Deck 9: Intangible Assets, Goodwill, Mineral Resources, and Government Grants

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/81

Play

Full screen (f)

Deck 9: Intangible Assets, Goodwill, Mineral Resources, and Government Grants

1

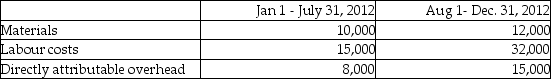

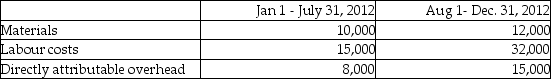

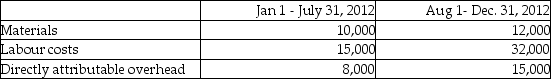

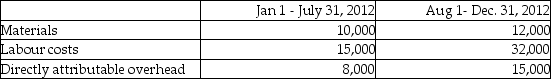

SuperIdeas Corp, a publicly accountable entity, incurred the following costs in its research and development division:  At August 1, 2012, SuperIdeas determined that the project was technically feasible but not commercially viable. How much, if any, of the costs can be capitalized for fiscal 2012?

At August 1, 2012, SuperIdeas determined that the project was technically feasible but not commercially viable. How much, if any, of the costs can be capitalized for fiscal 2012?

A)$0

B)$44,000

C)$59,000

D)$92,000

At August 1, 2012, SuperIdeas determined that the project was technically feasible but not commercially viable. How much, if any, of the costs can be capitalized for fiscal 2012?

At August 1, 2012, SuperIdeas determined that the project was technically feasible but not commercially viable. How much, if any, of the costs can be capitalized for fiscal 2012?A)$0

B)$44,000

C)$59,000

D)$92,000

A

2

Which statement is correct?

A)Costs can continue to be capitalized in the post development phase.

B)The project must meet IAS 38 criteria before development costs can be capitalized.

C)The development phase includes generating new ideas or searching for new materials.

D)The research phase includes designing, constructing or testing a prototype.

A)Costs can continue to be capitalized in the post development phase.

B)The project must meet IAS 38 criteria before development costs can be capitalized.

C)The development phase includes generating new ideas or searching for new materials.

D)The research phase includes designing, constructing or testing a prototype.

B

3

Which of the following is a difference between intangible assets and property, plant, and equipment (PPE)?

A)Held for use in the ordinary course of business.

B)Benefit more than one year.

C)Physical substance.

D)Lack of identifiability.

A)Held for use in the ordinary course of business.

B)Benefit more than one year.

C)Physical substance.

D)Lack of identifiability.

C

4

Which criteria under IAS 38 would be met if the "project has a dedicated group of qualified staff"?

A)Technical feasibility.

B)Marketability of usefulness.

C)Resource adequacy.

D)Ability to use or sell.

A)Technical feasibility.

B)Marketability of usefulness.

C)Resource adequacy.

D)Ability to use or sell.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

5

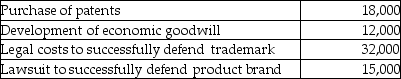

Patent Corp., a publicly accountable entity, purchased the following assets:  How much, if any, of the costs can be capitalized as intangible assets?

How much, if any, of the costs can be capitalized as intangible assets?

A)$0

B)$30,000

C)$62,000

D)$77,000

How much, if any, of the costs can be capitalized as intangible assets?

How much, if any, of the costs can be capitalized as intangible assets?A)$0

B)$30,000

C)$62,000

D)$77,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is not a characteristic of intangible assets?

A)Intangibles do not have physical substance.

B)Intangibles benefit more than one year.

C)Intangibles have fixed determinable cash flows.

D)Intangibles are held for use in the ordinary course of business.

A)Intangibles do not have physical substance.

B)Intangibles benefit more than one year.

C)Intangibles have fixed determinable cash flows.

D)Intangibles are held for use in the ordinary course of business.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

7

Which statement is correct?

A)Research is original or planned investigation to gather new knowledge or understanding.

B)Under IFRS all research costs can be either capitalized or expensed.

C)Research activities must be technically feasible as well as commercially viable.

D)Research is application of findings or knowledge towards new plans, designs or products.

A)Research is original or planned investigation to gather new knowledge or understanding.

B)Under IFRS all research costs can be either capitalized or expensed.

C)Research activities must be technically feasible as well as commercially viable.

D)Research is application of findings or knowledge towards new plans, designs or products.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not a characteristic of an intangible asset?

A)It has no physical substance.

B)Its useful life may exceed its legal life.

C)It may be amortized using the straight-line method.

D)It may be impaired and written off.

A)It has no physical substance.

B)Its useful life may exceed its legal life.

C)It may be amortized using the straight-line method.

D)It may be impaired and written off.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

9

Explain how goodwill arises in a business. Give an example in your response.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not a difference between intangible assets and property, plant and equipment (PPE)?

A)Intangibles do not have physical substance.

B)PPE and intangibles benefit for more than one year.

C)Intangibles are not held for use in the ordinary course of business.

D)PPE are held for use in the ordinary course of business.

A)Intangibles do not have physical substance.

B)PPE and intangibles benefit for more than one year.

C)Intangibles are not held for use in the ordinary course of business.

D)PPE are held for use in the ordinary course of business.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

11

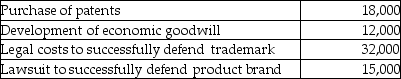

Patent Corp., a publicly accountable entity, incurred the following costs:  How much of the costs can be capitalized as intangible assets?

How much of the costs can be capitalized as intangible assets?

A)$18,000

B)$50,000

C)$65,000

D)$77,000

How much of the costs can be capitalized as intangible assets?

How much of the costs can be capitalized as intangible assets?A)$18,000

B)$50,000

C)$65,000

D)$77,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

12

Which criteria under IAS 38 would be met if the "project plan outlines the feasibility and timeline of the project"?

A)Measurement reliability.

B)Ability to use or sell.

C)Technical feasibility.

D)Management intention.

A)Measurement reliability.

B)Ability to use or sell.

C)Technical feasibility.

D)Management intention.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

13

Which statement is not correct?

A)Goodwill represents the difference between the purchase price and the fair value of net assets acquired.

B)Fair value is the after-tax amount at which an item could be sold in an arm's length transaction.

C)Economic goodwill differs from accounting goodwill and can be created by branding.

D)Fair value is the amount which could be exchanged in an arm's length transaction.

A)Goodwill represents the difference between the purchase price and the fair value of net assets acquired.

B)Fair value is the after-tax amount at which an item could be sold in an arm's length transaction.

C)Economic goodwill differs from accounting goodwill and can be created by branding.

D)Fair value is the amount which could be exchanged in an arm's length transaction.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

14

Research Corp., a publicly accountable entity, incurred the following costs in its research and development division:  At July 31, 2012, Research Corp. determined that the project was technically feasible and commercially viable. Research Corp. had sufficient resources and intentions to complete the project and was confident that there was demand in the marketplace for the product. How much, if any, of the costs can be capitalized for fiscal 2012?

At July 31, 2012, Research Corp. determined that the project was technically feasible and commercially viable. Research Corp. had sufficient resources and intentions to complete the project and was confident that there was demand in the marketplace for the product. How much, if any, of the costs can be capitalized for fiscal 2012?

A)$0

B)$44,000

C)$59,000

D)$92,000

At July 31, 2012, Research Corp. determined that the project was technically feasible and commercially viable. Research Corp. had sufficient resources and intentions to complete the project and was confident that there was demand in the marketplace for the product. How much, if any, of the costs can be capitalized for fiscal 2012?

At July 31, 2012, Research Corp. determined that the project was technically feasible and commercially viable. Research Corp. had sufficient resources and intentions to complete the project and was confident that there was demand in the marketplace for the product. How much, if any, of the costs can be capitalized for fiscal 2012?A)$0

B)$44,000

C)$59,000

D)$92,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

15

Which statement is correct?

A)Capitalization of costs ceases when the post development phase begins.

B)The development phase includes generating new ideas or searching for new materials.

C)The project must meet IAS 38 criteria before research costs can be capitalized.

D)The post development phase includes designing, constructing or testing a prototype.

A)Capitalization of costs ceases when the post development phase begins.

B)The development phase includes generating new ideas or searching for new materials.

C)The project must meet IAS 38 criteria before research costs can be capitalized.

D)The post development phase includes designing, constructing or testing a prototype.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

16

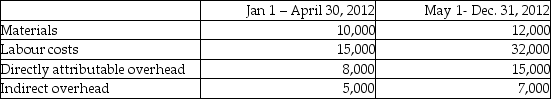

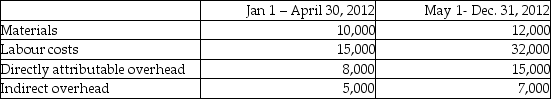

New Ventures Corp., a publicly accountable entity, incurred the following costs in its research and development division:  At April 30, 2012, New Ventures determined that the project was technically feasible and commercially viable. New Ventures had sufficient resources and intentions to complete the project and was confident that there was demand in the marketplace for the product. How much, if any, of the costs can be capitalized for fiscal 2012?

At April 30, 2012, New Ventures determined that the project was technically feasible and commercially viable. New Ventures had sufficient resources and intentions to complete the project and was confident that there was demand in the marketplace for the product. How much, if any, of the costs can be capitalized for fiscal 2012?

A)$0

B)$59,000

C)$66,000

D)$92,000

At April 30, 2012, New Ventures determined that the project was technically feasible and commercially viable. New Ventures had sufficient resources and intentions to complete the project and was confident that there was demand in the marketplace for the product. How much, if any, of the costs can be capitalized for fiscal 2012?

At April 30, 2012, New Ventures determined that the project was technically feasible and commercially viable. New Ventures had sufficient resources and intentions to complete the project and was confident that there was demand in the marketplace for the product. How much, if any, of the costs can be capitalized for fiscal 2012?A)$0

B)$59,000

C)$66,000

D)$92,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

17

Which statement is correct?

A)Under IFRS, research costs must fulfill six specific criteria.

B)Under IFRS, all research costs must be expensed as incurred.

C)Development activities must be technically feasible.

D)Adequate financial resources must exist to complete research activities.

A)Under IFRS, research costs must fulfill six specific criteria.

B)Under IFRS, all research costs must be expensed as incurred.

C)Development activities must be technically feasible.

D)Adequate financial resources must exist to complete research activities.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is a difference between intangible assets and property, plant and equipment (PPE)?

A)Intangibles lack physical substance.

B)PPE benefit more than one year.

C)Intangibles are held for use in the ordinary course of business.

D)Intangible assets are generally identifiable.

A)Intangibles lack physical substance.

B)PPE benefit more than one year.

C)Intangibles are held for use in the ordinary course of business.

D)Intangible assets are generally identifiable.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

19

Which statement is not correct?

A)Goodwill equals the purchase price less the fair value of net assets acquired.

B)Intangible assets can be purchased or internally created.

C)Economic goodwill equals accounting goodwill and can be created by branding.

D)Intangible assets are identifiable assets without physical substance.

A)Goodwill equals the purchase price less the fair value of net assets acquired.

B)Intangible assets can be purchased or internally created.

C)Economic goodwill equals accounting goodwill and can be created by branding.

D)Intangible assets are identifiable assets without physical substance.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

20

Assume that a company has spent $1 million during the year and is deciding whether these costs should be expensed as research costs or capitalized as development costs. Explain the impact of undercapitalization of development costs on the financial statements.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

21

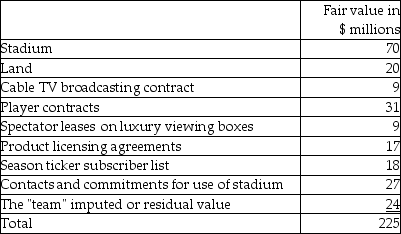

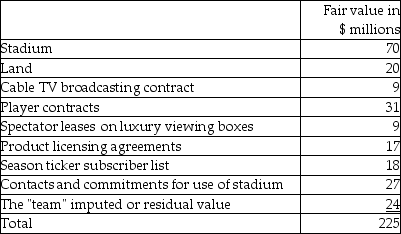

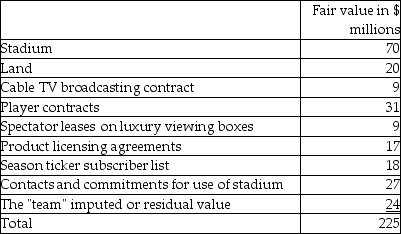

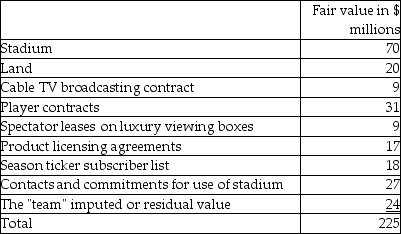

A professional sports team and related items (including a stadium)were bought by an exceedingly wealthy investor and sports fan. The negotiated price was $225,000,000. Details of what was purchased and the agreed fair values are as follows:

The team has been less than successful in its professional sports league and has been recording losses of $1,000,000 to $8,000,000 per year on its audited financial statements for the past five years. It was these losses that prompted the last owner to sell the team and related assets.

The team has been less than successful in its professional sports league and has been recording losses of $1,000,000 to $8,000,000 per year on its audited financial statements for the past five years. It was these losses that prompted the last owner to sell the team and related assets.

Required:

a. There are several identifiable intangible assets noted on the list. Group these assets into three classes, being those that are

(i)easily measurable and identifiable;

(ii)reasonably measurable and identifiable; and

(iii)very difficult to measure and identify.

For each group, what common quality or feature of these items distinguishes their classification?

b. While all the items can be assigned a value, would you capitalize all these amounts?

Explain your conclusion.

The team has been less than successful in its professional sports league and has been recording losses of $1,000,000 to $8,000,000 per year on its audited financial statements for the past five years. It was these losses that prompted the last owner to sell the team and related assets.

The team has been less than successful in its professional sports league and has been recording losses of $1,000,000 to $8,000,000 per year on its audited financial statements for the past five years. It was these losses that prompted the last owner to sell the team and related assets.Required:

a. There are several identifiable intangible assets noted on the list. Group these assets into three classes, being those that are

(i)easily measurable and identifiable;

(ii)reasonably measurable and identifiable; and

(iii)very difficult to measure and identify.

For each group, what common quality or feature of these items distinguishes their classification?

b. While all the items can be assigned a value, would you capitalize all these amounts?

Explain your conclusion.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

22

Listed below are several transactions that occurred during the year. In each case, all the amounts were debited to an account called "R and D costs." At the end of the year the company wants this account closed out and the amounts either expensed or capitalized to an asset account called "Development costs."

a. During the year $34,000,000 was paid to staff in the research division of a pharmaceutical firm. Supplies used totaled $3,000,000. Rent on the research building totaled $1,000,000. Utilities totaled $1,400,000. Head office allocated $1,500,000 in general overhead to the research division. The total spent on research was $40,900,000. The company is completing five different projects investigating whether five different drug combinations effectively reduce cancer in patients. One of the five drugs was very successful in most cases. Market research shows there is a huge market for this drug. The Board has committed resources to complete the project and market the drug; 10% of the total research staff is working on the successful drug combination.

b. During the year $22,000,000 was paid to staff to investigate whether a drug combination was effective for reducing a specific type of cancer. The drug was very successful in most cases. Management is committed to continuing this project and has secured financial and technical resources to see if the drug will prove to be commercially viable.

c. Last year $70,000,000 in costs were capitalized as all the development cost criteria were satisfied for a specific drug combination. During the current year a further $10,000,000 was spent that can be directly attributed to this drug's development. Near the end of the year a competitor surprisingly started selling a similar drug. The first-mover advantage of the competing drug seriously challenges the market usefulness and success of the drug this company is researching. Management and the Board are nonetheless financially and strategically committed to launching their drug in 18 months.

Required:

Prepare the journal entry required for each case. Explain your proposed treatment

a. During the year $34,000,000 was paid to staff in the research division of a pharmaceutical firm. Supplies used totaled $3,000,000. Rent on the research building totaled $1,000,000. Utilities totaled $1,400,000. Head office allocated $1,500,000 in general overhead to the research division. The total spent on research was $40,900,000. The company is completing five different projects investigating whether five different drug combinations effectively reduce cancer in patients. One of the five drugs was very successful in most cases. Market research shows there is a huge market for this drug. The Board has committed resources to complete the project and market the drug; 10% of the total research staff is working on the successful drug combination.

b. During the year $22,000,000 was paid to staff to investigate whether a drug combination was effective for reducing a specific type of cancer. The drug was very successful in most cases. Management is committed to continuing this project and has secured financial and technical resources to see if the drug will prove to be commercially viable.

c. Last year $70,000,000 in costs were capitalized as all the development cost criteria were satisfied for a specific drug combination. During the current year a further $10,000,000 was spent that can be directly attributed to this drug's development. Near the end of the year a competitor surprisingly started selling a similar drug. The first-mover advantage of the competing drug seriously challenges the market usefulness and success of the drug this company is researching. Management and the Board are nonetheless financially and strategically committed to launching their drug in 18 months.

Required:

Prepare the journal entry required for each case. Explain your proposed treatment

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

23

What is economic profit as it would be defined in finance or economics? Why is accounting net income not the same as an economist's determination of earnings, as measured from a shareholder's perspective?

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

24

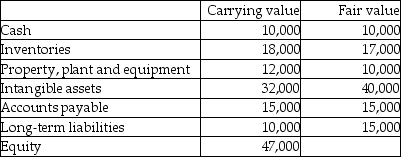

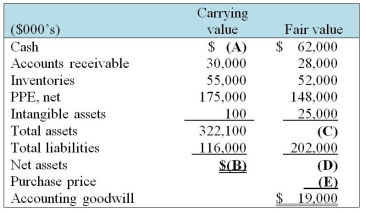

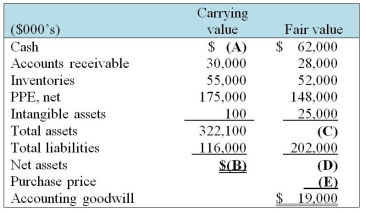

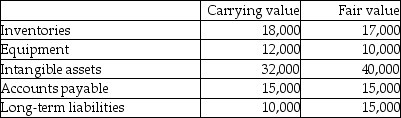

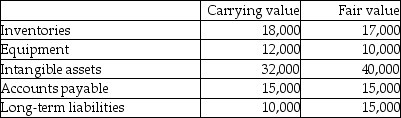

Patent Corp., a publicly accountable entity, purchased a company with the following assets and liabilities for $100,000:  How much goodwill should be recorded?

How much goodwill should be recorded?

A)$47,000

B)$53,000

C)$70,000

D)$100,000

How much goodwill should be recorded?

How much goodwill should be recorded?A)$47,000

B)$53,000

C)$70,000

D)$100,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

25

What are the unique features that lead to the differing accounting treatment between research and development costs?

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

26

What factor will not affect the estimated useful life of a finite lived intangible asset?

A)Legal life of the asset.

B)Productive capacity.

C)Competitive pressures.

D)Technological obsolescence.

A)Legal life of the asset.

B)Productive capacity.

C)Competitive pressures.

D)Technological obsolescence.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

27

Explain the accounting requirements for externally purchased intangibles and internally developed intangibles.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

28

Which criteria under IAS 38 would be met if there is a "project budget that outlines the specific costs, so the costs of the project are likely to be measured with sufficient reliability"?

A)Measurement reliability.

B)Management intention.

C)Technical feasibility.

D)Resource adequacy.

A)Measurement reliability.

B)Management intention.

C)Technical feasibility.

D)Resource adequacy.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

29

Which statement is not correct?

A)Assessing the useful life of an intangible asset requires professional judgment.

B)The residual value of an intangible asset is the same as the asset's salvage value.

C)The straight-line method of amortization is generally used for intangible assets.

D)An equal pattern is reflected by the straight-line method of amortization.

A)Assessing the useful life of an intangible asset requires professional judgment.

B)The residual value of an intangible asset is the same as the asset's salvage value.

C)The straight-line method of amortization is generally used for intangible assets.

D)An equal pattern is reflected by the straight-line method of amortization.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

30

Explain the accounting for internally developed intangible assets.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

31

A professional sports team and related items (including a stadium)were bought by an exceedingly wealthy investor and sports fan. The negotiated price was $225,000,000. Details of what was purchased and the agreed fair values are as follows:

The team has been less than successful in its professional sports league and has been recording losses of $1,000,000 to $8,000,000 per year on its audited financial statements for the past five years. It was these losses that prompted the last owner to sell the team and related assets.

The team has been less than successful in its professional sports league and has been recording losses of $1,000,000 to $8,000,000 per year on its audited financial statements for the past five years. It was these losses that prompted the last owner to sell the team and related assets.

Required:

a. Of the $225 million purchase price, how much of it relates to tangible assets? What percentage of the purchase price relates to tangible assets?

b. Describe the nature of the future economic benefits associated with each of the intangible assets acquired. For example, for the cablevision broadcasting contract, this would be the present value of the future payments expected from contracts for the broadcast of games on cablevision channels plus potential renewal contracts thereafter.

The team has been less than successful in its professional sports league and has been recording losses of $1,000,000 to $8,000,000 per year on its audited financial statements for the past five years. It was these losses that prompted the last owner to sell the team and related assets.

The team has been less than successful in its professional sports league and has been recording losses of $1,000,000 to $8,000,000 per year on its audited financial statements for the past five years. It was these losses that prompted the last owner to sell the team and related assets.Required:

a. Of the $225 million purchase price, how much of it relates to tangible assets? What percentage of the purchase price relates to tangible assets?

b. Describe the nature of the future economic benefits associated with each of the intangible assets acquired. For example, for the cablevision broadcasting contract, this would be the present value of the future payments expected from contracts for the broadcast of games on cablevision channels plus potential renewal contracts thereafter.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

32

Explain how earnings can be manipulated through choices made in the estimated useful lives for intangible assets.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

33

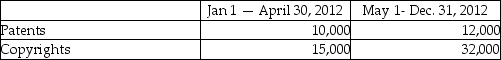

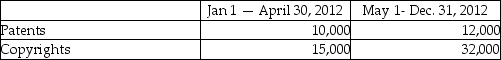

New Ventures Corp., a publicly accountable entity, capitalized the following costs:  Which statement is correct?

Which statement is correct?

A)Both of these assets will have an indefinite useful life.

B)Both of these assets will have a definite useful life.

C)For both assets, the useful life will be equal to the asset's legal life.

D)For both assets, the useful life could be shorter than its legal life.

Which statement is correct?

Which statement is correct?A)Both of these assets will have an indefinite useful life.

B)Both of these assets will have a definite useful life.

C)For both assets, the useful life will be equal to the asset's legal life.

D)For both assets, the useful life could be shorter than its legal life.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

34

Listed below are several transactions that occurred during the year. In each case, all the amounts were debited to an account called "R and D costs." At the end of the year the company wants this account closed out and the amounts either expensed or capitalized to an asset account called "Development costs." a. During the year $5,500,000 was paid to staff to investigate whether a drug combination was effective for reducing a specific type of cancer in mice. Evidence showed it materially reduced the effects of this cancer in the mice.

b. During the year $12,000,000 was paid to staff to investigate whether a drug combination was effective for reducing a specific type of cancer for terminally ill cancer patients. The trials were successful in a limited number of cases but the results were mixed.

c. During the year $44,000,000 was paid to staff to investigate whether a drug combination was effective in reducing a specific type of cancer. The drug was very successful in most cases. Market research shows a huge market for this drug. The Board has committed further resources to complete the development of this project and to market the drug.

d. During the year $41,000,000 was paid to staff to investigate whether a drug combination was effective in reducing a specific type of cancer. The drug combination was very successful in most cases. Market research shows huge a market for this drug combination. The company is too small and does not have adequate funds to complete the balance of the drug testing, so it is looking for a large pharmaceutical firm to take it over and complete the process.

Required:

Prepare the journal entry required for each case. Explain your proposed treatment.

b. During the year $12,000,000 was paid to staff to investigate whether a drug combination was effective for reducing a specific type of cancer for terminally ill cancer patients. The trials were successful in a limited number of cases but the results were mixed.

c. During the year $44,000,000 was paid to staff to investigate whether a drug combination was effective in reducing a specific type of cancer. The drug was very successful in most cases. Market research shows a huge market for this drug. The Board has committed further resources to complete the development of this project and to market the drug.

d. During the year $41,000,000 was paid to staff to investigate whether a drug combination was effective in reducing a specific type of cancer. The drug combination was very successful in most cases. Market research shows huge a market for this drug combination. The company is too small and does not have adequate funds to complete the balance of the drug testing, so it is looking for a large pharmaceutical firm to take it over and complete the process.

Required:

Prepare the journal entry required for each case. Explain your proposed treatment.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

35

What factor will not affect the estimated useful life of a finite lived intangible asset?

A)Legal life of the asset.

B)Technological obsolescence.

C)Physical condition of the asset.

D)Certainty of future cash flows.

A)Legal life of the asset.

B)Technological obsolescence.

C)Physical condition of the asset.

D)Certainty of future cash flows.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

36

Which statement is correct about indefinite lived intangible assets?

A)This is an infinite lived asset.

B)The asset is expected to continue providing economic benefits for the foreseeable future.

C)Management does not know how long the asset is expected to provide economic benefits.

D)The asset has fixed and determinable cash flows.

A)This is an infinite lived asset.

B)The asset is expected to continue providing economic benefits for the foreseeable future.

C)Management does not know how long the asset is expected to provide economic benefits.

D)The asset has fixed and determinable cash flows.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

37

Explain the difference in recognition of externally acquired intangibles versus internally developed intangibles.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is not a parameter of amortization?

A)Amortizable amount.

B)Salvage value.

C)Residual value.

D)Pattern of amortization.

A)Amortizable amount.

B)Salvage value.

C)Residual value.

D)Pattern of amortization.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

39

Why is it important to understand the difference between research costs and development costs?

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is NOT a "class" of intangible assets?

A)Industrial designs.

B)Raw materials.

C)Patents.

D)Computer software.

A)Industrial designs.

B)Raw materials.

C)Patents.

D)Computer software.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

41

Which statement is not correct?

A)In accounting for mineral resources, IFRS 6 applies for the exploration and evaluation phase.

B)In accounting for mineral resources, IAS 38 applies for the development phase.

C)A mineral site entering the development phase would normally satisfy the six criteria required for capitalization.

D)In accounting for mineral resources, IAS 38 is not applicable for any phase.

A)In accounting for mineral resources, IFRS 6 applies for the exploration and evaluation phase.

B)In accounting for mineral resources, IAS 38 applies for the development phase.

C)A mineral site entering the development phase would normally satisfy the six criteria required for capitalization.

D)In accounting for mineral resources, IAS 38 is not applicable for any phase.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

42

Which statement is correct?

A)In the extraction phase, the mineral site is ready for mineral production.

B)In the extraction phase, the mineral site is prepared for resource extraction.

C)In the extraction phase, the mineral site is assessed for technical viability.

D)In the extraction phase, the six criteria required for capitalization are met.

A)In the extraction phase, the mineral site is ready for mineral production.

B)In the extraction phase, the mineral site is prepared for resource extraction.

C)In the extraction phase, the mineral site is assessed for technical viability.

D)In the extraction phase, the six criteria required for capitalization are met.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

43

Which statement does not describe the "successful efforts" method?

A)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the outcome is successful.

B)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the production is technically feasible.

C)A method of accounting that capitalizes costs of mineral exploration and evaluation until the production is successful.

D)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the production is commercially viable.

A)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the outcome is successful.

B)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the production is technically feasible.

C)A method of accounting that capitalizes costs of mineral exploration and evaluation until the production is successful.

D)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the production is commercially viable.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

44

Which statement describes the "full cost" method?

A)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the outcome is successful.

B)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the production is technically feasible.

C)A method of accounting that capitalizes costs of mineral exploration and evaluation costs without regard to outcome.

D)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the production is commercially viable.

A)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the outcome is successful.

B)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the production is technically feasible.

C)A method of accounting that capitalizes costs of mineral exploration and evaluation costs without regard to outcome.

D)A method of accounting that capitalizes costs of mineral exploration and evaluation only if the production is commercially viable.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

45

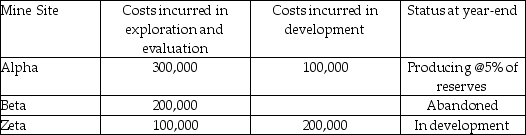

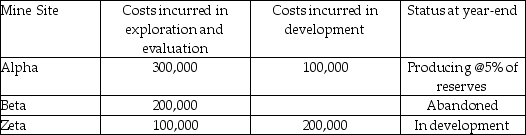

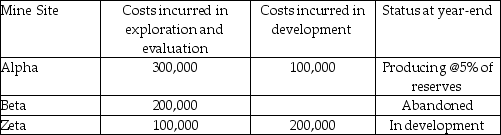

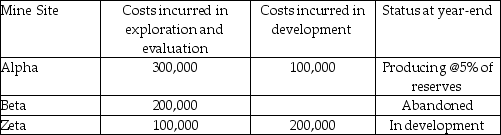

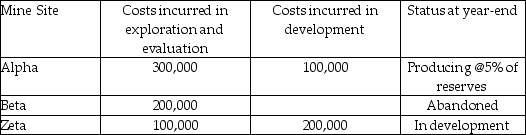

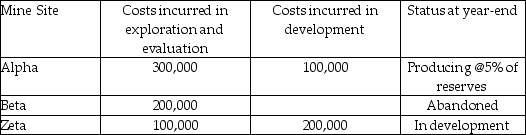

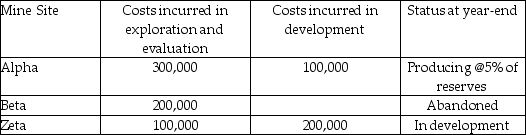

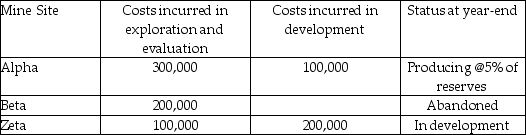

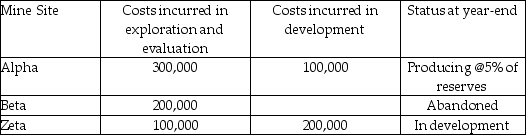

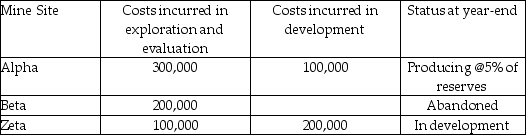

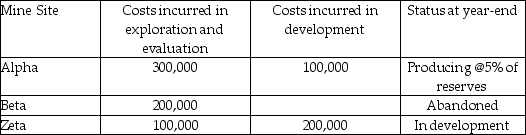

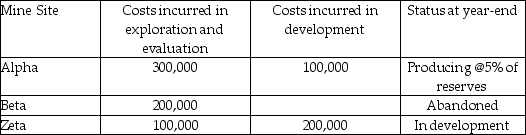

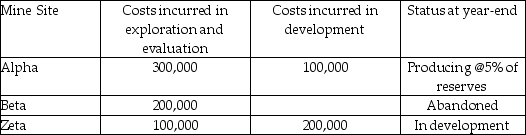

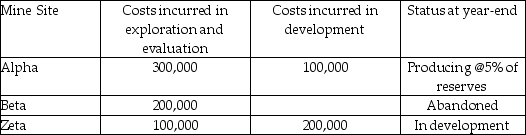

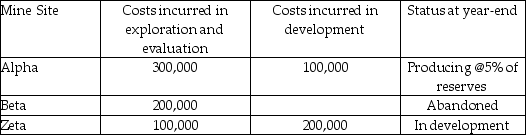

Soorya Resources incurred the following costs:  How much would be capitalized as "intangible assets" under the full cost method?

How much would be capitalized as "intangible assets" under the full cost method?

A)$300,000

B)$400,000

C)$500,000

D)$600,000

How much would be capitalized as "intangible assets" under the full cost method?

How much would be capitalized as "intangible assets" under the full cost method?A)$300,000

B)$400,000

C)$500,000

D)$600,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

46

Soorya Resources incurred the following costs:  How much would be capitalized as "intangible assets" under the successful efforts method?

How much would be capitalized as "intangible assets" under the successful efforts method?

A)$300,000

B)$400,000

C)$500,000

D)$600,000

How much would be capitalized as "intangible assets" under the successful efforts method?

How much would be capitalized as "intangible assets" under the successful efforts method?A)$300,000

B)$400,000

C)$500,000

D)$600,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

47

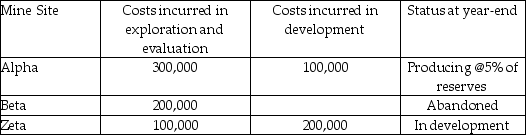

Calculate the missing amounts by completing the table below.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

48

GoodResources incurred the following costs:  How much would be capitalized as "property, plant or equipment" under the successful efforts method?

How much would be capitalized as "property, plant or equipment" under the successful efforts method?

A)$100,000

B)$200,000

C)$300,000

D)$700,000

How much would be capitalized as "property, plant or equipment" under the successful efforts method?

How much would be capitalized as "property, plant or equipment" under the successful efforts method?A)$100,000

B)$200,000

C)$300,000

D)$700,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

49

Below are several intangible assets. For each case suggest whether the item should be amortized. If amortization is recommended, what is the useful life that it should be amortized over? Provide justification for your recommendation.

a. Aye Corp purchased a brand name for $1,000,000. The firm has the exclusive right to use this name forever.

b. Bee Corp has developed a strong corporate reputation and its products are highly sought-after in the luxury goods market. Last year, $40,000,000 was spent on advertising its brand in top-tier fashion magazines and at the top fashion shows around the world.

c. Cee Corp paid $25,000,000 for the five-year exclusive privilege to have a famous celebrity endorse and use the company's sports equipment. This contract entitles Cee to renew the contract for a further two-year exclusive endorsement arrangement for a fixed fee of $10,000,000, due midway through the last year of the current contract.

a. Aye Corp purchased a brand name for $1,000,000. The firm has the exclusive right to use this name forever.

b. Bee Corp has developed a strong corporate reputation and its products are highly sought-after in the luxury goods market. Last year, $40,000,000 was spent on advertising its brand in top-tier fashion magazines and at the top fashion shows around the world.

c. Cee Corp paid $25,000,000 for the five-year exclusive privilege to have a famous celebrity endorse and use the company's sports equipment. This contract entitles Cee to renew the contract for a further two-year exclusive endorsement arrangement for a fixed fee of $10,000,000, due midway through the last year of the current contract.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

50

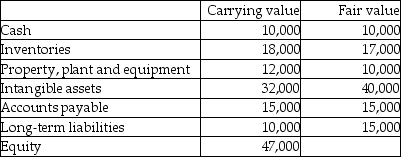

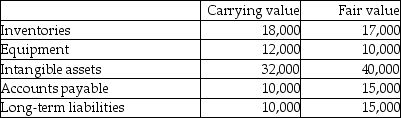

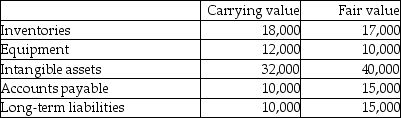

Growth Corp., a publicly accountable entity, purchased a company with the following assets and liabilities for $100,000:  Which of the following is not correct about the difference between carrying value and fair value?

Which of the following is not correct about the difference between carrying value and fair value?

A)Long-term liabilities could have a higher value due lower interest rates.

B)Inventories could have a lower fair value due to obsolescence.

C)Equipment could have a lower fair value due to decreased productive capacity.

D)Inventories could have a lower fair value due to accounting errors.

Which of the following is not correct about the difference between carrying value and fair value?

Which of the following is not correct about the difference between carrying value and fair value?A)Long-term liabilities could have a higher value due lower interest rates.

B)Inventories could have a lower fair value due to obsolescence.

C)Equipment could have a lower fair value due to decreased productive capacity.

D)Inventories could have a lower fair value due to accounting errors.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

51

Soorya Resources incurred the following costs:  How much would be recorded as depletion expense under the successful efforts method?

How much would be recorded as depletion expense under the successful efforts method?

A)$5,000

B)$15,000

C)$30,000

D)$45,000

How much would be recorded as depletion expense under the successful efforts method?

How much would be recorded as depletion expense under the successful efforts method?A)$5,000

B)$15,000

C)$30,000

D)$45,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

52

Explain the difference between indefinite lived and finite lived intangible assets.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

53

GoodResources incurred the following costs:  How much would be capitalized as "property, plant or equipment" under the full cost method?

How much would be capitalized as "property, plant or equipment" under the full cost method?

A)$100,000

B)$200,000

C)$300,000

D)$700,000

How much would be capitalized as "property, plant or equipment" under the full cost method?

How much would be capitalized as "property, plant or equipment" under the full cost method?A)$100,000

B)$200,000

C)$300,000

D)$700,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

54

Which statement is correct?

A)In the exploration and evaluation phase, the mineral site is ready for mineral production.

B)In the exploration and evaluation phase, the mineral site is prepared for resource extraction.

C)In the exploration and evaluation phase, the mineral site is assessed for commercial viability.

D)In the exploration and evaluation phase, the six criteria required for capitalization are met.

A)In the exploration and evaluation phase, the mineral site is ready for mineral production.

B)In the exploration and evaluation phase, the mineral site is prepared for resource extraction.

C)In the exploration and evaluation phase, the mineral site is assessed for commercial viability.

D)In the exploration and evaluation phase, the six criteria required for capitalization are met.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

55

Which statement is correct?

A)In the exploration phase, the mineral site is ready for mineral production.

B)In the extraction phase, the mineral site is assessed for commercial viability.

C)In the extraction phase, the mineral site is assessed for technical viability.

D)In the development phase, the mineral site is prepared for resource extraction.

A)In the exploration phase, the mineral site is ready for mineral production.

B)In the extraction phase, the mineral site is assessed for commercial viability.

C)In the extraction phase, the mineral site is assessed for technical viability.

D)In the development phase, the mineral site is prepared for resource extraction.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

56

Which statement is not correct?

A)Significant uncertainties exist during mineral exploration.

B)Entities can choose to either capitalize or expense mineral exploration costs.

C)IFRS 6 applies when the mineral resources enter the development phase.

D)Under IFRS, all costs must be expensed if a mineral site is not worthy of further exploration.

A)Significant uncertainties exist during mineral exploration.

B)Entities can choose to either capitalize or expense mineral exploration costs.

C)IFRS 6 applies when the mineral resources enter the development phase.

D)Under IFRS, all costs must be expensed if a mineral site is not worthy of further exploration.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

57

Growth Corp., a publicly accountable entity, purchased a company with the following assets and liabilities for $97,000:  Which of the following is not correct?

Which of the following is not correct?

A)Accounting goodwill of $55,000 will be recorded.

B)Accounting goodwill of $60,000 will be recorded.

C)The fair value of net tangible assets is $27,000.

D)Equipment could have a lower fair value due to decreased productive capacity.

Which of the following is not correct?

Which of the following is not correct?A)Accounting goodwill of $55,000 will be recorded.

B)Accounting goodwill of $60,000 will be recorded.

C)The fair value of net tangible assets is $27,000.

D)Equipment could have a lower fair value due to decreased productive capacity.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

58

Which statement is correct?

A)In the development phase, the mineral site is ready for mineral production.

B)In the development phase, the mineral site is assessed for commercial viability.

C)In the development phase, the mineral site is assessed for technical viability.

D)In the development phase, the six criteria required for capitalization are met.

A)In the development phase, the mineral site is ready for mineral production.

B)In the development phase, the mineral site is assessed for commercial viability.

C)In the development phase, the mineral site is assessed for technical viability.

D)In the development phase, the six criteria required for capitalization are met.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

59

Which statement is not correct?

A)The three phases in mining activities are: mineral exploration, development and extraction.

B)The accounting for mineral exploration is conceptually similar to that for research activities.

C)Mineral exploration costs can be capitalized because markets for mineral resources are well established.

D)A mineral site entering the development phase would normally satisfy the six criteria required for capitalization.

A)The three phases in mining activities are: mineral exploration, development and extraction.

B)The accounting for mineral exploration is conceptually similar to that for research activities.

C)Mineral exploration costs can be capitalized because markets for mineral resources are well established.

D)A mineral site entering the development phase would normally satisfy the six criteria required for capitalization.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

60

Which statement is not correct?

A)Under the successful efforts method, costs of all projects remain capitalized.

B)ASPE allows either the full cost or successful efforts method to be used.

C)Under the successful efforts method, only costs of successful projects remain capitalized.

D)Under IFRS, all costs must be expensed if a mineral site is not worthy of further exploration.

A)Under the successful efforts method, costs of all projects remain capitalized.

B)ASPE allows either the full cost or successful efforts method to be used.

C)Under the successful efforts method, only costs of successful projects remain capitalized.

D)Under IFRS, all costs must be expensed if a mineral site is not worthy of further exploration.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

61

Xavier Corp capitalized exploration and evaluation costs of $470,000. A further $1,357,000 was spent on tangible property, plant, and equipment to develop an oil well. Reserves at the beginning of the year were 480,000 barrels. During the year, the Corp produced 57,600 barrels of oil.

Calculate the amounts for depletion and depreciation.

Calculate the amounts for depletion and depreciation.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

62

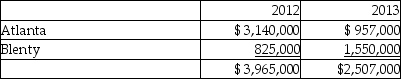

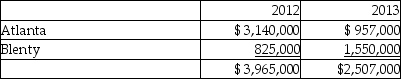

Kryan Corp. mines and produces aluminum. During 2012, the company explored two new sites and evaluated them for aluminum ore potential. By the December 31, 2012 year-end, both sites remained in the evaluation stage. During 2013, evaluation of site Atlanta was completed and the site was deemed to have sufficient quantities of ore; consequently, development of the site began. However, site Blenty was determined to have ore concentrations too low to be commercially viable. The following is the cost of exploration and evaluation incurred on the two sites:

Required:

Required:

Record the journal entries in 2012 and 2013 relating to the exploration and evaluation costs using the full cost method.

Required:

Required:Record the journal entries in 2012 and 2013 relating to the exploration and evaluation costs using the full cost method.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

63

In 2012, StartUp Inc. (SU)set up a new manufacturing facility in Manitoba. To encourage SU to set up its factory, the province provided equipment with a fair market value of $45,000 and an estimated useful life of 5 years using straight-line depreciation. What journal entry would be required in fiscal 2013, if the net method is used?

A)No entry is required.

B)A credit to other comprehensive income - donated assets of $9,000.

C)A credit to deferred income of $9,000.

D)A credit to accumulated depreciation for $9,000.

A)No entry is required.

B)A credit to other comprehensive income - donated assets of $9,000.

C)A credit to deferred income of $9,000.

D)A credit to accumulated depreciation for $9,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

64

Wind Town is a builder of wind turbines that are used in electricity generation. To encourage the installation of wind turbines and the development of wind power technology, the provincial government has several programs in place that support the industry. In 2012, Wind Town incurred the following costs that were potentially eligible for government subsidies:

i. The company spent $10 million on research and development (R&D); these costs are eligible for a 25% tax credit. The $10 million had been previously expensed.

ii. For each megawatt of wind power generating capacity installed, the government provides a subsidy of $100,000 to the customer. In 2012, Wind Town installed 17 megawatts for its customers (utility companies).

iii. Wind Town is eligible for a full tax rebate on sales tax normally levied on materials used in the construction of its turbine factory. This sales tax amounted to 5% of the materials cost of $35 million.

Required:

a. Record the journal entries for the above transactions using the gross method for government grants.

b. Record the journal entries for the above transactions using the net method for government grants.

i. The company spent $10 million on research and development (R&D); these costs are eligible for a 25% tax credit. The $10 million had been previously expensed.

ii. For each megawatt of wind power generating capacity installed, the government provides a subsidy of $100,000 to the customer. In 2012, Wind Town installed 17 megawatts for its customers (utility companies).

iii. Wind Town is eligible for a full tax rebate on sales tax normally levied on materials used in the construction of its turbine factory. This sales tax amounted to 5% of the materials cost of $35 million.

Required:

a. Record the journal entries for the above transactions using the gross method for government grants.

b. Record the journal entries for the above transactions using the net method for government grants.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

65

How does IFRS require that government grants for property, plant and equipment (PPE)be recorded?

A)The government grant should be recorded using the income approach.

B)The government grant should be recorded using the capital approach.

C)The government grant should not be recorded using either the income or capital approach.

D) IFRS do not provide any guidance for recording government grant.

A)The government grant should be recorded using the income approach.

B)The government grant should be recorded using the capital approach.

C)The government grant should not be recorded using either the income or capital approach.

D) IFRS do not provide any guidance for recording government grant.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

66

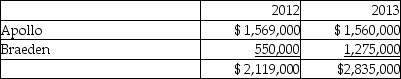

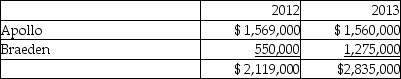

Kryan Corp. mines and produces aluminum. During 2012, the company explored two new sites and evaluated them for aluminum ore potential. By the December 31, 2012 year-end, both sites remained in the evaluation stage. During 2013, evaluation of site Apollo was completed and the site was deemed to have sufficient quantities of ore; consequently, development of the site began. However, site Braeden was determined to have ore concentrations too low to be commercially viable. The following is the cost of exploration and evaluation incurred on the two sites:

Required:

Required:

Record the journal entries in 2012 and 2013 relating to the exploration and evaluation costs using the successful efforts method. Assume that Kryan has a policy of capitalizing the costs of exploration and evaluation.

Required:

Required:Record the journal entries in 2012 and 2013 relating to the exploration and evaluation costs using the successful efforts method. Assume that Kryan has a policy of capitalizing the costs of exploration and evaluation.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

67

How does IFRS require that government grants for property, plant and equipment (PPE)be recorded?

A)The government grant should be recorded directly to equity.

B)The government grant should be recorded indirectly to equity via income.

C)The government grant should not be recorded directly to equity via income.

D)The government grant should not be recorded directly to equity.

A)The government grant should be recorded directly to equity.

B)The government grant should be recorded indirectly to equity via income.

C)The government grant should not be recorded directly to equity via income.

D)The government grant should not be recorded directly to equity.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

68

What is the appropriate treatment for re-payment of government grants under ASPE?

A)Accounted for prospectively.

B)Accounted for retrospectively.

C)Partial prospective treatment and partial retrospective treatment.

D)Full prospective treatment and full retrospective treatment.

A)Accounted for prospectively.

B)Accounted for retrospectively.

C)Partial prospective treatment and partial retrospective treatment.

D)Full prospective treatment and full retrospective treatment.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

69

GoodResources incurred the following costs:  How much would be recorded as depletion expense under the full cost method?

How much would be recorded as depletion expense under the full cost method?

A)$5,000

B)$15,000

C)$30,000

D)$45,000

How much would be recorded as depletion expense under the full cost method?

How much would be recorded as depletion expense under the full cost method?A)$5,000

B)$15,000

C)$30,000

D)$45,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

70

Soorya Resources incurred the following costs:  How much would be recorded as depreciation expense under the successful efforts method?

How much would be recorded as depreciation expense under the successful efforts method?

A)$5,000

B)$15,000

C)$30,000

D)$45,000

How much would be recorded as depreciation expense under the successful efforts method?

How much would be recorded as depreciation expense under the successful efforts method?A)$5,000

B)$15,000

C)$30,000

D)$45,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

71

In 2012, Waverly Corp. set up a new manufacturing facility in Nova Scotia. To encourage Waverly to set up its factory, the province provided equipment with a fair value of $250,000 and an estimated useful life of 15 years using straight-line depreciation. What journal entry would be required to record the equipment contribution in fiscal 2012, using the gross method?

A)A credit to donation revenue of $250,000.

B)A credit to other comprehensive income - donated assets of $250,000.

C)A credit to deferred income of $250,000.

D)A credit to property, plant and equipment for $250,000.

A)A credit to donation revenue of $250,000.

B)A credit to other comprehensive income - donated assets of $250,000.

C)A credit to deferred income of $250,000.

D)A credit to property, plant and equipment for $250,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

72

In 2012, New Wave Inc. (NW)set up a new manufacturing facility in Manitoba. To encourage NW to set up its factory, the province provided equipment with a fair value of $75,000 and an estimated useful life of 10 years using straight-line depreciation. What journal entry would be required to record the equipment contribution in fiscal 2012, using the net method?

A)A credit to donation revenue of $75,000.

B)A credit to other comprehensive income - donated assets of $75,000.

C)A credit to deferred income of $75,000.

D)A credit to property, plant and equipment for $75,000.

A)A credit to donation revenue of $75,000.

B)A credit to other comprehensive income - donated assets of $75,000.

C)A credit to deferred income of $75,000.

D)A credit to property, plant and equipment for $75,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

73

Explain how government grants are accounted for and presented in the financial statements.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

74

Explain the accounting for assets in the mineral resource exploration industry.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

75

Lilly Limited is planning to enlarge its factory in an economically challenged area of Canada. The federal, provincial, and municipal governments are all keen to assist the firm in making this investment successful, and hopefully generate permanent and significant economic and social benefits for the region. Collaboratively the three levels of government and the company have made the following commitments:

i. Lilly will build a factory that will cost $90 million.

ii. The city will donate the land for the factory, which has a fair value of $6,000,000. Upon completing construction, the legal title of the land will be transferred to Lilly.

iii. For the next five years, the city will reduce the property and municipal taxes the company has to pay on the new factory by 15%. It is estimated that these taxes would be $2,200,000 per year before the discount.

iv. The federal government will provide a forgivable loan of $7,500,000 to assist in the financing of the factory. The loan will be forgiven over five years if the company employs at least 220 workers per year in the new factory.

v. For the next five years, the provincial government will provide a training subsidy of $2,500,000 a year for the employment and skill development of local residents.

vi. The federal government will give Lilly a $1,200,000 grant immediately for having had a factory in the region for the past 10 years.

vii. The federal government will give Lilly $15,000,000 in five years if it maintains an average workforce of 920 workers employed at the new factory. During the first year an average of 235 workers were employed, as the factory was in the start-up stage.

Required:

a. Prepare journal entries to record each of the seven items described above for the first year. Assume all estimates and expectations for the first year are correct and the factory is built and operational in the first year. Lilly Limited uses the net method to record grants. No depreciation will be recorded in the first year.

b. What will be the annual depreciation expense for the factory starting in year two? Lilly Limited uses the net method to record grants. The factory is expected to have useful life of 30 years (excluding the first year in the start-up phase)and no material residual value. The company uses straight-line depreciation.

c. By how much was net income increased because of government assistance in the first year? For the second year, assume all continuing conditions to be eligible for the grants are met. How much was net income increased by in the second year? Ignore income taxes.

i. Lilly will build a factory that will cost $90 million.

ii. The city will donate the land for the factory, which has a fair value of $6,000,000. Upon completing construction, the legal title of the land will be transferred to Lilly.

iii. For the next five years, the city will reduce the property and municipal taxes the company has to pay on the new factory by 15%. It is estimated that these taxes would be $2,200,000 per year before the discount.

iv. The federal government will provide a forgivable loan of $7,500,000 to assist in the financing of the factory. The loan will be forgiven over five years if the company employs at least 220 workers per year in the new factory.

v. For the next five years, the provincial government will provide a training subsidy of $2,500,000 a year for the employment and skill development of local residents.

vi. The federal government will give Lilly a $1,200,000 grant immediately for having had a factory in the region for the past 10 years.

vii. The federal government will give Lilly $15,000,000 in five years if it maintains an average workforce of 920 workers employed at the new factory. During the first year an average of 235 workers were employed, as the factory was in the start-up stage.

Required:

a. Prepare journal entries to record each of the seven items described above for the first year. Assume all estimates and expectations for the first year are correct and the factory is built and operational in the first year. Lilly Limited uses the net method to record grants. No depreciation will be recorded in the first year.

b. What will be the annual depreciation expense for the factory starting in year two? Lilly Limited uses the net method to record grants. The factory is expected to have useful life of 30 years (excluding the first year in the start-up phase)and no material residual value. The company uses straight-line depreciation.

c. By how much was net income increased because of government assistance in the first year? For the second year, assume all continuing conditions to be eligible for the grants are met. How much was net income increased by in the second year? Ignore income taxes.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is correct with respect to the accounting for re-payment of government grants?

A)Accounted for prospectively under IFRS.

B)Accounted for retrospectively under ASPE.

C)Partial prospective treatment and partial retrospective treatment under ASPE.

D)Partial prospective treatment and partial retrospective treatment under IFRS.

A)Accounted for prospectively under IFRS.

B)Accounted for retrospectively under ASPE.

C)Partial prospective treatment and partial retrospective treatment under ASPE.

D)Partial prospective treatment and partial retrospective treatment under IFRS.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

77

GoodResources incurred the following costs:  How much would be recorded as depreciation expense under the full cost method?

How much would be recorded as depreciation expense under the full cost method?

A)$5,000

B)$15,000

C)$30,000

D)$45,000

How much would be recorded as depreciation expense under the full cost method?

How much would be recorded as depreciation expense under the full cost method?A)$5,000

B)$15,000

C)$30,000

D)$45,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

78

What is the appropriate treatment for re-payment of government grants under IFRS?

A)Accounted for prospectively.

B)Accounted for retrospectively.

C)Partial prospective treatment and partial retrospective treatment.

D)Full prospective treatment and full retrospective treatment.

A)Accounted for prospectively.

B)Accounted for retrospectively.

C)Partial prospective treatment and partial retrospective treatment.

D)Full prospective treatment and full retrospective treatment.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

79

In 2012, Waverley Corp. set up a new manufacturing facility in Nova Scotia. To encourage Waverly to set up its factory, the province provided equipment with a fair value of $250,000 and an estimated useful life of 10 years using straight-line depreciation. What journal entry would be required in fiscal 2013, using the gross method?

A)A credit to donation revenue of $25,000.

B)A credit to other comprehensive income - donated assets of $25,000.

C)A credit to other income - government grant of $25,000.

D)A credit to depreciation expense for $25,000.

A)A credit to donation revenue of $25,000.

B)A credit to other comprehensive income - donated assets of $25,000.

C)A credit to other income - government grant of $25,000.

D)A credit to depreciation expense for $25,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is correct with respect to the accounting for re-payment of government grants?

A)Accounted for prospectively under IFRS.

B)Accounted for retrospectively under ASPE.

C)Accounted for prospectively under ASPE

D)Accounted for retrospectively under IFRS.

A)Accounted for prospectively under IFRS.

B)Accounted for retrospectively under ASPE.

C)Accounted for prospectively under ASPE

D)Accounted for retrospectively under IFRS.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck