Deck 13: Investor Behaviour and Capital Market Efficiency

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/73

Play

Full screen (f)

Deck 13: Investor Behaviour and Capital Market Efficiency

1

According to the CAPM,investors should hold ________ assets in combination with the market portfolio of all risky securities.

A) more risky

B) risk free

C) less risky

D) same risk

A) more risky

B) risk free

C) less risky

D) same risk

risk free

2

Which of the following statements is false?

A) Nonzero alphas may merely indicate that the wrong market proxy is beings used; they do not necessarily indicate forgone positive NPV investment opportunities.

B) The true market portfolio contains much more than just stocks, it includes bonds, real estate, art, precious metals, and any other investment vehicles available.

C) If the true market portfolio is efficient, but the proxy portfolio is not highly correlated with the true market portfolio, then the true market portfolio will not be efficient and stocks will have nonzero alphas.

D) Much of the investment wealth cannot be included in the proxy for the market portfolio since it does not trade in competitive markets.

A) Nonzero alphas may merely indicate that the wrong market proxy is beings used; they do not necessarily indicate forgone positive NPV investment opportunities.

B) The true market portfolio contains much more than just stocks, it includes bonds, real estate, art, precious metals, and any other investment vehicles available.

C) If the true market portfolio is efficient, but the proxy portfolio is not highly correlated with the true market portfolio, then the true market portfolio will not be efficient and stocks will have nonzero alphas.

D) Much of the investment wealth cannot be included in the proxy for the market portfolio since it does not trade in competitive markets.

If the true market portfolio is efficient, but the proxy portfolio is not highly correlated with the true market portfolio, then the true market portfolio will not be efficient and stocks will have nonzero alphas.

3

Which of the following statements is false?

A) Over the years since the discovery of the CAPM, it has become increasingly clear to researchers and practitioners alike that by forming portfolios based on market capitalization, book-to-market ratios, and past returns, one can construct trading strategies that have a positive alpha.

B) Momentum trading strategy is to form portfolios based on market capitalization, book-to-market ratios, and past returns, and by doing so one can construct trading strategies that have a positive alpha.

C) Over the years since the discovery of the CAPM, it has become increasingly clear to researchers and practitioners alike that by forming portfolios based on market capitalization, book-to-market ratios, and past returns, one can construct trading strategies that have a negative alpha.

D) Over the years since the discovery of the CAPM, momentum trading strategy has been developed by forming portfolios based on market capitalization, book-to-market ratios, and past returns. By using such a strategy, one can construct trading strategies that have a positive alpha.

A) Over the years since the discovery of the CAPM, it has become increasingly clear to researchers and practitioners alike that by forming portfolios based on market capitalization, book-to-market ratios, and past returns, one can construct trading strategies that have a positive alpha.

B) Momentum trading strategy is to form portfolios based on market capitalization, book-to-market ratios, and past returns, and by doing so one can construct trading strategies that have a positive alpha.

C) Over the years since the discovery of the CAPM, it has become increasingly clear to researchers and practitioners alike that by forming portfolios based on market capitalization, book-to-market ratios, and past returns, one can construct trading strategies that have a negative alpha.

D) Over the years since the discovery of the CAPM, momentum trading strategy has been developed by forming portfolios based on market capitalization, book-to-market ratios, and past returns. By using such a strategy, one can construct trading strategies that have a positive alpha.

Over the years since the discovery of the CAPM, it has become increasingly clear to researchers and practitioners alike that by forming portfolios based on market capitalization, book-to-market ratios, and past returns, one can construct trading strategies that have a negative alpha.

4

Investors can ________ without reducing their expected return.

A) take more risk

B) take less risk

C) take the same risk

D) reduce risk

A) take more risk

B) take less risk

C) take the same risk

D) reduce risk

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is false?

A) A significant fraction of investors might care about aspects of their portfolios other than expected return and volatility, and so would be unwilling to hold inefficient investment portfolios.

B) Although the true market portfolio of all invested wealth might be efficient, the proxy portfolio might not track the actual market very well.

C) We might be using the wrong proxy portfolio when we calculate alphas.

D) The true market portfolio consists of all traded investment wealth in the economy.

A) A significant fraction of investors might care about aspects of their portfolios other than expected return and volatility, and so would be unwilling to hold inefficient investment portfolios.

B) Although the true market portfolio of all invested wealth might be efficient, the proxy portfolio might not track the actual market very well.

C) We might be using the wrong proxy portfolio when we calculate alphas.

D) The true market portfolio consists of all traded investment wealth in the economy.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

6

What does the existence of a positive alpha investment strategy imply?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is false?

A) Once the characteristic variables have been identified and measured for each firm, the return of each characteristic can be inferred from the data.

B) Even though the risk and return associated with each characteristic may remain stable, because the characteristics of a firm may change over time, so will the firm's risk and expected return.

C) Using a long period of time to estimate beta reduces measurement error, but because firms evolve dynamically, old data might not reflect the current risk profile of the firm.

D) Rather than attempting to estimate the risk and expected return of the firm indirectly, the characteristic variable model of returns views firms as a portfolio of different measurable "characteristics" that together determine the firm's risk and return.

A) Once the characteristic variables have been identified and measured for each firm, the return of each characteristic can be inferred from the data.

B) Even though the risk and return associated with each characteristic may remain stable, because the characteristics of a firm may change over time, so will the firm's risk and expected return.

C) Using a long period of time to estimate beta reduces measurement error, but because firms evolve dynamically, old data might not reflect the current risk profile of the firm.

D) Rather than attempting to estimate the risk and expected return of the firm indirectly, the characteristic variable model of returns views firms as a portfolio of different measurable "characteristics" that together determine the firm's risk and return.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

8

Explain why the market portfolio proxy may not be efficient.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is NOT an investment likely to be found in any proxy for the market portfolio?

A) Human capital

B) Stocks

C) Bonds

D) Precious metals

A) Human capital

B) Stocks

C) Bonds

D) Precious metals

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is false?

A) There is an economic reason why firm's betas might vary-the firm itself varies.

B) Only a few years of data are required to estimate risk premiums, since both risk premiums and betas remain stable over time.

C) When firms make new investments in new areas or shut down unprofitable projects in old areas their risk profiles change as well.

D) Calculating the cost of capital using multifactor models like the FFC factor specification or the CAPM relies on accurate estimates of risk premiums and betas.

A) There is an economic reason why firm's betas might vary-the firm itself varies.

B) Only a few years of data are required to estimate risk premiums, since both risk premiums and betas remain stable over time.

C) When firms make new investments in new areas or shut down unprofitable projects in old areas their risk profiles change as well.

D) Calculating the cost of capital using multifactor models like the FFC factor specification or the CAPM relies on accurate estimates of risk premiums and betas.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements is false?

A) Researchers use a proxy portfolio like the S&P/TSX Composite Index in Canada or the S&P 500 Index in the U.S. and assume that it will be highly correlated to the true market portfolio.

B) Many mutual funds exist that follow both the momentum-based trading strategy and the market capitalization/book-to-market--based strategy.

C) The true market portfolio should not consist of all traded investment wealth in the economy.

D) If the true market portfolio is efficient but the proxy portfolio is not highly correlated with the true market, then the proxy will not be efficient and stocks will have nonzero alphas.

A) Researchers use a proxy portfolio like the S&P/TSX Composite Index in Canada or the S&P 500 Index in the U.S. and assume that it will be highly correlated to the true market portfolio.

B) Many mutual funds exist that follow both the momentum-based trading strategy and the market capitalization/book-to-market--based strategy.

C) The true market portfolio should not consist of all traded investment wealth in the economy.

D) If the true market portfolio is efficient but the proxy portfolio is not highly correlated with the true market, then the proxy will not be efficient and stocks will have nonzero alphas.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

12

Various trading strategies appear to offer non-zero alphas when we examine real world data.If indeed these alphas are positive,it could be explained by any of the following statements EXCEPT:

A) Investors are systematically ignoring positive-NPV investment opportunities.

B) The market portfolio is inefficient, but the market portfolio proxy used to calculate the alphas is efficient.

C) A stock's beta with the market portfolio does not adequately measure a stock's systematic risk.

D) The positive alpha trading strategies contain risk that investors are unwilling to bear but the CAPM does not capture.

A) Investors are systematically ignoring positive-NPV investment opportunities.

B) The market portfolio is inefficient, but the market portfolio proxy used to calculate the alphas is efficient.

C) A stock's beta with the market portfolio does not adequately measure a stock's systematic risk.

D) The positive alpha trading strategies contain risk that investors are unwilling to bear but the CAPM does not capture.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

13

Uninformed individuals tend to ________ the precision of their knowledge.In finance,we call this presumptuousness the ________ hypothesis.

A) underestimate, underconfidence

B) overestimate, overconfidence

C) underestimate, overconfidence

D) overestimate, underconfidence

A) underestimate, underconfidence

B) overestimate, overconfidence

C) underestimate, overconfidence

D) overestimate, underconfidence

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is false?

A) The most important example of non-tradeable wealth is human capital.

B) If investors have a significant amount of non-tradeable wealth, this wealth will be an important part of their portfolios, but will not be part of the market portfolio of tradeable securities.

C) If the entire portfolio of investments is efficient, then just the tradeable part of the portfolio should be efficient also.

D) Researchers have found evidence that the presence of human capital can explain at least part of the reason for the inefficiency of the most commonly used market proxies.

A) The most important example of non-tradeable wealth is human capital.

B) If investors have a significant amount of non-tradeable wealth, this wealth will be an important part of their portfolios, but will not be part of the market portfolio of tradeable securities.

C) If the entire portfolio of investments is efficient, then just the tradeable part of the portfolio should be efficient also.

D) Researchers have found evidence that the presence of human capital can explain at least part of the reason for the inefficiency of the most commonly used market proxies.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

15

There is an important difference between the characteristic variable model and the multifactor models.That difference is that

A) in the multifactor models, the returns of the factor portfolios are observed, and we estimate the sensitivity of each stock to the different factors. In the characteristic variable model, the weight of each stock on each characteristic is observed, and then we estimate the return associated with each characteristic.

B) in the multifactor models, the returns of the factor portfolios are observed, and we estimate the return associated with each characteristic. In the characteristic variable model, the weight of each stock on each characteristic is observed, and then we estimate the sensitivity of each stock to the different factors.

C) in the characteristic variable model, the returns of the factor portfolios are observed, and we estimate the the return associated with each characteristic. In the multifactor models, the weight of each stock on each characteristic is observed, and then we estimate the sensitivity of each stock to the different factors.

D) in the multifactor models, the returns of the factor portfolios are not observed, and we estimate the sensitivity of each stock to the different factors. In the characteristic variable model, the weight of each stock on each characteristic is not observed, and then we estimate the return associated with each characteristic.

A) in the multifactor models, the returns of the factor portfolios are observed, and we estimate the sensitivity of each stock to the different factors. In the characteristic variable model, the weight of each stock on each characteristic is observed, and then we estimate the return associated with each characteristic.

B) in the multifactor models, the returns of the factor portfolios are observed, and we estimate the return associated with each characteristic. In the characteristic variable model, the weight of each stock on each characteristic is observed, and then we estimate the sensitivity of each stock to the different factors.

C) in the characteristic variable model, the returns of the factor portfolios are observed, and we estimate the the return associated with each characteristic. In the multifactor models, the weight of each stock on each characteristic is observed, and then we estimate the sensitivity of each stock to the different factors.

D) in the multifactor models, the returns of the factor portfolios are not observed, and we estimate the sensitivity of each stock to the different factors. In the characteristic variable model, the weight of each stock on each characteristic is not observed, and then we estimate the return associated with each characteristic.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is false?

A) We cannot observe the returns of the characteristic variables directly, so their returns in each period are estimated directly from firms' returns by regressing the return of all firms onto the value of the characteristic variables.

B) Another approach is to use the estimated returns of the characteristic variables to estimate the covariance between pairs of stocks, or between a stock and the market index. The idea behind this approach is that if firms' characteristics change over time, the covariance between the characteristic returns may be more stable than the covariance between stocks themselves.

C) If you view a stock as portfolio of characteristic variables, then the stock's expected return is the sum over all the variables of the amount of each characteristic variable the stock contains times the expected return of that variable.

D) There are a number of ways that people use the estimated relation between the characteristic variables and returns. Perhaps the most straightforward approach is simply to use the relation to estimate each stock's expected return.

A) We cannot observe the returns of the characteristic variables directly, so their returns in each period are estimated directly from firms' returns by regressing the return of all firms onto the value of the characteristic variables.

B) Another approach is to use the estimated returns of the characteristic variables to estimate the covariance between pairs of stocks, or between a stock and the market index. The idea behind this approach is that if firms' characteristics change over time, the covariance between the characteristic returns may be more stable than the covariance between stocks themselves.

C) If you view a stock as portfolio of characteristic variables, then the stock's expected return is the sum over all the variables of the amount of each characteristic variable the stock contains times the expected return of that variable.

D) There are a number of ways that people use the estimated relation between the characteristic variables and returns. Perhaps the most straightforward approach is simply to use the relation to estimate each stock's expected return.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

17

One of the most important implications of our discussion of risk and return is the benefit of ________.

A) diversification

B) take certain risk

C) pursue higher return

D) reduce risk level

A) diversification

B) take certain risk

C) pursue higher return

D) reduce risk level

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is false?

A) If the CAPM correctly computed the risk premium, investors would stop investing only when they expected the alpha of an investment strategy to be negative.

B) If the CAPM correctly computes the risk premium, an investment opportunity with a positive alpha is a positive-NPV investment opportunity.

C) If the CAPM correctly computes the risk premium, investors should flock to invest in positive alpha stocks.

D) Anyone can implement a momentum trading strategy and therefore generate a positive investment opportunity.

A) If the CAPM correctly computed the risk premium, investors would stop investing only when they expected the alpha of an investment strategy to be negative.

B) If the CAPM correctly computes the risk premium, an investment opportunity with a positive alpha is a positive-NPV investment opportunity.

C) If the CAPM correctly computes the risk premium, investors should flock to invest in positive alpha stocks.

D) Anyone can implement a momentum trading strategy and therefore generate a positive investment opportunity.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is false?

A) The existence of the momentum trading strategy has been widely known for at least ten years.

B) The information required to implement a momentum strategy is not readily available to investors.

C) If the market portfolio is not efficient, then a stock's beta with the market is not an adequate measure of its systematic risk.

D) If the market portfolio is not efficient, then the so-called profits from a positive alpha trading strategy are really returns for bearing risk that investors are averse to and the CAPM doesn't capture.

A) The existence of the momentum trading strategy has been widely known for at least ten years.

B) The information required to implement a momentum strategy is not readily available to investors.

C) If the market portfolio is not efficient, then a stock's beta with the market is not an adequate measure of its systematic risk.

D) If the market portfolio is not efficient, then the so-called profits from a positive alpha trading strategy are really returns for bearing risk that investors are averse to and the CAPM doesn't capture.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is false?

A) If indeed alphas are positive, it is possible that the positive alpha trading strategies contain risk that investors are unwilling to bear but that the CAPM does not capture.

B) If indeed alphas are positive, it is possible that the costs of implementing investment strategies are larger than the NPVs of undertaking them.

C) If indeed alphas are positive, then investors have to be systematically ignoring positive-NPV investment opportunities.

D) The only way a positive-NPV investment opportunity can exist in a market is if some barrier to entry restricts competition.

A) If indeed alphas are positive, it is possible that the positive alpha trading strategies contain risk that investors are unwilling to bear but that the CAPM does not capture.

B) If indeed alphas are positive, it is possible that the costs of implementing investment strategies are larger than the NPVs of undertaking them.

C) If indeed alphas are positive, then investors have to be systematically ignoring positive-NPV investment opportunities.

D) The only way a positive-NPV investment opportunity can exist in a market is if some barrier to entry restricts competition.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

21

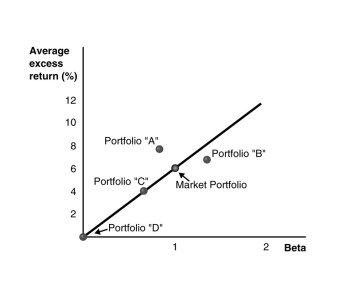

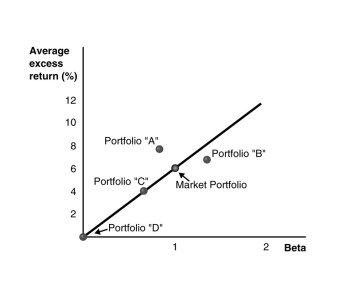

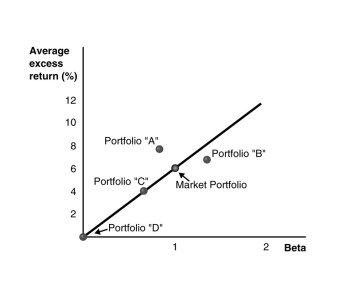

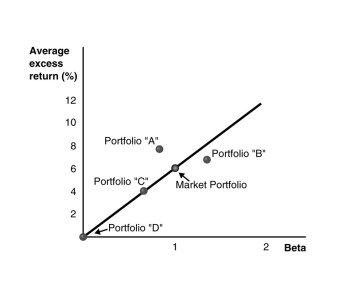

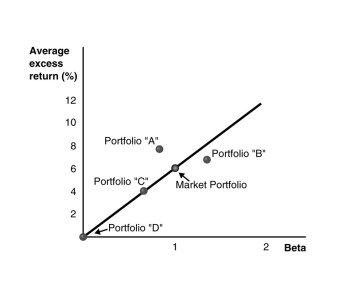

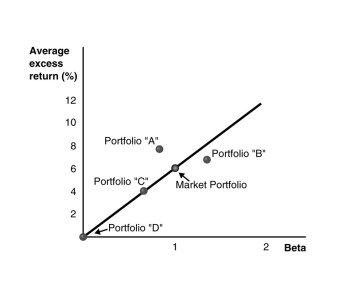

Use the figure for the question(s) below.

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "B" is/are correct? 1.Portfolio "B" has a positive alpha.

2)Portfolio "B" is overpriced.

3)Portfolio "B" is less risky than the market portfolio.

4)Portfolio "B" should not exist if the market portfolio is efficient.

A) 2 and 4

B) 4 only

C) 1, 3, and 4

D) 1 and 4

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "B" is/are correct? 1.Portfolio "B" has a positive alpha.

2)Portfolio "B" is overpriced.

3)Portfolio "B" is less risky than the market portfolio.

4)Portfolio "B" should not exist if the market portfolio is efficient.

A) 2 and 4

B) 4 only

C) 1, 3, and 4

D) 1 and 4

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

22

Stock returns tend to be ________ when it is a ________ at the location of the stock exchange.

A) higher, rainy day

B) lower, sunny day

C) higher, sunny day

D) lower, rainy day

A) higher, rainy day

B) lower, sunny day

C) higher, sunny day

D) lower, rainy day

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

23

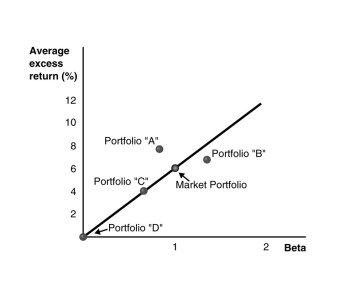

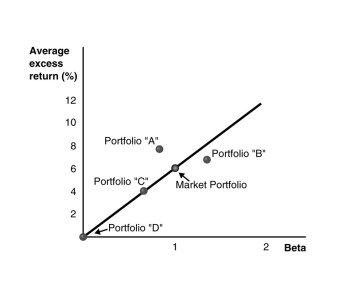

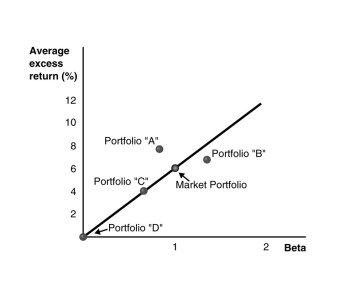

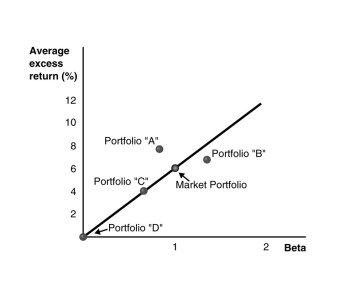

Use the figure for the question(s) below.

Consider the following graph of the security market line:

Portfolio "A"

A) has a relatively lower expected return than predicted.

B) has a positive alpha.

C) falls below the SML.

D) is overpriced.

Consider the following graph of the security market line:

Portfolio "A"

A) has a relatively lower expected return than predicted.

B) has a positive alpha.

C) falls below the SML.

D) is overpriced.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is false?

A) Portfolios with high market capitalizations will have positive alphas if the market portfolio is not efficient.

B) The size effect is the observation that firms with high book-to-market ratios have positive alphas.

C) If the market portfolio is not efficient, then a portfolio of high book-to-market stocks will likely have positive alphas.

D) Portfolios with low book-to-market ratios will have negative alphas if the market portfolio is not efficient.

A) Portfolios with high market capitalizations will have positive alphas if the market portfolio is not efficient.

B) The size effect is the observation that firms with high book-to-market ratios have positive alphas.

C) If the market portfolio is not efficient, then a portfolio of high book-to-market stocks will likely have positive alphas.

D) Portfolios with low book-to-market ratios will have negative alphas if the market portfolio is not efficient.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

25

The phenomenon in which individuals imitate each other's actions,is referred to as ________.

A) her behaviour

B) cascade effect

C) disposition effect

D) sensation seeking

A) her behaviour

B) cascade effect

C) disposition effect

D) sensation seeking

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

26

Why is the high trading volume observed in markets inconsistent with the CAPM equilibrium?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

27

When the market portfolio is not efficient,theory predicts that stocks with ________ market capitalizations or ________ book-to-market ratios will have ________ alphas.

A) high; low; positive

B) low; high; negative

C) low; high; positive

D) high; low; negative

A) high; low; positive

B) low; high; negative

C) low; high; positive

D) high; low; negative

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements is false?

A) If the market portfolio is efficient, then all securities and portfolios must plot on the SML, not just individual stocks.

B) For most stocks the standard errors of the alpha estimates are large, so it is impossible to conclude that the alphas are statistically different from zero.

C) It is not difficult to find individual stocks that, in the past, have not plotted on the SML.

D) Small stocks (those with lower market capitalization) have lower average returns.

A) If the market portfolio is efficient, then all securities and portfolios must plot on the SML, not just individual stocks.

B) For most stocks the standard errors of the alpha estimates are large, so it is impossible to conclude that the alphas are statistically different from zero.

C) It is not difficult to find individual stocks that, in the past, have not plotted on the SML.

D) Small stocks (those with lower market capitalization) have lower average returns.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

29

The phenomenon in which individuals believe others have superior information which they can take advantage of by copying their trades is referred to as ________.

A) her behaviour

B) cascade effect

C) disposition effect

D) sensation seeking

A) her behaviour

B) cascade effect

C) disposition effect

D) sensation seeking

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

30

Investors tend to ________ to stocks that ________ and ________ stocks that ________ since the time of purchase.

A) hold on, have lost value, sell, have risen in value

B) sell, have lost value, hold on, have risen in value

C) hold on, have risen in value, sell have lost value.

D) sell, have lost value, hold on, have risen in value..

A) hold on, have lost value, sell, have risen in value

B) sell, have lost value, hold on, have risen in value

C) hold on, have risen in value, sell have lost value.

D) sell, have lost value, hold on, have risen in value..

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

31

Use the figure for the question(s) below.

Consider the following graph of the security market line:

The market portfolio

A) is underpriced.

B) has a positive alpha.

C) is overpriced.

D) falls on the SML.

Consider the following graph of the security market line:

The market portfolio

A) is underpriced.

B) has a positive alpha.

C) is overpriced.

D) falls on the SML.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is false?

A) A momentum strategy is one where you buy stocks that have had low past returns and (short) sell stocks that have had high past returns.

B) Over the years since the discovery of the CAPM, it has become increasingly clear to researchers and practitioners alike that by forming portfolios based on market capitalization, book-to-market ratios, and past returns, one can construct trading strategies that have a positive alpha.

C) Portfolios containing firms with the highest realized returns over the previous six months have positive alphas over the next six months.

D) If the market portfolio is not efficient, then a portfolio of small stocks will likely have positive alphas.

A) A momentum strategy is one where you buy stocks that have had low past returns and (short) sell stocks that have had high past returns.

B) Over the years since the discovery of the CAPM, it has become increasingly clear to researchers and practitioners alike that by forming portfolios based on market capitalization, book-to-market ratios, and past returns, one can construct trading strategies that have a positive alpha.

C) Portfolios containing firms with the highest realized returns over the previous six months have positive alphas over the next six months.

D) If the market portfolio is not efficient, then a portfolio of small stocks will likely have positive alphas.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

33

Use the figure for the question(s) below.

Consider the following graph of the security market line:

Portfolio "B"

A) is less risky than the market portfolio.

B) is overpriced.

C) has a positive alpha.

D) falls above the SML.

Consider the following graph of the security market line:

Portfolio "B"

A) is less risky than the market portfolio.

B) is overpriced.

C) has a positive alpha.

D) falls above the SML.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

34

Stocks with lower market capitalizations have ________ average returns.This empirical result is called the size effect.

A) higher

B) lower

C) zero

D) weighted

A) higher

B) lower

C) zero

D) weighted

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

35

Investors appear to put too ________ weight on ________ rather than considering all the ________.

A) less, their own experience, historical evidence

B) much, their own experience, historical evidence

C) less, historical evidence, their own experience

D) much, historical evidence, their own experience

A) less, their own experience, historical evidence

B) much, their own experience, historical evidence

C) less, historical evidence, their own experience

D) much, historical evidence, their own experience

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

36

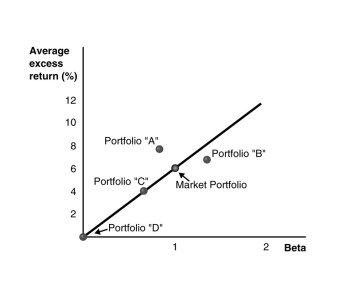

Use the figure for the question(s) below.

Consider the following graph of the security market line:

Portfolio "C"

A) is less risky than the market portfolio.

B) has a relatively lower expected return than predicted.

C) is underpriced.

D) has a negative alpha.

Consider the following graph of the security market line:

Portfolio "C"

A) is less risky than the market portfolio.

B) has a relatively lower expected return than predicted.

C) is underpriced.

D) has a negative alpha.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is false?

A) The size effect is the observation that small stocks have positive alphas.

B) When considering portfolios formed based on the market-to-book ratio, most of the portfolios plot below the security market line.

C) The largest alphas occur in the smallest size deciles.

D) When considering portfolios formed based on size, although the portfolios with the higher betas yield higher returns, most size portfolios plot above the security market line.

A) The size effect is the observation that small stocks have positive alphas.

B) When considering portfolios formed based on the market-to-book ratio, most of the portfolios plot below the security market line.

C) The largest alphas occur in the smallest size deciles.

D) When considering portfolios formed based on size, although the portfolios with the higher betas yield higher returns, most size portfolios plot above the security market line.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

38

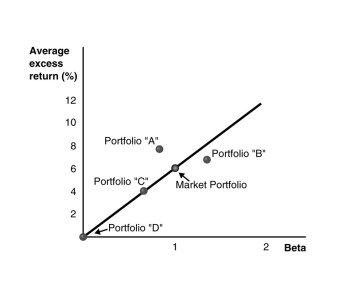

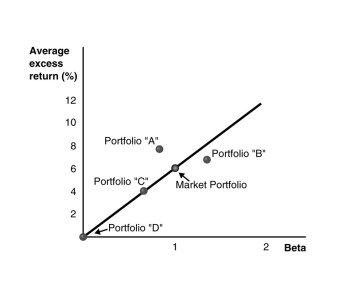

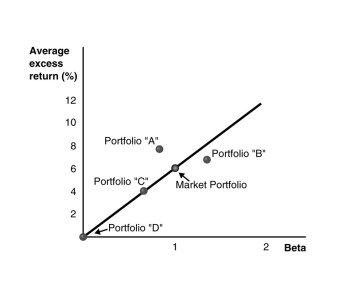

Use the figure for the question(s) below.

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "A" is/are correct? 1.Portfolio "A" has a positive alpha.

2)Portfolio "A" is overpriced.

3)Portfolio "A" is less risky than the market portfolio.

4)Portfolio "A" should not exist if the market portfolio is efficient.

A) 1 and 2

B) 1, 3, and 4

C) 1 and 3

D) 1, 2, 3, and 4

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "A" is/are correct? 1.Portfolio "A" has a positive alpha.

2)Portfolio "A" is overpriced.

3)Portfolio "A" is less risky than the market portfolio.

4)Portfolio "A" should not exist if the market portfolio is efficient.

A) 1 and 2

B) 1, 3, and 4

C) 1 and 3

D) 1, 2, 3, and 4

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

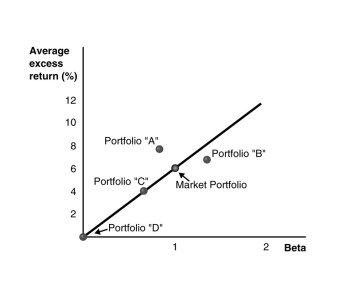

39

Use the figure for the question(s) below.

Consider the following graph of the security market line:

Portfolio "D"

A) falls below the SML.

B) has a negative alpha.

C) is overpriced.

D) offers an expected return equal to the risk-free rate.

Consider the following graph of the security market line:

Portfolio "D"

A) falls below the SML.

B) has a negative alpha.

C) is overpriced.

D) offers an expected return equal to the risk-free rate.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

40

________ may also reflect a reluctance to "admit a mistake" by taking the loss.

A) Relative wealth concerns

B) Rational expectations

C) Familiarity bias

D) Disposition effect

A) Relative wealth concerns

B) Rational expectations

C) Familiarity bias

D) Disposition effect

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

41

Use the information for the question(s) below.

Consider two firms, Chihuahua Corporation and Bernard Industries, that are each expected to pay the same $1.5 million dividend every year in perpetuity. Chihuahua Corporation is riskier and has a cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has a cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12%.

The market value for Chihuahua Corporation is closest to

A) $10.0 million.

B) $12.5 million.

C) $12.0 million.

D) $15.0 million.

Consider two firms, Chihuahua Corporation and Bernard Industries, that are each expected to pay the same $1.5 million dividend every year in perpetuity. Chihuahua Corporation is riskier and has a cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has a cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12%.

The market value for Chihuahua Corporation is closest to

A) $10.0 million.

B) $12.5 million.

C) $12.0 million.

D) $15.0 million.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

42

Use the equation for the question(s) below.

Consider the following regression model:

-The term ?is a(n)

A) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

B) error term that has an expectation of zero and is uncorrelated with either factor.

C) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

D) constant term.

Consider the following regression model:

-The term ?is a(n)

A) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

B) error term that has an expectation of zero and is uncorrelated with either factor.

C) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

D) constant term.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

43

Use the equation for the question(s) below.

Consider the following regression model:

The term is a(n)

is a(n)

A) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

B) constant term.

C) error term that has an expectation of zero and is uncorrelated with either factor.

D) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

Consider the following regression model:

The term

is a(n)

is a(n)A) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

B) constant term.

C) error term that has an expectation of zero and is uncorrelated with either factor.

D) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

44

Use the equation for the question(s) below.

Consider the following regression model:

Which of the following statements is false?

A) It is not actually necessary to identify the efficient portfolio itself. All that is required is to identify a collection of portfolios from which the efficient portfolio can be constructed.

B) Although we might not be able to identify the efficient portfolio itself, we know some characteristics of the efficient portfolio.

C) An efficient portfolio can be constructed from other diversified portfolios.

D) An efficient portfolio need not be well diversified.

Consider the following regression model:

Which of the following statements is false?

A) It is not actually necessary to identify the efficient portfolio itself. All that is required is to identify a collection of portfolios from which the efficient portfolio can be constructed.

B) Although we might not be able to identify the efficient portfolio itself, we know some characteristics of the efficient portfolio.

C) An efficient portfolio can be constructed from other diversified portfolios.

D) An efficient portfolio need not be well diversified.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

45

Use the equation for the question(s) below.

Consider the following regression model:

-The term s is a(n)

A) error term that has an expectation of zero and is uncorrelated with either factor.

B) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

C) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

D) constant term.

Consider the following regression model:

-The term s is a(n)

A) error term that has an expectation of zero and is uncorrelated with either factor.

B) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

C) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

D) constant term.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

46

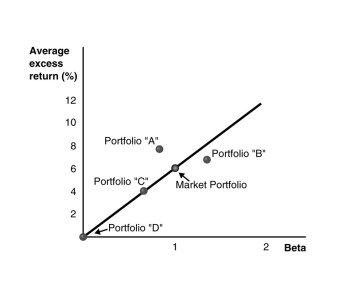

Use the figure for the question(s) below.

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "C" is/are correct? 1.Portfolio "C" has a negative alpha.

2)Portfolio "C" is overpriced.

3)Portfolio "C" is less risky than the market portfolio.

4)Portfolio "C" should not exist if the market portfolio is efficient.

A) 1 and 3

B) 2 and 4

C) 1, 3, and 4

D) 3 only

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "C" is/are correct? 1.Portfolio "C" has a negative alpha.

2)Portfolio "C" is overpriced.

3)Portfolio "C" is less risky than the market portfolio.

4)Portfolio "C" should not exist if the market portfolio is efficient.

A) 1 and 3

B) 2 and 4

C) 1, 3, and 4

D) 3 only

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

47

Use the equation for the question(s) below.

Consider the following regression model:

Which of the following statements is false?

A) The risk premium of any marketable security can be written as the sum of the risk premiums of each factor multiplied by the sensitivity of the stock with those factors.

B) The factor beta measures the sensitivity of the stock to a particular factor.

C) If we use more than one portfolio as factors, then together these factors will capture systematic risk, but each factor captures different components of the systematic risk.

D) When we use more than one portfolio to capture risk, the model is known as a single factor model.

Consider the following regression model:

Which of the following statements is false?

A) The risk premium of any marketable security can be written as the sum of the risk premiums of each factor multiplied by the sensitivity of the stock with those factors.

B) The factor beta measures the sensitivity of the stock to a particular factor.

C) If we use more than one portfolio as factors, then together these factors will capture systematic risk, but each factor captures different components of the systematic risk.

D) When we use more than one portfolio to capture risk, the model is known as a single factor model.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

48

A group of portfolios from which we can form an efficient portfolio is called

A) factor portfolios.

B) semi-efficient portfolios.

C) partially efficient portfolios.

D) characteristic portfolios.

A) factor portfolios.

B) semi-efficient portfolios.

C) partially efficient portfolios.

D) characteristic portfolios.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

49

One of the reasons that it is extremely difficult in practice to identify portfolios that are efficient is because

A) we cannot measure the realized return and the standard deviation of a portfolio with great accuracy.

B) we cannot measure the expected return and the standard deviation of a portfolio with great accuracy.

C) we cannot measure the weighted average return and the standard deviation of a portfolio with great accuracy.

D) we cannot measure the required return and the standard deviation of a portfolio with great accuracy.

A) we cannot measure the realized return and the standard deviation of a portfolio with great accuracy.

B) we cannot measure the expected return and the standard deviation of a portfolio with great accuracy.

C) we cannot measure the weighted average return and the standard deviation of a portfolio with great accuracy.

D) we cannot measure the required return and the standard deviation of a portfolio with great accuracy.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

50

The size effect reflects the fact that returns of small stocks appear ________ even accounting for their ________ beta.

A) high, lower

B) low, higher

C) low, lower

D) high, higher

A) high, lower

B) low, higher

C) low, lower

D) high, higher

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

51

Use the equation for the question(s) below.

Consider the following regression model:

The term is a(n)

is a(n)

A) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

B) error term that has an expectation of zero and is uncorrelated with either factor.

C) constant term.

D) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

Consider the following regression model:

The term

is a(n)

is a(n)A) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

B) error term that has an expectation of zero and is uncorrelated with either factor.

C) constant term.

D) measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

52

Book-to-market ratio is the ratio of ________.

A) book value of assets to the market value of assets

B) book value of equity to the market value of equity

C) book value of debts to the market value of debts

D) book value of working capital to the market value of working capital

A) book value of assets to the market value of assets

B) book value of equity to the market value of equity

C) book value of debts to the market value of debts

D) book value of working capital to the market value of working capital

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

53

All else being equal a ________ alpha implies that the stock also has a relative ________ expected return.

A) positive, high

B) negative, high

C) positive, low

D) negative, low

A) positive, high

B) negative, high

C) positive, low

D) negative, low

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

54

Use the information for the question(s) below.

Consider two firms, Chihuahua Corporation and Bernard Industries, that are each expected to pay the same $1.5 million dividend every year in perpetuity. Chihuahua Corporation is riskier and has a cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has a cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12%.

The market value for Bernard Industries is closest to

A) $12.0 million.

B) $10.0 million.

C) $15.0 million.

D) $12.5 million.

Consider two firms, Chihuahua Corporation and Bernard Industries, that are each expected to pay the same $1.5 million dividend every year in perpetuity. Chihuahua Corporation is riskier and has a cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has a cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12%.

The market value for Bernard Industries is closest to

A) $12.0 million.

B) $10.0 million.

C) $15.0 million.

D) $12.5 million.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

55

The size effect reveals that stocks with a ________ book-to-market ratio have ________ alphas.

A) low, positive

B) low, negative

C) high, positive

D) high,negative

A) low, positive

B) low, negative

C) high, positive

D) high,negative

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

56

Use the information for the question(s) below.

Consider two firms, Chihuahua Corporation and Bernard Industries, that are each expected to pay the same $1.5 million dividend every year in perpetuity. Chihuahua Corporation is riskier and has a cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has a cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12%.

The alpha for Bernard is closest to:

A) +5%

B) -2%

C) -3%

D) +2%

Consider two firms, Chihuahua Corporation and Bernard Industries, that are each expected to pay the same $1.5 million dividend every year in perpetuity. Chihuahua Corporation is riskier and has a cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has a cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12%.

The alpha for Bernard is closest to:

A) +5%

B) -2%

C) -3%

D) +2%

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

57

Use the information for the question(s) below.

Consider two firms, Chihuahua Corporation and Bernard Industries, that are each expected to pay the same $1.5 million dividend every year in perpetuity. Chihuahua Corporation is riskier and has a cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has a cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12%.

The alpha for Chihuahua is closest to:

A) +2%

B) -5%

C) -3%

D) +3%

Consider two firms, Chihuahua Corporation and Bernard Industries, that are each expected to pay the same $1.5 million dividend every year in perpetuity. Chihuahua Corporation is riskier and has a cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has a cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12%.

The alpha for Chihuahua is closest to:

A) +2%

B) -5%

C) -3%

D) +3%

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

58

Rather than relying on the efficiency of a single portfolio (such as the market),multifactor models rely on ________ that an efficient portfolio can be constructed from a collection of well-diversified portfolios or factors.

A) the stronger condition

B) the neutral condition

C) the weaker condition

D) the unbiased condition

A) the stronger condition

B) the neutral condition

C) the weaker condition

D) the unbiased condition

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

59

________ have historically earned ________ returns than the market portfolio.

A) Small stocks, higher average

B) Big stocks, higher average

C) Small stocks, lower average

D) Big stocks, lower average

A) Small stocks, higher average

B) Big stocks, higher average

C) Small stocks, lower average

D) Big stocks, lower average

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

60

Investment strategy that ________ stocks that have had past ________ returns and ________ stocks that have had past ________ return is called a momentum strategy.

A) buys, low, sells high

B) sells, high, buys, low

C) buys, high, sells, low

D) sells, low, buys high

A) buys, low, sells high

B) sells, high, buys, low

C) buys, high, sells, low

D) sells, low, buys high

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

61

Use the equation for the question(s) below.

Consider the following regression model:

Which of the following statements is false?

A) Rather than relying on the efficiency of a single portfolio (such as the market), multifactor models rely on the weaker condition that an efficient portfolio can be constructed from a collection of well-diversified portfolios or factors.

B) A positive alpha in a single factor model means that the portfolios that implement the trading strategy capture risk that is not captured by the market portfolio.

C) Multifactor models have a distinct advantage over single-factor models in that it is much easier to identify a collection of portfolios that captures systematic risk than just a single portfolio.

D) Trading strategies based on market capitalization, book-to-market ratios, and momentum have been developed that appear to have zero alphas.

Consider the following regression model:

Which of the following statements is false?

A) Rather than relying on the efficiency of a single portfolio (such as the market), multifactor models rely on the weaker condition that an efficient portfolio can be constructed from a collection of well-diversified portfolios or factors.

B) A positive alpha in a single factor model means that the portfolios that implement the trading strategy capture risk that is not captured by the market portfolio.

C) Multifactor models have a distinct advantage over single-factor models in that it is much easier to identify a collection of portfolios that captures systematic risk than just a single portfolio.

D) Trading strategies based on market capitalization, book-to-market ratios, and momentum have been developed that appear to have zero alphas.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

62

According to a survey of 392 CFOs conducted by John Graham and Campbell Harvey,the most common method used in corporate America to estimate the cost of capital is

A) the CAPM.

B) multifactor models.

C) characteristic models.

D) the dividend discount model.

A) the CAPM.

B) multifactor models.

C) characteristic models.

D) the dividend discount model.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

63

Use the equation for the question(s) below.

Consider the following factor model:

E[Rs] - rf =![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) book-to-market. B) momentum. C) size. D) the overall market.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7d_b9bd_d9478de7ef04_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) (E[RMkt] - rf) +

(E[RMkt] - rf) + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) book-to-market. B) momentum. C) size. D) the overall market.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7e_b9bd_1b433c6d1544_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RSMB] +

E[RSMB] + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) book-to-market. B) momentum. C) size. D) the overall market.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7f_b9bd_49034246e9b7_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RHML] +

E[RHML] + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) book-to-market. B) momentum. C) size. D) the overall market.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_c390_b9bd_1996fde6fa1a_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RPR1 YR]

E[RPR1 YR]

The term![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) book-to-market. B) momentum. C) size. D) the overall market.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd29_11b3_b9bd_69c037cb4093_TB1619_11.jpg) measures the sensitivity of the securities' returns to

measures the sensitivity of the securities' returns to

A) book-to-market.

B) momentum.

C) size.

D) the overall market.

Consider the following factor model:

E[Rs] - rf =

![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) book-to-market. B) momentum. C) size. D) the overall market.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7d_b9bd_d9478de7ef04_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) (E[RMkt] - rf) +

(E[RMkt] - rf) + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) book-to-market. B) momentum. C) size. D) the overall market.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7e_b9bd_1b433c6d1544_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RSMB] +

E[RSMB] + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) book-to-market. B) momentum. C) size. D) the overall market.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7f_b9bd_49034246e9b7_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RHML] +

E[RHML] + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) book-to-market. B) momentum. C) size. D) the overall market.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_c390_b9bd_1996fde6fa1a_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RPR1 YR]

E[RPR1 YR]The term

![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) book-to-market. B) momentum. C) size. D) the overall market.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd29_11b3_b9bd_69c037cb4093_TB1619_11.jpg) measures the sensitivity of the securities' returns to

measures the sensitivity of the securities' returns toA) book-to-market.

B) momentum.

C) size.

D) the overall market.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

64

Use the equation for the question(s) below.

Consider the following regression model:

Which of the following statements is false?

A) As a practical matter, it is extremely difficult to identify portfolios that are efficient because we cannot measure the expected return and the standard deviation of a portfolio with great accuracy.

B) The portfolios in a multifactor model can be thought of as either risk factors themselves or portfolios of stocks correlated with unobservable risk factors.

C) Each factor beta is the expected percent change in the excess return of a security for a 1% change in the excess return of the factor portfolio.

D) Even if the market portfolio is not efficient, it still must capture all components of systematic risk.

Consider the following regression model:

Which of the following statements is false?

A) As a practical matter, it is extremely difficult to identify portfolios that are efficient because we cannot measure the expected return and the standard deviation of a portfolio with great accuracy.

B) The portfolios in a multifactor model can be thought of as either risk factors themselves or portfolios of stocks correlated with unobservable risk factors.

C) Each factor beta is the expected percent change in the excess return of a security for a 1% change in the excess return of the factor portfolio.

D) Even if the market portfolio is not efficient, it still must capture all components of systematic risk.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

65

One of the major reasons that there is so little consensus in practice about which of the four models to use is because

A) financial economics has reached the point where we can provide a theory of expected returns that gives a precise estimate of the cost of capital.

B) financial economics has not yet reached the point where we can provide a theory of realized returns that gives a precise estimate of the cost of capital.

C) financial economics has not yet reached the point where we can provide a theory of expected returns that gives a precise estimate of the cost of capital.

D) financial economics has reached the point where we can provide a theory of realized returns that gives a precise estimate of the cost of capital.

A) financial economics has reached the point where we can provide a theory of expected returns that gives a precise estimate of the cost of capital.

B) financial economics has not yet reached the point where we can provide a theory of realized returns that gives a precise estimate of the cost of capital.

C) financial economics has not yet reached the point where we can provide a theory of expected returns that gives a precise estimate of the cost of capital.

D) financial economics has reached the point where we can provide a theory of realized returns that gives a precise estimate of the cost of capital.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

66

Use the equation for the question(s) below.

Consider the following regression model:

Which of the following statements is false?

A) Because expected returns are not easy to estimate, each portfolio that is added to a multifactor model increases the difficulty of implementing the model.

B) The self-financing portfolio made from high minus low book-to-market stocks is called the high-minus-low (HML) portfolio.

C) The FFC factor specification was identified a little more than ten years ago. Although it is widely used in academic literature to measure risk, much debate persists about whether it really is a significant improvement over the CAPM.

D) A trading strategy that each year short sells portfolio S (small stocks) and uses this position to buy portfolio B (big stocks) has produced positive risk adjusted returns historically. This self-financing portfolio is widely known as the small minus big (SMB) portfolio.

Consider the following regression model:

Which of the following statements is false?

A) Because expected returns are not easy to estimate, each portfolio that is added to a multifactor model increases the difficulty of implementing the model.

B) The self-financing portfolio made from high minus low book-to-market stocks is called the high-minus-low (HML) portfolio.

C) The FFC factor specification was identified a little more than ten years ago. Although it is widely used in academic literature to measure risk, much debate persists about whether it really is a significant improvement over the CAPM.

D) A trading strategy that each year short sells portfolio S (small stocks) and uses this position to buy portfolio B (big stocks) has produced positive risk adjusted returns historically. This self-financing portfolio is widely known as the small minus big (SMB) portfolio.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

67

Use the equation for the question(s) below.

Consider the following factor model:

E[Rs] - rf =![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) the overall market. B) book-to-market. C) size. D) momentum.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7d_b9bd_d9478de7ef04_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) (E[RMkt] - rf) +

(E[RMkt] - rf) + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) the overall market. B) book-to-market. C) size. D) momentum.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7e_b9bd_1b433c6d1544_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RSMB] +

E[RSMB] + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) the overall market. B) book-to-market. C) size. D) momentum.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7f_b9bd_49034246e9b7_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RHML] +

E[RHML] + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) the overall market. B) book-to-market. C) size. D) momentum.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_c390_b9bd_1996fde6fa1a_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RPR1 YR]

E[RPR1 YR]

The term![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) the overall market. B) book-to-market. C) size. D) momentum.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd29_11b4_b9bd_ad6aca9844e7_TB1619_11.jpg) measures the sensitivity of the securities' returns to

measures the sensitivity of the securities' returns to

A) the overall market.

B) book-to-market.

C) size.

D) momentum.

Consider the following factor model:

E[Rs] - rf =

![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) the overall market. B) book-to-market. C) size. D) momentum.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7d_b9bd_d9478de7ef04_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) (E[RMkt] - rf) +

(E[RMkt] - rf) + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) the overall market. B) book-to-market. C) size. D) momentum.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7e_b9bd_1b433c6d1544_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RSMB] +

E[RSMB] + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) the overall market. B) book-to-market. C) size. D) momentum.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_9c7f_b9bd_49034246e9b7_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RHML] +

E[RHML] + ![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) the overall market. B) book-to-market. C) size. D) momentum.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd28_c390_b9bd_1996fde6fa1a_TB1619_11_TB1619_11_TB1619_11_TB1619_11.jpg) E[RPR1 YR]

E[RPR1 YR]The term

![<strong>Use the equation for the question(s) below. Consider the following factor model: E[R<sub>s</sub>] - r<sub>f</sub> = (E[R<sub>Mkt</sub>] - r<sub>f</sub>) + E[R<sub>SMB</sub>] + E[R<sub>HML</sub>] + E[RPR1 YR] The term measures the sensitivity of the securities' returns to</strong> A) the overall market. B) book-to-market. C) size. D) momentum.](https://d2lvgg3v3hfg70.cloudfront.net/TB1619/11ea7db1_bd29_11b4_b9bd_ad6aca9844e7_TB1619_11.jpg) measures the sensitivity of the securities' returns to

measures the sensitivity of the securities' returns toA) the overall market.

B) book-to-market.

C) size.

D) momentum.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

68

Use the equation for the question(s) below.

Consider the following regression model:

Which of the following statements is false?

A) A portfolio that costs nothing to construct is called a self-financing portfolio.

B) The most obvious portfolio to use in a multifactor model is the market portfolio itself.

C) In general, a self-financing portfolio is any portfolio with portfolio weights that sum to one rather than zero.

D) We can construct a self-financing portfolio by going long some stocks, and going short other stocks with equal market value.

Consider the following regression model:

Which of the following statements is false?

A) A portfolio that costs nothing to construct is called a self-financing portfolio.

B) The most obvious portfolio to use in a multifactor model is the market portfolio itself.

C) In general, a self-financing portfolio is any portfolio with portfolio weights that sum to one rather than zero.

D) We can construct a self-financing portfolio by going long some stocks, and going short other stocks with equal market value.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

69

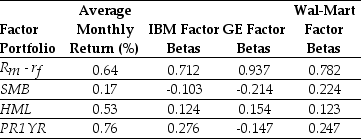

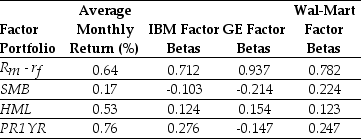

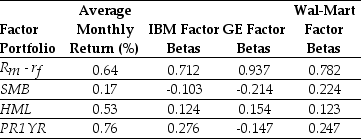

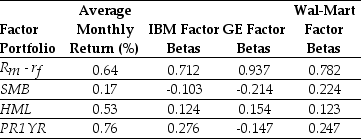

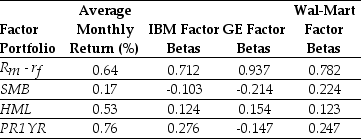

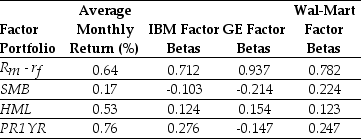

Use the table for the question(s) below.

Consider the following information regarding the Fama French Carhart four factor model:

Using the FFC four factor model and the historical average monthly returns,the expected monthly return for GE is closest to:

A) 0.53%

B) 0.73%

C) 0.79%

D) 0.71%