Deck 11: Proprietorships, partnerships, and Corporations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/88

Play

Full screen (f)

Deck 11: Proprietorships, partnerships, and Corporations

1

On January 2,Year 1,Torres Corporation issued 20,000 shares of $10 par-value common stock for $11 per share.Which of the following statements is true?

A) The Common Stock account will increase by $220,000.

B) The Cash account will increase by $200,000.

C) Total stockholders' equity will increase by $200,000.

D) The Paid-in Capital in Excess of Par Value account will increase by $20,000.

A) The Common Stock account will increase by $220,000.

B) The Cash account will increase by $200,000.

C) Total stockholders' equity will increase by $200,000.

D) The Paid-in Capital in Excess of Par Value account will increase by $20,000.

The Paid-in Capital in Excess of Par Value account will increase by $20,000.

2

Which of the following terms designates the maximum number of shares of stock that a corporation may issue?

A) Number of shares issued

B) Number of shares authorized

C) Par value

D) Number of shares outstanding

A) Number of shares issued

B) Number of shares authorized

C) Par value

D) Number of shares outstanding

Number of shares authorized

3

Which of the following statements is the most common explanation as to why a company might have a negative amount of total stockholders' equity on its balance sheet?

A) Its total assets exceed its total liabilities.

B) Its total revenues are less than its total expenses in the current period.

C) Its cash is segregated in a separate bank account designated for emergency uses.

D) It has a negative balance in its Retained Earnings account.

A) Its total assets exceed its total liabilities.

B) Its total revenues are less than its total expenses in the current period.

C) Its cash is segregated in a separate bank account designated for emergency uses.

D) It has a negative balance in its Retained Earnings account.

It has a negative balance in its Retained Earnings account.

4

Blair Scott started a sole proprietorship by depositing $75,000 cash in a business checking account.During the accounting period,the business borrowed $30,000 from a bank,earned $18,000 of net income,and Scott withdrew $12,000 cash from the business.Based on this information,what is the balance in Scott's capital account at the end of the accounting period?

A) $93,000

B) $111,000

C) $72,000

D) $81,000

A) $93,000

B) $111,000

C) $72,000

D) $81,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

5

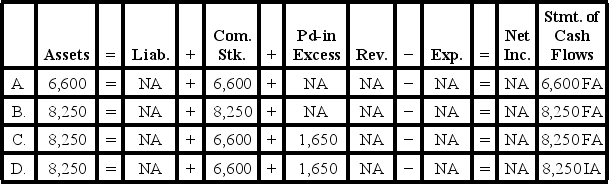

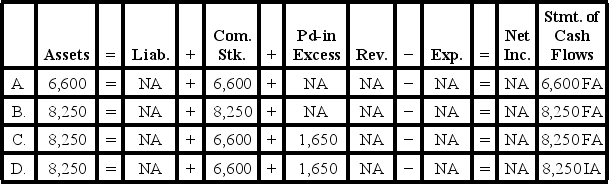

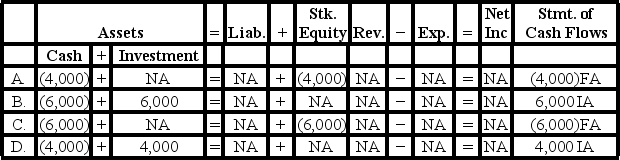

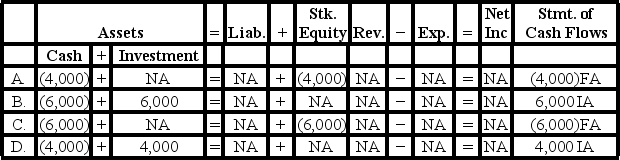

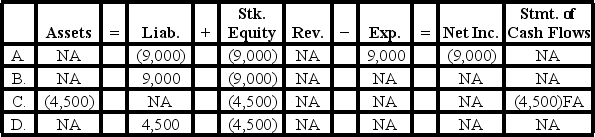

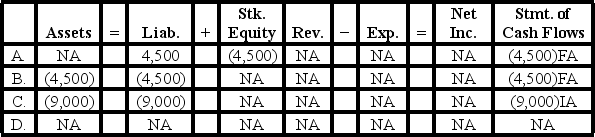

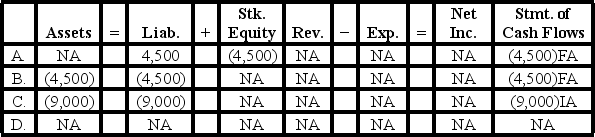

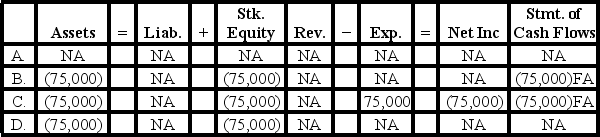

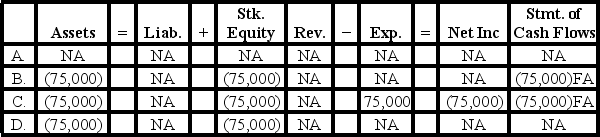

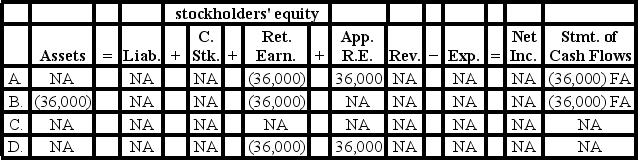

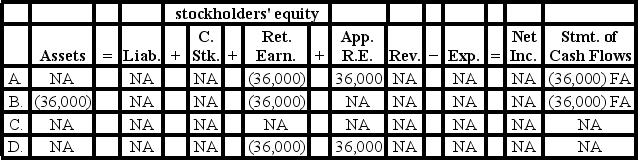

On January 12,Year 1,Gilliam Corporation issued 550 shares of $12 par-value common stock for $15 per share.The number of shares authorized is 5,000,and the number of shares outstanding prior to this transaction was 1,200.Which of the following describes the effect of the January 12 transaction on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is a disadvantage of a sole proprietorship?

A) Entrenched management

B) Double taxation

C) Personal liability

D) Excessive regulation

A) Entrenched management

B) Double taxation

C) Personal liability

D) Excessive regulation

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following entities would have a "Paid-in Capital in Excess" account in the equity section of the balance sheet?

A) A corporation

B) A municipality

C) A sole proprietorship

D) A partnership

A) A corporation

B) A municipality

C) A sole proprietorship

D) A partnership

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not normally a preference given to the holders of preferred stock?

A) The right to receive a specified amount of dividends prior to any being paid to common stockholders.

B) The right to vote before the common stockholders at the corporation's annual meeting.

C) The right to receive preference over common stockholders as to the distribution of assets during a liquidation process.

D) All of these are preferences given to preferred stock.

A) The right to receive a specified amount of dividends prior to any being paid to common stockholders.

B) The right to vote before the common stockholders at the corporation's annual meeting.

C) The right to receive preference over common stockholders as to the distribution of assets during a liquidation process.

D) All of these are preferences given to preferred stock.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

9

Which form of business organization is established as a separate legal entity?

A) Sole proprietorship

B) Partnership

C) Corporation

D) None of these

A) Sole proprietorship

B) Partnership

C) Corporation

D) None of these

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

10

Ogilvie Corp.issued 12,000 shares of no-par stock for $40 per share.Ogilvie was authorized to issue 35,000 shares.What effect will this event have on the elements of the company's financial statements?

A) Increase assets and increase stockholders' equity by $1,400,000.

B) Increase assets and increase stockholders' equity by $480,000.

C) Increase cash inflows from investing activities by $480,000.

D) None of these answer choices are correct.

A) Increase assets and increase stockholders' equity by $1,400,000.

B) Increase assets and increase stockholders' equity by $480,000.

C) Increase cash inflows from investing activities by $480,000.

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is not considered an advantage of the corporate form of business organization?

A) Ability to raise capital

B) Continuity of existence

C) Ease of transferability of ownership

D) Lack of government regulation

A) Ability to raise capital

B) Continuity of existence

C) Ease of transferability of ownership

D) Lack of government regulation

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

12

What is meant by the term "double taxation?"

A) Corporations must pay income taxes on their net income, and their stockholders must pay income taxes on their dividends.

B) In a partnership, both partners are required to claim their share of net income on their tax returns.

C) A sole proprietorship must pay income taxes on its net income and the owner is also required to pay income taxes on withdrawals.

D) A sole proprietorship must pay income taxes to both the state government and the federal government.

A) Corporations must pay income taxes on their net income, and their stockholders must pay income taxes on their dividends.

B) In a partnership, both partners are required to claim their share of net income on their tax returns.

C) A sole proprietorship must pay income taxes on its net income and the owner is also required to pay income taxes on withdrawals.

D) A sole proprietorship must pay income taxes to both the state government and the federal government.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements about types of business entities is true?

A) For accounting purposes, a sole proprietorship is not a separate entity from its owner.

B) Ownership in a partnership is represented by having shares of capital stock.

C) One advantage of the corporation form is the ability to raise capital.

D) Sole proprietorships are subject to double taxation.

A) For accounting purposes, a sole proprietorship is not a separate entity from its owner.

B) Ownership in a partnership is represented by having shares of capital stock.

C) One advantage of the corporation form is the ability to raise capital.

D) Sole proprietorships are subject to double taxation.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

14

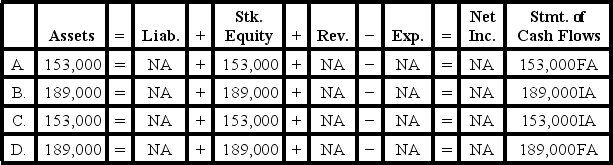

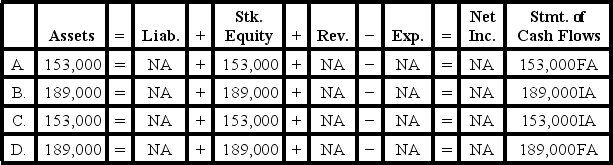

On February 2,Year 1,Farmer Corporation issued 9,000 shares of no-par stock for $17 per share.Within two hours of the issue,the stock's price jumped on the New York Stock Exchange to $21 per share.Which of the following answers describes the effect of the February 2 transaction on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following entities would report income tax expense on its income statement?

A) Sole proprietorship.

B) Corporation.

C) Partnership.

D) All of these answer choices are correct.

A) Sole proprietorship.

B) Corporation.

C) Partnership.

D) All of these answer choices are correct.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following best describes how each share of par value stock issued is reported in the Common Stock account?

A) Current market value

B) Average issue price

C) Par or stated value

D) Lower of cost or market

A) Current market value

B) Average issue price

C) Par or stated value

D) Lower of cost or market

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements about par value is true?

A) Par value dictates the initial price of the stock.

B) Par value may be revised each time a company issues more shares of stock.

C) Par value is generally greater than market value.

D) Par value has little connection to the market value of the stock.

A) Par value dictates the initial price of the stock.

B) Par value may be revised each time a company issues more shares of stock.

C) Par value is generally greater than market value.

D) Par value has little connection to the market value of the stock.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements best describes the term "par value?"

A) The number of shares currently in the hands of stockholders

B) The amount that must be paid to purchase a share of stock

C) Determined by dividing total stockholder's equity by the number of shares of stock

D) An amount used in determining a corporation's legal capital

A) The number of shares currently in the hands of stockholders

B) The amount that must be paid to purchase a share of stock

C) Determined by dividing total stockholder's equity by the number of shares of stock

D) An amount used in determining a corporation's legal capital

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

19

Fixit Corporation issued 20,000 shares of $20 par value common stock at its current market price of $32.How does this event affect total stockholders' equity?

A) It increases by $640,000.

B) It is unaffected.

C) It increases by $240,000.

D) It increases by $400,000.

A) It increases by $640,000.

B) It is unaffected.

C) It increases by $240,000.

D) It increases by $400,000.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

20

Fred and Barney started a partnership.During Year 1,Fred invested $20,000 in the business and Barney invested $32,000.The partnership agreement called for each partner to receive an annual distribution equal to 15% of his capital contribution.Any further earnings were to be retained in the business and divided equally between the partners.The partnership reported net income of $38,000 during Year 1.How will the $38,000 of net income be split between Fred and Barney respectively? (Hint: Consider both the cash withdrawals and allocation of remaining income.)

Fred Barney

A)

B)

C)

D)

Fred Barney

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is a contra equity account?

A) Retained Earnings

B) Paid-in Capital in Excess of Par Value

C) Treasury Stock

D) Appropriated Retained Earnings

A) Retained Earnings

B) Paid-in Capital in Excess of Par Value

C) Treasury Stock

D) Appropriated Retained Earnings

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

22

How is treasury stock reported on a corporation's balance sheet?

A) As an addition to total paid-in capital

B) As a deduction in determining total stockholders' equity

C) As a deduction from total paid-in capital

D) As a deduction from retained earnings

A) As an addition to total paid-in capital

B) As a deduction in determining total stockholders' equity

C) As a deduction from total paid-in capital

D) As a deduction from retained earnings

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

23

For Year 2,the Sacramento Corporation had beginning and ending Retained Earnings balances of $208,054 and $231,012,respectively.Also during Year 2,the board of directors declared cash dividends of $29,000,which were paid during Year 2.The board also declared a stock dividend,which was issued and required a transfer in the amount of $16,000 to paid-in capital.Total expenses during Year 2 were $32,916.Based on this information,what was the amount of total revenue for Year 2?

A) $68,158

B) $143,154

C) $100,874

D) $179,132

A) $68,158

B) $143,154

C) $100,874

D) $179,132

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

24

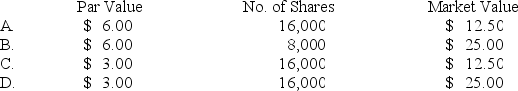

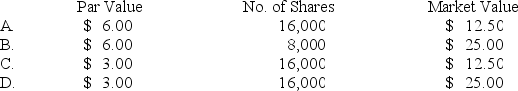

Helena Corporation declared a 2-for-1 stock split on 8,000 shares of $6 par value common stock.If the market price of the stock had been $25 a share before the split,the par value,number of shares,and approximate market value after the split would be:

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

25

What effect will the declaration and distribution of a stock dividend have on net income and cash flows?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

26

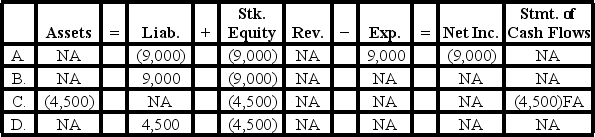

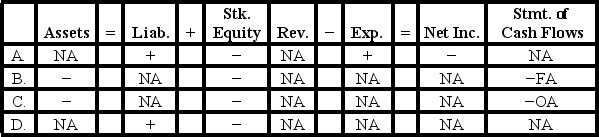

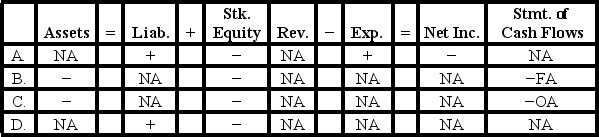

Kellogg,Inc.purchased 200 shares of its own $20 par value stock for $30 cash per share.Which of the following answers reflects how this purchase of treasury stock would affect the elements of Kellogg's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

27

Flagler Corporation shows a total of $660,000 in its Common Stock account and $1,600,000 in its Paid-in Capital Excess account.The par value of Flagler's common stock is $8.How many shares of Flagler stock have been issued?

A) 117,500

B) 200,000

C) 82,500

D) The number of shares cannot be determined using the information provided.

A) 117,500

B) 200,000

C) 82,500

D) The number of shares cannot be determined using the information provided.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

28

How will the entry to record the declaration of the dividend on March 1 affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

29

Montana Company was authorized to issue 200,000 shares of common stock.The company had issued 50,000 shares of stock when it purchased 10,000 shares of treasury stock.After the purchase of treasury stock,the number of outstanding shares of common stock was which of the following?

A) 190,000

B) 60,000

C) 40,000

D) 50,000

A) 190,000

B) 60,000

C) 40,000

D) 50,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

30

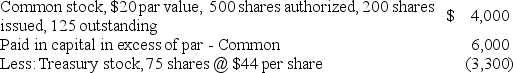

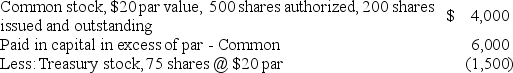

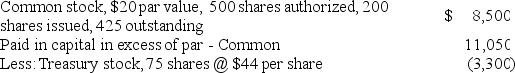

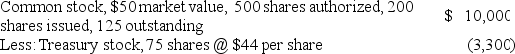

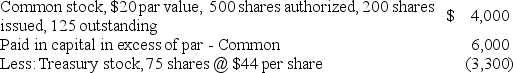

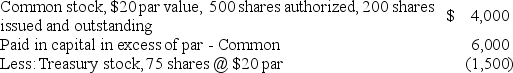

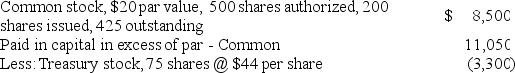

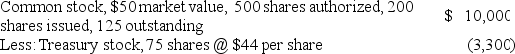

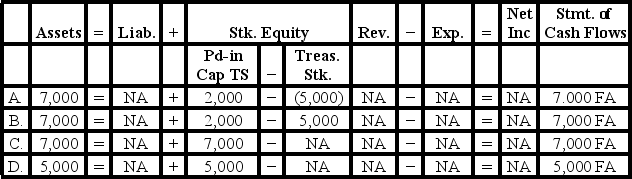

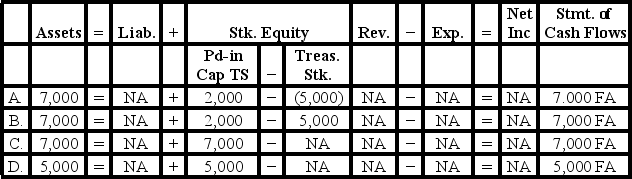

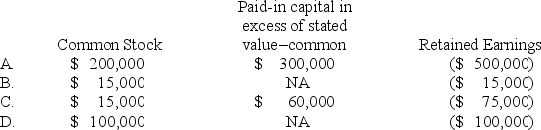

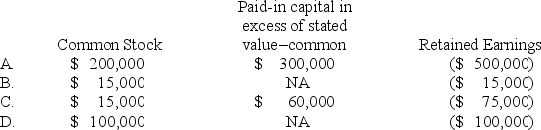

During the year,Todd Corporation issued 200 shares of $20 par value common stock for $50 a share.A total of 500 shares were authorized.In addition,the company purchased 75 shares of treasury stock at $44 a share.Which of the following best presents the related lines in the stockholders' equity section of the company's balance sheet?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements about Treasury Stock is correct?

A) The balance in the Treasury Stock account increases paid-in capital.

B) The balance in the Treasury Stock account reduces paid-in capital.

C) The balance in the Treasury Stock account reduces total Stockholders' Equity.

D) The balance in the Treasury Stock reduces Retained Earnings.

A) The balance in the Treasury Stock account increases paid-in capital.

B) The balance in the Treasury Stock account reduces paid-in capital.

C) The balance in the Treasury Stock account reduces total Stockholders' Equity.

D) The balance in the Treasury Stock reduces Retained Earnings.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

32

Voiles Company reissued 200 shares of its treasury stock.The treasury stock originally cost $25 per share and was reissued for $35 per share.Select the answer that accurately reflects how the reissue of the treasury stock would affect the elements of Voiles financial statements.

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

33

How will the May 1 payment of the dividend affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

34

How does the payment of a previously declared cash dividend affect the elements of the financial statements?

A) Decreases assets and stockholders' equity

B) Increases liabilities and decreases stockholders' equity

C) Decreases liabilities and increases stockholders' equity

D) None of these answer choices are correct.

A) Decreases assets and stockholders' equity

B) Increases liabilities and decreases stockholders' equity

C) Decreases liabilities and increases stockholders' equity

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements is a reason why a company would buy treasury stock?

A) Because management believes the market price of the stock is undervalued.

B) To have stock available to issue to employees in stock option plans.

C) To avoid a hostile takeover.

D) All of these are reasons a company would buy treasury stock.

A) Because management believes the market price of the stock is undervalued.

B) To have stock available to issue to employees in stock option plans.

C) To avoid a hostile takeover.

D) All of these are reasons a company would buy treasury stock.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

36

Curtain Co.paid dividends of $6,000,$12,000,and $20,000 during Year 1,Year 2,and Year 3,respectively.The company had 1,000 shares of 5%,$200 par value preferred stock outstanding that paid a cumulative dividend.What is the total amount of dividends paid to common shareholders during Year 3?

A) $4,000

B) $6,000

C) $8,000

D) $10,000

A) $4,000

B) $6,000

C) $8,000

D) $10,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

37

At the end of the accounting period,Houston Company had $12,000 of common stock,paid-in capital in excess of par value-common of $11,000,retained earnings of $12,000,and $4,000 of treasury stock.What is the total amount of stockholders' equity?

A) $37,000

B) $39,000

C) $19,000

D) $31,000

A) $37,000

B) $39,000

C) $19,000

D) $31,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

38

How would the declaration of a cash dividend affect the calculation of a company's price-earnings ratio? (Hint: Do not consider any change in the market price of the stock that might occur because of the declaration of the dividend.)

A) It will have no effect on the price-earnings ratio.

B) The effect depends on the market price of the stock at the time the dividend is declared.

C) It will decrease the price-earnings ratio.

D) It will increase the price-earnings ratio.

A) It will have no effect on the price-earnings ratio.

B) The effect depends on the market price of the stock at the time the dividend is declared.

C) It will decrease the price-earnings ratio.

D) It will increase the price-earnings ratio.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

39

How does the issuance of a common stock dividend normally impact the calculation of a company's price-earnings (P/E)ratio?

A) It decreases the P/E ratio.

B) It would not be expected to impact the P/E ratio.

C) It increase the P/E ratio.

D) The impact on the P/E ratio cannot be determined.

A) It decreases the P/E ratio.

B) It would not be expected to impact the P/E ratio.

C) It increase the P/E ratio.

D) The impact on the P/E ratio cannot be determined.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

40

The board of directors of Chandler Company declared a cash dividend.Which of the following choices accurately reflects how this event would affect the elements of the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

41

An advantage of the corporate form of business organization is that corporations are free from double taxation.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements about why companies choose not to pay cash dividends is (are)true?

A) The board and management prefer to reinvest all net income for future growth.

B) The corporation does not have sufficient cash.

C) The corporation does not have sufficient retained earnings.

D) All of these statements are true.

A) The board and management prefer to reinvest all net income for future growth.

B) The corporation does not have sufficient cash.

C) The corporation does not have sufficient retained earnings.

D) All of these statements are true.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following describes,in part,how the declaration of a stock dividend affects the elements of the financial statements?

A) Decreases total assets

B) Increases total stockholders' equity

C) Decreases paid-in capital in excess of par value-common

D) No effect on total stockholders' equity

A) Decreases total assets

B) Increases total stockholders' equity

C) Decreases paid-in capital in excess of par value-common

D) No effect on total stockholders' equity

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

44

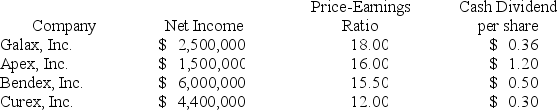

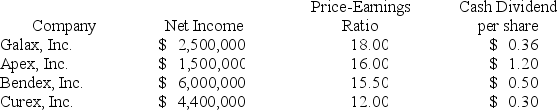

Ben Weaver is planning to invest in one of the following companies based on their average performance over the past five years,summarized below.

If Ben is looking for a company that is likely to achieve rapid growth in revenues and profitability,which one should he choose?

A) Galax, Inc.

B) Apex, Inc.

C) Bendex, Inc.

D) Curex, Inc.

If Ben is looking for a company that is likely to achieve rapid growth in revenues and profitability,which one should he choose?

A) Galax, Inc.

B) Apex, Inc.

C) Bendex, Inc.

D) Curex, Inc.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

45

Articles of incorporation,prepared by a business that wishes to incorporate,normally include,but are not limited to,the corporation's name and purpose,its location,and provisions for capital stock.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

46

Napoli Industries had net income for Year 2 of $650,000.Napoli had an average number of shares outstanding at the end of the year of 500,000 shares.On January 1,Year 2,the market price of Napoli's stock was $20 per share.On December 31,Year 2,the market price was $22 per share.What is the price-earnings ratio for Napoli at the end of Year 2?

A) 16.9

B) 16.2

C) 15.4

D) None of these answer choices is correct

A) 16.9

B) 16.2

C) 15.4

D) None of these answer choices is correct

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following would not be a reason to expect an increase in the market price of the stock of Carlyle Corporation?

A) Carlyle Corp. has a history of earnings growth.

B) Investors expect that revenue and earnings growth in the future will not be as great as revenue and earnings growth has been in the past.

C) The market price has been influenced by positive financial information that is not provided in the financial statements.

D) Investors believe Carlyle Corp. has potential for earnings growth.

A) Carlyle Corp. has a history of earnings growth.

B) Investors expect that revenue and earnings growth in the future will not be as great as revenue and earnings growth has been in the past.

C) The market price has been influenced by positive financial information that is not provided in the financial statements.

D) Investors believe Carlyle Corp. has potential for earnings growth.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

48

What is the expected impact of a 2-for-1 stock split?

A) A decrease in the market price of the stock

B) Increased protection of the interest of creditors

C) An increase in the par value of the stock

D) The absorption of treasury stock

A) A decrease in the market price of the stock

B) Increased protection of the interest of creditors

C) An increase in the par value of the stock

D) The absorption of treasury stock

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

49

[The following information applies to the questions displayed below.]

Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances:

![<strong>[The following information applies to the questions displayed below.] Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances: At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share. -What is the amount of retained earnings that will be transferred to paid-in capital as a result of the stock dividend issued by Gilligan Corporation?</strong> A) $60,500 B) $16,500 C) $44,000 D) $108,500](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f20_f0a1_ace2_5568a00c35de_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.

At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.

-What is the amount of retained earnings that will be transferred to paid-in capital as a result of the stock dividend issued by Gilligan Corporation?

A) $60,500

B) $16,500

C) $44,000

D) $108,500

Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances:

![<strong>[The following information applies to the questions displayed below.] Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances: At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share. -What is the amount of retained earnings that will be transferred to paid-in capital as a result of the stock dividend issued by Gilligan Corporation?</strong> A) $60,500 B) $16,500 C) $44,000 D) $108,500](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f20_f0a1_ace2_5568a00c35de_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.

At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.-What is the amount of retained earnings that will be transferred to paid-in capital as a result of the stock dividend issued by Gilligan Corporation?

A) $60,500

B) $16,500

C) $44,000

D) $108,500

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

50

Chadwick Associates retained $850,000 of net income in the business in Year 1.If $75,000 was appropriated to satisfy the restrictive covenant of a loan agreement,what are the effects of the appropriation on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

51

On June 10,Year 1,Burton Builders,Inc.,a publicly traded company,announced that it had been awarded a contract to build a football stadium at a contract price of $500 million.This contract would increase its projected revenues by 20% over the next three years.Which of the following statements is correct with regard to this announcement?

A) The market price of Burton's stock will probably be higher on June 11, Year 1 than on June 10th.

B) Burton's net cash flow from operations will increase by 20% over the next three years.

C) Burton's assets should be increased by $500 million on June 10, Year 1 to recognize this contract.

D) Burton's net income will increase by 20% over the next three years.

A) The market price of Burton's stock will probably be higher on June 11, Year 1 than on June 10th.

B) Burton's net cash flow from operations will increase by 20% over the next three years.

C) Burton's assets should be increased by $500 million on June 10, Year 1 to recognize this contract.

D) Burton's net income will increase by 20% over the next three years.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

52

[The following information applies to the questions displayed below.]

Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances:

![<strong>[The following information applies to the questions displayed below.] Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances: At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share. -What is the number of shares outstanding after the stock dividend is issued?</strong> A) 57,750 B) 55,000 C) 52,250 D) 525,000](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f20_f0a1_ace2_5568a00c35de_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.

At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.

-What is the number of shares outstanding after the stock dividend is issued?

A) 57,750

B) 55,000

C) 52,250

D) 525,000

Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances:

![<strong>[The following information applies to the questions displayed below.] Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances: At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share. -What is the number of shares outstanding after the stock dividend is issued?</strong> A) 57,750 B) 55,000 C) 52,250 D) 525,000](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f20_f0a1_ace2_5568a00c35de_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.

At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.-What is the number of shares outstanding after the stock dividend is issued?

A) 57,750

B) 55,000

C) 52,250

D) 525,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

53

On July 1,Year 1,Village Bookstore,Inc.appropriated retained earnings in the amount of $36,000 for a future remodeling project in the basement of the bookstore.On June 30,Year 1,the balance of Retained Earnings was $82,800 and the Cash balance was $43,200.Which of the following answers shows the effect of the July 1 event on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

54

At the time that Kirby Company issued a 2-for-1 stock split,the company had 5,000 shares of $6 par value common stock outstanding.Stockholders' equity also included $15,000 of paid in capital in excess of par value-common and $22,000 of retained earnings.Which of the following statements regarding the impact of the stock split is true?

A) The balance of the common stock account will be $30,000.

B) The amount of paid-in capital in excess of par-common will become $150,000.

C) The balance in the retained earnings account will become $11,000.

D) The number of outstanding shares of common stock will be 2,500.

A) The balance of the common stock account will be $30,000.

B) The amount of paid-in capital in excess of par-common will become $150,000.

C) The balance in the retained earnings account will become $11,000.

D) The number of outstanding shares of common stock will be 2,500.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

55

How is the price-earnings ratio calculated?

A) Market price per share of stock divided by earnings per share

B) The interest rate on borrowed money divided by the current prime rate

C) The price of a company's products as compared to its net income

D) The market value of a company's stock divided by average earnings over the past three years

A) Market price per share of stock divided by earnings per share

B) The interest rate on borrowed money divided by the current prime rate

C) The price of a company's products as compared to its net income

D) The market value of a company's stock divided by average earnings over the past three years

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

56

A corporation is a legal entity created by the authority of a state government,separate and distinct from its owners.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

57

On September 1,Year 1,Orville Corporation has unrestricted retained earnings of $600,000,appropriated retained earnings of $400,000,cash of $850,000,and accounts payable of $50,000.What is the maximum amount that can be used for cash dividends?

A) $850,000

B) $600,000

C) $800,000

D) $450,000

A) $850,000

B) $600,000

C) $800,000

D) $450,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

58

Franklin Corporation reported net income of $75,000 in Year 1.The company had 100,000 shares of $12 par value common stock outstanding and a market price of $18 per share.What is Franklin's price-earnings ratio?

A) 2.4

B) 24

C) 16.6

D) 1.5

A) 2.4

B) 24

C) 16.6

D) 1.5

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

59

Rocco Corporation decides to issue a 7.5% stock dividend on 20,000 outstanding shares of $10 stated value common stock.The distribution is made at the time the market value of the stock is $50 a share.How will the entry to record this transaction affect the company's stockholders' equity accounts?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

60

Establishing a sole proprietorship generally requires the owner to get a charter from the state government.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

61

The earnings of sole proprietorships are taxable to the owners rather than the company itself.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

62

Personal liability is a significant disadvantage of the partnership form of business organization.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

63

The stock market crash in 1929 led to the beginning of the extensive regulation of trading stock on stock exchanges.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

64

Preferred stockholders' claims to a corporation's assets take precedence over the claims of some creditors.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

65

The balance sheet of a sole proprietorship will report two equity accounts: one for amounts contributed by the owner,and one for the earnings of the business.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

66

In a closely held corporation,exchanges of stock are limited to transactions between individuals.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

67

Preferred stockholders generally have no voting rights in a corporation.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

68

A separate capital account is maintained for each partner in a partnership.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

69

Van Buren Corporation issued 5,000 shares of $6 par common stock for $24 per share.For this transaction,Common Stock should be increased by $120,000.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

70

Chisolm Corporation issued 10,000 shares of $5 par common stock for $22 per share.As a result of this transaction,Chisolm's legal capital increased by $50,000.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

71

All corporations are subject to extensive government regulation.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

72

Lack of ease in transferability of ownership is one of the disadvantages of the corporate form of business organization.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

73

The Securities and Exchange Commission (SEC)has the authority to set and enforce auditing,attestation,quality control,and ethics standards for auditors of public companies.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

74

The number of shares of stock outstanding generally is greater than the number of shares of stock issued.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

75

A distribution by a sole proprietorship to the owner is called a withdrawal.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

76

The book value of a share of stock is equal to the market or selling price of the stock.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

77

The class or type of stock that every corporation must have is preferred stock.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

78

A partner is responsible for his/her own actions,but not for actions taken by another partner on behalf of the partnership.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

79

A corporation might buy some of its own stock to help keep the market price from falling.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

80

Weller Corporation issued 10,000 shares of no-par common stock for $25 per share.For this transaction,Common Stock should be increased by $250,000.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck