Deck 8: Risky Asset Pricing Models and the Capm

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 8: Risky Asset Pricing Models and the Capm

1

For international investors without access to imputation tax credits,the traditional form of the CAPM is not applicable.

False

Explanation: Small open economy prices are set by international investors in a world economy.For imputation,international investors do not have direct access to imputation tax credits,and are indeed specifically excluded under the tax law.In this case,the traditional CAPM is applicable.

Explanation: Small open economy prices are set by international investors in a world economy.For imputation,international investors do not have direct access to imputation tax credits,and are indeed specifically excluded under the tax law.In this case,the traditional CAPM is applicable.

2

An asset in the Australian market has a beta of 1.0.If the variance of the asset is 10% and the variance of the market index is 25%,what is the asset's covariance with the market?

C

Explanation: Rearranging equation 8.2,and using the inputs provided,we can compute the covariance of the asset with the market to be 1 0.25 = 0.25.

Explanation: Rearranging equation 8.2,and using the inputs provided,we can compute the covariance of the asset with the market to be 1 0.25 = 0.25.

3

The beta of the market:

C

Explanation: Considering equation 8.6,page 241,we can see that the beta of the market is equal to one.

Explanation: Considering equation 8.6,page 241,we can see that the beta of the market is equal to one.

4

The standard deviation of returns of an inefficient portfolio is __________ the standard deviation of an efficient portfolio,provided both portfolios have equal expected returns.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

According to the CAPM,if the expected return on the market return is 5% and the risk-free rate is 2%,the beta of a portfolio with a 6.5% return is 2.0.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

In the context of the capital asset pricing model,the systematic measure of risk is captured by beta.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

The zero-beta form of the CAPM uses a zero-beta portfolio in place of the return on the market portfolio.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

The beta of the market is equal to minus 1.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is not a characteristic of a portfolio that lies on both the capital market line and the security market line?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Empirical results estimated from historical data indicate that betas are always close to zero.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

In using the CAPM with positively skewed asset returns,the estimate of expected returns must be adjusted upwards.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

Imputation tax was introduced in Australia in 1983.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

Given a correlation coefficient of 0.85 between portfolio A and the market portfolio,a standard deviation of portfolio A of 26% and a standard deviation of the market portfolio of 18%,what is the portfolio beta?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

CBA has a beta of 1.6 and WPL has a beta of 1.8.Given this,calculate the beta for a portfolio consisting of 65% in CBA and 35% in WPL.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

The __________ of an asset will help to identify the most appropriate risk-free rate to be used in calculations of expected returns.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

Calculate the beta for an asset with a variance of 10%,where the market has a variance of 15% and a covariance with the asset of 20%.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

Consider the CAPM.The expected return on the market is 18%.The expected return on a stock with a beta of 1.2 is 20%.What is the risk-free rate?

A)2%

B)6%

C)8%

D)12%

A)2%

B)6%

C)8%

D)12%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

Arbitrage is based on the idea that _________.

A)assets with identical risks must have the same expected rate of return

B)securities with similar risk should sell at different prices

C)the expected returns from equally risky assets are different

D)markets are perfectly efficient

A)assets with identical risks must have the same expected rate of return

B)securities with similar risk should sell at different prices

C)the expected returns from equally risky assets are different

D)markets are perfectly efficient

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

A continuous time version of the CAPM was developed by Oliver (1997).

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

The CAPM assumes that asset returns are positively skewed but otherwise normal.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

Testing the CAPM is difficult,as empirical tests have to rely on __________ data,whereas the CAPM is an __________ model.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

An asset has a standard deviation of 15% and a correlation with the market portfolio of 0.46.If the market has a standard deviation of 25%,what is the beta of the asset?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

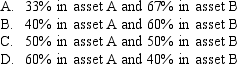

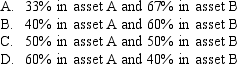

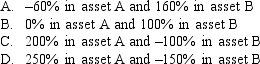

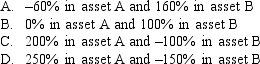

Assume the CAPM is the correct asset pricing model,and the risk-free rate of return is 6% and the market portfolio has an expected return and a standard deviation of 16% and 0.10%,respectively.An investor has a portfolio consisting of asset A,which has a beta of 1.6,and asset B,which has a beta of 0.6.If the investor wishes to earn a return identical to that of the market portfolio,what weight should the investor place in assets A and B?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

Assume the CAPM is the correct asset pricing model,the risk-free rate of return is 6%,and the market portfolio has an expected return and a standard deviation of 16% and 0.10%,respectively.An investor has a portfolio consisting of asset A,which has a beta of 0.6,and asset B,which has a beta of 0.8.If the investor wishes to earn a return identical to that of the market portfolio,what weight should the investor place in assets A and B?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Assume the CAPM is the correct asset pricing model.An asset has a standard deviation of 30% and the market has a standard deviation of 20%.What would the correlation of the asset with the market need to be if the asset were to have the same expected return as the risk-free asset?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

Expected returns are also called:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

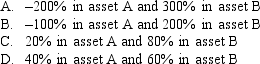

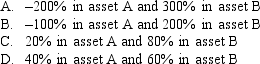

Assume the CAPM is the correct asset pricing model,the risk-free rate of return is 6%,and the market portfolio has an expected return and a standard deviation of 16% and 0.10%,respectively.An investor has a portfolio consisting of asset A,which has a beta of 1.6,and asset B,which has a beta of 0.6.If the investor wishes to earn a return identical to that of the risk-free asset,what weight should the investor place in assets A and B?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

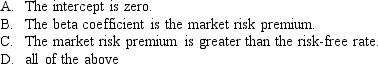

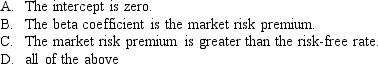

Which of the following is a testable proposition in empirical regression tests of the CAPM of average excess returns against beta?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

Please refer to Figure 8.3.Under SML,both portfolios must have the same beta in equilibrium.However,the relationship breaks down in the CML.While the CAPM prices all assets,the CML can only be used to price efficient portfolios.

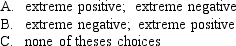

If the distribution of returns is non-normal and positively skewed,the investor has a greater probability of earning __________ returns rather than __________ returns.

If the distribution of returns is non-normal and positively skewed,the investor has a greater probability of earning __________ returns rather than __________ returns.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

The SML is valid for _______________,and the CML is valid for ______________.

A)only individual assets;well-diversified portfolios only

B)only well-diversified portfolios;only individual assets

C)both well-diversified portfolios and individual assets;both well-diversified portfolios and individual assets

D)both well-diversified portfolios and individual assets;well-diversified portfolios only

A)only individual assets;well-diversified portfolios only

B)only well-diversified portfolios;only individual assets

C)both well-diversified portfolios and individual assets;both well-diversified portfolios and individual assets

D)both well-diversified portfolios and individual assets;well-diversified portfolios only

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

An asset has a standard deviation of 30% and a correlation with the market portfolio of 0.60.If the market has a standard deviation of 30%,how much lower is the beta of the asset relative to the market?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

Assume the CAPM is the correct asset pricing model,the risk-free rate of return is 6%,and the market portfolio has an expected return and a standard deviation of 16% and 0.10%,respectively.An investor has a portfolio consisting of asset A,which has a beta of 0.75,and asset B,which has a beta of 1.25.If the investor wishes to earn a return identical to that of the risk-free asset,what weight should the investor place in assets A and B?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

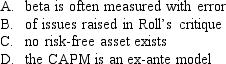

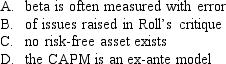

The issue that realised returns only relate to actual returns in the long-term is relevant to use of the CAPM because:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

Where thin trading is present in a market index used for the approximation of a beta,the beta will be __________ for a thinly traded company,and __________ for a frequently traded stock.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

Beta stability tends to:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

In empirical tests of the CAPM in excess return form,the intercept in a regression of average returns against beta should be:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

Assume the CAPM is the correct asset pricing model.An asset has a standard deviation of 40% and the market has a standard deviation of 15%.What would the correlation of the asset with the market need to be if the asset were to have the same expected return as the market?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

Assume the CAPM is the correct asset pricing model,and the risk-free rate of return is 6% and the market has an expected return and a standard deviation of 16% and 0.10%,respectively.An investor has a portfolio consisting of equal amounts in assets A and B.Asset A has an expected return of 8%.If the portfolio has an expected return of 10%,what is the covariance between asset B and the market portfolio?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

In his famous critique of the CAPM,Roll argued that the CAPM ______________.

A)is not testable because the true market portfolio can never be observed

B)is of limited use because systematic risk can never be entirely eliminated

C)should be replaced by the APT

D)should be replaced by the Fama-French three-factor model

A)is not testable because the true market portfolio can never be observed

B)is of limited use because systematic risk can never be entirely eliminated

C)should be replaced by the APT

D)should be replaced by the Fama-French three-factor model

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

An asset has a standard deviation of 5% and a correlation with the market portfolio of 0.70.If the market has a standard deviation of 28%,what is the beta of the asset?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck