Deck 7: Financial Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

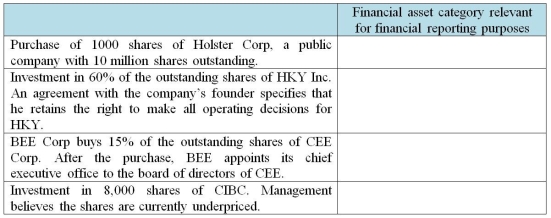

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

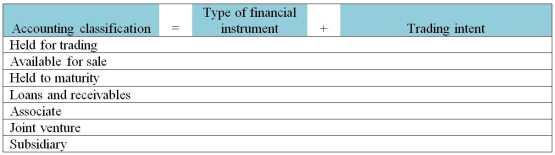

Question

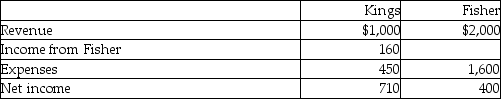

Question

Question

Question

Question

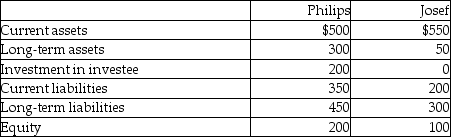

Question

Question

Question

Question

Question

Question

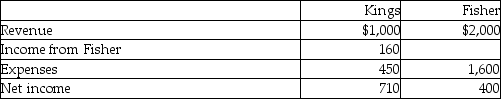

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

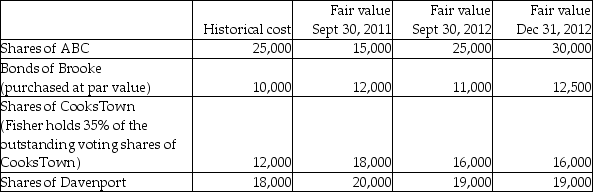

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/141

Play

Full screen (f)

Deck 7: Financial Assets

1

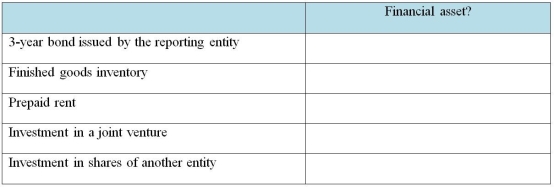

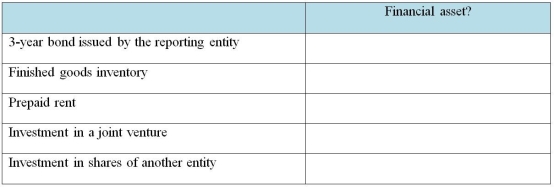

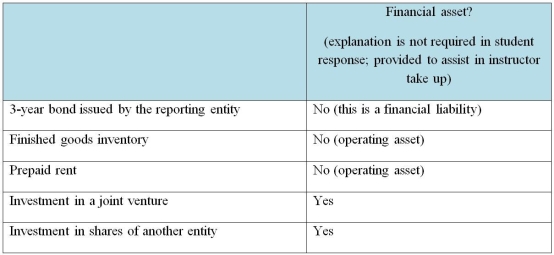

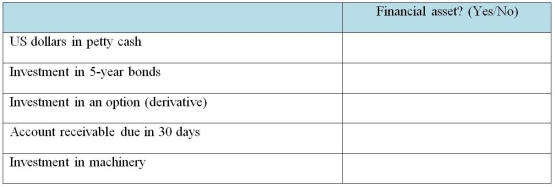

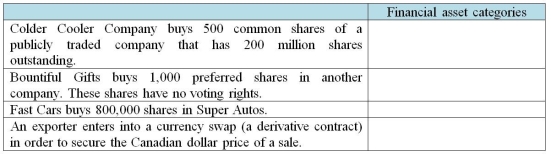

Identify whether each of the following items is a financial asset:

2

Explain the difference between a joint arrangement, joint control, joint operation and a joint venture. Explain how each type of investment is accounted for under IFRS.

A joint arrangement is a contractual arrangement whereby two or more parties undertake an economic activity that is subject to joint control by those parties.

Joint control is the contractually agreed upon sharing of control over an economic activity. Joint control exists only when the strategic decisions relating to the activity require the unanimous consent of the parties sharing control.

Joint operation is a type of joint arrangement where the investor has rights to the assets and obligations for the liabilities of the arrangement. The proportionate consolidation method is used.

Joint venture is a type of joint arrangement where the investor has rights to the net assets of the arrangement. The equity method of accounting is used.

Joint control is the contractually agreed upon sharing of control over an economic activity. Joint control exists only when the strategic decisions relating to the activity require the unanimous consent of the parties sharing control.

Joint operation is a type of joint arrangement where the investor has rights to the assets and obligations for the liabilities of the arrangement. The proportionate consolidation method is used.

Joint venture is a type of joint arrangement where the investor has rights to the net assets of the arrangement. The equity method of accounting is used.

3

Explain the difference between a joint arrangement, joint control, joint operation and a joint venture.

A joint arrangement is a contractual arrangement whereby two or more parties undertake an economic activity that is subject to joint control by those parties.

Joint control is the contractually agreed upon sharing of control over an economic activity. Joint control exists only when the strategic decisions relating to the activity require the unanimous consent of the parties sharing control.

Joint operation is a type of joint arrangement where the investor has rights to the assets and obligations for the liabilities of the arrangement.

Joint venture is a type of joint arrangement where the investor has rights to the net assets of the arrangement.

Joint control is the contractually agreed upon sharing of control over an economic activity. Joint control exists only when the strategic decisions relating to the activity require the unanimous consent of the parties sharing control.

Joint operation is a type of joint arrangement where the investor has rights to the assets and obligations for the liabilities of the arrangement.

Joint venture is a type of joint arrangement where the investor has rights to the net assets of the arrangement.

4

Explain the difference between a joint arrangement, joint control, joint operation and a joint venture. Explain how each type of investment is accounted for under IFRS. Explain the underlying reasons for the difference in accounting methods for these investments.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

5

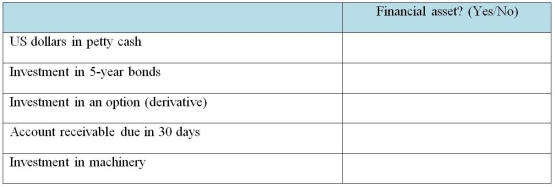

Identify whether each of the following items is a financial asset:

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

6

Which statement is correct about debt instruments?

A)A contract whose value changes according to a specified variable.

B)A contract that gives the holder the residual interest in an entity.

C)A contract that gives the holder joint interest in an entity.

D)A contract that is not an equity instrument or a derivative.

A)A contract whose value changes according to a specified variable.

B)A contract that gives the holder the residual interest in an entity.

C)A contract that gives the holder joint interest in an entity.

D)A contract that is not an equity instrument or a derivative.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

7

Describe the single most important characteristic of a financial asset that distinguishes it from a real asset.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

8

Explain why there is no one single measurement basis that is suitable for all financial assets. Does this mean that a company can choose any measurement base for any investment?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

9

Explain what financial assets are, how they differ from other types of assets, and why there is a variety of measurement standards for different categories of financial assets.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

10

Explain the characteristics of a financial asset. Discuss if cash has the characteristics of a financial asset. Why is (or is not)cash a financial asset?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

11

Which item is an example of a financial asset?

A)Share certificate of a public company.

B)Land.

C)Inventory.

D)Equipment.

A)Share certificate of a public company.

B)Land.

C)Inventory.

D)Equipment.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

12

What is a financial asset?

A)An asset that has a fixed or determinable cash flow.

B)Assets such as land and buildings that generate future cash flows.

C)An asset arising from contractual agreements on future cash flows.

D)An asset that does not generate future cash flows.

A)An asset that has a fixed or determinable cash flow.

B)Assets such as land and buildings that generate future cash flows.

C)An asset arising from contractual agreements on future cash flows.

D)An asset that does not generate future cash flows.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

13

Which statement is correct about an equity instrument?

A)A contract whose value changes according to a specified variable, requires little or no initial investment and is settled at a future date.

B)A contract that gives the holder the residual interest in an entity after deducting all of its liabilities.

C)Any contract that entitles the holder to joint interest in an entity after deducting all of its liabilities, and is settled at a future date.

D)Any contract that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

A)A contract whose value changes according to a specified variable, requires little or no initial investment and is settled at a future date.

B)A contract that gives the holder the residual interest in an entity after deducting all of its liabilities.

C)Any contract that entitles the holder to joint interest in an entity after deducting all of its liabilities, and is settled at a future date.

D)Any contract that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is correct about joint operations?

A)Joint operation is not a type of joint arrangement.

B)Joint operation is the same as a joint venture.

C)Proportionate consolidation is used for a joint operation.

D)Equity method of accounting is used for a joint operation.

A)Joint operation is not a type of joint arrangement.

B)Joint operation is the same as a joint venture.

C)Proportionate consolidation is used for a joint operation.

D)Equity method of accounting is used for a joint operation.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

15

Which statement is correct about financial instruments?

A)A contract whose value changes according to a specified variable, requires little or no initial investment and is settled at a future date.

B)A contract that gives the holder the residual interest in an entity after deducting all of its liabilities.

C)Any contract that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

D)Any contract that entitles the holder to joint interest in an entity after deducting all of its liabilities.

A)A contract whose value changes according to a specified variable, requires little or no initial investment and is settled at a future date.

B)A contract that gives the holder the residual interest in an entity after deducting all of its liabilities.

C)Any contract that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

D)Any contract that entitles the holder to joint interest in an entity after deducting all of its liabilities.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

16

Which item is an example of a real asset?

A)Share certificates.

B)Building.

C)Bonds.

D)Accounts receivable.

A)Share certificates.

B)Building.

C)Bonds.

D)Accounts receivable.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

17

Eastern Company contributes $5 million while Western Company contributes management expertise toward the creation of a joint venture called Ying. Ying purchases a building and obtains a mortgage to finance the purchase. The joint venture renovates the building with the help of contractors, who are paid 25 days after they render their services. After completion of renovations, Ying operates the building as a hotel. It also sells some of the rooms to individual investors. As a part of the purchase of each room, an investor has rights to 30% of the revenue from the hotel room purchased, while Ying retains 70% to cover operating costs.

Identify all the financial assets involved in the above situation.

Identify all the financial assets involved in the above situation.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

18

Which item is an example of real property?

A)Land.

B)Equipment.

C)Inventory.

D)Accounts receivable.

A)Land.

B)Equipment.

C)Inventory.

D)Accounts receivable.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

19

Victoria purchases a hotel with 100 similar rooms. To help finance this purchase, Victoria sells these rooms to individual investors for $200,000 each. An investor who owns a single room receives 55% of 1% of the revenue of the hotel (i.e., 0.55%), while the hotel retains the other 0.45%. An investor who wishes to liquidate his/her investment may sell his/her room back to Victoria for the original $200,000, but cannot otherwise sell the room to other parties.

Identify all the financial assets involved in the above situation.

Identify all the financial assets involved in the above situation.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

20

Which statement is correct about derivative instruments?

A)Any contract that entitles the holder to joint interest in an entity after deducting all of its liabilities.

B)A contract whose value changes according to a specified variable, requires little or no initial investment, and is settled at a future date.

C)Any contract that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

D)A contract that gives the holder the residual interest in an entity after deducting all of its liabilities.

A)Any contract that entitles the holder to joint interest in an entity after deducting all of its liabilities.

B)A contract whose value changes according to a specified variable, requires little or no initial investment, and is settled at a future date.

C)Any contract that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

D)A contract that gives the holder the residual interest in an entity after deducting all of its liabilities.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

21

Which statement is correct about an associate?

A)An arrangement where one party has the power to participate in the financial and operating policy decisions of another entity.

B)An arrangement where one entity governs the financial and operating policies about another entity.

C)A contractual arrangement whereby two or more parties share control over an economic activity and all strategic decisions requires unanimous consent by all parties.

D)An arrangement that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

A)An arrangement where one party has the power to participate in the financial and operating policy decisions of another entity.

B)An arrangement where one entity governs the financial and operating policies about another entity.

C)A contractual arrangement whereby two or more parties share control over an economic activity and all strategic decisions requires unanimous consent by all parties.

D)An arrangement that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

22

Explain the meaning of and give an example for the following categories of financial instruments: equity, a derivative, or debt.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

23

Which statement is correct about a financial instrument?

A)An arrangement where one party has the power to participate in the financial and operating policy decisions of another entity.

B)An arrangement where one entity governs the financial and operating policies about another entity.

C)A contractual arrangement whereby two or more parties share control over an economic activity and all strategic decisions requires unanimous consent by all parties.

D)An arrangement that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

A)An arrangement where one party has the power to participate in the financial and operating policy decisions of another entity.

B)An arrangement where one entity governs the financial and operating policies about another entity.

C)A contractual arrangement whereby two or more parties share control over an economic activity and all strategic decisions requires unanimous consent by all parties.

D)An arrangement that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

24

What is a "subsidiary"?

A)An entity where unanimous consent is required by the owners.

B)An entity that is controlled by another entity.

C)An entity over which the investor has the ability to participate in decisions affecting the entity's operations.

D)An entity that sells shares to the public.

A)An entity where unanimous consent is required by the owners.

B)An entity that is controlled by another entity.

C)An entity over which the investor has the ability to participate in decisions affecting the entity's operations.

D)An entity that sells shares to the public.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

25

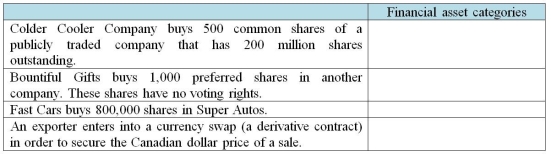

For financial reporting purposes, financial assets can be put into one of eight categories: subsidiaries, joint ventures, associates, held for trading, available for sale, held to maturity, joint operations, and loans and receivables. For each of the following items, identify the possible categories into which it can be placed. More than one category is possible for an item.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

26

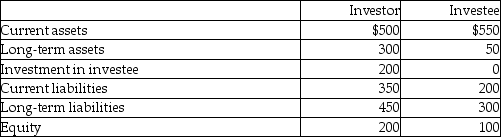

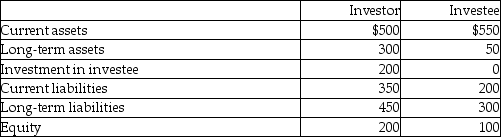

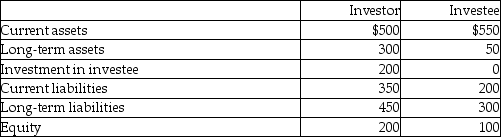

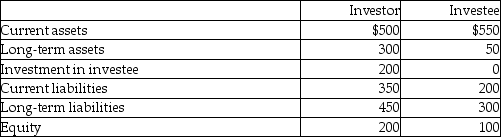

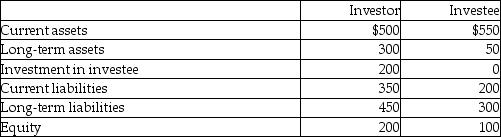

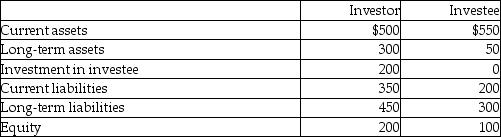

Based on the following information, what amount will be presented for "equity" on the consolidated balance sheet of Investor for its wholly owned subsidiary?

A)$100

B)$300

C)$600

D)$700

A)$100

B)$300

C)$600

D)$700

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

27

Which statement is not correct?

A)Held-for-trading investments are carried at fair value.

B)Available-for-sale investments are carried at fair value.

C)Held-to-maturity investments are carried at fair value.

D)Loans and receivables are carried at amortized cost.

A)Held-for-trading investments are carried at fair value.

B)Available-for-sale investments are carried at fair value.

C)Held-to-maturity investments are carried at fair value.

D)Loans and receivables are carried at amortized cost.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

28

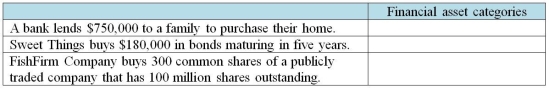

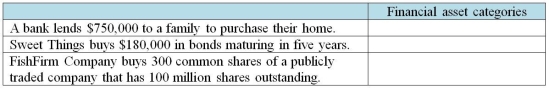

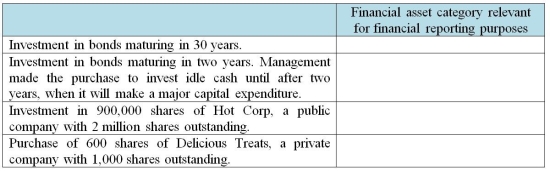

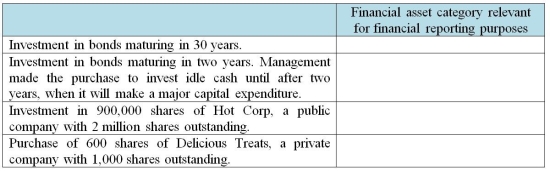

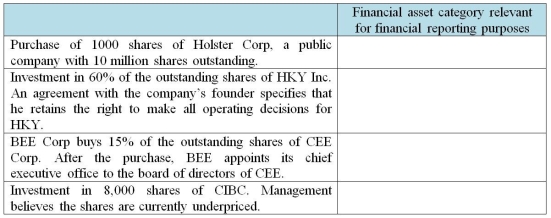

Classify each of the following items into one of the eight categories of financial assets relevant for financial reporting purposes. Select the category that best suits the situation given.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

29

Which statement is correct about subsidiaries?

A)An arrangement where one party has the power to participate in the financial and operating policy decisions of another entity.

B)An arrangement where one entity governs the financial and operating policies about another entity.

C)A contractual arrangement whereby two or more parties share control over an economic activity and all strategic decisions requires unanimous consent by all parties.

D)An arrangement that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

A)An arrangement where one party has the power to participate in the financial and operating policy decisions of another entity.

B)An arrangement where one entity governs the financial and operating policies about another entity.

C)A contractual arrangement whereby two or more parties share control over an economic activity and all strategic decisions requires unanimous consent by all parties.

D)An arrangement that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

30

What is the meaning of "control"?

A)The power to participate in the financial and operating policy decisions of the investee.

B)The power to govern the financial and operating policies of an entity.

C)The power to share in strategic decisions affecting an entity.

D)The power to sell the shares of an entity.

A)The power to participate in the financial and operating policy decisions of the investee.

B)The power to govern the financial and operating policies of an entity.

C)The power to share in strategic decisions affecting an entity.

D)The power to sell the shares of an entity.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

31

Which statement is correct about joint arrangements?

A)An arrangement where one party has the power to participate in the financial and operating policy decisions of another entity.

B)An arrangement where one entity governs the financial and operating policies of another entity.

C)A contractual arrangement whereby two or more parties share control over an economic activity and all strategic decisions requires unanimous consent by all parties.

D)An arrangement that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

A)An arrangement where one party has the power to participate in the financial and operating policy decisions of another entity.

B)An arrangement where one entity governs the financial and operating policies of another entity.

C)A contractual arrangement whereby two or more parties share control over an economic activity and all strategic decisions requires unanimous consent by all parties.

D)An arrangement that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

32

Classify each of the following items into one of the eight categories of financial assets relevant for financial reporting purposes. Select the category that best suits the situation given.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

33

Based on the following information, what amount will be presented for "investment in investee" on the consolidated balance sheet of Spenser for its wholly owned subsidiary?

A)$0

B)$200

C)$300

D)$600

A)$0

B)$200

C)$300

D)$600

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

34

Which statement is not correct about "control"?

A)Control is presumed when an entity has more than 50% of the voting power of the investee.

B)Having control allows the entity to direct the strategic operations of the investee.

C)Control is presumed when an entity owns more than 50% of the investee.

D)Consolidation is used when an entity has control over the investee.

A)Control is presumed when an entity has more than 50% of the voting power of the investee.

B)Having control allows the entity to direct the strategic operations of the investee.

C)Control is presumed when an entity owns more than 50% of the investee.

D)Consolidation is used when an entity has control over the investee.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

35

Elyse Inc. made the following investments during its 2012 fiscal year.

a. The company places $3,000 in a 8-month term deposit with its bank.

b. The company purchases from its broker a call option on 2,500 shares of BMO Financial, a publicly traded company, for $5,500, in anticipation of an increase in the stock price.

c. The company buys 30% of the outstanding shares of NEXT Corp. The purchase was made in anticipation of a bid by BEFORE Corp. to purchase all of the shares of NEXT within the next nine months.

d. The company buys $35,000 of shares in a publicly traded corporation with a market capitalization of more than $20 billion.

Required:

Identify how the company should categorize the above financial assets. Briefly explain the reason for the classification.

a. The company places $3,000 in a 8-month term deposit with its bank.

b. The company purchases from its broker a call option on 2,500 shares of BMO Financial, a publicly traded company, for $5,500, in anticipation of an increase in the stock price.

c. The company buys 30% of the outstanding shares of NEXT Corp. The purchase was made in anticipation of a bid by BEFORE Corp. to purchase all of the shares of NEXT within the next nine months.

d. The company buys $35,000 of shares in a publicly traded corporation with a market capitalization of more than $20 billion.

Required:

Identify how the company should categorize the above financial assets. Briefly explain the reason for the classification.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

36

For financial reporting purposes, financial assets can be put into one of eight categories: subsidiaries, joint ventures, associates, held for trading, available for sale, held to maturity, joint operations, and loans and receivables. For each of the following items, identify the possible categories into which it can be placed. More than one category is possible for an item.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is true about the equity method of accounting?

A)This method is used when the investor has no influence over the associate.

B)This method is a condensed consolidation that shows the investor's share of the net assets and net income of the investee.

C)This method record dividends from the associate as income from operations.

D)This method has the same accounting impact as the amortized cost method.

A)This method is used when the investor has no influence over the associate.

B)This method is a condensed consolidation that shows the investor's share of the net assets and net income of the investee.

C)This method record dividends from the associate as income from operations.

D)This method has the same accounting impact as the amortized cost method.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

38

Which statement is correct about joint arrangements?

A)IFRS distinguishes between joint operations and joint ventures.

B)IFRS uses the terms joint operations and joint ventures inter-changeably.

C)IFRS permits either the proportionate consolidation method or equity method.

D)IFRS permits only the equity method.

A)IFRS distinguishes between joint operations and joint ventures.

B)IFRS uses the terms joint operations and joint ventures inter-changeably.

C)IFRS permits either the proportionate consolidation method or equity method.

D)IFRS permits only the equity method.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

39

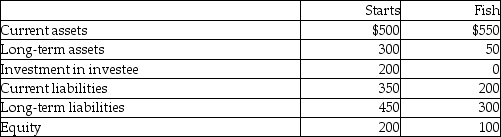

Based on the following information, what amount will be presented for current assets on the consolidated balance sheet of Investor for its wholly owned subsidiary?

A)$300

B)$500

C)$550

D)$1,050

A)$300

B)$500

C)$550

D)$1,050

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

40

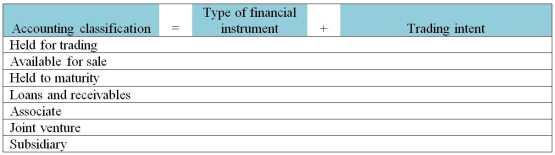

For each of the following financial asset classifications shown in the left column, identify the combinations of (i)the type of financial instrument in the middle column that can be put into that classification and (ii)the trading intent that would lead to that classification.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

41

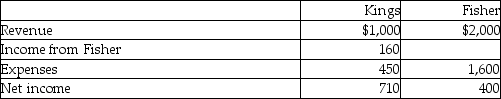

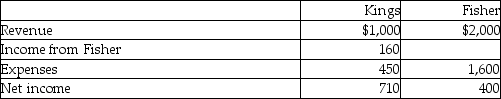

Kings has a 40% joint operation interest in Fisher. Based on the following information, what amount will be presented for "revenues" on Kings' proportionately consolidated income statement?

A)$1,000

B)$1,800

C)$2,000

D)$3,000

A)$1,000

B)$1,800

C)$2,000

D)$3,000

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

42

When there is no specific trading intention, what should an investment be classified as?

A)Held to maturity.

B)Available for sale.

C)Loans and receivables.

D)Associate.

A)Held to maturity.

B)Available for sale.

C)Loans and receivables.

D)Associate.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

43

Which statement is not correct about the equity method?

A)The investment account on the balance sheet equals the original cost plus the investor's share of the investee's post-acquisition changes in net assets.

B)This method results in reflecting two legal entities as one economic unit for financial reporting purposes.

C)Income is recognized equal to the investor's share of the investee's net income.

D)Dividends from the investee are deducted from the investor's investment account.

A)The investment account on the balance sheet equals the original cost plus the investor's share of the investee's post-acquisition changes in net assets.

B)This method results in reflecting two legal entities as one economic unit for financial reporting purposes.

C)Income is recognized equal to the investor's share of the investee's net income.

D)Dividends from the investee are deducted from the investor's investment account.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

44

Invest Up Hardware operates a chain of hardware stores. Recent operations have been stable and profitable, resulting in a significant amount of cash inflows. During the past fiscal year ended December 31, the company made a number of investments, as described below.

a. Invest Up bought 30,000 shares of Machine Mart, a supplier of equipment for construction and renovations. With in-depth knowledge of the hardware retailing business, Invest Up's management believes that Machine Mart's shares are undervalued and that the company could make a quick profit selling the shares within the next 12 months. Invest Up purchased the shares at $18 each, and received $0.30 per share dividends during the year. The shares traded at $29 at the fiscal year-end.

b. The company purchased 12,000 units of a mutual fund which cost $28 each. Management had no specific trading intentions for this investment; rather, it was a means of parking excess cash. At the end of the year, the units had a quoted market value of $24.

c. At the beginning of the year, Invest Up bought 25% of the common shares in Builder Bee, one of its smaller suppliers, for $6 million. These shares had a fair value of $6.6 million at the end of the year. During the year, Builder Bee reported net income of $1,500,000 and paid total dividends of $10,000

Required:

Determine how Invest Up should report the above investments in its financial statements. Include both the effects on the balance sheet and the statement of comprehensive income.

a. Invest Up bought 30,000 shares of Machine Mart, a supplier of equipment for construction and renovations. With in-depth knowledge of the hardware retailing business, Invest Up's management believes that Machine Mart's shares are undervalued and that the company could make a quick profit selling the shares within the next 12 months. Invest Up purchased the shares at $18 each, and received $0.30 per share dividends during the year. The shares traded at $29 at the fiscal year-end.

b. The company purchased 12,000 units of a mutual fund which cost $28 each. Management had no specific trading intentions for this investment; rather, it was a means of parking excess cash. At the end of the year, the units had a quoted market value of $24.

c. At the beginning of the year, Invest Up bought 25% of the common shares in Builder Bee, one of its smaller suppliers, for $6 million. These shares had a fair value of $6.6 million at the end of the year. During the year, Builder Bee reported net income of $1,500,000 and paid total dividends of $10,000

Required:

Determine how Invest Up should report the above investments in its financial statements. Include both the effects on the balance sheet and the statement of comprehensive income.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

45

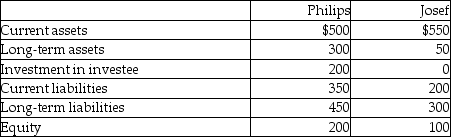

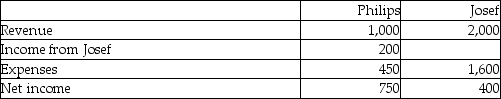

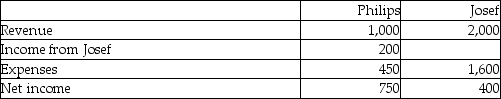

Philips has a 50% joint operation interest in Josef. Based on the following information, what amount will be presented for current assets on Philips' proportionately consolidated balance sheet?

A)$500

B)$550

C)$775

D)$1,050

A)$500

B)$550

C)$775

D)$1,050

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

46

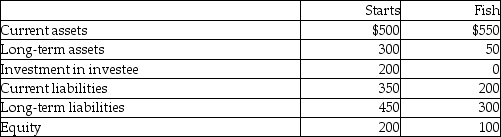

Starts has a 60% joint operation interest in Fish. Based on the following information, what amount will be presented for current liabilities on Starts' proportionately consolidated balance sheet?

A)$550

B)$470

C)$350

D)$200

A)$550

B)$470

C)$350

D)$200

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

47

Which statement is not correct about "joint arrangements"?

A)Joint arrangements usually have a limited life and a defined set of objectives or activities.

B)A joint arrangement is the same as a partnership for financial accounting purposes.

C)Unanimous consent for all decisions is required of all parties.

D)There is a contractually agreed sharing of control over economic activities.

A)Joint arrangements usually have a limited life and a defined set of objectives or activities.

B)A joint arrangement is the same as a partnership for financial accounting purposes.

C)Unanimous consent for all decisions is required of all parties.

D)There is a contractually agreed sharing of control over economic activities.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

48

What is the meaning of "joint control"?

A)Ability to participate in the financial and operating policy decisions of the investee.

B)Ability to govern the financial and operating policies of an entity.

C)The power to share in strategic decisions affecting an entity.

D)Ability to sell the shares of an entity.

A)Ability to participate in the financial and operating policy decisions of the investee.

B)Ability to govern the financial and operating policies of an entity.

C)The power to share in strategic decisions affecting an entity.

D)Ability to sell the shares of an entity.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

49

Which statement is not correct about "associates"?

A)Holding 18% of the voting power of the investee may mean significant influence exists.

B)The ability to exercise significant influence over the investee mitigates moral hazard.

C)The ability to exercise significant influence over the investee mitigates adverse selection.

D)Significant influence is not presumed if 20% of the voting power of the investee is held.

A)Holding 18% of the voting power of the investee may mean significant influence exists.

B)The ability to exercise significant influence over the investee mitigates moral hazard.

C)The ability to exercise significant influence over the investee mitigates adverse selection.

D)Significant influence is not presumed if 20% of the voting power of the investee is held.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

50

Accounting standards provide for a variety of different measurement bases for different types of financial assets. IFRS has several measurement bases, namely:

•consolidation

•fair value with changes through income

•proportionate consolidation

•fair value with changes through other comprehensive income

•equity method

•amortized cost

Required:

a. Explain why reporting entities should, on the one hand, use consolidation, proportionate consolidation, and the equity method for investments in subsidiaries, joint ventures, and associates, but on the other hand, use the fair value methods for equity investments that are held for trading or available for sale.

b. Explain, for investments in debt securities, why the amortized cost method is more appropriate for held-to-maturity investments, but one of the fair value methods is more appropriate for held-for-trading or available-for-sale securities.

c. Explain why it is appropriate for changes in fair value to flow through income when the investment is classified as held for trading, but the same changes in fair value flow through other comprehensive income when the investment is classified as available for sale.

•consolidation

•fair value with changes through income

•proportionate consolidation

•fair value with changes through other comprehensive income

•equity method

•amortized cost

Required:

a. Explain why reporting entities should, on the one hand, use consolidation, proportionate consolidation, and the equity method for investments in subsidiaries, joint ventures, and associates, but on the other hand, use the fair value methods for equity investments that are held for trading or available for sale.

b. Explain, for investments in debt securities, why the amortized cost method is more appropriate for held-to-maturity investments, but one of the fair value methods is more appropriate for held-for-trading or available-for-sale securities.

c. Explain why it is appropriate for changes in fair value to flow through income when the investment is classified as held for trading, but the same changes in fair value flow through other comprehensive income when the investment is classified as available for sale.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

51

Kings has a 40% joint operation interest in Fisher. Based on the following information, what amount will be presented for "income from Fisher" on Kings' proportionately consolidated income statement?

A)$0

B)$160

C)$400

D)$710

A)$0

B)$160

C)$400

D)$710

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

52

Philips has a 50% joint operation interest in Josef. Based on the following information, what amount will be presented for net income on Philips' proportionately consolidated income statement?

A)$200

B)$550

C)$750

D)$1,150

A)$200

B)$550

C)$750

D)$1,150

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

53

How does having significant influence over an investee alleviate information asymmetry?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

54

On January 1, 2013, Ella Ltd. purchased 25% of the common shares of JB Inc. for $2,200,000. In 2013, JB reported net income of $280,000 and paid dividends of $100,000.

Required:

a. Which of the following conditions must be met for Ella to use the equity method to report its investment in JB?

i. Ella owns at least 20% of the voting shares of JB.

ii. Ella has control over JB.

iii. Ella has a significant interest in JB.

iv. Ella is able to exercise significant influence over JB.

b. How much income would be reported by Ella in 2013 related to its investment in JB under the equity method?

Required:

a. Which of the following conditions must be met for Ella to use the equity method to report its investment in JB?

i. Ella owns at least 20% of the voting shares of JB.

ii. Ella has control over JB.

iii. Ella has a significant interest in JB.

iv. Ella is able to exercise significant influence over JB.

b. How much income would be reported by Ella in 2013 related to its investment in JB under the equity method?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

55

Which statement about investments is not correct?

A)A held-for-trading investment is a non-strategic investment.

B)An investment in an associate is a strategic investment.

C)An available-for-sale investment is a strategic investment.

D)A held-to-maturity investment is a non-strategic investment.

A)A held-for-trading investment is a non-strategic investment.

B)An investment in an associate is a strategic investment.

C)An available-for-sale investment is a strategic investment.

D)A held-to-maturity investment is a non-strategic investment.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

56

What is an "associate"?

A)An entity where unanimous consent over decisions is required by the owners.

B)An entity where the investor can exercise unilateral control over the decisions of the investee.

C)An entity where the investor has the ability to participate in decisions affecting the investee.

D)An entity that cannot sell shares to the public or issue debt in the marketplace.

A)An entity where unanimous consent over decisions is required by the owners.

B)An entity where the investor can exercise unilateral control over the decisions of the investee.

C)An entity where the investor has the ability to participate in decisions affecting the investee.

D)An entity that cannot sell shares to the public or issue debt in the marketplace.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

57

Which statement is not correct about strategic investments?

A)Proportionate consolidation is used for joint ventures because of the presence of joint control.

B)Proportionate share of the investee's assets is included in the joint venturer's balance sheet.

C)Consolidation effectively results in two legal entities being reported as one economic unit.

D)The fair value through profit or loss method is used for strategic investments.

A)Proportionate consolidation is used for joint ventures because of the presence of joint control.

B)Proportionate share of the investee's assets is included in the joint venturer's balance sheet.

C)Consolidation effectively results in two legal entities being reported as one economic unit.

D)The fair value through profit or loss method is used for strategic investments.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

58

What is the meaning of "significant influence"?

A)The power to participate in the financial and operating policy decisions of the investee.

B)The power to govern the financial and operating policies of an entity.

C)The power to share in strategic decisions affecting an entity.

D)The power to sell the shares of an entity.

A)The power to participate in the financial and operating policy decisions of the investee.

B)The power to govern the financial and operating policies of an entity.

C)The power to share in strategic decisions affecting an entity.

D)The power to sell the shares of an entity.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

59

Explain the nature of and the appropriate accounting treatment for investments in subsidiaries, joint ventures, and associates.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

60

What is a "joint arrangement"?

A)An entity where unanimous consent by the owners for all decisions is required.

B)An entity that is controlled by another entity.

C)An entity over which the investor has the ability to participate in decisions affecting the entity's operations.

D)An entity that sells shares to the public.

A)An entity where unanimous consent by the owners for all decisions is required.

B)An entity that is controlled by another entity.

C)An entity over which the investor has the ability to participate in decisions affecting the entity's operations.

D)An entity that sells shares to the public.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

61

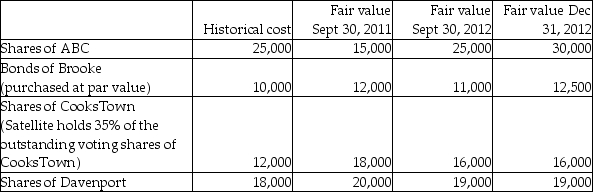

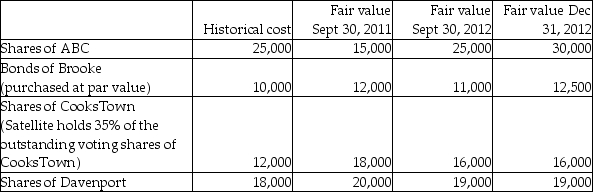

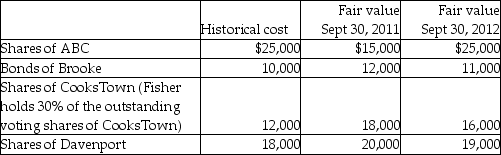

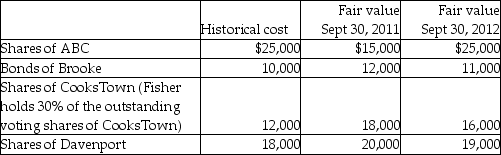

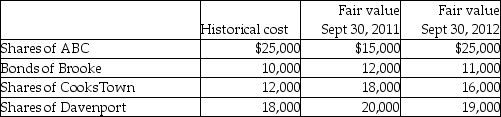

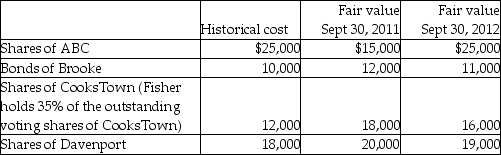

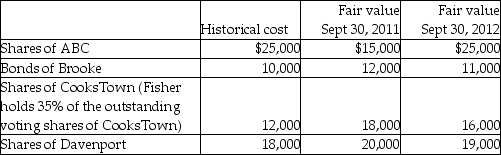

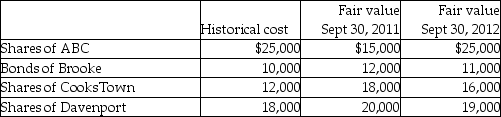

Fisher Corporation has the following investments at September 30, 2012:  What method of accounting will Fisher use to account for its investment in Cookstown if this investment is classified as an associate?

What method of accounting will Fisher use to account for its investment in Cookstown if this investment is classified as an associate?

A)Amortized cost.

B)Equity method.

C)Fair value through other comprehensive income.

D)Fair value through profit or loss.

What method of accounting will Fisher use to account for its investment in Cookstown if this investment is classified as an associate?

What method of accounting will Fisher use to account for its investment in Cookstown if this investment is classified as an associate?A)Amortized cost.

B)Equity method.

C)Fair value through other comprehensive income.

D)Fair value through profit or loss.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

62

Which statement is correct about a loan or a receivable instrument?

A)A financial investment that has fixed or determinable payments, but is not quoted in an active market.

B)A financial instrument that the entity has designated as available for sale as a result of the entity not expecting to recover substantially all of its initial investment for reasons other than credit deterioration.

C)A financial instrument that the entity has designated as available for sale on initial recognition.

D)A financial instrument that the entity intends to sell in the near term.

A)A financial investment that has fixed or determinable payments, but is not quoted in an active market.

B)A financial instrument that the entity has designated as available for sale as a result of the entity not expecting to recover substantially all of its initial investment for reasons other than credit deterioration.

C)A financial instrument that the entity has designated as available for sale on initial recognition.

D)A financial instrument that the entity intends to sell in the near term.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

63

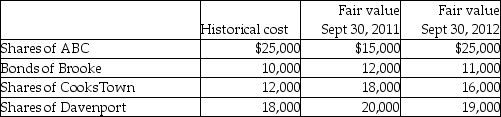

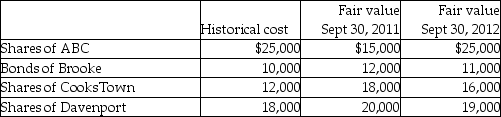

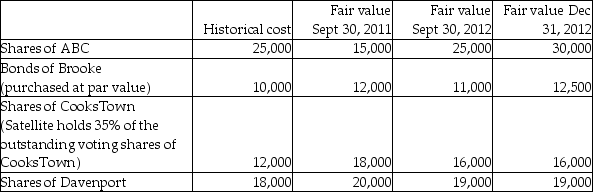

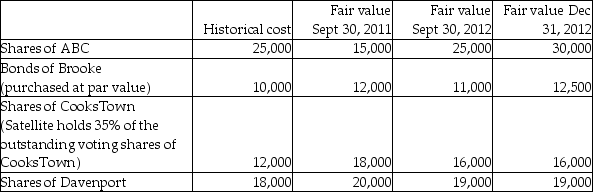

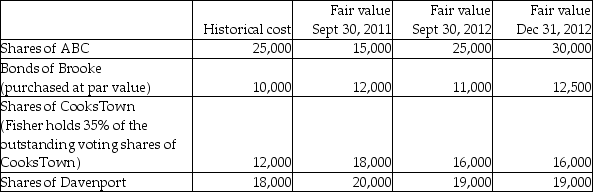

Satellite Corporation has the following investments at December 31, 2012:  If Satellite classifies its investment in Davenport as held for trading, what amount will be reported for the investment at September 30, 2012?

If Satellite classifies its investment in Davenport as held for trading, what amount will be reported for the investment at September 30, 2012?

A)$1,000

B)$18,000

C)$19,000

D)$20,000

If Satellite classifies its investment in Davenport as held for trading, what amount will be reported for the investment at September 30, 2012?

If Satellite classifies its investment in Davenport as held for trading, what amount will be reported for the investment at September 30, 2012?A)$1,000

B)$18,000

C)$19,000

D)$20,000

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

64

Which statement best describes a held-for-trading instrument?

A)A financial investment that has fixed or determinable payments and fixed maturity that an entity intends and is able to hold to maturity.

B)A financial investment that has not been otherwise classified as one of the other six categories of financial assets.

C)A financial investment that has fixed or determinable payments, but is not quoted in an active market.

D)A financial investment acquired for the purpose of selling in the near term.

A)A financial investment that has fixed or determinable payments and fixed maturity that an entity intends and is able to hold to maturity.

B)A financial investment that has not been otherwise classified as one of the other six categories of financial assets.

C)A financial investment that has fixed or determinable payments, but is not quoted in an active market.

D)A financial investment acquired for the purpose of selling in the near term.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

65

How should derivatives be classified?

A)Held for trading.

B)Held to maturity.

C)Available for sale.

D)Proportionate consolidation.

A)Held for trading.

B)Held to maturity.

C)Available for sale.

D)Proportionate consolidation.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

66

Which statement is not correct?

A)Held-for-trading investments are carried at amortized cost.

B)Loans and receivables are carried at amortized cost.

C)Held-to-maturity investments are carried at amortized cost.

D)Available-for-sale investments are carried at fair value.

A)Held-for-trading investments are carried at amortized cost.

B)Loans and receivables are carried at amortized cost.

C)Held-to-maturity investments are carried at amortized cost.

D)Available-for-sale investments are carried at fair value.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

67

Fisher Corporation has the following investments at September 30, 2012:  What method of accounting will Fisher use to account for its investment in Brooke if this investment is classified as available for sale?

What method of accounting will Fisher use to account for its investment in Brooke if this investment is classified as available for sale?

A)Amortized cost.

B)Equity method.

C)Fair value through other comprehensive income.

D)Fair value through profit or loss.

What method of accounting will Fisher use to account for its investment in Brooke if this investment is classified as available for sale?

What method of accounting will Fisher use to account for its investment in Brooke if this investment is classified as available for sale?A)Amortized cost.

B)Equity method.

C)Fair value through other comprehensive income.

D)Fair value through profit or loss.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

68

Fisher Corporation has the following investments at September 30, 2012:  What method of accounting will Fisher use to account for its investment in Brooke, if this investment is classified as held to maturity?

What method of accounting will Fisher use to account for its investment in Brooke, if this investment is classified as held to maturity?

A)Amortized cost.

B)Equity method.

C)Fair value through other comprehensive income.

D)Fair value through profit or loss.

What method of accounting will Fisher use to account for its investment in Brooke, if this investment is classified as held to maturity?

What method of accounting will Fisher use to account for its investment in Brooke, if this investment is classified as held to maturity?A)Amortized cost.

B)Equity method.

C)Fair value through other comprehensive income.

D)Fair value through profit or loss.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

69

Which statement is correct about a held-for-trading investment?

A)The investment is recorded at fair value.

B)Changes in fair value are recorded in OCI.

C)The investment is recorded at amortized cost.

D)The category cannot include debt instruments.

A)The investment is recorded at fair value.

B)Changes in fair value are recorded in OCI.

C)The investment is recorded at amortized cost.

D)The category cannot include debt instruments.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

70

What factor is not important in classifying an investment as held for trading?

A)Whether the instrument is a debt, equity or derivative instrument.

B)Whether the instrument has a set maturity date.

C)What the intentions of management are.

D)Whether the instrument generates dividends.

A)Whether the instrument is a debt, equity or derivative instrument.

B)Whether the instrument has a set maturity date.

C)What the intentions of management are.

D)Whether the instrument generates dividends.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

71

What should a debt instrument be classified as when there is no intention to trade it?

A)Held to maturity.

B)Available for sale.

C)Loans and receivables.

D)Held for trading.

A)Held to maturity.

B)Available for sale.

C)Loans and receivables.

D)Held for trading.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

72

Fisher Corporation has the following investments at September 30, 2012:  What method of accounting can Fisher not use to account for its investment in Cookstown?

What method of accounting can Fisher not use to account for its investment in Cookstown?

A)Amortized cost.

B)Equity method.

C)Fair value through other comprehensive income.

D)Fair value through profit or loss.

What method of accounting can Fisher not use to account for its investment in Cookstown?

What method of accounting can Fisher not use to account for its investment in Cookstown?A)Amortized cost.

B)Equity method.

C)Fair value through other comprehensive income.

D)Fair value through profit or loss.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

73

What should a debt investment be classified as when there is an intention to trade it?

A)Held to maturity.

B)Available for sale.

C)Loans and receivables.

D)Held for trading.

A)Held to maturity.

B)Available for sale.

C)Loans and receivables.

D)Held for trading.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

74

Fisher Corporation has the following investments at September 30, 2012:  What method of accounting will Fisher use to account for its investment in ABC, if this investment is classified as held for trading?

What method of accounting will Fisher use to account for its investment in ABC, if this investment is classified as held for trading?

A)Amortized cost.

B)Equity method.

C)Fair value through other comprehensive income.

D)Fair value through profit or loss.

What method of accounting will Fisher use to account for its investment in ABC, if this investment is classified as held for trading?

What method of accounting will Fisher use to account for its investment in ABC, if this investment is classified as held for trading?A)Amortized cost.

B)Equity method.

C)Fair value through other comprehensive income.

D)Fair value through profit or loss.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

75

Which statement is correct about an available-for-sale investment?

A)The investment is reported at historical cost.

B)Changes in fair value are recorded in OCI.

C)These investments are acquired for selling in the near term.

D)Changes in fair value are recorded in income.

A)The investment is reported at historical cost.

B)Changes in fair value are recorded in OCI.

C)These investments are acquired for selling in the near term.

D)Changes in fair value are recorded in income.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

76

Satellite Corporation has the following investments at December 31, 2012:  If Satellite classifies its investment in Davenport as available for sale, what amount will be reported for the investment at September 30, 2012?

If Satellite classifies its investment in Davenport as available for sale, what amount will be reported for the investment at September 30, 2012?

A)$1,000

B)$18,000

C)$19,000

D)$20,000

If Satellite classifies its investment in Davenport as available for sale, what amount will be reported for the investment at September 30, 2012?

If Satellite classifies its investment in Davenport as available for sale, what amount will be reported for the investment at September 30, 2012?A)$1,000

B)$18,000

C)$19,000

D)$20,000

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

77

Which investment could be classified as held for maturity?

A)Equity instrument.

B)Debt instrument.

C)Derivative.

D)Associate.

A)Equity instrument.

B)Debt instrument.

C)Derivative.

D)Associate.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

78

Fisher Corporation has the following investments at December 31, 2012:  If Fisher classifies its investment in Brooke as held to maturity, what amount will be reported in Fisher's 2012 year-end balance sheet?

If Fisher classifies its investment in Brooke as held to maturity, what amount will be reported in Fisher's 2012 year-end balance sheet?

A)$10,000

B)$11,000

C)$12,000

D)$12,500

If Fisher classifies its investment in Brooke as held to maturity, what amount will be reported in Fisher's 2012 year-end balance sheet?

If Fisher classifies its investment in Brooke as held to maturity, what amount will be reported in Fisher's 2012 year-end balance sheet?A)$10,000

B)$11,000

C)$12,000

D)$12,500

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

79

What factor is not important in classifying an investment as held for trading?

A)Whether the instrument is a debt, equity or derivative instrument.

B)Whether management intends to sell the instrument shortly after purchase.

C)Whether gains will be realized in the next operating cycle.

D)Whether the instrument has a fixed maturity date.

A)Whether the instrument is a debt, equity or derivative instrument.

B)Whether management intends to sell the instrument shortly after purchase.

C)Whether gains will be realized in the next operating cycle.

D)Whether the instrument has a fixed maturity date.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

80

What factor(s)differentiate a held-to-maturity investment from a "loan or receivable"?

A)Whether the instrument is a debt, equity or derivative instrument.

B)Whether the instrument has a set maturity date.

C)Whether the instrument trades in an active market.

D)Whether fair value information is available for the instrument.

A)Whether the instrument is a debt, equity or derivative instrument.

B)Whether the instrument has a set maturity date.

C)Whether the instrument trades in an active market.

D)Whether fair value information is available for the instrument.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck