Deck 13: Consumer and Business Credit

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

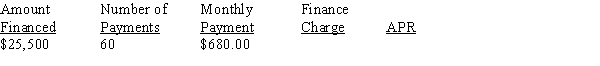

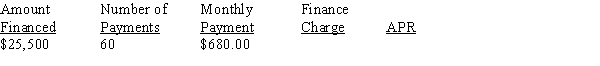

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

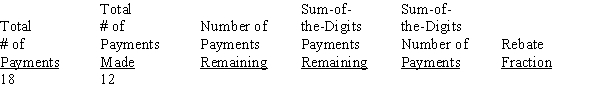

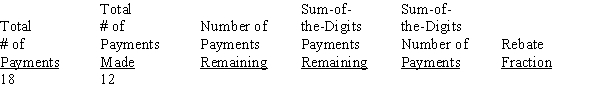

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/128

Play

Full screen (f)

Deck 13: Consumer and Business Credit

1

The ____________________ is the dollar amount that is paid for the credit.

finance charge

2

Loans backed by tangible assets are known as ____________________ loans.

secured

3

A pre-approved amount of open-end credit, based on a borrower's ability to pay, is called a(n) ____________________.

line of credit

4

When installment loans are paid off early, the borrower is entitled to a finance charge ____________________.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

5

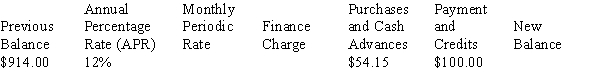

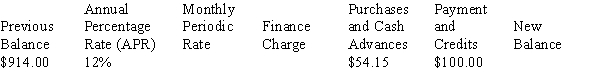

Vanessa has a revolving credit account at an annual percentage rate of 12%. Her previous monthly balance is $427.24. Find the new balance if Vanessa's account showed the following activity. (Use the unpaid balance method)

A) $542.17

B) $482.24

C) $557.96

D) $444.58

A) $542.17

B) $482.24

C) $557.96

D) $444.58

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

6

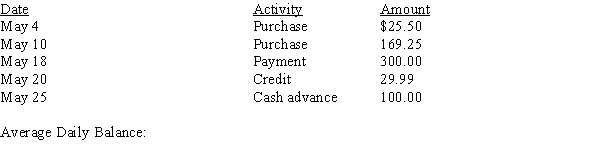

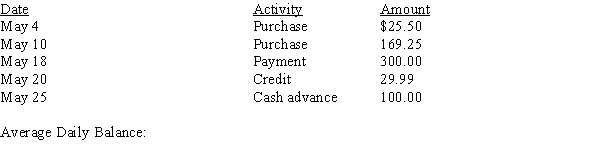

Luigi has a revolving credit account at an annual percentage rate of 15%. Use the average daily balance method to find the new balance given the following activity:

A) $342.36

B) $483.83

C) $271.75

D) $145.96

A) $342.36

B) $483.83

C) $271.75

D) $145.96

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

7

The effective or true interest rate on an installment loan is considerably ____________________ than the simple add-on rate.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

8

The ____________________, also known as the APR, is the effective or true annual interest rate being charged for credit.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

9

Liz has a revolving credit account at an annual percentage rate of 12%. Use the average daily balance method to find the new balance given the following statement of account:

A) $170.41

B) $185.54

C) $446.36

D) $128.35

A) $170.41

B) $185.54

C) $446.36

D) $128.35

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

10

____________________ is the most popular type of open-end credit.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

11

Loans backed by a simple promise to repay are known as ____________________ loans.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

12

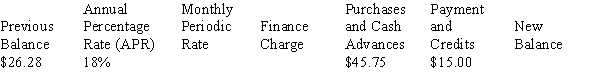

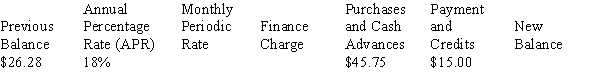

You have a revolving credit account at an annual percentage rate of 18%. Use the average daily balance method to find the new balance given the following statement of account:

A) $177.62

B) $275.84

C) $236.28

D) $178.96

A) $177.62

B) $275.84

C) $236.28

D) $178.96

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

13

Kimberly has a revolving credit account at an annual percentage rate of 15%. Her previous monthly balance is $784.19. Find the new balance if Kimberly's account showed the following activity. (Use the unpaid balance method)

A) $723.92

B) $1,635.07

C) $1,634.16

D) $2,000.00

A) $723.92

B) $1,635.07

C) $1,634.16

D) $2,000.00

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

14

____________________ loans are lump-sum loans whereby the borrower repays the principal plus interest in a specified number of equal monthly payments.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

15

You have a revolving credit account at an annual percentage rate of 18%. Use the average daily balance method to find the new balance given the following statement of account:

A) $295.20

B) $275.84

C) $298.51

D) $182.96

A) $295.20

B) $275.84

C) $298.51

D) $182.96

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

16

Javier has a revolving credit account at an annual percentage rate of 18%. His previous monthly balance is $362.11. Find the new balance if Julio's account showed the following activity. (Use the unpaid balance method)

A) $639.90

B) $596.86

C) $634.16

D) $535.00

A) $639.90

B) $596.86

C) $634.16

D) $535.00

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

17

LeAnna has a revolving credit account at an annual percentage rate of 15%. Her previous monthly balance is $928.26. Find the new balance if LeAnna's account showed the following activity. (Use the unpaid balance method)

A) $911.75

B) $900.15

C) $547.98

D) $212.76

A) $911.75

B) $900.15

C) $547.98

D) $212.76

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

18

Candida has a revolving credit account at an annual percentage rate of 24%. Her previous monthly balance is $549.79. Find the new balance using the previous month's balance method if Candida's account showed the following activity: Payment, $143.30; Country Lumber (charge), $230.18; Zahir Antiques (credit), $398.05; Mountain Vineyards (charge), 204.94; Bart's Garage (charge), $214.21.

A) $449.79

B) $557.77

C) $668.77

D) $499.79

A) $449.79

B) $557.77

C) $668.77

D) $499.79

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

19

The widely accepted method for calculating the finance charge rebate known as the sum-of-the-digits method or the ____________________.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

20

The ____________________ rate is the lending rate at which the largest and most creditworthy corporations borrow money from banks.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

21

Mariann purchases a kitchen set costing $3,480 by taking out an 12% add-on installment loan. The loan requires a 25% down payment and equal monthly payments for 3 years. How much are Mariann's monthly payments?

A) $92.67

B) $98.60

C) $105.33

D) $126.49

A) $92.67

B) $98.60

C) $105.33

D) $126.49

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

22

You take out an installment loan to purchase a sailplane costing $34,100. You make a down payment of $8,600 and finance the balance by making monthly payments of $1,176.72 for 24 months. Use the APR formula to find the APR.

A) 12.52%

B) 8.65%

C) 9.99%

D) 4.15%

A) 12.52%

B) 8.65%

C) 9.99%

D) 4.15%

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

23

Jacob purchases camping equipment at a cost of $3,450 by taking out an 9% add-on installment loan. The loan requires a 10% down payment and equal monthly payments for 2 years. How much are Jacob's monthly payments?

A) $74.89

B) $225.15

C) $152.66

D) $92.44

A) $74.89

B) $225.15

C) $152.66

D) $92.44

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

24

Carlee takes out an installment loan to finance the purchase of a pickup truck costing $34,500. Her loan requires a 33.33% down payment and equal monthly payments of $575 for 28 months. Calculate the total deferred payment price.

A) $24,560.33

B) $25,660.67

C) $26,060.33

D) $27,598.85

A) $24,560.33

B) $25,660.67

C) $26,060.33

D) $27,598.85

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

25

Orestes purchases a patio set costing $2,430 by taking out an 12.5% add-on installment loan. The loan requires a 20% down payment and equal monthly payments for 3 years. How much are Orestes' monthly payments?

A) $82.67

B) $74.25

C) $125.33

D) $96.49

A) $82.67

B) $74.25

C) $125.33

D) $96.49

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

26

Karolyn takes out an installment loan to finance the purchase of a violin costing $14,750. Her loan requires a 10.625% down payment and equal monthly payments of $355 for 48 months. Calculate the total deferred payment price.

A) $22,360.33

B) $15,960.67

C) $21,256.62

D) $18,607.19

A) $22,360.33

B) $15,960.67

C) $21,256.62

D) $18,607.19

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

27

Ravonda purchased a ring costing $30,000 by taking out a 5.5% add-on installment loan. The loan requires a 25% down payment and equally monthly payments for 4 years. How much are her monthly payments?

A) $681.75

B) $695.24

C) $529.52

D) $571.88

A) $681.75

B) $695.24

C) $529.52

D) $571.88

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

28

Adriana wishes to take out an installment loan to finance the purchase of a sailplane costing $51,600. Her loan requires a 30% down payment and equal monthly payments of $1,557.25 for 42 months. What is the amount of the finance charge on this loan?

A) $29,284.50

B) $25,695.27

C) $43,580.64

D) $48,350.00

A) $29,284.50

B) $25,695.27

C) $43,580.64

D) $48,350.00

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

29

Your Office Supply has a $42,500 line of credit that charges an annual percentage rate of prime rate plus 3%. Their starting balance on March 1 was $10,600. On March 5, they borrowed $7,500. On March 14, the business made a payment of $3,300, and on March 18, they borrowed $5,300. If the current prime rate is 9%, what is the new balance?

A) $26,100.00

B) $20,276.10

C) $27,583.43

D) $18,400.29

A) $26,100.00

B) $20,276.10

C) $27,583.43

D) $18,400.29

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

30

Boyd purchases a snow blower costing $1,752 by taking out a 13.5% add-on installment loan. The loan requires a 35% down payment and equal monthly payments for 2 years. How much is the finance charge on this loan?

A) $307.48

B) $425.15

C) $391.04

D) $407.25

A) $307.48

B) $425.15

C) $391.04

D) $407.25

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

31

Sunshine purchased a sports car costing $31,200. She made a down payment of $4,700 and financed the balance with an installment loan for 48 months. If the payments are $688.12 each month, use Table 13-1 from your text to find the APR.

A) 10.75%

B) 9.85%

C) 12.15%

D) 11.25%

A) 10.75%

B) 9.85%

C) 12.15%

D) 11.25%

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

32

You purchase a used sports utility vehicle costing $30,000 by taking out a 9% add-on installment loan. The loan requires a 15% down payment and equal monthly payments for 5 years. How much are your monthly payments?

A) $616.25

B) $695.24

C) $709.52

D) $776.19

A) $616.25

B) $695.24

C) $709.52

D) $776.19

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

33

Alex wishes to take out an installment loan to finance the purchase of a lawn mower costing $715. Her loan requires a 2.75% down payment and equal monthly payments of $125.78 for 9 months. What is the amount of the finance charge on this loan?

A) $425.47

B) $417.02

C) $430.64

D) $436.68

A) $425.47

B) $417.02

C) $430.64

D) $436.68

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

34

You take out an installment loan to purchase a time-share costing $18,000. You make a down payment of $2,700 and finance the balance by making monthly payments of $762 for 24 months. Use Table 13-1 from your text to find the APR.

A) 17.50%

B) 17.75%

C) 18.00%

D) 18.25%

A) 17.50%

B) 17.75%

C) 18.00%

D) 18.25%

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

35

Sammi purchased a used car costing $30,000 by taking out 3.5% add-on loan. The loan requires an 18% down payment and equal monthly payments for 5 years. How much are his monthly payments?

A) $481.75

B) $595.24

C) $629.52

D) $496.19

A) $481.75

B) $595.24

C) $629.52

D) $496.19

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

36

Chase has a $42,500 line of credit which charges an annual percentage rate of prime rate plus 5%. His starting balance on June 1 was $2,550. On June 4, he borrowed $5,300. On June 9, Chris made a payment of $800, and on June 17, he borrowed $5,600. If the current prime rate is 10%, what is his new balance?

A) $12,050.59

B) $12,598.99

C) $12,850.00

D) $12,766.83

A) $12,050.59

B) $12,598.99

C) $12,850.00

D) $12,766.83

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

37

Eddy purchased a club membership costing $2,530. He made a down payment of $530 and financed the balance with an installment loan for 48 months. If the payments are $59.27 each month, use Table 13-1 from your text to find the APR.

A) 19.75%

B) 16.00%

C) 18.50%

D) 17.50%

A) 19.75%

B) 16.00%

C) 18.50%

D) 17.50%

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

38

Grandin wishes to take out an installment loan to finance the purchase of a small antique dining set costing $71,500. Her loan requires a 22.5% down payment and equal payments of $2,557 for 40 months. What is the amount of the finance charge on this loan?

A) $46,867.50

B) $45,695.27

C) $43,580.64

D) $48,350.00

A) $46,867.50

B) $45,695.27

C) $43,580.64

D) $48,350.00

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

39

Ted purchased a speedboat costing $15,800 by taking out an installment loan. He made a down payment of $4,000 and financed the balance for 36 months. If the payments are $383.53 each month, find the APR using Table 13-1.

A) 8.50%

B) 10.00%

C) 10.50%

D) 10.75%

A) 8.50%

B) 10.00%

C) 10.50%

D) 10.75%

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

40

You have a $22,500 line of credit which charges an annual percentage rate of prime rate plus 5%. Your starting balance on April 1 was $6,750. On April 5, you made a payment of $2,500. On April 14, you borrowed $5,100, and on April 17, you borrowed $3,800. If the current prime rate is 8%, what is your new balance?

A) $15,885.12

B) $13,250.17

C) $13,150.14

D) $14,699.54

A) $15,885.12

B) $13,250.17

C) $13,150.14

D) $14,699.54

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

41

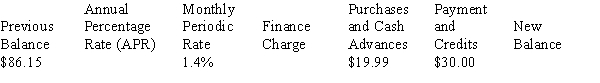

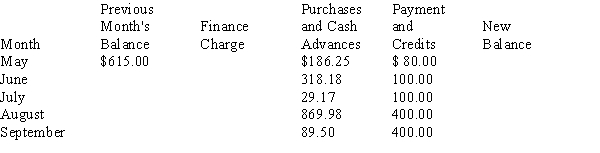

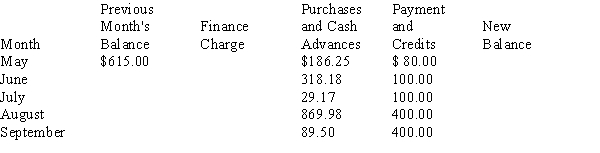

Calculate the missing information on the following revolving charge account. Interest is calculated on the unpaid or previous month's balance, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

42

Franki finances a motor home for $44,300 by taking out an installment loan for 36 months. The payments were $1,784.31 per month and the total finance charge was $19,935.16. After 21 months, Franki decided to pay off the loan. After calculating the finance charge rebate, find the loan payoff amount.

A) $22,490.17

B) $23,897.36

C) $22,417.77

D) $23,172.73

A) $22,490.17

B) $23,897.36

C) $22,417.77

D) $23,172.73

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

43

A finance company offers a 24-month installment loan with an APR of 13.5%. Robert wishes to use the loan to finance a delivery truck for $31,200. After using Table 13-1 from your text to find the finance charge, calculate the monthly payment.

A) $612.11

B) $1,475.50

C) $1,490.58

D) $1,651.00

A) $612.11

B) $1,475.50

C) $1,490.58

D) $1,651.00

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

44

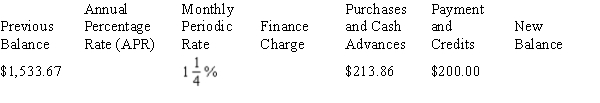

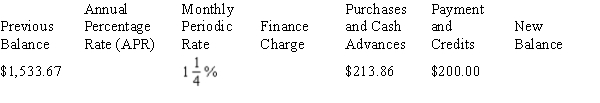

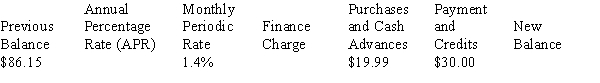

Calculate the missing information on the following revolving charge account. Interest is calculated on the unpaid or previous month's balance, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

45

Calculate the missing information on the following revolving charge account. Interest is calculated on the unpaid or previous month's balance, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

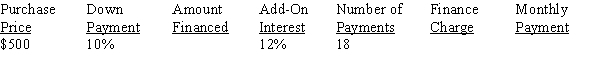

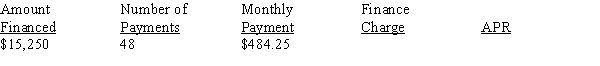

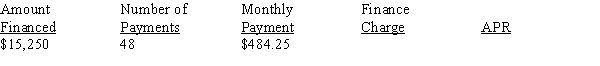

46

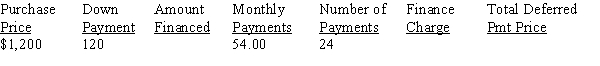

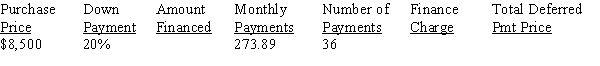

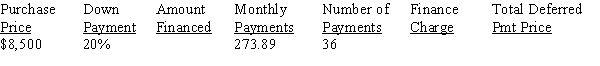

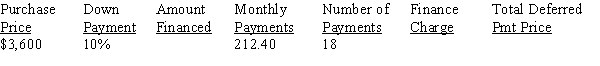

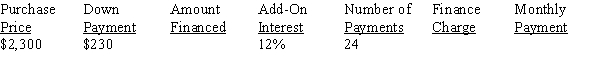

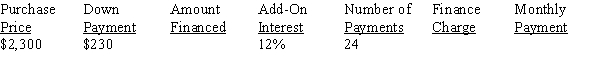

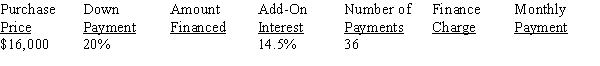

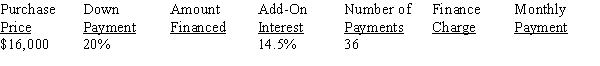

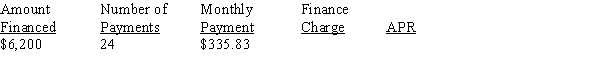

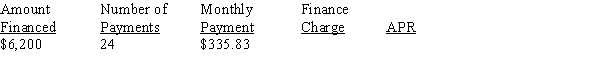

Calculate the amount financed, the finance charge, and the total deferred payment price for the following installment loan, rounding dollars to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

47

You wish to finance the purchase of a boat home for $38,600. A finance company offers an APR of 10% on a 24-month installment loan. After using Table 13-1 from your text to find the finance charge, calculate the monthly payment.

A) $1,781.23

B) $1,619.08

C) $1,769.17

D) $1,608.33

A) $1,781.23

B) $1,619.08

C) $1,769.17

D) $1,608.33

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

48

You wish to finance the purchase of some living room furniture for $3,800. A bank offers an APR of 16.75% on a 36-month installment loan. After first using Table 13-1 from your text to find the finance charge, calculate your monthly payment.

A) $105.56

B) $135.01

C) $123.10

D) $149.10

A) $105.56

B) $135.01

C) $123.10

D) $149.10

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

49

Suppose you take out a 60-month installment loan to finance one year of tuition for $13,100. The payments are $327.50 per month and the total finance charge is $6,550. After 24 months, you decide to pay off the loan. After calculating the finance charge rebate, find your loan payoff, using the "Rule-of-78."

A) $7,623.77

B) $9,406.23

C) $5,476.23

D) $11,790.00

A) $7,623.77

B) $9,406.23

C) $5,476.23

D) $11,790.00

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

50

A finance company offers a 36-month installment loan with an APR of 10.5%. Jerry wishes to use the loan to finance an engagement ring for $21,500. After first using Table 13-1 from your text to find the finance charge, calculate the monthly payment.

A) $698.81

B) $785.35

C) $659.93

D) $597.22

A) $698.81

B) $785.35

C) $659.93

D) $597.22

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

51

Andonia Hellas has a revolving charge account. The finance charge is calculated on the previous month's balance, and the annual percentage rate is 21%. Complete the 5-month account activity table for Andonia, rounding to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

52

Calculate the missing information on the following revolving charge account. Interest is calculated on the unpaid or previous month's balance, rounding to the nearest cent.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

53

Calculate the average daily balance for the month of May of an account with a previous month's balance of $950.00 and the activity below. Assume a 31-day cycle.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

54

Marisol finances a sports car for $27,100 by taking out an installment loan for 36 months. The payments were $978.61 per month and the total finance charge was $8,129.96. After 22 months, Marisol decided to pay off the loan. After calculating the finance charge rebate, find her loan payoff amount.

A) $13,700.54

B) $12,418.79

C) $12,995.85

D) $14,862.23

A) $13,700.54

B) $12,418.79

C) $12,995.85

D) $14,862.23

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

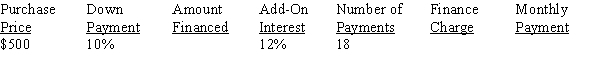

55

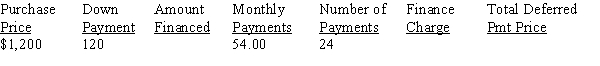

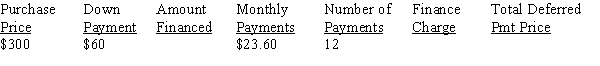

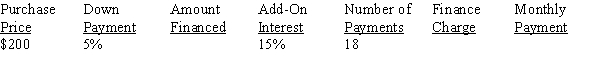

Calculate the amount financed, the finance charge, and the total deferred payment price for the following installment loan, rounding dollars to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

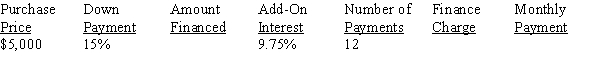

56

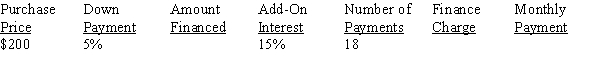

Calculate the amount financed, the finance charge, and the total deferred payment price for the following installment loan, rounding dollars to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

57

May finances a refrigerator for $1,250 by taking out an installment loan for 48 months. The payments are $38.54 per month and the total finance charge is $599.92. After 30 months, May decided to pay off the loan. After calculating the finance charge rebate (using the "Rule-of-78"), find her loan payoff.

A) $896.96

B) $606.49

C) $425.04

D) $824.96

A) $896.96

B) $606.49

C) $425.04

D) $824.96

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

58

Scott finances a Jet Ski for $4,600 by taking out an installment loan for 48 months. The payments are $153.33 per month and the total finance charge is $2,759.84. After 36 months, Scott decided to pay off the loan. After calculating the finance charge rebate (using the "Rule-of-78"), find his loan payoff.

A) $276.99

B) $1,562.97

C) $1,839.96

D) $1,656.91

A) $276.99

B) $1,562.97

C) $1,839.96

D) $1,656.91

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

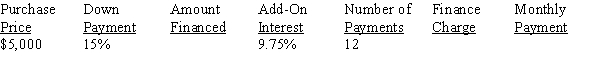

59

Calculate the amount financed, the finance charge, and the total deferred payment price for the following installment loan, rounding dollars to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

60

A bank offers a 24-month installment loan with an APR of 10.5%. Martha wishes to use the loan to finance a sofa for $1,000. After using Table 13-1 from your text to find the finance charge, calculate the monthly payment.

A) $46.38

B) $41.67

C) $52.97

D) $46.04

A) $46.38

B) $41.67

C) $52.97

D) $46.04

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

61

Calculate the amount financed, finance charge, and the amount of the monthly payments for the following add-on interest loan, rounding dollars to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

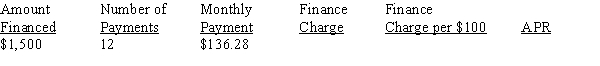

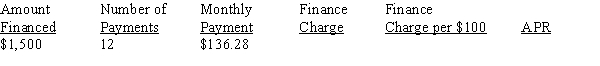

62

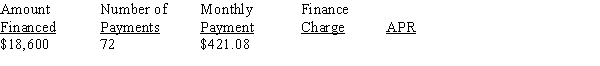

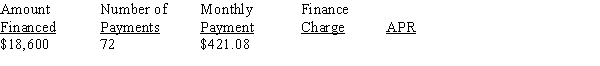

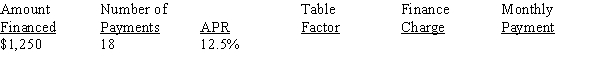

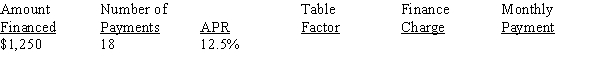

Calculate the annual percentage rate for the following installment loan using the APR formula, rounding dollars to the nearest cent and percents to the nearest hundredth.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

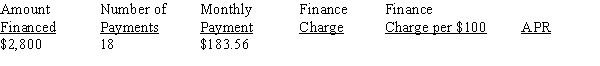

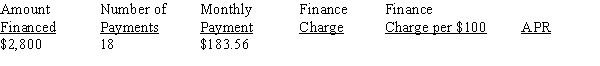

63

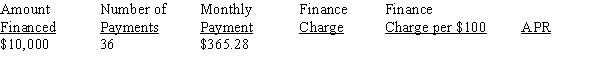

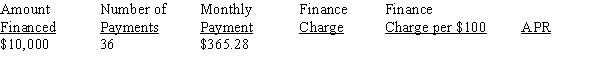

Calculate the finance charge, the finance charge per $100, and the annual percentage rate for the following installment loan using the APR tables, Table 13-1 from your text (round dollars to the nearest cent).

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

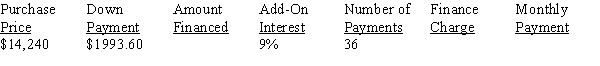

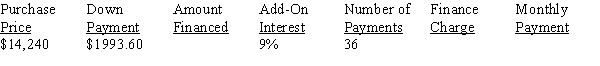

64

Calculate the amount financed, finance charge, and the amount of the monthly payments for the following add-on interest loan, rounding dollars to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

65

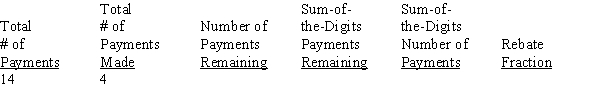

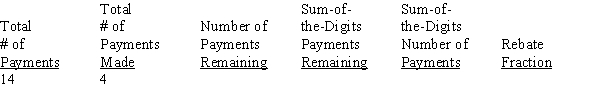

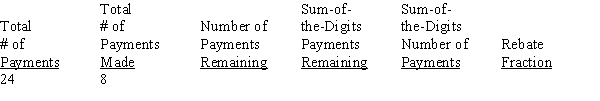

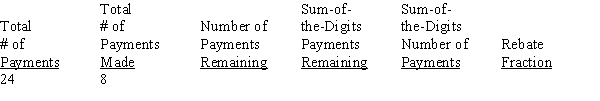

For the following installment loan being paid off early, calculate the required information.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

66

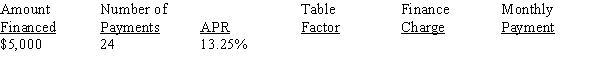

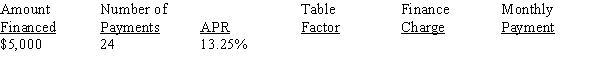

Calculate the finance charge, the finance charge per $100, and the annual percentage rate for the following installment loan using the APR tables, Table 13-1 from your text (round dollars to the nearest cent).

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

67

Calculate the amount financed, finance charge, and the amount of the monthly payments for the following add-on interest loan, rounding dollars to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

68

Calculate the amount financed, finance charge, and the amount of the monthly payments for the following add-on interest loan, rounding dollars to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

69

Calculate the amount financed, finance charge, and the amount of the monthly payments for the following add-on interest loan, rounding dollars to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

70

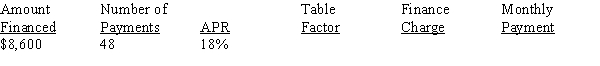

Calculate the finance charge and monthly payment for the following loan using the APR tables, Table 13-1 from your text, rounding dollars to the nearest cent.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

71

Calculate the annual percentage rate for the following installment loan using the APR formula, rounding dollars to the nearest cent and percents to the nearest hundredth.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

72

Calculate the finance charge, the finance charge per $100, and the annual percentage rate for the following installment loan using the APR tables, Table 13-1 from your text (round dollars to the nearest cent).

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

73

For the following installment loan being paid off early, calculate the required information.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

74

Calculate the annual percentage rate for the following installment loan using the APR formula, rounding dollars to the nearest cent and percents to the nearest hundredth.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

75

Calculate the finance charge and monthly payment for the following loan using the APR tables, Table 13-1 from your text, rounding dollars to the nearest cent.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

76

Calculate the amount financed, finance charge, and the amount of the monthly payments for the following add-on interest loan, rounding dollars to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

77

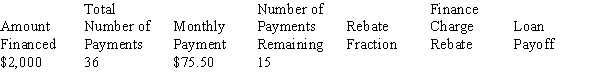

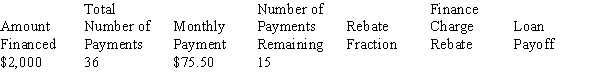

The following installment loan is being paid off early. Calculate the rebate fraction, the finance charge rebate, and the loan payoff for the loan, rounding dollars to the nearest cent:

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

78

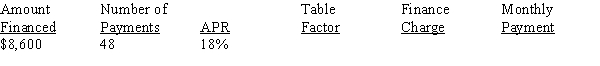

Calculate the finance charge and monthly payment for the following loan using the APR tables, Table 13-1 from your text, rounding dollars to the nearest cent.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

79

Calculate the annual percentage rate for the following installment loan using the APR formula, rounding dollars to the nearest cent and percents to the nearest hundredth.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

80

For the following installment loan being paid off early, calculate the required information.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck