Deck 21: Mergers, acquisitions, and Corporate Control

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/100

Play

Full screen (f)

Deck 21: Mergers, acquisitions, and Corporate Control

1

If the cost of debt increases to 12 percent,should Needsalift proceed with the acquisition?

A) No, with the debt cost at 12 percent, the value of the acquisition falls below $10 million by $853,000.

B) No, with the debt cost at 12 percent, the value of the acquisition falls below $10 million by $680,518.

C) Yes, since the increased cost of debt does not affect the value of the acquisition to Needsalift.

D) Yes, with the debt cost at 12 percent the value of the acquisition exceeds $10 million by $335,374.

A) No, with the debt cost at 12 percent, the value of the acquisition falls below $10 million by $853,000.

B) No, with the debt cost at 12 percent, the value of the acquisition falls below $10 million by $680,518.

C) Yes, since the increased cost of debt does not affect the value of the acquisition to Needsalift.

D) Yes, with the debt cost at 12 percent the value of the acquisition exceeds $10 million by $335,374.

Yes, with the debt cost at 12 percent the value of the acquisition exceeds $10 million by $335,374.

2

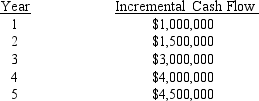

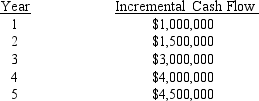

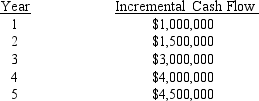

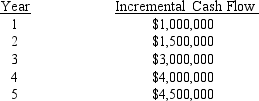

You are analyzing the potential acquisition of Nothing Better! Ice Creams, Inc. by your firm, Needsalift, Inc. The ice cream firm is a wholly owned subsidiary of Grand Lake Investments, which has set a firm selling price of $10,000,000. From your work you estimate that Nothing Better! will generate the following incremental cash flows for Needsalift:

To fund the $10 million price, Needsalift can use $2 million from internal sources (retained earnings) with a required return of 15 percent, while the rest would come from a new debt issue yielding 10 percent. Needsalift's tax rate is 40 percent.

To fund the $10 million price, Needsalift can use $2 million from internal sources (retained earnings) with a required return of 15 percent, while the rest would come from a new debt issue yielding 10 percent. Needsalift's tax rate is 40 percent.

What is the required return on the acquisition of Nothing Better! for Needsalift?

A) 15.0%

B) 10.5%

C) 7.8%

D) 11.0%

To fund the $10 million price, Needsalift can use $2 million from internal sources (retained earnings) with a required return of 15 percent, while the rest would come from a new debt issue yielding 10 percent. Needsalift's tax rate is 40 percent.

To fund the $10 million price, Needsalift can use $2 million from internal sources (retained earnings) with a required return of 15 percent, while the rest would come from a new debt issue yielding 10 percent. Needsalift's tax rate is 40 percent.What is the required return on the acquisition of Nothing Better! for Needsalift?

A) 15.0%

B) 10.5%

C) 7.8%

D) 11.0%

7.8%

3

Milner - Poudre

Milner Manufacturing plans to acquire Poudre Chemicals, by giving Poudre shareholders 1.75 shares of Milner stock per share of Poudre. There are 2 million shares of Poudre Chemicals outstanding, with a pre-merger-offer price of $25 per share, and Milner's pre-offer stock price is $16.50.

What is the control premium being offered by Milner Manufacturing?

A) $3.875 per share

B) $18.75 per share

C) $8.50 per share

D) $14.875 per share

Milner Manufacturing plans to acquire Poudre Chemicals, by giving Poudre shareholders 1.75 shares of Milner stock per share of Poudre. There are 2 million shares of Poudre Chemicals outstanding, with a pre-merger-offer price of $25 per share, and Milner's pre-offer stock price is $16.50.

What is the control premium being offered by Milner Manufacturing?

A) $3.875 per share

B) $18.75 per share

C) $8.50 per share

D) $14.875 per share

$3.875 per share

4

Suppose Smart Products' stock price is $40 per share,and there are 12,000,000 shares outstanding.How many new shares must Smart issue to acquire Snazzy Snaps at the maximum price?

A) 6,534,325

B) 2,568,242

C) 1,727,255

D) 4,639,773

A) 6,534,325

B) 2,568,242

C) 1,727,255

D) 4,639,773

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

5

Milner - Poudre

Milner Manufacturing plans to acquire Poudre Chemicals, by giving Poudre shareholders 1.75 shares of Milner stock per share of Poudre. There are 2 million shares of Poudre Chemicals outstanding, with a pre-merger-offer price of $25 per share, and Milner's pre-offer stock price is $16.50.

What is the value of the transaction at the time of the offer for Milner Manufacturing?

A) $87,500,000

B) $33,000,000

C) $50,000,000

D) $57,750,000

Milner Manufacturing plans to acquire Poudre Chemicals, by giving Poudre shareholders 1.75 shares of Milner stock per share of Poudre. There are 2 million shares of Poudre Chemicals outstanding, with a pre-merger-offer price of $25 per share, and Milner's pre-offer stock price is $16.50.

What is the value of the transaction at the time of the offer for Milner Manufacturing?

A) $87,500,000

B) $33,000,000

C) $50,000,000

D) $57,750,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

6

Smart Products

Suppose Smart Products has three divisions which contribute 40, 35, and 25 percent each to its revenues.

Now suppose Smart Products acquires a competitor of one of its divisions and the new shares of revenues are 60,25,and 15 percent.Is Smart Products more or less focused?

A) less focused; the HI increases to 0.445

B) less focused; the HI decreases to 0.25

C) more focused; the HI decreases to 0.25

D) more focused; the HI increases to 0.445

Suppose Smart Products has three divisions which contribute 40, 35, and 25 percent each to its revenues.

Now suppose Smart Products acquires a competitor of one of its divisions and the new shares of revenues are 60,25,and 15 percent.Is Smart Products more or less focused?

A) less focused; the HI increases to 0.445

B) less focused; the HI decreases to 0.25

C) more focused; the HI decreases to 0.25

D) more focused; the HI increases to 0.445

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following anti-takeover measures may actually help align manager and shareholder interests?

A) super majority votes

B) pac man defense

C) golden parachutes

D) staggered director elections

A) super majority votes

B) pac man defense

C) golden parachutes

D) staggered director elections

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

8

If the project were financed completely with equity (retained earnings)and the required return remained unchanged post-acquisition,what is the most Needsalift would be willing to pay for Nothing Better! Ice Creams?

A) $9,319,482

B) $8,500,638

C) $10,000,000

D) $9,771,379

A) $9,319,482

B) $8,500,638

C) $10,000,000

D) $9,771,379

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

9

You are analyzing the potential acquisition of Nothing Better! Ice Creams, Inc. by your firm, Needsalift, Inc. The ice cream firm is a wholly owned subsidiary of Grand Lake Investments, which has set a firm selling price of $10,000,000. From your work you estimate that Nothing Better! will generate the following incremental cash flows for Needsalift:

To fund the $10 million price, Needsalift can use $2 million from internal sources (retained earnings) with a required return of 15 percent, while the rest would come from a new debt issue yielding 10 percent. Needsalift's tax rate is 40 percent.

To fund the $10 million price, Needsalift can use $2 million from internal sources (retained earnings) with a required return of 15 percent, while the rest would come from a new debt issue yielding 10 percent. Needsalift's tax rate is 40 percent.

What is the value of the proposed acquisition to Needsalift?

A) $9,771,379

B) $10,666,344

C) $8,500,678

D) $10,596,175

To fund the $10 million price, Needsalift can use $2 million from internal sources (retained earnings) with a required return of 15 percent, while the rest would come from a new debt issue yielding 10 percent. Needsalift's tax rate is 40 percent.

To fund the $10 million price, Needsalift can use $2 million from internal sources (retained earnings) with a required return of 15 percent, while the rest would come from a new debt issue yielding 10 percent. Needsalift's tax rate is 40 percent.What is the value of the proposed acquisition to Needsalift?

A) $9,771,379

B) $10,666,344

C) $8,500,678

D) $10,596,175

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

10

Milner - Poudre

Milner Manufacturing plans to acquire Poudre Chemicals, by giving Poudre shareholders 1.75 shares of Milner stock per share of Poudre. There are 2 million shares of Poudre Chemicals outstanding, with a pre-merger-offer price of $25 per share, and Milner's pre-offer stock price is $16.50.

If,six months later at the completion of the merger,Milner's stock price has dropped to $14 per share,what is the completed control premium percentage?

A) -44.0%

B) -15.15%

C) -0.50%

D) -2.0%

Milner Manufacturing plans to acquire Poudre Chemicals, by giving Poudre shareholders 1.75 shares of Milner stock per share of Poudre. There are 2 million shares of Poudre Chemicals outstanding, with a pre-merger-offer price of $25 per share, and Milner's pre-offer stock price is $16.50.

If,six months later at the completion of the merger,Milner's stock price has dropped to $14 per share,what is the completed control premium percentage?

A) -44.0%

B) -15.15%

C) -0.50%

D) -2.0%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

11

Smart Products

Suppose Smart Products has three divisions which contribute 40, 35, and 25 percent each to its revenues.

What is Smart Products' Herfindahl Index on focus?

A) 1.0

B) 0.40

C) 0.345

D) 0.333

Suppose Smart Products has three divisions which contribute 40, 35, and 25 percent each to its revenues.

What is Smart Products' Herfindahl Index on focus?

A) 1.0

B) 0.40

C) 0.345

D) 0.333

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

12

If the board of directors of a target seeks an alternative,"friendly," acquirer,then it is said to be using which takeover defense?

A) just say no

B) standstill

C) white squire

D) white knight

A) just say no

B) standstill

C) white squire

D) white knight

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

13

If an acquirer wishes to keep the identity of a target after the acquisition,it most likely will seek a

A) statutory merger.

B) subsidiary merger.

C) consolidation.

D) none of the above allow the target to keep a separate identity.

A) statutory merger.

B) subsidiary merger.

C) consolidation.

D) none of the above allow the target to keep a separate identity.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

14

Smart Acquires Snazzy

Smart Products plans to acquire Snazzy Snaps, which will create $8 million in incremental cash flows for Smart each year for the first six years. Smart Products plans to divest Snazzy Snaps at the end of the sixth year for $112,500,000. Smart's beta (b) is 1.2, and is expected to remain so after the acquisition. The risk free rate is 5 percent and the expected return on the market is 16 percent. Smart Products has a 100 percent equity capital structure which will be maintained post-acquisition.

Refer to Smart Acquires Snazzy.If Smart Products' beta (b)falls to 0.95 post-acquisition,what would its weighted average cost of capital be?

A) 9.05%

B) 18.2%

C) 12.10%

D) 15.45%

Smart Products plans to acquire Snazzy Snaps, which will create $8 million in incremental cash flows for Smart each year for the first six years. Smart Products plans to divest Snazzy Snaps at the end of the sixth year for $112,500,000. Smart's beta (b) is 1.2, and is expected to remain so after the acquisition. The risk free rate is 5 percent and the expected return on the market is 16 percent. Smart Products has a 100 percent equity capital structure which will be maintained post-acquisition.

Refer to Smart Acquires Snazzy.If Smart Products' beta (b)falls to 0.95 post-acquisition,what would its weighted average cost of capital be?

A) 9.05%

B) 18.2%

C) 12.10%

D) 15.45%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

15

What is the maximum price Smart Products can pay for Snazzy Snaps?

A) $30,153,951

B) $69,090,200

C) $102,729,660

D) $48,257,950

A) $30,153,951

B) $69,090,200

C) $102,729,660

D) $48,257,950

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

16

A corporate control change like Pepsi's divestiture of its restaurant holdings is called a(n)

A) bust-up

B) equity carve out

C) spin-off

D) split-up

A) bust-up

B) equity carve out

C) spin-off

D) split-up

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

17

A change in corporate control brought about by the creation of new shares with special voting rights is a(n)

A) management buyout.

B) employee stock ownership plan.

C) dual-class recapitalization.

D) Florida.

A) management buyout.

B) employee stock ownership plan.

C) dual-class recapitalization.

D) Florida.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is a means of changing corporate control?

A) merger

B) management buyout

C) proxy contest

D) all of the above

A) merger

B) management buyout

C) proxy contest

D) all of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

19

Smart Acquires Snazzy

Smart Products plans to acquire Snazzy Snaps, which will create $8 million in incremental cash flows for Smart each year for the first six years. Smart Products plans to divest Snazzy Snaps at the end of the sixth year for $112,500,000. Smart's beta (b) is 1.2, and is expected to remain so after the acquisition. The risk free rate is 5 percent and the expected return on the market is 16 percent. Smart Products has a 100 percent equity capital structure which will be maintained post-acquisition.

Refer to Smart Acquires Snazzy.What is Smart Products' cost of equity?

A) 24.2%

B) 18.2%

C) 16.0%

D) 11.0%

Smart Products plans to acquire Snazzy Snaps, which will create $8 million in incremental cash flows for Smart each year for the first six years. Smart Products plans to divest Snazzy Snaps at the end of the sixth year for $112,500,000. Smart's beta (b) is 1.2, and is expected to remain so after the acquisition. The risk free rate is 5 percent and the expected return on the market is 16 percent. Smart Products has a 100 percent equity capital structure which will be maintained post-acquisition.

Refer to Smart Acquires Snazzy.What is Smart Products' cost of equity?

A) 24.2%

B) 18.2%

C) 16.0%

D) 11.0%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

20

Refer to Smart Acquires Snazzy.If Smart Products' beta (b)falls to 0.95 post-acquisition,what would its weighted average cost of capital be?

A) 9.05%

B) 18.2%

C) 12.10%

D) 15.45%

A) 9.05%

B) 18.2%

C) 12.10%

D) 15.45%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

21

Antitakeover measures in a corporate charter are called

A) shark repellents

B) bear hugs

C) poison pills

D) white knights

A) shark repellents

B) bear hugs

C) poison pills

D) white knights

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

22

How many shares would be given to Miller's shareholders in a stock-financed deal?

A) 10,000

B) 8,621

C) 17,857

D) 14,478

A) 10,000

B) 8,621

C) 17,857

D) 14,478

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

23

Stock market evidence reveals

A) target shareholders receive larger premia in mergers than tender offers.

B) target shareholders' returns have decreased over time.

C) target shareholders receive larger premia when there are multiple bidders.

D) target shareholders receive smaller premia when target management resists.

A) target shareholders receive larger premia in mergers than tender offers.

B) target shareholders' returns have decreased over time.

C) target shareholders receive larger premia when there are multiple bidders.

D) target shareholders receive smaller premia when target management resists.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is (are)not value-enhancing motives for mergers and acquisitions?

A) external expansion

B) economies of scale and/or scope

C) diversification

D) managerial synergies

A) external expansion

B) economies of scale and/or scope

C) diversification

D) managerial synergies

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

25

For Smith and Miller,what would be the exchange ratio in a pure stock exchange merger?

A) 57.48%

B) 34.48%

C) 63.48%

D) 25.42%

A) 57.48%

B) 34.48%

C) 63.48%

D) 25.42%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

26

If you were the shareholder in a firm that became the target of an acquisition bid,which method of payment would stock market evidence suggest signals a better deal?

A) stock swap

B) stock/cash mixture

C) cash for stock

D) all, if the price is right

A) stock swap

B) stock/cash mixture

C) cash for stock

D) all, if the price is right

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

27

If GM were to merge with Wal-Mart,this would be called a

A) vertical merger

B) product extension merger

C) pure conglomerate merger

D) none of the above

A) vertical merger

B) product extension merger

C) pure conglomerate merger

D) none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

28

What is the net value of the acquisition to Smith if cash is used?

A) $245,000

B) -$5,000

C) -$250,000

D) $5,000

A) $245,000

B) -$5,000

C) -$250,000

D) $5,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

29

Conglomerate mergers may be explained by which of the following?

A) seeking financial synergies

B) availability of free cash flow

C) diversification/risk reduction

D) all of the above

A) seeking financial synergies

B) availability of free cash flow

C) diversification/risk reduction

D) all of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

30

A merger that combines companies with similar but not identical lines of business is called a

A) product extension merger

B) pure conglomerate merger

C) vertical merger

D) none of the above

A) product extension merger

B) pure conglomerate merger

C) vertical merger

D) none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

31

Smith-Miler Merger

Smith Enterprises can acquire Miller, Inc for $250,000 in either cash or stock. Both companies are 100% equity financed. The synergy value of the acquisition for Smith is $35,000. Currently Smith has 25,000 shares outstanding which trade at $29 a share, whereas Miller has 15,000 shares outstanding that trade at $14 a share.

What is the merger premium over Miller's stock price?

A) 19%

B) 16%

C) 21%

D) 23%

Smith Enterprises can acquire Miller, Inc for $250,000 in either cash or stock. Both companies are 100% equity financed. The synergy value of the acquisition for Smith is $35,000. Currently Smith has 25,000 shares outstanding which trade at $29 a share, whereas Miller has 15,000 shares outstanding that trade at $14 a share.

What is the merger premium over Miller's stock price?

A) 19%

B) 16%

C) 21%

D) 23%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

32

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $35 and they set the exchange ratio at 0.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $18 a share.

Refer to Bavarian Merger.If you owned 250 shares of Bavarian Sausage what would be the value of your stock holdings after the merger?

A) $3,600

B) $4,500

C) $7,000

D) $8,750

Refer to Bavarian Merger.If you owned 250 shares of Bavarian Sausage what would be the value of your stock holdings after the merger?

A) $3,600

B) $4,500

C) $7,000

D) $8,750

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

33

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $35 and they set the exchange ratio at 0.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $18 a share.

Refer to Bavarian Merger.If you owned 250 shares of Bavarian Sausage what would be the control premium?

A) 55.6%

B) 35.7%

C) 62.5%

D) 41.9%

Refer to Bavarian Merger.If you owned 250 shares of Bavarian Sausage what would be the control premium?

A) 55.6%

B) 35.7%

C) 62.5%

D) 41.9%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

34

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $35 and they set the exchange ratio at 0.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $18 a share.

Refer to Bavarian Merger.What is the transaction value of the merger?

A) $1.5 billion

B) $2.1 billion

C) $750 million

D) $500 million

Refer to Bavarian Merger.What is the transaction value of the merger?

A) $1.5 billion

B) $2.1 billion

C) $750 million

D) $500 million

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

35

A transaction in which two or more business organizations combine into a single entity is called a(n)

A) acquisition

B) merger

C) consolidation

D) none of the above

A) acquisition

B) merger

C) consolidation

D) none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

36

Smith-Miler Merger

Smith Enterprises can acquire Miller, Inc for $250,000 in either cash or stock. Both companies are 100% equity financed. The synergy value of the acquisition for Smith is $35,000. Currently Smith has 25,000 shares outstanding which trade at $29 a share, whereas Miller has 15,000 shares outstanding that trade at $14 a share.

What is the value of Miller to Smith?

A) $35,000

B) $245,000

C) $210,000

D) $125,000

Smith Enterprises can acquire Miller, Inc for $250,000 in either cash or stock. Both companies are 100% equity financed. The synergy value of the acquisition for Smith is $35,000. Currently Smith has 25,000 shares outstanding which trade at $29 a share, whereas Miller has 15,000 shares outstanding that trade at $14 a share.

What is the value of Miller to Smith?

A) $35,000

B) $245,000

C) $210,000

D) $125,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

37

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $35 and they set the exchange ratio at 0.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $18 a share.

How many shares will Bavarian Brew issue in exchange for Bavarian Sausage's shares.

A) 75 million

B) 60 million

C) 100 million

D) 50 million

How many shares will Bavarian Brew issue in exchange for Bavarian Sausage's shares.

A) 75 million

B) 60 million

C) 100 million

D) 50 million

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

38

The transformation of a public corporation into a private company by the employees of the corporation itself is called a(n)

A) management buyout

B) employee stock ownership plan

C) reverse LBO

D) reverse merger

A) management buyout

B) employee stock ownership plan

C) reverse LBO

D) reverse merger

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

39

Recent stock market evidence reveals

A) target and bidder shareholders receive significant positive returns.

B) target shareholders receive significant positive returns, while acquirers' returns are actually negative.

C) acquiring firms' shareholders receive a larger share than target shareholders of the increased value of the combined firms.

D) acquirers' returns have been increasing over time.

A) target and bidder shareholders receive significant positive returns.

B) target shareholders receive significant positive returns, while acquirers' returns are actually negative.

C) acquiring firms' shareholders receive a larger share than target shareholders of the increased value of the combined firms.

D) acquirers' returns have been increasing over time.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

40

FASB Statement 141 holds that

A) goodwill is to be amortized over time.

B) goodwill can no longer be created in merged financial statements.

C) goodwill can be increased or decreased over time after the merger.

D) goodwill is to be regularly evaluated for impairment.

A) goodwill is to be amortized over time.

B) goodwill can no longer be created in merged financial statements.

C) goodwill can be increased or decreased over time after the merger.

D) goodwill is to be regularly evaluated for impairment.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

41

The percentage of shares owned that triggers a legal requirement to identify one as a significant stockholder of a company is

A) 1%

B) 4.9%

C) 5%

D) 20%

A) 1%

B) 4.9%

C) 5%

D) 20%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

42

Bavarian-Bavarian Merger

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $45 and they set the exchange ratio at 1.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $23 a share.

Twelve months after the merger Bavarian Brew's stock price drops to $37.

After the drop in the stock price for Bavarian Brew,what is the control premium?

A) 252.0%

B) 189.6%

C) 52.6%

D) 124.4%

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $45 and they set the exchange ratio at 1.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $23 a share.

Twelve months after the merger Bavarian Brew's stock price drops to $37.

After the drop in the stock price for Bavarian Brew,what is the control premium?

A) 252.0%

B) 189.6%

C) 52.6%

D) 124.4%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

43

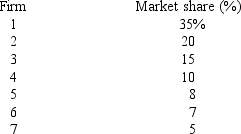

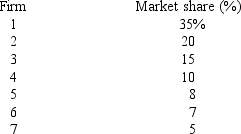

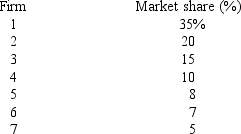

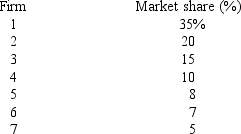

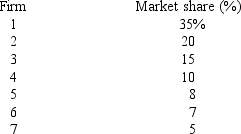

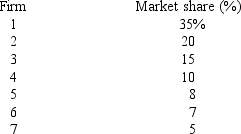

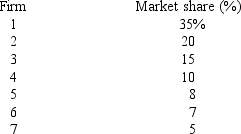

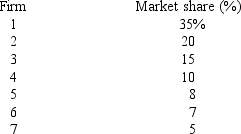

Exhibit 21-1

Refer to Exhibit 21-1.If firms 6 and 7 were to merge what would be the HHI of the industry?

A) 2,088

B) 2,158

C) 2,495

D) 1,645

Refer to Exhibit 21-1.If firms 6 and 7 were to merge what would be the HHI of the industry?

A) 2,088

B) 2,158

C) 2,495

D) 1,645

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

44

When a firm sells the assets and/or resources of a subsidiary or division of the firm to another organization,that is called

A) a recapitalizations.

B) a divestiture.

C) a reverse split.

D) none of the above.

A) a recapitalizations.

B) a divestiture.

C) a reverse split.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

45

Exhibit 21-1

Refer to Exhibit 21-1.If firms 1 and 7 were to merge what is the HHI of the industry?

A) 2,050

B) 2,469

C) 2,438

D) 2,945

Refer to Exhibit 21-1.If firms 1 and 7 were to merge what is the HHI of the industry?

A) 2,050

B) 2,469

C) 2,438

D) 2,945

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

46

Exhibit 21-1

Refer to Exhibit 21-1.What is the HHI of this industry?

A) 2,088

B) 1,645

C) 2,495

D) 1,325

Refer to Exhibit 21-1.What is the HHI of this industry?

A) 2,088

B) 1,645

C) 2,495

D) 1,325

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

47

Backward integration is a type of

A) horizontal merger.

B) vertical merger.

C) market power merger.

D) none of the above.

A) horizontal merger.

B) vertical merger.

C) market power merger.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

48

A structured purchase of the target's shares in which the acquirer announces a public offer to buy a minimum number of shares at a specific price is called

A) LBO

B) tender offer

C) exchange offer

D) green mail

A) LBO

B) tender offer

C) exchange offer

D) green mail

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

49

Bavarian-Bavarian Merger

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $45 and they set the exchange ratio at 1.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $23 a share.

Twelve months after the merger Bavarian Brew's stock price drops to $37.

If you owned 200 shares of Bavarian Sausage what would be the control premium?

A) 252%

B) 125%

C) 52%

D) 189%

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $45 and they set the exchange ratio at 1.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $23 a share.

Twelve months after the merger Bavarian Brew's stock price drops to $37.

If you owned 200 shares of Bavarian Sausage what would be the control premium?

A) 252%

B) 125%

C) 52%

D) 189%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

50

Bavarian-Bavarian Merger

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $45 and they set the exchange ratio at 1.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $23 a share.

Twelve months after the merger Bavarian Brew's stock price drops to $37.

How many shares will Bavarian Brew issue in the exchange offer?

A) 75 million

B) 135 million

C) 95 million

D) 150 million

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $45 and they set the exchange ratio at 1.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $23 a share.

Twelve months after the merger Bavarian Brew's stock price drops to $37.

How many shares will Bavarian Brew issue in the exchange offer?

A) 75 million

B) 135 million

C) 95 million

D) 150 million

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

51

By the FTC definition,the merger between Exxon and Mobil is a(n)

A) vertical merger.

B) horizontal merger.

C) integrated merger.

D) all of the above.

A) vertical merger.

B) horizontal merger.

C) integrated merger.

D) all of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

52

Exhibit 21-1

Refer to Exhibit 21-1.If firms 1 and 2 were to merge what would be the HHI of the industry?

A) 2,088

B) 3,488

C) 2,495

D) 1,645

Refer to Exhibit 21-1.If firms 1 and 2 were to merge what would be the HHI of the industry?

A) 2,088

B) 3,488

C) 2,495

D) 1,645

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

53

When a parent company creates a new company with its own shares by issuing shares of that company which used to be a division or subsidiary of the parent company,the transaction is called

A) a divestiture.

B) a reverse split.

C) a spin-off.

D) none of the above

A) a divestiture.

B) a reverse split.

C) a spin-off.

D) none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

54

Bavarian-Bavarian Merger

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $45 and they set the exchange ratio at 1.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $23 a share.

Twelve months after the merger Bavarian Brew's stock price drops to $37.

After the drop in the stock price for Bavarian Brew,what is the transaction value of the merger?

A) $4.995 billion

B) $2.775 billion

C) $3.585 billion

D) $5.239 billion

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $45 and they set the exchange ratio at 1.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $23 a share.

Twelve months after the merger Bavarian Brew's stock price drops to $37.

After the drop in the stock price for Bavarian Brew,what is the transaction value of the merger?

A) $4.995 billion

B) $2.775 billion

C) $3.585 billion

D) $5.239 billion

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

55

For Smith and Miller,what is the value of the post merger firm if cash is used?

A) $-5,000

B) $725,000

C) $720,000

D) $250,000

A) $-5,000

B) $725,000

C) $720,000

D) $250,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

56

For Smith and Miller,what is the stock price of the new firm after a cash acquisition?

A) $29

B) $28.80

C) $18

D) $21.50

A) $29

B) $28.80

C) $18

D) $21.50

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

57

Company B's resources were completely absorbed by Company A after their merger.The merger between the two companies was a

A) statutory merger

B) subsidiary merger

C) consolidation

D) none of the above

A) statutory merger

B) subsidiary merger

C) consolidation

D) none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

58

Corporate control refers to what aspect of a corporation or business organization?

A) monitoring

B) supervision

C) direction

D) all of the above

A) monitoring

B) supervision

C) direction

D) all of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

59

A transaction in which two or more business organizations combine into a single entity is called

A) an acquisition

B) a merger

C) a buyout

D) all of the above

A) an acquisition

B) a merger

C) a buyout

D) all of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

60

Bavarian-Bavarian Merger

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $45 and they set the exchange ratio at 1.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $23 a share.

Twelve months after the merger Bavarian Brew's stock price drops to $37.

What is the transaction value of the merger for Bavarian Brew?

A) $3.375 billion

B) $6.075 billion

C) $135 million

D) $1.350 billion

Bavarian Brew is planning on acquiring Bavarian Sausage in a pure exchange merger. Bavarian Brew's stock is currently trading at $45 and they set the exchange ratio at 1.80. Bavarian Sausage has 75 million shares outstanding which are currently trading at $23 a share.

Twelve months after the merger Bavarian Brew's stock price drops to $37.

What is the transaction value of the merger for Bavarian Brew?

A) $3.375 billion

B) $6.075 billion

C) $135 million

D) $1.350 billion

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements is false?

A) Bidders almost always offer target firm shareholders a premium price for their stock.

B) The average premium for completed U.S. mergers for the last 30 years has averaged about 20%.

C) Premiums exist for mergers in many other countries in addition to the U.S.

D) The merger premium is the difference between pre-merger market value and acquisition value.

A) Bidders almost always offer target firm shareholders a premium price for their stock.

B) The average premium for completed U.S. mergers for the last 30 years has averaged about 20%.

C) Premiums exist for mergers in many other countries in addition to the U.S.

D) The merger premium is the difference between pre-merger market value and acquisition value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

62

Natural growth,or internal expansion into a new market is also called

A) acquired entry.

B) merged entry.

C) greenfield entry.

D) entrepreneurial entry.

A) acquired entry.

B) merged entry.

C) greenfield entry.

D) entrepreneurial entry.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

63

The suggestion that poorly monitored managers will pursue mergers to maximize their corporation's asset size because managerial compensation is usually based on firm size is called

A) the managerialism theory of managers.

B) the concept of unintended consequences.

C) the untrustable manager theory of managers.

D) none of the above.

A) the managerialism theory of managers.

B) the concept of unintended consequences.

C) the untrustable manager theory of managers.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

64

Generally speaking,the return associated with acquisitions are higher for

A) debt financed transactions.

B) equity financed transactions.

C) cash transactions.

D) the acquirer than for the target.

A) debt financed transactions.

B) equity financed transactions.

C) cash transactions.

D) the acquirer than for the target.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following statements is false?

A) Most acquisitions are hostile.

B) Even is a bid is considered hostile, ultimately over half of those bids are successful.

C) Hostile takeovers peaked in the 1980s.

D) Hostile takeovers are more rare in other countries than they are in the United States.

A) Most acquisitions are hostile.

B) Even is a bid is considered hostile, ultimately over half of those bids are successful.

C) Hostile takeovers peaked in the 1980s.

D) Hostile takeovers are more rare in other countries than they are in the United States.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

66

The merger wave of the 1980's was different from other merger waves because

A) of the availability of low quality debt financing.

B) of the need for further conglomerates during that time.

C) of the highly scrutinized process by the department of justice during that time.

D) none of the above.

A) of the availability of low quality debt financing.

B) of the need for further conglomerates during that time.

C) of the highly scrutinized process by the department of justice during that time.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

67

Goodwill reflects

A) the premium that an acquiring firm is willing to pay in excess of net asset market value for a target firm.

B) the premium that an acquiring firm is willing to pay in excess of net asset book value for a target firm.

C) the premium that an acquiring firm is willing to pay in excess of net asset market value, if that premium is paid for with securities instead of cash.

D) none of the above.

A) the premium that an acquiring firm is willing to pay in excess of net asset market value for a target firm.

B) the premium that an acquiring firm is willing to pay in excess of net asset book value for a target firm.

C) the premium that an acquiring firm is willing to pay in excess of net asset market value, if that premium is paid for with securities instead of cash.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

68

A finely tuned measure of business concentration that examines how a firm concentrates its efforts on its core business is known as:

A) conglomerate classification

B) corporate focus

C) diversification focus

D) primary classification

E) Standard Industry Classification

A) conglomerate classification

B) corporate focus

C) diversification focus

D) primary classification

E) Standard Industry Classification

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

69

The push for "portfolio" corporations in the 1960's was so great that the vast majority of mergers that took place during that time were

A) horizontal mergers.

B) vertical mergers.

C) conglomerate mergers.

D) none of the above.

A) horizontal mergers.

B) vertical mergers.

C) conglomerate mergers.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

70

Financial synergies are largely the anticipated result of

A) vertical mergers.

B) horizontal mergers.

C) conglomerate mergers.

D) forced mergers.

A) vertical mergers.

B) horizontal mergers.

C) conglomerate mergers.

D) forced mergers.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

71

Which piece of legislation was enacted to prevent the formation of trusts?

A) the Clayton Act.

B) the Federal Trade Commissions Act.

C) the Sherman Antitrust Act.

D) the Celler-Kefauver Act.

A) the Clayton Act.

B) the Federal Trade Commissions Act.

C) the Sherman Antitrust Act.

D) the Celler-Kefauver Act.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

72

A merger in which both the acquirer and target disappear as separate corporations,combining to form an entirely new corporation with new common stock is known as a(n):

A) statutory merger

B) subsidiary merger

C) acquisition

D) consolidation

E) takeover

A) statutory merger

B) subsidiary merger

C) acquisition

D) consolidation

E) takeover

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

73

If a deli meat distributor were to acquire a meat processing plant,that would be an example of

A) a forward integration merger.

B) a backward integration merger.

C) a horizontal merger.

D) none of the above.

A) a forward integration merger.

B) a backward integration merger.

C) a horizontal merger.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

74

The purchase of additional resources by a business enterprise is known as a(n):

A) statutory merger

B) subsidiary merger

C) acquisition

D) consolidation

E) takeover

A) statutory merger

B) subsidiary merger

C) acquisition

D) consolidation

E) takeover

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

75

Economies of scale,economies of scope,and resource complementarities are all

A) sources of operational synergy.

B) the main reasons for an acquisition.

C) false pretenses for an acquisition.

D) none of the above.

A) sources of operational synergy.

B) the main reasons for an acquisition.

C) false pretenses for an acquisition.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

76

TargetCorp.shareholders will be receiving 6 shares of Acquire Inc.for each 10 shares of TargetCorp.that they own.TargetCorp.'s shares are currently priced at $15 per share while the shares of Acquire are (and will remain)worth $30 per share.What is the dollar premium that Acquire is paying for each 100 shares of TargetCorp?

A) $3,500

B) $1,800

C) $1,500

D) $300

A) $3,500

B) $1,800

C) $1,500

D) $300

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

77

If a wheat mill were to acquire a bread making company,that would be an example of

A) a forward integration merger.

B) a backward integration merger.

C) a horizontal merger.

D) none of the above.

A) a forward integration merger.

B) a backward integration merger.

C) a horizontal merger.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

78

A mixed offering is a merger that is financed with

A) debt and equity.

B) cash and securities.

C) debt and trade credit.

D) none of the above.

A) debt and equity.

B) cash and securities.

C) debt and trade credit.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

79

The greater the number of unrelated divisions that a conglomerate firm operates in creates

A) a smaller Herfindahl Index number.

B) a larger Herfindahl Index number.

C) a Herfindahl Index number that does not necessarily change.

D) there is not enough information to determine.

A) a smaller Herfindahl Index number.

B) a larger Herfindahl Index number.

C) a Herfindahl Index number that does not necessarily change.

D) there is not enough information to determine.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

80

The first U.S.merger wave,in 1897 was largely the result of

A) a backlash created by the anti-trust legislation of the 1890's.

B) industrialization.

C) a growing emphasis on a truly national economy rather than a grouping of regional economies.

D) none of the above.

A) a backlash created by the anti-trust legislation of the 1890's.

B) industrialization.

C) a growing emphasis on a truly national economy rather than a grouping of regional economies.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck