Deck 12: Income Tax Allocation

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/4

Play

Full screen (f)

Deck 12: Income Tax Allocation

1

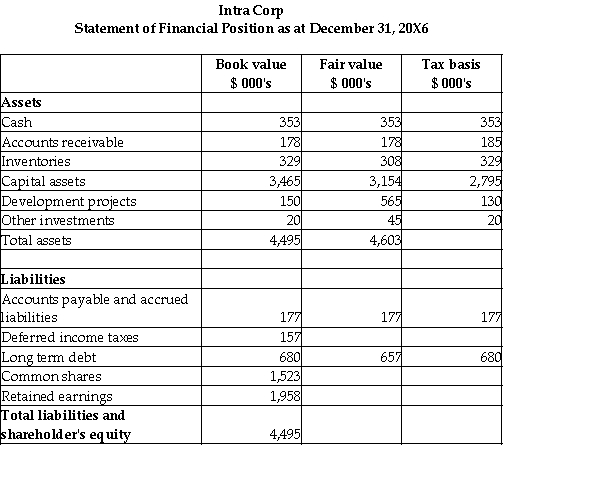

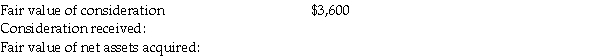

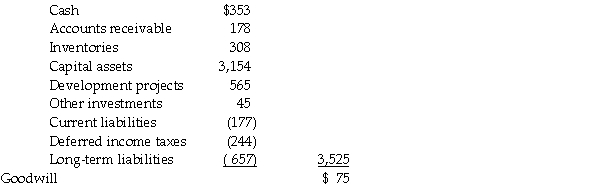

On January 1,20X7,Falcon acquired 100% of the outstanding shares of Intra for $3,600,000.Both are mining companies involved in nickel and copper production.The balance sheet for Intra at the date of acquisition is shown below together with estimated of the fair values and tax values of Intra's recorded assets and liabilities.

The tax rate for Intra and for Falcon is 30%.

Required:

What is the amount of goodwill to be recorded for this business combination?

The tax rate for Intra and for Falcon is 30%.

Required:

What is the amount of goodwill to be recorded for this business combination?

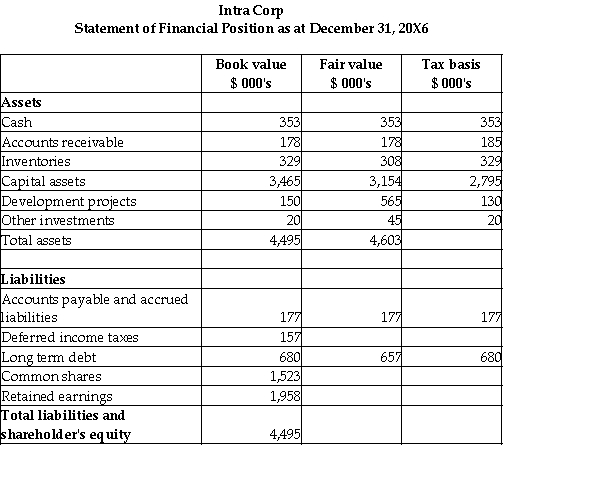

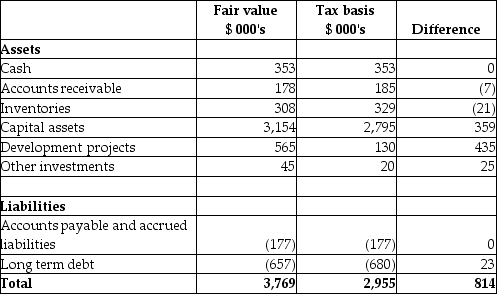

Deferred Income taxes

Deferred Income taxesTemporary difference × tax rate = $814 × 30% = 244

Calculation of goodwill (in 000s):

2

Foster Ltd.acquired 100% of Benson Ltd.The carrying values of Benson's capital assets differed from their fair values and their fair values differ from their adjusted cost bases for tax purposes.Which of the following statements is true?

A)The difference between Benson's carrying values and its fair values creates a deferred tax asset or liability that is part of the allocation of the acquisition cost.

B)The difference between Benson's fair values and its adjusted cost bases for tax purposes creates a deferred tax asset or liability that is part of the allocation of the acquisition cost.

C)The difference between Benson's carrying values and its adjusted cost bases for tax purposes creates a deferred tax asset or liability that is part of the allocation of the acquisition cost.

D)No deferred tax asset or liability arises from the above situation.

A)The difference between Benson's carrying values and its fair values creates a deferred tax asset or liability that is part of the allocation of the acquisition cost.

B)The difference between Benson's fair values and its adjusted cost bases for tax purposes creates a deferred tax asset or liability that is part of the allocation of the acquisition cost.

C)The difference between Benson's carrying values and its adjusted cost bases for tax purposes creates a deferred tax asset or liability that is part of the allocation of the acquisition cost.

D)No deferred tax asset or liability arises from the above situation.

B

3

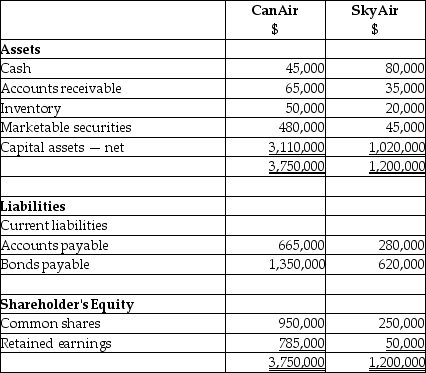

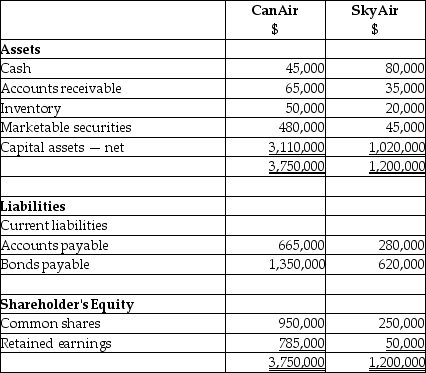

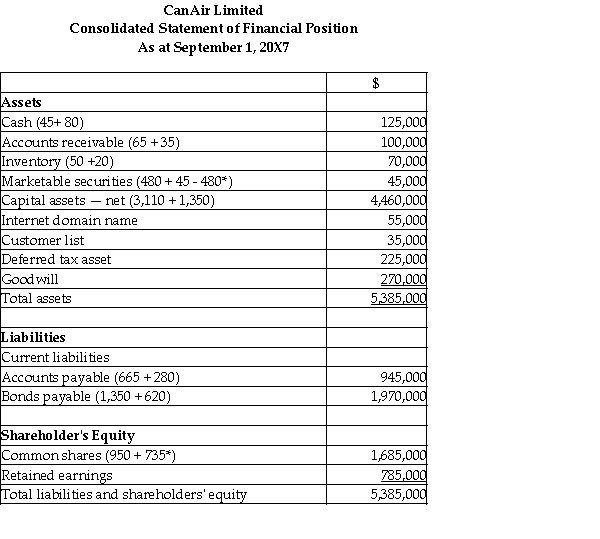

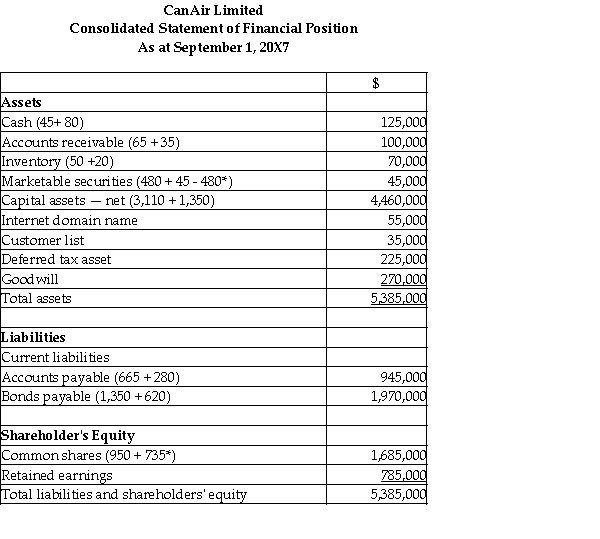

On September 1,20X7,CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc.for $1,215,000.Can Air will pay for this acquisition by cashing in all of its marketable securities and issuing share capital for the remaining amount.The balances showing on the statement of financial position for the two companies at August 31,20X7 are as follows:

After a review of the financial assets and liabilities,CanAir determines that some of the assets of SkyAir have fair values different from their carrying values.These items are listed below:

Capital assets - fair value is $1,350,000

Internet domain name - fair value is $55,000

Customer lists - fair value is $35,000

In addition,SkyAir has tax losses available for carryforward that have a fair value of $225,000 and it is probable that they will be realized in the future.

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1,20X7.

After a review of the financial assets and liabilities,CanAir determines that some of the assets of SkyAir have fair values different from their carrying values.These items are listed below:

Capital assets - fair value is $1,350,000

Internet domain name - fair value is $55,000

Customer lists - fair value is $35,000

In addition,SkyAir has tax losses available for carryforward that have a fair value of $225,000 and it is probable that they will be realized in the future.

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1,20X7.

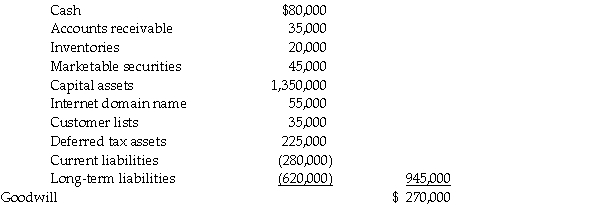

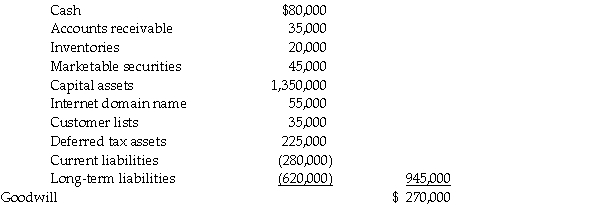

Calculation of goodwill:  Consideration received:

Consideration received:

Fair value of net assets acquired:

*Note: The purchase price of $1,215,000 is paid with cash from the marketable securities of $480,000 and an issue of shares totalling $735,000.

*Note: The purchase price of $1,215,000 is paid with cash from the marketable securities of $480,000 and an issue of shares totalling $735,000.

Consideration received:

Consideration received:Fair value of net assets acquired:

*Note: The purchase price of $1,215,000 is paid with cash from the marketable securities of $480,000 and an issue of shares totalling $735,000.

*Note: The purchase price of $1,215,000 is paid with cash from the marketable securities of $480,000 and an issue of shares totalling $735,000. 4

O'Ball Ltd.wants to acquire Kiro Ltd.to take advantage of its tax losses and credit carry forwards.In what way can O'Ball accomplish this?

A)O'Ball can purchase Kiro's net assets.

B)O'Ball can do a share exchange with Kiro.

C)O'Ball can either purchase Kiro's net assets or purchase Kiro's shares.

D)O'Ball can either purchase Kiro's net assets or do a share exchange with Kiro.

A)O'Ball can purchase Kiro's net assets.

B)O'Ball can do a share exchange with Kiro.

C)O'Ball can either purchase Kiro's net assets or purchase Kiro's shares.

D)O'Ball can either purchase Kiro's net assets or do a share exchange with Kiro.

Unlock Deck

Unlock for access to all 4 flashcards in this deck.

Unlock Deck

k this deck