Deck 3: The International Investment Environment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 3: The International Investment Environment

1

It is impossible for a foreign investor to invest in markets with capital restrictions.

False

Explanation: Where foreign capital restrictions apply,the foreign market is not regarded as directly investable.Rather,investment is usually via a form of fund.These funds are known as 'country funds',and operate with local government approval.

Explanation: Where foreign capital restrictions apply,the foreign market is not regarded as directly investable.Rather,investment is usually via a form of fund.These funds are known as 'country funds',and operate with local government approval.

2

A rate of USD/AUD 0.94 indicates that the 1AUD is worth 0.94USD.

True

Explanation: The quotation of USD/AUD means USD per one AUD.Hence,a rate of USD/AUD 0.94 indicates that one AUD is worth 0.94 USD.

Explanation: The quotation of USD/AUD means USD per one AUD.Hence,a rate of USD/AUD 0.94 indicates that one AUD is worth 0.94 USD.

3

The wholesale rate applies to private investors dealing in A$1 000 000 or more.

True

Explanation: Exchange rates can be quoted as wholesale or retail rates.The wholesale rate is the inter-bank or inter-dealer rate,and generally only applies to private investors if they are dealing in A$1 000 000 or more.The retail rate is the rate that is applicable to private investors in general.

Explanation: Exchange rates can be quoted as wholesale or retail rates.The wholesale rate is the inter-bank or inter-dealer rate,and generally only applies to private investors if they are dealing in A$1 000 000 or more.The retail rate is the rate that is applicable to private investors in general.

4

In the Australian forex market,a rate of 1AUD = 0.6425-0.6465 EUR would be expressed as AUD/EUR 0.6425-0.6465.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

A forex rate given in Sydney of USD/AUD 0.9835-0.9965 means that the FX dealer will be willing to buy 1AUD for 0.9835USD.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

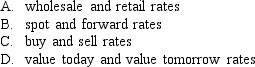

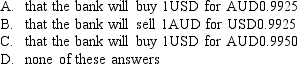

The 'spread' is the difference between the:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

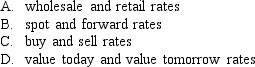

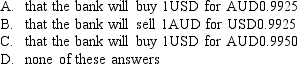

A foreign exchange rate of USD/AUD 0.9925-0.9950 indicates:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

Primary risks from overseas investment include market risk and .

A)information risk

B)exchange rate risk

C)political risk

D)all of these answers

A)information risk

B)exchange rate risk

C)political risk

D)all of these answers

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

The NZ Alternative Market (NZAX)is the New Zealand's main board and has over 150 listed securities.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

The main additional risk arising from investing in international markets to those risks investing in domestic market is:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Australia is different to most other foreign markets in that it uses the direct method of quotation.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

The type of rate that quotes the rate when settlement will occur on the first business day following the transaction is called:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

When investment restrictions apply to a foreign equity market,the most common means of markets entry is through:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

An indirect quotation given in Sydney would involve foreign currencies being expressed in terms of the value of 1 Australian dollar.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following maintains a portfolio of stocks in the foreign country and is subject to trading and reporting regulations in that country?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

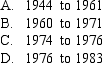

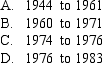

The Australian dollar was pegged to a basket of currencies during what period?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

The sole differentiating factor of emerging markets is that they are markets of developing countries that have experienced rapid change and growth.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

A foreign investor investing in the Australian equity market will have its foreign currency denominated return reduced if the Australian dollar appreciates relative to the foreign currency.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

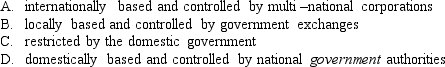

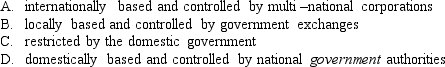

Most financial markets are:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

The type of rate that quotes the rate used in a forward contract when settlement is more than two business days after the transaction is called:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

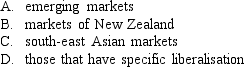

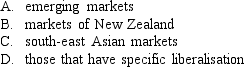

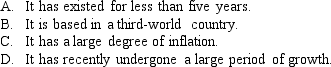

Emerging markets are typically characterised as:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Which are possible problems of emerging markets?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

In terms of the dollar value of transactions for all currencies,which of the following foreign exchange participants was the most heavily used in the most recent period?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

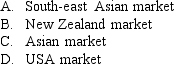

Which region of the world has varying levels of market regulation and restrictions on foreign trading throughout its jurisdictions due mainly to local authorities?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

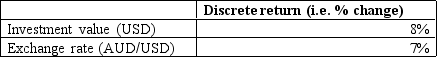

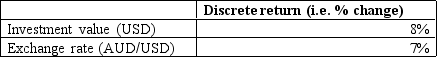

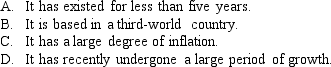

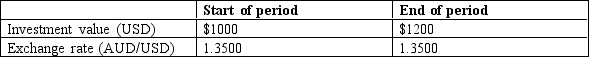

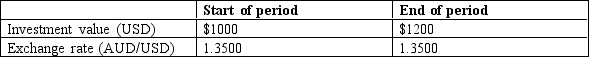

Given the information contained in the table regarding a foreign investment an Australian investor made in the US,what is the discrete Australian dollar (AUD)return over the period?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

According to table 3.1,foreign financial institutions were most heavily used as foreign exchange participants in 2012,followed by non-financial institutions and then Australian financial institutions.

Using the information contained in the table,what is the EUR/USD mid-rate?

Using the information contained in the table,what is the EUR/USD mid-rate?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

According to table 3.1,foreign financial institutions were most heavily used as foreign exchange participants in 2012,followed by non-financial institutions and then Australian financial institutions.

Using the information contained in the table,what amount would an investor receive from exchanging 1EUR for AUD?

Using the information contained in the table,what amount would an investor receive from exchanging 1EUR for AUD?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

Given the information contained in the table regarding a foreign investment an Australian investor made in the US,what is the discrete Australian dollar (AUD)return over the period?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

The Emerging Market Database (EMDB)is broadly categorised into four sub groups.Which group consists of organisations that have relied upon the market for finance rather than traditional banking sources?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following characteristics typically applies to an emerging market?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

An Australian investor purchases a European-based investment at a price of EUR52.50 when the exchange rate was EUR0.6500/AUD.If the investment is sold for a price of EUR55.00 and the investor's AUD discrete return was 10%,what was the exchange rate when the investment was sold?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

According to table 3.1,foreign financial institutions were most heavily used as foreign exchange participants in 2012,followed by non-financial institutions and then Australian financial institutions.

Using the information contained in the table,for the AUD/USD exchange rate,what is the ask rate assuming direct rates from a US perspective?

Using the information contained in the table,for the AUD/USD exchange rate,what is the ask rate assuming direct rates from a US perspective?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

According to table 3.1,foreign financial institutions were most heavily used as foreign exchange participants in 2012,followed by non-financial institutions and then Australian financial institutions.

Using the information contained in the table,what amount would an investor receive from exchanging 1AUD for EUR?

Using the information contained in the table,what amount would an investor receive from exchanging 1AUD for EUR?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

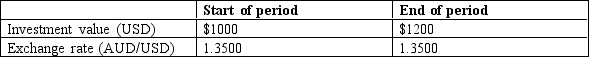

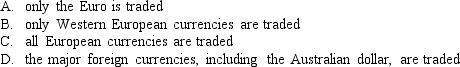

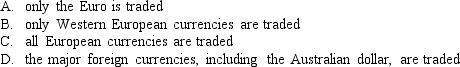

The Euromarket consists of a currency market where:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

The international study by Izan,Jalleh and Ong in 1991 suggests that Australian investors can reduce their risk through international investment by what percentage per annum?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

According to table 3.1,foreign financial institutions were most heavily used as foreign exchange participants in 2012,followed by non-financial institutions and then Australian financial institutions.

Using the information contained in the table,for the AUD/USD exchange rate,what is the bid rate,assuming direct rates from an Australian perspective?

Using the information contained in the table,for the AUD/USD exchange rate,what is the bid rate,assuming direct rates from an Australian perspective?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

According to table 3.1,foreign financial institutions were most heavily used as foreign exchange participants in 2012,followed by non-financial institutions and then Australian financial institutions.

Using the information contained in the table,what is the USD/EUR mid-rate?

Using the information contained in the table,what is the USD/EUR mid-rate?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

Given the information contained in the table regarding a foreign investment an Australian investor made in the US,what is the discrete Australian dollar (AUD)return over the period?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

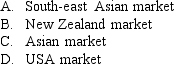

In mid-1997,which part of the world struggled in financial crisis?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

An Australian investor purchases a European-based investment at a price of EUR52.50 when the exchange rate was AUD0.6500/AUD.If the exchange rate when the investment was sold was 0.6400,what must the investor sell the investment for to make a discrete return of 15%?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck