Deck 11: The Statement of Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/133

Play

Full screen (f)

Deck 11: The Statement of Cash Flows

1

Current assets on the Balance Sheet would be affected by and be part of operating activities.

True

2

The direct method of formatting a Statement of Cash Flows starts with net income.

False

3

A Statement of Cash Flows shows the company's sources of cash,but does not detail how the cash was used by the company.

False

4

A comparative Balance Sheet reports at least two consecutive years of information that can be used to compile a Statement of Cash Flows.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

5

For a business to remain successful,investing activities must be the main source of its cash over the long run.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

6

Operating activities reflect such things as purchasing fixed assets.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

7

The Statement of Cash Flows reports the sources and uses of cash from all of the following EXCEPT:

A)managerial activities.

B)financing activities.

C)operating activities.

D)investing activities.

A)managerial activities.

B)financing activities.

C)operating activities.

D)investing activities.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

8

Cash received from issuing stock would be included in financing activities.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

9

The three types of business activities on a Statement of Cash Flows are operating,investing,and management activities.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

10

The ________ is the financial statement associated with the operating,investing and financing activities of a corporation.

A)Income Statement

B)Statement of Stockholders' Equity

C)Statement of Cash Flows

D)Balance Sheet

A)Income Statement

B)Statement of Stockholders' Equity

C)Statement of Cash Flows

D)Balance Sheet

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

11

The accuracy of the Statement of Cash Flows can be verified by computing the change in the balance of the:

A)cash and cash equivalent accounts.

B)equity account.

C)revenue accounts.

D)asset and liability accounts.

A)cash and cash equivalent accounts.

B)equity account.

C)revenue accounts.

D)asset and liability accounts.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

12

The difference between the direct and indirect methods is the format of the financing section.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

13

The Balance Sheet reports the ending cash,but does not include cash equivalents.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

14

The Cash Flows from operations arrived at using the indirect method is different than that arrived at using the direct method.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

15

A comparative Balance Sheet details why the ending cash balance increased or decreased.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

16

The cash flow statement and Balance Sheet use accrual accounting.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

17

The Statement of Cash Flows is prepared to show why the cash amount changed from the beginning of the period to the end of the period.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

18

The purpose of the Statement of Cash Flows is to show:

A)the revenue earned.

B)the profits that were earned.

C)the expenses that were paid.

D)how cash was received and used during the period.

A)the revenue earned.

B)the profits that were earned.

C)the expenses that were paid.

D)how cash was received and used during the period.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

19

The cash flow statement is the communicating link between the:

A)Statement of Stockholders' Equity and the cash reported on the Balance Sheet.

B)Income Statement and the Statement of Stockholders' Equity.

C)cash reported on the Balance Sheet and the accrual based Income Statement.

D)cash reported on the Balance Sheet and the Statement of Stockholders' Equity.

A)Statement of Stockholders' Equity and the cash reported on the Balance Sheet.

B)Income Statement and the Statement of Stockholders' Equity.

C)cash reported on the Balance Sheet and the accrual based Income Statement.

D)cash reported on the Balance Sheet and the Statement of Stockholders' Equity.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

20

The investing and financing sections of the Statement of Cash Flows is the same for the indirect and direct method.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

21

Investing Cash Flows affect:

A)current assets and current liabilities.

B)long-term asset accounts.

C)equity accounts.

D)long-term liability accounts.

A)current assets and current liabilities.

B)long-term asset accounts.

C)equity accounts.

D)long-term liability accounts.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is NOT a use of cash for a business?

A)Operating the business

B)Buying long-term assets with cash

C)Paying cash dividends

D)All of the above are uses of cash.

A)Operating the business

B)Buying long-term assets with cash

C)Paying cash dividends

D)All of the above are uses of cash.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

23

Operating Cash Flows under the indirect method starts with the net income for the period from the Income Statement.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is NOT a part of operating activities?

A)Paying dividends

B)Paying payables

C)Earnings revenue

D)Paying utilities

A)Paying dividends

B)Paying payables

C)Earnings revenue

D)Paying utilities

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

25

Bach Company sold an asset with a book value of $56,000 for $100,000 cash.Which of the following is a TRUE statement?

A)Gain on sale equals $100,000 and Cash inflow equals $100,000.

B)Gain on sale equals $56,000 and Cash inflow equals $56,000.

C)Gain on sale equals $44,000 and Cash inflow equals $100,000.

D)Gain on sale equals $100,000 and Cash inflow equals $46,000.

A)Gain on sale equals $100,000 and Cash inflow equals $100,000.

B)Gain on sale equals $56,000 and Cash inflow equals $56,000.

C)Gain on sale equals $44,000 and Cash inflow equals $100,000.

D)Gain on sale equals $100,000 and Cash inflow equals $46,000.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

26

In order to prepare a Statement of Cash Flows using the indirect method,you need the Income Statement only.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

27

The operating section of a Statement of Cash Flows using the indirect method is prepared differently from the operating section of a Statement of Cash Flows using the direct method.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

28

Aspen Corp.sold an asset with a book value of $56,000 for $35,000 cash.Which of the following is a TRUE statement?

A)Loss on sale equals $35,000 and Cash inflow equals $35,000.

B)Loss on sale equals $56,000 and Cash inflow equals $56,000.

C)Loss on sale equals $21,000 and Cash inflow equals $35,000.

D)Loss on sale equals $35,000 and Cash inflow equals $21,000.

A)Loss on sale equals $35,000 and Cash inflow equals $35,000.

B)Loss on sale equals $56,000 and Cash inflow equals $56,000.

C)Loss on sale equals $21,000 and Cash inflow equals $35,000.

D)Loss on sale equals $35,000 and Cash inflow equals $21,000.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is NOT a part of investing activities?

A)Buying a building

B)Collecting on a loan receivable

C)Borrowing money

D)Selling off equipment

A)Buying a building

B)Collecting on a loan receivable

C)Borrowing money

D)Selling off equipment

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

30

Are all increases to cash from financing activities the result of a favorable situation?

A)Yes,an increase to cash is always good.

B)No,cash could increase in this category as a result of replacing long-term assets.

C)Yes,this increase would reflect the results of the company's daily activities.

D)No,although some increases in this category could be positive,some,such as an increase in long-term debt might be the result of an unfavorable situation.

A)Yes,an increase to cash is always good.

B)No,cash could increase in this category as a result of replacing long-term assets.

C)Yes,this increase would reflect the results of the company's daily activities.

D)No,although some increases in this category could be positive,some,such as an increase in long-term debt might be the result of an unfavorable situation.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following activities is computed differently using the two methods of formatting a Statement of Cash Flows?

A)Operating activities

B)Financing activities

C)Investing activities

D)Both operating activities and investing activities

A)Operating activities

B)Financing activities

C)Investing activities

D)Both operating activities and investing activities

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

32

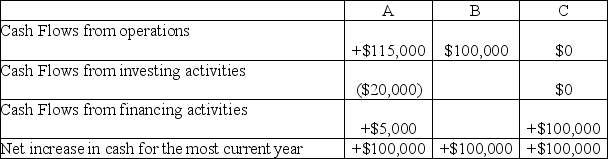

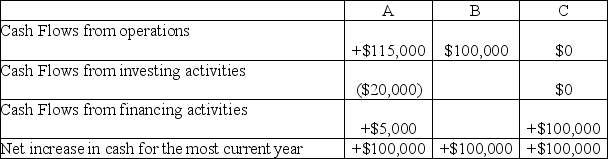

As you approach graduation,you are evaluating your job offers from the following companies.Assuming that all other factors are equal (pay,benefits,location,job duties,industry,company size,company age etc. ),for which of the following companies would you chose to work and why?

A)Company A,the company is generating cash from its daily operations,investing in long-term assets and generating cash from its' owners or borrowing a relatively small amount.

B)Company B,the company only generates cash from its daily operations and is not spending the cash for any other reason.

C)Company C,the company only generates cash from the owners.

D)All three companies offer the same opportunity for the future.

A)Company A,the company is generating cash from its daily operations,investing in long-term assets and generating cash from its' owners or borrowing a relatively small amount.

B)Company B,the company only generates cash from its daily operations and is not spending the cash for any other reason.

C)Company C,the company only generates cash from the owners.

D)All three companies offer the same opportunity for the future.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

33

Operating activities are transactions and events associated with selling a product or providing a service related to the:

A)revenues and expenses reported on the Income Statement.

B)assets and liabilities reported on the Balance Sheet.

C)net income reported on the Statement of Retained Earnings.

D)Retained Earnings reported on the Balance Sheet.

A)revenues and expenses reported on the Income Statement.

B)assets and liabilities reported on the Balance Sheet.

C)net income reported on the Statement of Retained Earnings.

D)Retained Earnings reported on the Balance Sheet.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

34

Most businesses prefer to use the indirect method of formatting a Statement of Cash Flows.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is NOT a source of cash for a business?

A)Operating the business

B)Long-term borrowing of cash

C)Buying long-term assets with cash

D)Stockholders' cash investment

A)Operating the business

B)Long-term borrowing of cash

C)Buying long-term assets with cash

D)Stockholders' cash investment

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is NOT a part of financing activities?

A)Paying dividends

B)Issuing stock

C)Paying off loans

D)Buying land

A)Paying dividends

B)Issuing stock

C)Paying off loans

D)Buying land

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

37

Operating Cash Flows affect:

A)current assets and current liabilities.

B)long-term asset accounts.

C)equity accounts.

D)long-term liability accounts.

A)current assets and current liabilities.

B)long-term asset accounts.

C)equity accounts.

D)long-term liability accounts.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

38

When comparing net cash provided by operations using the direct method versus indirect method,we find that:

A)net cash is higher using the indirect method.

B)net cash is lower using the indirect method.

C)there is no difference in the net cash between the two methods.

D)Depreciation Expense is used in the direct method.

A)net cash is higher using the indirect method.

B)net cash is lower using the indirect method.

C)there is no difference in the net cash between the two methods.

D)Depreciation Expense is used in the direct method.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

39

Financing activities affect:

A)current and long-term assets.

B)current and long-term liabilities.

C)current assets and current liabilities.

D)long-term liabilities and equity accounts.

A)current and long-term assets.

B)current and long-term liabilities.

C)current assets and current liabilities.

D)long-term liabilities and equity accounts.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

40

Are all decreases to cash the result of an unfavorable situation?

A)Yes,decreases to cash are always bad.

B)No,cash could decrease as a result of acquiring long-term assets which the company needs to expand or stay competitive.

C)Yes,cash could decrease as a result of paying off long-term debt which is an unfavorable action to take.

D)No,cash could decrease because the company issued more stock.

A)Yes,decreases to cash are always bad.

B)No,cash could decrease as a result of acquiring long-term assets which the company needs to expand or stay competitive.

C)Yes,cash could decrease as a result of paying off long-term debt which is an unfavorable action to take.

D)No,cash could decrease because the company issued more stock.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

41

Losses on the sale of long-term assets are:

A)added to operating activities.

B)subtracted from operating activities.

C)added to investing activities.

D)subtracted from investing activities.

A)added to operating activities.

B)subtracted from operating activities.

C)added to investing activities.

D)subtracted from investing activities.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

42

The purchase of treasury stock is shown as a cash outflow in the investing section of the cash flow statement.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

43

Robbins Company distributed a 5% common stock dividend,this will be reported in the financing activity section of the cash flow statement.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

44

The cost of purchasing long-term assets,such as buildings and land,are:

A)added to operating activities.

B)subtracted from operating activities.

C)added to investing activities.

D)subtracted from investing activities.

A)added to operating activities.

B)subtracted from operating activities.

C)added to investing activities.

D)subtracted from investing activities.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

45

A decrease in a current liability causes an increase in cash.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

46

A transaction acquiring land by issuing a note for the full purchase price would not appear on the cash flow statement because no cash was involved,but it may be disclosed in a separate section.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

47

Changes in the long-term assets and long-term liabilities accounts must be analyzed to determine how they are presented in the operating section of a cash flow statement.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

48

Changes in long-term liabilities belong in the financing section of a cash flow statement using the indirect method.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

49

Acquisitions and sales of long-term assets belong in the financing section of a cash flow statement using the indirect method.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

50

Which would be added back to net income in the operating section of an indirect cash flow statement?

A)A decrease in Accounts Payable

B)Depreciation

C)An increase in Accounts Receivable

D)An increase in inventory

A)A decrease in Accounts Payable

B)Depreciation

C)An increase in Accounts Receivable

D)An increase in inventory

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

51

Even though depreciation,depletion and amortization are expenses,they are considered non-cash transactions and must be subtracted from net income in the operating activities section of an indirect method cash flow statement.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

52

A transaction that exchanged a building for shares of stock would be an investing activity and would appear on the cash flow statement.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

53

The sum of the net increases/decreases in the operating,investing and financing sections of the cash flow statement is equal to the change in cash over the period.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

54

Business transactions that do NOT involve the payment or receipt of cash are considered to be non-cash transactions.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

55

Cash receipts from the sale of long-term assets,such as equipment and vehicles,are:

A)added to operating activities.

B)subtracted from operating activities.

C)added to investing activities.

D)subtracted from investing activities.

A)added to operating activities.

B)subtracted from operating activities.

C)added to investing activities.

D)subtracted from investing activities.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

56

Changes in all current assets EXCEPT ________ are adjustments to net income in the operating section of an indirect cash flow statement.

A)prepaid expenses

B)inventory

C)cash

D)notes receivable

A)prepaid expenses

B)inventory

C)cash

D)notes receivable

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

57

Which would be subtracted from net income in the operating section of an indirect cash flow statement?

A)A decrease in Notes Payable

B)A decrease in prepaid expenses

C)An increase in sales tax payable

D)An increase in inventory

A)A decrease in Notes Payable

B)A decrease in prepaid expenses

C)An increase in sales tax payable

D)An increase in inventory

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

58

Gains and losses do not represent Cash Flows.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

59

Gains on the sale of long-term assets are:

A)added to investing activities.

B)added to financing activities.

C)added to operating activities.

D)subtracted from operating activities.

A)added to investing activities.

B)added to financing activities.

C)added to operating activities.

D)subtracted from operating activities.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

60

Which would NOT be subtracted from net income in the operating section of an indirect cash flow statement?

A)An increase in prepaid expenses

B)An increase in Accounts Payable

C)A decrease in Accounts Payable

D)An increase in notes receivable

A)An increase in prepaid expenses

B)An increase in Accounts Payable

C)A decrease in Accounts Payable

D)An increase in notes receivable

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

61

An increase in long-term Mortgage Payable would mean a(n):

A)increase in cash flow from investing activities.

B)decrease in cash flow from investing activities.

C)increase in cash flow from financing activities.

D)decrease in cash flow from financing activities.

A)increase in cash flow from investing activities.

B)decrease in cash flow from investing activities.

C)increase in cash flow from financing activities.

D)decrease in cash flow from financing activities.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

62

When preparing the Statement of Cash Flows by the indirect method,if current liabilities increase,the difference is:

A)added to net income.

B)added to investing activities.

C)deducted from net income.

D)deducted from investing activities.

A)added to net income.

B)added to investing activities.

C)deducted from net income.

D)deducted from investing activities.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

63

Under the indirect method of cash flow,which of the following adjustments would NOT be made to net income when computing cash from operating activities?

A)Add an increase in Accounts Payable

B)Add Depreciation Expense

C)Add a decrease in Accounts Payable

D)Subtract the gain on sale of land

A)Add an increase in Accounts Payable

B)Add Depreciation Expense

C)Add a decrease in Accounts Payable

D)Subtract the gain on sale of land

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

64

Transactions involving the purchase and sale of long-term assets,lending money and collecting the principal on loans are called:

A)investing activities.

B)operating activities.

C)financing activities.

D)buying and selling activities.

A)investing activities.

B)operating activities.

C)financing activities.

D)buying and selling activities.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

65

An example of a cash outflow from investing activities is:

A)issuance of a note payable.

B)making a loan to another company.

C)paying cash dividends.

D)the purchase of treasury stock.

A)issuance of a note payable.

B)making a loan to another company.

C)paying cash dividends.

D)the purchase of treasury stock.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

66

Of the following,which is NOT classified as an investing activity on the Statement of Cash Flows?

A)Sale of equipment for cash

B)Purchasing land

C)Collecting the principal on loans

D)Selling goods and services

A)Sale of equipment for cash

B)Purchasing land

C)Collecting the principal on loans

D)Selling goods and services

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

67

An example of a cash outflow from financing activities is:

A)paying dividends in cash.

B)buying additional inventory.

C)selling land.

D)collecting notes receivable.

A)paying dividends in cash.

B)buying additional inventory.

C)selling land.

D)collecting notes receivable.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is NOT a cash inflow or outflow from an investing activity?

A)A loan made to another party

B)A payment made to acquire property

C)The purchase of treasury stock

D)The sale of the common stock of another company which had been owned by our company.

A)A loan made to another party

B)A payment made to acquire property

C)The purchase of treasury stock

D)The sale of the common stock of another company which had been owned by our company.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

69

An example of a cash inflow from financing activities is:

A)collecting money owed by customers.

B)issuing preferred stock.

C)selling a piece of equipment.

D)paying off a bond.

A)collecting money owed by customers.

B)issuing preferred stock.

C)selling a piece of equipment.

D)paying off a bond.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

70

The Accounts Receivable balance has decreased during the year.How would this affect the Statement of Cash Flows operations section under the indirect method?

A)It is already included in the net income.

B)It would be added back to net income.

C)It would be subtracted from net income.

D)It does not affect the cash flow from operations.

A)It is already included in the net income.

B)It would be added back to net income.

C)It would be subtracted from net income.

D)It does not affect the cash flow from operations.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

71

Under the indirect method,which of the following is NOT a proper adjustment to net income under operating activities?

A)Adding a decrease in inventory

B)Subtracting an increase in salaries payable

C)Deducting an increase in prepaid expenses

D)Subtracting a gain on the sale of equipment

A)Adding a decrease in inventory

B)Subtracting an increase in salaries payable

C)Deducting an increase in prepaid expenses

D)Subtracting a gain on the sale of equipment

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

72

The Accounts Payable balance has decreased during the year.How would this affect the Statement of Cash Flows operations section under the indirect method?

A)It is already included in the net income.

B)It would be added back to net income.

C)It would be subtracted from net income.

D)It does not affect the cash flow from operations.

A)It is already included in the net income.

B)It would be added back to net income.

C)It would be subtracted from net income.

D)It does not affect the cash flow from operations.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

73

Goldman Company's Accounts Receivable decreased by $25,000 and its Accounts Payable increased by $12,000.What is the net effect on cash from operations under the indirect method?

A)+$37,000

B)-$13,000

C)-$37,000

D)+$13,000

A)+$37,000

B)-$13,000

C)-$37,000

D)+$13,000

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

74

Activities that increase and decrease as a result of selling a company's stock are:

A)marketing activities.

B)operating activities.

C)investing activities.

D)financing activities.

A)marketing activities.

B)operating activities.

C)investing activities.

D)financing activities.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

75

Caesario Company's Accounts Receivable increased by $35,000 and their Accounts Payable decreased by $18,000.What is the net effect on cash from operations under the indirect method?

A)+$53,000

B)-$17,000

C)-$53,000

D)+$17,000

A)+$53,000

B)-$17,000

C)-$53,000

D)+$17,000

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

76

A Statement of Cash Flows would NOT disclose:

A)stock dividends declared.

B)bonds payable issued.

C)purchase of treasury stock.

D)capital stock issued.

A)stock dividends declared.

B)bonds payable issued.

C)purchase of treasury stock.

D)capital stock issued.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

77

In the indirect method of Cash Flows,which of the following would be added to net income?

A)A decrease in inventory

B)An increase in Prepaid Insurance

C)A decrease in Accounts Payable

D)An increase in Accounts Receivable

A)A decrease in inventory

B)An increase in Prepaid Insurance

C)A decrease in Accounts Payable

D)An increase in Accounts Receivable

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

78

Of the following,which would be added back to net income in the operating section of a cash flow statement using the indirect method?

A)Increase in inventory

B)Decrease in Accounts Payable

C)Increase in Accounts Receivable

D)Decrease in Prepaid Insurance

A)Increase in inventory

B)Decrease in Accounts Payable

C)Increase in Accounts Receivable

D)Decrease in Prepaid Insurance

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

79

A transaction involving the exchange of stock for equipment would be recorded as a(n):

A)operating activity.

B)investing activity.

C)financing activity.

D)noncash investing and financing activity.

A)operating activity.

B)investing activity.

C)financing activity.

D)noncash investing and financing activity.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

80

The Supplies balance has decreased during the year.How would this affect the Statement of Cash Flows operations section under the indirect method?

A)It is already included in the net income.

B)It would be added back to net income.

C)It would be subtracted from net income.

D)It does not affect the cash flow from operations.

A)It is already included in the net income.

B)It would be added back to net income.

C)It would be subtracted from net income.

D)It does not affect the cash flow from operations.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck