Deck 18: Family Tax Planning

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/168

Play

Full screen (f)

Deck 18: Family Tax Planning

1

Paula creates a trust,income payable to John (age 18)for 6 years,remainder to Elizabeth (age 39).In determining the value of Elizabeth's interest,use the multiple provided in the tables for a person age 45 (age 39 plus the 6-year intervening interest).

False

Under the valuation tables for term certain,use the multiple given for a six-year interest.This is the remainder factor applicable to Elizabeth.John's intervening income interest is 1 minus Elizabeth's remainder factor.

Under the valuation tables for term certain,use the multiple given for a six-year interest.This is the remainder factor applicable to Elizabeth.John's intervening income interest is 1 minus Elizabeth's remainder factor.

2

A farm has a best use valuation of $1.5 million and a current use valuation of $1 million.If § 2032A is elected,the farm can be valued in the deceased owner's gross estate at $1 million.

True

3

Buy and sell agreements can be used to help solve the estate tax valuation problems involved in the transfer by death of an interest in a small business.

True

4

A qualifying heir should not make the § 2032A special valuation election if he is not sure that he will keep the property for the full 10 years.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

5

Edgar creates a trust,life estate to Connie (age 46),remainder to Gene (age 18).In determining the value of the life estate,use the multiple given in the IRS valuation table for a person age 18.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

6

In arriving at the valuation of assets for estate tax purposes,the geographic location of the property is to be disregarded.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

7

In valuing a life insurance policy that has not matured (i.e.,the insured is still alive),it makes a difference whether the policy is paid up.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

8

Any recapture of special use valuation estate tax savings will be imposed on the qualified heir.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

9

When stock in a corporation is not traded,a discount for lack of marketability may be available.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

10

One way to dispute the existence of large goodwill is to argue that the decedent was not a key person in the operation of the business.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

11

A discount for valuation purposes is allowed when the stock involved represents a minority interest.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

12

A recapture of special use valuation will occur even if a qualified heir ceases to use the property for farming purposes but does not otherwise dispose of it.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

13

Application of the blockage rule has not been limited to just the valuation of stocks and bonds.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

14

The sole objective of family tax planning is to minimize gift and estate taxes on transfers of property within the family unit.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

15

At the time of his death,Fred held some notes receivable for loans he made to his two daughters and the payment of which he forgives in his will.The amount to be included in Fred's gross estate as to these notes is affected by his forgiveness.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

16

At the time of his death,Rex owned an RV.For valuation purposes,the RV should be included in his gross estate at the price a dealer in RVs would pay for the property.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

17

Noncommercial annuity contracts must be valued using the tables issued by the IRS.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

18

If a decedent's household goods are sold through public auction,the price received should be the valuation used for Federal estate tax purposes.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

19

The recapture of special use valuation estate tax savings can have income tax implications.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

20

If a stock redemption is to be carried out,a cross-purchase type of buy and sell agreement must be involved.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

21

Richard and Marie are tenants in common in a tract of land.Upon Richard's prior death,Marie's income tax basis in the land will not change.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

22

Federal gift taxes paid on a pre-death gift can be subject to the Federal estate tax.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

23

If depreciable property is transferred by gift,any recapture potential carries over to the donee.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

24

Neither the transfer by gift or by death avoids the recognition (for income tax purposes)of any deferred interest on U.S.savings bonds.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

25

Passing installment notes by death will avoid any income tax on the deferred gain.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

26

The election by an estate of § 2032A (special use valuation as to real estate)or § 2032 (the alternate valuation date)will have no effect on the income tax basis of the property received by the heirs.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

27

As to property received as a gift,a donee's basis for loss can be different than her basis for gain.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

28

A gift of installment notes causes any deferred gross profit on the notes to be taxed to the donees.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

29

The special use valuation method of § 2032A is not available for valuing transfers by gift.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

30

Leonard inherits a traditional IRA from his wife.Leonard may roll over the IRA into his own and defer any distribution from it until age 70 1/2.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

31

If depreciable property is passed by death,recapture potential carries over to the heir.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

32

Four years prior to death,a decedent makes a gift of an insurance policy on his life.In testing for the percentage requirements of the special use valuation method (i.e.,§ 2032A),the life insurance policy is considered.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

33

A traditional IRA is not subject to both estate and income taxes,so a withdrawal by the heir does not constitute income in respect of a decedent (IRD).

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

34

The value of an asset listed on the estate tax return becomes its income tax basis.This valuation is not subject to challenge by an heir who later sells the property.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

35

A donee's income tax basis in property received as a gift includes any gift tax paid by the donor.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

36

One of the advantages of an estate freeze is that the preferred stock is not included in the gross estate of the donor.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

37

The Nelsons make gifts of appreciated stock investments to their children (ages 14 to 17).If the children later sell the stock,less tax probably will result than if the parents had not made the gifts and sold the stock themselves.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

38

When carrying out an estate freeze with family limited partnerships,the donors make gifts of the general partnership interests but retain the limited partnership interests.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

39

Brad and Heather are husband and wife and live in New Mexico.Under Brad's will,his share of the community property passes to the children.Upon Brad's prior death,there will be a change in Heather's income tax basis in her half of the community property.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

40

In an estate freeze,the preferred stock is taxed twice-first upon the gift,and second when the donor dies.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

41

If a decedent's will allows the executor to substitute a different charity for the one named in the will,no charitable deduction for estate tax purposes is allowed.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

42

Which,if any,of the following statements reflects the correct tax valuation rules?

A)The value of a note receivable is its face amount.

B)The geographical location of the property is relevant.

C)Sentimental value should be considered.

D)Values listed in the classified section of the newspaper are not representative.

E)None of the above.

A)The value of a note receivable is its face amount.

B)The geographical location of the property is relevant.

C)Sentimental value should be considered.

D)Values listed in the classified section of the newspaper are not representative.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

43

In satisfying the more-than-35% test for qualification under § 6166,interests in more than one closely held business are aggregated when the decedent's gross estate includes 20% or more of the value of each such business.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

44

Several years ago,Sid purchased land listing ownership as "Sid,Hope,and Faith,equal joint tenants." In the current year,Faith dies first.One-third of the value of the land is included in Faith's probate estate.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

45

In satisfying the more-than-35% test of § 6166 (i.e.,extended estate tax payment schedule relative to an interest in a closely held business),any prior gifts the decedent may have made must be considered.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

46

Under proper circumstances,a disclaimer by an heir may increase the charitable deduction allowed a decedent.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

47

Because of the estate tax deduction,a testamentary bequest to charity is preferable to a lifetime transfer.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

48

A disclaimer by a surviving spouse may not generate additional estate tax even though it reduces the amount of marital deduction allowed.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

49

Under Cindy's will,her share of their community property passes to Van,her surviving spouse.Cindy's property is subject to probate.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

50

Cost and time are usually saved by passing ownership to out-of-state real estate by gift rather than by death.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

51

Herbert leaves one-half of his estate to his wife,Ramona,and the remainder to a qualified charity.Herbert's estate taxes would not be reduced if Ramona disclaims her interest in favor of the charity.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

52

Abigail owns an insurance policy on her life payable to her estate.On Abigail's death,the insurance proceeds are included in both her probate estate and gross estate.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

53

Derrick dies,and under the terms of his will,all of his property passes outright to Dion (Derrick's surviving wife).Under these circumstances,there is no need for Derrick's executor to make a QTIP election.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

54

A decedent owned 15% of the voting stock of Falcon Corporation.Falcon has 43 shareholders.The decedent's estate can qualify for the § 6166 election.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

55

Harvey owns a certificate of deposit listed as: "Harvey,payable on proof of death to April." On Harvey's prior death,the CD is subject to probate.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

56

If § 6166 applies,a 2% rate of interest applies to the full amount of the estate tax value as to which the estate tax is deferred.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

57

For the IRS to grant a discretionary extension of time to pay estate taxes (under § 6161),the executor must show that the estate would otherwise undergo undue hardship.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

58

In a husband/wife setting,good tax planning dictates that each spouse should pass by will all of his or her assets to the surviving spouse.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

59

The deferral approach to the estate tax marital deduction (as opposed to the equalization approach)is advisable if the surviving spouse is in good health and has few assets.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

60

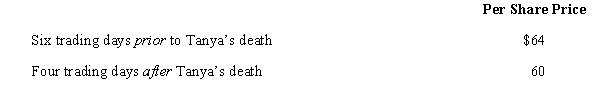

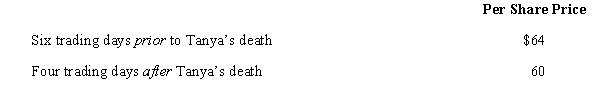

At the time of her death,Tanya owned stock in Petrel Corporation.The stock is traded on a local exchange with the most recent selling prices as follows.

Presuming no alternate valuation date election,Tanya's gross estate should include a per share value of

A)$24.00.

B)$38.00.

C)$61.60.

D)$62.40.

E)None of the above.

Presuming no alternate valuation date election,Tanya's gross estate should include a per share value of

A)$24.00.

B)$38.00.

C)$61.60.

D)$62.40.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

61

Which,if any,are characteristics of the valuation tables issued by the IRS?

A)The IRS must issue new updated tables once a year.

B)To determine the factor for a remainder interest, subtract the life estate factor provided in the table from one.

C)The same table that provides the factor for a life estate can be used to determine the value of an income interest for a term certain.

D)To use the tables, the Federal interest rate for the month of the transfer must be known.

E)None of the above.

A)The IRS must issue new updated tables once a year.

B)To determine the factor for a remainder interest, subtract the life estate factor provided in the table from one.

C)The same table that provides the factor for a life estate can be used to determine the value of an income interest for a term certain.

D)To use the tables, the Federal interest rate for the month of the transfer must be known.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

62

Lesley and Morgan are husband and wife and have always lived in Idaho,a community property state.At the time of Morgan's prior death,their community property includes:

Under Morgan's will,all of her property passes to Lesley.After Morgan's death,Lesley takes an income tax basis of:

A)$900,000 in Kite and $450,000 in Merlin.

B)$900,000 in Kite and $500,000 in Merlin.

C)$800,000 in Kite and $450,000 in Merlin.

D)$800,000 in Kite and $500,000 in Merlin.

E)None of the above.

Under Morgan's will,all of her property passes to Lesley.After Morgan's death,Lesley takes an income tax basis of:

A)$900,000 in Kite and $450,000 in Merlin.

B)$900,000 in Kite and $500,000 in Merlin.

C)$800,000 in Kite and $450,000 in Merlin.

D)$800,000 in Kite and $500,000 in Merlin.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

63

Which,if any,of the following statements properly characterize features involving buy-sell agreements?

A)Agreements cannot be used to control disposition of partnership interests.

B)If properly structured, the agreements can control valuation for estate tax purposes.

C)If a stock redemption is proposed, utilize a cross-purchase type.

D)Arrangements work best when the interest to be transferred involves publicly traded securities.

E)None of the above.

A)Agreements cannot be used to control disposition of partnership interests.

B)If properly structured, the agreements can control valuation for estate tax purposes.

C)If a stock redemption is proposed, utilize a cross-purchase type.

D)Arrangements work best when the interest to be transferred involves publicly traded securities.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

64

In 1985,Justin,a resident of New York,purchases realty for $300,000 listing title as "Justin and Debra,tenants by the entirety with right of survivorship." In 2008,Justin predeceases Debra when the realty is worth $1,200,000.Debra's income tax basis in the property is:

A)$150,000.

B)$600,000.

C)$750,000.

D)$1,200,000.

E)None of the above.

A)$150,000.

B)$600,000.

C)$750,000.

D)$1,200,000.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

65

In January 2008,Sid makes a gift of his beach house (basis of $112,000; fair market value of $412,000)to his aunt.As a result of the transfer,Sid pays a gift tax of $20,000.The aunt dies in December 2008,when the property is worth $420,000.Under the terms of the aunt's will,the property passes to Sid.Sid's income tax basis in the beach house is:

A)$117,000.

B)$127,000.

C)$132,000.

D)$420,000.

E)None of the above.

A)$117,000.

B)$127,000.

C)$132,000.

D)$420,000.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

66

In June 2007,Becky makes a gift of securities (basis $412,000; fair market value $812,000)to her uncle,upon which a gift tax of $40,000 is paid.The uncle dies in July 2008,when the securities are worth $900,000.Under the terms of the uncle's will,the securities return to Becky.Becky's income tax basis in the securities is:

A)$940,000.

B)$900,000.

C)$452,000.

D)$432,000.

E)None of the above.

A)$940,000.

B)$900,000.

C)$452,000.

D)$432,000.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

67

In 2008,Clara's father dies and leaves her the family farm.The farm has a current use value of $2,000,000 and a best use value of $2,500,000.If the § 2032A election is made,the farm should be included in the father's gross estate at a value of:

A)$1,540,000 ($2,500,000 - $960,000).

B)$2,000,000.

C)$1,040,000 ($2,000,000 - $960,000).

D)$900,000.

E)None of the above.

A)$1,540,000 ($2,500,000 - $960,000).

B)$2,000,000.

C)$1,040,000 ($2,000,000 - $960,000).

D)$900,000.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

68

Pam makes a gift of land (basis of $312,000; fair market value of $912,000)to her granddaughter,Tracy.As a result of the transfer,Pam paid a gift tax of $45,000.Tracy's income tax basis in the land is:

A)$342,000 if the gift was made after 1976.

B)$357,000 if the gift was made after 1976.

C)$327,000 if the gift was made after 1976.

D)$312,000 if the gift was made before 1977.

E)None of the above.

A)$342,000 if the gift was made after 1976.

B)$357,000 if the gift was made after 1976.

C)$327,000 if the gift was made after 1976.

D)$312,000 if the gift was made before 1977.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

69

In a typical "estate freeze" involving stock:

A)The owner makes a gift of both common and preferred stock.

B)The common stock is subject to the gift tax but not to the estate tax.

C)The preferred stock is subject to the gift tax but not to the estate tax.

D)The common stock is subject to both the gift tax and the estate tax.

E)None of the above.

A)The owner makes a gift of both common and preferred stock.

B)The common stock is subject to the gift tax but not to the estate tax.

C)The preferred stock is subject to the gift tax but not to the estate tax.

D)The common stock is subject to both the gift tax and the estate tax.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

70

Which,if any,of the following statements correctly reflects the operational rules under § 2032A ("special use" valuation)?

A)The § 2032A election is available for gift tax situations.

B)The § 2032A election permits the valuation of qualifying property at its "best" use value.

C)In meeting the 50% test and 25% test, the qualifying property is considered at its "best" use value.

D)If § 2032A is elected, only a sale of the qualifying property within the next 10 years will cause recapture.

E)None of the above.

A)The § 2032A election is available for gift tax situations.

B)The § 2032A election permits the valuation of qualifying property at its "best" use value.

C)In meeting the 50% test and 25% test, the qualifying property is considered at its "best" use value.

D)If § 2032A is elected, only a sale of the qualifying property within the next 10 years will cause recapture.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

71

In April 2007,Austin makes a gift of real estate (basis of $200,000; fair market value $600,000)to his aunt.After the gift,the aunt makes $55,000 worth of capital improvements to the property.The aunt dies in March 2008,when the property is worth $640,000.Under the aunt's will,the realty passes to Kinsey (Austin's wife).Kinsey's income tax basis in the property is:

A)$695,000.

B)$640,000.

C)$255,000.

D)$200,000.

E)None of the above.

A)$695,000.

B)$640,000.

C)$255,000.

D)$200,000.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

72

In 2008,Valerie made a gift of stock (basis of $112,000; fair market value of $412,000)to her grandson,Ryan.As a result of the transfer,Valerie paid a gift tax of $20,000.Ryan's income tax basis in the stock is:

A)$117,000 for gain or loss.

B)$127,000 for gain and $112,000 for loss.

C)$127,000 for gain or loss.

D)$132,000 for gain or loss.

E)None of the above.

A)$117,000 for gain or loss.

B)$127,000 for gain and $112,000 for loss.

C)$127,000 for gain or loss.

D)$132,000 for gain or loss.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

73

Paul dies and leaves his traditional IRA to Evelyn.Which statement is correct?

A)Because of the step-up in basis received at death, the IRA causes no income tax consequences to Evelyn.

B)The IRA is not included in Paul's gross estate.

C)If Evelyn is Paul's daughter, she can roll over the IRA into her own IRA without causing any adverse tax consequences.

D)If Evelyn is Paul's surviving spouse, she can defer any distributions from the IRA until she reaches age 70 1/2 without causing any adverse tax consequences.

E)None of the above.

A)Because of the step-up in basis received at death, the IRA causes no income tax consequences to Evelyn.

B)The IRA is not included in Paul's gross estate.

C)If Evelyn is Paul's daughter, she can roll over the IRA into her own IRA without causing any adverse tax consequences.

D)If Evelyn is Paul's surviving spouse, she can defer any distributions from the IRA until she reaches age 70 1/2 without causing any adverse tax consequences.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

74

In a typical estate freeze involving family limited partnerships established by parents for their children:

A)By gift, the parents transfer interests as general partners, retaining the limited partnership interests.

B)By gift, the parents transfer limited partnership interests, retaining the general partner interests.

C)The interests transferred to the children involve the control of the business.

D)As to the interests passing to the children, large discounts are claimed due to the blockage factor.

E)None of the above.

A)By gift, the parents transfer interests as general partners, retaining the limited partnership interests.

B)By gift, the parents transfer limited partnership interests, retaining the general partner interests.

C)The interests transferred to the children involve the control of the business.

D)As to the interests passing to the children, large discounts are claimed due to the blockage factor.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

75

Corey owns all of the stock of Blond Corporation which includes both common and preferred shares.The preferred stock is noncumulative,has no redemption date,and possesses no liquidation preference.In 1995,Corey makes a gift to his adult children of all of the common stock.He dies in 2008 still owning the preferred stock.The value of the Blond stock on the relevant dates is:

One of the tax consequences of this estate freeze is:

A)Corey's gross estate includes $0 as to the stock.

B)Corey's gross estate includes $5,000,000 as to the stock.

C)Corey made a gift of $3,000,000 in 1995.

D)Corey made a gift of $3,400,000 in 1995.

E)None of the above is correct.

One of the tax consequences of this estate freeze is:

A)Corey's gross estate includes $0 as to the stock.

B)Corey's gross estate includes $5,000,000 as to the stock.

C)Corey made a gift of $3,000,000 in 1995.

D)Corey made a gift of $3,400,000 in 1995.

E)None of the above is correct.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

76

With respect to a stock interest in a closely held corporation,which,if any,of the following factors work to increase the gross estate value of the interest?

A)The stock is not marketable.

B)A minority interest is involved.

C)The profits of the business are less than the industry average.

D)The blockage rule applies.

E)None of the above.

A)The stock is not marketable.

B)A minority interest is involved.

C)The profits of the business are less than the industry average.

D)The blockage rule applies.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

77

Which,if any,of the following factors should reduce the value of a note receivable included in the gross estate of the holder?

A)The interest rate provided for is 2%.

B)The note is payable on demand.

C)The note is supported by collateral.

D)The note is forgiven by the decedent's will.

E)None of the above.

A)The interest rate provided for is 2%.

B)The note is payable on demand.

C)The note is supported by collateral.

D)The note is forgiven by the decedent's will.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

78

At the time of her death,Sally was a shareholder in Oriole Corporation.In valuing the Oriole stock included in Sally's gross estate,the IRS contends that the corporation possessed considerable goodwill.In disputing this contention,which of the following point(s)is/are relevant?

A)To provide financing, Oriole has been obtaining its working capital from the shareholders at an above market rate of interest.

B)The rate of return used by the IRS for the type of business involved is too low.

C)Average net profit figures include large losses from unrelated investments.

D)Sally was not an employee of Oriole but was merely a passive investor.

E)None of the above.

A)To provide financing, Oriole has been obtaining its working capital from the shareholders at an above market rate of interest.

B)The rate of return used by the IRS for the type of business involved is too low.

C)Average net profit figures include large losses from unrelated investments.

D)Sally was not an employee of Oriole but was merely a passive investor.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

79

Which,if any,of the items listed below are valid factors utilized in valuing the stock in a closely held corporation?

A)The company's dividend-paying capacity.

B)The nature of the business.

C)The history of the company since its inception.

D)The book value of the stock.

E)All of the above.

A)The company's dividend-paying capacity.

B)The nature of the business.

C)The history of the company since its inception.

D)The book value of the stock.

E)All of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

80

At the time of Rick's death,he owned 70% of the stock in Robin Corporation,a closely held family business.Over the past five years,Robin has averaged annual profits of $400,000 in an industry where the usual rate of return is 9%.If the book value of the corporation's assets is $1,000,000 and goodwill exists,what might be a realistic value of the stock in Rick's gross estate?

A)$1,785,000.

B)$2,550,000.

C)$1,550,000.

D)$310,000.

E)None of the above.

A)$1,785,000.

B)$2,550,000.

C)$1,550,000.

D)$310,000.

E)None of the above.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck