Deck 3: Corporations: Special Situations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/76

Play

Full screen (f)

Deck 3: Corporations: Special Situations

1

The DPAD cannot exceed 50% of the W-2 wages paid.

True

The limitation is 50% of the W-2 wages paid.

The limitation is 50% of the W-2 wages paid.

2

A large NOL carryover from a prior year when combined with large QPAI for the current year will substantially increase a corporation's DPAD for the current year.

False

If anything,the NOL carryover may reduce (not increase)DPAD.Recall that DPAD is a percentage of the lesser of QPAI or TI.As an NOL carryover reduces TI,this could limit the DPAD allowed.

If anything,the NOL carryover may reduce (not increase)DPAD.Recall that DPAD is a percentage of the lesser of QPAI or TI.As an NOL carryover reduces TI,this could limit the DPAD allowed.

3

In connection with the construction of a housing project,a contractor pays an architect to design the homes being built.The architect's fee is an embedded service that does not qualify as DPGR.

False

Architectural services qualify for DPAD and constitute a separate category of DPGR.

Architectural services qualify for DPAD and constitute a separate category of DPGR.

4

Andrew,a process engineer for an oil company,inherited a beachfront lot from an uncle.In his spare time,he builds a beach cottage on the lot and later sells the property through a realtor.The sale proceeds Andrew receives are not DPGR.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

5

A taxpayer who prepares and sells Chinese food at several of its restaurant locations can qualify for DPAD as to the receipts only from take-out orders and home-delivery sales.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

6

Green Company,a U.S.corporation based in Arkansas,manufactures and sells a product which includes some components made in Mexico.All of Green's income from sales might constitute DPGR.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

7

DPAD for 2008 is 6% of the greater of QPAI or TI,but not to exceed the W-2 wages limitation.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

8

The formula in determining DPAD for individual taxpayers is the same as that applicable to corporations.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

9

Arlene,an advertising executive,pays a contractor to build a lodge on property she owns in Colorado.If Arlene sells the lodge,the proceeds (less the cost of the land)will be DPGR.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

10

Maize Corporation,a Miami contractor,pays Crane Engineering a fee to design bridges for a highway Maize will build in the Dominican Republic.The fee Crane receives is not DPGR.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

11

For testing purposes as to DPAD,taxable income is replaced by modified adjusted gross income in the case of an individual.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

12

DPGR cannot include the cost of an embedded service that is included in the sale of a manufactured product.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

13

In arriving at the W-2 wages limitation,only the wages paid that are properly allocable to DPGR can be considered in 2008.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

14

Like the ETI it replaced,DPAD is intended to encourage U.S.exports to foreign countries.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

15

The overall effect of the DPAD is similar to that of a rate reduction or a tax credit.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

16

DPAD decreases as the cost of manufacturing a product increases.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

17

The W-2 wages limitation as to DPAD encourages the use of independent contractors.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

18

The percentage applicable for computing DPAD will ultimately increase to 9%.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

19

If QPAI cannot be used in any one year due to the TI limitation,it can be carried over to future years.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

20

A taxpayer that has no QPAI can still be able to claim a DPAD.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

21

Percentage depletion claimed in excess of the adjusted bases of property can be a tax preference item.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

22

Reasonable needs for purposes of the accumulated earnings tax do not include loans to shareholders.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

23

The definition of an expanded affiliated group (EAG)for DPAD purposes is broader than that applicable to the filing of consolidated tax returns.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

24

An S corporation can be subject to the ACE provisions.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

25

The starting point for computing ACE is AMTI,which is defined as regular taxable income after AMT adjustments (other than the NOL and ACE adjustments)and after tax preferences.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

26

Regular tax depreciation lives cannot be used for AMT purposes.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

27

The AMT rate for corporations is the same as for individuals.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

28

The ACE adjustment can be a negative amount.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

29

In the case of corporations that are members of an expanded affiliated group (EAG),the DPAD is determined by treating the group as a single taxpayer.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

30

The AMT NOL deduction is limited to 80%.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

31

A corporation that passes the $5 million average gross receipts test will continue to be treated as a small business corporation (e.g.,no AMT)for 3 years automatically.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

32

The accumulated earnings credit for a personal service corporation is the greater of $150,000 or the current E & P for the year needed to meet the reasonable needs of the business.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

33

Under some circumstances,the sale of prepared food at a taxpayer's retail facility can qualify as DPGR.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

34

The AMT rate for corporations is lower than the rates for individuals.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

35

AMTI may be defined as regular taxable income after AMT adjustments (other than the NOL and ACE adjustments)and after tax preferences.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

36

Once a small corporation for AMT purposes,always a small corporation.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

37

A positive ACE adjustment is beneficial to a corporation.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

38

A business with taxable income less than $1 million cannot be subject to the AMT.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

39

The regular foreign tax credit is not available to reduce AMT liability.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

40

Passive activity losses of certain closely held corporations and personal service corporations may be an AMT adjustment.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

41

Chev Corporation,a calendar year corporation,has alternative minimum taxable income (before any exemption)of $1.28 million for 2008.The company is not a small corporation.If the regular corporate tax is $209,000,Chev's alternative minimum tax for 2008 is:

A)$47,000.

B)$209,000.

C)$256,000.

D)$1,280,000.

E)None of the above.

A)$47,000.

B)$209,000.

C)$256,000.

D)$1,280,000.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

42

Which,if any,of the following is a characteristic of the DPAD?

A)Not applicable in situations involving S corporations.

B)Applicable only to manufactured goods that are exported from the U.S.

C)Can never apply when the rendition of personal services is involved.

D)Can sometimes apply when some of the components of a product are manufactured in foreign countries.

E)None of the above.

A)Not applicable in situations involving S corporations.

B)Applicable only to manufactured goods that are exported from the U.S.

C)Can never apply when the rendition of personal services is involved.

D)Can sometimes apply when some of the components of a product are manufactured in foreign countries.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

43

The exemption amount is phased out entirely when AMTI reaches:

A)$40,000.

B)$310,000.

C)$1,000,000.

D)$5,000,000.

E)Some other amount.

A)$40,000.

B)$310,000.

C)$1,000,000.

D)$5,000,000.

E)Some other amount.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

44

Silver Corporation has average gross receipts of $5.7 million,$4.6 million,and $4.8 million in 2006,2007,and 2008,respectively.Silver is:

A)Not subject to the corporate income tax.

B)A small corporation with respect to the AMT.

C)Not subject to the AMT.

D)Not a small corporation with respect to the AMT.

E)None of the above.

A)Not subject to the corporate income tax.

B)A small corporation with respect to the AMT.

C)Not subject to the AMT.

D)Not a small corporation with respect to the AMT.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

45

Yvonne Corporation manufactures and sells ceramic dinnerware.The company also sells dinnerware that is purchased from unrelated foreign producers.During tax year 2008,Yvonne had a U.S.profit of $1.2 million (QPAI)and a loss from the imported merchandise of $100,000.What is Yvonne's DPAD?

A)None.

B)$33,000.

C)$66,000.

D)$72,000.

E)None of the above.

A)None.

B)$33,000.

C)$66,000.

D)$72,000.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

46

Staff,Inc.,has taxable income of $10 million in 2008.What is the maximum DPAD tax savings for this C corporation?

A)None.

B)$204,000.

C)$210,000.

D)$600,000.

E)None of the above.

A)None.

B)$204,000.

C)$210,000.

D)$600,000.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements does not reflect the rules regarding pass-through entities and DPAD?

A)Since the deduction is determined at the owner level, each owner must make the computation separately.

B)The entity allocates to each owner his or her share of any QPAI.

C)In the case of partnerships, guaranteed payments are not regarded as W-2 wages.

D)A partner cannot be allocated any W-2 wages if the share of QPAI is zero.

E)None of the above.

A)Since the deduction is determined at the owner level, each owner must make the computation separately.

B)The entity allocates to each owner his or her share of any QPAI.

C)In the case of partnerships, guaranteed payments are not regarded as W-2 wages.

D)A partner cannot be allocated any W-2 wages if the share of QPAI is zero.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

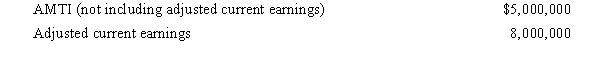

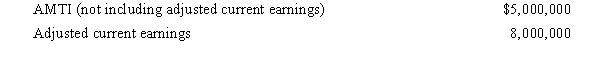

48

A corporation has the following items related to the AMT.

The corporation's AMT,if any,is:

A)$0.

B)$8,196,080.

C)$8,703,900.

D)$18,300,580.

E)None of the above.

The corporation's AMT,if any,is:

A)$0.

B)$8,196,080.

C)$8,703,900.

D)$18,300,580.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

49

If a corporation is subject to the § 541 penalty tax on personal holding companies,it cannot also be subject to the penalty tax on unreasonable accumulations under § 531.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

50

Gem Corporation,a calendar year taxpayer,has AMTI (before adjustment for adjusted current earnings)of $6 million for 2008.If Gem Corporation's ACE is $15 million,its tentative minimum tax for 2008 is:

A)$4.2 million.

B)$3.45 million.

C)$2.55 million.

D)$2.02 million.

E)None of the above.

A)$4.2 million.

B)$3.45 million.

C)$2.55 million.

D)$2.02 million.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

51

Maria Corporation manufactures and sells ceramic dinnerware.The company also sells dinnerware that is purchased from unrelated foreign producers.During the tax year 2008,Maria had a U.S.profit of $1.2 million (QPAI)and a profit from the imported merchandise of $100,000.What is Maria's DPAD?

A)None.

B)$36,000.

C)$72,000.

D)$78,000.

E)None of the above.

A)None.

B)$36,000.

C)$72,000.

D)$78,000.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

52

Boasso Corporation manufactures an exercise machine at a cost of $800 and sells the machine to Kershaw Corporation for $1,000 in 2008.Kershaw incurs TV advertising expenses of $300 and sells the machine by phone order for $1,600.If Boasso and Kershaw corporations are members of an expanded affiliated group (EAG),their DPGR is:

A)$30.

B)$500.

C)$1,000.

D)$1,600.

E)None of the above.

A)$30.

B)$500.

C)$1,000.

D)$1,600.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

53

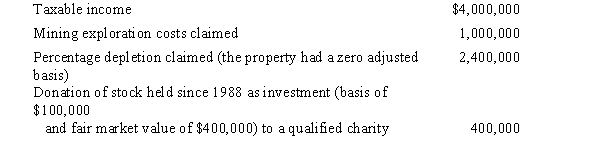

In 2008,Jay Corporation (a calendar year taxpayer)had the following transactions:

For 2008,Jay Corporation's AMTI is:

A)$6,900,000.

B)$7,150,000.

C)$7,250,000.

D)$7,300,000.

E)None of the above.

For 2008,Jay Corporation's AMTI is:

A)$6,900,000.

B)$7,150,000.

C)$7,250,000.

D)$7,300,000.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

54

Boat Corporation manufactures an exercise machine at a cost of $800 and sells the machine to Kite Corporation for $1,000 in 2008.Kite incurs TV advertising expenses of $300 and sells the machine by phone order for $1,600.If Boat and Kite corporations are members of an expanded affiliated group (EAG),their DPAD is:

A)$30.

B)$500.

C)$1,000.

D)$1,600.

E)None of the above.

A)$30.

B)$500.

C)$1,000.

D)$1,600.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

55

If a corporation's income is solely from rents,it will not be subject to the § 541 penalty tax on personal holding companies.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

56

Which entity is subject to the ACE provisions?

A)S corporation.

B)Real estate investment trust (REITs).

C)Real estate investment companies.

D)Real estate mortgage investment conduits.

E)None of the above.

A)S corporation.

B)Real estate investment trust (REITs).

C)Real estate investment companies.

D)Real estate mortgage investment conduits.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

57

Bacon Corporation manufactures an exercise machine at a cost of $800 and sells the machine to Kirby Corporation for $1,000 in 2008.Kirby incurs TV advertising expenses of $300 and sells the machine by phone order for $1,600.If Bacon and Kirby corporations are members of an expanded affiliated group (EAG),their QPAI is:

A)$30.

B)$500.

C)$1,000.

D)$1,600.

E)None of the above.

A)$30.

B)$500.

C)$1,000.

D)$1,600.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

58

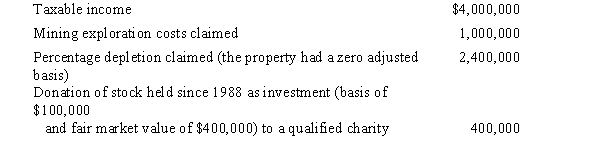

During 2008,Brown Corporation (a calendar year taxpayer)has $4,000,000 of taxable income and the following transactions:

Brown Corporation's alternative minimum tax (AMT)for 2008 is:

A)$90,000.

B)$500,000.

C)$700,000.

D)$1,360,000.

E)None of the above.

Brown Corporation's alternative minimum tax (AMT)for 2008 is:

A)$90,000.

B)$500,000.

C)$700,000.

D)$1,360,000.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

59

For purposes of the penalty tax on accumulated earnings under § 531,reasonable needs of the business does not include:

A)Loans to shareholders.

B)Self-insurance.

C)Loans to suppliers and customers.

D)Product liability losses.

E)Plant expansion.

A)Loans to shareholders.

B)Self-insurance.

C)Loans to suppliers and customers.

D)Product liability losses.

E)Plant expansion.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following items will be added to unadjusted AMTI in arriving at ACE?

A)Tax-exempt income.

B)80% dividends received deduction.

C)Federal income tax.

D)Penalties and fines.

E)None of the above.

A)Tax-exempt income.

B)80% dividends received deduction.

C)Federal income tax.

D)Penalties and fines.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

61

Why is the DPAD benefit somewhat unique?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

62

Swan Corporation has gross receipts of $3 million of which $1 million are non-DPGR.CGS identified with DPGR is $1.3 million,while overall selling and administrative expenses are $600,000.Under the simplified deduction method,determine Swan's QPAI.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

63

Maize Corporation has average gross receipts of $5.5 million,$4.7 million,and $4.6 million in 2005,2006,and 2007,respectively.Is the company a small corporation with respect to the AMT?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

64

With respect to the AMT,what is the minimum tax credit?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

65

What is the accumulated earnings credit?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

66

Baker Corporation manufactures and sells birdhouses and feeders.The company also sells similar items that are imported from foreign countries.During the current year,Baker had a profit of $600,000 from its own products but a loss of $50,000 from the imported goods.

a.What is Baker's QPAI?

b.What is Baker's DPAD if the current year is 2006? 2008? 2010?

a.What is Baker's QPAI?

b.What is Baker's DPAD if the current year is 2006? 2008? 2010?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

67

The controller of Palm,Inc.,provides you with the following information.

Calculate any PHC tax.

Calculate any PHC tax.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

68

Grey,Inc.,has $2 million in gross receipts of which $1.2 million is DPGR.CGS is $850,000 and other deductions (marketing,administrative)are $350,000.Using the small business simplified deduction method,determine Grey's QPAI.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

69

What is the small corporation exemption?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

70

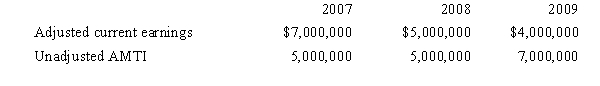

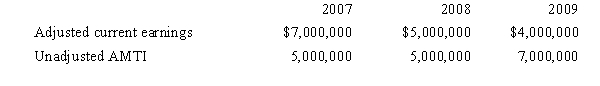

A calendar year corporation reports the following information for the years listed:

Compute the ACE adjustment for each year.

Compute the ACE adjustment for each year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

71

Owl Corporation,a calendar year taxpayer,has a beginning balance in accumulated E & P of $3.5 million and current earnings of $1 million.If Owl can justify accumulations for the needs of the business of $3.7 million,its accumulated earnings credit for ATI purposes is:

A)$0.

B)$200,000.

C)$250,000.

D)$3.7 million.

E)None of the above.

A)$0.

B)$200,000.

C)$250,000.

D)$3.7 million.

E)None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

72

Cordinal,Inc.engages in production activities that generate QPAI of $460,000 and taxable income (without taking into account the DPAD and NOL)of $600,000 in 2008.The company also has an NOL carryover to 2008 of $500,000 and qualified W-2 wages of $300,000.Calculate any DPAD.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

73

Wren Corporation,a calendar year taxpayer,manufactures and sells candles.It has several factories in the U.S.and one in Jamaica.During 2008,it had DPGR of $4.1 million from the U.S.factories.

a.If the gross receipts from the products made in Jamaica are $200,000, what is Wren's DPGR for 2008?

b.If the gross receipts sourced to the Jamaica plant are $300,000, what is Wren's DPGR for 2008?

a.If the gross receipts from the products made in Jamaica are $200,000, what is Wren's DPGR for 2008?

b.If the gross receipts sourced to the Jamaica plant are $300,000, what is Wren's DPGR for 2008?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

74

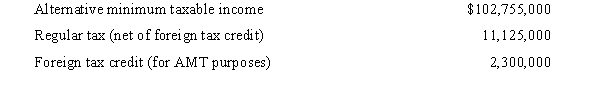

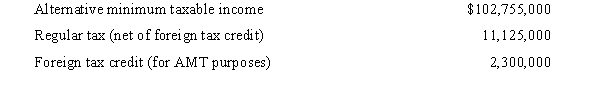

Calculate the alternative minimum tax for a retail corporation whose tax return reflects the following amounts:

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

75

Rose Corporation sells customized outdoor grills.It purchases various parts and materials from foreign sources for $500 and incurs $160 in labor costs at a factory in South Carolina to fabricate and assemble the product.Rose also incurs packaging,selling,and other costs of $40 and sells the grill for $800.If tax year 2008 is involved,calculate Rose's per unit:

a.DPGR

b.QPAI

c.DPAD

a.DPGR

b.QPAI

c.DPAD

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

76

Explain the wages limitation.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck