Deck 18: Alternative Investments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 18: Alternative Investments

1

Business ideas need money,and it is easiest for a business to try to raise money through a public float.

False

Explanation: Business ideas need money,and it is simply not feasible for a business to try to raise money through a public float when it is at an early stage,often without a confirmed product or market.

Explanation: Business ideas need money,and it is simply not feasible for a business to try to raise money through a public float when it is at an early stage,often without a confirmed product or market.

2

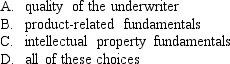

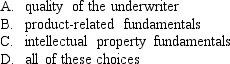

Which factor did Guo,Lev and Zhou (2005)find plays an important role in the success of a venture capital?

D

Explanation: Venture capitalists can play an important role in the business success through reputational signalling.Guo,Lev and Zhou (2005)examine factors associated with biotech IPOs.They find that the quality of the underwriters and venture capital backing,as well as product-related and intellectual property fundamentals,can explain around 60-80% of the pricing of the IPO.

Explanation: Venture capitalists can play an important role in the business success through reputational signalling.Guo,Lev and Zhou (2005)examine factors associated with biotech IPOs.They find that the quality of the underwriters and venture capital backing,as well as product-related and intellectual property fundamentals,can explain around 60-80% of the pricing of the IPO.

3

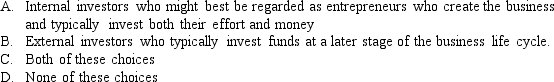

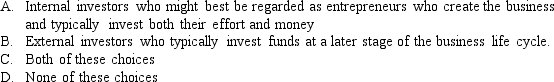

Which of the following is type of private equity investors?

C

Explanation: Internal and external investors are two types of private equity investors.

Explanation: Internal and external investors are two types of private equity investors.

4

Guo,Lev and Zhou (2005)find that several factors play an important role in the success of a venture capital.How much of the IPO pricing can these factors explain?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is not a stage in the private equity life cycle?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

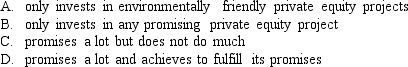

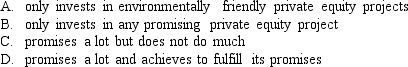

6

Private equity funds:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

The angel stage of investing is never associated with other cash streams,such as government grants,industry grants and university seed funding.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

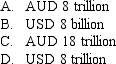

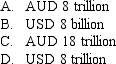

8

By the end of the 1990s,private equity was worth almost ___ in the USA.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

A blue-sky company is one that:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Biotech firms that make it through to a public float generally undergo how many rounds of venture capital financing?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

The seminal study of Moskowitz and Vissing-Jørgensen (2002),which has estimated rates of return to private equity in the USA over the 1990s,reports that returns to private equity over the early 1990s were 12.3% p.a.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

The venture capital stage often involves several tranches of financing in which the amount of the investment and the number of investors grows.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

Entrepreneurs are humans,but they do not suffer from arrogance and insolence.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

Brav and Gompers (1997)analyse the short-run performance of venture-backed IPOs in comparison to non-venture-backed IPOs.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

Private equity returns are difficult to estimate due to the fact:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

Private equity is usually sourced from a few select wealthy individuals or specialist funds who are willing to contribute a relatively large proportion of the capital required to propel the business forward.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

The range of businesses in which private equity is held tends to be concentrated in:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

Venture capitalists are rarely involved in the governance and management of a venture that they finance.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

Alternative investments (AI)do not generally represent an asset class that tends to be restricted to professional fund managers and very large private investors.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

Moskowitz and Vissing-Jørgensen (2002)estimate that,for those households that hold private equity,that investment represents 41% of household wealth.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

Several studies into returns from venture capital funds have generally supported the notion of high returns.What arithmetic return on financing rounds to IPO did Cochrane (2005)report?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Over the period,the average annual return on the hedge fund index was p.a. ,which is better than the average annual return on the world index of 10.8% p.a. ,but worse than Australia at p.a.and worse than the emerging market index at 20% p.a.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

The long-short strategy is one of the most common strategies in the hedge fund industry and relies upon:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

Which is the round of funding where the business should be generating some external revenue?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Please refer to figure 18.8.The hedge fund index has been more stable and has generally exhibited the least volatility,given that it represents what is,essentially,a diversified portfolio across a diversified series of strategies.

What is the average performance fee for a hedge fund in Australia?

What is the average performance fee for a hedge fund in Australia?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

Which type of fund has the objective to establish an overall position that is uncorrelated with traditional asset classes?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

Once a business is at the stage of the IPO,how much does the lead venture capitalist,on average,hold of the firm?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

The investment strategy of a hedge fund is to invest in:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

Once adjusted for risk,the beta estimate of venture capital firms is approximately:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following are characteristics of a hedge fund?

I)Pooling of assets

II)Strict regulatory oversight by the SEC

III)Investing in equities,debt instruments,and derivative instruments

IV)Professional management of assets

A)I and II only

B)II and III only

C)III and IV only

D)I,III,and IV only

I)Pooling of assets

II)Strict regulatory oversight by the SEC

III)Investing in equities,debt instruments,and derivative instruments

IV)Professional management of assets

A)I and II only

B)II and III only

C)III and IV only

D)I,III,and IV only

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

Which type of hedge fund may monitor the futures and spot markets to identify situations when prices in the two markets depart from the cost-of-carry model?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

After five years post listing,venture-backed IPOs earn a cumulative return of:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

Which capital is generally the largest of the venture capital fund-raising rounds?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

At which funding round does the business appear to have a good product but it is not generating sufficient income?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

After five years post listing,non-venture-backed IPOs earn a cumulative return of:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

From a portfolio perspective,infrastructure assets are regarded as _________risk,but offering a return.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

Once a business is at the stage of the IPO,how much do the venture capitalists,on average,hold of the firm?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

Which type of hedge fund examines relationships between global markets to find relationships that do not conform with economic theory?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

The distribution of returns to venture capital is:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Hedge funds tend to be characterised by:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck