Deck 15: Futures and Forward Contracts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 15: Futures and Forward Contracts

1

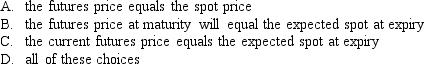

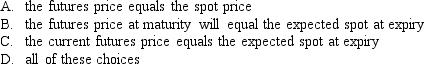

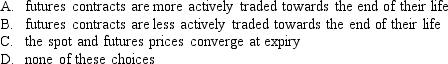

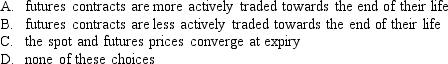

If there is no risk premium in the futures market then:

C

Explanation: If there is no risk premium in current futures prices,such that speculation is not rewarded,then on average,the current futures price equals the expected futures price at expiration.

Explanation: If there is no risk premium in current futures prices,such that speculation is not rewarded,then on average,the current futures price equals the expected futures price at expiration.

2

Short futures contract requires no cash to change hands when initiated?

False

Explanation: Forward contract requires no cash to change hands when initiated.

Explanation: Forward contract requires no cash to change hands when initiated.

3

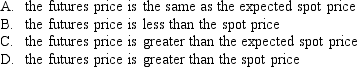

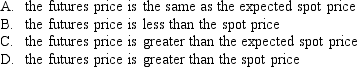

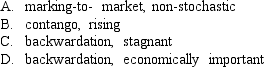

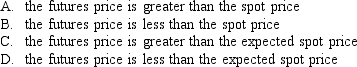

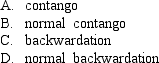

Which of the following best represents the phenomenon of contango?

D

Explanation: Where futures prices lie above the spot price this forms a typical case for future contracts in which there are substantial carrying costs.Situations in which the futures price lies above the spot price are known as contango.

Explanation: Where futures prices lie above the spot price this forms a typical case for future contracts in which there are substantial carrying costs.Situations in which the futures price lies above the spot price are known as contango.

4

In an inefficient market,the basis risk at the expiry of a future contract will be zero.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

The buyer of a forward contract assumes a short position.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

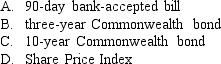

6

Cox,Ingersoll & Ross (1981),research has found that ???_______________ ,being a key feature of futures contracts has no impact on pricing where interest rates are _____________ and it can explain differences between futures and forward prices where interest rates and underlying asset price are correlated.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

The Sydney Futures Exchange (SFE)changed its name to the ASX Futures Exchange in which year?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

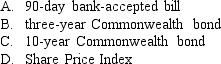

8

The first financial futures contract traded on the SFE was the:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

For an SPI futures contract where the risk-free rate is 5% p.a.and the underlying spot dividend yield is 2%,the futures price will be above that of the spot before maturity.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

The SPI futures contract was first traded on the SFE in 1979.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

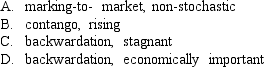

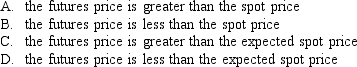

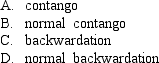

Which of the following best represents the phenomenon of normal backwardation?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

There is a general consensus that futures trading results in an increase in market volatility.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

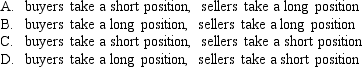

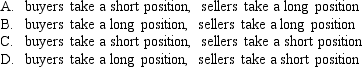

Which of the following is true of parties to a forward contract?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

The basis converges to zero over the life of the futures contract because:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

An investor in the currency forward market who expects the Australian dollar to appreciate will gain from taking a short position.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

Situations where the current futures price lies below the expected futures price are called:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

The use of standardised derivative contracts ensures a homogenous product but this does not help promote trading activity.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

In converting a forward point quotation to a forward rate,if the forward points fall,such that the second number is smaller than the first,the forward points are subtracted from the spot rate.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

Swaps,like futures contracts,are generally written with zero value.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

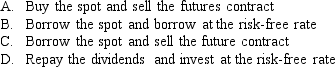

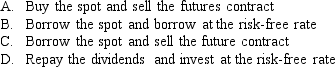

The reason(s)for the basis is/are:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

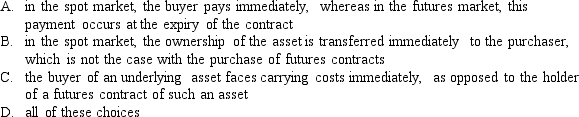

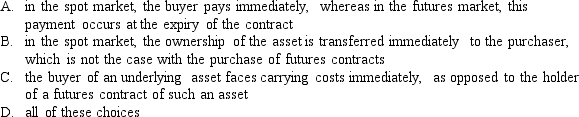

The S&P/ASX200 spot contract is at 4055 and has a dividend yield of 8% p.a.The risk-free rate is 7% and the SPI futures price is currently trading at 4058.Which of the following statements is part of an arbitrage strategy to profit from this information?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Forward contracts _________ traded on an organised exchange,and futures contracts __________ traded on an organised exchange.

A)are;are

B)are;are not

C)are not;are

D)are not;are not

A)are;are

B)are;are not

C)are not;are

D)are not;are not

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

To be able to undertake futures transactions,an investor must establish an account.To establish that account and to trade certain obligations are needed first,they are:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

What is the price of a bill with 45 days to maturity,a face value of $1 000 000 and a yield of 6.75% p.a.?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

The S&P/ASX200 spot contract is at 4055,and has a dividend yield of 8% p.a.The risk-free rate is 7% and the SPI futures price is currently trading at 4058.Given this information,calculate the amount by which the futures contract is mispriced according to the cost-of-carry model.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

Suppose S&P 200 is at 6020.Assume the continuous dividend yield is 4.5% p.a.and the risk-free rate of returns is 3% p.a.If a SPI futures contract has 62 days left to expiry,what should its price be?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

Contracts for difference (CFD's)are a/an ____________ between a buyer and seller to exchange the difference in the price of an underlying asset that occurs from when the contract is ________ through to when it is closed.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

The S&P/ASX200 spot contract is at 4310,and has a dividend yield of 8% p.a.The risk-free rate is 5% and the SPI futures price is currently trading at 4710.Given this information,calculate the amount by which the futures contract is mispriced according to the cost-of-carry model.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

An investor who goes short in a futures contract will _____ any increase in value of the underlying asset and will _____ any decrease in value in the underlying asset.

A)pay;pay

B)pay;receive

C)receive;pay

D)receive;receive

A)pay;pay

B)pay;receive

C)receive;pay

D)receive;receive

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

The S&P/ASX200 spot contract is at 4055 and has a dividend yield of 8% p.a.The risk-free rate is 7% and the SPI futures price is currently trading at 4080.Which of the following statements is part of an arbitrage strategy to profit from this information?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following have been suggested as reasons for the existence of beneficial swaps to firms?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

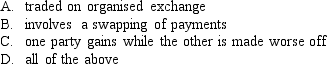

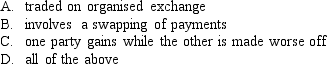

Which of the following is a feature of a swap?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

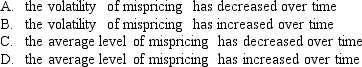

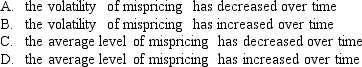

Studies of the performance of cost-of-carry models have concluded that:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

Futures contracts have many advantages over forward contracts except that _________.

A)futures positions are easier to trade

B)futures contracts are tailored to the specific needs of the investor

C)futures trading preserves the anonymity of the participants

D)counterparty credit risk is not a concern on futures

A)futures positions are easier to trade

B)futures contracts are tailored to the specific needs of the investor

C)futures trading preserves the anonymity of the participants

D)counterparty credit risk is not a concern on futures

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

A futures contract __________.

A)is a contract to be signed in the future by the buyer and the seller of a commodity

B)is an agreement to buy or sell a specified amount of an asset at a predetermined price on the expiration date of the contract

C)is an agreement to buy or sell a specified amount of an asset at whatever the spot price happens to be on the expiration date of the contract

D)gives the buyer the right,but not the obligation,to buy an asset some time in the future

A)is a contract to be signed in the future by the buyer and the seller of a commodity

B)is an agreement to buy or sell a specified amount of an asset at a predetermined price on the expiration date of the contract

C)is an agreement to buy or sell a specified amount of an asset at whatever the spot price happens to be on the expiration date of the contract

D)gives the buyer the right,but not the obligation,to buy an asset some time in the future

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

Hodgson and Nicholls (1991)find that in Australia there has been __________ volatility in the stock market since the introduction of the SPI futures contract.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

Assume that the S&P 200 is at 3850.The continuous dividend yield is 5.5% per annum and the risk free rate is 6.5% per annum.An SPI contract with 45 days to expiry would be priced at?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

In a study by Heaney in 1995,the decrease in futures mispricing has been attributed to:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

Interest rate swaps involve the exchange of ________________.

A)actual fixed-rate bonds for actual floating-rate bonds

B)actual floating-rate bonds for actual fixed-rate bonds

C)net interest payments and an actual principal swap

D)net interest payments based on notional principal,but no exchange of principal

A)actual fixed-rate bonds for actual floating-rate bonds

B)actual floating-rate bonds for actual fixed-rate bonds

C)net interest payments and an actual principal swap

D)net interest payments based on notional principal,but no exchange of principal

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

If the SPI futures contract is quoted as 3750,the value of one SPI contract is:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck