Deck 17: Cash, payables, and Liquidity Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/104

Play

Full screen (f)

Deck 17: Cash, payables, and Liquidity Management

1

Bavarian Sausage Cash Transfer

Bavarian Sausage needs to transfer $250,000 from its deposit account into its concentration account. The company could do it with an EDT which would cost $1.50 or a wire transfer for $17. The wire transfer would result in the funds being deposited in the concentration account 2 days earlier. The firm's opportunity cost is 10% and we assume a 360 day year.

What is the minimum transfer amount for which the transfer would be beneficial for Bavarian Sausage?

A) $55,800

B) $27,900

C) $13,850

D) $41,950

Bavarian Sausage needs to transfer $250,000 from its deposit account into its concentration account. The company could do it with an EDT which would cost $1.50 or a wire transfer for $17. The wire transfer would result in the funds being deposited in the concentration account 2 days earlier. The firm's opportunity cost is 10% and we assume a 360 day year.

What is the minimum transfer amount for which the transfer would be beneficial for Bavarian Sausage?

A) $55,800

B) $27,900

C) $13,850

D) $41,950

$27,900

2

Bavarian Brew Float

Bavarian Brew receives about 350 checks a day with an average check size of $550. Currently customer's payments spend 2 days in the mail. Once a check is received it takes about 1.5 days to process it and another 4 days to clear the banking system. The firm's opportunity cost is 10%. Assume a 365-day year.

Bavarian Brew is contemplating implementing a collection system that would decrease the collection float by 2.5 days.What would be the annual benefit of that system?

A) $481,250

B) $48,125

C) $96,250

D) $75,480

Bavarian Brew receives about 350 checks a day with an average check size of $550. Currently customer's payments spend 2 days in the mail. Once a check is received it takes about 1.5 days to process it and another 4 days to clear the banking system. The firm's opportunity cost is 10%. Assume a 365-day year.

Bavarian Brew is contemplating implementing a collection system that would decrease the collection float by 2.5 days.What would be the annual benefit of that system?

A) $481,250

B) $48,125

C) $96,250

D) $75,480

$48,125

3

Your supplier offers you trade terms of 3/10 net 40.What is the implicit interest that you pay on the trade credit if you do not take the discount?

A) 37.63%

B) 0%

C) 36.50%

D) 28.22%

A) 37.63%

B) 0%

C) 36.50%

D) 28.22%

37.63%

4

You are contemplating purchasing a $1,000,000 181 day T-Bill that is selling at a discount of 4.25%.What is the bond market yield of the T-Bill?

A) 4.25%

B) 4.34%

C) 4.40%

D) 4.15%

A) 4.25%

B) 4.34%

C) 4.40%

D) 4.15%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

5

A collection system that is characterized by many collection points with each having a depository account at a local bank is called

A) field banking system

B) mail based collection system

C) electronic invoice presentment and payment system

D) electronic bill presentment and payment system

A) field banking system

B) mail based collection system

C) electronic invoice presentment and payment system

D) electronic bill presentment and payment system

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

6

You are contemplating purchasing a $1,000,000 181 day T-Bill that is selling at a discount of 4.25%.What is the dollar discount on the T-Bill?

A) $21,368.06

B) $42,500

C) $38,845.26

D) $19,367.51

A) $21,368.06

B) $42,500

C) $38,845.26

D) $19,367.51

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

7

Bavarian Sausage Cash Transfer

Bavarian Sausage needs to transfer $250,000 from its deposit account into its concentration account. The company could do it with an EDT which would cost $1.50 or a wire transfer for $17. The wire transfer would result in the funds being deposited in the concentration account 2 days earlier. The firm's opportunity cost is 10% and we assume a 360 day year.

What is the net benefit for Bavarian Sausage from using the wire transfer?

A) $53.01

B) $137.89

C) $60.95

D) $121.89

Bavarian Sausage needs to transfer $250,000 from its deposit account into its concentration account. The company could do it with an EDT which would cost $1.50 or a wire transfer for $17. The wire transfer would result in the funds being deposited in the concentration account 2 days earlier. The firm's opportunity cost is 10% and we assume a 360 day year.

What is the net benefit for Bavarian Sausage from using the wire transfer?

A) $53.01

B) $137.89

C) $60.95

D) $121.89

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

8

Bavarian Brew Float

Bavarian Brew receives about 350 checks a day with an average check size of $550. Currently customer's payments spend 2 days in the mail. Once a check is received it takes about 1.5 days to process it and another 4 days to clear the banking system. The firm's opportunity cost is 10%. Assume a 365-day year.

Bavarian Brew is contemplating implementing a lockbox system.If the system has an annual cost of $60,000,by how many days would the float have to be reduced for the company to implement the system?

A) 2.52 days

B) 3.12 days

C) 3.75 days

D) 4.74 days

Bavarian Brew receives about 350 checks a day with an average check size of $550. Currently customer's payments spend 2 days in the mail. Once a check is received it takes about 1.5 days to process it and another 4 days to clear the banking system. The firm's opportunity cost is 10%. Assume a 365-day year.

Bavarian Brew is contemplating implementing a lockbox system.If the system has an annual cost of $60,000,by how many days would the float have to be reduced for the company to implement the system?

A) 2.52 days

B) 3.12 days

C) 3.75 days

D) 4.74 days

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

9

A collection system that is characterized by many collection points with each having a depository account at a local bank is called

A) field banking system

B) mail based collection system

C) electronic invoice presentment and payment system

D) electronic bill presentment and payment system

A) field banking system

B) mail based collection system

C) electronic invoice presentment and payment system

D) electronic bill presentment and payment system

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

10

Funds that have been sent by the payer,but are not yet usable by the payee are called

A) tax balance

B) ledger balance

C) float

D) none of the above

A) tax balance

B) ledger balance

C) float

D) none of the above

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

11

Bavarian Sausage Cash Transfer

Bavarian Sausage needs to transfer $250,000 from its deposit account into its concentration account. The company could do it with an EDT which would cost $1.50 or a wire transfer for $17. The wire transfer would result in the funds being deposited in the concentration account 2 days earlier. The firm's opportunity cost is 10% and we assume a 360 day year.

What is the benefit for Bavarian Sausage from using the wire transfer?

A) $138.89

B) $69.44

C) $109.57

D) $53.61

Bavarian Sausage needs to transfer $250,000 from its deposit account into its concentration account. The company could do it with an EDT which would cost $1.50 or a wire transfer for $17. The wire transfer would result in the funds being deposited in the concentration account 2 days earlier. The firm's opportunity cost is 10% and we assume a 360 day year.

What is the benefit for Bavarian Sausage from using the wire transfer?

A) $138.89

B) $69.44

C) $109.57

D) $53.61

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

12

Special post office boxes set up by the firm to expedite the receipt and processing of its accounts receivables are called

A) safety-deposit boxes

B) lockboxes

C) float reducers

D) none of the above

A) safety-deposit boxes

B) lockboxes

C) float reducers

D) none of the above

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

13

Smith Enterprise has a one year credit line of $5,000,000 with Second Bank.On average Smith uses half of the credit line.Second Bank charges a .67% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +2%.Assuming that the LIBOR is currently at 4.3%,what is Smith's effective borrowing rate?

A) 6.97%

B) 6.30%

C) 7.21%

D) 5.98%

A) 6.97%

B) 6.30%

C) 7.21%

D) 5.98%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

14

The amount of time that it takes for a check to clear through the banking system is called

A) mail float

B) processing float

C) clearing float

D) delivery float

A) mail float

B) processing float

C) clearing float

D) delivery float

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

15

You are contemplating purchasing a $1,000,000 181 day T-Bill that is selling at a discount of 4.25%.What is the purchase price of the T-Bill?

A) $21,368.06

B) $978,631.94

C) $1,000,000

D) $954,621.52

A) $21,368.06

B) $978,631.94

C) $1,000,000

D) $954,621.52

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

16

Bavarian Brew Float

Bavarian Brew receives about 350 checks a day with an average check size of $550. Currently customer's payments spend 2 days in the mail. Once a check is received it takes about 1.5 days to process it and another 4 days to clear the banking system. The firm's opportunity cost is 10%. Assume a 365-day year.

What is the availability float of Bavarian Brew?

A) 2 days

B) 4 days

C) 7.5 days

D) 1.5 days

Bavarian Brew receives about 350 checks a day with an average check size of $550. Currently customer's payments spend 2 days in the mail. Once a check is received it takes about 1.5 days to process it and another 4 days to clear the banking system. The firm's opportunity cost is 10%. Assume a 365-day year.

What is the availability float of Bavarian Brew?

A) 2 days

B) 4 days

C) 7.5 days

D) 1.5 days

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

17

Bavarian Brew Float

Bavarian Brew receives about 350 checks a day with an average check size of $550. Currently customer's payments spend 2 days in the mail. Once a check is received it takes about 1.5 days to process it and another 4 days to clear the banking system. The firm's opportunity cost is 10%. Assume a 365-day year.

What is Bavarian Brew's collection float?

A) 4 days

B) 2 days

C) 1.5 days

D) 7.5 days

Bavarian Brew receives about 350 checks a day with an average check size of $550. Currently customer's payments spend 2 days in the mail. Once a check is received it takes about 1.5 days to process it and another 4 days to clear the banking system. The firm's opportunity cost is 10%. Assume a 365-day year.

What is Bavarian Brew's collection float?

A) 4 days

B) 2 days

C) 1.5 days

D) 7.5 days

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

18

Bavarian Brew Float

Bavarian Brew receives about 350 checks a day with an average check size of $550. Currently customer's payments spend 2 days in the mail. Once a check is received it takes about 1.5 days to process it and another 4 days to clear the banking system. The firm's opportunity cost is 10%. Assume a 365-day year.

Bavarian Brew is contemplating implementing a lockbox system that would decrease the collection float by 2 days.What would be the most the company should be willing to pay on an annual basis for the system?

A) $96,250

B) $482,500

C) $38,500

D) $48,125

Bavarian Brew receives about 350 checks a day with an average check size of $550. Currently customer's payments spend 2 days in the mail. Once a check is received it takes about 1.5 days to process it and another 4 days to clear the banking system. The firm's opportunity cost is 10%. Assume a 365-day year.

Bavarian Brew is contemplating implementing a lockbox system that would decrease the collection float by 2 days.What would be the most the company should be willing to pay on an annual basis for the system?

A) $96,250

B) $482,500

C) $38,500

D) $48,125

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

19

The collection,concentration,and disbursement of funds for the company is called

A) target cash balance

B) cash position management

C) bank account analysis

D) none of the above

A) target cash balance

B) cash position management

C) bank account analysis

D) none of the above

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

20

You are contemplating purchasing a $1,000,000 181 day T-Bill that is selling at a discount of 4.25%.What is the money market yield of the T-Bill?

A) 4.34%

B) 4.25%

C) 4.40$%

D) 4.15%

A) 4.34%

B) 4.25%

C) 4.40$%

D) 4.15%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

21

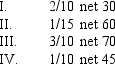

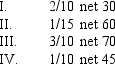

Suppose your firm can borrow at 10%.Which of the following discounts should your firm take?

A) II only

B) I and III

C) II and IV

D) I, III, and IV

A) II only

B) I and III

C) II and IV

D) I, III, and IV

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

22

For which of the following would missing (that is,not taking)the discount be the least costly?

A) 2/10 net 40

B) 1/15 net 60

C) 3/10 net 70

D) 1/10 net 50

A) 2/10 net 40

B) 1/15 net 60

C) 3/10 net 70

D) 1/10 net 50

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

23

Place the following in the correct order of priority for selecting short-term investments:

A) expected return, liquidity, preservation of capital

B) expected return, preservation of capital, liquidity

C) liquidity, expected return, preservation of capital

D) preservation of capital, liquidity, expected return

A) expected return, liquidity, preservation of capital

B) expected return, preservation of capital, liquidity

C) liquidity, expected return, preservation of capital

D) preservation of capital, liquidity, expected return

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

24

The purpose of a "positive pay" service is to

A) reduce availability and clearing float

B) only clear checks when a firm's cash balance is positive.

C) reduce a firm's exposure to check fraud.

D) move funds to into a zero balance account.

A) reduce availability and clearing float

B) only clear checks when a firm's cash balance is positive.

C) reduce a firm's exposure to check fraud.

D) move funds to into a zero balance account.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following credit terms has the highest relevant cost?

A) 3/10 net 60

B) 2/10 net 30

C) 2/15 net 45

D) 4/15 net 90

A) 3/10 net 60

B) 2/10 net 30

C) 2/15 net 45

D) 4/15 net 90

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

26

A producer of specialty electronic components is located in Arkansas,while many of its customers are located in California,Texas,and Florida.This company may seek to use

A) electronic invoice presentment and bill paying.

B) lock boxes.

C) concentration banks.

D) all of the above.

A) electronic invoice presentment and bill paying.

B) lock boxes.

C) concentration banks.

D) all of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

27

Smith Enterprise Credit line (w/o comp)

Smith Enterprise has an one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. Assume that the LIBOR is 6.3%

Refer to Smith Enterprise Credit line (w/o comp).What would be the effective borrowing rate if you exhausted your line of credit?

A) 8.04%

B) 7.80%

C) 8.48%

D) 8.21%

Smith Enterprise has an one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. Assume that the LIBOR is 6.3%

Refer to Smith Enterprise Credit line (w/o comp).What would be the effective borrowing rate if you exhausted your line of credit?

A) 8.04%

B) 7.80%

C) 8.48%

D) 8.21%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

28

Dilly Deli, Inc., a nation-wide chain of deli-style restaurants, has built a $34,000 balance in one of its regional bank accounts. It wishes to move $30,000 to its main concentration account. A DTC cost $1.50 and requires 3 days to clear; an EDT costs $3.00 but requires only 1 day to clear; and a wire transfer costs $15 and clears the same day. Dilly Deli, Inc. can earn 7% on short term investments.

Refer to Dilly Deli.Which of the following is true?

A) The wire transfer dominates both the DTC and the EDT.

B) The wire transfer dominates the EDT but not the DTC.

C) The DTC dominates both the EDT and the wire transfer.

D) The EDT dominates the DTC and the wire transfer.

Refer to Dilly Deli.Which of the following is true?

A) The wire transfer dominates both the DTC and the EDT.

B) The wire transfer dominates the EDT but not the DTC.

C) The DTC dominates both the EDT and the wire transfer.

D) The EDT dominates the DTC and the wire transfer.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

29

Smith Enterprise Credit Line

Smith Enterprise has a one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. The bank also requires a 5% compensating balance.

If Smith needs to borrow $3,250,000,what is the effective borrowing rate if the LIBOR equals 6.3%?

A) 8.62%

B) 8.04%

C) 7.59%

D) 8.43%

Smith Enterprise has a one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. The bank also requires a 5% compensating balance.

If Smith needs to borrow $3,250,000,what is the effective borrowing rate if the LIBOR equals 6.3%?

A) 8.62%

B) 8.04%

C) 7.59%

D) 8.43%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

30

Smith Enterprise Credit line (w/o comp)

Smith Enterprise has an one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. Assume that the LIBOR is 6.3%

Refer to Smith Enterprise Credit line (w/o comp).What is the change in your EBR if you only borrow $2,000,000 instead of $3,250,000?

A) increases by .44%

B) decreases by .44%

C) does not change

D) increases by .78%

Smith Enterprise has an one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. Assume that the LIBOR is 6.3%

Refer to Smith Enterprise Credit line (w/o comp).What is the change in your EBR if you only borrow $2,000,000 instead of $3,250,000?

A) increases by .44%

B) decreases by .44%

C) does not change

D) increases by .78%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

31

Most money market mutual funds set their net asset value at a fixed ____ per share.

A) $1

B) $10

C) $100

D) $1,000

A) $1

B) $10

C) $100

D) $1,000

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

32

Extending payment beyond the due date in order to reduce the cash conversion cycle

A) is an accepted "stretching" of credit terms.

B) is an unethical cash management practice.

C) is an unethical cash management practice, but can be viewed as acceptable.

D) is backwards; this actually increases the cash conversion cycle.

A) is an accepted "stretching" of credit terms.

B) is an unethical cash management practice.

C) is an unethical cash management practice, but can be viewed as acceptable.

D) is backwards; this actually increases the cash conversion cycle.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

33

Smith Enterprise Credit line (w/o comp)

Smith Enterprise has an one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. Assume that the LIBOR is 6.3%

Refer to Smith Enterprise Credit line (w/o comp).If you only borrowed $2,000,000 against the line,what would be your effective borrowing rate?

A) 7.80%

B) 8.04%

C) 8.45%

D) 8.48%

Smith Enterprise has an one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. Assume that the LIBOR is 6.3%

Refer to Smith Enterprise Credit line (w/o comp).If you only borrowed $2,000,000 against the line,what would be your effective borrowing rate?

A) 7.80%

B) 8.04%

C) 8.45%

D) 8.48%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

34

A major retail firm like Walmart or Target would most likely not use

A) point of sale information systems

B) a cash concentration bank

C) lock boxes

D) any of the above

A) point of sale information systems

B) a cash concentration bank

C) lock boxes

D) any of the above

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

35

Smith Enterprise Credit Line

Smith Enterprise has a one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. The bank also requires a 5% compensating balance.

What is the most that Smith can effectively borrow against the line without having to deposit additional funds with the bank?

A) $5,000,000

B) $4,255,374

C) $4,586,408

D) $4,761,905

Smith Enterprise has a one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. The bank also requires a 5% compensating balance.

What is the most that Smith can effectively borrow against the line without having to deposit additional funds with the bank?

A) $5,000,000

B) $4,255,374

C) $4,586,408

D) $4,761,905

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

36

In which situation below would a lock-box system likely produce greater benefits?

A) when interest rates are very low

B) when interest rates are very high

C) when the firm's customers are concentrated locally

D) when the firm collects with ACH transfers

A) when interest rates are very low

B) when interest rates are very high

C) when the firm's customers are concentrated locally

D) when the firm collects with ACH transfers

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

37

Smith Enterprise Credit line (w/o comp)

Smith Enterprise has an one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. Assume that the LIBOR is 6.3%

What is Smith's effective borrowing rate?

A) 8.45%

B) 7.59%

C) 8.04%

D) 7.80%

Smith Enterprise has an one year credit line of $5,000,000 with Second Bank. On average Smith uses $3,250,000 of the credit line. Second Bank charges a .45% commitment fee on the unused portion of the line and the interest rate is set at LIBOR +1.5%. Assume that the LIBOR is 6.3%

What is Smith's effective borrowing rate?

A) 8.45%

B) 7.59%

C) 8.04%

D) 7.80%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

38

The benefit(s)of a lock box system include

A) reduction of mail float.

B) reduction of processing float.

C) reduction of availability float.

D) all of the above.

A) reduction of mail float.

B) reduction of processing float.

C) reduction of availability float.

D) all of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following has the greatest potential to be the longest?

A) mail float

B) processing float

C) availability float

D) clearing float

A) mail float

B) processing float

C) availability float

D) clearing float

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

40

The cash manager should seek to

A) maximize disbursement float and maximize collection float.

B) minimize disbursement float and minimize collection float.

C) maximize disbursement float and minimize collection float.

D) minimize disbursement float and maximize collection float.

A) maximize disbursement float and maximize collection float.

B) minimize disbursement float and minimize collection float.

C) maximize disbursement float and minimize collection float.

D) minimize disbursement float and maximize collection float.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

41

Currently,a $1 million,91-day T-bill sells for a 2.5% discount.What is the bond equivalent yield?

A) 2.500%

B) 2.516%

C) 2.551%

D) 2.532%

A) 2.500%

B) 2.516%

C) 2.551%

D) 2.532%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

42

Coyote Valley Products has daily cash collections of $500,000. The cash management staff has determined (1) customers' payments are in the mail an average of 3 days; (2) processing after receipt averages 1 day; and (3) after deposit funds are cleared on average in 2 days. Assume a 365 day year.

If Coyote Valley Products faces a 9% opportunity cost of funds,what is the value of reducing float by 2 days?

A) $1,000,000

B) $45,000

C) $49,315

D) $90,000

If Coyote Valley Products faces a 9% opportunity cost of funds,what is the value of reducing float by 2 days?

A) $1,000,000

B) $45,000

C) $49,315

D) $90,000

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

43

The time between receipt of the payment and its deposit into the firm's account is

A) mail float.

B) processing float.

C) availability float.

D) clearing float.

A) mail float.

B) processing float.

C) availability float.

D) clearing float.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

44

A business such as a restaurant,that receives local checks,cash,and debit card payments is more likely to utilize a(n)

A) field-banking system for collections.

B) mail-based system for collections.

C) electronic system for collections.

D) lockbox system for collections.

A) field-banking system for collections.

B) mail-based system for collections.

C) electronic system for collections.

D) lockbox system for collections.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

45

$100 million dollar days of float could be arrived at by

A) $100 million dollars worth of checks with an average of 5 days of float.

B) $20 million dollars worth of checks with an average of 5 days of float.

C) $10 million dollars worth of checks with an average of 20 days of float.

D) $10 million dollars worth of checks with an average of 5 days of float.

A) $100 million dollars worth of checks with an average of 5 days of float.

B) $20 million dollars worth of checks with an average of 5 days of float.

C) $10 million dollars worth of checks with an average of 20 days of float.

D) $10 million dollars worth of checks with an average of 5 days of float.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

46

The difference between a lockbox system and a mail-based system is

A) that a mail-based system is more secure.

B) that a lockbox system is really a post office box that is emptied by the firm's bank.

C) that a lockbox system requires a larger in-house collection system for the firm.

D) none of the above.

A) that a mail-based system is more secure.

B) that a lockbox system is really a post office box that is emptied by the firm's bank.

C) that a lockbox system requires a larger in-house collection system for the firm.

D) none of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

47

The primary role of the cash manager

A) on the collections side is to minimize collection float and to maximize float on the payments side.

B) on the collections side is to maximize collection float and to minimize float on the payments side.

C) on the collections side is to maximize collection float and to maximize float on the payments side.

D) none of the above.

A) on the collections side is to minimize collection float and to maximize float on the payments side.

B) on the collections side is to maximize collection float and to minimize float on the payments side.

C) on the collections side is to maximize collection float and to maximize float on the payments side.

D) none of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

48

The Barrell Company is approached by a bank that offers to implement a lockbox system of receipts for the firm.If the new system is implemented,it will reduce float by 6 days per year.If Barrell's cost of capital is 11.5% and its annual sales are expected to be $10,00,000,then what is the maximum amount that Barrell is willing to pay for the lockbox system?

A) $1,890.41

B) $18,904.11

C) $164,438.56

D) $1,150,000.00

A) $1,890.41

B) $18,904.11

C) $164,438.56

D) $1,150,000.00

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

49

Coyote Valley Products has daily cash collections of $500,000. The cash management staff has determined (1) customers' payments are in the mail an average of 3 days; (2) processing after receipt averages 1 day; and (3) after deposit funds are cleared on average in 2 days. Assume a 365 day year.

If Coyote Valley Products faces an 8% opportunity cost of funds,what is the most it would pay to implement a lock-box system that reduces collection float by 2 days?

A) $40,000

B) $60,000

C) $80,000

D) $100,000

If Coyote Valley Products faces an 8% opportunity cost of funds,what is the most it would pay to implement a lock-box system that reduces collection float by 2 days?

A) $40,000

B) $60,000

C) $80,000

D) $100,000

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

50

Dilly Deli, Inc., a nation-wide chain of deli-style restaurants, has built a $34,000 balance in one of its regional bank accounts. It wishes to move $30,000 to its main concentration account. A DTC cost $1.50 and requires 3 days to clear; an EDT costs $3.00 but requires only 1 day to clear; and a wire transfer costs $15 and clears the same day. Dilly Deli, Inc. can earn 7% on short term investments.

If the earnings rate for Dilly Deli,Inc.is 3%,which of the following is true?

A) The wire transfer dominates both the DTC and EDT.

B) The wire transfer dominates the EDT but not the DTC.

C) The DTC dominates both the EDT and the wire transfer.

D) The EDT dominates the DTC and the wire transfer.

If the earnings rate for Dilly Deli,Inc.is 3%,which of the following is true?

A) The wire transfer dominates both the DTC and EDT.

B) The wire transfer dominates the EDT but not the DTC.

C) The DTC dominates both the EDT and the wire transfer.

D) The EDT dominates the DTC and the wire transfer.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

51

Coyote Valley Products has daily cash collections of $500,000. The cash management staff has determined (1) customers' payments are in the mail an average of 3 days; (2) processing after receipt averages 1 day; and (3) after deposit funds are cleared on average in 2 days. Assume a 365 day year.

Coyote Valley's bank,Grand Lake National,proposes a lock-box collection and processing arrangement that will reduce collection float by 2 days.If the system will cost Coyote Valley $115,000 per year,what is the minimum opportunity cost of funds that would make the system beneficial?

A) 23.0%

B) 15.6%

C) 19.8%

D) 11.5%

Coyote Valley's bank,Grand Lake National,proposes a lock-box collection and processing arrangement that will reduce collection float by 2 days.If the system will cost Coyote Valley $115,000 per year,what is the minimum opportunity cost of funds that would make the system beneficial?

A) 23.0%

B) 15.6%

C) 19.8%

D) 11.5%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

52

Coyote Valley Products has daily cash collections of $500,000. The cash management staff has determined (1) customers' payments are in the mail an average of 3 days; (2) processing after receipt averages 1 day; and (3) after deposit funds are cleared on average in 2 days. Assume a 365 day year.

What would be the benefit of a lock-box system that reduced mail float by 1.5 days,eliminated processing float,and reduced clearing float by 1 day,if Coyote Valley Products faces a 9% opportunity cost of funds?

A) $112,500

B) $157,500

C) $180,000

D) $67,500

What would be the benefit of a lock-box system that reduced mail float by 1.5 days,eliminated processing float,and reduced clearing float by 1 day,if Coyote Valley Products faces a 9% opportunity cost of funds?

A) $112,500

B) $157,500

C) $180,000

D) $67,500

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

53

Liquidity management involves

A) earning a positive return on idle excess cash balances.

B) obtaining low-cost financing for meeting unexpected needs and seasonal cash shortages.

C) maintaining the greatest degree of liquidity possible for the firm's assets.

D) both a and b

A) earning a positive return on idle excess cash balances.

B) obtaining low-cost financing for meeting unexpected needs and seasonal cash shortages.

C) maintaining the greatest degree of liquidity possible for the firm's assets.

D) both a and b

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

54

Coyote Valley Products has daily cash collections of $500,000. The cash management staff has determined (1) customers' payments are in the mail an average of 3 days; (2) processing after receipt averages 1 day; and (3) after deposit funds are cleared on average in 2 days. Assume a 365 day year.

Refer to Coyote Valley Products.What is the firm's collection float,in days?

A) 6

B) 5

C) 4

D) 3

Refer to Coyote Valley Products.What is the firm's collection float,in days?

A) 6

B) 5

C) 4

D) 3

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

55

Currently,a $1 million,91-day T-bill sells at a 2.5% discount.What is the money market yield?

A) 2.500%

B) 2.516%

C) 2.551%

D) 2.532%

A) 2.500%

B) 2.516%

C) 2.551%

D) 2.532%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

56

Funds that have been sent by the payer but are not yet usable funds to the payee are

A) float.

B) overdrawn funds.

C) still available for the use of the payer.

D) none of the above.

A) float.

B) overdrawn funds.

C) still available for the use of the payer.

D) none of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

57

Suppose the cash manager of Smart Products just bought a 91-day T-bill for $992,416.67.What are the discount and bond equivalent yields on this security?

A) 3.06%, 3.03%

B) 3.03%, 3.06%

C) 3.00%, 3.06%

D) 3.00%, 3.03%

A) 3.06%, 3.03%

B) 3.03%, 3.06%

C) 3.00%, 3.06%

D) 3.00%, 3.03%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

58

The primary role(s)of the cash manager is

A) to manage the cash flow time line related to collection of funds.

B) to manage the cash flow time line related to concentration of funds.

C) to manage the cash flow time line related to disbursement of funds.

D) all of the above

A) to manage the cash flow time line related to collection of funds.

B) to manage the cash flow time line related to concentration of funds.

C) to manage the cash flow time line related to disbursement of funds.

D) all of the above

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

59

Dilly Deli, Inc., a nation-wide chain of deli-style restaurants, has built a $34,000 balance in one of its regional bank accounts. It wishes to move $30,000 to its main concentration account. A DTC cost $1.50 and requires 3 days to clear; an EDT costs $3.00 but requires only 1 day to clear; and a wire transfer costs $15 and clears the same day. Dilly Deli, Inc. can earn 7% on short term investments.

Refer to Dilly Deli.Again assume short term investments can earn 7%.What is the minimum amount that needs to be transferred in order to make the wire transfer more cost effective than the EDT?

A) $62,751

B) $78,214

C) $70,393

D) $66,482

Refer to Dilly Deli.Again assume short term investments can earn 7%.What is the minimum amount that needs to be transferred in order to make the wire transfer more cost effective than the EDT?

A) $62,751

B) $78,214

C) $70,393

D) $66,482

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

60

Currently,a 91-day Treasury bill sells at a 2.5% discount.What is the price of a $1 million investment?

A) $993,967.12

B) $871,250.00

C) $993,750.00

D) $993,680.56

A) $993,967.12

B) $871,250.00

C) $993,750.00

D) $993,680.56

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

61

Near-cash assets in the form of short-term investments are often called

A) marketable securities.

B) corporate bonds.

C) treasury notes.

D) treasury bonds.

A) marketable securities.

B) corporate bonds.

C) treasury notes.

D) treasury bonds.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements concerning mail-based collection systems is true?

A) Regardless of recent developments in payment processing equipment, it is still too expensive for smaller companies to use mail-based collection systems.

B) Generally it is cheaper for high-volume processors to use the lockbox system rather than mail-based collection systems.

C) Low-volume processors may find that using a lockbox system is more cost effective than a mail-based collection system.

D) All of the above statements are true.

E) Only (a) and (b) are true.

A) Regardless of recent developments in payment processing equipment, it is still too expensive for smaller companies to use mail-based collection systems.

B) Generally it is cheaper for high-volume processors to use the lockbox system rather than mail-based collection systems.

C) Low-volume processors may find that using a lockbox system is more cost effective than a mail-based collection system.

D) All of the above statements are true.

E) Only (a) and (b) are true.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is not a benefit of using EIPP in the business-to-business market?

A) Reduced float to the receiving party

B) Lower cost of receivables processing for the receiver and payment initiation and reconciliation costs for the payer

C) Better forecasting for both receiver and payer

D) Lower cost of receivables processing for the payer and payment initiation and reconciliation costs for the receiver.

E) All of the above are benefits

A) Reduced float to the receiving party

B) Lower cost of receivables processing for the receiver and payment initiation and reconciliation costs for the payer

C) Better forecasting for both receiver and payer

D) Lower cost of receivables processing for the payer and payment initiation and reconciliation costs for the receiver.

E) All of the above are benefits

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is not an advantage of cash concentration?

A) It creates a large pool of funds for use in making short-term cash investments.

B) Concentrating the firm's cash in one account improves the tracking and internal control of the firm's cash.

C) It results in having fewer investment opportunities to choose from.

D) All of the above are advantages.

A) It creates a large pool of funds for use in making short-term cash investments.

B) Concentrating the firm's cash in one account improves the tracking and internal control of the firm's cash.

C) It results in having fewer investment opportunities to choose from.

D) All of the above are advantages.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

65

An unsigned check drawn on one of the firm's bank accounts and deposited in another of the firm's bank accounts is

A) an automated clearinghouse debit transfer.

B) a depository transfer check.

C) a wire transfer.

D) none of the above.

A) an automated clearinghouse debit transfer.

B) a depository transfer check.

C) a wire transfer.

D) none of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

66

A bank service that provides early notification of checks that will be presented against a company's account on a given day is called

A) a controlled disbursement.

B) a positive pay disbursement.

C) an integrated accounts payable.

D) none of the above.

A) a controlled disbursement.

B) a positive pay disbursement.

C) an integrated accounts payable.

D) none of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

67

A preauthorized electronic withdrawal for the payer's account is known as

A) a depository transfer check.

B) an automated clearinghouse debit transfer.

C) a wire transfer.

D) none of the above.

A) a depository transfer check.

B) an automated clearinghouse debit transfer.

C) a wire transfer.

D) none of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

68

A supplier has offered you credit terms of 3/10 net 30.What is the implied rate of interest in the terms?

A) 56.44%

B) 37.08%

C) 5.69%

D) 3.09%

A) 56.44%

B) 37.08%

C) 5.69%

D) 3.09%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

69

You are offered credit terms of 1/20 net 45.What is the implied rate of interest by the discount?

A) 1.01%

B) 12.12%

C) 14.75%

D) 25.25%

A) 1.01%

B) 12.12%

C) 14.75%

D) 25.25%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

70

You need to decide whether your firm should transfer funds from a deposit account to a transfer account via EDT that will cost $2 or via a wire transfer that will cost $20.It is a Friday so the wire transfer will save you 3 days of float.If your cost of capital is 8%,then how large must the transfer be in order to be indifferent between the wire and the ADT? round to the nearest dollar.

A) $82,125

B) $30,417

C) $27,375

D) $3,042

A) $82,125

B) $30,417

C) $27,375

D) $3,042

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

71

A component of the average payment period is

A) the time from the purchase of raw materials until the firm places the payment in the mail.

B) the time it takes after the firm places its payment in the mail until the supplier has withdrawn funds from the firm's account.

C) both a and b

D) either a or b

A) the time from the purchase of raw materials until the firm places the payment in the mail.

B) the time it takes after the firm places its payment in the mail until the supplier has withdrawn funds from the firm's account.

C) both a and b

D) either a or b

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

72

Your cost of capital is 8% and you are offered a discount of 1% for early payment,otherwise the entire amount is due in 60 days.How many days after purchase will cause you to be indifferent between taking the discount and not taking the discount?

A) 46.08 days

B) 21.69 days

C) 13.91 days

D) 60 days

A) 46.08 days

B) 21.69 days

C) 13.91 days

D) 60 days

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

73

A 60-day treasury bill is priced at a 4% discount rate.What is the bond-equivalent yield of the security?

A) 4.00%

B) 4.03%

C) 4.08%

D) 6.67%

A) 4.00%

B) 4.03%

C) 4.08%

D) 6.67%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

74

What is the money market yield for a one-year treasury bill that is priced at a 4% discount?

A) 3.83%

B) 4%

C) 4.17%

D) 4.22%

A) 3.83%

B) 4%

C) 4.17%

D) 4.22%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

75

The primary purpose of the accounts payable function

A) is to examine all incoming invoices and determine the proper amount to be paid.

B) is to generate float for the firm.

C) is to pay invoices as soon as possible.

D) none of the above.

A) is to examine all incoming invoices and determine the proper amount to be paid.

B) is to generate float for the firm.

C) is to pay invoices as soon as possible.

D) none of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

76

Your cost of capital is 16% and you are offered credit terms of 1/10 net 60.Do you take the discount or not and why?

A) you take the discount because 7.37% is less than 16%

B) you do not take the discount because 7.37% is less than 16%

C) you take the discount because 23.37% is greater than 16%

D) you do not take the discount because 7.37% is less than 16.0%

A) you take the discount because 7.37% is less than 16%

B) you do not take the discount because 7.37% is less than 16%

C) you take the discount because 23.37% is greater than 16%

D) you do not take the discount because 7.37% is less than 16.0%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

77

Your firm is expected to have $15,000,000 in sales next year and its cost of capital is 13.5%.How many days of float will a lockbox system have to save you in order to pay for a system that will cost your firm $27,740 per year?

A) 2 days

B) 3 days

C) 4 days

D) 5 days

A) 2 days

B) 3 days

C) 4 days

D) 5 days

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

78

National Groceries chooses to have it local stores make payments on their own payables.National utilizes a

A) centralized payment system.

B) fragmented payment system.

C) decentralized payment system.

D) none of the above.

A) centralized payment system.

B) fragmented payment system.

C) decentralized payment system.

D) none of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements is a detailed invoice listing all checks cleared,account charges,lockbox charges,electronic transactions,etc.?

A) bank statement

B) bank account analysis statement

C) reconciliation statement

D) financial statement

E) none of the above

A) bank statement

B) bank account analysis statement

C) reconciliation statement

D) financial statement

E) none of the above

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following can be thought of as an electronic DTC?

A) Wire transfer

B) Automated Clearinghouse Debit Transfer

C) Concentrated banking

D) Field-banking system

E) None of the above

A) Wire transfer

B) Automated Clearinghouse Debit Transfer

C) Concentrated banking

D) Field-banking system

E) None of the above

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck