Deck 14: Raising Equity Capital

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 14: Raising Equity Capital

1

Which of the following is NOT a reason why an investor would choose to invest in new and growing firms as a limited partner in a venture capital firm rather than making those investments directly by themselves?

A)Venture capital firms use their control of the companies they invest in to protect those investments.

B)The investments of venture capital firm are more diversified than the investments of a single individual.

C)A venture capital firm generally has a wide range of expertise among its general partners.

D)The investor will have a direct say in how the companies that the venture capital firm funds will be run.

A)Venture capital firms use their control of the companies they invest in to protect those investments.

B)The investments of venture capital firm are more diversified than the investments of a single individual.

C)A venture capital firm generally has a wide range of expertise among its general partners.

D)The investor will have a direct say in how the companies that the venture capital firm funds will be run.

D

2

Simone founded her company using $150,000 of her own money,issuing herself 300,000 shares of stock.An angel investor bought an additional 200,000 shares for $100,000.She now sells another 500,000 shares of stock to a venture capitalist for $2 million.What percentage of the firm does Simone now own?

A)10%

B)20%

C)30%

D)40%

A)10%

B)20%

C)30%

D)40%

C

3

A large publishing firm specializing in college textbooks wishes to expand into online delivery of its materials.In order to facilitate this,it invests in a number of small start-up companies that deliver college courses online and uses these companies to start diversifying the delivery of its content.Which of the following best describes the role of the publishing firm as described above?

A)a venture capitalist

B)an institutional investor

C)a corporate investor

D)a family investor

A)a venture capitalist

B)an institutional investor

C)a corporate investor

D)a family investor

C

4

Which of the following is LEAST likely to be a possible source of funds to finance a growing business?

A)angel investors

B)venture capital firms

C)institutional investors

D)family investors

A)angel investors

B)venture capital firms

C)institutional investors

D)family investors

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

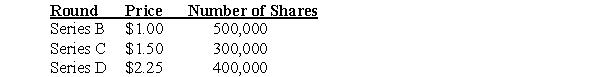

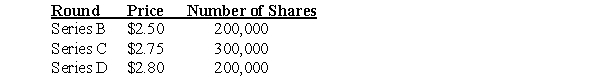

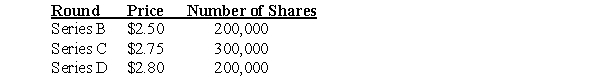

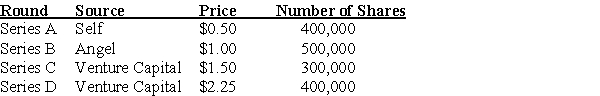

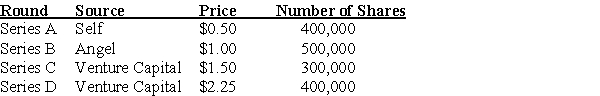

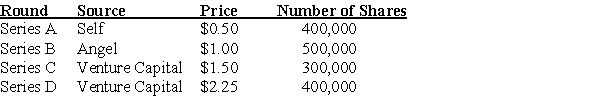

Jeremy founded a company.He issues 200,000 shares of series A stock for his own $100,000 investment.He then goes through three further rounds of investment,as shown below:

Which of the following is closest to the percentage of the company owned by the Series D investors?

A)25%

B)29%

C)33%

D)46%

Which of the following is closest to the percentage of the company owned by the Series D investors?

A)25%

B)29%

C)33%

D)46%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

6

When a company founder sells stock to outside investors in order to raise capital,the share of the company owned by the founder and the founder's control over the company will be reduced.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

7

A firm's founder sells equity to outside investors for the first time in the form of preferred stock.In what way is this preferred stock most likely to differ from the preferred stock issued by an established public firm?

A)It will have a larger dividend.

B)It will most likely not pay cash dividends.

C)It will give the holder seniority in any liquidation of the company.

D)It cannot be converted into common stock.

A)It will have a larger dividend.

B)It will most likely not pay cash dividends.

C)It will give the holder seniority in any liquidation of the company.

D)It cannot be converted into common stock.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

Equity investors in a private company usually plan to realize a return on their investment by selling their stock when that company is acquired by another firm or sold to the public in a public offering.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

The Ontario Teacher's Pension Plan is a pension fund for public school teachers in the province of Ontario.It has a large and diverse portfolio of investments,both in Canada and internationally,and had net assets in December 2007 of C$108.5 billion.Which of the following best describes the Ontario Teacher's Pension Plan?

A)an angel investor

B)a venture capitalist

C)an institutional investor

D)a family investor

A)an angel investor

B)a venture capitalist

C)an institutional investor

D)a family investor

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

Jeremy founded a company.He issues 200,000 shares of series A stock for his own $100,000 investment.He then goes through three further rounds of investment,as shown below:

What is the post-money valuation for the series-D funding round?

A)$1.95 million

B)$2.025 million

C)$2.85 million

D)$3.15 million

What is the post-money valuation for the series-D funding round?

A)$1.95 million

B)$2.025 million

C)$2.85 million

D)$3.15 million

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements is NOT true regarding venture capitalists?

A)They can provide substantial capital for young companies.

B)The firms offer limited partners a number of advantages over investing directly in start-ups themselves as angel investors.

C)They use their control to protect their investments,so they may therefore perform a key nurturing and monitoring role for the firm.

D)They might invest for strategic objectives in addition to the desire for investment returns.

A)They can provide substantial capital for young companies.

B)The firms offer limited partners a number of advantages over investing directly in start-ups themselves as angel investors.

C)They use their control to protect their investments,so they may therefore perform a key nurturing and monitoring role for the firm.

D)They might invest for strategic objectives in addition to the desire for investment returns.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

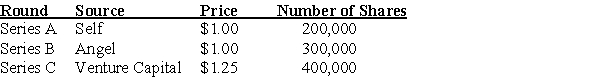

12

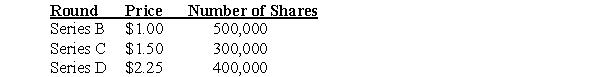

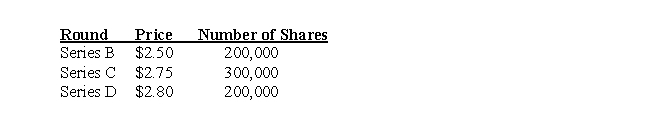

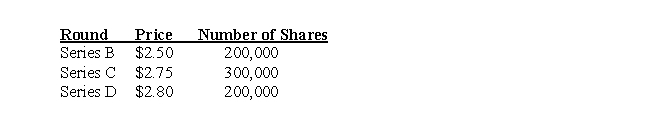

The founder of a company issues 100,000 shares of series A stock for his own $250,000 investment.He then goes through three further rounds of investment,as shown below:

What is the post-money valuation for the series-D funding round?

A)$1.96 million

B)$2.14 million

C)$2.24 million

D)$2.43 million

What is the post-money valuation for the series-D funding round?

A)$1.96 million

B)$2.14 million

C)$2.24 million

D)$2.43 million

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following best describes a limited partnership that specializes in raising money to invest in the private equity of young firms?

A)venture capital firms

B)institutional investors

C)corporate investors

D)family investors

A)venture capital firms

B)institutional investors

C)corporate investors

D)family investors

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

An entrepreneur founded his company using $200,000 of his own money,issuing himself 200,000 shares of stock.An angel investor bought an additional 100,000 shares for $200,000.The entrepreneur now sells another 400,000 shares of stock to a venture capitalist for $1 million.What is the post-money valuation of the company?

A)$1,000,000

B)$1,140,000

C)$1,750,000

D)$2,000,000

A)$1,000,000

B)$1,140,000

C)$1,750,000

D)$2,000,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

Simone founded her company using $150,000 of her own money,issuing herself 300,000 shares of stock.An angel investor bought an additional 200,000 shares for $100,000.She now sells another 500,000 shares of stock to a venture capitalist for $2 million.What is the post-money valuation of the company?

A)$2,000,000

B)$2,250,000

C)$4,000,000

D)$6,000,000

A)$2,000,000

B)$2,250,000

C)$4,000,000

D)$6,000,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

The founder of a company issues 100,000 shares of stock of series A stock for his own $250,000 investment.He then goes through three further rounds of investment,as shown below:

Which of the following is closest to the percentage of the company owned by the founder of the company?

A)12.5%

B)25.0%

C)37.5%

D)42%

Which of the following is closest to the percentage of the company owned by the founder of the company?

A)12.5%

B)25.0%

C)37.5%

D)42%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements is NOT true regarding angel investors?

A)They are typically arranged as limited partnerships.

B)For many start-ups,the first round of outside private equity financing is often obtained from them.

C)Because their capital investment is often large relative to the amount of capital already in place at the firm,they typically receive a sizeable equity share in the business in return for their funds.

D)These investors are frequently friends or acquaintances of the entrepreneur.

A)They are typically arranged as limited partnerships.

B)For many start-ups,the first round of outside private equity financing is often obtained from them.

C)Because their capital investment is often large relative to the amount of capital already in place at the firm,they typically receive a sizeable equity share in the business in return for their funds.

D)These investors are frequently friends or acquaintances of the entrepreneur.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

Why do most people launching a start-up company acquire their funds through the venture capital industry rather than through angel investors?

A)Most entrepreneurs are not willing to relinquish the control of their business demanded by angel investors.

B)Most entrepreneurs do not want the fees associated with investment by an angel investor.

C)Most entrepreneurs do not need the expertise brought to a young firm by an angel investor.

D)Most entrepreneurs do not have any relationships with individuals with substantial capital to invest.

A)Most entrepreneurs are not willing to relinquish the control of their business demanded by angel investors.

B)Most entrepreneurs do not want the fees associated with investment by an angel investor.

C)Most entrepreneurs do not need the expertise brought to a young firm by an angel investor.

D)Most entrepreneurs do not have any relationships with individuals with substantial capital to invest.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is NOT a common name for a corporation that invests in private companies?

A)strategic investor

B)corporate partner

C)venture partner

D)strategic partner

A)strategic investor

B)corporate partner

C)venture partner

D)strategic partner

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

Nature's Bounty,an organic seed company,is seeking to grow from a small company selling seeds in local markets into a company that sells seeds across several states.The funding for this expansion comes from a wealthy individual who uses his considerable inherited wealth to fund a variety of eco-friendly businesses.Which of the following best describes this individual's relationship with Nature's Bounty?

A)an angel investor

B)a venture capitalist

C)an institutional investor

D)a corporate investor

A)an angel investor

B)a venture capitalist

C)an institutional investor

D)a corporate investor

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

Suppose you sold the 1 million shares to the angel investor for $500,000.What was your percentage ownership in the company immediately following the angel investor's investment?

A)50%

B)33.3%

C)66.7%

D)100%

A)50%

B)33.3%

C)66.7%

D)100%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

The firm commitment process is the most common practice for IPOs in the United States.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

Use the information for the question(s)below.

You founded your own firm three years ago.You initially contributed $200,000 of your own money and in return you received 2 million shares of stock.Since then,you have sold an additional 1 million shares of stock to angel investors.You are now considering raising capital from a venture capital firm.This venture capital firm would invest $5 million and would receive 2 million newly issued shares in return.

The post-money valuation of your firm is closest to:

A)$12.5 million

B)$5.2 million

C)$10.0 million

D)$5.0 million

You founded your own firm three years ago.You initially contributed $200,000 of your own money and in return you received 2 million shares of stock.Since then,you have sold an additional 1 million shares of stock to angel investors.You are now considering raising capital from a venture capital firm.This venture capital firm would invest $5 million and would receive 2 million newly issued shares in return.

The post-money valuation of your firm is closest to:

A)$12.5 million

B)$5.2 million

C)$10.0 million

D)$5.0 million

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is FALSE?

A)The general partners work for the venture capital firm and run the venture capital firm;they are called venture capitalists.

B)An important consideration for investors in private companies is their exit strategyhow they will eventually realize the return from their investment.

C)When a company founder decides to sell equity to outside investors for the first time,it is common practice for private companies to issue common stock rather than preferred stock to raise capital.

D)Institutional investors such as pension funds,insurance companies,endowments,and foundations manage large quantities of money.

A)The general partners work for the venture capital firm and run the venture capital firm;they are called venture capitalists.

B)An important consideration for investors in private companies is their exit strategyhow they will eventually realize the return from their investment.

C)When a company founder decides to sell equity to outside investors for the first time,it is common practice for private companies to issue common stock rather than preferred stock to raise capital.

D)Institutional investors such as pension funds,insurance companies,endowments,and foundations manage large quantities of money.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is an activity typically taken by an underwriter during an IPO of a company?

A)helping the company with all necessary filings

B)determining the offer price

C)marketing the IPO

D)all of the above

A)helping the company with all necessary filings

B)determining the offer price

C)marketing the IPO

D)all of the above

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

After the venture capitalist's investment,what percentage of the firm will you own?

A)50%

B)40%

C)33%

D)25%

A)50%

B)40%

C)33%

D)25%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

What are venture capital firms?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

What is the difference between preferred stocks issued by a private company and a mature company?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose you sold the 1 million shares to the angel investor for $500,000.What was the post-money valuation of your shares immediately following the angel investor's investment?

A)$500,000

B)$1.0 million

C)$2.0 million

D)$2.5 million

A)$500,000

B)$1.0 million

C)$2.0 million

D)$2.5 million

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements is FALSE?

A)The preferred stock issued by young companies typically does not pay regular cash dividends.

B)The preferred stock issued by young companies usually gives the owner an option to convert it to common stock on some future date,so it is often called callable preferred stock.

C)If the company runs into financial difficulties,the preferred stockholders have a senior claim on the assets of the firm relative to any common stockholders.

D)Preferred stock issued by mature companies such as banks usually has a preferential dividend and seniority in any liquidation and sometimes special voting rights.

A)The preferred stock issued by young companies typically does not pay regular cash dividends.

B)The preferred stock issued by young companies usually gives the owner an option to convert it to common stock on some future date,so it is often called callable preferred stock.

C)If the company runs into financial difficulties,the preferred stockholders have a senior claim on the assets of the firm relative to any common stockholders.

D)Preferred stock issued by mature companies such as banks usually has a preferential dividend and seniority in any liquidation and sometimes special voting rights.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

After the venture capitalist's investment,the post-money valuation of the angel investor's shares is closest to:

A)$12.5 million

B)$4.0 million

C)$5.0 million

D)$2.5 million

A)$12.5 million

B)$4.0 million

C)$5.0 million

D)$2.5 million

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

The main advantages for a firm in going public are greater liquidity,better access to capital,and greater ability of investors to monitor the management of the firm.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

At what stage of the IPO process do senior management and the lead underwriters travel to promote the company and explain their rationale for the offer price to the underwriters' largest customers?

A)when filing with the SEC

B)when valuating the firm

C)when managing risk

D)when matching buyers to sellers of the stock

A)when filing with the SEC

B)when valuating the firm

C)when managing risk

D)when matching buyers to sellers of the stock

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

34

In a best-efforts IPO,the underwriter guarantees that all stock will be sold.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is NOT a reason why an IPO is attractive to the managers of a private company?

A)It gives their private equity investors the opportunity to diversify.

B)It gives access to large amounts of capital in the IPO.

C)It reduces the complexity of requirements regulating the company's management.

D)It gives access to much larger amounts of capital through the public markets in subsequent offerings.

A)It gives their private equity investors the opportunity to diversify.

B)It gives access to large amounts of capital in the IPO.

C)It reduces the complexity of requirements regulating the company's management.

D)It gives access to much larger amounts of capital through the public markets in subsequent offerings.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following best describes those shares sold when a company goes public which raise new capital?

A)primary offering

B)secondary offering

C)tertiary offering

D)preliminary offering

A)primary offering

B)secondary offering

C)tertiary offering

D)preliminary offering

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is FALSE?

A)A venture capital firm is a limited partnership that specializes in raising money to invest in the private equity of young firms.

B)Venture capitalists typically control about three-quarters of the seats on a start-up's board of directors,and often represent the single largest voting block on the board.

C)The initial capital that is required to start a business is usually provided by the entrepreneur herself and her immediate family.

D)Individual investors who buy equity in small private firms are called angel investors.

A)A venture capital firm is a limited partnership that specializes in raising money to invest in the private equity of young firms.

B)Venture capitalists typically control about three-quarters of the seats on a start-up's board of directors,and often represent the single largest voting block on the board.

C)The initial capital that is required to start a business is usually provided by the entrepreneur herself and her immediate family.

D)Individual investors who buy equity in small private firms are called angel investors.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

38

What are angel investors?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

39

Assuming that this is the venture capitalist's first investment in your firm,what percentage of the firm will the venture capitalist own?

A)50%

B)40%

C)25%

D)33%

A)50%

B)40%

C)25%

D)33%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

40

After the venture capitalist's investment,the post-money valuation of your shares is closest to:

A)$5.0 million

B)$12.5 million

C)$4.0 million

D)$2.5 million

A)$5.0 million

B)$12.5 million

C)$4.0 million

D)$2.5 million

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

41

As part of the registration statement ,the preliminary prospectus circulates to investors before the stock is offered.This preliminary prospectus is also called a(n)

A)IPO filing.

B)10-K filing.

C)blue whale.

D)red herring.

A)IPO filing.

B)10-K filing.

C)blue whale.

D)red herring.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

42

In its IPO,Jillian's Imprints,a small publishing house,offered stock at a price of $8.00 per share.The underwriters of this IPO had a spread of 6.5% per share.If 2 million shares were sold,what funds did Jillian's receive from the IPO?

A)$5.21 million

B)$14.96 million

C)$16.00 million

D)$17.04 million

A)$5.21 million

B)$14.96 million

C)$16.00 million

D)$17.04 million

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

43

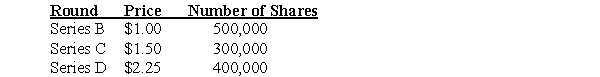

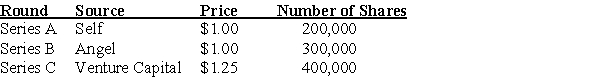

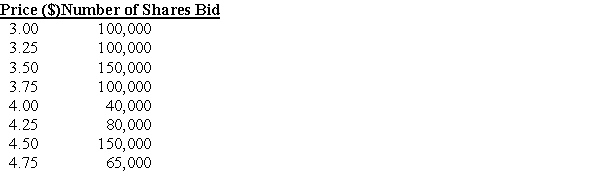

The founders and owners of a private company have funded it through the following rounds of investment:

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.What portion of the company will be owned by the angel investor after the IPO?

A)12%

B)16%

C)22%

D)30%

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.What portion of the company will be owned by the angel investor after the IPO?

A)12%

B)16%

C)22%

D)30%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is FALSE?

A)Once a company goes public,it must satisfy all of the requirements of public companies.

B)Organizations such as the Securities and Exchange Commission (SEC),the securities exchanges (including the NYSE and the NASDAQ),and Congress (through the Sarbanes-Oxley Act of 2002)adopted new standards that focused on more thorough financial disclosure,greater accountability,and more stringent requirements for the board of directors.

C)The major advantage of undertaking an IPO is also one of the major disadvantages of an IPO: When investors diversify their holdings,the equity holders of the corporation become more concentrated.

D)Several high profile corporate scandals during the early part of the twenty-first century prompted tougher regulations designed to address corporate abuses.

A)Once a company goes public,it must satisfy all of the requirements of public companies.

B)Organizations such as the Securities and Exchange Commission (SEC),the securities exchanges (including the NYSE and the NASDAQ),and Congress (through the Sarbanes-Oxley Act of 2002)adopted new standards that focused on more thorough financial disclosure,greater accountability,and more stringent requirements for the board of directors.

C)The major advantage of undertaking an IPO is also one of the major disadvantages of an IPO: When investors diversify their holdings,the equity holders of the corporation become more concentrated.

D)Several high profile corporate scandals during the early part of the twenty-first century prompted tougher regulations designed to address corporate abuses.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is FALSE?

A)Once the issue price (or offer price)is set,underwriters may invoke another mechanism to protect themselves against a loss - the over-allotment allocation.

B)Before the offer price is set,the underwriters work closely with the company to come up with a price range that they believe provides a reasonable valuation for the firm.

C)Before an IPO,the company prepares the final registration statement and final prospectus containing all the details of the IPO,including the number of shares offered and the offer price.

D)A "road trip" is where senior management and the lead underwriters travel around the country (and sometimes around the world)promoting the company and explaining their rationale for the offer price to the underwriters' largest customers - mainly institutional investors such as mutual funds and pension funds.

A)Once the issue price (or offer price)is set,underwriters may invoke another mechanism to protect themselves against a loss - the over-allotment allocation.

B)Before the offer price is set,the underwriters work closely with the company to come up with a price range that they believe provides a reasonable valuation for the firm.

C)Before an IPO,the company prepares the final registration statement and final prospectus containing all the details of the IPO,including the number of shares offered and the offer price.

D)A "road trip" is where senior management and the lead underwriters travel around the country (and sometimes around the world)promoting the company and explaining their rationale for the offer price to the underwriters' largest customers - mainly institutional investors such as mutual funds and pension funds.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements is FALSE?

A)In recent years,the investment banking firm of W.R.Hambrecht and Company has attempted to change the IPO process by selling new issues directly to the public using an online auction IPO mechanism called Open IPO.

B)The lead underwriter is the primary banking firm responsible for managing the deal.The lead underwriter provides most of the advice and arranges for a group of other underwriters,called the syndicate,to help market and sell the issue.

C)Because of the potential conflict of interest,the underwriter will not make a market in the stock after the issue.

D)The SEC requires that companies prepare a registration statement,a legal document that provides financial and other information about the company to investors,prior to an IPO.Company managers work closely with the underwriters to prepare this registration statement and submit it to the SEC.

A)In recent years,the investment banking firm of W.R.Hambrecht and Company has attempted to change the IPO process by selling new issues directly to the public using an online auction IPO mechanism called Open IPO.

B)The lead underwriter is the primary banking firm responsible for managing the deal.The lead underwriter provides most of the advice and arranges for a group of other underwriters,called the syndicate,to help market and sell the issue.

C)Because of the potential conflict of interest,the underwriter will not make a market in the stock after the issue.

D)The SEC requires that companies prepare a registration statement,a legal document that provides financial and other information about the company to investors,prior to an IPO.Company managers work closely with the underwriters to prepare this registration statement and submit it to the SEC.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

47

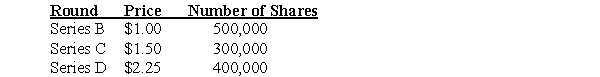

David found a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.What share of the company will David own after the IPO?

A)11%

B)14%

C)16%

D)22%

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.What share of the company will David own after the IPO?

A)11%

B)14%

C)16%

D)22%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

48

The founders and owners of a private company have funded it through the following rounds of investment:

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.What will be the IPO price per share?

A)$12

B)$22

C)$36

D)$45

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.What will be the IPO price per share?

A)$12

B)$22

C)$36

D)$45

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

49

David found a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.What will be the IPO price per share?

A)$3.40

B)$20.25

C)$33.33

D)$60.00

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.What will be the IPO price per share?

A)$3.40

B)$20.25

C)$33.33

D)$60.00

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following best describes a firm commitment IPO?

A)The underwriter purchases the entire issue at a small discount and then resells it at the offer price.

B)The underwriter sells new issues directly to the public in an online auction.

C)The underwriter tries to sell the stock for the best possible price but does not guarantee that the stock will be sold.

D)The underwriter solicits bids from investors and chooses the highest price at which there is sufficient demand to sell the entire issue.

A)The underwriter purchases the entire issue at a small discount and then resells it at the offer price.

B)The underwriter sells new issues directly to the public in an online auction.

C)The underwriter tries to sell the stock for the best possible price but does not guarantee that the stock will be sold.

D)The underwriter solicits bids from investors and chooses the highest price at which there is sufficient demand to sell the entire issue.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements is FALSE?

A)After deciding to go public,managers of the company work with an underwriter,an investment banking firm that manages the offering and designs its structure.

B)The shares that are sold in the IPO may either be new shares that raise new capital,known as a secondary offering,or existing shares that are sold by current shareholders (as part of their exit strategy),known as a primary offering.

C)Many IPOs,especially the larger offerings,are managed by a group of underwriters.

D)At an IPO,a firm offers a large block of shares for sale to the public for the first time.

A)After deciding to go public,managers of the company work with an underwriter,an investment banking firm that manages the offering and designs its structure.

B)The shares that are sold in the IPO may either be new shares that raise new capital,known as a secondary offering,or existing shares that are sold by current shareholders (as part of their exit strategy),known as a primary offering.

C)Many IPOs,especially the larger offerings,are managed by a group of underwriters.

D)At an IPO,a firm offers a large block of shares for sale to the public for the first time.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

52

The founder of a company currently holds 12 million of the 15 million shares in that company.She considers an IPO where she sells a mix of primary shares and 2 million of her own secondary shares for $18 per share.If she wants to retain a 60% ownership of the company,how much money can she raise in this IPO?

A)$30 million

B)$42 million

C)$54 million

D)$66 million

A)$30 million

B)$42 million

C)$54 million

D)$66 million

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

53

What is the major reason that underwriters tend to offer stocks in an IPO at a price that is below that which the market will pay?

A)to gain from the rise in value of any stocks they hold after the IPO

B)to reduce their exposure to losses from unsold stock

C)to benefit from greenshoe provisions

D)to increase their spread

A)to gain from the rise in value of any stocks they hold after the IPO

B)to reduce their exposure to losses from unsold stock

C)to benefit from greenshoe provisions

D)to increase their spread

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

54

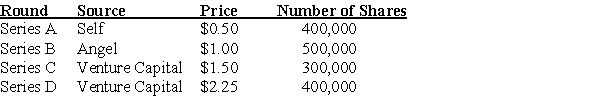

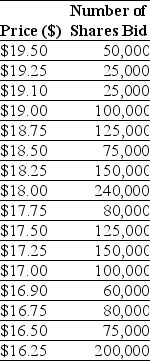

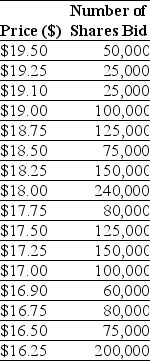

Felicity Industries is selling 2 million shares of stock in an auction IPO.At the end of the bidding period they have received the bids shown above.Which of the following is closest to the price at which the shares will be offered?

A)$5.00

B)$5.25

C)$5.75

D)$6.00

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements regarding firm commitment IPOs is FALSE?

A)If the entire issue does not sell out,the remaining shares must be sold at a lower price and the underwriter must take the loss.

B)The underwriter purchases the entire issue (at a the offer price)and then resells it at a slightly higher price to interested investors.

C)It is the most common underwriting arrangement.

D)The underwriter guarantees that it will sell all of the stock at the offer price.

A)If the entire issue does not sell out,the remaining shares must be sold at a lower price and the underwriter must take the loss.

B)The underwriter purchases the entire issue (at a the offer price)and then resells it at a slightly higher price to interested investors.

C)It is the most common underwriting arrangement.

D)The underwriter guarantees that it will sell all of the stock at the offer price.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements regarding best efforts IPOs is FALSE?

A)For smaller IPOs,the underwriter commonly accepts the deal on this basis.

B)The underwriter does not guarantee that the stock will be sold,but instead tries to sell the stock for the best possible price.

C)Often these arrangements have an all-or-none clause: either all of the shares are sold in the IPO,or the deal is called off.

D)If the entire issue does not sell out,the underwriter is on the hook.

A)For smaller IPOs,the underwriter commonly accepts the deal on this basis.

B)The underwriter does not guarantee that the stock will be sold,but instead tries to sell the stock for the best possible price.

C)Often these arrangements have an all-or-none clause: either all of the shares are sold in the IPO,or the deal is called off.

D)If the entire issue does not sell out,the underwriter is on the hook.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements is FALSE?

A)The process of selling stock to the public for the first time is called a seasoned equity offering (SEO).

B)Public companies typically have access to much larger amounts of capital through the public markets.

C)By going public,companies give their private equity investors the ability to diversify.

D)The two advantages of going public are greater liquidity and better access to capital.

A)The process of selling stock to the public for the first time is called a seasoned equity offering (SEO).

B)Public companies typically have access to much larger amounts of capital through the public markets.

C)By going public,companies give their private equity investors the ability to diversify.

D)The two advantages of going public are greater liquidity and better access to capital.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

58

Bejeweled,a chain of crafting shops,is selling 500,000 shares of stock in an auction IPO.At the end of the bidding period they have received the bids shown above.Which of the following is closest to the price at which the shares will be offered?

A)$3.50

B)$3.75

C)$4.25

D)$4.75

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements is FALSE?

A)Underwriters appear to use the information they acquire during the book-building stage to intentionally underprice the IPO,thereby reducing their exposure to losses.

B)The bluetooth option allows the underwriter to issue more stock,amounting to 15% of the original offer size,at the IPO offer price.

C)The lead underwriter usually makes a market in the stock and assigns an analyst to cover it.

D)In most cases,the preexisting shareholders are subject to a 180-day lockup;they cannot sell their shares for 180 days after the IPO.Once the lockup period expires,they are free to sell their shares.

A)Underwriters appear to use the information they acquire during the book-building stage to intentionally underprice the IPO,thereby reducing their exposure to losses.

B)The bluetooth option allows the underwriter to issue more stock,amounting to 15% of the original offer size,at the IPO offer price.

C)The lead underwriter usually makes a market in the stock and assigns an analyst to cover it.

D)In most cases,the preexisting shareholders are subject to a 180-day lockup;they cannot sell their shares for 180 days after the IPO.Once the lockup period expires,they are free to sell their shares.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

60

Harrison Products is selling 1 million shares of stock in an auction IPO.At the end of the bidding period they have received the bids shown above.Which of the following is closest to the price at which the shares will be offered?

A)$6.25

B)$6.60

C)$6.75

D)$7.00

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

61

How does the size of an issue affect the fees charged by underwriters?

A)Although large issues generally have a smaller spread,the large number of shares released means that the total fees are somewhat larger than for smaller issues.

B)Large issues generally have a similar spread to small issues and thus attract much greater fees.

C)Large issues have a reduced spread,which means that the total fees are generally the same as for smaller issues.

D)Large issues have substantially larger direct costs and,thus,must charge a larger spread in order to be profitable for the underwriter.

A)Although large issues generally have a smaller spread,the large number of shares released means that the total fees are somewhat larger than for smaller issues.

B)Large issues generally have a similar spread to small issues and thus attract much greater fees.

C)Large issues have a reduced spread,which means that the total fees are generally the same as for smaller issues.

D)Large issues have substantially larger direct costs and,thus,must charge a larger spread in order to be profitable for the underwriter.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

62

Dusty Corporation is issuing an IPO with an issue price of $15 per share that is expected to raise about $100 million.Which of the following is likely to be true?

A)The price of the stock will be less than $15 at the close of the first trading day.

B)The cost of the IPO to Dusty will be about $7 million.

C)The stock will perform very well in the three to five years after the issue.

D)None of the above is likely to happen.

A)The price of the stock will be less than $15 at the close of the first trading day.

B)The cost of the IPO to Dusty will be about $7 million.

C)The stock will perform very well in the three to five years after the issue.

D)None of the above is likely to happen.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements concerning the volume and number of IPOs issued over time is most correct?

A)They are cyclical.

B)They tend to rise over time.

C)They tend to fall over time.

D)They remain approximately the same over time.

A)They are cyclical.

B)They tend to rise over time.

C)They tend to fall over time.

D)They remain approximately the same over time.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

64

Newly listed firms tend to perform relatively poorly in the three to five years after their IPOs.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

65

What are some of the highlights of Google's IPO process?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

66

Stock issued in an IPO usually trades significantly higher at the end of the first day of trading than the original IPO price.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following is NOT one of the four characteristics of IPOs that puzzle financial economists?

A)On average,IPOs appear to be underpriced.

B)The long-run performance of a newly public company (three to five years from the date of issue)is superior to the overall market return.

C)The number of issues is highly cyclical.

D)The costs of the IPO are very high,and it is unclear why firms willingly incur such high costs.

A)On average,IPOs appear to be underpriced.

B)The long-run performance of a newly public company (three to five years from the date of issue)is superior to the overall market return.

C)The number of issues is highly cyclical.

D)The costs of the IPO are very high,and it is unclear why firms willingly incur such high costs.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

68

How does the total cost of issuing stock for the first time compare to the costs of other securities?

A)substantially larger than the costs for most other securities

B)about the same as the cost for most other securities

C)substantially less than the cost for a few other securities

D)substantially less than the costs for most other securities

A)substantially larger than the costs for most other securities

B)about the same as the cost for most other securities

C)substantially less than the cost for a few other securities

D)substantially less than the costs for most other securities

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

69

How does the costs of IPO puzzle financial economists?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is a notable puzzle in IPOs?

A)The number of IPOs is highly underestimated.

B)The number of IPOs is highly cyclical.

C)The number of IPOs is highly seasonal.

D)The number of IPOs is almost the same every year.

A)The number of IPOs is highly underestimated.

B)The number of IPOs is highly cyclical.

C)The number of IPOs is highly seasonal.

D)The number of IPOs is almost the same every year.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

71

The cost of issuing an IPO in the U.S.is higher than most other security issuance fees.A typical spread is:

A)5%

B)6%

C)7%

D)8%

A)5%

B)6%

C)7%

D)8%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

72

How does IPO pricing puzzle financial economists?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

73

What are some of the disadvantages of going public?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

74

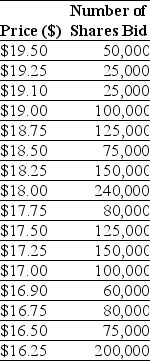

Use the information for the question(s)below.

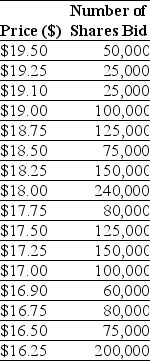

Luther Industries is in the process of selling shares of stock in an auction IPO.At the end of the bidding period,Luther's investment bank has received the following bids:

The proceeds from the IPO be if Luther is selling 1.25 million shares is closest to:

A)$20.6 million

B)$21.6 million

C)$21.1 million

D)$20.9 million

Luther Industries is in the process of selling shares of stock in an auction IPO.At the end of the bidding period,Luther's investment bank has received the following bids:

The proceeds from the IPO be if Luther is selling 1.25 million shares is closest to:

A)$20.6 million

B)$21.6 million

C)$21.1 million

D)$20.9 million

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following statements regarding exit strategies is FALSE?

A)An alternative way to provide liquidity to its investors is for the company to become a publicly traded company.

B)An important consideration for investors in private companies is their exit strategy or how they will eventually realize the return from their investment

C)Often large corporations purchase successful start-up companies.In such a case,the acquiring company purchases the outstanding stock of the private company,allowing all investors to cash out.

D)Roughly 25% of venture capital exits from 2001-2005 occurred through mergers or acquisitions.

A)An alternative way to provide liquidity to its investors is for the company to become a publicly traded company.

B)An important consideration for investors in private companies is their exit strategy or how they will eventually realize the return from their investment

C)Often large corporations purchase successful start-up companies.In such a case,the acquiring company purchases the outstanding stock of the private company,allowing all investors to cash out.

D)Roughly 25% of venture capital exits from 2001-2005 occurred through mergers or acquisitions.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

76

Use the information for the question(s)below.

Luther Industries is in the process of selling shares of stock in an auction IPO.At the end of the bidding period,Luther's investment bank has received the following bids:

What will the offer price of these shares be if Luther is selling 1 million shares?

A)$17.00

B)$17.50

C)$17.25

D)$16.75

Luther Industries is in the process of selling shares of stock in an auction IPO.At the end of the bidding period,Luther's investment bank has received the following bids:

What will the offer price of these shares be if Luther is selling 1 million shares?

A)$17.00

B)$17.50

C)$17.25

D)$16.75

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

77

What is the general long run performance of an IPO?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

78

Underpricing of an IPO would most likely be greatest in which of the following markets?

A)Australia

B)China

C)Japan

D)United States

A)Australia

B)China

C)Japan

D)United States

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

79

The offer price of shares in an IPO is generally less than the price those shares sell for at the end of the first trading day.Which of the following parties suffer most from this situation?

A)the buyers of shares after the initial offering

B)the underwriters of the IPO

C)the pre-IPO shareholders of the issuing firm

D)the lead underwriter of the IPO

A)the buyers of shares after the initial offering

B)the underwriters of the IPO

C)the pre-IPO shareholders of the issuing firm

D)the lead underwriter of the IPO

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

80

What are some of the advantages of going public?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck