Deck 27: Earnings Per Share

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/43

Play

Full screen (f)

Deck 27: Earnings Per Share

1

Which of the following equity instruments would be considered to be ordinary shares for the purposes of AASB 133?

A) Ordinary shares that receive a dividend at the discretion of the ownership group or its representatives.

B) Preference shares that are entitled to a fixed low rate of dividends and an additional dividend when the rate of dividend to other classes of shares exceeds that fixed rate.

C) Ordinary shares that have the right to a cumulative fixed rate of dividends.

D) Ordinary shares that receive a dividend at the discretion of the ownership group or its representatives and preference shares that are entitled to a fixed low rate of dividends and an additional dividend when the rate of dividend to other classes of shares exceeds that fixed rate.

E) All of the given answers.

A) Ordinary shares that receive a dividend at the discretion of the ownership group or its representatives.

B) Preference shares that are entitled to a fixed low rate of dividends and an additional dividend when the rate of dividend to other classes of shares exceeds that fixed rate.

C) Ordinary shares that have the right to a cumulative fixed rate of dividends.

D) Ordinary shares that receive a dividend at the discretion of the ownership group or its representatives and preference shares that are entitled to a fixed low rate of dividends and an additional dividend when the rate of dividend to other classes of shares exceeds that fixed rate.

E) All of the given answers.

D

2

The definition of earnings contained in AASB 133:

A) Net profit attributable to ordinary shareholders of the parent entity net of preference dividends.

B) Net profit excluding earnings attributable to minority interests and is measured before the costs of servicing equity other than dividends on ordinary shares are deducted.

C) Net profit excluding earnings attributable to minority outside equity interests.

D) Excludes any cumulative preference dividends not paid in the period and is measured before the costs of servicing equity other than dividends on ordinary shares are deducted.

E) None of the given answers.

A) Net profit attributable to ordinary shareholders of the parent entity net of preference dividends.

B) Net profit excluding earnings attributable to minority interests and is measured before the costs of servicing equity other than dividends on ordinary shares are deducted.

C) Net profit excluding earnings attributable to minority outside equity interests.

D) Excludes any cumulative preference dividends not paid in the period and is measured before the costs of servicing equity other than dividends on ordinary shares are deducted.

E) None of the given answers.

A

3

Gaslight Ltd has earnings after tax of $1,260,000 for the year ended 30 June 2005.At the beginning of the period Gaslight had 570,000 fully paid-up ordinary shares on issue.On 30 December 2004 the company made a 1 for 2 bonus issue.The last sale price of the shares immediately prior to the bonus issue was $4.50 each.What are the earnings per share taking into account the bonus issue?

A) $3.32

B) $1.47

C) $1.87

D) $3.00

E) None of the given answers.

A) $3.32

B) $1.47

C) $1.87

D) $3.00

E) None of the given answers.

B

4

Benjy Ltd has 8,000,000 ordinary shares on issue at the beginning of the year,1 July 2005.These shares were issued at $1.00 each and have a current market value at the end of the period of $5.20.On 1 September 2005,Benjy Ltd bought back 1,000,000 ordinary shares originally issued at $1.50 for $4.00 each.On 1 February 2006,2,000,000 shares were issued at the current market value of these shares.On 1 March 2006,900,000 partly paid-up ordinary shares were issued at an issue price of $5.00.These shares were partly paid to $4.00.Shares are not granted proportionate rights to receive dividends.This right attaches only when the shares are fully paid.The shares,however,do provide a proportionate right to vote at annual general meetings.What is the weighted average number of shares calculated in accordance with AASB 133?

A) 8,232,438

B) 8,083,333

C) 7,991,781

D) 8,803,333

E) None of the given answers.

A) 8,232,438

B) 8,083,333

C) 7,991,781

D) 8,803,333

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

5

For the purpose of calculating earnings per share,the denominator is:

A) outstanding ordinary shares at balance date.

B) weighted average number of fully paid ordinary shares.

C) weighted average number of the sum fully paid ordinary shares and partly paid equivalents.

D) outstanding ordinary shares at balance date and weighted average number of fully paid ordinary shares.

E) All of the given answers.

A) outstanding ordinary shares at balance date.

B) weighted average number of fully paid ordinary shares.

C) weighted average number of the sum fully paid ordinary shares and partly paid equivalents.

D) outstanding ordinary shares at balance date and weighted average number of fully paid ordinary shares.

E) All of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

6

Cooren Ltd has 1,520,000 ordinary shares on issue at the beginning of the year,1 July 2004.These shares were issued at $2.00 each and have a current market value of $3.50.On 1 October 2004,400,000 ordinary fully paid shares were issued for at the current market value of these shares.On 1 March 2005 Cooren Ltd bought back 100,000 shares originally issued at $2.50 for $3.25 each.What is the weighted average number of shares calculated in accordance with AASB 133?

A) 1,515,178

B) 1,785,753

C) 1,751,707

D) 1,820,000

E) None of the given answers.

A) 1,515,178

B) 1,785,753

C) 1,751,707

D) 1,820,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

7

Cavendish Ltd has 2,000,000 ordinary shares on issue at the beginning of the year,1 July 2006.These shares were issued at $2.00 each and at the end of the period have a current market value of $4.50.On 1 August 2006,Cavendish Ltd bought back 300,000 ordinary shares originally issued at $2.50 for $3.00 each.On 1 November 2006,800,000 shares were issued fully paid up at the current market value of these shares.On 1 March 2007,300,000 partly paid-up ordinary shares were issued at an issue price of $3.50.These shares were partly paid to $2.00.The partly paid shares are permitted proportionate rights to vote and receive dividends based on the relationship between the amount paid up and the issue price. For the year ended 30 June 2007,the net income after tax was $1,050,000.

What are the basic earnings per share for Cavendish Ltd for the year ended 30 June 2007?

A) $0.24

B) $0.45

C) $0.46

D) $0.49

E) None of the given answers.

What are the basic earnings per share for Cavendish Ltd for the year ended 30 June 2007?

A) $0.24

B) $0.45

C) $0.46

D) $0.49

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following entities is not in the scope of AASB 133 "Earnings per Share"?

A) Partnerships.

B) Reporting entities in the process of listing on the Australian Stock Exchange.

C) Entities that voluntarily disclose earnings per share.

D) Reporting entities with listed ordinary shares.

E) None of the given answers.

A) Partnerships.

B) Reporting entities in the process of listing on the Australian Stock Exchange.

C) Entities that voluntarily disclose earnings per share.

D) Reporting entities with listed ordinary shares.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

9

Beuno Ltd has 3,000,000 ordinary shares on issue at the beginning of the year,1 July 2006.These shares were issued at $2.00 each and at the end of the period have a current market value of $4.50.On 1 August 2006,Beuno Ltd bought back 600,000 ordinary shares originally issued at $2.50 for $3.00 each.On 1 November 2006,500,000 shares were issued fully paid up at the current market value of these shares.On 1 March 2007,200,000 partly paid-up ordinary shares were issued at an issue price of $3.50.These shares were partly paid to $2.00.The partly paid shares are permitted proportionate rights to vote and receive dividends based on the relationship between the amount paid up and the issue price.What is the weighted average number of shares calculated in accordance with AASB 133?

A) 2,782,466

B) 2,797,613

C) 2,799,918

D) 2,820,665

E) None of the given answers.

A) 2,782,466

B) 2,797,613

C) 2,799,918

D) 2,820,665

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

10

Craven Ltd has 10,000,000 ordinary shares on issue at the beginning of the year,1 July 2003.These shares were issued at $0.50 each and have a current market value of $3.00.On 1 November 2003,Craven Ltd bought back 1,000,000 ordinary shares originally issued at $0.50 for $1.90 each.On 1 February 2004,1,500,000 shares were issued fully paid up at the current market value of these shares.Also during the period,500,000 partly paid-up ordinary shares were issued.They were issued on 1 April 2004 at an issue price of $2.90.These shares were partly paid to $1.80.The partly paid shares are permitted proportionate rights to vote and receive dividends based on the relationship between the amount paid up and the issue price. Craven Ltd has 3,000,000,$1.00 preference shares that provide cumulative dividends at a rate of 8 per cent.

For the year ended 30 June 2004,the net income after tax was $20,000,000.

What are the basic earnings per share for Craven Ltd for the year ended 30 June 2007?

A) $1.99

B) $2.00

C) $1.96

D) $1.53

E) None of the given answers.

For the year ended 30 June 2004,the net income after tax was $20,000,000.

What are the basic earnings per share for Craven Ltd for the year ended 30 June 2007?

A) $1.99

B) $2.00

C) $1.96

D) $1.53

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

11

BI Ltd has 7,000,000 ordinary shares on issue at the beginning of the year,1 July 2004.These shares were issued at $4.50 each and have a current market value of $8.00.On 1 September 2004,BI Ltd bought back 500,000 ordinary shares originally issued at $4.50 for $6.50 each.On 1 December 2004,1,000,000 shares were issued fully paid up at the current market value of these shares.Also during the period,800,000 partly paid-up ordinary shares were issued.They were issued on 1 February 2005 at an issue price of $7.20.These shares were partly paid to $4.50.The partly paid shares are permitted proportionate rights to vote and receive dividends based on the relationship between the amount paid up and the issue price. BI Ltd has 1,000,000,$1.00 preference shares that provide non-cumulative dividends at a rate of 10 per cent.The dividends were not paid this period.

For the year ended 30 June 2004,the net loss after tax was $1,000,000.

What are the basic earnings per share for BI Ltd for the year ended 30 June 2005?

A) None required because the company made a loss.

B) ($0.15)

C) $0.20

D) ($0.14)

E) None of the given answers.

For the year ended 30 June 2004,the net loss after tax was $1,000,000.

What are the basic earnings per share for BI Ltd for the year ended 30 June 2005?

A) None required because the company made a loss.

B) ($0.15)

C) $0.20

D) ($0.14)

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

12

The earnings per share figure are likely to be of interest to shareholders and potential investors because:

A) It calculates the relationship between the share price and the earnings of the entity so that it reflects the market's evaluation of the quality of earnings of the entity.

B) It may be a useful predictor of share price to the extent that earnings are linked to future cash flows and the market reacts to unexpected changes in earnings.

C) The relationship between dividends and earnings provides a useful prediction of the likely future cash flows to shareholders from their investment in the entity.

D) It calculates the return on the capital invested by each shareholder for the period and so is a key benchmark for evaluating the success of the entity.

E) None of the given answers.

A) It calculates the relationship between the share price and the earnings of the entity so that it reflects the market's evaluation of the quality of earnings of the entity.

B) It may be a useful predictor of share price to the extent that earnings are linked to future cash flows and the market reacts to unexpected changes in earnings.

C) The relationship between dividends and earnings provides a useful prediction of the likely future cash flows to shareholders from their investment in the entity.

D) It calculates the return on the capital invested by each shareholder for the period and so is a key benchmark for evaluating the success of the entity.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

13

AASB 133 requires a bonus issue made during a period to be treated by:

A) Removing the effect of the bonus issue by deflating the number of shares to the equivalent of the weighted average number of ordinary shares that would have been on issue in the period if the bonus issue had not taken place.

B) No adjustment is required. the calculation of the weighted average number of shares issued during the period automatically takes into account the effect of issuing more shares.

C) Increasing the number of shares issued before the bonus issue as if the bonus issue had been made at the beginning of the period. Previous period's earnings per share reported for comparative purposes also should be adjusted for the effect of the bonus issue.

D) Calculating the earnings per share both by deflating the number of shares issued to pre-bonus issue numbers so that the earnings per share may be compared to previous periods and also calculating the 'post-bonus issue' earnings per share as a basis for continuing comparison in future periods.

E) None of the given answers.

A) Removing the effect of the bonus issue by deflating the number of shares to the equivalent of the weighted average number of ordinary shares that would have been on issue in the period if the bonus issue had not taken place.

B) No adjustment is required. the calculation of the weighted average number of shares issued during the period automatically takes into account the effect of issuing more shares.

C) Increasing the number of shares issued before the bonus issue as if the bonus issue had been made at the beginning of the period. Previous period's earnings per share reported for comparative purposes also should be adjusted for the effect of the bonus issue.

D) Calculating the earnings per share both by deflating the number of shares issued to pre-bonus issue numbers so that the earnings per share may be compared to previous periods and also calculating the 'post-bonus issue' earnings per share as a basis for continuing comparison in future periods.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

14

According to AASB 133 the weighting applied to calculate the weighted-average number of shares is:

A) The number of days that the shares that the shares are outstanding as a proportion of the total number of days in the period.

B) To weight the total number of shares by the market capitalisation value of each share.

C) To weight the total number of shares on issue for the period by the proportion of the total number of shares or other equity instruments on issue during the period.

D) To weight the number of shares calculated in accordance with AASB 133 by their issue price regardless of the period in which the shares were issued or their current market value.

E) None of the given answers.

A) The number of days that the shares that the shares are outstanding as a proportion of the total number of days in the period.

B) To weight the total number of shares by the market capitalisation value of each share.

C) To weight the total number of shares on issue for the period by the proportion of the total number of shares or other equity instruments on issue during the period.

D) To weight the number of shares calculated in accordance with AASB 133 by their issue price regardless of the period in which the shares were issued or their current market value.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

15

The effect of a bonus issue on the market value of an entity's equity is:

A) The number of shares are increased, meaning that each shareholder benefits from the conversion of retained earnings into additional shares. Each shareholder benefits proportionately equally, however, so their relative positions remain the same.

B) The total equity of the entity remains the same, apart from the reclassification of reserves used to make the bonus issue. Each shareholder benefits from the ability to sell off the additional shares provided, so the market value of the entity remains the same.

C) Because shareholders often respond to a bonus issue by selling off the 'windfall' shares, the market price is observed to often drop as a result of the increased supply of shares for sale.

D) Theoretically it should have no effect, but empirical evidence suggests that a bonus issue is used to signal an increase in dividends, so the total market value of the entity does sometimes increase.

E) None of the given answers.

A) The number of shares are increased, meaning that each shareholder benefits from the conversion of retained earnings into additional shares. Each shareholder benefits proportionately equally, however, so their relative positions remain the same.

B) The total equity of the entity remains the same, apart from the reclassification of reserves used to make the bonus issue. Each shareholder benefits from the ability to sell off the additional shares provided, so the market value of the entity remains the same.

C) Because shareholders often respond to a bonus issue by selling off the 'windfall' shares, the market price is observed to often drop as a result of the increased supply of shares for sale.

D) Theoretically it should have no effect, but empirical evidence suggests that a bonus issue is used to signal an increase in dividends, so the total market value of the entity does sometimes increase.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

16

Ordinary shares are defined by AASB 133 as including ownership interests that are:

A) Fully paid up for the whole of the period.

B) Redeemable in full or in part at the discretion of the management of the entity.

C) Called an ordinary share.

D) Part of an equity instrument that is subordinate to all other classes of equity instruments.

E) None of the given answers.

A) Fully paid up for the whole of the period.

B) Redeemable in full or in part at the discretion of the management of the entity.

C) Called an ordinary share.

D) Part of an equity instrument that is subordinate to all other classes of equity instruments.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

17

Bates Ltd has 6,000,000 ordinary shares on issue at the beginning of the year,1 July 2003.These shares were issued at $4.00 each and have a current market value of $6.25.On 1 February 2004,Bates Ltd bought back 300,000 ordinary shares originally issued at $4.50 for $5.60 each.On 1 May 2004,1,000,000 fully paid-up shares were issued at the current market value.What is the weighted average number of shares calculated in accordance with AASB 1027?

A) 6,059,452

B) 6,196,552

C) 6,041,096

D) 6,627,397

E) None of the given answers.

A) 6,059,452

B) 6,196,552

C) 6,041,096

D) 6,627,397

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

18

AASB 133 requires partly paid ordinary shares to be accounted for in the calculation of earnings per share by:

A) Including in the number of ordinary shares the partly paid ordinary share equivalents weighted by the proportion of the total issue value of the share that was paid up at the end of the reporting period.

B) Including in the number of ordinary shares the partly paid ordinary share equivalents calculated as a proportionate weighted average of the total market capitalisation of the fully paid-up shares defined as ordinary according to AASB 133.

C) Including in the number of ordinary shares the ordinary share equivalents represented by the proportionate rights of partly paid shares to participate in dividends, weighted by the proportion of the total number of days in the period that the partly paid shares were entitled to those rights.

D) Excluding them from the calculation completely.

E) None of the given answers.

A) Including in the number of ordinary shares the partly paid ordinary share equivalents weighted by the proportion of the total issue value of the share that was paid up at the end of the reporting period.

B) Including in the number of ordinary shares the partly paid ordinary share equivalents calculated as a proportionate weighted average of the total market capitalisation of the fully paid-up shares defined as ordinary according to AASB 133.

C) Including in the number of ordinary shares the ordinary share equivalents represented by the proportionate rights of partly paid shares to participate in dividends, weighted by the proportion of the total number of days in the period that the partly paid shares were entitled to those rights.

D) Excluding them from the calculation completely.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

19

The calculation of the theoretical ex-rights price of a share may be expressed as:

A) (Aggregate market price per share immediately prior to exercise of rights plus dividends receivable on the shares) divided by number of shares outstanding after the exercise of rights.

B) (Aggregate market price per share immediately prior to exercise of rights plus proceeds from the exercise of rights) divided by number of shares outstanding after the exercise of rights.

C) (Aggregate market price per share immediately after the exercise of rights plus proceeds from the exercise of rights) divided by number of shares outstanding before the exercise of rights.

D) (Aggregate market price per share immediately after the exercise of rights plus proceeds from the exercise of rights) divided by number of shares outstanding after the exercise of rights.

E) None of the given answers.

A) (Aggregate market price per share immediately prior to exercise of rights plus dividends receivable on the shares) divided by number of shares outstanding after the exercise of rights.

B) (Aggregate market price per share immediately prior to exercise of rights plus proceeds from the exercise of rights) divided by number of shares outstanding after the exercise of rights.

C) (Aggregate market price per share immediately after the exercise of rights plus proceeds from the exercise of rights) divided by number of shares outstanding before the exercise of rights.

D) (Aggregate market price per share immediately after the exercise of rights plus proceeds from the exercise of rights) divided by number of shares outstanding after the exercise of rights.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

20

According to AASB 133 the number of shares included in the weighted-average number of shares is determined by:

A) The number of shares that meet the definition of ordinary shares as at the end of the reporting period.

B) The number of shares that are on issue as ordinary shares for part or all of the period.

C) The number of ordinary shares (that meet the definition of ordinary shares) at the beginning of the period plus any ordinary shares issued during the period less any reductions in ordinary shares during the period.

D) The number of ordinary shares (as defined) that are issued or partly paid up at the beginning of the period plus any shares issued during the period whether fully or partly paid up.

E) None of the given answers.

A) The number of shares that meet the definition of ordinary shares as at the end of the reporting period.

B) The number of shares that are on issue as ordinary shares for part or all of the period.

C) The number of ordinary shares (that meet the definition of ordinary shares) at the beginning of the period plus any ordinary shares issued during the period less any reductions in ordinary shares during the period.

D) The number of ordinary shares (as defined) that are issued or partly paid up at the beginning of the period plus any shares issued during the period whether fully or partly paid up.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statement)are true in accordance with AASB 133?

A) If a bonus or rights issue is made at the prevailing market price of the shares, then there is no bonus element in the issue.

B) An entity is required to disclose earnings per share even though a loss has been made for the period.

C) All reporting entities are required disclose earnings per share and diluted earnings per share in the notes to the accounts.

D) An entity is required to disclose earnings per share in the statement of financial position.

E) In-the-money options are antidilutive.

A) If a bonus or rights issue is made at the prevailing market price of the shares, then there is no bonus element in the issue.

B) An entity is required to disclose earnings per share even though a loss has been made for the period.

C) All reporting entities are required disclose earnings per share and diluted earnings per share in the notes to the accounts.

D) An entity is required to disclose earnings per share in the statement of financial position.

E) In-the-money options are antidilutive.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

22

Phlox Ltd has a profit after tax of $6 590,000 for the period ended 30 June 2005.Phlox Ltd also has $1,000,000 of 6 per cent cumulative preference shares.The dividends on the preference shares are not treated as expenses in the income statement. As at 1 July 2004 there were 3,000,000 fully paid ordinary shares issued.Phlox Ltd also has $1,500,000 in convertible debentures issued for the full year.It pays interest of 5 per cent per annum and could be converted to 300,000 ordinary shares at the option of the debenture-holders.There are also 100,000 share options currently on issue with an exercise price of $1.30.The average market price for ordinary shares during the year was $2.70.The tax rate is 33 per cent.What are the diluted earnings per share for Phlox Ltd in accordance with AASB 133?

A) $1.92

B) $1.95

C) $1.97

D) $2.20

E) None of the given answers.

A) $1.92

B) $1.95

C) $1.97

D) $2.20

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

23

Rose Ltd has a net income after tax of $3,400,000 for the year ended 30 June 2005.At the beginning of the period Rose Ltd has 1,800,000 fully paid-up ordinary shares on issue.On 1 October 2004 Rose had issued a further 200,000 fully paid-up ordinary shares at an issue price of $5.00.On 1 May 2005 Rose Ltd made a 1 for 4 bonus issue of ordinary shares out of retained earnings.The last sale price of an ordinary share before the bonus issue was $5.50.The basic earnings per share for the period ended 30 June 2004 was $2.00 per share.What are the earnings per share figure for the period ended 30 June 2005 and what are the comparative earnings per share for the previous year to be reported in the 2005 financial reports according to AASB 133?

A) Current period (2005): $1.67; Previous period (2004): $2.00

B) Current period (2005): $1.34; Previous period (2004): $2.50

C) Current period (2005): $1.83; Previous period (2004): $1.50

D) Current period (2005): $1.40; Previous period (2004): $1.60

E) None of the given answers.

A) Current period (2005): $1.67; Previous period (2004): $2.00

B) Current period (2005): $1.34; Previous period (2004): $2.50

C) Current period (2005): $1.83; Previous period (2004): $1.50

D) Current period (2005): $1.40; Previous period (2004): $1.60

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

24

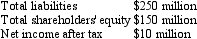

Nogales Ltd is planning to raise $100 million to finance its research and development program in the lucrative biotechnology division of the company.The company's internal forecasts for the year ended 30 June 2009 for selected accounts follow:  There are 10,000,000 ordinary shares on issue.The entity has a debt covenant that debt to equity ratio be kept at less than two.

There are 10,000,000 ordinary shares on issue.The entity has a debt covenant that debt to equity ratio be kept at less than two.

Three alternatives for funding the projects were considered by the board of directors:

Issue of ordinary shares equivalent to $100 million (equivalent to 5 million ordinary shares)

Issue of 10%,10-year non-convertible notes

Issue of 6%,preference shares (redeemable on 30 June 2019)

Which of the following statement made by a director is correct with respect to the three funding alternatives?

A) The 10-year non-convertible notes issue will have no dilution effect and no impact on the company's debt covenant.

B) Earnings per share will decline by one third with the issue of ordinary shares.

C) The issue of preference shares will have no dilution effect and no impact on the company's debt covenant.

D) Earnings per share will decline by one third with the issue of ordinary shares and the issue of preference shares will have no dilution effect and no impact on the company's debt covenant.

E) None of the given answers

There are 10,000,000 ordinary shares on issue.The entity has a debt covenant that debt to equity ratio be kept at less than two.

There are 10,000,000 ordinary shares on issue.The entity has a debt covenant that debt to equity ratio be kept at less than two.Three alternatives for funding the projects were considered by the board of directors:

Issue of ordinary shares equivalent to $100 million (equivalent to 5 million ordinary shares)

Issue of 10%,10-year non-convertible notes

Issue of 6%,preference shares (redeemable on 30 June 2019)

Which of the following statement made by a director is correct with respect to the three funding alternatives?

A) The 10-year non-convertible notes issue will have no dilution effect and no impact on the company's debt covenant.

B) Earnings per share will decline by one third with the issue of ordinary shares.

C) The issue of preference shares will have no dilution effect and no impact on the company's debt covenant.

D) Earnings per share will decline by one third with the issue of ordinary shares and the issue of preference shares will have no dilution effect and no impact on the company's debt covenant.

E) None of the given answers

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

25

In order to determine whether or not potential ordinary shares are dilutive,AASB 133 requires:

A) each issue to be considered separately and ranked from greatest dilution to least dilution.

B) each issue to be included in the calculation on the basis of date of issue, i.e. earliest to the latest issue.

C) each issue to be considered separately and included in the calculation in the order of the number of ordinary shares to be potentially issued, from highest to lowest.

D) each issue to be considered separately the number of ordinary shares on issue, from highest to lowest.

E) None of the given answers.

A) each issue to be considered separately and ranked from greatest dilution to least dilution.

B) each issue to be included in the calculation on the basis of date of issue, i.e. earliest to the latest issue.

C) each issue to be considered separately and included in the calculation in the order of the number of ordinary shares to be potentially issued, from highest to lowest.

D) each issue to be considered separately the number of ordinary shares on issue, from highest to lowest.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

26

In accordance with AASB 113,which of the above option(s)is/are potentially diluting for Navajo Ltd for the year ended 30 June 2009?

A) I, II and III

B) I and II

C) II and III

D) I only

E) None of the given answers.

A) I, II and III

B) I and II

C) II and III

D) I only

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

27

Under which of the following situations would the potential ordinary shares be included in the calculation of diluted earnings per share?

A) Conversion of the potential ordinary shares would increase the loss from continuing ordinary operations per share.

B) Conversion of the potential ordinary shares would increase earnings per share.

C) Earnings per incremental share are greater than basic earnings per share.

D) Out-of-the money options.

E) None of the given answers.

A) Conversion of the potential ordinary shares would increase the loss from continuing ordinary operations per share.

B) Conversion of the potential ordinary shares would increase earnings per share.

C) Earnings per incremental share are greater than basic earnings per share.

D) Out-of-the money options.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

28

Dormant Ltd has a net income after tax of $2,540,000 for the year ended 30 June 2005.At the beginning of the period Dormant Ltd had 3,000,000 fully paid-up ordinary shares on issue.On 1 November 2004 Dormant Ltd makes a rights issue of 1 fully paid share for every 6 shares held.The required payment for the rights issue shares was $2.00.The last cum rights price was $3.00.What are the basic earnings per share for the period ended 30 June 2005 in accordance with AASB 133?

A) $0.73

B) $0.75

C) $0.76

D) $0.78

E) None of the given answers.

A) $0.73

B) $0.75

C) $0.76

D) $0.78

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

29

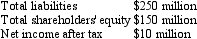

Tucson Ltd reported a net income after tax of $2,850,000 for the year ended 30 June 2009.The capital structure of Tucson Ltd follows:  Tucson Ltd paid its preference shareholders during the year and there are non dividends in arrears.All potential ordinary shares were outstanding on 1 July 2008.

Tucson Ltd paid its preference shareholders during the year and there are non dividends in arrears.All potential ordinary shares were outstanding on 1 July 2008.

The company's tax rate is 30%.

In accordance with AASB 133,the basic earnings per share and diluted earnings per share for Tucson Ltd should be:

A) $5.64; $5.48.

B) $5.64; $5.44.

C) $5.70; $5.44.

D) $5.70; $5.48.

E) None of the given answers.

Tucson Ltd paid its preference shareholders during the year and there are non dividends in arrears.All potential ordinary shares were outstanding on 1 July 2008.

Tucson Ltd paid its preference shareholders during the year and there are non dividends in arrears.All potential ordinary shares were outstanding on 1 July 2008.The company's tax rate is 30%.

In accordance with AASB 133,the basic earnings per share and diluted earnings per share for Tucson Ltd should be:

A) $5.64; $5.48.

B) $5.64; $5.44.

C) $5.70; $5.44.

D) $5.70; $5.48.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

30

Awake Ltd has a net income after tax of $5,620,000 for the year ended 30 June 2006.At the beginning of the period Awake Ltd has 1,000,000 fully paid-up ordinary shares on issue.On 1 February 2006 Awake Ltd makes a rights issue of 1 fully paid share for every 4 shares held.The required payment for the rights issue shares was $3.00.The last cum rights price was $3.80.Awake Ltd also has 2,000,000,$1.00,cumulative,7 per cent preference shares on issue for the whole period.The dividends on the preference shares are not treated as expenses in the income statement. What are the basic earnings per share for the period ended 30 June 2005 in accordance with AASB 133?

A) $4.39

B) $4.61

C) $4.97

D) $5.22

E) None of the given answers.

A) $4.39

B) $4.61

C) $4.97

D) $5.22

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

31

Gimlet Ltd has earnings after tax of $930,000 for the year ended 30 June 2005.At the beginning of the period Gaslight had 250,000 fully paid-up ordinary shares on issue.On 30 December 2004 the company made a 1 for 6 bonus issue.The last sale price of the shares immediately prior to the bonus issue was $1.35 each.What are the earnings per share taking into account the bonus issue?

A) $3.72

B) $4.13

C) $4.34

D) $3.19

E) None of the given answers.

A) $3.72

B) $4.13

C) $4.34

D) $3.19

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

32

For the purpose of calculating dilutive earnings per share,options on issue are:

A) Assumed exercised and converted at the beginning of the period or the date of issue whichever is latest.

B) Are assumed dilutive only when it results to an issue of ordinary shares for less than the average market price during the period.

C) Are assumed dilutive only when it results to an issue of ordinary shares for less than the end-of-period market price.

D) are treated similar to a bonus issue.

E) None of the given answers.

A) Assumed exercised and converted at the beginning of the period or the date of issue whichever is latest.

B) Are assumed dilutive only when it results to an issue of ordinary shares for less than the average market price during the period.

C) Are assumed dilutive only when it results to an issue of ordinary shares for less than the end-of-period market price.

D) are treated similar to a bonus issue.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

33

On a 1 July 2006,Mayorga Ltd has 3,000,000 ordinary shares on issue at the beginning of the year.During the year the movements in the company's outstanding ordinary shares are as follows: On 1 August 2006,a rights issue of 600,000 ordinary shares at current market price of $2.50.

On 1 March 2007,200,000 partly paid-up ordinary shares were issued at an issue price of $3.50.These shares were partly paid to $2.00.The partly paid shares are permitted proportionate rights to vote and receive dividends based on the relationship between the amount paid up and the issue price.

What is the weighted average number of shares for Mayorga Ltd for the year ending 30 June 2007 that is in accordance with AASB 133 "Earnings per share"?

A) 3,549,042

B) 3 587,242

C) 3,614,286

D) 3,800,000

E) None of the given answers.

On 1 March 2007,200,000 partly paid-up ordinary shares were issued at an issue price of $3.50.These shares were partly paid to $2.00.The partly paid shares are permitted proportionate rights to vote and receive dividends based on the relationship between the amount paid up and the issue price.

What is the weighted average number of shares for Mayorga Ltd for the year ending 30 June 2007 that is in accordance with AASB 133 "Earnings per share"?

A) 3,549,042

B) 3 587,242

C) 3,614,286

D) 3,800,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

34

In accordance with AASB 133,which of the following information is required to be presented on the face of the income statement? I: Basic and diluted EPS from continuing operations attributable to ordinary shareholders of the parent entity

II: Basic and diluted EPS for discontinued operations

III: Basic and diluted loss per share

A) All of the given answers

B) I and II

C) I only

D) I and III

E) None of the given answers.

II: Basic and diluted EPS for discontinued operations

III: Basic and diluted loss per share

A) All of the given answers

B) I and II

C) I only

D) I and III

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

35

Jackie Ltd has a profit after tax of $6 590 000 for the period ended 30 June 2013.In addition it has $1,000,000 of 6 per cent cumulative preference shares.The dividends on the preference shares are not treated as expenses in the income statement. Jackie Ltd has 3 000 000 ordinary shares on issue at the beginning of the year,1 July 2012.On 1 November 2012,there was a one-for-six rights issue with a subscription price of $4.00 each.The current market value of these shares is $4.50.

On 1 March 2013,200 000 partly paid-up ordinary shares were issued at an issue price of $4.50.These shares were partly paid to $2.25.The partly paid shares are permitted proportionate rights to vote and receive dividends based on the relationship between the amount paid up and the issue price.

What is the Basic EPS for Jackie Ltd for the year ending 30 June 2013 that is in accordance with AASB 133 "Earnings per Share"?

A) $1.91

B) $1.93

C) $1.94

D) $1.95

E) $1.97

On 1 March 2013,200 000 partly paid-up ordinary shares were issued at an issue price of $4.50.These shares were partly paid to $2.25.The partly paid shares are permitted proportionate rights to vote and receive dividends based on the relationship between the amount paid up and the issue price.

What is the Basic EPS for Jackie Ltd for the year ending 30 June 2013 that is in accordance with AASB 133 "Earnings per Share"?

A) $1.91

B) $1.93

C) $1.94

D) $1.95

E) $1.97

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

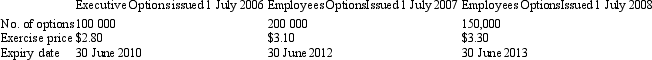

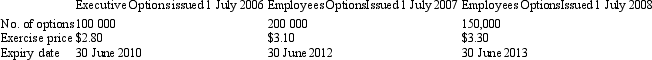

36

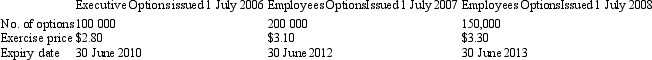

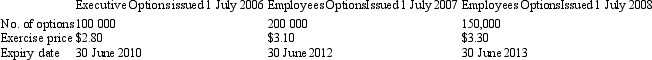

Fitzroy Ltd has the following potential ordinary shares on issue as at 30 June 2009:  The closing price for Fitzroy Ltd shares on 30 June 2009 was $3.35 and the average share price for the period was $3.20.

The closing price for Fitzroy Ltd shares on 30 June 2009 was $3.35 and the average share price for the period was $3.20.

Which of following statements is correct with respect to the determination of a dilutive security that is in accordance with AASB 133 "Earnings per Share"?

A) Executive options (issued on 1 July 2006) and employee options (issued on 1 July 2007) are both dilutive.

B) Executive options (issued on 1 July 2006) and employee options (issued on 1 July 2008) are both dilutive.

C) Employee options (issued on 1 July 2007) and employee options (issued on 1 July 2008) are both dilutive.

D) All the above potential ordinary shares are dilutive.

E) None of the given answers potential ordinary shares are dilutive

The closing price for Fitzroy Ltd shares on 30 June 2009 was $3.35 and the average share price for the period was $3.20.

The closing price for Fitzroy Ltd shares on 30 June 2009 was $3.35 and the average share price for the period was $3.20.Which of following statements is correct with respect to the determination of a dilutive security that is in accordance with AASB 133 "Earnings per Share"?

A) Executive options (issued on 1 July 2006) and employee options (issued on 1 July 2007) are both dilutive.

B) Executive options (issued on 1 July 2006) and employee options (issued on 1 July 2008) are both dilutive.

C) Employee options (issued on 1 July 2007) and employee options (issued on 1 July 2008) are both dilutive.

D) All the above potential ordinary shares are dilutive.

E) None of the given answers potential ordinary shares are dilutive

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

37

Daisy Ltd has a net income after tax of $2,000,000 for the year ended 30 June 2003.At the beginning of the period Daisy Ltd has 900,000 fully paid-up ordinary shares on issue.On 1 December 2002 Daisy Ltd had issued a further 300,000 fully paid-up ordinary shares at an issue price of $2.00.On 1 March 2003 Daisy Ltd made a 1 for 6 bonus issue of ordinary shares out of retained earnings.The last sale price of an ordinary share before the bonus issue was $2.50.At the beginning of the current period Daisy Ltd also had 500,000,$1.00,5 per cent cumulative preference shares on issue.The dividends on the preference shares are not treated as expenses in the income statement. The basic earnings per share for the period ended 30 June 2002 was $1.50 per share.What are the earnings per share figure for the period ended 30 June 2003 and what are the comparative earnings per share for the previous year to be reported in the 2003 financial reports according to AASB 133?

A) Current period (2003): $1.58; Previous period (2002): $1.29

B) Current period (2003): $1.60; Previous period (2002): $1.75

C) Current period (2003): $1.73; Previous period (2002): $1.29

D) Current period (2003): $1.75; Previous period (2002): $1.75

E) None of the given answers.

A) Current period (2003): $1.58; Previous period (2002): $1.29

B) Current period (2003): $1.60; Previous period (2002): $1.75

C) Current period (2003): $1.73; Previous period (2002): $1.29

D) Current period (2003): $1.75; Previous period (2002): $1.75

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

38

In relation to Option 1 issued on 1 July 2006,how many shares are deemed to be issued for no consideration?

A) Nil

B) 18,750

C) 22,388

D) 100,000

E) None of the given answers.

A) Nil

B) 18,750

C) 22,388

D) 100,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

39

Pilbarra Ltd has a profit after tax of $20,220,000 for the period ended 30 June 2005.Pilbarra Ltd also has $15,000,000 of 5 per cent cumulative preference shares.The dividends on the preference shares are not treated as expenses in the income statement. As at 1 July 2004 there were 12,000,000 fully paid ordinary shares issued.Pilbarra Ltd also has $6,000,000 in convertible debentures issued for the full year.It pays interest of 4.5 per cent per annum and could be converted to 3,000,000 ordinary shares at the option of the debenture-holders.There are also 900,000 share options currently on issue with an exercise price of $4.50.The average market price for ordinary shares during the year was $6.90.In addition to the preference shares mentioned above,Pilbarra Ltd also has 1,000,000,$1.00,4 per cent cumulative convertible preference shares that are convertible at the option of the entity.It is probable that these preference shares will be converted some time in the next period.The tax rate is 33 per cent.What are the diluted earnings per share for Pilbarra Ltd in accordance with AASB 133?

A) $1.17

B) $1.21

C) $1.26

D) $2.20

E) None of the given answers.

A) $1.17

B) $1.21

C) $1.26

D) $2.20

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

40

Flagstaff Ltd has the following potentially diluting securities outstanding for the year ended 30 June 2009: $200,000 6.5% Convertible Note (10,000 ordinary shares)

$200,000 6.5% Convertible Preference shares (10,000 ordinary shares)

10,000 employee options convertible to one ordinary share (Exercise price $2.50; average market price during the year was $2.70)

50,000 executive options convertible to one ordinary share (exercise price $4.50)

Basic EPS for the year ended 30 June 2009 is calculated at $1.20 per share.

Rank the above securities in the order of most dilutive to least dilutive potential ordinary shares that is in accordance with AASB 133

A) Executive options, employee options, convertible preference shares and convertible notes.

B) Executive options, employee options, convertible notes and convertible preference shares.

C) Employee options and convertible notes.

D) Employee options, convertible notes and convertible preference shares.

E) None of the given answers.

$200,000 6.5% Convertible Preference shares (10,000 ordinary shares)

10,000 employee options convertible to one ordinary share (Exercise price $2.50; average market price during the year was $2.70)

50,000 executive options convertible to one ordinary share (exercise price $4.50)

Basic EPS for the year ended 30 June 2009 is calculated at $1.20 per share.

Rank the above securities in the order of most dilutive to least dilutive potential ordinary shares that is in accordance with AASB 133

A) Executive options, employee options, convertible preference shares and convertible notes.

B) Executive options, employee options, convertible notes and convertible preference shares.

C) Employee options and convertible notes.

D) Employee options, convertible notes and convertible preference shares.

E) None of the given answers.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

41

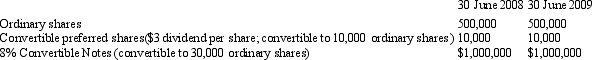

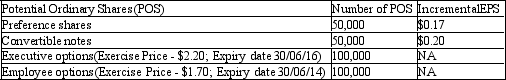

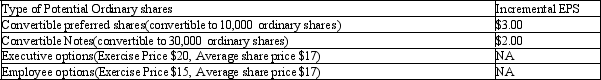

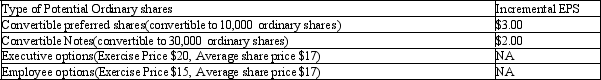

ABC Ltd's basic earnings per share is $1.25 for the year ended 2012.The company has the following outstanding potential ordinary shares at the start of the year with the following information:  Average share price for ABC Ltd during the year is $1.80.

Average share price for ABC Ltd during the year is $1.80.

Which of the above potential ordinary shares is the most dilutive and least dilutive POS in accordance with AASB 133 "Earnings per Share",respectively?

A) Convertible notes, employee options;

B) Executive options, convertible notes;

C) Employee options, convertible notes;

D) Preference shares, executive options;

E) Executive options, preference shares.

Average share price for ABC Ltd during the year is $1.80.

Average share price for ABC Ltd during the year is $1.80.Which of the above potential ordinary shares is the most dilutive and least dilutive POS in accordance with AASB 133 "Earnings per Share",respectively?

A) Convertible notes, employee options;

B) Executive options, convertible notes;

C) Employee options, convertible notes;

D) Preference shares, executive options;

E) Executive options, preference shares.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

42

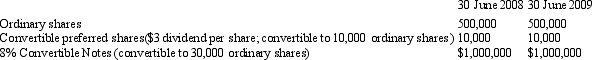

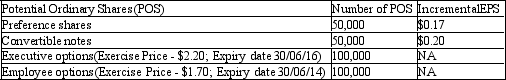

Tucson Ltd reported basic EPS was $5.70 for the year ended 30 June 2009.It also has the following potential ordinary shares outstanding for the entire period.  The share price on 30 June 2009 is $21.00.

The share price on 30 June 2009 is $21.00.

Which of the above potential ordinary shares is the most dilutive and least dilutive POS in accordance with AASB 133 "Earnings per Share",respectively?

A) Employee options; Convertible preference shares;

B) Employee options; Convertible notes;

C) Executive options; Convertible preference shares;

D) Executive options; Convertible notes;

E) Convertible notes; Convertible preference shares

The share price on 30 June 2009 is $21.00.

The share price on 30 June 2009 is $21.00.Which of the above potential ordinary shares is the most dilutive and least dilutive POS in accordance with AASB 133 "Earnings per Share",respectively?

A) Employee options; Convertible preference shares;

B) Employee options; Convertible notes;

C) Executive options; Convertible preference shares;

D) Executive options; Convertible notes;

E) Convertible notes; Convertible preference shares

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

43

Richmond Ltd has the following potential ordinary shares on issue as at 30 June 2009:  The closing price for Richmond Ltd shares on 30 June 2009 was $3.35 and the average share price for the period was $3.20.

The closing price for Richmond Ltd shares on 30 June 2009 was $3.35 and the average share price for the period was $3.20.

What is the total number of shares deemed issued for no consideration for all of above potential ordinary shares that is in accordance with AASB 133 "Earnings per Share"?

A) 14 063;

B) 18 750;

C) 31 343;

D) 33 582;

E) 281 250

The closing price for Richmond Ltd shares on 30 June 2009 was $3.35 and the average share price for the period was $3.20.

The closing price for Richmond Ltd shares on 30 June 2009 was $3.35 and the average share price for the period was $3.20.What is the total number of shares deemed issued for no consideration for all of above potential ordinary shares that is in accordance with AASB 133 "Earnings per Share"?

A) 14 063;

B) 18 750;

C) 31 343;

D) 33 582;

E) 281 250

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck