Deck 8: Bond Valuation and Risk

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/90

Play

Full screen (f)

Deck 8: Bond Valuation and Risk

1

Zero coupon bonds with a par value of $1,000,000 have a maturity of 10 years, and a required rate of return of 9 percent. What is the current price?

A)$363,212

B)$385,500

C)$422,400

D)$424,100

E)none of the above

A)$363,212

B)$385,500

C)$422,400

D)$424,100

E)none of the above

C

2

The value of ____-risk securities will be relatively ____.

A)high; high

B)high; low

C)low; low

D)none of the above

A)high; high

B)high; low

C)low; low

D)none of the above

B

3

If the coupon rate ____ the required rate of return, the price of a bond ____ par value.

A)equals; equals

B)exceeds; is less than

C)is less than; is greater than

D)B and C

E)none of the above

A)equals; equals

B)exceeds; is less than

C)is less than; is greater than

D)B and C

E)none of the above

A

4

The appropriate discount rate for valuing any bond is the

A)bond's coupon rate.

B)bond's coupon rate adjusted for the expected inflation rate over the life of the bond.

C)Treasury bill rate with an adjustment to include a risk premium if one exists.

D)yield that could be earned on alternative investments with similar risk and maturity.

A)bond's coupon rate.

B)bond's coupon rate adjusted for the expected inflation rate over the life of the bond.

C)Treasury bill rate with an adjustment to include a risk premium if one exists.

D)yield that could be earned on alternative investments with similar risk and maturity.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

5

A bond with a 12 percent quarterly coupon rate has a yield to maturity of 16 percent. The bond has a par value of $1,000 and matures in 20 years. Based on this information, a fair price of this bond is $____.

A)1,302

B)763

C)761

D)1,299

A)1,302

B)763

C)761

D)1,299

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

6

The prices of bonds with ____ are most sensitive to interest rate movements.

A)high coupon payments

B)zero coupon payments

C)small coupon payments

D)none of the above (The size of the coupon payment does not affect sensitivity of bond prices to interest rate movements.)

A)high coupon payments

B)zero coupon payments

C)small coupon payments

D)none of the above (The size of the coupon payment does not affect sensitivity of bond prices to interest rate movements.)

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

7

Assume that the price of a $1,000 zero coupon bond with five years to maturity is $567 when the required rate of return is 12 percent. If the required rate of return suddenly changes to 15 percent, what is the price elasticity of the bond?

A)-0.980

B)+.980

C)-0.494

D)+.494

E)none of the above

A)-0.980

B)+.980

C)-0.494

D)+.494

E)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

8

As interest rates increase, long-term bond prices

A)increase by a greater degree than short-term bond prices.

B)increase by an equal degree as short-term bond prices.

C)decrease by a greater degree than short-term bond prices.

D)decrease by an equal degree as short-term bond prices.

E)decrease by a smaller degree than short-term bond prices.

A)increase by a greater degree than short-term bond prices.

B)increase by an equal degree as short-term bond prices.

C)decrease by a greater degree than short-term bond prices.

D)decrease by an equal degree as short-term bond prices.

E)decrease by a smaller degree than short-term bond prices.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

9

The larger the investor's ____ relative to the ____, the larger the ____ of a bond with a particular par value.

A)discount rate; required rate of return; discount

B)required rate of return; discount rate; discount

C)required rate of return; discount rate; premium

D)none of the above

A)discount rate; required rate of return; discount

B)required rate of return; discount rate; discount

C)required rate of return; discount rate; premium

D)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

10

A bond with a $1,000 par value has an 8 percent annual coupon rate. It will mature in 4 years, and annual coupon payments are made at the end of each year. Present annual yields on similar bonds are 6 percent. What should be the current price?

A)$1,069.31

B)$1,000.00

C)$9712

D)$927.66

E)none of the above

A)$1,069.31

B)$1,000.00

C)$9712

D)$927.66

E)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

11

A(n) ____ in the expected level of inflation results in ____ pressure on bond prices.

A)increase; upward

B)increase; downward

C)decrease; downward

D)none of the above

A)increase; upward

B)increase; downward

C)decrease; downward

D)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

12

The valuation of bonds is generally perceived to be ____ the valuation of equity securities.

A)more difficult than

B)easier than

C)just as difficult as

D)none of the above

A)more difficult than

B)easier than

C)just as difficult as

D)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

13

Other things held constant, bond prices should increase when inflationary expectations rise.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

14

When financial institutions expect interest rates to ____, they may ____.

A)increase; sell bonds and buy short-term securities

B)increase; sell short-term securities and buy bonds

C)decrease; sell bonds and buy short-term securities

D)B and C

A)increase; sell bonds and buy short-term securities

B)increase; sell short-term securities and buy bonds

C)decrease; sell bonds and buy short-term securities

D)B and C

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

15

A bond with a ten percent coupon rate bond pays interest semi-annually. Par value is $1,000. The bond has three years to maturity. The investors' required rate of return is 12 percent. What is the present value of the bond?

A)$1,021

B)$1,000

C)$981

D)$951

E)none of the above

A)$1,021

B)$1,000

C)$981

D)$951

E)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

16

For a given par value of a bond, the higher the investor's required rate of return is above the coupon rate, the

A)greater is the premium on the price.

B)greater is the discount on the price.

C)smaller is the premium on the price.

D)smaller is the discount on the price.

A)greater is the premium on the price.

B)greater is the discount on the price.

C)smaller is the premium on the price.

D)smaller is the discount on the price.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

17

From the perspective of investing institutions, the most attractive foreign bonds offer a ____ and are denominated in a currency that ____ over the investment horizon.

A)high yield; appreciates

B)high yield; remains stable

C)low yield; appreciates

D)low yield; depreciates

A)high yield; appreciates

B)high yield; remains stable

C)low yield; appreciates

D)low yield; depreciates

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

18

An expected ____ in economic growth places ____ pressure on bond prices.

A)increase; downward

B)increase; upward

C)decrease; downward

D)none of the above

A)increase; downward

B)increase; upward

C)decrease; downward

D)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

19

If a financial institution's bond portfolio contains a relatively large portion of ____, it will be ____.

A)high coupon bonds; more favorably affected by declining interest rates

B)zero or low coupon bonds; more favorably affected by declining interest rates

C)zero or low coupon bonds; more favorably affected by rising interest rates

D)high coupon bonds; completely insulated from rising interest rates

A)high coupon bonds; more favorably affected by declining interest rates

B)zero or low coupon bonds; more favorably affected by declining interest rates

C)zero or low coupon bonds; more favorably affected by rising interest rates

D)high coupon bonds; completely insulated from rising interest rates

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

20

If the coupon rate equals the required rate of return, the price of the bond

A)should be above its par value.

B)should be below its par value.

C)should be equal to its par value.

D)is negligible.

A)should be above its par value.

B)should be below its par value.

C)should be equal to its par value.

D)is negligible.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

21

A bank buys bonds with a par value of $25 million for $24,040,000. The coupon rate is 10 percent, and the bonds pay annual payments. The bonds mature in four years. The bank wants to sell them in two years, and estimates the required rate of return in two years will be 8 percent. What will the market value of the bonds be in two years?

A)$24,113,418

B)$24,667,230

C)$25,000,000

D)$25,891,632

A)$24,113,418

B)$24,667,230

C)$25,000,000

D)$25,891,632

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

22

Assume that the value of liabilities equals that of earning assets. If asset portfolio durations are ____ than liability portfolio durations, then the market value of assets are ____ interest-rate sensitive than the market value of liabilities.

A)greater; more

B)greater; equally

C)greater; less

D)less; equally

E)B and D

A)greater; more

B)greater; equally

C)greater; less

D)less; equally

E)B and D

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

23

The bonds that are most sensitive to interest rate movements have

A)no coupon and a short-term maturity.

B)high coupons and a short-term maturity.

C)high coupons and a long-term maturity.

D)no coupon and a long-term maturity.

A)no coupon and a short-term maturity.

B)high coupons and a short-term maturity.

C)high coupons and a long-term maturity.

D)no coupon and a long-term maturity.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

24

If bond portfolio managers expect interest rates to increase in the future, they would likely ____ their holdings of bonds now, which could cause the prices of bonds to ____ as a result of their actions.

A)increase; increase

B)increase; decrease

C)decrease; decrease

D)decrease; increase

A)increase; increase

B)increase; decrease

C)decrease; decrease

D)decrease; increase

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

25

Morgan would like to purchase a bond that has a par value of $1,000, pays $80 at the end of each year in coupon payments, and has 10 years remaining until maturity. If the prevailing annualized yield on other bonds with similar characteristics is 6 percent, how much will Morgan pay for the bond?

A)$1,000.00

B)$1,147.20

C)$856.80

D)none of the above

A)$1,000.00

B)$1,147.20

C)$856.80

D)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

26

A $1,000 par bond with five years to maturity is currently priced at $892. Annual interest payments are $90. What is the yield to maturity?

A)13 percent

B)12 percent

C)11 percent

D)10 percent

A)13 percent

B)12 percent

C)11 percent

D)10 percent

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

27

As interest rates consistently decline over a specific period, the market price of a bond you own would likely ____ over this period. (Assume no major change in the bond's default risk.)

A)consistently increase

B)consistently decrease

C)remain unchanged

D)change in a direction that cannot be determined with the above information

A)consistently increase

B)consistently decrease

C)remain unchanged

D)change in a direction that cannot be determined with the above information

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

28

When two securities have the same expected cash flows, the value of the ____ security will be higher than the value of the ____ security.

A)high-risk; low-risk

B)low-risk; high-risk

C)high-risk; high-risk

D)low-risk; low-risk

E)none of the above

A)high-risk; low-risk

B)low-risk; high-risk

C)high-risk; high-risk

D)low-risk; low-risk

E)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

29

If analysts expect that the demand for loanable funds will decrease, and the supply of loanable funds will increase, they would most likely expect interest rates to ____ and prices of existing bonds to ____.

A)increase; increase

B)increase; decrease

C)decrease; decrease

D)decrease; increase

A)increase; increase

B)increase; decrease

C)decrease; decrease

D)decrease; increase

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

30

The price of short-term bonds are commonly ____ those of long-term bonds.

A)more volatile than

B)equally volatile as

C)less volatile than

D)A and C occur with about equal frequency

A)more volatile than

B)equally volatile as

C)less volatile than

D)A and C occur with about equal frequency

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

31

Consider a coupon bond that sold at par value two years ago. If interest rates are much higher now than when this bond was issued, the coupon rate of that bond will likely be ____ the prevailing interest rates, and the present value of the bonds will be ____ its par value.

A)above; above

B)above; below

C)below; below

D)below; above

A)above; above

B)above; below

C)below; below

D)below; above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

32

An insurance company purchases corporate bonds in the secondary market with six years to maturity. Total par value is $55 million. The coupon rate is 11 percent, with annual interest payments. If the expected required rate of return in 4 years is 9 percent, what will the market value of the bonds be then?

A)$52,115,093

B)$55,341,216

C)$55,000,000

D)$56,935,022

A)$52,115,093

B)$55,341,216

C)$55,000,000

D)$56,935,022

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

33

As interest rates consistently rise over a specific period, the market price of a bond you own would likely ____ over this period. (Assume no major change in the bond's default risk.)

A)consistently increase

B)consistently decrease

C)remain unchanged

D)change in a direction that cannot be determined with the above information

A)consistently increase

B)consistently decrease

C)remain unchanged

D)change in a direction that cannot be determined with the above information

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

34

If the United States announces that it will borrow an additional $10 billion, this announcement will normally cause the bond traders to expect

A)higher interest rates in the future, and will buy bonds now.

B)higher interest rates in the future, and will sell bonds now.

C)stable interest rates in the future, and will buy bonds now.

D)lower interest rates in the future, and will buy bonds now.

E)lower interest rates in the future, and will sell bonds now.

A)higher interest rates in the future, and will buy bonds now.

B)higher interest rates in the future, and will sell bonds now.

C)stable interest rates in the future, and will buy bonds now.

D)lower interest rates in the future, and will buy bonds now.

E)lower interest rates in the future, and will sell bonds now.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

35

The prices of ____-coupon and ____ maturities are most sensitive to changes in the required rate of return.

A)low; short

B)low; long

C)high; short

D)high; long

A)low; short

B)low; long

C)high; short

D)high; long

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following will most likely cause bond prices to increase? (Assume no possibility of higher inflation in the future.)

A)reduced Treasury borrowing along with anticipation that money supply growth will decrease

B)reduced Treasury borrowing along with anticipation that money supply growth will increase

C)an anticipated drop in money supply growth along with increasing Treasury borrowing

D)higher levels of Treasury borrowing and corporate borrowing

A)reduced Treasury borrowing along with anticipation that money supply growth will decrease

B)reduced Treasury borrowing along with anticipation that money supply growth will increase

C)an anticipated drop in money supply growth along with increasing Treasury borrowing

D)higher levels of Treasury borrowing and corporate borrowing

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

37

The market value of long-term bonds is ____ sensitive to interest rate movements; as interest rates fall, the market value of long-term bonds ____.

A)slightly; rises

B)very; rises

C)very; declines

D)slightly; declines

A)slightly; rises

B)very; rises

C)very; declines

D)slightly; declines

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

38

If analysts expect that the demand for loanable funds will increase, and the supply of loanable funds will decrease, they would most likely expect interest rates to ____ and prices of existing bonds to ____.

A)increase; increase

B)increase; decrease

C)decrease; decrease

D)decrease; increase

A)increase; increase

B)increase; decrease

C)decrease; decrease

D)decrease; increase

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

39

If bond portfolio managers expect interest rates to decrease in the future, they would likely ____ their holdings of bonds now, which could cause the prices of bonds to ____ as a result of their actions.

A)increase; increase

B)increase; decrease

C)decrease; decrease

D)decrease; increase

A)increase; increase

B)increase; decrease

C)decrease; decrease

D)decrease; increase

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

40

Consider a coupon bond that sold at par value two years ago. If interest rates are much lower now than when this bond was issued, the coupon rate of that bond will likely be ____ the prevailing interest rates, and the present value of the bonds will be ____ its par value.

A)above; above

B)above; below

C)below; below

D)below; above

A)above; above

B)above; below

C)below; below

D)below; above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

41

Assume bond portfolio managers actively manage their portfolios. If they expect interest rates to ____, they would shift toward ____.

A)increase; long-maturity bonds with zero-coupon rates

B)decrease; short-maturity bonds with high-coupon rates

C)increase; high-coupon bonds with long maturities

D)decrease; long-maturity bonds with zero-coupon rates

A)increase; long-maturity bonds with zero-coupon rates

B)decrease; short-maturity bonds with high-coupon rates

C)increase; high-coupon bonds with long maturities

D)decrease; long-maturity bonds with zero-coupon rates

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

42

If the coupon rate of a bond is above the investor's required rate of return, the price of the bond should be below its par value.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

43

The appropriate price of a bond is simply the sum of the cash flows to be received.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

44

If the level of inflation is expected to ____, there will be ____ pressure on interest rates and ____ pressure on the required rate of return on bonds.

A)increase; upward; downward

B)decrease; upward; downward

C)decrease; upward; upward

D)increase; downward; upward

E)increase; upward; upward

A)increase; upward; downward

B)decrease; upward; downward

C)decrease; upward; upward

D)increase; downward; upward

E)increase; upward; upward

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

45

A zero-coupon bond makes no coupon payments.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

46

If the Treasury issues an unusually large amount of bonds in the primary market, it places ____ on bond prices, and ____ on yields to be earned by investors that purchase bonds and plan to hold them to maturity.

A)downward pressure; downward pressure

B)downward pressure; upward pressure

C)upward pressure; upward pressure

D)upward pressure; downward pressure

A)downward pressure; downward pressure

B)downward pressure; upward pressure

C)upward pressure; upward pressure

D)upward pressure; downward pressure

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

47

The long-term, risk-free interest rate is driven by inflationary expectations, economic growth, the money supply, and the budget deficit.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following bonds is most susceptible to interest rate risk from an investor's perspective?

A)short-term, high-coupon

B)short-term, low-coupon

C)long-term, high-coupon

D)long-term, zero-coupon

A)short-term, high-coupon

B)short-term, low-coupon

C)long-term, high-coupon

D)long-term, zero-coupon

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

49

An increase in either the risk-free rate or the general level of the risk premium on bonds results in a higher required rate of return and therefore causes bond prices to increase.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is most likely to cause a decrease in bond prices?

A)a decrease in money supply growth and an increase in the demand for loanable funds

B)a forecast of decreasing oil prices

C)a forecast of a stronger dollar

D)an increase in money supply growth and no change in the demand for loanable funds

A)a decrease in money supply growth and an increase in the demand for loanable funds

B)a forecast of decreasing oil prices

C)a forecast of a stronger dollar

D)an increase in money supply growth and no change in the demand for loanable funds

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

51

Assume a bond with a $1,000 par value and an 11 percent coupon rate, two years remaining to maturity, and a 10 percent yield to maturity. The duration of this bond is

A)1.90 years.

B)1.50 years.

C)1.92 years.

D)none of the above

A)1.90 years.

B)1.50 years.

C)1.92 years.

D)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

52

The market price of a bond is partly determined by the timing of the payments made to bondholders.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

53

Sioux Financial Corp. has forecasted its bond portfolio value for one year ahead to be $105 million. In one year, it expects to receive $10,000,000 in coupon payments. The bond portfolio today is worth $101 million. What is the forecasted return of this bond portfolio?

A)10 percent

B)8.82 percent

C)4.32 percent

D)13.86 percent

E)none of the above

A)10 percent

B)8.82 percent

C)4.32 percent

D)13.86 percent

E)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

54

Hurricane Corp. recently purchased corporate bonds in the secondary market with a par value of $11 million, a coupon rate of 12 percent (with annual coupon payments), and four years until maturity. If Bullock intends to sell the bonds in two years and expects investors' required rate of return at that time on similar investments to be 14 percent at that time, what is the expected market value of the bonds in two years?

A)$9.33 million

B)$11.00 million

C)$10.64 million

D)$9.82 million

E)none of the above

A)$9.33 million

B)$11.00 million

C)$10.64 million

D)$9.82 million

E)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

55

Using a(n) ____ strategy, investors allocate funds evenly to bonds in each of several different maturity classes.

A)matching

B)laddered

C)barbell

D)interest rate

E)none of the above

A)matching

B)laddered

C)barbell

D)interest rate

E)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

56

Assume a bond with a $1,000 par value and an 11 percent coupon rate, two years remaining to maturity, and a 10 percent yield to maturity. The modified duration of this bond is

A)1.73 years.

B)1.71 years.

C)1.90 years.

D)none of the above

A)1.73 years.

B)1.71 years.

C)1.90 years.

D)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

57

The relationship reflecting the actual response of a bond's price to a change in bond yields is

A)concave.

B)convex.

C)linear.

D)quadratic.

A)concave.

B)convex.

C)linear.

D)quadratic.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

58

Bonds that sell below their par value are called premium bonds.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

59

With a(n) ____ strategy, funds are allocated to bonds with a short term to maturity and bonds with a long term to maturity. Thus, this strategy allocates some funds to achieving a relatively high return and other funds to covering liquidity needs.

A)matching

B)laddered

C)barbell

D)interest rate

E)none of the above

A)matching

B)laddered

C)barbell

D)interest rate

E)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

60

The valuation of bonds is generally perceived to be more difficult than the valuation of equity securities.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

61

A bond portfolio containing a large portion of zero-coupon bonds will be more favorably affected by declining interest rates than a bond portfolio containing no zero-coupon bonds.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

62

As interest rates increase, prices of short-term bonds will decline by a greater degree than prices on long-term bonds.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

63

Duration is a measure of bond price sensitivity.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

64

Because of a change in the required rate of return from 11 percent to 13 percent, the bond price of a zero-coupon bond will fall from $1,000 to $860. Thus, the bond price elasticity for this bond is

A)0.77.

B)-0.77.

C)-0.90.

D)-1.06.

E)none of the above.

A)0.77.

B)-0.77.

C)-0.90.

D)-1.06.

E)none of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

65

Foreign investors anticipating dollar depreciation are less willing to hold U.S. bonds because the coupon payments will convert to less of their home currency.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

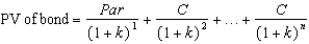

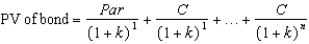

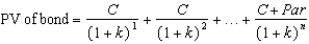

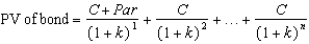

66

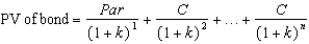

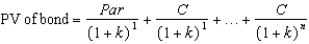

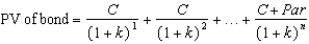

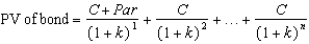

Which of the following formulas best describes the value of a bond?

A)

B)

C)

D)

E)none of the above

A)

B)

C)

D)

E)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

67

The required rate of return on a certain bond changes from 12 percent to 8 percent, causing the price of the bond to change from $900 to $1,100. The bond price elasticity of this bond is

A)-0.36.

B)-0.44.

C)-0.55.

D)-0.67.

E)0.67.

A)-0.36.

B)-0.44.

C)-0.55.

D)-0.67.

E)0.67.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

68

Julia just purchased a $1,000 par value bond with a 10 percent annual coupon rate and a life of twenty years. The bond has four years remaining until maturity, and the yield to maturity is 12 percent. How much did Julia pay for the bond?

A)$1,063.40

B)$1,000

C)$939.25

D)none of the above

A)$1,063.40

B)$1,000

C)$939.25

D)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

69

A bond has a $1,000 par value and an 8 percent coupon rate. The bond has four years remaining to maturity and a 10 percent yield to maturity. This bond's modified duration is ____ years.

A)1.33

B)1.27

C)3.24

D)1.31

E)none of the above

A)1.33

B)1.27

C)3.24

D)1.31

E)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

70

An economic announcement signaling ____ economic growth in the future will probably cause bond prices to ____.

A)weak; decrease

B)strong; increase

C)weak; increase

D)strong; decrease

E)Answers C and D are correct.

A)weak; decrease

B)strong; increase

C)weak; increase

D)strong; decrease

E)Answers C and D are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

71

To determine the present value of a bond that pays semiannual interest, which of the following adjustments should not be made to compute the price of the bond?

A)The annualized coupon should be split in half.

B)The annual discount rate should be divided by 2.

C)The number of annual periods should be doubled.

D)The par value should be split in half.

E)All of the above adjustments have to be made.

A)The annualized coupon should be split in half.

B)The annual discount rate should be divided by 2.

C)The number of annual periods should be doubled.

D)The par value should be split in half.

E)All of the above adjustments have to be made.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

72

In a laddered strategy, investors create a bond portfolio that will generate periodic income that can match their expected periodic expenses.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

73

Stephanie would like to purchase a bond that has a par value of $1,000, pays $80 at the end of each year in coupon payments, and has ten years remaining until maturity. If the prevailing annualized yield on other bonds with similar characteristics is 6 percent, how much will Stephanie pay for the bond?

A)$1,000.00

B)$1,147.20

C)$856.80

D)none of the above

A)$1,000.00

B)$1,147.20

C)$856.80

D)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

74

If the level of inflation is expected to decrease, there will be upward pressure on interest rates and on the required rate of return on bonds.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

75

Any announcement that signals stronger than expected economic growth tends to increase bond prices.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

76

Bond price elasticity is the percentage change in bond prices divided by the percentage change in the required rate of return.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

77

A $1,000 par value bond, paying $50 semiannually, with an 8 percent yield to maturity and five years remaining to maturity should sell for

A)$1,000.00.

B)$1,081.11.

C)$798.70.

D)$880.22.

E)none of the above.

A)$1,000.00.

B)$1,081.11.

C)$798.70.

D)$880.22.

E)none of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

78

Assume a bond with a $1,000 par value and an 11 percent coupon rate, two years remaining to maturity, and a 10 percent yield to maturity. The duration of this bond is ____ years.

A)1.92

B)1.50

C)1.90

D)none of the above

A)1.92

B)1.50

C)1.90

D)none of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

79

If the level of inflation is expected to ____, there will be ____ pressure on interest rates and ____ pressure on the required rate of return on bonds.

A)increase; upward; downward

B)decrease; upward; downward

C)decrease; upward; upward

D)increase; upward; upward

E)increase; downward; upward

A)increase; upward; downward

B)decrease; upward; downward

C)decrease; upward; upward

D)increase; upward; upward

E)increase; downward; upward

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

80

International diversification of bonds reduces the sensitivity of a bond portfolio to any single country's interest rate movements.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck