Deck 16: Capital Structure

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/109

Play

Full screen (f)

Deck 16: Capital Structure

1

What role do industries play in the capital structure choice for a firm?

Industries are found to have distinct patterns in their capital structures.For example,software companies such as Microsoft are far less levered than are automobile manufacturers such as Ford Motor.

2

Which of the following do firms consider in the choice of securities issued?

A)The tax consequences of the chosen security.

B)The transactions costs of the chosen security.

C)Whether the chosen security will have a fair price in the market.

D)All of the above are considered.

A)The tax consequences of the chosen security.

B)The transactions costs of the chosen security.

C)Whether the chosen security will have a fair price in the market.

D)All of the above are considered.

D

3

Equity in a firm with no debt is called unlevered equity.

True

4

Financial managers prefer to choose the same debt level no matter which industry they operate in.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

5

What considerations should managers have while deciding on their capital structure?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

6

With perfect capital markets,because different choices of capital structure offer a benefit to investors,they affect the value of the firm.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is FALSE?

A)The relative proportions of debt,equity,and other securities that a firm has outstanding constitute its capital structure.

B)The most common choices are financing through equity alone and financing through a combination of debt and equity.

C)The project's net present value (NPV)represents the value to the new investors of the firm created by the project.

D)When corporations raise funds from outside investors,they must choose which type of security to issue.

A)The relative proportions of debt,equity,and other securities that a firm has outstanding constitute its capital structure.

B)The most common choices are financing through equity alone and financing through a combination of debt and equity.

C)The project's net present value (NPV)represents the value to the new investors of the firm created by the project.

D)When corporations raise funds from outside investors,they must choose which type of security to issue.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

8

A project will give a one-time cash flow of $25,000 after one year.If the project risk requires a return of 12%,what is the levered value of the firm with perfect capital markets?

A)$19,882

B)$22,321

C)$22,000

D)more information needed

A)$19,882

B)$22,321

C)$22,000

D)more information needed

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

9

A project will give a one-time cash flow of $20,000 after one year.If the project risk requires a return of 10%,what is the levered value of the firm with perfect capital markets?

A)$18,182

B)$20,000

C)$19,000

D)more information needed

A)$18,182

B)$20,000

C)$19,000

D)more information needed

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

10

Investment cash flows are independent of financing choices in a

A)market with frictions.

B)perfect capital market.

C)setting with frictions in investment returns.

D)firm with leverage.

A)market with frictions.

B)perfect capital market.

C)setting with frictions in investment returns.

D)firm with leverage.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

11

Equity in a firm with no debt is called

A)levered equity.

B)unlevered equity.

C)risk-free equity.

D)risky equity.

A)levered equity.

B)unlevered equity.

C)risk-free equity.

D)risky equity.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

12

What is the capital structure of a firm?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

13

Equity in a firm with debt is called

A)levered equity.

B)risk-free equity.

C)unlevered equity.

D)risky equity.

A)levered equity.

B)risk-free equity.

C)unlevered equity.

D)risky equity.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

14

MM Proposition I states that in a perfect capital market the total value of a firm is equal to the market value of the ________ generated by its assets.

A)earnings after taxes

B)earnings after interest

C)cash flows after taxes

D)free cash flows

A)earnings after taxes

B)earnings after interest

C)cash flows after taxes

D)free cash flows

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

15

The relative proportions of debt,equity,and other securities that a firm has outstanding constitute its

A)capital structure.

B)leverage.

C)retained earnings.

D)paid out capital.

A)capital structure.

B)leverage.

C)retained earnings.

D)paid out capital.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

16

With perfect capital markets,the total value of a firm should not depend on its capital structure.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

17

Even if two firms operate in the same industry,they may prefer different choices of debt-equity ratios.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

18

A firm will give a one-time cash flow of $22,000 after one year.If the project risk requires a return of 11%,what is the levered value of the firm with perfect capital markets?

A)$18,182

B)$20,000

C)$19,820

D)more information needed

A)$18,182

B)$20,000

C)$19,820

D)more information needed

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

19

A firm's ________ ratio is the fraction of the firm's total value that corresponds to debt.

A)debt-to-equity

B)asset

C)debt-to-value

D)liability

A)debt-to-equity

B)asset

C)debt-to-value

D)liability

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

20

A financial manager makes a choice of the amount and source of capital based on how the choice will impact

A)debt-equity ratio.

B)debt value.

C)earnings per share.

D)firm value.

A)debt-equity ratio.

B)debt value.

C)earnings per share.

D)firm value.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

21

A firm requires an investment of $20,000 and will return $26,500 after one year.If the firm borrows $5,000 at 7% what is the return on levered equity?

A)43%

B)39%

C)41%

D)45%

A)43%

B)39%

C)41%

D)45%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

22

In general,issuing equity may not dilute the ownership of existing shareholders if

A)the value of new shares is equal to the value of debt.

B)the new shares are sold at a fair price.

C)the firm has no debt financing.

D)the firm uses debt conservatively.

A)the value of new shares is equal to the value of debt.

B)the new shares are sold at a fair price.

C)the firm has no debt financing.

D)the firm uses debt conservatively.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

23

When investors use leverage in their own portfolios to adjust the leverage choice made by the firm,it is referred to as

A)outside debt.

B)retained earnings.

C)homemade leverage.

D)payout ratio.

A)outside debt.

B)retained earnings.

C)homemade leverage.

D)payout ratio.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

24

A firm has a market value of assets of $50,000.It borrows $10,000 at 7%.If the unlevered cost of equity is 15%,what is the firm's cost of equity capital?

A)16%

B)17%

C)18%

D)19%

A)16%

B)17%

C)18%

D)19%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

25

A firm has a market value of assets of $50,000.It borrows $10,000 at 3%.If the unlevered cost of equity is 15%,what is the firm's cost of equity capital?

A)16%

B)17%

C)18%

D)19%

A)16%

B)17%

C)18%

D)19%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

26

A firm requires an investment of $20,000 and will return $25,000 after one year.If the firm borrows $10,000 at 7% what is the return on levered equity?

A)43%

B)29%

C)37%

D)39%

A)43%

B)29%

C)37%

D)39%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

27

By adding leverage,the returns on the firm are split between debt holders and equity holders,but equity holder risk increases because

A)interest payments can be rolled over.

B)dividends are paid first.

C)debt and equity have equal priority.

D)interest payments have first priority.

A)interest payments can be rolled over.

B)dividends are paid first.

C)debt and equity have equal priority.

D)interest payments have first priority.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

28

A firm has a market value of assets of $50,000.It borrows $10,000 at 5%.If the unlevered cost of equity is 15%,what is the firm's cost of equity capital?

A)17.5%

B)18.5%

C)19.2%

D)20.6%

A)17.5%

B)18.5%

C)19.2%

D)20.6%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is FALSE?

A)When a firm issues new shares that account for a significant percentage of its outstanding shares,the transaction is called a leveraged recapitalization.

B)MM Proposition I applies to capital structure decisions made at any time during the life of the firm.

C)By choosing positive-NPV projects that are worth more than their initial investment,the firm can enhance its value.

D)The choice of capital structure does not change the value of the firm if the cash flows generated by the firm's assets are assumed to remain constant.

A)When a firm issues new shares that account for a significant percentage of its outstanding shares,the transaction is called a leveraged recapitalization.

B)MM Proposition I applies to capital structure decisions made at any time during the life of the firm.

C)By choosing positive-NPV projects that are worth more than their initial investment,the firm can enhance its value.

D)The choice of capital structure does not change the value of the firm if the cash flows generated by the firm's assets are assumed to remain constant.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

30

It is not correct to discount the cash flows of a levered firm with the cost of equity of the unlevered firm because

A)leverage decreases the risk of equity of the firm.

B)leverage changes the unlevered cost of equity.

C)leverage increases the risk of the equity of the firm.

D)cost of debt decreases in this setting.

A)leverage decreases the risk of equity of the firm.

B)leverage changes the unlevered cost of equity.

C)leverage increases the risk of the equity of the firm.

D)cost of debt decreases in this setting.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is FALSE?

A)As long as investors can borrow or lend at the same interest rate as the firm,homemade leverage is a perfect substitute for the use of leverage by the firm.

B)When investors use leverage in their own portfolios to adjust the leverage choice made by the firm,we say that they are using homemade leverage.

C)The value of the firm is determined by the present value (PV)of the cash flows from its current and future investments.

D)The investor can re-create the payoffs of unlevered equity by borrowing and using the proceeds to purchase the equity of the firm.

A)As long as investors can borrow or lend at the same interest rate as the firm,homemade leverage is a perfect substitute for the use of leverage by the firm.

B)When investors use leverage in their own portfolios to adjust the leverage choice made by the firm,we say that they are using homemade leverage.

C)The value of the firm is determined by the present value (PV)of the cash flows from its current and future investments.

D)The investor can re-create the payoffs of unlevered equity by borrowing and using the proceeds to purchase the equity of the firm.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is NOT one of Modigliani and Miller's set of conditions referred to as perfect capital markets?

A)All investors hold the efficient portfolio of assets.

B)There are no taxes,transaction costs,or issuance costs associated with security trading.

C)A firm's financing decisions do not change the cash flows generated by its investments,nor do they reveal new information about them.

D)Investors and firms can trade the same set of securities at competitive market prices equal to the present value (PV)of their future cash flows.

A)All investors hold the efficient portfolio of assets.

B)There are no taxes,transaction costs,or issuance costs associated with security trading.

C)A firm's financing decisions do not change the cash flows generated by its investments,nor do they reveal new information about them.

D)Investors and firms can trade the same set of securities at competitive market prices equal to the present value (PV)of their future cash flows.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

33

In a setting where there is no risk that a firm will default,leverage ________ the risk of equity.

A)increases

B)decreases

C)does not change

D)cannot say for sure

A)increases

B)decreases

C)does not change

D)cannot say for sure

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

34

A firm requires an investment of $30,000 and will return $35,000 after 1 year.If the firm borrows $20,000 at 10% what is the return on levered equity?

A)43%

B)30%

C)37%

D)39%

A)43%

B)30%

C)37%

D)39%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

35

A firm requires an investment of $30,000 and borrows $10,000 at 6%.If the return on equity is 15%,what is the firm's pre tax WACC?

A)14%

B)13%

C)12%

D)11%

A)14%

B)13%

C)12%

D)11%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is FALSE?

A)The Law of One Price implies that leverage will affect the total value of the firm under perfect capital market conditions.

B)In the absence of taxes or other transaction costs,the total cash flow paid out to all of a firm's security holders is equal to the total cash flow generated by the firm's assets.

C)With perfect capital markets,leverage merely changes the allocation of cash flows between debt and equity,without altering the total cash flows of the firm.

D)In a perfect capital market,the total value of a firm is equal to the market value of the total cash flows generated by its assets and is not affected by its choice of capital structure.

A)The Law of One Price implies that leverage will affect the total value of the firm under perfect capital market conditions.

B)In the absence of taxes or other transaction costs,the total cash flow paid out to all of a firm's security holders is equal to the total cash flow generated by the firm's assets.

C)With perfect capital markets,leverage merely changes the allocation of cash flows between debt and equity,without altering the total cash flows of the firm.

D)In a perfect capital market,the total value of a firm is equal to the market value of the total cash flows generated by its assets and is not affected by its choice of capital structure.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

37

A firm requires an investment of $20,000 and borrows $10,000 at 8%.If the return on equity is 20%,what is the firm's pre tax WACC?

A)14%

B)15%

C)16%

D)17%

A)14%

B)15%

C)16%

D)17%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is FALSE?

A)As long as the firm's choice of securities does not change the cash flows generated by its assets,the capital structure decision will not change the total value of the firm or the amount of capital it can raise.

B)If securities are fairly priced,then buying or selling securities has a net present value (NPV)of zero and,therefore,should not change the value of a firm.

C)The future repayments that the firm must make on its debt are equal in value to the amount of the loan it receives up front.

D)An investor who would like more leverage than the firm has chosen can lend and add leverage to his or her own portfolio.

A)As long as the firm's choice of securities does not change the cash flows generated by its assets,the capital structure decision will not change the total value of the firm or the amount of capital it can raise.

B)If securities are fairly priced,then buying or selling securities has a net present value (NPV)of zero and,therefore,should not change the value of a firm.

C)The future repayments that the firm must make on its debt are equal in value to the amount of the loan it receives up front.

D)An investor who would like more leverage than the firm has chosen can lend and add leverage to his or her own portfolio.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

39

Leverage can ________ a firm's expected earnings per share,but does not necessarily increase the share price.

A)decrease

B)dilute

C)increase

D)not change

A)decrease

B)dilute

C)increase

D)not change

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

40

A firm requires an investment of $40,000 and borrows $10,000 at 8%.If the return on equity is 20%,what is the firm's pre tax WACC?

A)14%

B)15%

C)16%

D)17%

A)14%

B)15%

C)16%

D)17%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is FALSE?

A)The unlevered beta measures the market risk of the firm's business activities,ignoring any additional risk due to leverage.

B)If a firm holds $1 in cash and has $1 of risk-free debt,then the interest earned on the cash will equal the interest paid on the debt.The cash flows from each source cancel each other,just as if the firm held no cash and no debt.

C)The unlevered beta measures the market risk of the firm without leverage,which is equivalent to the beta of the firm's assets.

D)When a firm changes its capital structure without changing its investments,its levered beta will remain unaltered,however,its asset beta will change to reflect the effect of the capital structure change on its risk.

A)The unlevered beta measures the market risk of the firm's business activities,ignoring any additional risk due to leverage.

B)If a firm holds $1 in cash and has $1 of risk-free debt,then the interest earned on the cash will equal the interest paid on the debt.The cash flows from each source cancel each other,just as if the firm held no cash and no debt.

C)The unlevered beta measures the market risk of the firm without leverage,which is equivalent to the beta of the firm's assets.

D)When a firm changes its capital structure without changing its investments,its levered beta will remain unaltered,however,its asset beta will change to reflect the effect of the capital structure change on its risk.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

42

Use the information for the question(s)below.

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

Assume that in addition to 1.25 billion common shares outstanding,Luther has stock options given to employees valued at $2 billion.After the repurchase how many shares will Luther have outstanding?

A)1.0 billion

B)1.2 billion

C)0.75 billion

D)1.1 billion

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

Assume that in addition to 1.25 billion common shares outstanding,Luther has stock options given to employees valued at $2 billion.After the repurchase how many shares will Luther have outstanding?

A)1.0 billion

B)1.2 billion

C)0.75 billion

D)1.1 billion

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

43

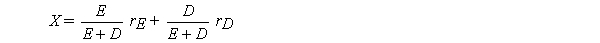

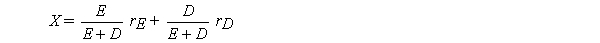

Consider the following equation for the question(s)below:

The E in the equation above represents

A)the value of the firm's equity.

B)the value of the firm's debt.

C)the value of the firm's unlevered equity.

D)the market value of the firm's assets.

The E in the equation above represents

A)the value of the firm's equity.

B)the value of the firm's debt.

C)the value of the firm's unlevered equity.

D)the market value of the firm's assets.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is FALSE?

A)Holding cash has the opposite effect of leverage on risk and return.

B)We use the market value of the firms' net debt when computing its WACC and unlevered beta to measure the cost of capital and market risk of the firm's business assets.

C)Since the WACC does not change with the use of leverage,the value of the firm's free cash flow evaluated using the WACC does not change,and so the enterprise value of the firm does not depend on its financing choices.

D)Even if the firm's capital structure is more complex,the WACC is calculated by computing the weighted average cost of only the firm's debt and equity.

A)Holding cash has the opposite effect of leverage on risk and return.

B)We use the market value of the firms' net debt when computing its WACC and unlevered beta to measure the cost of capital and market risk of the firm's business assets.

C)Since the WACC does not change with the use of leverage,the value of the firm's free cash flow evaluated using the WACC does not change,and so the enterprise value of the firm does not depend on its financing choices.

D)Even if the firm's capital structure is more complex,the WACC is calculated by computing the weighted average cost of only the firm's debt and equity.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

45

Use the information for the question(s)below.

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

After the repurchase how many shares will Luther have outstanding?

A)0.75 billion

B)1.0 billion

C)1.1 billion

D)1.2 billion

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

After the repurchase how many shares will Luther have outstanding?

A)0.75 billion

B)1.0 billion

C)1.1 billion

D)1.2 billion

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

46

Consider the following equation for the question(s)below:

The A in the equation above represents

A)the value of the firm's debt.

B)the market value of the firm's assets.

C)the value of the firm's equity.

D)the value of the firm's unlevered equity.

The A in the equation above represents

A)the value of the firm's debt.

B)the market value of the firm's assets.

C)the value of the firm's equity.

D)the value of the firm's unlevered equity.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

47

Use the information for the question(s)below.

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

Assume that in addition to 1.25 billion common shares outstanding,Luther has stock options given to employees valued at $2 billion.The market value of Luther's non-cash assets is closest to:

A)$22 billion

B)$20 billion

C)$25 billion

D)$18 billion

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

Assume that in addition to 1.25 billion common shares outstanding,Luther has stock options given to employees valued at $2 billion.The market value of Luther's non-cash assets is closest to:

A)$22 billion

B)$20 billion

C)$25 billion

D)$18 billion

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

48

Use the information for the question(s)below.

Consider two firms,With and Without,that have identical assets that generate identical cash flows.Without is an all-equity firm,with 1 million shares outstanding that trade for a price of $24 per share.With has 2 million shares outstanding and $12 million in debt at an interest rate of 5%.

Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as With.You have $5000 of your own money to invest and you plan on buying With stock.Using homemade (un)leverage,how much do you need to invest at the risk-free rate so that the payoff of your account will be the same as a $5000 investment in Without stock?

A)$5000

B)$0

C)$2500

D)$4000

Consider two firms,With and Without,that have identical assets that generate identical cash flows.Without is an all-equity firm,with 1 million shares outstanding that trade for a price of $24 per share.With has 2 million shares outstanding and $12 million in debt at an interest rate of 5%.

Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as With.You have $5000 of your own money to invest and you plan on buying With stock.Using homemade (un)leverage,how much do you need to invest at the risk-free rate so that the payoff of your account will be the same as a $5000 investment in Without stock?

A)$5000

B)$0

C)$2500

D)$4000

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements is FALSE?

A)The levered equity return equals the unlevered return,plus an extra "kick" due to leverage.

B)By holding a portfolio of the firm's equity and its debt,we can replicate the cash flows from holding its levered equity.

C)The cost of capital of levered equity is equal to the cost of capital of unlevered equity plus a premium that is proportional to the market value debt-equity ratio.

D)If a firm is unlevered,all of the free cash flows generated by its assets are available to be paid out to its equity holders.

A)The levered equity return equals the unlevered return,plus an extra "kick" due to leverage.

B)By holding a portfolio of the firm's equity and its debt,we can replicate the cash flows from holding its levered equity.

C)The cost of capital of levered equity is equal to the cost of capital of unlevered equity plus a premium that is proportional to the market value debt-equity ratio.

D)If a firm is unlevered,all of the free cash flows generated by its assets are available to be paid out to its equity holders.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

50

Use the information for the question(s)below.

Consider two firms,With and Without,that have identical assets that generate identical cash flows.Without is an all-equity firm,with 1 million shares outstanding that trade for a price of $24 per share.With has 2 million shares outstanding and $12 million in debt at an interest rate of 5%.

According to MM Proposition I,the stock price for With is closest to:

A)$8.00

B)$24.00

C)$6.00

D)$12.00

Consider two firms,With and Without,that have identical assets that generate identical cash flows.Without is an all-equity firm,with 1 million shares outstanding that trade for a price of $24 per share.With has 2 million shares outstanding and $12 million in debt at an interest rate of 5%.

According to MM Proposition I,the stock price for With is closest to:

A)$8.00

B)$24.00

C)$6.00

D)$12.00

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

51

Use the information for the question(s)below.

Consider two firms,With and Without,that have identical assets that generate identical cash flows.Without is an all-equity firm,with 1 million shares outstanding that trade for a price of $24 per share.With has 2 million shares outstanding and $12 million in debt at an interest rate of 5%.

Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as With.You have $5000 of your own money to invest and you plan on buying Without stock.Using homemade leverage you borrow enough in your margin account so that the payoff of your margined purchase of Without stock will be the same as a $5000 investment in With stock.The number of shares of Without stock you purchased is closest to:

A)425

B)1650

C)2000

D)825

Consider two firms,With and Without,that have identical assets that generate identical cash flows.Without is an all-equity firm,with 1 million shares outstanding that trade for a price of $24 per share.With has 2 million shares outstanding and $12 million in debt at an interest rate of 5%.

Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as With.You have $5000 of your own money to invest and you plan on buying Without stock.Using homemade leverage you borrow enough in your margin account so that the payoff of your margined purchase of Without stock will be the same as a $5000 investment in With stock.The number of shares of Without stock you purchased is closest to:

A)425

B)1650

C)2000

D)825

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

52

Consider the following equation for the question(s)below:

The U in the equation above represents

A)the value of the firm's equity.

B)the market value of the firm's assets.

C)the value of the firm's unlevered equity.

D)the value of the firm's debt.

The U in the equation above represents

A)the value of the firm's equity.

B)the market value of the firm's assets.

C)the value of the firm's unlevered equity.

D)the value of the firm's debt.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements is FALSE?

A)Investors can alter the leverage choice of the firm to suit their personal tastes either by borrowing and reducing leverage or by holding bonds and adding more leverage.

B)On the market value balance sheet the total value of all securities issued by the firm must equal the total value of the firm's assets.

C)The market value balance sheet captures the idea that value is created by a firm's choice of assets and investments.

D)One application of MM Proposition I is the useful device known as the market value balance sheet of the firm.

A)Investors can alter the leverage choice of the firm to suit their personal tastes either by borrowing and reducing leverage or by holding bonds and adding more leverage.

B)On the market value balance sheet the total value of all securities issued by the firm must equal the total value of the firm's assets.

C)The market value balance sheet captures the idea that value is created by a firm's choice of assets and investments.

D)One application of MM Proposition I is the useful device known as the market value balance sheet of the firm.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is FALSE?

A)While debt itself may be cheap,it increases the risk and therefore the cost of capital of the firm's equity.

B)Although debt does not have a lower cost of capital than equity,we can consider this cost in isolation.

C)We can use MM Proposition I to derive an explicit relationship between leverage and the equity cost of capital.

D)The total market value of the firm's securities is equal to the market value of its assets,whether the firm is unlevered or levered.

A)While debt itself may be cheap,it increases the risk and therefore the cost of capital of the firm's equity.

B)Although debt does not have a lower cost of capital than equity,we can consider this cost in isolation.

C)We can use MM Proposition I to derive an explicit relationship between leverage and the equity cost of capital.

D)The total market value of the firm's securities is equal to the market value of its assets,whether the firm is unlevered or levered.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is FALSE?

A)With no debt,the WACC is equal to the unlevered equity cost of capital.

B)With perfect capital markets,a firm's WACC is dependent of its capital structure and is equal to its equity cost of capital only if the firm is unlevered.

C)As the firm borrows at the low cost of capital for debt,its equity cost of capital rises,but the net effect is that the firm's WACC is unchanged.

D)Although debt has a lower cost of capital than equity,leverage does not lower a firm's WACC.

A)With no debt,the WACC is equal to the unlevered equity cost of capital.

B)With perfect capital markets,a firm's WACC is dependent of its capital structure and is equal to its equity cost of capital only if the firm is unlevered.

C)As the firm borrows at the low cost of capital for debt,its equity cost of capital rises,but the net effect is that the firm's WACC is unchanged.

D)Although debt has a lower cost of capital than equity,leverage does not lower a firm's WACC.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements is FALSE?

A)If we can identify a comparison firm whose assets have the same risk as the project being evaluated,and if the comparison firm is levered,then we can use its equity cost of capital as the cost of capital for the project.

B)We can calculate the cost of capital of the firm's assets by computing the weighted average of the firm's equity and debt cost of capital,which we refer to as the firm's weighted average cost of capital.

C)The portfolio of a firm's equity and debt replicates the returns we would earn if the firm were unlevered.

D)When evaluating any potential investment project,we must use a discount rate that is appropriate given the risk of the project's free cash flow.

A)If we can identify a comparison firm whose assets have the same risk as the project being evaluated,and if the comparison firm is levered,then we can use its equity cost of capital as the cost of capital for the project.

B)We can calculate the cost of capital of the firm's assets by computing the weighted average of the firm's equity and debt cost of capital,which we refer to as the firm's weighted average cost of capital.

C)The portfolio of a firm's equity and debt replicates the returns we would earn if the firm were unlevered.

D)When evaluating any potential investment project,we must use a discount rate that is appropriate given the risk of the project's free cash flow.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

57

Use the information for the question(s)below.

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

With perfect capital markets,what is the market value of Luther's equity after the share repurchase?

A)$15 billion

B)$10 billion

C)$25 billion

D)$20 billion

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

With perfect capital markets,what is the market value of Luther's equity after the share repurchase?

A)$15 billion

B)$10 billion

C)$25 billion

D)$20 billion

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

58

Use the information for the question(s)below.

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

With perfect capital markets,what is the market price per share of Luther's stock after the share repurchase?

A)$25

B)$24

C)$15

D)$20

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

With perfect capital markets,what is the market price per share of Luther's stock after the share repurchase?

A)$25

B)$24

C)$15

D)$20

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

59

Use the information for the question(s)below.

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

The market value of Luther's non-cash assets is closest to:

A)$20 billion

B)$19 billion

C)$25 billion

D)$24 billion

Luther is a successful logistical services firm that currently has $5 billion in cash.Luther has decided to use this cash to repurchase shares from its investors and has already announced the stock repurchase plan.Currently Luther is an all-equity firm with 1.25 billion shares outstanding.Luther's shares are currently trading at $20 per share.

The market value of Luther's non-cash assets is closest to:

A)$20 billion

B)$19 billion

C)$25 billion

D)$24 billion

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

60

Use the information for the question(s)below.

Consider two firms,With and Without,that have identical assets that generate identical cash flows.Without is an all-equity firm,with 1 million shares outstanding that trade for a price of $24 per share.With has 2 million shares outstanding and $12 million in debt at an interest rate of 5%.

Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as With.You have $5000 of your own money to invest and you plan on buying With stock.Using homemade (un)leverage you invest enough at the risk-free rate so that the payoff of your account will be the same as a $5000 investment in Without stock.The number of shares of With stock you purchased is closest to:

A)100

B)425

C)1650

D)825

Consider two firms,With and Without,that have identical assets that generate identical cash flows.Without is an all-equity firm,with 1 million shares outstanding that trade for a price of $24 per share.With has 2 million shares outstanding and $12 million in debt at an interest rate of 5%.

Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as With.You have $5000 of your own money to invest and you plan on buying With stock.Using homemade (un)leverage you invest enough at the risk-free rate so that the payoff of your account will be the same as a $5000 investment in Without stock.The number of shares of With stock you purchased is closest to:

A)100

B)425

C)1650

D)825

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

61

A bankruptcy process is complex,time-consuming,and costly.The costs of bankruptcy include

A)dividend payments.

B)raw material costs.

C)costs of hiring legal experts,appraisers,and auctioneers.

D)taxes.

A)dividend payments.

B)raw material costs.

C)costs of hiring legal experts,appraisers,and auctioneers.

D)taxes.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

62

Suppose a project financed via an issue of debt requires six annual interest payments of $20 million each year.If the tax rate is 30% and the cost of debt is 8%,what is the value of the interest rate tax shield?

A)$31.35 million

B)$27.74 million

C)$23.20 million

D)$32.64 million

A)$31.35 million

B)$27.74 million

C)$23.20 million

D)$32.64 million

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

63

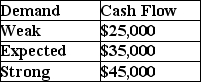

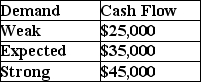

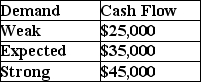

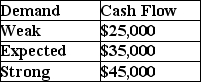

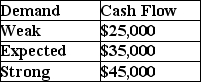

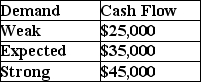

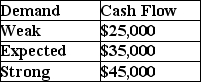

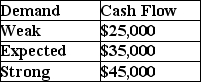

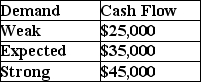

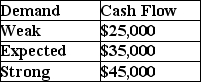

Use next year's Cash Flow Forecast for Blank Company to answer the following questions:

Suppose Blank Company has only one project,as forecast above,and an unlevered cost of equity of 8%.What is the value of the company?

A)$23,148.15

B)$32,407.40

C)$41,666.67

D)Cannot be determined with the information given.

Suppose Blank Company has only one project,as forecast above,and an unlevered cost of equity of 8%.What is the value of the company?

A)$23,148.15

B)$32,407.40

C)$41,666.67

D)Cannot be determined with the information given.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

64

A firm requires an investment of $30,000 and borrows $20,000 at 7%.If the return on equity is 15% and the tax rate is 30%,what is the firm's WACC?

A)8.27%

B)9.13%

C)10.4%

D)8.91%

A)8.27%

B)9.13%

C)10.4%

D)8.91%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

65

Use next year's Cash Flow Forecast for Blank Company to answer the following questions:

Suppose Blank Company has only one project,as forecast above,and an unlevered cost of equity of 8%.If the company borrows $10,000 at 5% to make the investment,what is expected return to equity holders?

A)8.0%

B)11.6%

C)9.33%

D)30.0%

Suppose Blank Company has only one project,as forecast above,and an unlevered cost of equity of 8%.If the company borrows $10,000 at 5% to make the investment,what is expected return to equity holders?

A)8.0%

B)11.6%

C)9.33%

D)30.0%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

66

A firm requires an investment of $30,000 and borrows $10,000 at 6%.If the return on equity is 15% and the tax rate is 30%,what is the firm's WACC?

A)11.4%

B)12.3%

C)7.8%

D)10.1%

A)11.4%

B)12.3%

C)7.8%

D)10.1%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

67

A firm requires an investment of $20,000 and borrows $10,000 at 8%.If the return on equity is 20% and the tax rate is 30%,what is the firm's WACC?

A)11.4%

B)12.8%

C)12..1%

D)13.2%

A)11.4%

B)12.8%

C)12..1%

D)13.2%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

68

The following equation:

Can be used to calculate all of the following EXCEPT:

A)the cost of capital for the firm's assets.

B)the levered cost of equity.

C)the unlevered cost of equity.

D)the weighted average cost of capital.

Can be used to calculate all of the following EXCEPT:

A)the cost of capital for the firm's assets.

B)the levered cost of equity.

C)the unlevered cost of equity.

D)the weighted average cost of capital.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

69

How does the interest paid by a firm affect its value to investors?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following equations would not be appropriate to use in a firm with risky debt?

A)βE = βU + (βU - βD)

(βU - βD)

B)βU = βE+ (βU - βD)

(βU - βD)

C)βE = βU + βU

βU

D)βU = βE +

βE +

βD

βD

A)βE = βU +

(βU - βD)

(βU - βD)B)βU = βE+

(βU - βD)

(βU - βD)C)βE = βU +

βU

βUD)βU =

βE +

βE + βD

βD

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

71

In general,the gain to investors from the tax deductibility of interest payments is referred to as the interest rate tax shield.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

72

Suppose a project financed via an issue of debt requires five annual interest payments of $20 million each year.If the tax rate is 30% and the cost of debt is 5%,what is the value of the interest rate tax shield?

A)$32.35 million

B)$22.25 million

C)$25.98 million

D)$22.67 million

A)$32.35 million

B)$22.25 million

C)$25.98 million

D)$22.67 million

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

73

Use next year's Cash Flow Forecast for Blank Company to answer the following questions:

Suppose Blank Company has only one project,as forecast above,and an unlevered cost of equity of 8%.If the company borrows $10,000 at 5% to make the investment,what is the return to equity holders if demand is strong?

A)8.0%

B)54.0%

C)28.6%

D)38.0%

Suppose Blank Company has only one project,as forecast above,and an unlevered cost of equity of 8%.If the company borrows $10,000 at 5% to make the investment,what is the return to equity holders if demand is strong?

A)8.0%

B)54.0%

C)28.6%

D)38.0%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

74

Use next year's Cash Flow Forecast for Blank Company to answer the following questions:

Suppose Blank Company has only one project,as forecast above,and an unlevered cost of equity of 8%.If the company borrows $10,000 at 5% to make the investment,what is the return to equity holders if demand is weak?

A)8.0%

B)-37.5%

C)-58.6%

D)-35.3%

Suppose Blank Company has only one project,as forecast above,and an unlevered cost of equity of 8%.If the company borrows $10,000 at 5% to make the investment,what is the return to equity holders if demand is weak?

A)8.0%

B)-37.5%

C)-58.6%

D)-35.3%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

75

What are some implications of market imperfections?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

76

A firm that does not have trouble meeting its debt obligations is said to be in financial distress.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

77

What effect does debt have on a firm's weighted average cost of capital?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

78

The direct costs of bankruptcy are estimated to be far greater,as a percent of assets,than the indirect costs of bankruptcy.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

79

Suppose a project financed via an issue of debt requires five annual interest payments of $10 million each year.If the tax rate is 30% and the cost of debt is 6%,what is the value of the interest rate tax shield?

A)$11.35 million

B)$12.21 million

C)$13.20 million

D)$12.64 million

A)$11.35 million

B)$12.21 million

C)$13.20 million

D)$12.64 million

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

80

Use next year's Cash Flow Forecast for Blank Company to answer the following questions:

Suppose Blank Company has only one project,as forecast above,and an unlevered cost of equity of 8%.If the company uses no leverage,what is expected return to equity holders?

A)8.0%

B)11.6%

C)9.33%

D)30.0%

Suppose Blank Company has only one project,as forecast above,and an unlevered cost of equity of 8%.If the company uses no leverage,what is expected return to equity holders?

A)8.0%

B)11.6%

C)9.33%

D)30.0%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck