Deck 15: Financial Planning

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

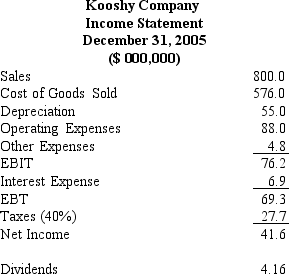

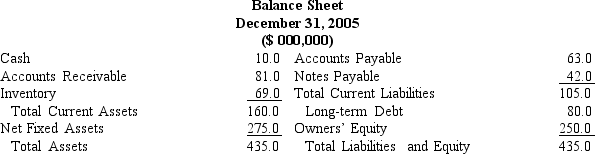

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/95

Play

Full screen (f)

Deck 15: Financial Planning

1

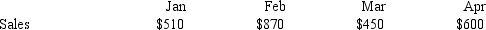

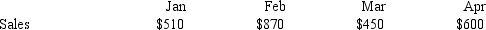

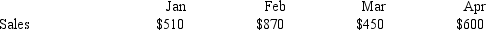

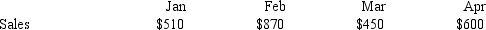

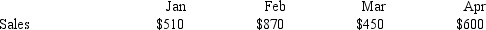

Bavarian Brew's schedule of projected cash disbursement

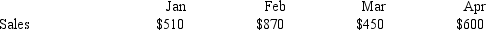

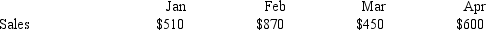

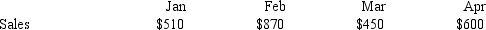

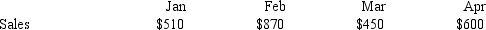

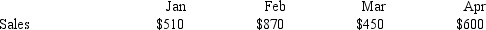

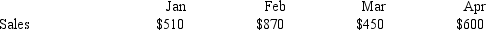

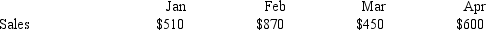

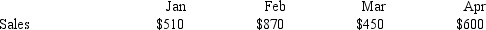

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

What is the value of Bavarian Brew's receivables account at the end of February?

A) $1074

B) $306

C) $204

D) $348

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.What is the value of Bavarian Brew's receivables account at the end of February?

A) $1074

B) $306

C) $204

D) $348

$1074

2

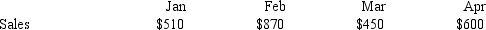

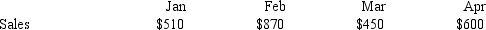

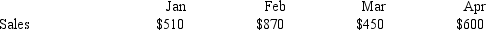

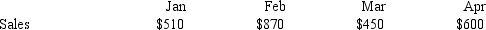

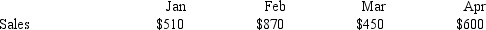

Bavarian Brew's schedule of projected cash disbursement

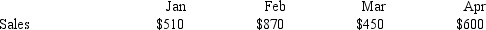

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

What are the cash disbursements for February? Assume Bavarian Brew had sales of $490 in December.

A) $598.25

B) $773.25

C) $548.25

D) $419.65

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.What are the cash disbursements for February? Assume Bavarian Brew had sales of $490 in December.

A) $598.25

B) $773.25

C) $548.25

D) $419.65

$773.25

3

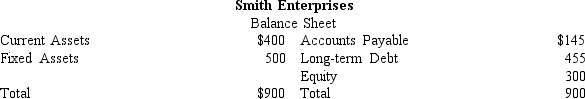

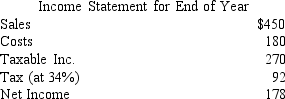

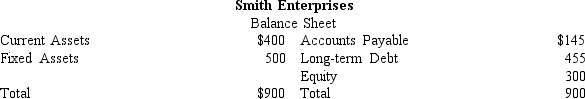

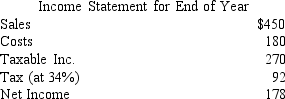

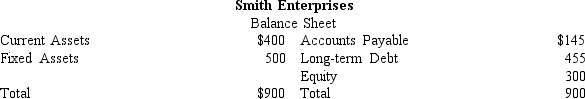

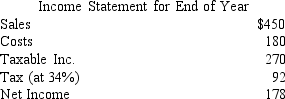

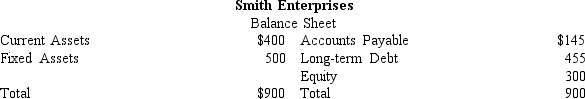

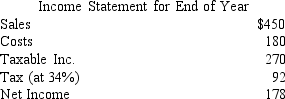

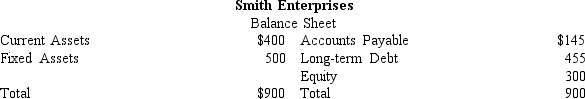

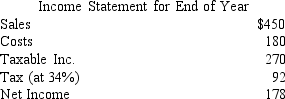

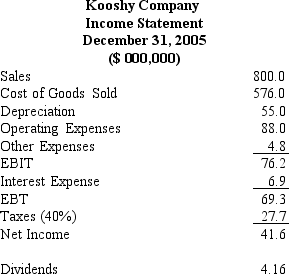

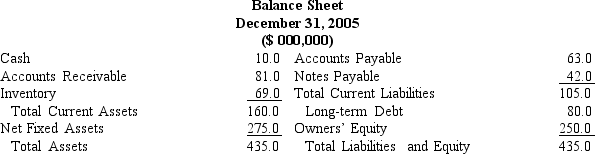

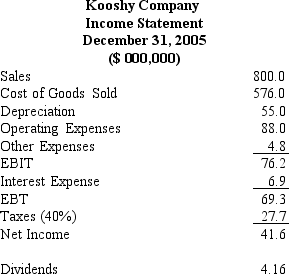

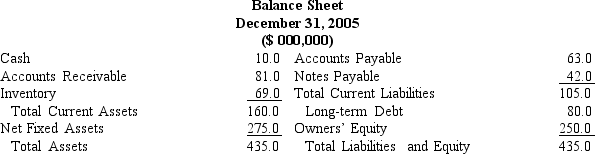

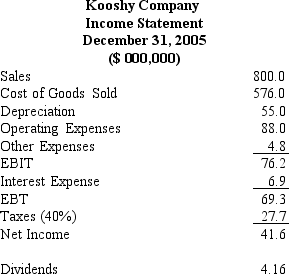

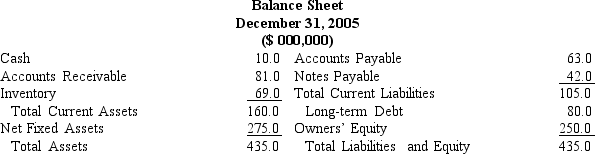

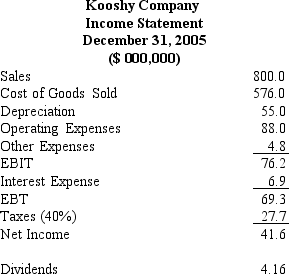

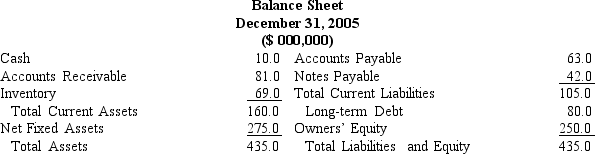

What is Smith's sustainable growth rate if the company has a dividend payout ratio of 75%?

A) 21.70%

B) 25.00%

C) 17.44%

D) 13.58%

17.44%

4

The statement of the firm's planned inflows and outflows of cash is called a(n)

A) income statement

B) balance sheet

C) cash budget

D) none of the above

A) income statement

B) balance sheet

C) cash budget

D) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

5

Bavarian Brew's schedule of projected cash disbursement

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

What is the value of the Bavarian Brew's accounts payable at the end of February? Assume the company had sales of $490 in December.

A) $688.50

B) $738.50

C) $638.50

D) $869.00

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.What is the value of the Bavarian Brew's accounts payable at the end of February? Assume the company had sales of $490 in December.

A) $688.50

B) $738.50

C) $638.50

D) $869.00

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

6

If Smith pays out 25% of their projected net income as dividends,what will be the company's addition to retained earnings,if sales grow by 25% and all items on the income statement grow proportionally with sales?

A) $222.75

B) $55.68

C) $167.07

D) $107.25

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

7

If Smith pays out 75% of net income as dividends and sales are expected to grow by 25%,what are the external funds required?

A) $133.06

B) $66.88

C) $121.88

D) $225.58

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

8

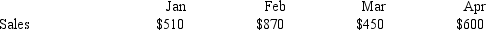

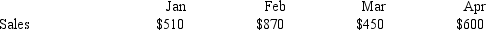

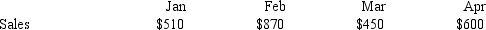

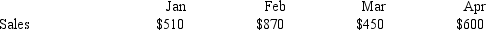

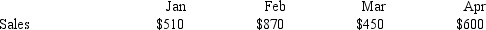

Bavarian Brew's schedule of projected cash disbursement

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

What are the Bavarian Brew's cash collections in April?

A) $528

B) $618

C) $702

D) $835

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.What are the Bavarian Brew's cash collections in April?

A) $528

B) $618

C) $702

D) $835

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

9

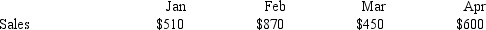

Bavarian Brew's schedule of projected cash disbursement

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

What is the value of Bavarian Brew's accounts payable at the end of April?

A) $346.63

B) $500.63

C) $1,000.63

D) $754.63

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.What is the value of Bavarian Brew's accounts payable at the end of April?

A) $346.63

B) $500.63

C) $1,000.63

D) $754.63

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

10

If sales are expected to grow at 15% what are Smith's retained earnings next year? Assume a constant profit margin and a dividend payout ratio of 50%.

A) $123.05

B) $246.10

C) $213.99

D) $102.47

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

11

A sales forecast that relies heavily on macroeconomic and industry forecasts is called a

A) top-down forecast

B) bottom-up forecast

C) plug figure

D) none of the above

A) top-down forecast

B) bottom-up forecast

C) plug figure

D) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

12

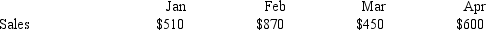

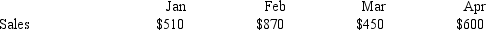

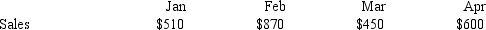

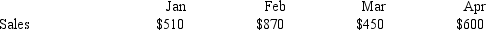

Bavarian Brew's schedule of projected cash disbursement

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

What is the value of Bavarian Brew's receivables at the end of April?

A) $780

B) $180

C) $600

D) $270

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.What is the value of Bavarian Brew's receivables at the end of April?

A) $780

B) $180

C) $600

D) $270

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

13

The short-term financing strategy where a company relies heavily on short term borrowing to finance a portion of their long term growth is called a(n)

A) conservative strategy

B) aggressive strategy

C) matching strategy

D) growth strategy

A) conservative strategy

B) aggressive strategy

C) matching strategy

D) growth strategy

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

14

Bavarian Brew's schedule of projected cash disbursement

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

What is the value of Bavarian Brew's accounts payable at the end of March?

A) $515.25

B) $755.25

C) $1,515.25

D) $1,015.25

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.What is the value of Bavarian Brew's accounts payable at the end of March?

A) $515.25

B) $755.25

C) $1,515.25

D) $1,015.25

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

15

Bavarian Brew's schedule of projected cash disbursement

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

What are Bavarian Brew's cash collections in March?

A) $726

B) $654

C) $324

D) $522

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.What are Bavarian Brew's cash collections in March?

A) $726

B) $654

C) $324

D) $522

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

16

Bavarian Brew's schedule of projected cash disbursement

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

Due to a change in economic conditions Bavarian Brew will only be able to collect 40% of its March sales in April.What is the effect on the company's cash receipts in April as a result of this change?

A) cash receipts decline by $180

B) cash receipts decline by $90

C) cash receipts increase by $270

D) cash receipts increase by $90

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.Due to a change in economic conditions Bavarian Brew will only be able to collect 40% of its March sales in April.What is the effect on the company's cash receipts in April as a result of this change?

A) cash receipts decline by $180

B) cash receipts decline by $90

C) cash receipts increase by $270

D) cash receipts increase by $90

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

17

The growth rate at which a company can grow without issuing new shares of common stock while maintaining a constant total asset turnover and equity multiplier is called a(n)

A) internal growth rate

B) sustainable growth rate

C) optimal growth rate

D) maximal growth rate

A) internal growth rate

B) sustainable growth rate

C) optimal growth rate

D) maximal growth rate

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

18

Bavarian Brew's schedule of projected cash disbursement

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

What are Bavarian Brew's cash disbursements in April?

A) $1,1046.63

B) $729.63

C) $679.63

D) $1,229.63

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.What are Bavarian Brew's cash disbursements in April?

A) $1,1046.63

B) $729.63

C) $679.63

D) $1,229.63

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

19

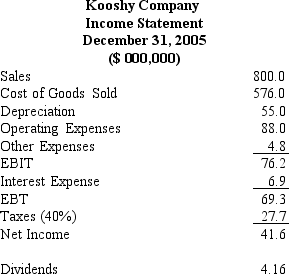

Using the percentage of sales method what will be Smith's net income if sales are expected to increase by 25%?

A) $222.75

B) $562.50

C) $225.00

D) $337.50

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

20

The method in which pro forma statements are constructed by assuring that all items grow in proportion to sales is called the

A) percentage of sales method

B) common size method

C) sales dilution method

D) sales receipt method

A) percentage of sales method

B) common size method

C) sales dilution method

D) sales receipt method

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

21

Bavarian Brew's schedule of projected cash disbursement

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

If Bavarian Brew starts the year with a cash balance of $500,what is the cash balance at the end of January? Assume that December sales were $450 and November sales were $550.

A) $483

B) $493

C) $497

D) $500

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

If Bavarian Brew starts the year with a cash balance of $500,what is the cash balance at the end of January? Assume that December sales were $450 and November sales were $550.

A) $483

B) $493

C) $497

D) $500

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose a firm forecasts sales growth larger than its sustainable growth rate,but plans to add fewer assets than the current asset to sales ratio implies.If other aspects of the firm's performance remain constant,the pro forma external funds required (EFR)

A) will likely be larger than the sustainable growth rate implies.

B) will likely be smaller than the sustainable growth rate implies.

C) will likely be the same as the sustainable growth rate implies.

D) cannot be determined from this information.

A) will likely be larger than the sustainable growth rate implies.

B) will likely be smaller than the sustainable growth rate implies.

C) will likely be the same as the sustainable growth rate implies.

D) cannot be determined from this information.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

23

If Kooshy Company forecasts a 20% sales increase,what will its pro forma cost of goods sold be,assuming it remains at the same percent of sales?

A) $576

B) $635

C) $691

D) $720

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

24

MoMoney Co.wants to increase its sustainable growth rate to 10%.If it maintains its 15% profit margin,25% retention ratio,and 0.25 liabilities to equity ratio,what must its total asset turnover value be?

A) 0.42

B) 0.65

C) 1.94

D) 2.37

A) 0.42

B) 0.65

C) 1.94

D) 2.37

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

25

Bavarian Brew's schedule of projected cash disbursement

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

What are Bavarian Brew's cash disbursements in March?

A) $1,128.25

B) $510.75

C) $750.75

D) $1,260.75

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.What are Bavarian Brew's cash disbursements in March?

A) $1,128.25

B) $510.75

C) $750.75

D) $1,260.75

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

26

DigIt! Corporation has the following financial information: its profit margin is 10%,its total asset turnover is 1.75,its assets to equity ratio is 1.5,and it pays out 35% of its earnings in dividends.What is its sustainable growth rate?

A) 22.10%

B) 20.57%

C) 9.75%

D) 47.39%

A) 22.10%

B) 20.57%

C) 9.75%

D) 47.39%

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

27

DigIt! Corporation has the following financial characteristics: its profit margin is 10%,its total asset turnover is 1.75,its asset to equity ratio is 1.5 and its sustainable growth rate is 20.6%.What dividend payout ratio is consistent with these values?

A) 45%

B) 55%

C) 65%

D) 35%

A) 45%

B) 55%

C) 65%

D) 35%

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

28

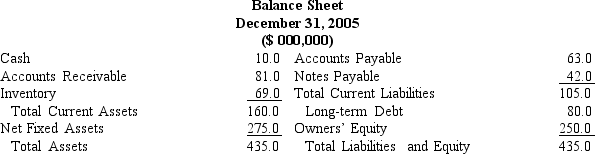

Suppose Kooshy wishes to maintain a minimum $10 million cash balance,accounts receivable are forecast to be 15% of sales,and inventory is expected to be 12% of forecast sales.Also,the firm plans to add $35 million to fixed assets (depreciate the additional assets over seven years).What is the pro forma level of total assets if sales are forecasted to increase 20%?

A) $487

B) $435

C) $519

D) $615

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose a firm experiences a seasonal pattern in its sales,in addition to a long-term upward trend.Which of the following financing plans has the potential to be less risky to the firm?

A) a conservative strategy

B) an aggressive strategy

C) a matching strategy

D) They are equally likely to be low-risk.

A) a conservative strategy

B) an aggressive strategy

C) a matching strategy

D) They are equally likely to be low-risk.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

30

Kooshy Company wishes to maintain its dividend policy in the upcoming year.What will be the pro forma addition to retained earnings if sales are forecasted to increase 20% and all costs are proportional to sales?

A) $5

B) $37

C) $50

D) $45

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

31

The rate at which a firm can grow without issuing any new shares of stock while keeping its dividend policy,financial policy,and profitability constant is the

A) optimal growth rate

B) marginal growth rate

C) sustainable growth rate

D) theoretical growth rate

A) optimal growth rate

B) marginal growth rate

C) sustainable growth rate

D) theoretical growth rate

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

32

Bavarian Brew's schedule of projected cash disbursement

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

Due to a change in economic conditions Bavarian Brew will only be able to collect 40% of its March sales in April.What is company's cash net cash flow in April as a result of this change?

A) $528

B) $1229.63

C) -$701.63

D) $701.63

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

Due to a change in economic conditions Bavarian Brew will only be able to collect 40% of its March sales in April.What is company's cash net cash flow in April as a result of this change?

A) $528

B) $1229.63

C) -$701.63

D) $701.63

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose a firm experiences a seasonal pattern in its sales,in addition to a long-term upward trend.Which of the following financing plans has the potential to be less costly to the firm?

A) a conservative strategy

B) an aggressive strategy

C) a matching strategy

D) they are equally likely to be low-cost

A) a conservative strategy

B) an aggressive strategy

C) a matching strategy

D) they are equally likely to be low-cost

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

34

Refer to Kooshy.Suppose pro forma net income is $50 and pro forma total assets are $525.If accounts payable maintain the same percent of sales,no new long term debt is issued,and the only addition to owners' equity is to retained earnings,what will be the pro forma balance in notes payable for a forecasted 20% increase in sales? (That is,use notes payable as the balancing account.)

A) $39

B) $74

C) $83

D) $4

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

35

Bavarian Brew's schedule of projected cash disbursement

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

What is Bavarian Brew's expected net cash flow in March?

A) -$402.25

B) $402.25

C) $726

D) -$1,128.25

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

What is Bavarian Brew's expected net cash flow in March?

A) -$402.25

B) $402.25

C) $726

D) -$1,128.25

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

36

Big Deal,Inc.wants to grow 30% next year.If it maintains its 40% dividend payout ratio,liabilities to equity ratio of 1,and total asset turnover of 2,what must its profit margin be to achieve this growth?

A) 9.6%

B) 25.8%

C) 38.5%

D) 51.2%

A) 9.6%

B) 25.8%

C) 38.5%

D) 51.2%

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

37

A firm can grow more rapidly if (consider each in isolation):

A) it pays larger dividends.

B) it uses less debt.

C) its asset to sales ratio is larger.

D) its profit margin is larger.

A) it pays larger dividends.

B) it uses less debt.

C) its asset to sales ratio is larger.

D) its profit margin is larger.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

38

Bavarian Brew's schedule of projected cash disbursement

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

If the cash balance at the beginning of March is $250,what is Bavarian Brew's cash balance at the end of the month?

A) $250

B) -$152.25

C) $652.25

D) -$652.25

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.

All of Bavarian Brew's sales are credit sales. The company collects 60% of its sales in the next month and the remainder in the month after that.The company's purchases are 75% of its sales. Of those purchases 15% are paid in cash, 50% are paid in the following month and the remainder in the month after that. The company's wages and salaries equal 15% of sales each month plus $50. Taxes of $125 are due in April. The company is going to purchase new machinery worth $1000 in March and pay 50% right away and the rest in April. In addition, the company will pay a $175 dividend in February.

If the cash balance at the beginning of March is $250,what is Bavarian Brew's cash balance at the end of the month?

A) $250

B) -$152.25

C) $652.25

D) -$652.25

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

39

If a company has a liabilities to equity ratio of 0.5,then its assets to equity ratio is

A) 0.5

B) 1.0

C) 1.5

D) 2.0

A) 0.5

B) 1.0

C) 1.5

D) 2.0

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following most likely is not a question asked in long-term financial planning?

A) What threats to our current business exist?

B) What is (are) our core competency(ies)?

C) Can we do better by leaving markets (selling assets) and investing elsewhere?

D) Should we acquire new vending machines for the employees' breakrooms?

A) What threats to our current business exist?

B) What is (are) our core competency(ies)?

C) Can we do better by leaving markets (selling assets) and investing elsewhere?

D) Should we acquire new vending machines for the employees' breakrooms?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

41

Silly Sally, Inc.

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

What is Silly Sally's change in cash for March?

A) $40 increase in cash

B) $40 decrease in cash

C) $85 increase in cash

D) $20 increase in cash

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

What is Silly Sally's change in cash for March?

A) $40 increase in cash

B) $40 decrease in cash

C) $85 increase in cash

D) $20 increase in cash

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

42

In the year just ended,Ellie May's Power Tools had net income of $200,000 based upon a sales level of $1,500,000.It's total assets are $800,000 while its total equity is $700,000.If Ellie May pays out 0% of its net income in dividends,then what is the firm's sustainable growth rate going forward?

A) .40%

B) 38%

C) 40%

D) none of the above

A) .40%

B) 38%

C) 40%

D) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

43

Consider the following information for Smart Products: total assets=$1000; sales=$1540; net profit margin=12%; dividend payout ratio=40%; accounts payable=$308.If sales are forecast to increase 30%,what is the "short cut" estimate of external funds required (EFR)?

A) $64

B) $208

C) $300

D) $462

A) $64

B) $208

C) $300

D) $462

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

44

Using ratios derived from the income statement and balance sheet above,what is Kooshy Company's sustainable growth rate?

A) 10.6%

B) 17.7%

C) 20.00%

D) 8.1%

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

45

The responsibility to assess the feasibility of a strategic plan given a firm's existing and prospective sources of funding falls primarily to the

A) senior management of the firm.

B) finance function within the firm.

C) accounting function within the firm.

D) marketing function within the firm.

A) senior management of the firm.

B) finance function within the firm.

C) accounting function within the firm.

D) marketing function within the firm.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following make(s)the planning process more complex than simply accepting all projects that look promising?

A) limits on capital

B) limits on production capacity

C) limits on human resources

D) all of the above

A) limits on capital

B) limits on production capacity

C) limits on human resources

D) all of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

47

Silly Sally, Inc.

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

Refer to Silly Sally,Inc.What are forecasted total cash collection for January?

A) $420

B) $442

C) $168

D) $240

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

Refer to Silly Sally,Inc.What are forecasted total cash collection for January?

A) $420

B) $442

C) $168

D) $240

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

48

A top-down approach to sales forecasting begins with

A) a firmwide sales objective.

B) a departmental head forecast.

C) a talk with the customer.

D) none of the above.

A) a firmwide sales objective.

B) a departmental head forecast.

C) a talk with the customer.

D) none of the above.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

49

Silly Sally, Inc.

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

Suppose Silly Sally,Inc.forecasts an ending cash balance of $20,its minimum desired balance,in January.If February's forecasted cash expenditures are $400,which of the following describes the changes to Silly Sally's cash balance and level of borrowing,if any,related to its minimum cash balance,at the end of February?

A) net cash flows of $21; borrowing will increase $21

B) net cash flows of $21; borrowing will decrease $21

C) net cash flows of $11; borrowing will increase $9

D) net cash flows of $11; borrowing will decrease $9

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

Suppose Silly Sally,Inc.forecasts an ending cash balance of $20,its minimum desired balance,in January.If February's forecasted cash expenditures are $400,which of the following describes the changes to Silly Sally's cash balance and level of borrowing,if any,related to its minimum cash balance,at the end of February?

A) net cash flows of $21; borrowing will increase $21

B) net cash flows of $21; borrowing will decrease $21

C) net cash flows of $11; borrowing will increase $9

D) net cash flows of $11; borrowing will decrease $9

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

50

Consider the following information for Smart Products: total assets=$1000; sales=$1540; net profit margin=12%; dividend payout ratio=40%; equity=$555.What is Smart Products' sustainable growth rate?

A) 7%

B) 13%

C) 25%

D) 52%

A) 7%

B) 13%

C) 25%

D) 52%

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

51

Financial planning encompasses all but the following:

A) setting long-run strategic goals

B) investing the firms long-term cash

C) preparing quarterly and annual budgets

D) all of the above

A) setting long-run strategic goals

B) investing the firms long-term cash

C) preparing quarterly and annual budgets

D) all of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

52

Silly Sally, Inc.

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

Refer to Silly Sally,Inc.What is the forecasted amount to be collected from cash sales in March?

A) $450

B) $360

C) $261

D) $180

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

Refer to Silly Sally,Inc.What is the forecasted amount to be collected from cash sales in March?

A) $450

B) $360

C) $261

D) $180

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

53

For the prior year,Billy Bob's Dress Shop had a net profit margin of 5% based upon a sales level of $100,000.It's total assets are $1,000,000 while its total equity is $300,000.If Billy Bob pays out 50% of its net income in dividends,then what is the firm's sustainable growth rate going forward?

A) .84%

B) 8.00%

C) 8.40%

D) none of the above

A) .84%

B) 8.00%

C) 8.40%

D) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

54

Increases in assets must be accompanied by

A) an increase in liabilities.

B) an increase in owners equity.

C) equal amounts of a) and b).

D) some combination of a) and b).

A) an increase in liabilities.

B) an increase in owners equity.

C) equal amounts of a) and b).

D) some combination of a) and b).

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

55

Using ratios derived from the income statement and balance sheet above,what is Kooshy Company's "shorthand" estimate of external funds required (EFR)for a 20% increase in sales?

A) -$4

B) $0

C) $29

D) $160

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

56

Silly Sally, Inc.

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

What are Silly Sally's forecasted cash outflows for February?

A) $270

B) $330

C) $395

D) $450

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

What are Silly Sally's forecasted cash outflows for February?

A) $270

B) $330

C) $395

D) $450

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

57

The multiyear action plan for the major investments and competitive initiative that the firm's managers believe will drive the future success of the enterprise is called

A) the firm's rollout plan.

B) the tactical plan.

C) the strategic plan.

D) none of the above.

A) the firm's rollout plan.

B) the tactical plan.

C) the strategic plan.

D) none of the above.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

58

Silly Sally, Inc.

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

Suppose Silly Sally experiences a change in customer payment patterns in accounts receivable,so that payments are now 30% in cash,and of the credit sales,60% are collected in one month,35% are collected in the second month,with the rest uncollected.What is the new forecasted collection for January,and how much is this different from the original forecast?

A) $408; $72 higher

B) $336; $93 lower

C) $442; $13 higher

D) $429; $13 lower

Silly Sally, Inc. forecasts the following sales levels: January, $420; February, $435; March, $450; and April, $470. Historically, 40% of its sales are for cash. Of the remaining sales, 80% are collected in one month, 15% are collected in the second month, while the rest remain uncollected. November sales were $380 and December sales were $500. (all values $000)

Purchases are made at 60% of the next month's sales forecast, and are paid for in the month of purchase. Other cash outlays are: rent, $10 monthly; wages and salaries, $50 monthly; a tax payment of $30 in March; an interest payment of $15 in March; and a planned purchase of $20 of new fixed assets in January.

Suppose Silly Sally experiences a change in customer payment patterns in accounts receivable,so that payments are now 30% in cash,and of the credit sales,60% are collected in one month,35% are collected in the second month,with the rest uncollected.What is the new forecasted collection for January,and how much is this different from the original forecast?

A) $408; $72 higher

B) $336; $93 lower

C) $442; $13 higher

D) $429; $13 lower

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

59

With regard to planning,the first priority for a firm that competes by achieving lowest cost production might be

A) to determine whether it should make additional investments in order to achieve even greater production efficiencies.

B) to assess whether new or expanded marketing programs might increase the value of the brand relative to those of competitors.

C) to intensify its efforts to further discriminate its brand from that of its competitors.

D) all of the above.

A) to determine whether it should make additional investments in order to achieve even greater production efficiencies.

B) to assess whether new or expanded marketing programs might increase the value of the brand relative to those of competitors.

C) to intensify its efforts to further discriminate its brand from that of its competitors.

D) all of the above.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

60

You are a financial consultant to a company that asks you what effect a change in leverage has on the firm's sustainable growth.Assuming all other things remain constant and if the percentage of assets that are financed with debt increases,then how will that affect the firm's sustainable growth rate?

A) the sustainable growth rate will decrease

B) the sustainable growth rate will increase

C) the effect is indeterminable

D) the sustainable growth rate will neither decrease or increase

A) the sustainable growth rate will decrease

B) the sustainable growth rate will increase

C) the effect is indeterminable

D) the sustainable growth rate will neither decrease or increase

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following roles does finance play in long-term planning?

A) Identifying problems that could develop if the firm's strategic plans do not develop as expected.

B) Evaluating the firm's existing and prospective sources of funding.

C) Risk management

D) All of the above

E) (a) and (b) only

A) Identifying problems that could develop if the firm's strategic plans do not develop as expected.

B) Evaluating the firm's existing and prospective sources of funding.

C) Risk management

D) All of the above

E) (a) and (b) only

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

62

A firm currently has $2,000,000 in assets and $1,000,000 in accounts payable.If the firm expects sales to increase by 10% from last year to next year,then what is the estimated external funds required if the firm pays all of its net income to shareholders?

A) $100,000

B) $1,000,000

C) $2,000,000

D) none of the above

A) $100,000

B) $1,000,000

C) $2,000,000

D) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

63

The percentage-of-sales method for forecasting pro forma financial statements assumes

A) that all income statement and balance sheet items grow in proportion to sales.

B) that all income statement and balance sheet items grow at a growing proportion to sales.

C) that all income statement and balance sheet items grow at a decreasing proportion to sales

D) none of the above.

A) that all income statement and balance sheet items grow in proportion to sales.

B) that all income statement and balance sheet items grow at a growing proportion to sales.

C) that all income statement and balance sheet items grow at a decreasing proportion to sales

D) none of the above.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

64

Marsha Start is looking to restart a home economics related business after an unfortunate incarceration.She forecasts that sales for June,July,and August will be $100,000,$150,000,and $80,000,respectively.Start expects for cash sales to make up 25% of the sales in each month with 90% of the credit sales collected in the month after the sale and the remainder 2 months after the sale.What is Start's estimated total cash collections in August for June sales?

A) $7,500

B) $101,750

C) $133,750

D) none of the above

A) $7,500

B) $101,750

C) $133,750

D) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

65

A bottom-up approach to sales forecasting begins with

A) a firmwide sales objective.

B) a departmental head forecast.

C) a talk with the customer.

D) none of the above.

A) a firmwide sales objective.

B) a departmental head forecast.

C) a talk with the customer.

D) none of the above.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

66

Exhibit 15-1

You are working to forecast the cash disbursements for a manufacturing company. Sales are forecasted to be $175,000, $200,000, $225,000, and $250,000 for January, February, March, and April, respectively. The firm purchases 25% of each amount in cash and will then pay 70% of the credit purchase in the month following the purchase with the remainder paid in full two months after the purchase.

Refer to Exhibit 15-1.What is the amount of February sales to be collected in March for the company?

A) $206,625

B) $105,000

C) $56,250

D) none of the above

You are working to forecast the cash disbursements for a manufacturing company. Sales are forecasted to be $175,000, $200,000, $225,000, and $250,000 for January, February, March, and April, respectively. The firm purchases 25% of each amount in cash and will then pay 70% of the credit purchase in the month following the purchase with the remainder paid in full two months after the purchase.

Refer to Exhibit 15-1.What is the amount of February sales to be collected in March for the company?

A) $206,625

B) $105,000

C) $56,250

D) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

67

The Retail Company currently has assets of $3,000,000 and accounts payable of $200,000.The firm's sales last year were $10,000,000 with a net profit margin of 1%.If the firm anticipates next year's sales to grow by 8% over that of last year and the firm pays out 25% of its net income in dividends,then what is the estimated external funds requirement for Retail?

A) $16,000

B) $81,000

C) $143,000

D) $240,000

A) $16,000

B) $81,000

C) $143,000

D) $240,000

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following roles does finance play in long-term planning?

A) Assessing the likelihood that a given strategic objective can be achieved.

B) Evaluating the firm's existing and prospective sources of funding.

C) Preparing and updating cash budgets to ensure the firm does not face a liquidity crisis.

D) all of the above

E) (b) and (c) only

A) Assessing the likelihood that a given strategic objective can be achieved.

B) Evaluating the firm's existing and prospective sources of funding.

C) Preparing and updating cash budgets to ensure the firm does not face a liquidity crisis.

D) all of the above

E) (b) and (c) only

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

69

Milton Gaming Company currently has assets of $3,000,000 and accounts payable of $200,000.The firm's sales last year were $10,000,000.If the firm anticipates next year's sales to grow by 8% over that of last year and the firm pays out 25% of its net income in dividends,then what net profit margin is required in order to have the estimated external funds required be equal to zero?

A) 27.00%

B) 25.00%

C) 2.77%

D) 2.50%

A) 27.00%

B) 25.00%

C) 2.77%

D) 2.50%

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

70

The Little Toy Company will start doing business in February and needs to forecast its total cash receipts for April.Its projected total sales are $15,000,$20,000,and $25,000 for February,March and April,respectively.Little Toy anticipates that 50% of sales will be for cash and 1/2 of credit sales will be collected the month after sale with the remained being collected 2 months after the sale.What the forecasted cash receipts to Little Toy in April?

A) $21,250

B) $17,500

C) $8,750

D) none of the above

A) $21,250

B) $17,500

C) $8,750

D) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is not a popular growth target?

A) Return on Investment

B) Economic Value Added

C) Market Value Added

D) Growth in Sales or Assets

A) Return on Investment

B) Economic Value Added

C) Market Value Added

D) Growth in Sales or Assets

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

72

If a company prefers to finance its required assets with a small portion of short-term borrowings,then that firm is utilizing a(n)

A) conservative financing strategy.

B) aggressive financing strategy.

C) matching strategy.

D) none of the above.

A) conservative financing strategy.

B) aggressive financing strategy.

C) matching strategy.

D) none of the above.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

73

If a company prefers to finance its required assets with a larger portion of short-term debt,then that firm is utilizing a(n)

A) conservative financing strategy.

B) aggressive financing strategy.

C) matching strategy.

D) none of the above.

A) conservative financing strategy.

B) aggressive financing strategy.

C) matching strategy.

D) none of the above.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

74

Exhibit 15-1

You are working to forecast the cash disbursements for a manufacturing company. Sales are forecasted to be $175,000, $200,000, $225,000, and $250,000 for January, February, March, and April, respectively. The firm purchases 25% of each amount in cash and will then pay 70% of the credit purchase in the month following the purchase with the remainder paid in full two months after the purchase.

Refer to Exhibit 15-1.What is the amount of February sales to be collected in April for the company?

A) $206,625

B) $105,000

C) $45,000

D) none of the above

You are working to forecast the cash disbursements for a manufacturing company. Sales are forecasted to be $175,000, $200,000, $225,000, and $250,000 for January, February, March, and April, respectively. The firm purchases 25% of each amount in cash and will then pay 70% of the credit purchase in the month following the purchase with the remainder paid in full two months after the purchase.

Refer to Exhibit 15-1.What is the amount of February sales to be collected in April for the company?

A) $206,625

B) $105,000

C) $45,000

D) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

75

Marsha Start is looking to restart a home economics related business after an unfortunate incarceration.She forecasts that sales for June,July,and August will be $100,000,$150,000,and $100,000,respectively.Start expects for cash sales to make up 25% of the sales in each month with 90% of the credit sales collected in the month after the sale and the remainder 2 months after the sale.What is Start's estimated total cash collections for August?

A) $20,000

B) $101,750

C) $133,750

D) none of the above

A) $20,000

B) $101,750

C) $133,750

D) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following statements is false?

A) The EVA method is conceptually valid but due to the disconnect it has between accrual-based accounting and economic value coupled with increased computational complexity, it is not the most popular method for growth planning.

B) Firms generally assumed that if ROI is greater than the firm's cost of capital then shareholder value will be created.

C) One of the typical growth targets is depreciation.

D) The popular growth targets tend to rely on accounting data and are typically measured on an annual basis.

A) The EVA method is conceptually valid but due to the disconnect it has between accrual-based accounting and economic value coupled with increased computational complexity, it is not the most popular method for growth planning.

B) Firms generally assumed that if ROI is greater than the firm's cost of capital then shareholder value will be created.

C) One of the typical growth targets is depreciation.

D) The popular growth targets tend to rely on accounting data and are typically measured on an annual basis.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is a source of discretionary or external financing?

A) a new debt issue

B) accounts payable

C) a new equity issue

D) both a and c

A) a new debt issue

B) accounts payable

C) a new equity issue

D) both a and c

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

78

A firm that tends to finance permanent assets with long-term debt and seasonal assets with short-term borrowing is following

A) an aggressive financing strategy.

B) a conservative financing strategy.

C) a matching financing strategy.

D) none of the above.

A) an aggressive financing strategy.

B) a conservative financing strategy.

C) a matching financing strategy.

D) none of the above.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

79

Economic Value Added (EVA)is:

A) the difference between net income and the cost of goods sold.

B) the difference between operating profit and the cost of funds.

C) the difference between net income and the cost of funds.

D) the difference between net operating profits after taxes and the cost of funds.

E) none of the above

A) the difference between net income and the cost of goods sold.

B) the difference between operating profit and the cost of funds.

C) the difference between net income and the cost of funds.

D) the difference between net operating profits after taxes and the cost of funds.

E) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

80

Cash receipts include

A) cash sales.

B) accounts receivable collections.

C) both a and b

D) none of the above.

A) cash sales.

B) accounts receivable collections.

C) both a and b

D) none of the above.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck