Deck 14: Quantitative Company Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 14: Quantitative Company Analysis

1

Brown (1980)finds a significantly better performance of firms that use LIFO compared with a sample of firms that don't.

False

Explanation: Brown (1980)finds no difference in abnormal return performance between the firms that switched to LIFO and a portfolio of control firms.Ricks (1982)finds that a portfolio of no-change firms outperformed those firms that switched to LIFO.However,these studies have been subject to methodological criticism (see Jennings,Mest and Thompson 1992).

Explanation: Brown (1980)finds no difference in abnormal return performance between the firms that switched to LIFO and a portfolio of control firms.Ricks (1982)finds that a portfolio of no-change firms outperformed those firms that switched to LIFO.However,these studies have been subject to methodological criticism (see Jennings,Mest and Thompson 1992).

2

Shevlin and Whittred (1994)found that,on average,returns are positive leading up to the release of an audit report.

False

Explanation: Results from Australian studies that have examined the impact of qualified audit reports find no abnormal price reaction on release of the audit report.However,on average,negative abnormal returns are observed leading up to the release,possibly reflecting the uncertainties that resulted in the audit qualification (Shevlin and Whittred 1984).

Explanation: Results from Australian studies that have examined the impact of qualified audit reports find no abnormal price reaction on release of the audit report.However,on average,negative abnormal returns are observed leading up to the release,possibly reflecting the uncertainties that resulted in the audit qualification (Shevlin and Whittred 1984).

3

In a study by Easton and Harris in 1991,what proportion of share return variation is explained by earnings figures?

C

Explanation: Easton and Harris (1991)found that the earnings number typically explains less than 10% of the variation in share returns around the release date.

Explanation: Easton and Harris (1991)found that the earnings number typically explains less than 10% of the variation in share returns around the release date.

4

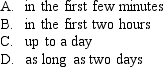

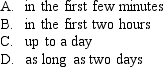

The Brown,Clinch and Foster (1992)study of earnings announcements concludes that most of the price reaction occurs __________ after the announcement.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

The study of Livnat and Zarowin (1990)finds that disaggregating cash flows into operating,financing and investing adds to the information content of accrual accounting.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

The accounting standards allow firms to use discretion in their choice of accounting methods.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

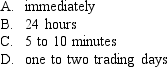

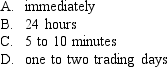

Patell and Wolfson (1984)found that in the USA the market responds to earnings announcements within:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

The Australian study by Cotter in 1995 finds that the correlation between earnings and returns is lower over a five-year period than over a 10-year period.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

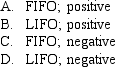

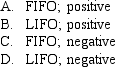

Sunder (1973,1975)finds that companies which change to __________ experienced a __________ share price reaction.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

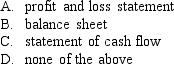

Which of the following contains a summary of the resources under the firm's control at the end of the reporting period?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Given a receivables turnover value of 5.326,the average collection period is 68 days.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

Standardised financial statements are also known as Generally Accepted Financial Statements (GAFS).

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

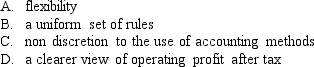

Generally accepted accounting practices (GAAP),provide for:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

Common-size balance sheets are prepared by dividing all quantities by total assets.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

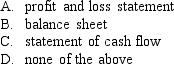

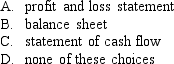

Which of the following contains a summary of the profitability of a firm over the reporting period?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

A firm increases its financial leverage when its ROA is greater than the cost of debt.Everything else equal,this change will probably increase the firm's ROE.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

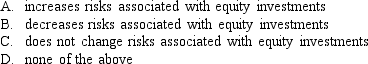

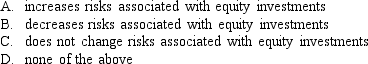

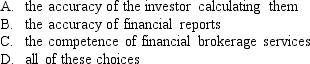

Evidence shows that mandated disclosure:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

The Lonergan study in 1996 found that fund managers believe that goodwill accounting has a major impact upon the share price.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

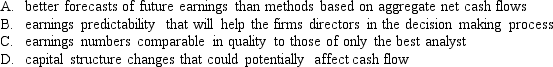

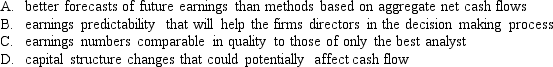

Research from Arthur,Cheng,Czernkowski (2010),report that earnings predictability has found that disaggregated cash flow models based on components of firm cash flows produce:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

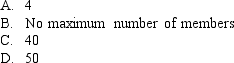

Proprietary companies have a limit of how many members?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

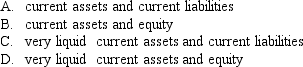

The quick ratio measures the relationship between:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

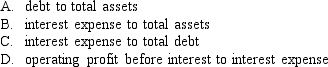

The interest coverage ratio is calculated as:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

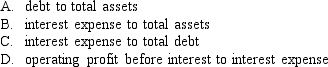

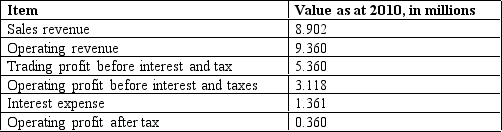

Note: The common shares are trading in the stock market for $15 per share

Refer to the financial statements of Flathead Lake Manufacturing Company.The firm's total asset turnover for 2012 is _________.(Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged. )

A.3.56

B.3.26

C.3.14

D.3.02

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

If the return on equity is 5% and the firm has a dividend payout ratio of 40%,what is the sustainable growth rate?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

All of the following ratios are related to efficiency except _______.

A)total asset turnover

B)fixed-asset turnover

C)average collection period

D)cash ratio

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

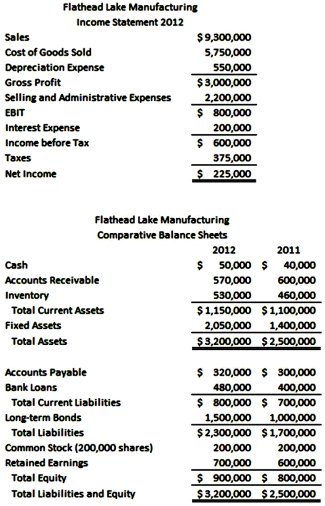

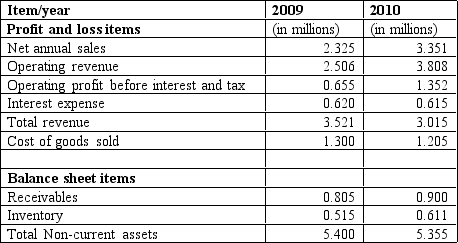

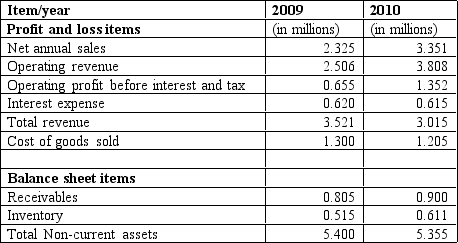

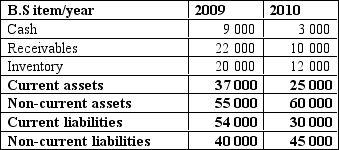

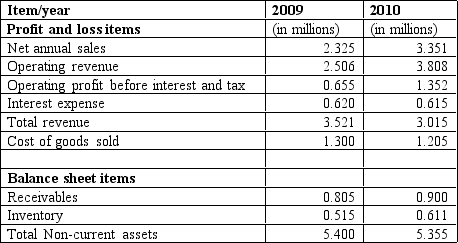

You are able to obtain the items in the table from a company's balance sheet and profit and loss for 2009 and 2010.Given this information,calculate an appropriate measure of business risk for the firm in 2010.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

You are able to obtain the items in the table from a company's balance sheet and profit and loss for 2009 and 2010.Given this information,calculate the receivables turnover for the firm for 2010.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

Operating ROA is calculated as __________,while ROE is calculated as _________.

A)EBIT/Total assets;Net profit/Total assets

B)Net profit/Total assets;EBIT/Total assets

C)EBIT/Total assets;Net profit/Equity

D)Net profit/EBIT;Sales/Total assets

A)EBIT/Total assets;Net profit/Total assets

B)Net profit/Total assets;EBIT/Total assets

C)EBIT/Total assets;Net profit/Equity

D)Net profit/EBIT;Sales/Total assets

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

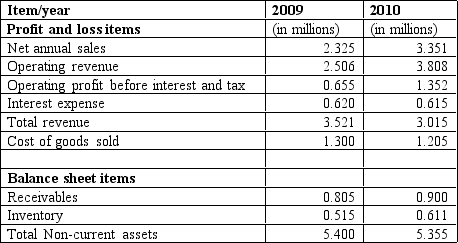

Given the above data,calculate the quick ratio for the firm for 2009.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

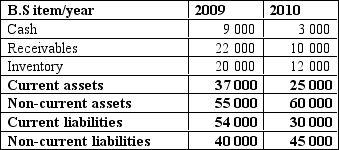

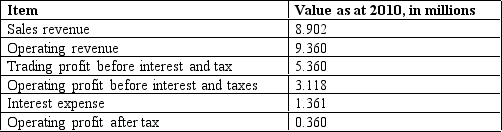

The above information is available for the firm ILA Ltd,which is listed on the Australian Stock Exchange.As a prospective investor in ILA,you are concerned about the level of debt the company has on issue.How far can the earnings of ILA fall before it will be unable to meets its debt obligations?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

You are able to obtain the items in the table from a company's balance sheet and profit and loss for 2009 and 2010.Given this information,calculate the average collection period for the firm for 2010.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

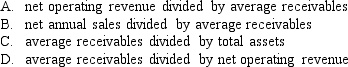

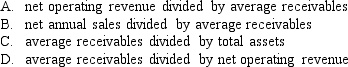

The receivables turnover ratio is calculated as:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

The above information is available for the firm ILA Ltd,which is listed on the Australian Stock Exchange.Calculate the trading profit margin for the firm.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

A firm has an ROE of 20% and a market-to-book ratio of 2.38.Its P/E ratio is _________.

A)8.4

B)11.9

C)17.62

D)47.6

A)8.4

B)11.9

C)17.62

D)47.6

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

Given the above data,calculate the current ratio for the firm for 2009.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

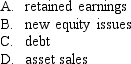

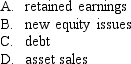

One problem with the internal growth rate measure is that it relies upon the assumption that all growth is financed by:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

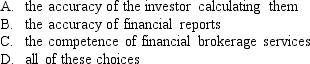

One problem with ratio analysis is that it relies upon:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

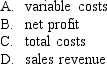

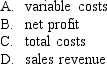

The presence of fixed production costs causes operating profit to vary more than __________ over the business cycle.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

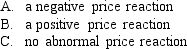

Australian studies find that companies with a qualified audit report experience:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

You are able to obtain the items in the table from a company's balance sheet and profit and loss for 2009 and 2010.Given this information,calculate the fixed assets turnover for the firm for 2010.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck