Deck 2: Australian Financial Markets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 2: Australian Financial Markets

1

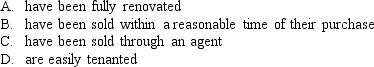

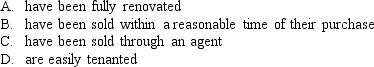

When constructing a residential property index,it is generally not assumed that properties:

A

Explanation: While indices are available for residential properties,the interpretation of these is subject to a number of implicit assumptions regarding the properties in the index.One of the most important of these is that the property has not been improved.That is,the property should remain the same over successive sales to determine the true change in the property value.Any improvements undertaken could result in an artificially high selling price,which would overstate the return on the investment.There is no requirement that a house be sold within a certain time or that an agent is used.

Explanation: While indices are available for residential properties,the interpretation of these is subject to a number of implicit assumptions regarding the properties in the index.One of the most important of these is that the property has not been improved.That is,the property should remain the same over successive sales to determine the true change in the property value.Any improvements undertaken could result in an artificially high selling price,which would overstate the return on the investment.There is no requirement that a house be sold within a certain time or that an agent is used.

2

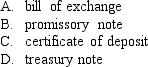

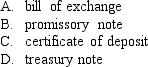

Which of the following is defined as a money market instrument that is termed a 'negotiable instrument'?

A

Explanation: 'Bills of exchange' can be discounted,or sold,in the money market as they are negotiable instruments.

Explanation: 'Bills of exchange' can be discounted,or sold,in the money market as they are negotiable instruments.

3

According to ASX short-selling rules,all short-sold positions must be settled within three days.

False

Explanation: The answer is false.The additional ASX rules that apply to short selling are outlined in the appendix 2.2.

Explanation: The answer is false.The additional ASX rules that apply to short selling are outlined in the appendix 2.2.

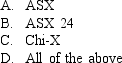

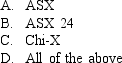

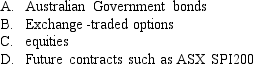

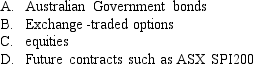

4

In Australia,the main organized securities markets available to investors included:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

Both LICs and LITs are closed end vehicles,though LICs distribute dividends.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

An accumulation index differs from a price index because it assumes that dividends are reinvested back into the stock.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

The culmination of the state stock exchanges eventuated in 1962.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

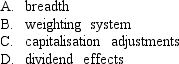

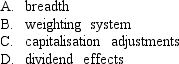

8

Which of the following does not affect(s)the performance on an index?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

The S&P/ASX 50 is the narrowest of the S&P/ASX indices.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Trading on the Australian stock exchange is conducted on the SEATS system.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following represent(s)the way in which Australian debt instruments are taxed differently from Australian equity instruments?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

Bills of exchange and debentures are both examples of securities traded on the Australian bond markets.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

A margin call occurs when the value of the borrowed money as a proportion of the portfolio value is too high.This ratio is typically known as the value to loan ratio.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

are traded in the ASX 24 system.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

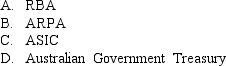

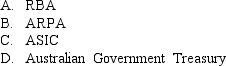

15

Which of the following bodies is responsible for the supervision of financial markets in Australia like ASX and ASX 24?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

Which index weighting systems are most share indices using?

A)equal-weighted index

B)value-weighted index

C)price-weighted index

D)All of above

A)equal-weighted index

B)value-weighted index

C)price-weighted index

D)All of above

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

According to the ASX minimum price steps,which of the following represents the smallest possible positive simple return for a share with a current price of $4.00?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

Trading on the Australian stock exchange is conducted on the CHESS system.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

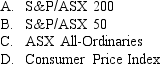

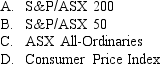

The broadest index in the Australian equity market is the:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

The Integrated Trading System (ITS)system which permits automated order processing is used by brokers to also report regulatory requirements.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

Cruiser Ltd has 3 000 000 shares on issue.The company makes a rights issue on the basis of one share for every six already held.The subscription price for a new share is $3.20 per share.The current market value of the company's shares is $4.00.What would be the ex-rights share price?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Assuming an imputation tax system with a corporate tax rate of 30%,what is the net personal tax for an investor with a personal tax rate of 30%,if the fully franked dividend is $10 000?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

Assuming an imputation tax system with a corporate tax rate of 30%,what is the after tax dividend for an investor with a personal tax rate of 47%,if the fully franked dividend is $14 000?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

Assume an investor buys an apartment for investment purpose for $400,000.The purchase is financed with 50,000 of the investor's money and the rest,$350,000,is borrowed at a rate of 8%.Suppose the apartment earns rental income of $10,000 and the investor earns $100,000 p.a.and the marginal tax rate is 37%.Calculate the loss on the property.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Assuming an imputation tax system with a corporate tax rate of 28%,what is the net personal tax for an investor with a personal tax rate of 45%,if the fully franked dividend is $14 000?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

Company ABC has a share price of $10 and has 400 000 shares on issue.If the company makes a bonus issue of 100 000 additional shares,calculate the ex-bonus price of shares in ABC.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

Assuming an imputation tax system with a corporate tax rate of 30%,what is the net personal tax for an investor with a personal tax rate of 15%,if the fully franked dividend is $14 000?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

Taxman Ltd currently has 4 500 000 shares on issue.Taxman Ltd makes a bonus issue on the basis of one share for every five shares currently held.Before the bonus issue,the company's shares trade at $8.50.What would be the expected ex-bonus price?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

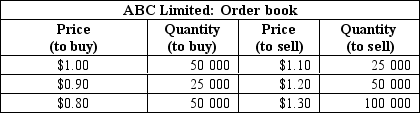

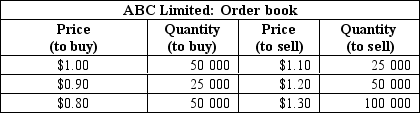

Given the order book for ABC limited,suppose a market order arrives to buy 100 000 shares.What is the cost of the 100 000 shares to the trader?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

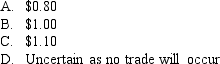

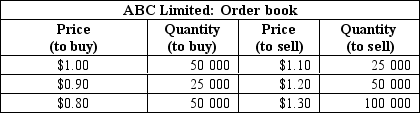

Given the order book for ABC Limited,suppose a limit order arrives to buy 1000 shares at $1.05.At what price will the trade occur? (Assume no new orders arrive after the limit order. )

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

An investor wants to calculate the continuously compounded return for month t for a company.If the share price of the company was $4.50 at the start of month t and $7.25 at the end of month t,then the month t continuously compounded return is:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

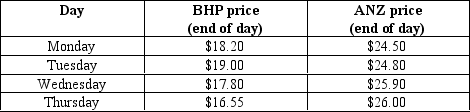

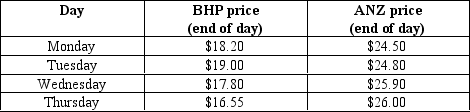

Consider the end of day prices for ANZ and BHP for Monday through Thursday.Suppose an investor short sells BHP over this period,calculate their continuously compounded return to the investor.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

Hendra Heights Ltd has 28 000 000 shares on issue.The company makes a rights issue on the basis of one share for every seven already held.The subscription price for a new share is $4.20 per share.If all rights are taken up such that the issue is fully subscribed,and the current market value of the company's shares is $7.50,what is the amount raised by the company through the rights issue?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

An investor wants to calculate the continuously compounded return for month t for a company.If the share price of the company was $4.50 at the start of month t and $7.25 at the end of month t and the company paid a dividend of $0.80 in month t,then the month t return is:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

Assuming an imputation tax system with a corporate tax rate of 28%,what is the after tax dividend for an investor with a personal tax rate of 15%,if the fully franked dividend is $21 000?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

Taxman Ltd currently has 4 500 000 shares on issue.Taxman Ltd makes a bonus issue on the basis of one share for every five shares currently held.Before the bonus issue,the company's shares were trading at $8.50.What is the new share price observed in the market (i.e.assuming no adjustment is made)?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

Given the order book for ABC Limited,suppose a market order arrives to buy 80,000 shares.At what price will the trade occur?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

Company DEF initially has a share price of $8.The company makes a rights issue on the basis of one for every five held,with a subscription price of $5.00.Calculate the ex-rights price of the DEF shares.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

Consider the end of day prices for ANZ and BHP for Monday through Thursday.Suppose an investor short sells BHP and buys ANZ,what will the continuously compounded return be on the investor's combined position if the investments have equal weight?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Company XYZ initially has a share price of $1.The company makes a rights issue on the basis of 1 for every 1 held,with a subscription price of $0.50.Calculate the ex-rights price of the XYZ shares.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck