of $89,500 at for 20 years. Find the total interest.

A) $99,502.31

B) $103,201.28

C) $96,946.40

D) $97,855.68

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

7

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Lyle has a mortgage of $96,000 at for 30 years. Find the total interest.

A) $151,795.20

B) $88,986.00

C) $247,795.20

D) $105,689.60

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Lyle has a mortgage of $96,000 at for 30 years. Find the total interest.

A) $151,795.20

B) $88,986.00

C) $247,795.20

D) $105,689.60

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

8

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Vannesa has a mortgage of $92,000 at for 20 years. Find the total interest.

A) $65,869.78

B) $55,922.85

C) $53,700.25

D) $59,910.40

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Vannesa has a mortgage of $92,000 at for 20 years. Find the total interest.

A) $65,869.78

B) $55,922.85

C) $53,700.25

D) $59,910.40

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

9

A(n) ____________________ is the limit on the amount the interest rate can increase on an ARM.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

10

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

Refer to Narrative in your text 14-1. Find the total interest for a mortgage of $112,500 at 6% for 30 years.

A) $130,500.00

B) $243,000.00

C) $125,876.54

D) $241,393.60

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

Refer to Narrative in your text 14-1. Find the total interest for a mortgage of $112,500 at 6% for 30 years.

A) $130,500.00

B) $243,000.00

C) $125,876.54

D) $241,393.60

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

11

Conventional loans are made by private lenders and generally have a(n) ____________________ interest rate than either FHA or VA loans.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

12

ARM stands for ____________________.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

13

A meeting at which the buyer and seller of real estate conclude all matters pertaining to the transaction is called a(n) ____________________.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

14

A home ____________________ loan is a lump-sum second mortgage loan made on the available equity in a home.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

15

____________________ is the process of paying off a financial obligation in a series of equal regular payments.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

16

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Find the total interest for a mortgage of $96,500 at for 25 years.

A) $99,000.00

B) $103,544.50

C) $125,876.54

D) $241,393.60

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Find the total interest for a mortgage of $96,500 at for 25 years.

A) $99,000.00

B) $103,544.50

C) $125,876.54

D) $241,393.60

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

17

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Ursula has a mortgage of $82,000 at for 25 years. Find the total interest.

A) $73,468.80

B) $87,986.00

C) $81,362.00

D) $101,689.60

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Ursula has a mortgage of $82,000 at for 25 years. Find the total interest.

A) $73,468.80

B) $87,986.00

C) $81,362.00

D) $101,689.60

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

18

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Prepare an amortization schedule for the first 2 payments of a $97,000 mortgage at for 20 years. Find the loan balance after 2 payments.

A) $96,696.87

B) $96,727.92

C) $96,454.98

D) $96,849.50

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Prepare an amortization schedule for the first 2 payments of a $97,000 mortgage at for 20 years. Find the loan balance after 2 payments.

A) $96,696.87

B) $96,727.92

C) $96,454.98

D) $96,849.50

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

19

Mortgage discount ____________________, added to the cost of a mortgage, allow the lender to increase the yield without showing an increase in the mortgage interest rate.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

20

An account used by mortgage lenders for the safekeeping of the funds accumulating to pay next year's property taxes and hazard insurance is called a(n) ____________________ account.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

21

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Amber takes out a $72,000 mortgage at for 25 years. Prepare an amortization schedule for the first 3 months. Find the loan balance after 3 payments.

A) $71,752.22

B) $70,966.67

C) $68,948.27

D) $69,895.36

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Amber takes out a $72,000 mortgage at for 25 years. Prepare an amortization schedule for the first 3 months. Find the loan balance after 3 payments.

A) $71,752.22

B) $70,966.67

C) $68,948.27

D) $69,895.36

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

22

You are purchasing a home for $220,000. The down payment is 30% and the balance will be financed with a 20-year mortgage at 9% and 2 discount points. You put down a deposit of $5,000 (applied to the down payment) when the sales contract was signed. You also have these expenses: credit report, $70; appraisal fee, $110; title insurance premium, 1% of amount financed; title search, $225; and attorney's fees, $600. Find your amount due at the closing.

A) $66,625

B) $78,912

C) $10,314

D) $58,655

A) $66,625

B) $78,912

C) $10,314

D) $58,655

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

23

Lisa bought a home with an adjustable-rate mortgage. The margin on the loan is 4.2% and the rate cap is 5.75% over the life of the loan. If the current index rate is 6.6%, what is the calculated interest rate of the ARM?

A) 9.5%

B) 10.8%

C) 6.75%

D) 12.5%

A) 9.5%

B) 10.8%

C) 6.75%

D) 12.5%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

24

A house is selling for $190,000. A deposit of $10,000 was made when the sales contract was signed. The down payment is 25% and the balance will be financed with a 25-year mortgage at 9% and 3 discount points. If the sellers are responsible for the broker's commission (6% of the purchase price); $1,250 in other closing costs; and the existing mortgage, with a balance of $70,000; what proceeds will they receive on the sale of the property?

A) $118,750

B) $125,380

C) $107,350

D) $94,840

A) $118,750

B) $125,380

C) $107,350

D) $94,840

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

25

A house is selling for $150,000. A deposit of $20,000 was made when the sales contract was signed. The down payment is 30% and the balance will be financed with a 25-year mortgage at 4.25% and 4 discount points. If the sellers are responsible for the broker's commission (6% of the purchase price); $1,300 in other closing costs; and the existing mortgage, with a balance of $40,000; what proceeds will they receive on the sale of the property?

A) $108,700.00

B) $99,700.00

C) $101,000.00

D) $69,450.00

A) $108,700.00

B) $99,700.00

C) $101,000.00

D) $69,450.00

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

26

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Find the monthly PITI Payment for Weezer based on a mortgage of $96,000 at a rate of for 20 years with annual property taxes and hazard insurance premium of $1,750 and $858 respectively.

A) $991.09

B) $849.92

C) $974.75

D) $1,059.59

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Find the monthly PITI Payment for Weezer based on a mortgage of $96,000 at a rate of for 20 years with annual property taxes and hazard insurance premium of $1,750 and $858 respectively.

A) $991.09

B) $849.92

C) $974.75

D) $1,059.59

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

27

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

Refer to Narrative in your text 14-1. You purchase a home for $69,750 at 6.75% for 30 years. The property taxes are $2,450 per year, and the hazard insurance premium is $256 semiannually. Find the monthly PITI payment.

A) $699.51

B) $594.73

C) $1,059.40

D) $246.83

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

Refer to Narrative in your text 14-1. You purchase a home for $69,750 at 6.75% for 30 years. The property taxes are $2,450 per year, and the hazard insurance premium is $256 semiannually. Find the monthly PITI payment.

A) $699.51

B) $594.73

C) $1,059.40

D) $246.83

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

28

You bought a home with an adjustable-rate mortgage. The margin on the loan is 5.4% and the rate cap is 6.25% over the life of the loan. If the current index rate is 7%, what is the calculated interest rate of the ARM?

A) 10.5%

B) 12.4%

C) 11.65%

D) 9.75%

A) 10.5%

B) 12.4%

C) 11.65%

D) 9.75%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

29

You are interested in purchasing a home listed at $120,000. The down payment is 30% and the balance will be financed with a 20-year mortgage at 9% and 3 discount points. You put down a deposit (applied to the down payment) of $15,000 when you signed the sales contract. You also have these expenses: credit report, $80; appraisal fee, $100; title insurance premium, 1% of amount financed; title search, $175; and attorneys fees, $600. Find your amount due at the closing.

A) $22,795.00

B) $24,475.00

C) $25,315.00

D) $10,315.00

A) $22,795.00

B) $24,475.00

C) $25,315.00

D) $10,315.00

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

30

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Lynn has a mortgage of $55,000 at for 20 years. The property taxes are $1,900 per year, and the hazard insurance premium is $780 per year. Find the monthly PITI payment.

A) $641.88

B) $528.33

C) $731.67

D) $495.86

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Lynn has a mortgage of $55,000 at for 20 years. The property taxes are $1,900 per year, and the hazard insurance premium is $780 per year. Find the monthly PITI payment.

A) $641.88

B) $528.33

C) $731.67

D) $495.86

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

31

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Prepare an amortization schedule for Betty after the first payment of a $55,000 mortgage at for 30 years. Find the loan balance after the first payment.

A) $54,972.87

B) $54,855.79

C) $54,782.92

D) $54,390.60

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Prepare an amortization schedule for Betty after the first payment of a $55,000 mortgage at for 30 years. Find the loan balance after the first payment.

A) $54,972.87

B) $54,855.79

C) $54,782.92

D) $54,390.60

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

32

Marjorie bought a home with an adjustable-rate mortgage. The margin on an adjustable-rate mortgage is 2.5% and the rate cap is 7% over the life of the loan. If the current index rate is 5.9%, what is the calculated interest rate of the ARM?

A) 9.4%

B) 8.4%

C) 10.5%

D) 7%

A) 9.4%

B) 8.4%

C) 10.5%

D) 7%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

33

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Shellie has a mortgage of $56,500 at for 25 years. The property taxes are $350 quarterly, and the hazard insurance premium is $239.50 semiannually. Find the monthly taxes and insurance payment.

A) $358.75

B) $290.79

C) $422.87

D) $156.58

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Shellie has a mortgage of $56,500 at for 25 years. The property taxes are $350 quarterly, and the hazard insurance premium is $239.50 semiannually. Find the monthly taxes and insurance payment.

A) $358.75

B) $290.79

C) $422.87

D) $156.58

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

34

Marta purchased a home with an adjustable rate mortgage. The margin on an adjustable-rate mortgage is 5.5% and the rate cap is 6.5% over the life of the loan. If the current index rate is 8.9%, find the maximum overall rate of the loan.

A) 19.7%

B) 18.5%

C) 19.2%

D) 20.9%

A) 19.7%

B) 18.5%

C) 19.2%

D) 20.9%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

35

The margin on an adjustable-rate mortgage is 5.5% and the rate cap is 6.55% over the life of the loan. If the current index rate is 6.25%, what is the calculated interest rate of the ARM?

A) 11.0%

B) 11.75%

C) 9.25%

D) 12.2%

A) 11.0%

B) 11.75%

C) 9.25%

D) 12.2%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

36

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

Refer to Narrative in your text 14-1. Garrison takes out a $62,500 mortgage at 6% for 15 years. Prepare an amortization schedule for the first 3 months. Find the loan balance after 3 payments.

A) $61,851.77

B) $61,872.89

C) $61,936.76

D) $62,003.24

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

Refer to Narrative in your text 14-1. Garrison takes out a $62,500 mortgage at 6% for 15 years. Prepare an amortization schedule for the first 3 months. Find the loan balance after 3 payments.

A) $61,851.77

B) $61,872.89

C) $61,936.76

D) $62,003.24

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

37

Fredrick bought a home with an adjustable-rate mortgage. The margin on an adjustable-rate mortgage is 3.5% and the rate cap is 5.25% over the life of the loan. If the current index rate is 7.9%, what is the calculated interest rate of the ARM?

A) 11.4%

B) 9.9%

C) 11.5%

D) 8.6%

A) 11.4%

B) 9.9%

C) 11.5%

D) 8.6%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

38

Narrative 14-1

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Tanyarita has a mortgage of $67,500 at for 20 years. The property taxes are $2,900 semiannually, and the hazard insurance premium is $150 quarterly. Find the monthly taxes and insurance payment.

A) $725.11

B) $383.42

C) $425.00

D) $533.33

For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, when necessary.

-Refer to Narrative in your text 14-1. Tanyarita has a mortgage of $67,500 at for 20 years. The property taxes are $2,900 semiannually, and the hazard insurance premium is $150 quarterly. Find the monthly taxes and insurance payment.

A) $725.11

B) $383.42

C) $425.00

D) $533.33

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

39

You are purchasing a home for $340,000. The down payment is 25% and the balance will be financed with a 25-year mortgage at 8% and 1 discount points. You put down a deposit of $10,000 (applied to the down payment) when the sales contract was signed. You also have these expenses: credit report, $80; appraisal fee, $140; title insurance premium, 1% of amount financed; title search, $300; and attorney's fees, $850. Find your amount due at the closing.

A) $340,000

B) $81,470

C) $81,170

D) $57,655

A) $340,000

B) $81,470

C) $81,170

D) $57,655

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

40

Scott is purchasing a home for $220,000. The down payment is 30% and the balance will be financed with a 15-year mortgage at 8% and 4 discount points. Scott made a deposit of $10,000 when the sales contract was signed. If the sellers are responsible for the broker's commission (6% for the purchase price); $1,250 in other closing costs; and the existing mortgage, with a balance of $55,000; what proceeds will they receive on the sale of the property?

A) $150,550.00

B) $163,750.00

C) $151,800.00

D) $69,450.00

A) $150,550.00

B) $163,750.00

C) $151,800.00

D) $69,450.00

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

41

Suppose you earn a gross income of $2,580 per month and apply for a mortgage with a monthly PITI of $830.76. You have other financial obligations totaling $118.68 per month. If the lending ratio guidelines are as given in the table below, what type of mortgage, if any, would you qualify for?

A) Both FHA and Conventional

B) Conventional only

C) Neither FHA nor Conventional

D) FHA only

A) Both FHA and Conventional

B) Conventional only

C) Neither FHA nor Conventional

D) FHA only

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

42

Using Table 14-1 from your text, calculate the required information for the following mortgage, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

43

Yara owns a home that was recently appraised for $189,000. The balance on the existing mortgage is $84,450. If Yara's bank is willing to loan up to 75% of the appraised value, find the potential amount of credit available on a home equity loan.

A) $55,682

B) $48,395

C) $56,124

D) $57,300

A) $55,682

B) $48,395

C) $56,124

D) $57,300

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

44

Carlos owns a home that was recently appraised for $132,000. The balance on the existing mortgage is $73,700. If Carlos's bank is willing to loan up to 75% of the appraised value, find the potential amount of credit available on a home equity loan.

A) $69,300.00

B) $133,000.00

C) $25,300.00

D) $52,700.00

A) $69,300.00

B) $133,000.00

C) $25,300.00

D) $52,700.00

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

45

A mortgage applicant who has a monthly gross income of $2,780 applies for a mortgage with a monthly PITI of $689.44. The applicant's other financial obligations total $405.88 per month. If the lending ratio guidelines are as given in the table below, what type of mortgage, if any, would the applicant qualify for?

A) Neither FHA nor Conventional

B) Both FHA and Conventional

C) FHA only

D) Conventional only

A) Neither FHA nor Conventional

B) Both FHA and Conventional

C) FHA only

D) Conventional only

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

46

Your home was recently appraised for $179,000. The balance on your existing mortgage is $115,050. If your bank is willing to loan up to 70% of the appraised value, what is the potential amount of credit available on a home equity loan?

A) $125,300.00

B) $240,335.00

C) $53,700.00

D) $10,250.00

A) $125,300.00

B) $240,335.00

C) $53,700.00

D) $10,250.00

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

47

Using Table 14-1 from your text, calculate the required information for the following mortgage, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

48

You bought a home with an adjustable-rate mortgage. The margin on the loan is 4.3% and the rate cap is 5.75% over the life of the loan. If the current index rate is 7.25%, what is the calculated interest rate of the ARM?

A) 10.5%

B) 11.75%

C) 11.55%

D) 9.55%

A) 10.5%

B) 11.75%

C) 11.55%

D) 9.55%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

49

Using Table 14-1 from your text, calculate the required information for the following mortgage, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

50

Calculate the monthly principal and interest (PI), using Table 14-1 from your text, and the monthly PITI for the following mortgage, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

51

Erin Casey purchased a home with a $90,000 mortgage at 9 1/2% for 30 years. Calculate the monthly payment and prepare an amortization schedule for the first four months of Erin's loan.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

52

Calculate the monthly principal and interest (PI), using Table 14-1 from your text, and the monthly PITI for the following mortgage, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

53

Suppose you earn a gross income of $2,730 per month and apply for a mortgage with a monthly PITI of $510.51. You have other financial obligations totaling $431.34 per month. (Use the ratio guidelines from your text) What type of mortgage, if any, would you qualify for?

A) FHA only

B) FHA and Conventional

C) Conventional only

D) None

A) FHA only

B) FHA and Conventional

C) Conventional only

D) None

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

54

A mortgage applicant who has a monthly gross income of $4,770 applies for a mortgage with monthly PITI of $1,669.50. The applicant's other financial obligations total $281.43 per month. (Use the ratio guidelines from your text) What type of mortgage, if any, would the applicant qualify for?

A) FHA only

B) none

C) Conventional only

D) FHA and Conventional

A) FHA only

B) none

C) Conventional only

D) FHA and Conventional

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

55

Calculate the monthly principal and interest (PI), using Table 14-1 from your text, and the monthly PITI for the following mortgage, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

56

Using Table 14-1 from your text, calculate the required information for the following mortgage, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

57

Using Table 14-1 from your text, calculate the required information for the following mortgage, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

58

Evelynn has a home that was recently appraised for $127,000, and the balance on the existing mortgage is $88,350. If a bank is willing to loan up to 75% of the appraised value, calculate the potential amount of credit available on a home equity loan.

A) $2,550.00

B) $8,650.00

C) $6,900.00

D) $70,900.00

A) $2,550.00

B) $8,650.00

C) $6,900.00

D) $70,900.00

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

59

Calculate the monthly principal and interest (PI), using Table 14-1 from your text, and the monthly PITI for the following mortgage, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

60

Lucerne earns a gross income of $5,500 per month and applies for a mortgage with a monthly PITI of $1,244. Lucerne has other financial obligations totaling $829 per month. (Use the ratio guidelines from your text) What type of mortgage, if any, would Lucerne qualify for?

A) FHA only

B) FHA and Conventional

C) Conventional only

D) None

A) FHA only

B) FHA and Conventional

C) Conventional only

D) None

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

61

For the following mortgage application, calculate the housing expense ratio and the total expense ratio, rounding to the nearest tenth of a percent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

62

For the following mortgage application, calculate the housing expense ratio and the total expense ratio, rounding to the nearest tenth of a percent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

63

Calculate the monthly principal and interest (PI), using Table 14-1 from your text, and the monthly PITI for the following mortgage, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

64

For the following second mortgage application, calculate the percentage of appraised value and the potential credit:

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

65

Narrative 14-2

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. Daniel Scher is financing an $86,200 mortgage at . He can finance for 20 years or 25 years. How much less will his monthly payment be if he chooses the 25 year mortgage?

. He can finance for 20 years or 25 years. How much less will his monthly payment be if he chooses the 25 year mortgage?

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. Daniel Scher is financing an $86,200 mortgage at

. He can finance for 20 years or 25 years. How much less will his monthly payment be if he chooses the 25 year mortgage?

. He can finance for 20 years or 25 years. How much less will his monthly payment be if he chooses the 25 year mortgage?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

66

For the following mortgage application, calculate the housing expense ratio and the total expense ratio, rounding to the nearest tenth of a percent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

67

Narrative 14-2

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. You have a mortgage of $79,000 at 6% for 20 years. Find the monthly payments and the total interest. Calculate total interest for your answer.

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. You have a mortgage of $79,000 at 6% for 20 years. Find the monthly payments and the total interest. Calculate total interest for your answer.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

68

For the following second mortgage application, calculate the percentage of appraised value and the potential credit:

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

69

Narrative 14-2

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. The Coles purchased a home with a mortgage of $105,000 at for 30 years. The mortgage payments are $789.60 per month. What is the amount of total interest on this mortgage?

for 30 years. The mortgage payments are $789.60 per month. What is the amount of total interest on this mortgage?

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. The Coles purchased a home with a mortgage of $105,000 at

for 30 years. The mortgage payments are $789.60 per month. What is the amount of total interest on this mortgage?

for 30 years. The mortgage payments are $789.60 per month. What is the amount of total interest on this mortgage?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

70

For the following mortgage application, calculate the housing expense ratio and the total expense ratio, rounding to the nearest tenth of a percent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

71

For the following mortgage application, calculate the housing expense ratio and the total expense ratio, rounding to the nearest tenth of a percent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

72

For the following second mortgage application, calculate the percentage of appraised value and the potential credit:

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

73

Narrative 14-2

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. Joe and Marcie Kerrigan are buying their first home. They are financing a $55,000 mortgage at for 30 years.

for 30 years.

A)What is their monthly payment?

B)What is the total amount of interest that will be paid on this mortgage?

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. Joe and Marcie Kerrigan are buying their first home. They are financing a $55,000 mortgage at

for 30 years.

for 30 years. A)What is their monthly payment?

B)What is the total amount of interest that will be paid on this mortgage?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

74

For the following second mortgage application, calculate the percentage of appraised value and the potential credit:

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

75

For the following second mortgage application, calculate the percentage of appraised value and the potential credit:

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

76

Narrative 14-2

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. You take out a $87,000 mortgage at 6% for 20 years. Prepare an amortization schedule for the first three months. Enter the loan balance after 3 payments as your answer.

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. You take out a $87,000 mortgage at 6% for 20 years. Prepare an amortization schedule for the first three months. Enter the loan balance after 3 payments as your answer.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

77

For the following second mortgage application, calculate the percentage of appraised value and the potential credit:

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

78

For the following mortgage application, calculate the housing expense ratio and the total expense ratio, rounding to the nearest tenth of a percent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

79

Calculate the monthly principal and interest (PI), using Table 14-1 from your text, and the monthly PITI for the following mortgage, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

80

Narrative 14-2

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. Find the monthly payment on a $96,200 mortgage at for 30 years. (Round to the nearest cent)

for 30 years. (Round to the nearest cent)

For problems in this section, use Table 14-1 from your text to find monthly mortgage payments.

Refer to Narrative in your text 14-2. Find the monthly payment on a $96,200 mortgage at

for 30 years. (Round to the nearest cent)

for 30 years. (Round to the nearest cent)

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck