Deck 12: S Corporations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/161

Play

Full screen (f)

Deck 12: S Corporations

1

Persons who were shareholders during any part of the year before the election date,but were not shareholders when the elction was made,also must consent to the election.

True

2

Most IRAs can own stock in an S corporation.

False

3

An S election made before becoming a corporation is valid the next 12-month tax year.

False

4

Where the S corporation rules are silent,C corporation provisions apply.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

5

If a resident alien shareholder moves outside the U.S.,the S election is terminated.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

6

An S corporation cannot incur a tax liability at the corporation level.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

7

The termination of an S election occurs on the day after a corporation ceases to be a small business corporation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

8

Distributions of appreciated property by an S corporation are not taxable to the entity.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

9

S corporations are treated as partnerships under state laws.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

10

Only 51% of the shareholders must consent to an S election.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

11

For a new corporation,a premature S election may not be effective.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

12

More S corporation returns are filed than C corporation returns.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

13

Tax-exempt income at the S level loses its special tax treatment for the shareholder.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

14

An estate may be a shareholder of an S corporation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

15

An S election is made on Form 2550.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

16

S corporation status allows shareholders to realize tax benefits from corporate losses immediately (assuming sufficient stock basis).

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

17

An S corporation can be a shareholder in another corporation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

18

Most limited liability partnerships can own stock in an S corporation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

19

Liabilities affect the owner's basis differently in an S corporation versus a partnership.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

20

NOL carryovers for C years can be used in an S corporation year.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

21

The pro rata method assigns an equal amount of each of the S corporation items (e.g.,LTCG)to each day of the year.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

22

All tax preference items flow through the S corporation,to be included in the shareholders' AMT calculations.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

23

An S corporation may not amortize organization expenses.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

24

An S shareholder who dies during the corporate tax year must report his or her share of the pro rata income (or loss)up to the date of death on the final individual tax return.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

25

An S corporation's AAA cannot have a negative balance.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

26

Distributions are made from OAA after AEP and AAA reach zero.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

27

Tax-exempt income is not separately stated on Schedule K of Form 1120S.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

28

An S corporation recognizes a loss when distributing assets that are worth less than their basis.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

29

Passive investment income includes gains from the sale of securities.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

30

An item that appears in the "Other Adjustments Account" affects basis,but not AAA,such as tax-exempt life insurance proceeds.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

31

Any distribution of cash or property by a corporation with respect to the stock during a post-termination transition period of approximately one year is applied against and reduces the adjusted basis of the stock.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

32

Tax-exempt income at the corporate level does flow through to the shareholders.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

33

An S corporation does not recognize gain on a distribution of appreciated property.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

34

An S corporation with earnings and profits can make a taxable dividend distribution by making a AAA bypass election.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

35

A capital loss allocated to a shareholder always reduces the accumulated adjustments account.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

36

A distribution from previously taxed income is not taxable.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

37

Post-termination distributions that are charged against OAA get tax-free treatment.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

38

On distribution of loss property,an S corporation receives a step-down in basis.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

39

Payment of an illegal kickback would increase a shareholder's stock basis.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

40

An S corporation does not recognize a loss when distributing assets that are worth less than their basis.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

41

The § 1374 tax is a shareholder-level tax on any built-in gain recognized when an S corporation disposes of an asset in a taxable disposition within 10 calendar years after the latest date on which the S election took effect.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

42

Stock basis is first increased by income items,then decreased by losses,and then decreased by distributions.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

43

It is not beneficial for an S corporation to issue § 1244 stock.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

44

In certain circumstances,an S shareholder's basis in her S stock can be reduced below zero.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

45

Passive investment income includes capital gains from the sale of stocks and securities after 2007.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

46

Which statement is incorrect?

A)S corporations are treated as corporations under state law.

B)S corporations for tax purposes are treated as partnerships.

C)Distributions of appreciated property are taxable to the S corporation.

D)The accumulated earnings tax does not apply to an S corporation.

E)None of the above.

A)S corporations are treated as corporations under state law.

B)S corporations for tax purposes are treated as partnerships.

C)Distributions of appreciated property are taxable to the S corporation.

D)The accumulated earnings tax does not apply to an S corporation.

E)None of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

47

The carryover period for the NOLs of a C corporation continues to run during S corporation years.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

48

Any excess of losses or deductions over both stock and debt basis is lost forever.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

49

An S corporation may be subject to the following tax.

A)Corporate income tax (§ 11).

B)Passive investment income tax.

C)Personal holding company tax.

D)Alternative minimum tax.

E)None of the above apply to S corporations.

A)Corporate income tax (§ 11).

B)Passive investment income tax.

C)Personal holding company tax.

D)Alternative minimum tax.

E)None of the above apply to S corporations.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

50

An S shareholder's basis includes a ratable share of any S corporation liabilities.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

51

Any losses that are suspended under the at-risk rules are carried forward and are available during an S corporation's post-termination period.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

52

The S corporation is entitled to a deduction for its NOL carryovers.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

53

Any distribution made by an S corporation during a tax year is taken into account before accounting for the year's losses.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

54

Any excess of S corporation losses or deductions over the shareholder's combined stock and debt basis is suspended until there is a subsequent stock or debt basis.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

55

The debt basis always is adjusted back to the original amount before any increase is made in the stock basis.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

56

Depletion in excess of basis in the property will cause an upward adjustment to an S shareholder's basis.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

57

The LIFO recapture tax is a variation of the passive investment income penalty tax.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

58

Compensation for services rendered to an S corporation is subject to FICA taxes.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

59

A shareholder's basis is decreased by stock purchases.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

60

The § 1202 exclusion of gain on disposition of S corporation stock is not available.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

61

Which statement is incorrect with respect to an S shareholder's consent?

A)An S election requires a consent from all corporate shareholders.

B)Both husband and wife must consent if one owns the stock as community property.

C)A consent extension is available only if Form 2553 is filed on a timely basis, reasonable cause is given, and the interests of the government are not jeopardized.

D)A consent must be in writing.

E)None of the above statements is incorrect.

A)An S election requires a consent from all corporate shareholders.

B)Both husband and wife must consent if one owns the stock as community property.

C)A consent extension is available only if Form 2553 is filed on a timely basis, reasonable cause is given, and the interests of the government are not jeopardized.

D)A consent must be in writing.

E)None of the above statements is incorrect.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

62

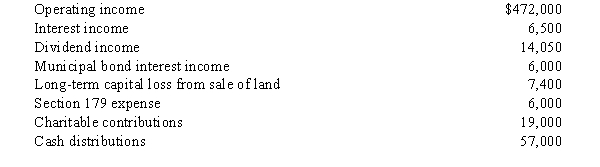

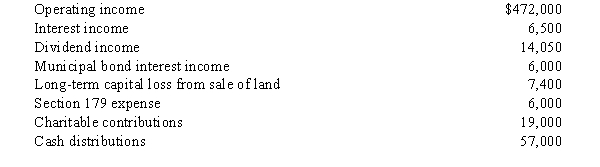

Beginning in 2008,the AAA of Amit,Inc.,an S corporation,has a balance of $782,000.During the year,the following items occur.

Amit's ending AAA balance is:

A)$1,171,100.

B)$1,185,150.

C)$1,191,150.

D)$1,242,150.

E)Some other amount.

Amit's ending AAA balance is:

A)$1,171,100.

B)$1,185,150.

C)$1,191,150.

D)$1,242,150.

E)Some other amount.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

63

Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2?

A)Charitable contributions.

B)Unreasonable compensation.

C)Payroll tax penalty assessed.

D)Section 1245 income.

E)None of the above.

A)Charitable contributions.

B)Unreasonable compensation.

C)Payroll tax penalty assessed.

D)Section 1245 income.

E)None of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

64

An S corporation must possess the following characteristics.

A)No more than one class of stock.

B)Corporation organized in the U.S.

C)Only one class of stock.

D)All of the above are required of an S corporation.

E)None of the above is required of an S corporation.

A)No more than one class of stock.

B)Corporation organized in the U.S.

C)Only one class of stock.

D)All of the above are required of an S corporation.

E)None of the above is required of an S corporation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

65

What statement is correct with respect to an S corporation?

A)There is no advantage also to elect § 1244 stock.

B)An S corporation can own 85% of an insurance company.

C)An estate may be a shareholder.

D)A voting trust arrangement is not available.

E)None of the above statements is true.

A)There is no advantage also to elect § 1244 stock.

B)An S corporation can own 85% of an insurance company.

C)An estate may be a shareholder.

D)A voting trust arrangement is not available.

E)None of the above statements is true.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

66

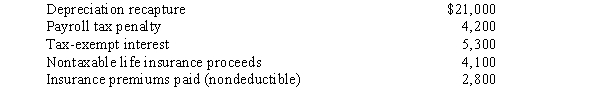

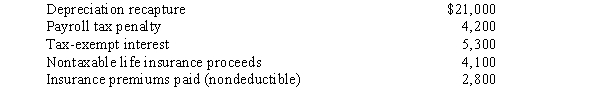

If the beginning balance in OAA is zero,and the following transactions occur,what is the ending OAA balance?

A)$1,300.

B)$6,600.

C)$23,300.

D)$27,500.

E)None of the above.

A)$1,300.

B)$6,600.

C)$23,300.

D)$27,500.

E)None of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

67

Several individuals acquire assets on behalf of Skip Corporation on May 29,2008,purchased assets on June 3,and begin doing business on June 11,2008.They subscribe to shares of stock,file articles of incorporation for Skip,and become shareholders on June 21,2008.The S election must be filed no later than 2 1/2 months after:

A)May 29, 2008.

B)June 3, 2008.

C)June 11, 2008.

D)June 21, 2008.

E)December 31, 2008.

A)May 29, 2008.

B)June 3, 2008.

C)June 11, 2008.

D)June 21, 2008.

E)December 31, 2008.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

68

On January 1,2008,Kinney,Inc.,an electing S corporation,has $4,000 of AEP and a balance of $10,000 in AAA.Kinney has two shareholders,Erin and Maine,each of whom owns 500 shares of Kinney's stock.Kinney's 2008 taxable income is $5,000.Kinney distributes $6,000 to each shareholder on February 1,2008,and distributes another $3,000 to each shareholder on September 1.How is Erin taxed on this distribution?

A)$500 dividend income.

B)$1,000 dividend income.

C)$1,500 dividend income.

D)$3,000 dividend income.

E)None of the above.

A)$500 dividend income.

B)$1,000 dividend income.

C)$1,500 dividend income.

D)$3,000 dividend income.

E)None of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

69

Identify a disadvantage of an S corporation.

A)Generally, trusts cannot be shareholders.

B)Losses flow through to the shareholders.

C)The AMT on corporations is avoided.

D)Tax-exempt income flows through to the shareholders.

E)None of the above is a disadvantage of the S election.

A)Generally, trusts cannot be shareholders.

B)Losses flow through to the shareholders.

C)The AMT on corporations is avoided.

D)Tax-exempt income flows through to the shareholders.

E)None of the above is a disadvantage of the S election.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

70

Which,if any,of the following can be eligible shareholders of an S corporation?

A)A resident alien.

B)Partnership.

C)A foreign corporation.

D)A nonqualifying trust.

E)None of the above can own stock.

A)A resident alien.

B)Partnership.

C)A foreign corporation.

D)A nonqualifying trust.

E)None of the above can own stock.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

71

Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2?

A)Payroll penalty.

B)Unreasonable compensation.

C)Life insurance proceeds (nontaxable to the recipient S corporation).

D)Taxable interest.

E)None of the above affects the OAA.

A)Payroll penalty.

B)Unreasonable compensation.

C)Life insurance proceeds (nontaxable to the recipient S corporation).

D)Taxable interest.

E)None of the above affects the OAA.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

72

Which,if any,of the following can be eligible shareholders of an S corporation?

A)A child, age 10.

B)A resident alien.

C)A voting trust.

D)An estate of a deceased shareholder.

E)All of the above can own stock.

A)A child, age 10.

B)A resident alien.

C)A voting trust.

D)An estate of a deceased shareholder.

E)All of the above can own stock.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

73

What statement is correct with respect to an S corporation?

A)There are now more LLCs than S corporations.

B)S corporation status allows shareholders to realize tax benefits from corporate losses immediately.

C)An S corporation is prohibited from being a member of an affiliated group.

D)An LLP may own stock in an S corporation.

E)None of the above.

A)There are now more LLCs than S corporations.

B)S corporation status allows shareholders to realize tax benefits from corporate losses immediately.

C)An S corporation is prohibited from being a member of an affiliated group.

D)An LLP may own stock in an S corporation.

E)None of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

74

Which,if any,of the following items decreases an S corporation's AAA?

A)Long-term capital loss.

B)Expenses related to tax-exempt income.

C)Depletion in excess of basis.

D)Distribution from earnings and profits.

E)None of the above.

A)Long-term capital loss.

B)Expenses related to tax-exempt income.

C)Depletion in excess of basis.

D)Distribution from earnings and profits.

E)None of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

75

Which type of distribution from an S corporation is taxed at the 5/15% rate?

A)AAA.

B)PTI.

C)OAA.

D)AEP.

E)None of the above.

A)AAA.

B)PTI.

C)OAA.

D)AEP.

E)None of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

76

Which corporation is eligible to make the S election?

A)Foreign corporation.

B)100% owned corporation.

C)An insurance company.

D)A U.S. bank.

E)None of the above can elect S status.

A)Foreign corporation.

B)100% owned corporation.

C)An insurance company.

D)A U.S. bank.

E)None of the above can elect S status.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

77

Which could constitute a second class of stock?

A)Treasury stock.

B)Phantom stock.

C)Unexercised stock options.

D)Warrants.

E)None of the above.

A)Treasury stock.

B)Phantom stock.

C)Unexercised stock options.

D)Warrants.

E)None of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

78

During 2008,Houston Nutt,the sole shareholder of a calendar year S corporation,received a distribution of $16,000.On December 31,2007,his stock basis was $4,000.The corporation earned $11,000 ordinary income during the year.It has no accumulated E & P.Which statement is correct?

A)Nutt recognizes a $1,000 LTCG.

B)Nutt's stock basis will be $2,000.

C)Nutt's ordinary income is $15,000.

D)Nutt's return of capital is $11,000.

E)None of the above.

A)Nutt recognizes a $1,000 LTCG.

B)Nutt's stock basis will be $2,000.

C)Nutt's ordinary income is $15,000.

D)Nutt's return of capital is $11,000.

E)None of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

79

Which statement is incorrect with respect to filing for an S election?

A)Form 2553 must be filed.

B)All shareholders must consent.

C)The election may be filed in the previous year.

D)An extension of time is available for filing Form 2553.

E)None of the above are incorrect.

A)Form 2553 must be filed.

B)All shareholders must consent.

C)The election may be filed in the previous year.

D)An extension of time is available for filing Form 2553.

E)None of the above are incorrect.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

80

Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2?

A)Taxable dividends.

B)Stock dividend (taxable).

C)Section 1250 gain.

D)Tax-exempt income.

E)None of the above.

A)Taxable dividends.

B)Stock dividend (taxable).

C)Section 1250 gain.

D)Tax-exempt income.

E)None of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck