Deck 3: Job Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

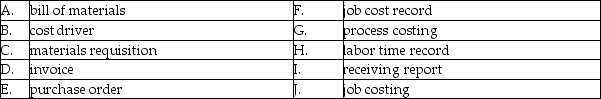

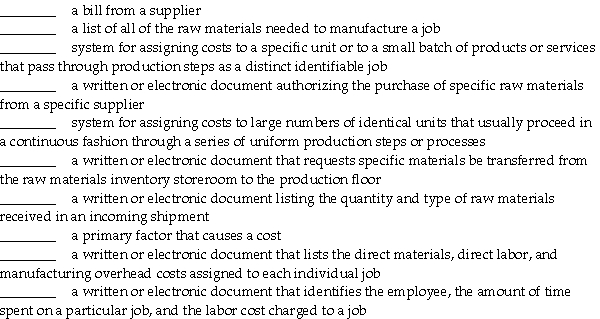

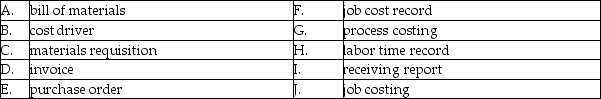

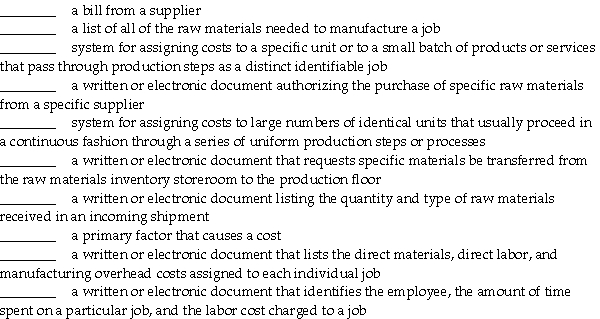

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/334

Play

Full screen (f)

Deck 3: Job Costing

1

A receiving report is typically a duplicate of the purchase order but without the prices and quantities pre-listed on the form.

True

2

Which product costing system would be better for custom-order products?

A)Product costing system

B)Company costing system

C)Job costing system

D)Overhead costing system

A)Product costing system

B)Company costing system

C)Job costing system

D)Overhead costing system

C

3

A paper mill company like International Paper would most likely use job costing.

False

4

Job costing systems accumulate the costs for each individual job.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

5

Generally Accepted Accounting Principles (GAAP)mandates the type of product costing system (job costing or process costing)that must be used by a manufacturer.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

6

Companies should always use job costing rather than process costing.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

7

Which product costing system would better account for a unique product?

A)Overhead costing system

B)Job costing system

C)Process costing system

D)Product costing system

A)Overhead costing system

B)Job costing system

C)Process costing system

D)Product costing system

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

8

All manufacturers use either a pure process costing system or a pure job costing system.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

9

The two basic types of costing systems are

A)product costing and materials inventory costing.

B)periodic costing and perpetual costing.

C)job costing and process costing.

D)periodic costing and process costing.

A)product costing and materials inventory costing.

B)periodic costing and perpetual costing.

C)job costing and process costing.

D)periodic costing and process costing.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

10

A food and beverage company like Coca-Cola would most likely use job costing.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is an example of an industry that would use a process costing-rather than a job costing-system?

A)Brugman Custom Cabinetry

B)Computer Repair

C)Pepsi

D)Smith & Zu Certified Public Accountants

A)Brugman Custom Cabinetry

B)Computer Repair

C)Pepsi

D)Smith & Zu Certified Public Accountants

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is an example of an industry that would use a process costing-rather than a job costing-system?

A)Coca-Cola

B)Boeing Jets

C)Centex Custom Homes

D)Snyder & Lewis,Attorneys at Law

A)Coca-Cola

B)Boeing Jets

C)Centex Custom Homes

D)Snyder & Lewis,Attorneys at Law

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following industries would be most likely to use a job costing system?

A)Chemicals

B)Food and beverage

C)Commercial building construction

D)Pharmaceuticals

A)Chemicals

B)Food and beverage

C)Commercial building construction

D)Pharmaceuticals

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

14

Process costing is used by companies that produce large numbers of identical units of production in a continuous fashion.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is most likely not to use process costing?

A)DuPont Chemical

B)Exxon-Mobile (gasoline)

C)Ashley Custom Furnishings

D)General Mills (cereal)

A)DuPont Chemical

B)Exxon-Mobile (gasoline)

C)Ashley Custom Furnishings

D)General Mills (cereal)

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

16

The end goal of process costing and job costing at a manufacturing company is the same: to find the cost of producing one unit of product.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

17

Job costing should only be used by manufacturers.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

18

Job costing is often used by professional service providers,such as law firms.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

19

A job costing system can be used by which types of companies?

A)Manufacturing and merchandising businesses

B)Service and manufacturing businesses

C)Service,manufacturing,and merchandising businesses

D)Service and merchandising businesses

A)Manufacturing and merchandising businesses

B)Service and manufacturing businesses

C)Service,manufacturing,and merchandising businesses

D)Service and merchandising businesses

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

20

Companies use job costing when their products or services vary in terms of materials needed,time required to complete the product,and/or the complexity of the production process.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

21

When raw materials are transferred out of the storeroom to the factory,their cost is transferred out of raw materials inventory and into work in process inventory.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

22

State whether each company below would be more likely to use a job costing system or a process costing system.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

23

A purchase order is used to order needed materials from suppliers.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

24

A manufacturer of luxury yachts would use which type of costing system?

A)Process costing

B)Job costing

C)Either job or process

D)Both job and process

A)Process costing

B)Job costing

C)Either job or process

D)Both job and process

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

25

A job cost record is a document that accumulates direct materials costs,direct labor costs and manufacturing overhead costs assigned to each individual job.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

26

A production schedule indicates the quantity and types of inventory that are scheduled to be manufactured during the period.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

27

When the products are shipped to customers,the cost of manufacturing those products becomes Cost of Goods Sold (COGS)shown on the company's balance sheet.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

28

Briefly explain the difference between job order and process costing and give examples of each.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

29

At a manufacturing company,inventory flows from work in process inventory,to raw materials inventory,to finished goods inventory.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

30

A labor time record identifies the employee and the amount of time the employee spent on a particular job.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

31

The bill of materials lists all of the raw materials needed to manufacture the job.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

32

________ is the system for assigning costs to unique cost objects.

A)Time costing

B)Process costing

C)Job costing

D)Service costing

A)Time costing

B)Process costing

C)Job costing

D)Service costing

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

33

Job order costing might be used by a

A)candy manufacturer.

B)custom home builder.

C)crude oil refinery.

D)cereal maker.

A)candy manufacturer.

B)custom home builder.

C)crude oil refinery.

D)cereal maker.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

34

For a manufacturing system,inventory flows from raw materials inventory to work in process inventory to finished goods inventory.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

35

A production schedule always covers a one-year period of time.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

36

An example of an industry that uses process costing might be a

A)custom printer.

B)homebuilder.

C)shipbuilder.

D)company that makes cement.

A)custom printer.

B)homebuilder.

C)shipbuilder.

D)company that makes cement.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

37

A manufacturer of plywood would use what type of product costing system?

A)Process costing

B)Job costing

C)Either job or process

D)Both job and process

A)Process costing

B)Job costing

C)Either job or process

D)Both job and process

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following types of costing is used for many similar products?

A)Process costing

B)Batch costing

C)Service costing

D)Job costing

A)Process costing

B)Batch costing

C)Service costing

D)Job costing

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

39

The quantities of incoming shipments of raw materials are counted and recorded on a purchase order.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

40

State whether each company below would be more likely to use a job costing system or a process costing system.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

41

When used,raw materials

A)would be classified as direct materials.

B)would be classified as direct labor.

C)would be classified as indirect materials.

D)cannot be determined with the information provided.

A)would be classified as direct materials.

B)would be classified as direct labor.

C)would be classified as indirect materials.

D)cannot be determined with the information provided.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

42

Which of these documents authorizes the purchase of specific raw materials from a specific supplier?

A)Labor time record

B)Materials inventory requisition form

C)Job cost record

D)Purchase order

A)Labor time record

B)Materials inventory requisition form

C)Job cost record

D)Purchase order

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

43

A ________ is a source document used to track employee hours.

A)labor time record

B)process costing

C)job cost record

D)job costing

A)labor time record

B)process costing

C)job cost record

D)job costing

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

44

A ________ is used to accumulate all of the direct materials and direct labor used on the job,as well as the manufacturing overhead allocated to the job.

A)bill of materials

B)job cost record

C)labor time record

D)production schedule

A)bill of materials

B)job cost record

C)labor time record

D)production schedule

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

45

In the basic flow of inventory through a manufacturing system,which of the following occurs third in the job costing system?

A)Finished goods inventory

B)Cost of goods sold

C)Raw materials inventory

D)Work in process inventory

A)Finished goods inventory

B)Cost of goods sold

C)Raw materials inventory

D)Work in process inventory

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

46

Briefly explain the flow of inventory through a manufacturing system into a company's job costing system from the purchase of materials to the sale of the products.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

47

For a manufacturer that uses job costing,show the order of the cost flow through the following accounts by numbering them from 1 to 4.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

48

In the basic flow of inventory through a manufacturing system,which of the following occurs first in a job costing system?

A)Cost of goods sold

B)Finished goods inventory

C)Work in process inventory

D)Raw materials inventory

A)Cost of goods sold

B)Finished goods inventory

C)Work in process inventory

D)Raw materials inventory

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

49

An internal request to transfer raw materials requires personnel to complete a

A)materials requisition document.

B)bill of materials document.

C)purchase order document.

D)labor time record document.

A)materials requisition document.

B)bill of materials document.

C)purchase order document.

D)labor time record document.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

50

For each of the following items,determine whether it would be more appropriate to increase

A)manufacturing overhead,or

B)work in process inventory.Enter either the letter A or the letter B on the line in front of each of the following statements.

A)manufacturing overhead,or

B)work in process inventory.Enter either the letter A or the letter B on the line in front of each of the following statements.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

51

A ________ is used to accumulate the costs of a job.

A)labor time record

B)materials inventory requisition form

C)bill of materials

D)job cost record

A)labor time record

B)materials inventory requisition form

C)bill of materials

D)job cost record

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

52

When direct materials are requisitioned,they flow directly into

A)cost of goods sold account.

B)finished goods inventory account.

C)work in process inventory account.

D)manufacturing overhead account.

A)cost of goods sold account.

B)finished goods inventory account.

C)work in process inventory account.

D)manufacturing overhead account.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

53

The ________ substantiates the total of the raw materials inventory account shown on the company's balance sheet.

A)bill of materials

B)raw materials records

C)materials requisition

D)labor time record

A)bill of materials

B)raw materials records

C)materials requisition

D)labor time record

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

54

In the basic flow of inventory through a manufacturing system,which of the following occurs last in the job costing system?

A)Finished goods inventory

B)Cost of goods sold

C)Raw materials inventory

D)Work in process inventory

A)Finished goods inventory

B)Cost of goods sold

C)Raw materials inventory

D)Work in process inventory

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

55

On the line in front of each statement,enter the letter corresponding to the term that best fits that statement.You may use a letter more than once and some letters may not be used at all.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

56

In the basic flow of inventory through a manufacturing system,which of the following occurs second in the job costing system?

A)Cost of goods sold

B)Finished goods inventory

C)Work in process inventory

D)Raw materials inventory

A)Cost of goods sold

B)Finished goods inventory

C)Work in process inventory

D)Raw materials inventory

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

57

The assignment of direct and indirect materials to a cost object reduces the

A)finished goods inventory account.

B)raw materials inventory account.

C)manufacturing overhead account.

D)work in process inventory account.

A)finished goods inventory account.

B)raw materials inventory account.

C)manufacturing overhead account.

D)work in process inventory account.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

58

A ________ is a document manufacturing production personnel use to request that the itemized materials be sent from the showroom into the factory.

A)cost ticket

B)job cost record

C)materials requisition

D)manufacturing ticket

A)cost ticket

B)job cost record

C)materials requisition

D)manufacturing ticket

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

59

Payroll-related costs for factory employees who do not work directly on the product are considered

A)direct labor.

B)selling expenses.

C)manufacturing overhead.

D)administrative costs.

A)direct labor.

B)selling expenses.

C)manufacturing overhead.

D)administrative costs.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

60

Which of these documents informs the storeroom to send specific materials to the factory floor?

A)Receiving report

B)Bill of materials

C)Purchase order

D)Materials requisition

A)Receiving report

B)Bill of materials

C)Purchase order

D)Materials requisition

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

61

The overhead allocation base should be the cost driver of manufacturing overhead costs.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

62

Generally accepted accounting principles (GAAP)mandate that manufacturing overhead must be treated as an inventoriable product cost for financial reporting purposes.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

63

Manufacturers follow four steps to implement a manufacturing overhead allocation system.In the last step,the company estimates the total amount of manufacturing overhead costs for the year.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

64

The key to allocating indirect manufacturing costs to jobs is to identify an appropriate allocation base.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

65

Allocating manufacturing overhead to jobs simply means "splitting up" the total manufacturing overhead costs among the jobs produced during the year.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

66

Manufacturers follow four steps to implement a manufacturing overhead allocation system.What is the first step?

A)Select an allocation base and estimate the total amount that will be used during the year.

B)Allocate some manufacturing overhead to each individual job.

C)Calculate a predetermined manufacturing overhead rate.

D)Estimate total manufacturing overhead costs for the coming year.

A)Select an allocation base and estimate the total amount that will be used during the year.

B)Allocate some manufacturing overhead to each individual job.

C)Calculate a predetermined manufacturing overhead rate.

D)Estimate total manufacturing overhead costs for the coming year.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

67

Manufacturing overhead may include depreciation on the factory plant and equipment,utilities to run the plant,property taxes and insurance on the plant,and salaries of plant janitors.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

68

The first three steps to allocating manufacturing overhead are taken before the year begins and include all of the following except

A)estimating total manufacturing overhead costs for the coming year.

B)selecting an allocation base and estimating the total amount that will be used during the year.

C)allocating some manufacturing overhead to each individual job.

D)calculating the predetermined manufacturing overhead rate.

A)estimating total manufacturing overhead costs for the coming year.

B)selecting an allocation base and estimating the total amount that will be used during the year.

C)allocating some manufacturing overhead to each individual job.

D)calculating the predetermined manufacturing overhead rate.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

69

What is the primary factor that causes a "cost" called?

A)Cost driver

B)Cost allocation

C)Materials requisition

D)Predetermined manufacturing overhead rate

A)Cost driver

B)Cost allocation

C)Materials requisition

D)Predetermined manufacturing overhead rate

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

70

The predetermined manufacturing overhead rate is calculated by multiplying the total estimated manufacturing overhead costs by the total estimated amount of the allocation base.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

71

The predetermined manufacturing overhead rate is calculated by dividing the total estimated manufacturing overhead costs by the total estimated amount of the allocation base.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

72

Manufacturers follow four steps to implement a manufacturing overhead allocation system.The last step is

A)allocate some manufacturing overhead to each individual job.

B)select an allocation base and estimate the total amount that will be used during the year.

C)estimate total manufacturing overhead costs for the coming year.

D)calculate a predetermined manufacturing overhead rate.

A)allocate some manufacturing overhead to each individual job.

B)select an allocation base and estimate the total amount that will be used during the year.

C)estimate total manufacturing overhead costs for the coming year.

D)calculate a predetermined manufacturing overhead rate.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

73

Manufacturing overhead costs cannot be directly traced to jobs.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

74

Manufacturers follow four steps to implement a manufacturing overhead allocation system.Which step is not performed before the year begins?

A)Allocate some manufacturing overhead to each individual job.

B)Select an allocation base and estimate the total amount that will be used during the year.

C)Estimate total manufacturing overhead costs for the coming year.

D)Calculate a predetermined manufacturing overhead rate.

A)Allocate some manufacturing overhead to each individual job.

B)Select an allocation base and estimate the total amount that will be used during the year.

C)Estimate total manufacturing overhead costs for the coming year.

D)Calculate a predetermined manufacturing overhead rate.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

75

Assigning manufacturing overhead costs and other indirect costs is called

A)cost driver.

B)cost allocation.

C)materials requisition.

D)predetermined manufacturing overhead rate.

A)cost driver.

B)cost allocation.

C)materials requisition.

D)predetermined manufacturing overhead rate.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

76

An equal amount of manufacturing overhead should be allocated to each job.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

77

The cost of wages paid to assembly-line workers should be treated as a manufacturing overhead cost.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

78

Manufacturers follow four steps to implement a manufacturing overhead allocation system.In the first step,the company estimates its total manufacturing overhead costs for the coming year.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

79

Manufacturers follow four steps to implement a manufacturing overhead allocation system.In the last step,to the company allocates some manufacturing overhead to each individual job.

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck

80

A(n)________ is an estimated manufacturing overhead rate computed during the year.

A)cost allocation

B)cost driver

C)predetermined manufacturing overhead rate

D)actual manufacturing overhead rate

A)cost allocation

B)cost driver

C)predetermined manufacturing overhead rate

D)actual manufacturing overhead rate

Unlock Deck

Unlock for access to all 334 flashcards in this deck.

Unlock Deck

k this deck