Deck 13: Risk, cost of Capital, and Valuation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/72

Play

Full screen (f)

Deck 13: Risk, cost of Capital, and Valuation

1

If a firm increases its use of both operating and financial leverage,then you should expect the firm's:

A)asset beta to exceed its equity beta.

B)beta of debt to exceed 1.0.

C)beta to remain constant as the increased operating leverage will offset the increased financial leverage.

D)equity beta to increase.

E)debt beta to exceed its equity beta.

A)asset beta to exceed its equity beta.

B)beta of debt to exceed 1.0.

C)beta to remain constant as the increased operating leverage will offset the increased financial leverage.

D)equity beta to increase.

E)debt beta to exceed its equity beta.

equity beta to increase.

2

Which one of these statements is correct concerning the CAPM?

A)The CAPM is the only available method for determining an appropriate discount rate for a proposed project.

B)The market rate of return is most commonly based on the forecasted return on the market for the next 5-year period.

C)CAPM is used quite frequently by firms in their capital budgeting process.

D)The expected return on the 30-year U.S.Treasury bond is the most commonly used as the risk-free rate of return.

E)An increase in the risk-free rate combined with a beta greater than 1.0 increases the discount rate computed using the CAPM.

A)The CAPM is the only available method for determining an appropriate discount rate for a proposed project.

B)The market rate of return is most commonly based on the forecasted return on the market for the next 5-year period.

C)CAPM is used quite frequently by firms in their capital budgeting process.

D)The expected return on the 30-year U.S.Treasury bond is the most commonly used as the risk-free rate of return.

E)An increase in the risk-free rate combined with a beta greater than 1.0 increases the discount rate computed using the CAPM.

CAPM is used quite frequently by firms in their capital budgeting process.

3

A firm with high operating leverage has:

A)low fixed costs in its production process.

B)high variable costs in its production process.

C)high fixed costs in its production process.

D)high total costs per unit.

E)low total costs per unit.

A)low fixed costs in its production process.

B)high variable costs in its production process.

C)high fixed costs in its production process.

D)high total costs per unit.

E)low total costs per unit.

high fixed costs in its production process.

4

Which one of these statements related to beta is correct?

A)Firm betas have less error than industry betas.

B)Firms should always rely on their own beta rather than their industry's beta.

C)Beta is unaffected by a firm's capital structure.

D)The sample size used to compute beta may be too small to yield a reliable result.

E)Firm betas rarely vary over time.

A)Firm betas have less error than industry betas.

B)Firms should always rely on their own beta rather than their industry's beta.

C)Beta is unaffected by a firm's capital structure.

D)The sample size used to compute beta may be too small to yield a reliable result.

E)Firm betas rarely vary over time.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

5

The cost of capital used to compute the present value of a project should be the rate that can be earned on:

A)the overall market portfolio.

B)the sponsoring firm's return on assets.

C)a financial asset of comparable risk.

D)a riskless asset with a similar life span.

E)the sponsoring firm's return on equity.

A)the overall market portfolio.

B)the sponsoring firm's return on assets.

C)a financial asset of comparable risk.

D)a riskless asset with a similar life span.

E)the sponsoring firm's return on equity.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

6

Assume you plot the monthly returns for a stock and also for the S&P 500.Using regression analysis,the straight line through these points that is developed by the analysis is referred to as the ________ which has a slope of ________ and an intercept of ________.

A)security market line; alpha; gamma

B)characteristic line; beta; alpha

C)characteristic line; alpha; beta

D)security market line; beta; gamma

E)characteristic line; gamma; alpha

A)security market line; alpha; gamma

B)characteristic line; beta; alpha

C)characteristic line; alpha; beta

D)security market line; beta; gamma

E)characteristic line; gamma; alpha

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

7

The beta of debt is commonly considered to be:

A)equal to the market beta.

B)one-half of the equity beta.

C)equal to the asset beta.

D)zero.

E)one.

A)equal to the market beta.

B)one-half of the equity beta.

C)equal to the asset beta.

D)zero.

E)one.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

8

A project with the same level of risk as an all-equity firm should be accepted if the project's:

A)internal rate of return exceeds the firm's cost of equity capital.

B)expected rate of return exceeds the market rate of return.

C)anticipated rate of return exceeds the firm's return on assets.

D)internal rate of return is positive given this level of risk.

E)expected rate of return exceeds the risk-free rate.

A)internal rate of return exceeds the firm's cost of equity capital.

B)expected rate of return exceeds the market rate of return.

C)anticipated rate of return exceeds the firm's return on assets.

D)internal rate of return is positive given this level of risk.

E)expected rate of return exceeds the risk-free rate.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

9

Companies will generally have a ________ beta if their:

A)low; stock price is relatively low.

B)high; sales are highly dependent on the market cycle.

C)high; sales are growing at a steady rate of increase.

D)high; sales are high compared to other firms in their industry.

E)low; production costs are primarily fixed in nature.

A)low; stock price is relatively low.

B)high; sales are highly dependent on the market cycle.

C)high; sales are growing at a steady rate of increase.

D)high; sales are high compared to other firms in their industry.

E)low; production costs are primarily fixed in nature.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

10

If the CAPM is used to estimate the cost of equity capital,the expected excess market return is equal to the:

A)return on the stock minus the risk-free rate.

B)return on the market minus the risk-free rate.

C)beta times the market risk premium.

D)beta times the risk-free rate.

E)market rate of return.

A)return on the stock minus the risk-free rate.

B)return on the market minus the risk-free rate.

C)beta times the market risk premium.

D)beta times the risk-free rate.

E)market rate of return.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

11

Assume LK Metals is similar to its industry with one exception; it has low fixed costs relative to all other firms in that industry.Given this,you should expect LK Metals to have:

A)a lower beta than its industry.

B)the same beta as the industry but a lower beta than the other firms in the industry.

C)a higher beta than its industry.

D)a higher beta than the industry and all the firms within that industry.

E)the same beta as the industry but a higher beta than the other firms in the industry.

A)a lower beta than its industry.

B)the same beta as the industry but a lower beta than the other firms in the industry.

C)a higher beta than its industry.

D)a higher beta than the industry and all the firms within that industry.

E)the same beta as the industry but a higher beta than the other firms in the industry.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

12

The beta of a firm is more likely to be high under which two conditions?

A)High cyclical business activity and low operating leverage

B)High cyclical business activity and high operating leverage

C)Low cyclical business activity and low financial leverage

D)Low cyclical business activity and low operating leverage

E)Low financial leverage and low operating leverage

A)High cyclical business activity and low operating leverage

B)High cyclical business activity and high operating leverage

C)Low cyclical business activity and low financial leverage

D)Low cyclical business activity and low operating leverage

E)Low financial leverage and low operating leverage

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

13

A firm with cyclical earnings is characterized by:

A)revenue patterns that vary with the business cycle.

B)high levels of debt in its capital structure.

C)high fixed costs.

D)high costs per unit.

E)low contribution margins.

A)revenue patterns that vary with the business cycle.

B)high levels of debt in its capital structure.

C)high fixed costs.

D)high costs per unit.

E)low contribution margins.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

14

For a levered firm the equity beta is ________ the asset beta.

A)greater than

B)less than

C)equal to

D)sometimes greater than and sometimes less than

E)unrelated to

A)greater than

B)less than

C)equal to

D)sometimes greater than and sometimes less than

E)unrelated to

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

15

The use of leverage:

A)increases both the asset and the equity betas.

B)decreases both the asset and the equity betas.

C)decreases the equity beta and increases the asset beta.

D)increases the equity beta but does not affect the asset beta.

E)decreases the equity beta but does not affect the asset beta.

A)increases both the asset and the equity betas.

B)decreases both the asset and the equity betas.

C)decreases the equity beta and increases the asset beta.

D)increases the equity beta but does not affect the asset beta.

E)decreases the equity beta but does not affect the asset beta.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

16

The issuance of stock to fund a project tends to:

A)have no effect on the previous shareholders.

B)create costless benefits for the firm.

C)cause any potential gains to the firm from the project to be lost.

D)affect future dividends but not the appreciation realized by previous shareholders.

E)dilute the capital gains that would have been earned by the previous shareholders.

A)have no effect on the previous shareholders.

B)create costless benefits for the firm.

C)cause any potential gains to the firm from the project to be lost.

D)affect future dividends but not the appreciation realized by previous shareholders.

E)dilute the capital gains that would have been earned by the previous shareholders.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

17

Comparing two otherwise equivalent firms,the beta of the common stock of the levered firm is ________ the beta of the common stock of the unlevered firm.

A)roughly equivalent to

B)significantly less than

C)slightly less than

D)greater than

E)equal to

A)roughly equivalent to

B)significantly less than

C)slightly less than

D)greater than

E)equal to

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

18

When estimating the cost of equity using the DDM,the factor that is the most apt to add error to this estimate is the:

A)value of the last dividend.

B)firm's tax rate.

C)historical beta.

D)dividend growth rate.

E)current stock price.

A)value of the last dividend.

B)firm's tax rate.

C)historical beta.

D)dividend growth rate.

E)current stock price.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

19

An industry is likely to have a low beta if the:

A)stream of revenues within that industry is less volatile than the market.

B)economy is in a recessionary period.

C)market for its goods is highly affected by the market cycle.

D)number of firms within the industry is fairly constant.

E)industry tends to use a lot of debt financing.

A)stream of revenues within that industry is less volatile than the market.

B)economy is in a recessionary period.

C)market for its goods is highly affected by the market cycle.

D)number of firms within the industry is fairly constant.

E)industry tends to use a lot of debt financing.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

20

The beta of a security is calculated as: (________ of a security's return with the return on the market portfolio/________).

A)Variance; Covariance of the market return

B)Covariance; Variance of the market return

C)Covariance; Standard deviation of the market return

D)Variance; Covariance of the security return

E)Covariance; Variance of the security return

A)Variance; Covariance of the market return

B)Covariance; Variance of the market return

C)Covariance; Standard deviation of the market return

D)Variance; Covariance of the security return

E)Covariance; Variance of the security return

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

21

The discount rate applied to an individual project should be based on the:

A)sources of funding for that project.

B)risks associated with the project's cash flows.

C)sponsoring firm's average level of risk.

D)expertise of the project's managers.

E)size and duration of the project's life.

A)sources of funding for that project.

B)risks associated with the project's cash flows.

C)sponsoring firm's average level of risk.

D)expertise of the project's managers.

E)size and duration of the project's life.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

22

When computing the weighted average cost of capital,which of these are adjusted for taxes?

A)Cost of equity

B)Cost of preferred stock

C)Both the cost of equity and the cost of preferred stock

D)The costs of debt and preferred stock

E)Cost of debt

A)Cost of equity

B)Cost of preferred stock

C)Both the cost of equity and the cost of preferred stock

D)The costs of debt and preferred stock

E)Cost of debt

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

23

When valuing a firm financed with debt and equity,the individual cash flows should be discounted using:

A)the market rate of return.

B)the average of the DDM and CAPM costs of equity.

C)(1 + WACC)T.

D)(1 + CAPM)T.

E)(r − g).

A)the market rate of return.

B)the average of the DDM and CAPM costs of equity.

C)(1 + WACC)T.

D)(1 + CAPM)T.

E)(r − g).

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

24

Which one of these is a correct means of calculating an expected rate of growth?

A)ROA × Dividend payout ratio

B)ROE × Profit margin

C)ROA × Retention ratio

D)ROA × Profit margin

E)ROE × Retention ratio

A)ROA × Dividend payout ratio

B)ROE × Profit margin

C)ROA × Retention ratio

D)ROA × Profit margin

E)ROE × Retention ratio

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

25

The terminal value of a firm is also commonly referred to as the:

A)final value.

B)cash value.

C)non-constant value.

D)estimated value.

E)horizon value.

A)final value.

B)cash value.

C)non-constant value.

D)estimated value.

E)horizon value.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

26

The weighted average cost of capital for a firm is the:

A)discount rate which the firm should apply to all the projects it undertakes.

B)overall rate which the firm must earn on its existing assets to maintain the value of its stock.

C)rate the firm should expect to pay on its next bond issue.

D)maximum rate which the firm should require on any projects it undertakes.

E)rate of return that the firm's preferred stockholders should expect to earn over the long term.

A)discount rate which the firm should apply to all the projects it undertakes.

B)overall rate which the firm must earn on its existing assets to maintain the value of its stock.

C)rate the firm should expect to pay on its next bond issue.

D)maximum rate which the firm should require on any projects it undertakes.

E)rate of return that the firm's preferred stockholders should expect to earn over the long term.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

27

If a firm applies its overall firm's beta to projects with varying levels of risk,the firm will tend to:

A)reject the riskiest projects.

B)accept all low-risk projects.

C)accept only projects of equal risk to its current operations.

D)remain at its current level of overall risk.

E)become riskier over time.

A)reject the riskiest projects.

B)accept all low-risk projects.

C)accept only projects of equal risk to its current operations.

D)remain at its current level of overall risk.

E)become riskier over time.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

28

The CAPM has an advantage over DDM because the CAPM:

A)explicitly adjusts for risk.

B)applies to firms that pay dividends.

C)has no measurement risk.

D)specifically considers a firm's rate of growth.

E)ignores changes in the overall market over time.

A)explicitly adjusts for risk.

B)applies to firms that pay dividends.

C)has no measurement risk.

D)specifically considers a firm's rate of growth.

E)ignores changes in the overall market over time.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

29

A firm's WACC can be correctly used to discount the expected cash flows of a new project when that project will:

A)have the same level of risk as the firm's current operations.

B)be financed solely with new debt and internal equity.

C)be managed by the firm's current managers.

D)be financed based on the firm's current debt-equity ratio.

E)be financed solely with internal equity.

A)have the same level of risk as the firm's current operations.

B)be financed solely with new debt and internal equity.

C)be managed by the firm's current managers.

D)be financed based on the firm's current debt-equity ratio.

E)be financed solely with internal equity.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

30

All else held constant,which one of these is most apt to increase the WACC of a levered firm?

A)An increase in the weight of debt

B)A decrease in a firm's equity beta

C)A decrease in the dividend growth rate

D)A decrease in the tax rate

E)An increase in the risk-free rate when the equity beta exceeds 1.0

A)An increase in the weight of debt

B)A decrease in a firm's equity beta

C)A decrease in the dividend growth rate

D)A decrease in the tax rate

E)An increase in the risk-free rate when the equity beta exceeds 1.0

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

31

Assume a levered firm plans to raise new capital to finance a project.To properly account for the flotation costs,the firm should:

A)subtract the pretax flotation cost from the project's NPV.

B)deduct the amount of the flotation cost from the cash flows for Year 1 of the project.

C)add the percentage of the flotation cost to the WACC when discounting the cash flows.

D)divide the amount of project capital needed by (1 − Weighted average flotation cost).

E)increase the target weights of both debt and equity to account for the flotation percentage.

A)subtract the pretax flotation cost from the project's NPV.

B)deduct the amount of the flotation cost from the cash flows for Year 1 of the project.

C)add the percentage of the flotation cost to the WACC when discounting the cash flows.

D)divide the amount of project capital needed by (1 − Weighted average flotation cost).

E)increase the target weights of both debt and equity to account for the flotation percentage.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

32

Lesco's is evaluating a project that has a different level of risk than the overall firm.This project should be evaluated:

A)using the market beta.

B)using the overall firm's beta.

C)using a beta commensurate with the project's risks.

D)at the market rate of return.

E)at the T-bill rate of return.

A)using the market beta.

B)using the overall firm's beta.

C)using a beta commensurate with the project's risks.

D)at the market rate of return.

E)at the T-bill rate of return.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

33

As of 2018,U.S.tax law limits the tax deduction for interest payments to 30 percent of:

A)EBIT.

B)EBT.

C)net income.

D)net revenue.

E)the total interest paid.

A)EBIT.

B)EBT.

C)net income.

D)net revenue.

E)the total interest paid.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

34

The flotation cost of internal equity is:

A)assumed to be zero.

B)assumed to be the same as the cost of external equity.

C)assigned a cost equal to the aftertax cost of equity.

D)assumed to be the same as the firm's return on equity.

E)assigned a cost equal to the risk-free rate.

A)assumed to be zero.

B)assumed to be the same as the cost of external equity.

C)assigned a cost equal to the aftertax cost of equity.

D)assumed to be the same as the firm's return on equity.

E)assigned a cost equal to the risk-free rate.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

35

The cost of preferred stock:

A)should be adjusted for taxes when computing WACC.

B)is ignored by all firms when computing WACC.

C)is generally calculated using the overall firm's beta.

D)is equal to the stock's dividend yield.

E)is set equal to the pretax cost of debt since it is a fixed income security.

A)should be adjusted for taxes when computing WACC.

B)is ignored by all firms when computing WACC.

C)is generally calculated using the overall firm's beta.

D)is equal to the stock's dividend yield.

E)is set equal to the pretax cost of debt since it is a fixed income security.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

36

Lewis Bros.currently has outstanding debt but has decided to issue additional debt for expansion purposes.The pretax cost of the new debt is best estimated at the ________ of the currently outstanding debt.

A)original yield to maturity

B)current yield to maturity

C)embedded cost

D)current yield

E)coupon rate

A)original yield to maturity

B)current yield to maturity

C)embedded cost

D)current yield

E)coupon rate

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

37

JR's is preparing to start a new project in an industry that differs significantly from its current operations.JR's has searched and found the beta of a firm that is a good fit as a pure play for this new project.Given this good fit,why might JR's assign a higher beta to the project than the beta of the pure play?

A)JR's should assign a project beta that is based on the average of JR's and the pure play firm's betas.

B)The expected project revenues may be less cyclical than those of the pure play firm.

C)JR's may use less debt in its operations than does the pure play firm.

D)The pure play firm has more experience in the new area than JR's does.

E)The project may incur flotation costs so a higher beta is warranted to offset the additional cost.

A)JR's should assign a project beta that is based on the average of JR's and the pure play firm's betas.

B)The expected project revenues may be less cyclical than those of the pure play firm.

C)JR's may use less debt in its operations than does the pure play firm.

D)The pure play firm has more experience in the new area than JR's does.

E)The project may incur flotation costs so a higher beta is warranted to offset the additional cost.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

38

A firm's net cash flow is calculated as:

A)EBIT − Taxes + Depreciation − Capital spending − Increases in net working capital.

B)EBIT + Taxes + Depreciation − Capital spending − Increases in net working capital.

C)EBIT − Taxes − Depreciation − Capital spending + Increases in net working capital.

D)EBIT − Taxes + Depreciation + Capital spending − Increases in net working capital.

E)EBIT + Taxes + Depreciation − Capital spending + Increases in net working capital.

A)EBIT − Taxes + Depreciation − Capital spending − Increases in net working capital.

B)EBIT + Taxes + Depreciation − Capital spending − Increases in net working capital.

C)EBIT − Taxes − Depreciation − Capital spending + Increases in net working capital.

D)EBIT − Taxes + Depreciation + Capital spending − Increases in net working capital.

E)EBIT + Taxes + Depreciation − Capital spending + Increases in net working capital.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

39

When computing WACC,you should use the:

A)pretax cost of debt because most corporations pay taxes at the same tax rate.

B)pretax cost of debt because it is the actual rate the firm is paying its bondholders.

C)current yield because it is based on the current market price of debt.

D)aftertax cost of debt because interest is partially,if not fully,tax deductible.

E)pretax yield to maturity because it considers the current market price of debt.

A)pretax cost of debt because most corporations pay taxes at the same tax rate.

B)pretax cost of debt because it is the actual rate the firm is paying its bondholders.

C)current yield because it is based on the current market price of debt.

D)aftertax cost of debt because interest is partially,if not fully,tax deductible.

E)pretax yield to maturity because it considers the current market price of debt.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

40

When calculating the weighted average flotation cost,the weights should be based on the:

A)mix of debt and equity that will be used to finance the specific project.

B)firm's target capital structure.

C)percentages of internal and external financing that will be used for the project.

D)firm's current mix of debt and equity.

E)average amounts of external capital raised during the past twelve months.

A)mix of debt and equity that will be used to finance the specific project.

B)firm's target capital structure.

C)percentages of internal and external financing that will be used for the project.

D)firm's current mix of debt and equity.

E)average amounts of external capital raised during the past twelve months.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

41

The Shoe Box pays an annual dividend of $3.80 on its preferred stock.What is the cost of preferred if the stock currently sells for $42.70 a share and the tax rate is 21 percent?

A)7.94 percent

B)11.87 percent

C)6.68 percent

D)9.39 percent

E)8.90 percent

A)7.94 percent

B)11.87 percent

C)6.68 percent

D)9.39 percent

E)8.90 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

42

Southern Imports is an all-equity firm with a beta of 1.32.The firm is considering a new project that entails less risk than its current operations and thus management feels that the firm's beta should be lowered by .18 when assigning a discount rate to this project.The market rate of return is 9.4 percent and the risk-free rate is 2.8 percent.What discount rate should be assigned to this project?

A)11.46 percent

B)11.21 percent

C)10.87 percent

D)6.49 percent

E)10.32 percent

A)11.46 percent

B)11.21 percent

C)10.87 percent

D)6.49 percent

E)10.32 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

43

Winslow and Sons is expected to pay an annual dividend of $1.35 per share one year from now with future increases of 2.5 percent annually.The stock currently sells for $14.70 a share.What is the cost of equity?

A)13.48 percent

B)12.29 percent

C)12.60 percent

D)11.68 percent

E)13.23 percent

A)13.48 percent

B)12.29 percent

C)12.60 percent

D)11.68 percent

E)13.23 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

44

Peter's Audio has a yield to maturity on its debt of 7.8 percent,a cost of equity of 12.4 percent,and a cost of preferred stock of 8 percent.The firm has 105 shares of common stock outstanding at a market price of $22 a share.There are 25 shares of preferred stock outstanding at a market price of $45 a share.The bond issue has a total face value of $1,500 and sells at 98 percent of face value.If the tax rate is 21 percent,what is the weighted average cost of capital assuming all interest is tax deductible?

A)9.68 percent

B)8.54 percent

C)8.69 percent

D)9.52 percent

E)9.45 percent

A)9.68 percent

B)8.54 percent

C)8.69 percent

D)9.52 percent

E)9.45 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

45

Clancy's just paid its annual dividend of $1.48 per share.Analysts expect the stock price to increase by 2.1 percent annually and value the stock at $14.65 per share currently.What is the cost of equity for this firm?

A)12.41 percent

B)13.32 percent

C)12.20 percent

D)13.87 percent

E)14.06 percent

A)12.41 percent

B)13.32 percent

C)12.20 percent

D)13.87 percent

E)14.06 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

46

Sound Systems has 200 shares of common stock outstanding at a market price of $37 a share.The firm recently paid an annual dividend in the amount of $1.20 per share and has a dividend growth rate of 4 percent.The firm also has 5 bonds outstanding with a face value of $1,000 per bond that are selling at 99 percent of par.The bonds have a coupon rate of 6 percent and a yield to maturity of 6.7 percent.All interest is tax deductible.If the tax rate is 21 percent,what is the weighted average cost of capital?

A)5.93 percent

B)6.87 percent

C)6.37 percent

D)6.54 percent

E)7.08 percent

A)5.93 percent

B)6.87 percent

C)6.37 percent

D)6.54 percent

E)7.08 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

47

Jack's Construction Co.has 80 bonds outstanding that are selling at their par value of $1,000 each.Bonds with similar characteristics are yielding a pretax 8.6 percent.The firm also has 4,000 shares of common stock outstanding.The stock has a beta of 1.1 and sells for $40 a share.The U.S.T-bill is yielding 4 percent,the market risk premium is 8 percent,and the firm's tax rate is 21 percent.What is the firm's weighted average cost of capital assuming its earnings are sufficient to classify all interest as a tax-deductible expense?

A)10.10 percent

B)11.39 percent

C)10.80 percent

D)10.65 percent

E)11.40 percent

A)10.10 percent

B)11.39 percent

C)10.80 percent

D)10.65 percent

E)11.40 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

48

What is the cost of equity for a firm that has a beta of 1.2 if the risk-free rate of return is 2.9 percent and the expected market return is 11.4 percent?

A)13.1 percent

B)10.8 percent

C)12.8 percent

D)14.4 percent

E)13.6 percent

A)13.1 percent

B)10.8 percent

C)12.8 percent

D)14.4 percent

E)13.6 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

49

Albert's recently paid its annual dividend of $1.98 per share.At that time,the firm announced that all future dividends will be increased by 2.2 percent annually.What is the firm's cost of equity if the stock is currently selling for $28.40 a share?

A)9.33 percent

B)11.32 percent

C)10.47 percent

D)11.08 percent

E)10.06 percent

A)9.33 percent

B)11.32 percent

C)10.47 percent

D)11.08 percent

E)10.06 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

50

High Road Tours has an aftertax cost of debt of 5.1 percent at its current tax rate of 34 percent.What will its aftertax cost of debt be if the tax rate drops to 21 percent? Assume all interest is tax deductible.

A)6.10 percent

B)5.92 percent

C)6.17 percent

D)4.03 percent

E)4.47 percent

A)6.10 percent

B)5.92 percent

C)6.17 percent

D)4.03 percent

E)4.47 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

51

Phil's Carvings wants to have a weighted average cost of capital of 9.5 percent.The firm has an aftertax cost of debt of 6.5 percent and a cost of equity of 12.75 percent.What debt-equity ratio is needed for the firm to achieve its targeted weighted average cost of capital?

A).84

B).92

C)1.08

D).76

E).67

A).84

B).92

C)1.08

D).76

E).67

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

52

HNT is an all-equity firm with a beta of .88.What will the firm's equity beta be if the firm switches to a debt-equity ratio of .35?

A).88

B)1.23

C).97

D)1.19

E)1.06

A).88

B)1.23

C).97

D)1.19

E)1.06

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

53

Barges has an asset beta of .57,the risk-free rate is 4.3 percent,and the market risk premium is 7.7 percent.What is the equity beta if the firm has a debt-equity ratio of .56?

A).46

B).89

C).74

D).37

E).32

A).46

B).89

C).74

D).37

E).32

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

54

Ladder Works has debt outstanding with a coupon rate of 6 percent and a yield to maturity of 6.8 percent.What is the aftertax cost of debt if the tax rate is 21 percent? Assume all interest is tax deductible.

A)5.37 percent

B)4.86 percent

C)4.74 percent

D)5.29 percent

E)5.13 percent

A)5.37 percent

B)4.86 percent

C)4.74 percent

D)5.29 percent

E)5.13 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

55

LR Engines stock is selling for $42.39 a share,has an ROE of 14.3 percent,and a dividend payout ratio of 35 percent.The next expected dividend is $1.62 a share.What is the cost of equity for this firm?

A)12.86 percent

B)13.12 percent

C)13.47 percent

D)12.52 percent

E)13.70 percent

A)12.86 percent

B)13.12 percent

C)13.47 percent

D)12.52 percent

E)13.70 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

56

Consolidated Transfer is an all-equity financed firm.The beta is .75,the market risk premium is 7.78 percent,and the risk-free rate is 3.84 percent.What is the expected rate of return on this stock?

A)6.80 percent

B)8.22 percent

C)9.54 percent

D)9.68 percent

E)8.46 percent

A)6.80 percent

B)8.22 percent

C)9.54 percent

D)9.68 percent

E)8.46 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

57

The cost of equity for RJ Corporation is 8.4 percent and the debt-equity ratio is .6.The expected return on the market is 10.4 percent and the risk-free rate is 3.8 percent.Using the common assumption for the debt beta,what is the asset beta?

A).70

B).44

C).62

D).67

E).59

A).70

B).44

C).62

D).67

E).59

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

58

APL has an overall cost of capital of 11.6 percent and a beta of 1.31.The firm is contemplating a new project that is unrelated to the firm's current operations.SKL is a firm that operates similarly to the new project and SKL has a cost of capital of 10.7 percent.APL knows that it will be less efficient than SKL and thus feels that an adjustment of +1 percent should be added to the project's discount rate to allow for this inefficiency.What discount rate should be assigned to the new project?

A)10.7 percent

B)11.3 percent

C)11.7 percent

D)11.6 percent

E)12.6 percent

A)10.7 percent

B)11.3 percent

C)11.7 percent

D)11.6 percent

E)12.6 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

59

BG's cost of equity is 9.4 percent,the expected return on the market is 13.6 percent,and the risk-free rate is 3.8 percent.What is the firm's debt-equity ratio if its asset beta is .36? Assume there is no preferred stock.

A).52

B).59

C).82

D).77

E).63

A).52

B).59

C).82

D).77

E).63

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

60

A firm has an equity beta of 1.2,the risk-free rate is 3.4 percent,the market return is 15.7 percent,and the pretax cost of debt is 9.4 percent.The debt-equity ratio is .47.If you apply the common beta assumptions,what is the firm's asset beta?

A).82

B).61

C).67

D).58

E).73

A).82

B).61

C).67

D).58

E).73

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

61

The Upper Tier has a current debt-equity ratio of .52 and a target debt-equity ratio of .45.The cost of floating equity is 9.5 percent and the flotation cost of debt is 6.6 percent.What should the firm use as their weighted average flotation cost?

A)8.01 percent

B)8.51 percent

C)8.33 percent

D)7.76 percent

E)8.60 percent

A)8.01 percent

B)8.51 percent

C)8.33 percent

D)7.76 percent

E)8.60 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

62

Hu's has 25,000 shares of common stock outstanding with a beta of 1.4,a market price of $32 a share,and a dividend yield of 5.7 percent.Dividends increase by 4.2 percent annually.The firm also has $450,000 of debt outstanding that is selling at 102 percent of par that has a yield to maturity of 6.8 percent.The tax rate is 21 percent and all interest is tax deductible.The firm is considering a project that has the same risk level as the firm's current operations,an initial cost of $328,000 and cash inflows of $52,500,$155,000,and $225,000 for Years 1 to 3,respectively.What is the NPV of the project?

A)$28,515

B)$31,492

C)$36,511

D)$27,006

E)$30,157

A)$28,515

B)$31,492

C)$36,511

D)$27,006

E)$30,157

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

63

World Corporation has traditionally employed a firm-wide discount rate for capital budgeting purposes.However,its two divisions,publishing and entertainment,have different degrees of risk given by βP = 1.1,βE = 1.8,while the beta for the overall firm is 1.3.The publishing division has proposed three projects with these internal rates of return: P1 = 13.2 percent; P2 = 12.4 percent; and P3 = 9.8 percent.The entertainment division has presented their three projects: E1 = 16.4 percent; E2 = 17.8 percent; and E3 = 14.7 percent.The risk-free rate is 4 percent and the market risk premium is 8 percent.Identify which projects will be accepted if the firm applies its overall beta to all projects.Then identify which projects will be accepted if the division betas are properly applied.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

64

Norris Co.has developed an improved version of its most popular product.To get this improvement to the market will cost $48 million but the project will return an additional $13.5 million for 5 years in net cash flows.The firm's debt-equity ratio is .25,the cost of equity is 13 percent,the pretax cost of debt is 9 percent,and the tax rate is 21 percent.All interest is tax deductible.What is the net present value of this proposed project?

A)$906,411

B)$902,459

C)$879,838

D)$884,318

E)$889,760

A)$906,411

B)$902,459

C)$879,838

D)$884,318

E)$889,760

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

65

The expected net cash flows of Advantage Leasing for the next three years are $42,000,$49,000,and $64,000,respectively.After three years,the growth rate of these cash flows will be a constant 2 percent annually.The WACC is 8 percent.What is the present value of the terminal value?

A)$881,822

B)$863,689

C)$959,259

D)$910,444

E)$828,406

A)$881,822

B)$863,689

C)$959,259

D)$910,444

E)$828,406

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

66

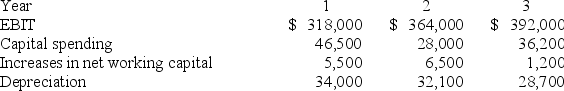

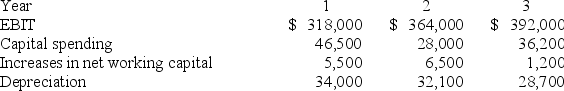

ABC is considering acquiring XYZ and has compiled this information on XYZ:  The applicable tax rate is 21 percent and the terminal value of XYZ as of Year 3 is $2.5 million.What is the NPV of this acquisition if the discount rate is 7.1 percent and the acquisition cost is $2.25 million?

The applicable tax rate is 21 percent and the terminal value of XYZ as of Year 3 is $2.5 million.What is the NPV of this acquisition if the discount rate is 7.1 percent and the acquisition cost is $2.25 million?

A)$538,316

B)$509,482

C)$499,003

D)$506,048

E)$496,399

The applicable tax rate is 21 percent and the terminal value of XYZ as of Year 3 is $2.5 million.What is the NPV of this acquisition if the discount rate is 7.1 percent and the acquisition cost is $2.25 million?

The applicable tax rate is 21 percent and the terminal value of XYZ as of Year 3 is $2.5 million.What is the NPV of this acquisition if the discount rate is 7.1 percent and the acquisition cost is $2.25 million?A)$538,316

B)$509,482

C)$499,003

D)$506,048

E)$496,399

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

67

On-line Text Co.has four new text publishing products that it is considering.The projects are of equal risk with a beta of 1.6.The risk-free rate is 4.2 percent and the market rate is expected to be 12.3 percent.The projects and their expected internal rates of return are: W = 14.4 percent; X = 18 percent,Y = 16.4 percent; and Z = 17.2 percent.Which projects should be accepted? Justify your acceptance decision.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

68

The Neptune Company offers network communications systems to computer users.The company is planning a major investment expansion but is unsure of the cost of equity capital as it has no publicly-traded equity.Your assignment is to determine an appropriate equity cost.List and explain the steps you will need to take to complete this assignment.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

69

Tin Roof's net cash flows for the next three years are projected at $72,000,$78,000,and $84,000,respectively.After that,the cash flows are expected to increase by 3.2 percent annually.The aftertax cost of debt is 6.2 percent and the cost of equity is 11.4 percent.What is the value of the firm if it is financed with 40 percent debt and 60 percent equity?

A)$1,215,650

B)$1,328,141

C)$1,461,439

D)$1,575,941

E)$1,279,623

A)$1,215,650

B)$1,328,141

C)$1,461,439

D)$1,575,941

E)$1,279,623

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

70

Explain a)the factors that determine a security's beta and b)how asset beta relates to equity beta.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

71

Downtown Stores can issue equity at a flotation cost of 8.76 percent and debt at 5.93 percent.The firm currently has a debt-equity ratio of .37 but prefers a ratio of .35.What should this firm use as their weighted average flotation cost?

A)8.26 percent

B)8.03 percent

C)8.34 percent

D)8.37 percent

E)8.00 percent

A)8.26 percent

B)8.03 percent

C)8.34 percent

D)8.37 percent

E)8.00 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

72

Suppose Simmons' common stock has a beta of 1.37,the risk-free rate is 3.4 percent,and the market risk premium is 8.2 percent.The yield to maturity on the firm's bonds is 7.6 percent and the debt-equity ratio is .45.What is the WACC if the tax rate is 23 percent and all interest is tax deductible?

A)14.07 percent

B)10.94 percent

C)12.60 percent

D)10.59 percent

E)11.91 percent

A)14.07 percent

B)10.94 percent

C)12.60 percent

D)10.59 percent

E)11.91 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck