Deck 9: Cash Flow and Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/98

Play

Full screen (f)

Deck 9: Cash Flow and Capital Budgeting

1

Paul earns $60,000 as an engineer,and he is considering quitting his job and going to graduate school.This $60,000 should be treated as a ____ if Paul runs an NPV analysis of his graduate degree.

A) sunk cost

B) opportunity cost

C) fixed cost

D) cannibalization cost

A) sunk cost

B) opportunity cost

C) fixed cost

D) cannibalization cost

opportunity cost

2

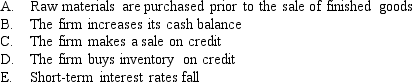

Which of the following items will lead to a rise in net working capital?

A) A,B,C

B) A,B,D,E

C) A,C

D) A,B,C,D

A) A,B,C

B) A,B,D,E

C) A,C

D) A,B,C,D

A,B,C

3

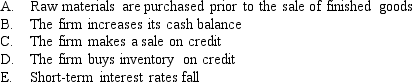

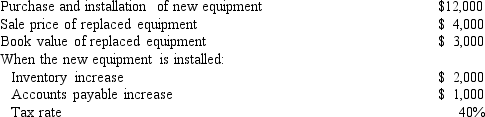

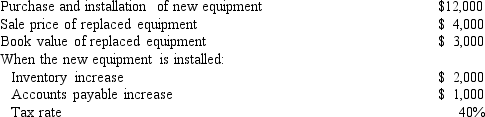

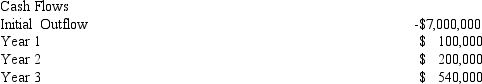

You are given the following information.What is the initial cash outflow?

A) $9,400

B) $9,000

C) $13,000

D) $10,600

A) $9,400

B) $9,000

C) $13,000

D) $10,600

$9,400

4

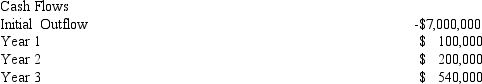

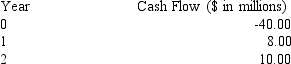

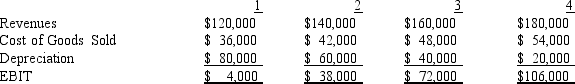

The cash flows associated with an investment project are as follows:  In year 4 and beyond,cash flows would continue to grow at 4 percent per year.Assume a discount rate of 10%.What is the NPV of this investment?

In year 4 and beyond,cash flows would continue to grow at 4 percent per year.Assume a discount rate of 10%.What is the NPV of this investment?

A) $385,220

B) $423,742

C) $631,104

D) $694,215

In year 4 and beyond,cash flows would continue to grow at 4 percent per year.Assume a discount rate of 10%.What is the NPV of this investment?

In year 4 and beyond,cash flows would continue to grow at 4 percent per year.Assume a discount rate of 10%.What is the NPV of this investment?A) $385,220

B) $423,742

C) $631,104

D) $694,215

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

5

NARRBEGIN: Exhibit 9-1

Exhibit 9-1

A project requires an initial investment in equipment and machinery of $10 million.The equipment is expected to have a 5-year lifetime with no salvage value and will be depreciated on a straight-line basis.The project is expected to generate revenues of $5.1 million each year for the 5 years and have operating expenses (not including depreciation)amounting to 1/3 of revenues.

Refer to Exhibit 9-1.The tax rate is 40%.What is the net cash flow in year 1?

A) 2.84m

B) 3.40m

C) 0.84m

D) 2.04m

Exhibit 9-1

A project requires an initial investment in equipment and machinery of $10 million.The equipment is expected to have a 5-year lifetime with no salvage value and will be depreciated on a straight-line basis.The project is expected to generate revenues of $5.1 million each year for the 5 years and have operating expenses (not including depreciation)amounting to 1/3 of revenues.

Refer to Exhibit 9-1.The tax rate is 40%.What is the net cash flow in year 1?

A) 2.84m

B) 3.40m

C) 0.84m

D) 2.04m

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

6

NARRBEGIN: Exhibit 9-1

Exhibit 9-1

A project requires an initial investment in equipment and machinery of $10 million.The equipment is expected to have a 5-year lifetime with no salvage value and will be depreciated on a straight-line basis.The project is expected to generate revenues of $5.1 million each year for the 5 years and have operating expenses (not including depreciation)amounting to 1/3 of revenues.

Refer to Exhibit 9-1.Assume the tax rate is 40%,and the cost of capital is 10%.What is the present value of cash inflows from year 1 to year 5? What percentage of this present value is attributed to the tax benefits accruing from depreciation?

A) $12.89m; 24%

B) $10.77m; 28%

C) 3.18m; 95%

D) 7.73m; 39%

E) $10.77m; 24%

Exhibit 9-1

A project requires an initial investment in equipment and machinery of $10 million.The equipment is expected to have a 5-year lifetime with no salvage value and will be depreciated on a straight-line basis.The project is expected to generate revenues of $5.1 million each year for the 5 years and have operating expenses (not including depreciation)amounting to 1/3 of revenues.

Refer to Exhibit 9-1.Assume the tax rate is 40%,and the cost of capital is 10%.What is the present value of cash inflows from year 1 to year 5? What percentage of this present value is attributed to the tax benefits accruing from depreciation?

A) $12.89m; 24%

B) $10.77m; 28%

C) 3.18m; 95%

D) 7.73m; 39%

E) $10.77m; 24%

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

7

Alpha Car Rental purchased 5 cars for a total of $100,000 three years ago.Now it is replacing the cars with newer vehicles.The company has depreciated 92.59% of the old cars,and sold these cars for a total of $ 25,000.Assume a tax rate of 40%.What is the cash inflow from the sale of these vehicles?

A) $25,000

B) $15,000

C) $17,964

D) $16,500

A) $25,000

B) $15,000

C) $17,964

D) $16,500

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

8

Capital budgeting must be placed on an incremental basis.This means that ____ must be ignored and ____ must be considered.

A) sunk cost; opportunity cost

B) sunk cost; financing cost

C) cannibalization; opportunity cost

D) opportunity cost; net working capital

A) sunk cost; opportunity cost

B) sunk cost; financing cost

C) cannibalization; opportunity cost

D) opportunity cost; net working capital

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

9

NARRBEGIN: Exhibit 9-1

Exhibit 9-1

A project requires an initial investment in equipment and machinery of $10 million.The equipment is expected to have a 5-year lifetime with no salvage value and will be depreciated on a straight-line basis.The project is expected to generate revenues of $5.1 million each year for the 5 years and have operating expenses (not including depreciation)amounting to 1/3 of revenues.

Refer to Exhibit 9-1.Assume the tax rate is 40%,and the cost of capital is 10%.What is the net present value of the project?

A) $2.89m

B) $0.77m

C) -$6.82m

D) -$2.27m

Exhibit 9-1

A project requires an initial investment in equipment and machinery of $10 million.The equipment is expected to have a 5-year lifetime with no salvage value and will be depreciated on a straight-line basis.The project is expected to generate revenues of $5.1 million each year for the 5 years and have operating expenses (not including depreciation)amounting to 1/3 of revenues.

Refer to Exhibit 9-1.Assume the tax rate is 40%,and the cost of capital is 10%.What is the net present value of the project?

A) $2.89m

B) $0.77m

C) -$6.82m

D) -$2.27m

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

10

Roger is considering the expansion of his business into a property he purchased two years ago.Which of the following items should not be included in the analysis of this expansion?

A) Roger can lease the property to another company for $12,000 per year.

B) Costs of hiring additional staff

C) The property was extensively renovated last year at a cost of $15,000.

D) The expansion will result in a slight increase of inventory carried.

A) Roger can lease the property to another company for $12,000 per year.

B) Costs of hiring additional staff

C) The property was extensively renovated last year at a cost of $15,000.

D) The expansion will result in a slight increase of inventory carried.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

11

Johnson Chemicals is considering an investment project.The project requires an initial $3 million outlay for equipment and machinery.Sales are projected to be $1.5 million per year for the next four years.The equipment will be fully depreciated straight-line by the end of year 4.Cost of goods sold and operating expense (not including depreciation)are predicted to be 30% of sales.The equipment can be sold for $400,000 at the end of year 4.Johnson Chemicals also needs to add net working capital of $100,000 immediately.The net working capital will be recovered in full at the end of the fourth year.Assume the tax rate is 40% and the cost of capital is 10%. What is the NPV of this investment?

A) $89,290

B) $80,199

C) $189,482

D) $72,909

A) $89,290

B) $80,199

C) $189,482

D) $72,909

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

12

A machine costs $3 million and has zero salvage value.Assume a discount rate of 10% and a 40% tax rate.The machine is depreciated straight-line over 3 years for tax purpose.What is the present value of depreciation tax savings associated with this machine?

A) $1,200,000

B) $994,741

C) $1,090,900

D) $400,000

A) $1,200,000

B) $994,741

C) $1,090,900

D) $400,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

13

Net working capital decreases when

A) inventory falls,accounts receivable falls,or accounts payable increases

B) inventory increases,accounts receivable increases,or accounts payable falls

C) cost of goods sold falls,or interest rate falls

D) operating expenses fall,or current assets increase

A) inventory falls,accounts receivable falls,or accounts payable increases

B) inventory increases,accounts receivable increases,or accounts payable falls

C) cost of goods sold falls,or interest rate falls

D) operating expenses fall,or current assets increase

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

14

A firm is evaluating two machines.Both machines meet the firm's quality standard.Machine A costs $40,000 initially and $1,000 per year to maintain.Machine B costs $24,000 initially and $2,000 per year to maintain.Machine A has a 6-year useful life and machine B has a 3-year useful life.Both machines have zero salvage value.Assume the firm will continue to replace worn-out machines with similar machines,and the discount rate is 7%.Which machine should the firm purchase?

A) Machine A

B) Machine B

C) The firm is indifferent to the two machines

D) Can't tell from the given information

A) Machine A

B) Machine B

C) The firm is indifferent to the two machines

D) Can't tell from the given information

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

15

Georgia Food is exploring the possibility of bringing a new frozen pasta to the market.Which of the following items are not relevant for the project's analysis?

A) Cost of increasing shelf space at grocery stores

B) Lost revenue from its frozen pizza sales since some customers will switch to purchase the new frozen pasta

C) Cost of advertising the new product

D) Market research funds the company has spent on testing the viability of the new product

A) Cost of increasing shelf space at grocery stores

B) Lost revenue from its frozen pizza sales since some customers will switch to purchase the new frozen pasta

C) Cost of advertising the new product

D) Market research funds the company has spent on testing the viability of the new product

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

16

A machine costs $3 million and has zero salvage value.The machine qualifies under the 3-year MARCS category.Assume a discount rate of 10% and a 40% tax rate.What is the present value of depreciation tax savings associated with this machine? (MARCS tax depreciation schedule of a 3-year class asset: 33.33% in year 1,44.45% in year 2,14.81% in year 3,and 7.41% in year 4)

A) $1,090,900

B) $1,200,000

C) $994,741

D) $998,684

A) $1,090,900

B) $1,200,000

C) $994,741

D) $998,684

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

17

Thompson Manufacturing must choose between two types of furnaces to install.Model A has a 6-year life,and an NPV of $5,000.Model B has a 5-year life,and an NPV of $4,200.The relevant discount rate is 12%.Which model should be chosen? What's the annual cash flow from that model?

A) Model B; $1,165

B) Model B; $840

C) Model A; $833

D) Model A; $1,216

A) Model B; $1,165

B) Model B; $840

C) Model A; $833

D) Model A; $1,216

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

18

A certain investment will require an immediate cash outflow of $3 million.At the end of each of the next three years,the investment will generate cash inflows of $1.3 million.If the discount rate is 10%,what is the project's NPV?

A) $211,734

B) -$303,886

C) $232,908

D) -$276,260

A) $211,734

B) -$303,886

C) $232,908

D) -$276,260

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

19

A project will generate a real cash flow three years from now of $100,000.If the nominal discount rate is 10% and expected inflation is 3%,what is the nominal cash flow for year 3?

A) $112,551

B) $106,090

C) $109,273

D) $122,504

A) $112,551

B) $106,090

C) $109,273

D) $122,504

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

20

Gamma Electronics is considering the purchase of testing equipment that will cost $500,000.The equipment has a 5-year lifetime with no salvage value.Assume the new machine will generate after-tax savings of $100,000 per year for the five years. If the firm has a 15% cost of capital,what is the equivalent annual cost of the equipment?

A) $32,924

B) $42,746

C) $49,158

D) $37,863

A) $32,924

B) $42,746

C) $49,158

D) $37,863

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

21

Cash Flows that occur if and only if a project is accepted are:

A) sunk costs.

B) terminal costs.

C) incremental cash flows.

D) current cash flows.

A) sunk costs.

B) terminal costs.

C) incremental cash flows.

D) current cash flows.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

22

Fox Entertainment is evaluating the NPV of launching a new iPet product.Fox paid a market research firm $120,000 last year to test the market viability of iPet.Fox Entertainment should treat this $120,000 as a ____ for the capital budgeting decision now confronting the firm.

A) fixed cost

B) opportunity cost

C) sunk cost

D) cannibalization cost

A) fixed cost

B) opportunity cost

C) sunk cost

D) cannibalization cost

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

23

Arizona Truck Company (ATC)is considering the replacement of an old truck.The old truck can be sold for $7,800 now.If it is sold in one year,the resale price will be $5,500,but ATC will spend $2,500 just before selling the truck to make it attractive to a buyer.Assume a cost of capital of 12%.What is the total cost of keeping the old truck for one more year? Express the cash flow in terms of its future value one year from now.

A) $5,121

B) $5,736

C) $4,800

D) $5,376

E) None of the above

A) $5,121

B) $5,736

C) $4,800

D) $5,376

E) None of the above

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

24

Cash flows on an alternative investment that a firm decides not to make are a(n):

A) opportunity cost.

B) sunk cost.

C) terminal value.

D) incremental cash flow.

A) opportunity cost.

B) sunk cost.

C) terminal value.

D) incremental cash flow.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

25

NARRBEGIN: Exhibit 9-2

Exhibit 9-2

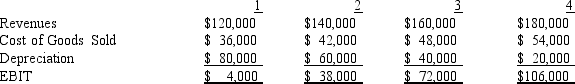

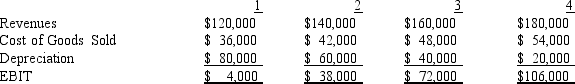

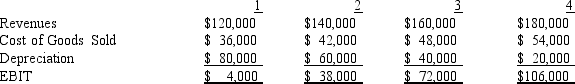

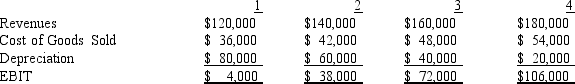

The following data are projected for a possible investment project:

Refer to Exhibit 9-2.The project requires an initial investment of $300,000.Working capital is anticipated to be variable at 10% of revenues; the working capital investment must be made at the beginning of each period,and will be recaptured in full at the end of year 4.The tax rate is 40%. What is the net cash flow to the firm in year 1?

A) $400

B) $82,400

C) $68,400

D) $80,400

E) $2,400

Exhibit 9-2

The following data are projected for a possible investment project:

Refer to Exhibit 9-2.The project requires an initial investment of $300,000.Working capital is anticipated to be variable at 10% of revenues; the working capital investment must be made at the beginning of each period,and will be recaptured in full at the end of year 4.The tax rate is 40%. What is the net cash flow to the firm in year 1?

A) $400

B) $82,400

C) $68,400

D) $80,400

E) $2,400

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

26

A firm that manufactures DVD players for automakers currently has excess capacity.The firm expects that it will exhaust its excess capacity in three years.At that time it will have to invest $2 million to build new capacity.Suppose that the firm can accept additional work as a subcontractor for another company.By doing so,the firm will receive a net cash inflow of $120,000 immediately and in each of the next two years.However,the firm will have to begin expansion two years earlier than originally planned to bring new capacity on line.Assume a discount rate of 10%. What is the NPV if the firm accepts the subcontractor job?

A) $328,264

B) -$18,843

C) $12,712

D) $298,422

A) $328,264

B) -$18,843

C) $12,712

D) $298,422

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

27

The value of a project at a given future point in time is known as:

A) the terminal value.

B) net working capital.

C) opportunity cost.

D) sunk cost.

A) the terminal value.

B) net working capital.

C) opportunity cost.

D) sunk cost.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

28

The system in the U.S.which defines the allowable annual depreciation deductions for various classes of assets is known as:

A) MACRS

B) CAMRS

C) RCMAS

D) SCRMA

A) MACRS

B) CAMRS

C) RCMAS

D) SCRMA

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

29

Future Semiconductor is considering the purchase of photolithography equipment that will cost $3 million.The equipment requires maintenance of $5,000 at the end of each of the next five years.After five years it will be sold for $500,000.Assume a cost of capital of 15% and no taxes.What is the present value of the cost of the equipment? What is the equivalent annual cost of the equipment?

A) $3,016,761; $899,947

B) $2,516,760; $750,789

C) $2,407,106; $718,077

D) $2,768,172; $825,789

A) $3,016,761; $899,947

B) $2,516,760; $750,789

C) $2,407,106; $718,077

D) $2,768,172; $825,789

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

30

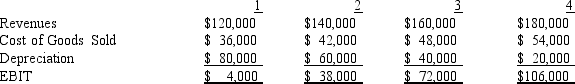

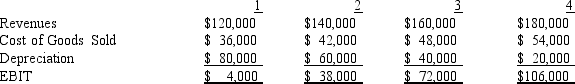

NARRBEGIN: Exhibit 9-2

Exhibit 9-2

The following data are projected for a possible investment project:

Refer to Exhibit 9-2.The project requires an initial investment of $300,000 on equipment.Working capital is anticipated to be variable at 10% of revenues; the working capital investment must be made at the beginning of each period,and will be recovered in full at the end of year 4.Equipment will be sold at its book value at the end of year 4.The tax rate is 40%. What is the net cash flow to the firm in year 4?

A) $101,600

B) $201,600

C) $183,600

D) $161,600

Exhibit 9-2

The following data are projected for a possible investment project:

Refer to Exhibit 9-2.The project requires an initial investment of $300,000 on equipment.Working capital is anticipated to be variable at 10% of revenues; the working capital investment must be made at the beginning of each period,and will be recovered in full at the end of year 4.Equipment will be sold at its book value at the end of year 4.The tax rate is 40%. What is the net cash flow to the firm in year 4?

A) $101,600

B) $201,600

C) $183,600

D) $161,600

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

31

The difference between current assets and current liabilities is known as:

A) working capital.

B) net working capital.

C) terminal capital.

D) marginal capital.

A) working capital.

B) net working capital.

C) terminal capital.

D) marginal capital.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

32

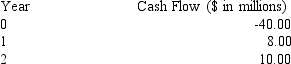

A project generates the following sequence of cash flows over two years:  Assume that cash flows after the second year grow at 2% annually in perpetuity,and the discount rate is 12%.What is the NPV of the project?

Assume that cash flows after the second year grow at 2% annually in perpetuity,and the discount rate is 12%.What is the NPV of the project?

A) $56.4m

B) $54.8m

C) $47.7 m

D) $50.4m

Assume that cash flows after the second year grow at 2% annually in perpetuity,and the discount rate is 12%.What is the NPV of the project?

Assume that cash flows after the second year grow at 2% annually in perpetuity,and the discount rate is 12%.What is the NPV of the project?A) $56.4m

B) $54.8m

C) $47.7 m

D) $50.4m

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

33

Kelley Group is considering an investment of $2 million in an asset with an economic life of four years.The cash revenues and expenses in year 1 are expected to be $1.8m and $0.5m respectively.Both revenues and expenses are expected to grow at 3 percent per year.The asset will be fully depreciated to zero using the straight line method over its economic life.The salvage value of the asset is expected to be $0.3m at the end of the fourth year.Kelley Group also needs to add net working capital of $0.1m immediately,and this capital will be recovered in full at the end of the project's life.The tax rate is 40%.What is the investment's cash flow in year 4?

A) $1.1323m

B) $1.4523m

C) $1.3323m

D) $1.3579m

A) $1.1323m

B) $1.4523m

C) $1.3323m

D) $1.3579m

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

34

The percentage of taxes owed on an incremental dollar of income is called:

A) the minimum tax rate.

B) the marginal tax rate.

C) the average tax rate.

D) the maximum tax rate.

A) the minimum tax rate.

B) the marginal tax rate.

C) the average tax rate.

D) the maximum tax rate.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

35

When a firm introduces a new product and some of the new product's sales come at the expense of the firm's existing products,this is known as:

A) sunk costs.

B) incremental costs.

C) marginal costs.

D) cannibalization.

A) sunk costs.

B) incremental costs.

C) marginal costs.

D) cannibalization.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

36

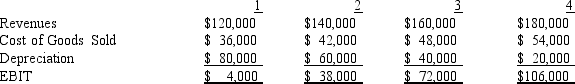

NARRBEGIN: Exhibit 9-2

Exhibit 9-2

The following data are projected for a possible investment project:

Refer to Exhibit 9-2.The project requires an initial investment of $300,000 on equipment.Working capital is anticipated to be variable at 10% of revenues; the working capital investment must be made at the beginning of each period,and will be recovered in full at the end of year 4.Equipment will be sold at its book value at the end of year 4.The tax rate is 40%. What is the net present value of the project if the firm's discount rate is 10%?

A) -$20,225

B) -$41,731

C) $24,155

D) $26,570

Exhibit 9-2

The following data are projected for a possible investment project:

Refer to Exhibit 9-2.The project requires an initial investment of $300,000 on equipment.Working capital is anticipated to be variable at 10% of revenues; the working capital investment must be made at the beginning of each period,and will be recovered in full at the end of year 4.Equipment will be sold at its book value at the end of year 4.The tax rate is 40%. What is the net present value of the project if the firm's discount rate is 10%?

A) -$20,225

B) -$41,731

C) $24,155

D) $26,570

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

37

NARRBEGIN: Exhibit 9-2

Exhibit 9-2

The following data are projected for a possible investment project:

Refer to Exhibit 9-2.The project requires an initial investment of $300,000.Working capital is anticipated to be variable at 10% of revenues; the working capital investment must be made at the beginning of each period,and will be recaptured in full at the end of year 4.The tax rate is 40%. What is the initial cash outlay?

A) $300,000

B) $312,000

C) $232,000

D) $220,000

Exhibit 9-2

The following data are projected for a possible investment project:

Refer to Exhibit 9-2.The project requires an initial investment of $300,000.Working capital is anticipated to be variable at 10% of revenues; the working capital investment must be made at the beginning of each period,and will be recaptured in full at the end of year 4.The tax rate is 40%. What is the initial cash outlay?

A) $300,000

B) $312,000

C) $232,000

D) $220,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

38

Sam's Insurance must choose between two types of printers.Both printers meet the firm's quality standard.Printer A costs $3,500 and is expected to last 3 years with operating costs of $380 per year.Printer B costs $2,500 and is expected to last 2 years with operating costs of $400 per year.Assume a discount rate of 10%.Which printer should Sam's Insurance purchase? What is the equivalent annual cost of this machine?

A) Printer B; $3,194

B) Printer A; $1,625

C) Printer B; $2,904

D) Printer A; $1,787

A) Printer B; $3,194

B) Printer A; $1,625

C) Printer B; $2,904

D) Printer A; $1,787

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

39

A cash outlay that has already been committed whether a project is accepted or not is known as a:

A) opportunity cost.

B) terminal value.

C) net cost.

D) sunk cost.

A) opportunity cost.

B) terminal value.

C) net cost.

D) sunk cost.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

40

Accountants measure inflows and outflows of business operations on:

A) a cash basis.

B) a profit basis.

C) an accrual basis.

D) an expense basis.

A) a cash basis.

B) a profit basis.

C) an accrual basis.

D) an expense basis.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

41

An increase in net working capital represents:

A) a cash inflow.

B) a cash outflow.

C) an increase in fixed assets.

D) a decrease in fixed assets.

A) a cash inflow.

B) a cash outflow.

C) an increase in fixed assets.

D) a decrease in fixed assets.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

42

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the operating cash flow for year 3?

A) $54,797

B) $64,798

C) $70,803

D) $10,487

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the operating cash flow for year 3?

A) $54,797

B) $64,798

C) $70,803

D) $10,487

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

43

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the depreciation expense in year 1?

A) $44,996

B) $10,004

C) $60,008

D) $19,994

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the depreciation expense in year 1?

A) $44,996

B) $10,004

C) $60,008

D) $19,994

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

44

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the operating cash flow for year 2?

A) $54,797

B) $64,798

C) $70,803

D) $10,487

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the operating cash flow for year 2?

A) $54,797

B) $64,798

C) $70,803

D) $10,487

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

45

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the depreciation expense in year 2?

A) $44,996

B) $10,004

C) $60,008

D) $19,994

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the depreciation expense in year 2?

A) $44,996

B) $10,004

C) $60,008

D) $19,994

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

46

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the book value of the machine at the end of year 3?

A) $44,996

B) $10,004

C) $60,008

D) $19,994

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the book value of the machine at the end of year 3?

A) $44,996

B) $10,004

C) $60,008

D) $19,994

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

47

NARRBEGIN: FAR Corporation

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the initial investment outlay for this project?

A) $10,000

B) $135,000

C) $145,000

D) $165,000

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the initial investment outlay for this project?

A) $10,000

B) $135,000

C) $145,000

D) $165,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

48

A decrease in accounts receivable will ____ net working capital.

A) increase

B) decrease

C) have no affect on

D) cannot be determined.

A) increase

B) decrease

C) have no affect on

D) cannot be determined.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

49

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the IRR of the project?

A) 22.79%

B) -10.01%

C) 19.47%

D) 27.36%

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the IRR of the project?

A) 22.79%

B) -10.01%

C) 19.47%

D) 27.36%

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

50

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the operating cash flow for year 1?

A) $54,797

B) $64,798

C) $70,803

D) $10,487

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the operating cash flow for year 1?

A) $54,797

B) $64,798

C) $70,803

D) $10,487

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

51

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the after-tax cash flow from selling the machine at the end of year 3?

A) $25,000

B) $5,999

C) $7,214

D) $19,001

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the after-tax cash flow from selling the machine at the end of year 3?

A) $25,000

B) $5,999

C) $7,214

D) $19,001

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

52

Financial analysts focus on ____ when evaluating potential investments.

A) cash

B) profit

C) accruals

D) expenses

A) cash

B) profit

C) accruals

D) expenses

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

53

The relevant tax rate for capital budgeting purposes is the:

A) average tax rate.

B) maximum tax rate.

C) minimum tax rate.

D) marginal tax rate.

A) average tax rate.

B) maximum tax rate.

C) minimum tax rate.

D) marginal tax rate.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

54

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the total cash flow generated in year 3?

A) $83,799

B) $54,797

C) $29,001

D) $15,098

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the total cash flow generated in year 3?

A) $83,799

B) $54,797

C) $29,001

D) $15,098

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

55

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the initial investment outlay for this project?

A) $10,000

B) $135,000

C) $145,000

D) $155,000

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the initial investment outlay for this project?

A) $10,000

B) $135,000

C) $145,000

D) $155,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

56

When a firm cannot invest in every positive NPV project because of limited funds,this is known as:

A) capital budgeting.

B) capital investing.

C) capital rationing.

D) capital financing.

A) capital budgeting.

B) capital investing.

C) capital rationing.

D) capital financing.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

57

An increase in inventory will ____ net working capital.

A) increase

B) decrease

C) have no affect on

D) cannot be determined.

A) increase

B) decrease

C) have no affect on

D) cannot be determined.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

58

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the depreciation expense in year 3?

A) $44,996

B) $10,004

C) $60,008

D) $19,994

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the depreciation expense in year 3?

A) $44,996

B) $10,004

C) $60,008

D) $19,994

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

59

An asset that falls into the 3-year MACRS asset class is fully depreciated over:

A) 2 years.

B) 3 years.

C) 4 years.

D) 5 years.

A) 2 years.

B) 3 years.

C) 4 years.

D) 5 years.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

60

NARRBEGIN: DSSS Corporation

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the NPV of the project?

A) $14.732

B) $12,986

C) $19,983

D) -$19,983

DSSS Corporation

DSSS Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $125,000.The cost of shipping and installation is an additional $10,000.The asset will fall into the 3-year MACRS class.The year 1- 4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $225,000 per year.Cost of goods sold will be 60% of sales.The project will require an increase in net working capital of $10,000.At the end of three years,DSSS plans on ending the project and selling the manufacturing equipment for $25,000.The marginal tax rate is 40% and DSSS Corporation's appropriate discount rate is 15%.

Refer to DSSS Corporation.What is the NPV of the project?

A) $14.732

B) $12,986

C) $19,983

D) -$19,983

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

61

The ____ makes capital budgeting ____ complicated.

A) human element,less

B) human element,more

C) human analysis,more

D) human analysis,less

A) human element,less

B) human element,more

C) human analysis,more

D) human analysis,less

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

62

NARRBEGIN: FAR Corporation

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the IRR of the project?

A) 12.01%

B) 8.74%

C) 5.92%

D) 4.78%

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the IRR of the project?

A) 12.01%

B) 8.74%

C) 5.92%

D) 4.78%

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

63

NARRBEGIN: FAR Corporation

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the after-tax cash flow from selling the machine at the end of year 3?

A) -$9,554

B) $35,000

C) $9,554

D) $25,446

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the after-tax cash flow from selling the machine at the end of year 3?

A) -$9,554

B) $35,000

C) $9,554

D) $25,446

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

64

When evaluating a potential capital budgeting decision,fixed asset expenditures

A) should be ignored.

B) often appear as the initial cash outflow for a project.

C) can be significantly increased due to the costs of installing the equipment.

D) All of the above are true.

E) Only (b)and (c)are true.

A) should be ignored.

B) often appear as the initial cash outflow for a project.

C) can be significantly increased due to the costs of installing the equipment.

D) All of the above are true.

E) Only (b)and (c)are true.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

65

To help rank projects in a capital rationing environment,managers often use the:

A) profitability index.

B) internal rate of return.

C) payback method.

D) accounting rate of return.

A) profitability index.

B) internal rate of return.

C) payback method.

D) accounting rate of return.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

66

NARRBEGIN: FAR Corporation

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the depreciation expense in year 1?

A) $49,995

B) $22,215

C) $11,115

D) $66,675

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the depreciation expense in year 1?

A) $49,995

B) $22,215

C) $11,115

D) $66,675

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements is false with regard to cash flows resulting from financing costs?

A) They should be included in the cash flow calculations.

B) Financing cash flows can include dividend payments to stockholders and interest payments to bondholders.

C) Financing costs are captured in the discount of a project's cash flows.

D) If cash outflows associated with financing costs were deducted from the cash flows for a project,it would be double-counting the financing costs of the investment.

E) All of the above statements are false.

A) They should be included in the cash flow calculations.

B) Financing cash flows can include dividend payments to stockholders and interest payments to bondholders.

C) Financing costs are captured in the discount of a project's cash flows.

D) If cash outflows associated with financing costs were deducted from the cash flows for a project,it would be double-counting the financing costs of the investment.

E) All of the above statements are false.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

68

NARRBEGIN: FAR Corporation

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the book value of the machine at the end of year 3?

A) $44,995

B) $22,215

C) $11,115

D) $66,675

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the book value of the machine at the end of year 3?

A) $44,995

B) $22,215

C) $11,115

D) $66,675

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following would fall under the definition of cannibalism as it applies to capital budgeting?

A) If a firm offered a 'low-fat' version of a current product and sales of that new product were expected to reduce sales of the current version.

B) The eating of the flesh of an animal by another animal.

C) If a competitor were to offer a similar or identical product to one your company already offers and this would lead to reduced sales of your product.

D) Both (a)and (c)are true.

E) None of the above is true.

A) If a firm offered a 'low-fat' version of a current product and sales of that new product were expected to reduce sales of the current version.

B) The eating of the flesh of an animal by another animal.

C) If a competitor were to offer a similar or identical product to one your company already offers and this would lead to reduced sales of your product.

D) Both (a)and (c)are true.

E) None of the above is true.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

70

NARRBEGIN: FAR Corporation

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the total cash flow generated in year 3?

A) $35,000

B) $9,554

C) $15,000

D) $40,446

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the total cash flow generated in year 3?

A) $35,000

B) $9,554

C) $15,000

D) $40,446

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

71

NARRBEGIN: FAR Corporation

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the operating cash flow for year 3?

A) $55,470

B) $60,000

C) $48,798

D) $37,686

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the operating cash flow for year 3?

A) $55,470

B) $60,000

C) $48,798

D) $37,686

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

72

Opportunity costs:

A) are irrelevant.

B) should be considered when determining an investment's relevant cash flows.

C) are equal to the firm's sunk costs.

D) all of the above.

A) are irrelevant.

B) should be considered when determining an investment's relevant cash flows.

C) are equal to the firm's sunk costs.

D) all of the above.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements is true?

A) Accountants measure cash flows on a cash basis rather than an accrual basis.

B) Financial analysts focus solely on accrual basis values rather than cash flows when evaluating potential investments.

C) Incremental cash flows effectively represent the marginal costs and marginal benefits expected to result from undertaking a proposed investment.

D) Both (a)and (c)are true.

E) All of the above statements are true.

A) Accountants measure cash flows on a cash basis rather than an accrual basis.

B) Financial analysts focus solely on accrual basis values rather than cash flows when evaluating potential investments.

C) Incremental cash flows effectively represent the marginal costs and marginal benefits expected to result from undertaking a proposed investment.

D) Both (a)and (c)are true.

E) All of the above statements are true.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

74

NARRBEGIN: FAR Corporation

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the depreciation expense in year 2?

A) $49,995

B) $22,215

C) $11,115

D) $66,675

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the depreciation expense in year 2?

A) $49,995

B) $22,215

C) $11,115

D) $66,675

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

75

Sunk costs:

A) are irrelevant.

B) should be considered when determining an investment's relevant cash flows.

C) are equal to the firm's opportunity costs.

D) all of the above.

A) are irrelevant.

B) should be considered when determining an investment's relevant cash flows.

C) are equal to the firm's opportunity costs.

D) all of the above.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following statements is true?

A) Depreciation is a noncash expense and reduces taxable income thereby reducing the cash outflow associated with tax payments.

B) Depreciation's impact upon cash flows can be accounted for by adding depreciation back to net income before interest and after taxes.

C) Depreciation's impact upon cash flows can be accounted for by adding the tax savings associated with the depreciation to net income before interest and after taxes.

D) All of the above statements are true.

E) Only (a)and (b)are true.

A) Depreciation is a noncash expense and reduces taxable income thereby reducing the cash outflow associated with tax payments.

B) Depreciation's impact upon cash flows can be accounted for by adding depreciation back to net income before interest and after taxes.

C) Depreciation's impact upon cash flows can be accounted for by adding the tax savings associated with the depreciation to net income before interest and after taxes.

D) All of the above statements are true.

E) Only (a)and (b)are true.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

77

NARRBEGIN: FAR Corporation

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the NPV of the project?

A) $21,597

B) $73,548

C) -$21,597

D) -$52,489

FAR Corporation

FAR Corporation is considering a new project to manufacture widgets.The cost of the manufacturing equipment is $150,000.The cost of shipping and installation is an additional $15,000.The asset will fall into the 3-year MACRS class.The year 1-4 MACRS percentages are 33.33%,44.45%,14.81%,and 7.41%,respectively.Sales are expected to be $300,000 per year.Cost of goods sold will be 80% of sales.The project will require an increase in net working capital of $15,000.At the end of three years,FAR plans on ending the project and selling the manufacturing equipment for $35,000.The marginal tax rate is 40% and FAR Corporation's appropriate discount rate is 12%.

Refer to FAR Corporation.What is the NPV of the project?

A) $21,597

B) $73,548

C) -$21,597

D) -$52,489

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

78

NARRBEGIN: FAR Corporation

FAR Corporation