Deck 4: The Time Value of Money

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 4: The Time Value of Money

1

Use the information for the question(s) below.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

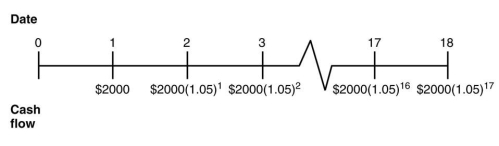

Suppose that a young couple has just had their first baby and they wish to insure that enough money will be available to pay for their child's college education.They decide to make deposits into an educational savings account on each of their daughter's birthdays,starting with her first birthday.Assume that the educational savings account will return a constant 7%.The parents deposit $2000 on their daughter's first birthday and plan to increase the size of their deposits by 5% each year.Draw a timeline that details the amount that would be available for the daughter's college expenses on her 18th birthday.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

Suppose that a young couple has just had their first baby and they wish to insure that enough money will be available to pay for their child's college education.They decide to make deposits into an educational savings account on each of their daughter's birthdays,starting with her first birthday.Assume that the educational savings account will return a constant 7%.The parents deposit $2000 on their daughter's first birthday and plan to increase the size of their deposits by 5% each year.Draw a timeline that details the amount that would be available for the daughter's college expenses on her 18th birthday.

2

Use the following information to answer the question(s) below.

Your great aunt Matilda put some money in an account for you on the day you were born. This account pays 8% interest per year. On your 21st birthday the account balance was $5,033.83.

The amount of money that would be in the account is you left the money there until your 65th birthday is closest to:

A) $29,556

B) $148,780

C) $168,824

D) $748,932

Your great aunt Matilda put some money in an account for you on the day you were born. This account pays 8% interest per year. On your 21st birthday the account balance was $5,033.83.

The amount of money that would be in the account is you left the money there until your 65th birthday is closest to:

A) $29,556

B) $148,780

C) $168,824

D) $748,932

$148,780

3

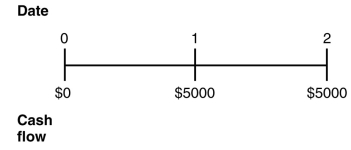

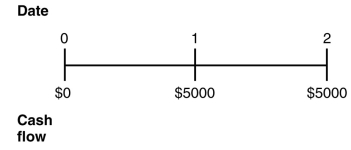

Use the figure for the question(s) below.

Which of the following statements regarding timelines is false?

A) Timelines are an important first step in organizing and then solving a financial problem.

B) We refer to a series of cash flows lasting several periods as a stream of cash flows.

C) Not every stream of cash flows can be represented on a timeline.

D) A timeline is a linear representation of the timing of the (expected) cash flows.

Which of the following statements regarding timelines is false?

A) Timelines are an important first step in organizing and then solving a financial problem.

B) We refer to a series of cash flows lasting several periods as a stream of cash flows.

C) Not every stream of cash flows can be represented on a timeline.

D) A timeline is a linear representation of the timing of the (expected) cash flows.

Not every stream of cash flows can be represented on a timeline.

4

Use the information for the question(s) below.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

Assume that college costs continue to increase an average of 4% per year and that all her college savings are invested in an account paying 7% interest.Draw a timeline that details the amount of money she will need to have in the future four each of her four years of her undergraduate education.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

Assume that college costs continue to increase an average of 4% per year and that all her college savings are invested in an account paying 7% interest.Draw a timeline that details the amount of money she will need to have in the future four each of her four years of her undergraduate education.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is false?

A) Finding the present value and compounding are the same.

B) A dollar today and a dollar in one year are not equivalent.

C) If you want to compare or combine cash flows that occur at different points in time, you first need to convert the cash flows into the same units or move them to the same point in time.

D) The equivalent value of two cash flows at two different points in time is sometimes referred to as the time value of money.

A) Finding the present value and compounding are the same.

B) A dollar today and a dollar in one year are not equivalent.

C) If you want to compare or combine cash flows that occur at different points in time, you first need to convert the cash flows into the same units or move them to the same point in time.

D) The equivalent value of two cash flows at two different points in time is sometimes referred to as the time value of money.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

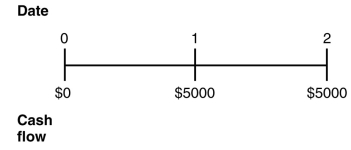

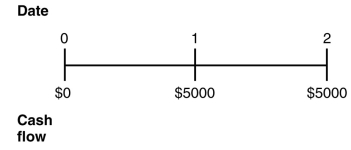

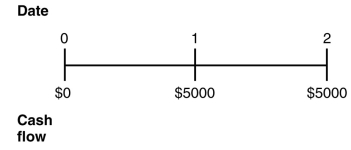

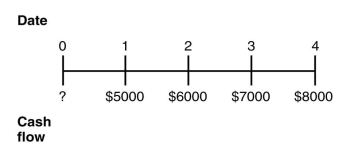

Use the figure for the question(s) below.

Which of the following statements regarding the timeline is false?

A) Date 1 is one year from now.

B) The $5000 below date 1 is the payment you will receive at the end of the first year.

C) The $5000 below date 2 is the payment you will receive at the beginning of the second year.

D) Date 0 represents today.

Which of the following statements regarding the timeline is false?

A) Date 1 is one year from now.

B) The $5000 below date 1 is the payment you will receive at the end of the first year.

C) The $5000 below date 2 is the payment you will receive at the beginning of the second year.

D) Date 0 represents today.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

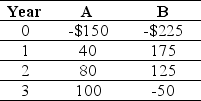

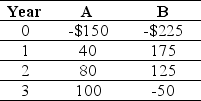

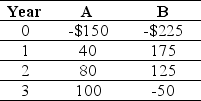

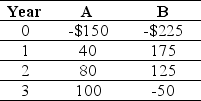

Use the table for the question(s) below.

Draw a timeline detailing the cash flows from investment "A."

Draw a timeline detailing the cash flows from investment "A."

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

Use the following information to answer the question(s) below.

Consider the following four alternatives:

1. $132 received in two years.

2. $160 received in five years.

3. $200 received in eight years.

4. $220 received in ten years.

The ranking of the four alternatives from most valuable to least valuable if the interest rate is 6% per year would be:

A) 1, 2, 3, 4

B) 1, 3, 2, 4

C) 4, 3, 1, 2

D) 3, 4, 2, 1

Consider the following four alternatives:

1. $132 received in two years.

2. $160 received in five years.

3. $200 received in eight years.

4. $220 received in ten years.

The ranking of the four alternatives from most valuable to least valuable if the interest rate is 6% per year would be:

A) 1, 2, 3, 4

B) 1, 3, 2, 4

C) 4, 3, 1, 2

D) 3, 4, 2, 1

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

At an annual interest rate of 7%,the present value of $5,000 received in five years is closest to:

A) $3,565

B) $6,750

C) $7,015

D) $7,035

A) $3,565

B) $6,750

C) $7,015

D) $7,035

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

At an annual interest rate of 7%,the future value of $5,000 in five years is closest to:

A) $3,565

B) $6,750

C) $7,015

D) $7,035

A) $3,565

B) $6,750

C) $7,015

D) $7,035

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

Use the following information to answer the question(s) below.

Your great aunt Matilda put some money in an account for you on the day you were born. This account pays 8% interest per year. On your 21st birthday the account balance was $5,033.83.

The amount of money that your great aunt Matilda originally put in the account is closest to:

A) $600

B) $800

C) $1,000

D) $1,200

Your great aunt Matilda put some money in an account for you on the day you were born. This account pays 8% interest per year. On your 21st birthday the account balance was $5,033.83.

The amount of money that your great aunt Matilda originally put in the account is closest to:

A) $600

B) $800

C) $1,000

D) $1,200

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

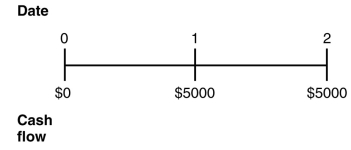

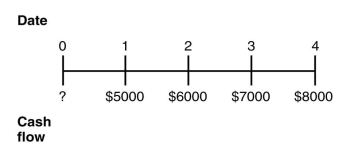

Use the figure for the question(s) below.

Which of the following statements regarding the timeline is false?

A) Date 1 is the end of the first year.

B) Date 0 is the beginning of the first year.

C) The space between date 0 and date 1 represents the time period between two specific dates.

D) You will find the timeline most useful in tracking cash flows if you interpret each point on the timeline as a period or interval of time.

Which of the following statements regarding the timeline is false?

A) Date 1 is the end of the first year.

B) Date 0 is the beginning of the first year.

C) The space between date 0 and date 1 represents the time period between two specific dates.

D) You will find the timeline most useful in tracking cash flows if you interpret each point on the timeline as a period or interval of time.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

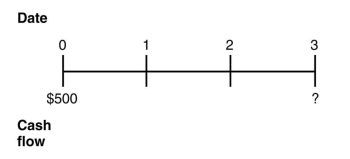

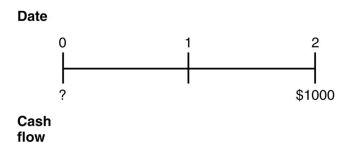

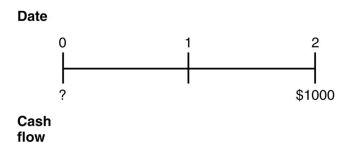

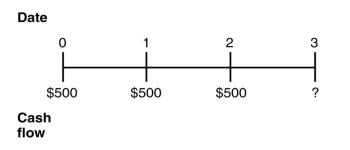

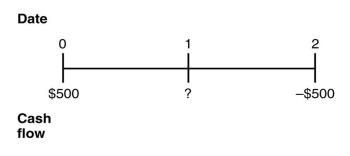

Consider the following timeline:

If the current market rate of interest is 10%,then the future value of this timeline is closest to:

A) $666

B) $500

C) $605

D) $650

If the current market rate of interest is 10%,then the future value of this timeline is closest to:

A) $666

B) $500

C) $605

D) $650

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is false?

A) The process of moving a value or cash flow forward in time is known as compounding.

B) The effect of earning interest on interest is known as compound interest.

C) It is only possible to compare or combine values at the same point in time.

D) A dollar in the future is worth more than a dollar today.

A) The process of moving a value or cash flow forward in time is known as compounding.

B) The effect of earning interest on interest is known as compound interest.

C) It is only possible to compare or combine values at the same point in time.

D) A dollar in the future is worth more than a dollar today.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

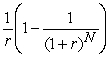

Which of the following statements is false?

A) The process of moving a value or cash flow backward in time is known as discounting.

B) FV =

C) The process of moving a value or cash flow forward in time is known as compounding.

D) The value of a cash flow that is moved forward in time is known as its future value.

A) The process of moving a value or cash flow backward in time is known as discounting.

B) FV =

C) The process of moving a value or cash flow forward in time is known as compounding.

D) The value of a cash flow that is moved forward in time is known as its future value.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

Use the table for the question(s) below.

Draw a timeline detailing the cash flows from investment "B."

Draw a timeline detailing the cash flows from investment "B."

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

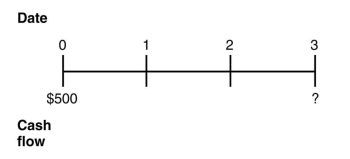

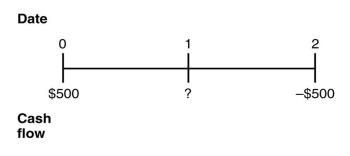

Consider the following time line:

If the current market rate of interest is 8%,then the present value of this timeline is closest to:

A) $1000

B) $857

C) $860

D) $926

If the current market rate of interest is 8%,then the present value of this timeline is closest to:

A) $1000

B) $857

C) $860

D) $926

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

Use the following information to answer the question(s) below.

Consider the following four alternatives:

1. $132 received in two years.

2. $160 received in five years.

3. $200 received in eight years.

4. $220 received in ten years.

The ranking of the four alternatives from most valuable to least valuable if the interest rate is 7% per year would be:

A) 1, 2, 3, 4

B) 4, 3, 2, 1

C) 3, 4 2, 1

D) 2, 3, 1, 4

Consider the following four alternatives:

1. $132 received in two years.

2. $160 received in five years.

3. $200 received in eight years.

4. $220 received in ten years.

The ranking of the four alternatives from most valuable to least valuable if the interest rate is 7% per year would be:

A) 1, 2, 3, 4

B) 4, 3, 2, 1

C) 3, 4 2, 1

D) 2, 3, 1, 4

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

Use the information for the question(s) below.

Joe just inherited the family business, and having no desire to run the family business, he has decided to sell it to an entrepreneur. In exchange for the family business, Joe has been offered an immediate payment of $100,000. Joe will also receive payments of $50,000 in one year, $50,000 in two years, and $75,000 in three years. The current market rate of interest for Joe is 6%.

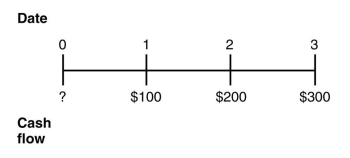

You have been offered the following investment opportunity,if you pay $2500 today,you will receive $1000 at the end of each of the next three years.Draw a timeline detailing this investment opportunity.

Joe just inherited the family business, and having no desire to run the family business, he has decided to sell it to an entrepreneur. In exchange for the family business, Joe has been offered an immediate payment of $100,000. Joe will also receive payments of $50,000 in one year, $50,000 in two years, and $75,000 in three years. The current market rate of interest for Joe is 6%.

You have been offered the following investment opportunity,if you pay $2500 today,you will receive $1000 at the end of each of the next three years.Draw a timeline detailing this investment opportunity.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

Use the information for the question(s) below.

Joe just inherited the family business, and having no desire to run the family business, he has decided to sell it to an entrepreneur. In exchange for the family business, Joe has been offered an immediate payment of $100,000. Joe will also receive payments of $50,000 in one year, $50,000 in two years, and $75,000 in three years. The current market rate of interest for Joe is 6%.

Draw a timeline detailing Joe's cash flows from the sale of the family business.

Joe just inherited the family business, and having no desire to run the family business, he has decided to sell it to an entrepreneur. In exchange for the family business, Joe has been offered an immediate payment of $100,000. Joe will also receive payments of $50,000 in one year, $50,000 in two years, and $75,000 in three years. The current market rate of interest for Joe is 6%.

Draw a timeline detailing Joe's cash flows from the sale of the family business.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

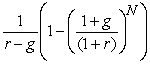

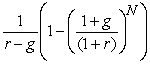

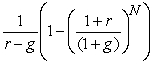

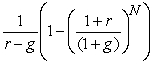

Which of the following statements regarding growing annuities is false?

A) A growing annuity is a stream of N growing cash flows, paid at regular intervals.

B) We assume that g < r when using the growing annuity formula.

C) PV of a growing annuity = C ×

D) A growing annuity is like a growing perpetuity that never comes to an end.

A) A growing annuity is a stream of N growing cash flows, paid at regular intervals.

B) We assume that g < r when using the growing annuity formula.

C) PV of a growing annuity = C ×

D) A growing annuity is like a growing perpetuity that never comes to an end.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

22

Use the following information to answer the question(s) below.

Nielson Motors is considering an opportunity that requires an investment of $1,000,000 today and will provide $250,000 one year from now, $450,000 two years from now, and $650,000 three years from now.

If the appropriate interest rate is 15%,then Nielson Motors should:

A) Invest in this opportunity since the NPV is positive.

B) Do Not Invest in this opportunity since the NPV is positive.

C) Invest in this opportunity since the NPV is negative.

D) Do Not Invest in this opportunity since the NPV is negative.

Nielson Motors is considering an opportunity that requires an investment of $1,000,000 today and will provide $250,000 one year from now, $450,000 two years from now, and $650,000 three years from now.

If the appropriate interest rate is 15%,then Nielson Motors should:

A) Invest in this opportunity since the NPV is positive.

B) Do Not Invest in this opportunity since the NPV is positive.

C) Invest in this opportunity since the NPV is negative.

D) Do Not Invest in this opportunity since the NPV is negative.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

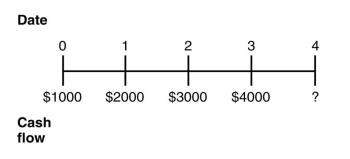

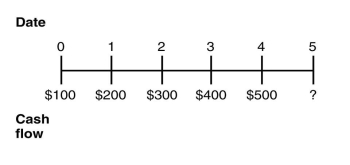

Consider the following timeline detailing a stream of cash flows:

If the current market rate of interest is 8%,then the future value of this stream of cash flows is closest to:

A) $11,699

B) $10,832

C) $12,635

D) $10,339

If the current market rate of interest is 8%,then the future value of this stream of cash flows is closest to:

A) $11,699

B) $10,832

C) $12,635

D) $10,339

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

Consider the following timeline detailing a stream of cash flows:

If the current market rate of interest is 6%,then the future value of this stream of cash flows is closest to:

A) $1,723

B) $1,500

C) $1,626

D) $1,288

If the current market rate of interest is 6%,then the future value of this stream of cash flows is closest to:

A) $1,723

B) $1,500

C) $1,626

D) $1,288

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

Consider the following timeline detailing a stream of cash flows:

If the current market rate of interest is 10%,then the present value of this stream of cash flows is closest to:

A) $674

B) $600

C) $460

D) $287

If the current market rate of interest is 10%,then the present value of this stream of cash flows is closest to:

A) $674

B) $600

C) $460

D) $287

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

Taggart Transcontinental currently has a bank loan outstanding that requires it to make three annual payments at the end of the next three years of $1,000,000 each.The bank has offered to allow Taggart Transcontinental to skip making the next two payments in lieu of making one large payment at the end of the loan's term in three years.If the interest rate on the loan is 6%,then the final payment that the bank will require to make Taggart Transcontinental indifferent between the two forms of payments is closest to:

A) $2,673,000

B) $3,000,000

C) $3,184,000

D) $3,375,000

A) $2,673,000

B) $3,000,000

C) $3,184,000

D) $3,375,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

At an annual interest rate of 7%,the future value of this timeline in year 3 is closest to:

A) $3,295

B) $3,600

C) $3,770

D) $4,035

A) $3,295

B) $3,600

C) $3,770

D) $4,035

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

Use the following information to answer the question(s) below.

Nielson Motors is considering an opportunity that requires an investment of $1,000,000 today and will provide $250,000 one year from now, $450,000 two years from now, and $650,000 three years from now.

If the appropriate interest rate is 10%,then the NPV of this opportunity is closest to:

A) ($88,000)

B) $88,000

C) $300,000

D) $1,300,000

Nielson Motors is considering an opportunity that requires an investment of $1,000,000 today and will provide $250,000 one year from now, $450,000 two years from now, and $650,000 three years from now.

If the appropriate interest rate is 10%,then the NPV of this opportunity is closest to:

A) ($88,000)

B) $88,000

C) $300,000

D) $1,300,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

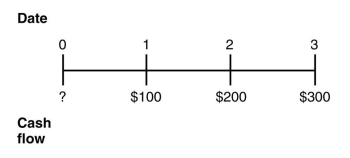

Consider the following timeline:

If the current market rate of interest is 9%,then the present value of this timeline as of year 0 is closest to:

A) $492

B) $637

C) $600

D) $400

If the current market rate of interest is 9%,then the present value of this timeline as of year 0 is closest to:

A) $492

B) $637

C) $600

D) $400

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

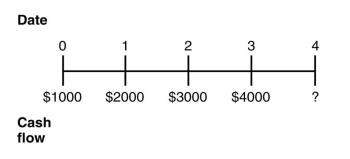

At an annual interest rate of 7%,the future value of this timeline in year 2 is closest to:

A) $3,080

B) $3,525

C) $3,770

D) $4,035

A) $3,080

B) $3,525

C) $3,770

D) $4,035

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements regarding perpetuities is false?

A) To find the value of a perpetuity one cash flow at a time would take forever.

B) A perpetuity is a stream of equal cash flows that occurs at regular intervals and lasts forever.

C) PV of a perpetuity =

D) One example of a perpetuity is the British government bond called a consol.

A) To find the value of a perpetuity one cash flow at a time would take forever.

B) A perpetuity is a stream of equal cash flows that occurs at regular intervals and lasts forever.

C) PV of a perpetuity =

D) One example of a perpetuity is the British government bond called a consol.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

Use the following information to answer the question(s) below.

Nielson Motors is considering an opportunity that requires an investment of $1,000,000 today and will provide $250,000 one year from now, $450,000 two years from now, and $650,000 three years from now.

If the appropriate interest rate is 10%,then Nielson Motors should:

A) Invest in this opportunity since the NPV is positive.

B) Do Not Invest in this opportunity since the NPV is positive.

C) Invest in this opportunity since the NPV is negative.

D) Do Not Invest in this opportunity since the NPV is negative.

Nielson Motors is considering an opportunity that requires an investment of $1,000,000 today and will provide $250,000 one year from now, $450,000 two years from now, and $650,000 three years from now.

If the appropriate interest rate is 10%,then Nielson Motors should:

A) Invest in this opportunity since the NPV is positive.

B) Do Not Invest in this opportunity since the NPV is positive.

C) Invest in this opportunity since the NPV is negative.

D) Do Not Invest in this opportunity since the NPV is negative.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

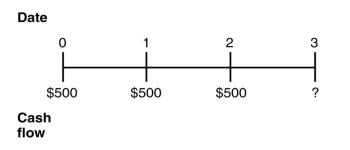

Consider the following timeline:

If the current market rate of interest is 7%,then the future value of this timeline as of year 3 is closest to:

A) $1720

B) $1500

C) $1404

D) $1717

If the current market rate of interest is 7%,then the future value of this timeline as of year 3 is closest to:

A) $1720

B) $1500

C) $1404

D) $1717

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

Use the information for the question(s) below.

Joe just inherited the family business, and having no desire to run the family business, he has decided to sell it to an entrepreneur. In exchange for the family business, Joe has been offered an immediate payment of $100,000. Joe will also receive payments of $50,000 in one year, $50,000 in two years, and $75,000 in three years. The current market rate of interest for Joe is 6%.

In terms of present value,how much will Joe receive for selling the family business?

Joe just inherited the family business, and having no desire to run the family business, he has decided to sell it to an entrepreneur. In exchange for the family business, Joe has been offered an immediate payment of $100,000. Joe will also receive payments of $50,000 in one year, $50,000 in two years, and $75,000 in three years. The current market rate of interest for Joe is 6%.

In terms of present value,how much will Joe receive for selling the family business?

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements is false?

A) FV =

B) PV =

C) FV = Cn × (1 + r)n

Cn × (1 + r)n

D) Most investment opportunities have multiple cash flows that occur at different points in time.

A) FV =

B) PV =

C) FV =

Cn × (1 + r)n

Cn × (1 + r)nD) Most investment opportunities have multiple cash flows that occur at different points in time.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

At an annual interest rate of 7%,the present value of this timeline in year 0 is closest to:

A) $3,080

B) $3,600

C) $3,770

D) $4,035

A) $3,080

B) $3,600

C) $3,770

D) $4,035

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

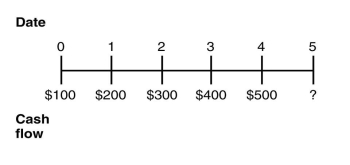

Consider the following timeline detailing a stream of cash flows:

If the current market rate of interest is 8%,then the present value of this stream of cash flows is closest to:

A) $22,871

B) $21,211

C) $24,074

D) $26,000

If the current market rate of interest is 8%,then the present value of this stream of cash flows is closest to:

A) $22,871

B) $21,211

C) $24,074

D) $26,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

Consider the following timeline:

If the current market rate of interest is 8%,then the value as of year 1 is closest to:

A) $0

B) $1003

C) $540

D) $77

If the current market rate of interest is 8%,then the value as of year 1 is closest to:

A) $0

B) $1003

C) $540

D) $77

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

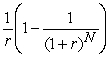

Which of the following statements regarding annuities is false?

A) PV of an annuity = C ×

B) The difference between an annuity and a perpetuity is that a perpetuity ends after some fixed number of payments.

C) An annuity is a stream of N equal cash flows paid at regular intervals.

D) Most car loans, mortgages, and some bonds are annuities.

A) PV of an annuity = C ×

B) The difference between an annuity and a perpetuity is that a perpetuity ends after some fixed number of payments.

C) An annuity is a stream of N equal cash flows paid at regular intervals.

D) Most car loans, mortgages, and some bonds are annuities.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements regarding growing perpetuities is false?

A) We assume that r < g for a growing perpetuity.

B) PV of a growing perpetuity =

C) To find the value of a growing perpetuity one cash flow at a time would take forever.

D) A growing perpetuity is a cash flow stream that occurs at regular intervals and grows at a constant rate forever.

A) We assume that r < g for a growing perpetuity.

B) PV of a growing perpetuity =

C) To find the value of a growing perpetuity one cash flow at a time would take forever.

D) A growing perpetuity is a cash flow stream that occurs at regular intervals and grows at a constant rate forever.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

You are thinking about investing in a mine that will produce $10,000 worth of ore in the first year.As the ore closest to the surface is removed it will become more difficult to extract the ore.Therefore,the value of the ore that you mine will decline at a rate of 8% per year forever.If the appropriate interest rate is 6%,then the value of this mining operation is closest to:

A) $71,429

B) $500,000

C) $166,667

D) This problem cannot be solved.

A) $71,429

B) $500,000

C) $166,667

D) This problem cannot be solved.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

If the appropriate interest rate is 8%,then present value of $500 paid at the beginning of each of the next 40 years is closest to:

A) $23

B) $5,962

C) $6,439

D) $20,0000

A) $23

B) $5,962

C) $6,439

D) $20,0000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

Consider a growing perpetuity that will pay $100 in one year.Each year after that,you will receive a payment on the anniversary of the last payment that is 6% larger than the last payment.This pattern of payments will continue forever.If the interest rate is 11%,then the value of this perpetuity is closest to:

A) $1,667

B) $588

C) $2,000

D) $909

A) $1,667

B) $588

C) $2,000

D) $909

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

Since your first birthday,your grandparents have been depositing $1000 into a savings account on everyone of your birthdays.The account pays 4% interest annually.Immediately after your grandparents make the deposit on your 18th birthday,the amount of money in your savings account will be closest to:

A) $25,645

B) $36,465

C) $12,659

D) $18,000

A) $25,645

B) $36,465

C) $12,659

D) $18,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

If the current rate of interest is 8%,then the future value 20 years from now of an investment that pays $1000 per year and lasts 20 years is closest to:

A) $45,762

B) $36,725

C) $9,818

D) $93,219

A) $45,762

B) $36,725

C) $9,818

D) $93,219

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

If the current rate of interest is 8%,then the present value of an investment that pays $1000 per year and lasts 20 years is closest to:

A) $18,519

B) $45,761

C) $9,818

D) $20,000

A) $18,519

B) $45,761

C) $9,818

D) $20,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

Your son is about to start kindergarten in a private school.Currently,the tuition is $12,000 per year,payable at the start of the school year.You expect annual tuition increases to average 6% per year over the next 13 years.Assuming that you son remains in this private school through high school and that your current interest rate is 7%,then the present value of your son's private school education is closest to:

A) $332,300

B) $137,900

C) $155,800

D) $156,000

A) $332,300

B) $137,900

C) $155,800

D) $156,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

The British government has a consol bond outstanding that pays ₤100 in interest each year.Assuming that the current interest rate in Great Britain is 5% and that you will receive your first interest payment one year from now,then the value of the consol bond is closest to:

A) ₤1000

B) ₤1100

C) ₤2100

D) ₤2000

A) ₤1000

B) ₤1100

C) ₤2100

D) ₤2000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

Kampgrounds Inc.is considering purchasing a parcel of wilderness land near a popular historic site.Although this land will cost Kampgrounds $400,000 today,by renting out wilderness campsites on this land,Kampgrounds expects to make $35,000 at the end of every year indefinitely.If the appropriate discount rate is 8%,then the NPV of this new wilderness campsite is closest to:

A) -$50,000

B) -$37,500

C) $37,500

D) $50,000

A) -$50,000

B) -$37,500

C) $37,500

D) $50,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements is false?

A) The difference between an annuity and a perpetuity is that an annuity ends after some fixed number of payments.

B) Most car loans, mortgages, and some bonds are annuities.

C) A growing perpetuity is a cash flow stream that occurs at regular intervals and grows at a constant rate forever.

D) An annuity is a stream of N equal cash flows paid at irregular intervals.

A) The difference between an annuity and a perpetuity is that an annuity ends after some fixed number of payments.

B) Most car loans, mortgages, and some bonds are annuities.

C) A growing perpetuity is a cash flow stream that occurs at regular intervals and grows at a constant rate forever.

D) An annuity is a stream of N equal cash flows paid at irregular intervals.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following formulas is incorrect?

A) PV of a growing annuity = C ×

B) PV of an annuity = C ×

C) PV of a growing perpetuity =

D) PV of a perpetuity =

A) PV of a growing annuity = C ×

B) PV of an annuity = C ×

C) PV of a growing perpetuity =

D) PV of a perpetuity =

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

Use the information for the question(s) below.

Assume that you are 30 years old today, and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%.

The future value at retirement (age 65)of your savings is closest to:

A) $497,530

B) $928,895

C) $1,263,236

D) $108,000

Assume that you are 30 years old today, and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%.

The future value at retirement (age 65)of your savings is closest to:

A) $497,530

B) $928,895

C) $1,263,236

D) $108,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

You work for a pharmaceutical company that has developed a new drug.The patent on the drug will last for 17 years.You expect that the drug will produce cash flows of $10 million in its first year and that this amount will grow at a rate of 4% per year for the next 17 years.Once the patent expires,other pharmaceutical companies will be able to produce generic equivalents of your drug and competition will drive any future profits to zero.If the interest rate is 12% per year,then the present value of producing this drug is closest to:

A) $71 million

B) $90 million

C) $170 million

D) $105 million

A) $71 million

B) $90 million

C) $170 million

D) $105 million

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

Use the information for the question(s) below.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

Assuming that costs continue to increase an average of 4% per year,tuition and other costs for one year for this student in 18 years when she enters college will be closest to:

A) $12,500

B) $21,500

C) $320,568

D) $25,323

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

Assuming that costs continue to increase an average of 4% per year,tuition and other costs for one year for this student in 18 years when she enters college will be closest to:

A) $12,500

B) $21,500

C) $320,568

D) $25,323

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

Your son is about to start kindergarten in a private school.Currently,the tuition is $12,000 per year,payable at the start of the school year.You expect annual tuition increases to average 6% per year over the next 13 years.Assuming that you son remains in this private school through high school and that your current interest rate is 6%,then the present value of your son's private school education is closest to:

A) $106,230

B) $156,000

C) $137,900

D) This problem cannot be solved

A) $106,230

B) $156,000

C) $137,900

D) This problem cannot be solved

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

Use the information for the question(s) below.

Assume that you are 30 years old today, and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%.

The present value (at age 30)of your retirement savings is closest to:

A) $87,000

B) $108,000

C) $46,600

D) $75,230

Assume that you are 30 years old today, and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%.

The present value (at age 30)of your retirement savings is closest to:

A) $87,000

B) $108,000

C) $46,600

D) $75,230

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

The British government has a consol bond outstanding that pays ₤100 in interest each year.Assuming that the current interest rate in Great Britain is 5% and that you will receive your first interest payment immediately upon purchasing the consol bond,then the value of the consol bond is closest to:

A) ₤2000

B) ₤2100

C) ₤1000

D) ₤1100

A) ₤2000

B) ₤2100

C) ₤1000

D) ₤1100

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

Suppose that a young couple has just had their first baby and they wish to insure that enough money will be available to pay for their child's college education.They decide to make deposits into an educational savings account on each of their daughter's birthdays,starting with her first birthday.Assume that the educational savings account will return a constant 7%.The parents deposit $2000 on their daughter's first birthday and plan to increase the size of their deposits by 5% each year.Assuming that the parents have already made the deposit for their daughter's 18th birthday,then the amount available for the daughter's college expenses on her 18th birthday is closest to:

A) $42,825

B) $97,331

C) $67,998

D) $103,063

A) $42,825

B) $97,331

C) $67,998

D) $103,063

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

Use the information for the question(s) below.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

Assuming that college costs continue to increase an average of 4% per year and that all her college savings are invested in an account paying 7% interest,then the amount of money she will need to have available at age 18 to pay for all four years of her undergraduate education is closest to:

A) $97,110

B) $107,532

C) $101,291

D) $50,000

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

Assuming that college costs continue to increase an average of 4% per year and that all her college savings are invested in an account paying 7% interest,then the amount of money she will need to have available at age 18 to pay for all four years of her undergraduate education is closest to:

A) $97,110

B) $107,532

C) $101,291

D) $50,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

If the appropriate interest rate is 8%,then present value of $500 paid at the end of each of the next 40 years is closest to:

A) $23

B) $5,962

C) $6,439

D) $20,0000

A) $23

B) $5,962

C) $6,439

D) $20,0000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

You have an investment opportunity that will cost you $10,000 today,but return $12,500 to you in one year.The IRR of this investment opportunity is closest to:

A) 80%

B) 125%

C) 20%

D) 25%

A) 80%

B) 125%

C) 20%

D) 25%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

Use the information for the question(s) below.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

Assuming that college costs continue to increase an average of 4% per year and that all her college savings are invested in an account paying 7% interest,then the amount of money she will need to have available at age 18 to pay for all four years of her undergraduate education is closest to:

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

Assuming that college costs continue to increase an average of 4% per year and that all her college savings are invested in an account paying 7% interest,then the amount of money she will need to have available at age 18 to pay for all four years of her undergraduate education is closest to:

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

The British government has just issued a new consol bond that sells for £1000 and pays interest of 8%.The annual interest payment on this bond must be:

A) £80

B) £8

C) £1000

D) £12,500

A) £80

B) £8

C) £1000

D) £12,500

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

Dagny Taggart is a graduating college senior and she is considering the costs of going to medical school.Beginning next fall,Dagny expects medical school tuition to run $45,000 for the first year and she estimates that tuition will increase by 6% each year.If Dagny is able to invest her money in an account paying 8% interest per year,then the present value to Dagny of four years of medical school tuition is closest to:

A) $149,045

B) $155,930

C) $162,095

D) $180,000

A) $149,045

B) $155,930

C) $162,095

D) $180,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is not a valid time value of money function in Excel?

A) PMT

B) NPER

C) I

D) FV

A) PMT

B) NPER

C) I

D) FV

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

Use the information for the question(s) below.

Assume that you are 30 years old today, and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%.

Assume that you are 30 years old today,and that you are planning on retiring at age 65.Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work.To save for your retirement,you plan on making annual contributions to a retirement account.Your first contribution will be made on your 31st birthday and will be 8% of this year's salary.Likewise,you expect to deposit 8% of your salary each year until you reach age 65.At retirement (age 65)you will begin withdrawing equal annual payments to pay for your living expenses during retirement (on your 65th birthday).If you expect to die one day before your 101st birthday (Your last withdraw will be on your 100th birthday)and if the annual rate of return is 7%,then how much money will you have to spend in each of your golden years of retirement?

Assume that you are 30 years old today, and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%.

Assume that you are 30 years old today,and that you are planning on retiring at age 65.Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work.To save for your retirement,you plan on making annual contributions to a retirement account.Your first contribution will be made on your 31st birthday and will be 8% of this year's salary.Likewise,you expect to deposit 8% of your salary each year until you reach age 65.At retirement (age 65)you will begin withdrawing equal annual payments to pay for your living expenses during retirement (on your 65th birthday).If you expect to die one day before your 101st birthday (Your last withdraw will be on your 100th birthday)and if the annual rate of return is 7%,then how much money will you have to spend in each of your golden years of retirement?

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

You are interested in purchasing a new automobile that costs $35,000.The dealership offers you a special financing rate of 6% APR (0.5%)per month for 48 months.Assuming that you do not make a down payment on the auto and you take the dealer's financing deal,then your monthly car payments would be closest to:

A) $729

B) $822

C) $842

D) $647

A) $729

B) $822

C) $842

D) $647

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

You are considering purchasing a new home.You will need to borrow $250,000 to purchase the home.A mortgage company offers you a 15 year fixed rate mortgage (180 months)at 9% APR (0.75% month).If you borrow the money from this mortgage company,your monthly mortgage payment will be closest to:

A) $2,585

B) $660

C) $2,535

D) $1,390

A) $2,585

B) $660

C) $2,535

D) $1,390

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

Wyatt oil is considering drilling a new self sustaining oil well at a cost of $1,000,000.This well will produce $100,000 worth of oil during the first year,but as oil is removed from the well the amount of oil produced will decline by 2%,per year forever.If the Wyatt oil's appropriate interest rate is 8%,then the NPV of this oil well is closest to:

A) -$250,000

B) $0

C) $250,000

D) $1,000,000

A) -$250,000

B) $0

C) $250,000

D) $1,000,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

How do you calculate (mathematically)the present value of a(n):

(a)perpetuity

(b)annuity

(c)growing perpetuity

(d)growing annuity

(a)perpetuity

(b)annuity

(c)growing perpetuity

(d)growing annuity

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

Suppose that you are considering an investment that will pay you $4000 per year for the next five years.The appropriate rate of interest is 5%.You want to know the present value of the cash flows from this investment.To solve this problem in Microsoft Excel,you would use which of the following excel formulas?

A) =PV(.05,5,4000,0,0)

B) =PV(.05,5,4000,0,1)

C) =PV(5,.05,4000,0)

D) =PV(5,5,4000,0)

A) =PV(.05,5,4000,0,0)

B) =PV(.05,5,4000,0,1)

C) =PV(5,.05,4000,0)

D) =PV(5,5,4000,0)

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

Use the information for the question(s) below.

Assume that you are 30 years old today, and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%.

The future value at retirement (age 65)of your savings is:

Assume that you are 30 years old today, and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%.

The future value at retirement (age 65)of your savings is:

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

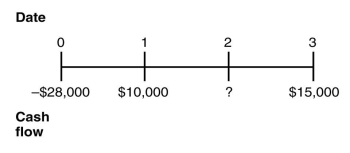

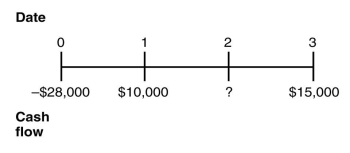

You are offered an investment opportunity that costs you $28,000,has an NPV of $2278,lasts for three years,has interest rate of 10%,and produces the following cash flows:

The missing cash flow from year 2 is closest to:

A) $12,500

B) $12,000

C) $13,000

D) $10,000

The missing cash flow from year 2 is closest to:

A) $12,500

B) $12,000

C) $13,000

D) $10,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

Henry Rearden is saving for retirement and has determined that to live comfortably he must save $3 million by his 65 birthday.Henry just turned 30 today,and he has decided that starting today and continuing on every birthday up to and including his 65th birthday,he will deposit the same amount into an individual retirement account (IRA).If Henry can earn 8% on his IRA,then the amount he must set aside each year to make sure that he will have $3 million in his account on his 65th birthday is closest to:

A) $16,035

B) $17,410

C) $83,335

D) $85,715

A) $16,035

B) $17,410

C) $83,335

D) $85,715

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

75

You are looking for a new truck and see the following advertisement."Own a new truck! No money down.Just five easy annual payments of $8000." You know that you can get the same truck from the dealer across town for only $31,120.The interest rate for the deal advertised is closest to:

A) 9%

B) 8%

C) 8.5%

D) 10%

A) 9%

B) 8%

C) 8.5%

D) 10%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

76

You are saving for retirement.To live comfortably,you decide that you will need $2.5 million dollars by the time you are 65.If today is your 30th birthday,and you decide,starting today,and on every birthday up to and including your 65th birthday,that you will deposit the same amount into your savings account.Assuming the interest rate is 5%,the amount that you must set aside each and every year on your birthday is closest to:

A) $71,430

B) $27,680

C) $26,100

D) $26,260

A) $71,430

B) $27,680

C) $26,100

D) $26,260

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

77

After your grandmother retired,she purchased an annuity contract for $250,000 that will pay her $25,000 at the end of every year until she dies.The appropriate interest rate for this annuity is 8%.The number of years that your grandmother must live in order to get more value out of the annuity than what she paid for it is closest to:

A) 21

B) 16

C) 8

D) 10

A) 21

B) 16

C) 8

D) 10

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

78

Francisco d'Anconia is considering an investment opportunity that costs $10,000 today and will pay $11,500 in two years.The IRR of this opportunity is closest to:

A) 7.25%

B) 7.50%

C) 10.00%

D) 15.00%

A) 7.25%

B) 7.50%

C) 10.00%

D) 15.00%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

79

Suppose that you deposit $10,000 in an account that pays 6% interest and you want to know how much will be in your account at the end of 10 years.To solve this problem in Microsoft Excel,you would use which of the following Excel formulas?

A) =FV(.06,10000,0,10)

B) =PV(.06,10000,0,10)

C) =FV(.06,10,0,10000)

D) =PV(.06,10,0,10000)

A) =FV(.06,10000,0,10)

B) =PV(.06,10000,0,10)

C) =FV(.06,10,0,10000)

D) =PV(.06,10,0,10000)

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

80

Define the following terms:

(a)perpetuity

(b)annuity

(c)growing perpetuity

(d)growing annuity

(a)perpetuity

(b)annuity

(c)growing perpetuity

(d)growing annuity

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck