Deck 12: Capital Structure

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/111

Play

Full screen (f)

Deck 12: Capital Structure

1

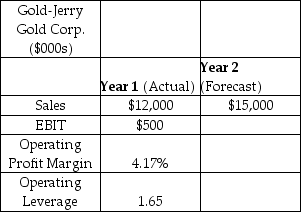

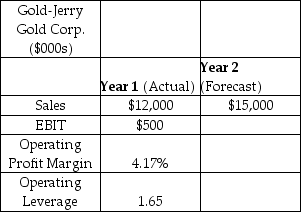

Gold-Jerry Gold Corporation is a mid-tier gold producer listed on the New York Stock Exchange.It is currently the end of Year 1,and the fiscal situation in the U.S and Europe is dire.Kenny Bania,an analyst at Gold-Jerry,forecasts that gold prices will rise during Year 2,since gold is regarded as a safe investment haven during periods of economic uncertainty.Bania is forecasting that Gold-Jerry's revenues will increase by 25% in Year 2.Use the data in the table to estimate Gold-Jerry's operating profit margin (EBIT/Sales)for Year 2.

A) 4.17%

B) 12.56%

C) 4.71%

D) 41.25%

E) 5.21%

A) 4.17%

B) 12.56%

C) 4.71%

D) 41.25%

E) 5.21%

4.71%

2

The degree of operating leverage varies with the level of

A) fixed assets.

B) total debt.

C) accumulated depreciation.

D) total equity.

E) monopoly power.

A) fixed assets.

B) total debt.

C) accumulated depreciation.

D) total equity.

E) monopoly power.

fixed assets.

3

If EBIT increases 15%,EPS increases by 30%,debt increases by 45%,and the tax rate declines by 5%,what is the degree of financial leverage?

A) 2

B) 1

C) 9

D) 3

E) 6

A) 2

B) 1

C) 9

D) 3

E) 6

2

4

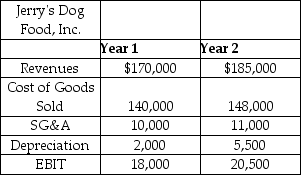

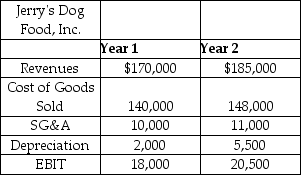

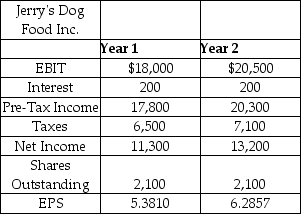

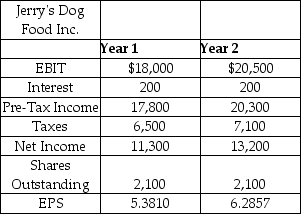

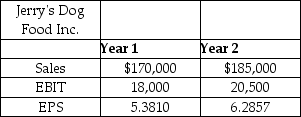

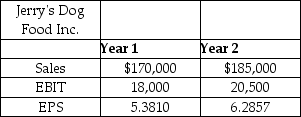

Jerry's Dog Food,Inc.is a dog food wholesaler located in Greenwich,Connecticut.Selected financial statement values for Jerry's are shown in the table below.What is the degree of operating leverage for Jerry's given the change in revenues from Year 1 to Year 2?

A) 3.40

B) 1.57

C) 0.11

D) 1.00

E) 0.85

A) 3.40

B) 1.57

C) 0.11

D) 1.00

E) 0.85

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

5

If sales increase 25%,EBIT increases 50%,debt increases 75%,and working capital increases 12.5%,what is the degree of operating leverage?

A) 2

B) 5

C) 3

D) 6

E) 4

A) 2

B) 5

C) 3

D) 6

E) 4

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is true?

A) When choosing a target capital structure, the goal is to increase the degree of operating leverage.

B) A firm's degree of operating leverage has no impact on how much debt it uses.

C) A firm's decision to use more debt can affect its cost of equity.

D) Total leverage can be calculated by adding the degrees of financial and operating leverage together.

E) All firms in an industry often have similar capital structures.

A) When choosing a target capital structure, the goal is to increase the degree of operating leverage.

B) A firm's degree of operating leverage has no impact on how much debt it uses.

C) A firm's decision to use more debt can affect its cost of equity.

D) Total leverage can be calculated by adding the degrees of financial and operating leverage together.

E) All firms in an industry often have similar capital structures.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

7

A 20% increase in sales causes EPS to rise from $4.00 to $6.50.Assuming the firm has no debt,what is its degree of operating leverage (DOL)?

A) 1.00

B) 1.50

C) 1.57

D) 3.13

E) 2.25

A) 1.00

B) 1.50

C) 1.57

D) 3.13

E) 2.25

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

8

The degree of operating leverage is defined as:

A) the percent change in EBIT over the percent change in sales

B) the percent change in EPS over the percent change in EBIT

C) the percent change in EPS over the percent change in sales

D) the percent change in EBIT over the percent change in EPS

E) the percent change in sales over the percent change in EBIT

A) the percent change in EBIT over the percent change in sales

B) the percent change in EPS over the percent change in EBIT

C) the percent change in EPS over the percent change in sales

D) the percent change in EBIT over the percent change in EPS

E) the percent change in sales over the percent change in EBIT

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

9

________ leverage is increased by having greater amounts of debt in the capital structure.

A) Operating

B) Financial

C) Business

D) Corporate

E) Coupon

A) Operating

B) Financial

C) Business

D) Corporate

E) Coupon

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

10

A 10% increase in sales causes EPS to rise from $0.50 to $0.56.Assuming the firm has no debt,what is its degree of operating leverage (DOL)?

A) 1.00

B) 1.20

C) 0.83

D) 1.50

E) 0.75

A) 1.00

B) 1.20

C) 0.83

D) 1.50

E) 0.75

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

11

Jerry's Dog Food,Inc.is a dog food wholesaler located in Greenwich,Connecticut.Selected financial statement values for Jerry's are shown in the table below.What is the degree of financial leverage for Jerry's given the change in earnings from Year 1 to Year 2?

A) 0.62

B) 2.55

C) 1.21

D) 1.01

E) 1.05

A) 0.62

B) 2.55

C) 1.21

D) 1.01

E) 1.05

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

12

Over the last year,sales at Downscale Department Store increased 10% and EBIT increased 5%.If the increase in earnings-per-share was 20%,what is the degree of total leverage?

A) 3

B) 4

C) 5

D) 2

E) 1

A) 3

B) 4

C) 5

D) 2

E) 1

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

13

What type of firm should have the least amount of operating leverage?

A) Airlines

B) Ship building

C) Accounting and consulting

D) Auto manufacturing

E) Electric utilities

A) Airlines

B) Ship building

C) Accounting and consulting

D) Auto manufacturing

E) Electric utilities

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

14

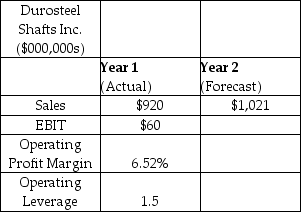

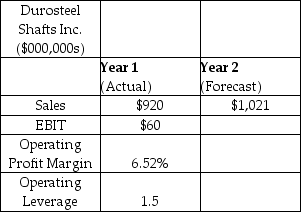

Durosteel Shafts Inc.supplies cam shafts to GM for their popular Chevy Malibu model.Automobile sales fell significantly during the recent financial crisis.Now,at the end of Year 1,GDP is growing again and GM is forecasting an increase in automobile sales of 11% over the coming year.Use the data in the table to estimate Durosteel's operating profit margin (EBIT/Sales)for Year 2.

A) 16.50%

B) 7.24%

C) 6.84%

D) 6.52%

E) 8.45%3

A) 16.50%

B) 7.24%

C) 6.84%

D) 6.52%

E) 8.45%3

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

15

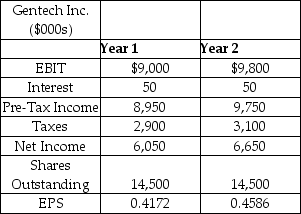

Gentech,Inc.is an integrated circuit (microchip)manufacturer based out of New Jersey.Its principal products include microprocessors and motherboard chipsets.Selected financial statement values for Gentech are shown in the table,below.What is the degree of financial leverage for Gentech given the change in earnings from Year 1 to Year 2?

A) 1.12

B) 1.01

C) 0.67

D) 3.11

E) 1.54

A) 1.12

B) 1.01

C) 0.67

D) 3.11

E) 1.54

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

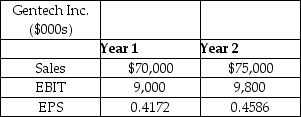

16

Gentech,Inc.is an integrated circuit (microchip)manufacturer based out of New Jersey.Its principal products include microprocessors and motherboard chipsets.Selected financial statement values for Gentech are shown in the table,below.What is the degree of operating leverage for Gentech given the change in revenues from Year 1 to Year 2?

A) 0.13

B) 1.17

C) 1.00

D) 1.24

E) 0.75

A) 0.13

B) 1.17

C) 1.00

D) 1.24

E) 0.75

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

17

Capital structure may be defined as

A) a collection of securities assembled by an investor.

B) a schedule of projects that have positive NPVs.

C) the use of bank loans by a firm.

D) the mix of debt and equity.

E) another term for the investment opportunities' schedule.

A) a collection of securities assembled by an investor.

B) a schedule of projects that have positive NPVs.

C) the use of bank loans by a firm.

D) the mix of debt and equity.

E) another term for the investment opportunities' schedule.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

18

For a given level of EBIT,greater changes in EPS produce

A) a decline in the degree of operating leverage.

B) a decline in the degree of financial leverage.

C) an increase in the degree of operating leverage.

D) no effect on any type of leverage.

E) an increase in the degree of financial leverage.

A) a decline in the degree of operating leverage.

B) a decline in the degree of financial leverage.

C) an increase in the degree of operating leverage.

D) no effect on any type of leverage.

E) an increase in the degree of financial leverage.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

19

The degree of financial leverage is defined as:

A) the percent change in EBIT over the percent change in sales

B) the percent change in EPS over the percent change in EBIT

C) the percent change in EPS over the percent change in sales

D) the percent change in EBIT over the percent change in EPS

E) the percent change in sales over the percent change in EPS

A) the percent change in EBIT over the percent change in sales

B) the percent change in EPS over the percent change in EBIT

C) the percent change in EPS over the percent change in sales

D) the percent change in EBIT over the percent change in EPS

E) the percent change in sales over the percent change in EPS

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

20

If sales are expected to increase 25%,EBIT is expected to increase 15%,and EPS is expected to increase 10%,what is the degree of operating leverage?

A) 2.5

B) 6.0

C) 1.5

D) 0.6

E) 1.7

A) 2.5

B) 6.0

C) 1.5

D) 0.6

E) 1.7

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

21

Gentech,Inc.is an integrated circuit (microchip)manufacturer based out of New Jersey.Its principal products include microprocessors and motherboard chipsets.Selected financial statement values for Gentech are shown in the table,below.What is the degree of total leverage for Gentech given the change in revenues from Year 1 to Year 2?

A) 1.39

B) 1.24

C) 1.11

D) 0.54

E) 0.96

A) 1.39

B) 1.24

C) 1.11

D) 0.54

E) 0.96

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

22

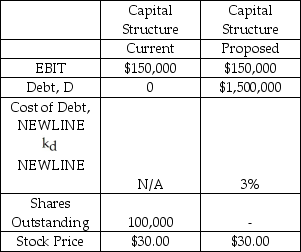

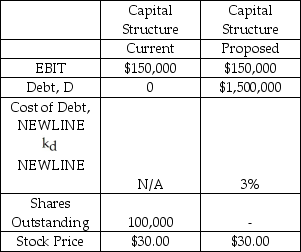

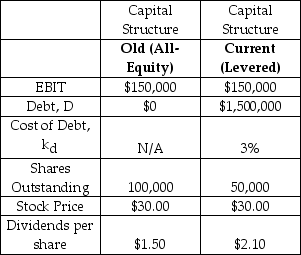

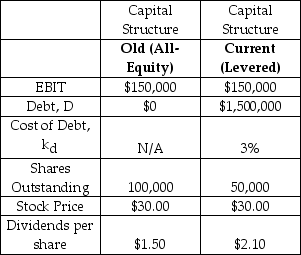

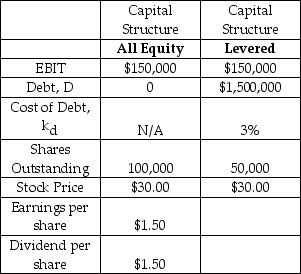

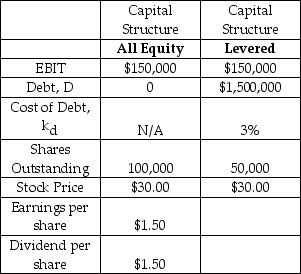

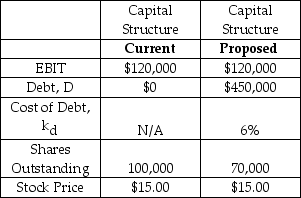

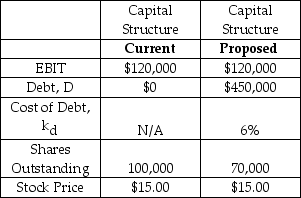

Selected financial information for the Baltimore & Ohio Railroad Corporation (B&O)is provided in the table below.B&O is currently all equity financed,but it is considering a leveraged capital structure,details of which are presented in the column labeled 'Proposed'.Under the proposed capital structure,B&O will use all of the new debt to repurchase (and cancel)shares.How many shares will be left outstanding after the repurchase,if B&O buys shares for $30.00 per share?

A) 50,000

B) 100,000

C) 75,000

D) 25,000

E) 33,000

A) 50,000

B) 100,000

C) 75,000

D) 25,000

E) 33,000

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements about debt is true?

A) Increasing debt increases the firm's flexibility.

B) As debt increases, distress costs decrease.

C) Using debt causes a loss of ownership by the firm.

D) Using debt allows the firm to earn money using someone else's money.

E) As the level of debt increases, the firm's credit rating begins to matter less.

A) Increasing debt increases the firm's flexibility.

B) As debt increases, distress costs decrease.

C) Using debt causes a loss of ownership by the firm.

D) Using debt allows the firm to earn money using someone else's money.

E) As the level of debt increases, the firm's credit rating begins to matter less.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

24

What is the average debt ratio for all firms?

A) 50%

B) 26%

C) 75%

D) 40%

E) 10%

A) 50%

B) 26%

C) 75%

D) 40%

E) 10%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

25

The financial analyst at Must-Peek Films found that the total leverage for the studio is 3.If EPS grew 40% and EBIT increased 24%,what was the percentage change in sales?

A) 12.2%

B) 22.5%

C) 13.3%

D) 15.0%

E) 16.4%

A) 12.2%

B) 22.5%

C) 13.3%

D) 15.0%

E) 16.4%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

26

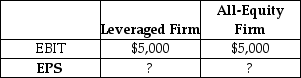

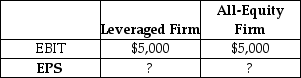

Consider two firms that are identical in every way except that one has $1,200 of debt and 350 shares of stock outstanding,while the other is all-equity and has 400 shares of stock outstanding.Assume that the debt is a perpetuity with annual coupons at the rate of 7%.What is each firm's earnings per share if EBIT is $5,000? Assume a tax rate of 40%.

A) EPSL = 8.39; EPSE = 7.50

B) EPSL = 8.39; EPSE = 8.39

C) EPSL = 7.50; EPSE = 7.50

D) EPSL = 7.50; EPSE = 8.39

E) EPSL = 8.43; EPSE = 7.50

A) EPSL = 8.39; EPSE = 7.50

B) EPSL = 8.39; EPSE = 8.39

C) EPSL = 7.50; EPSE = 7.50

D) EPSL = 7.50; EPSE = 8.39

E) EPSL = 8.43; EPSE = 7.50

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

27

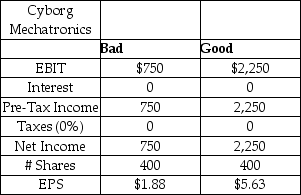

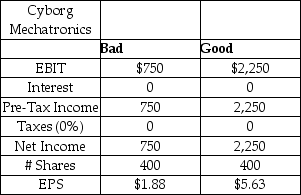

Cyborg Mechatronics is entirely equity financed with 400 shares outstanding and a market capitalization of $18,750 (P=$46.875).Current financial data for Cyborg is provided in the table below for two states of nature,which correspond with two levels of sales.The standard deviation of EPS is $1.875.The CFO of Cyborg,John Conner,is considering a change in capital structure.In particular,he is thinking about borrowing $6,562.50.He will borrow the money by issuing perpetual bonds with a face value of $6,562.50 and a coupon rate of 6%.The borrowed money will be used to repurchase shares at $46.875 per share.Repurchased shares will be cancelled.Taxes are 0%.First,calculate the EPS in each state of nature if Cyborg borrows the money.Second,calculate the standard deviation of the EPS.What is the ratio of the standard deviation of EPS with the leveraged capital structure to the standard deviation under the current,all equity capital structure?

A) 0.54

B) 1.25

C) 1.54

D) 1.88

E) 2.89

A) 0.54

B) 1.25

C) 1.54

D) 1.88

E) 2.89

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

28

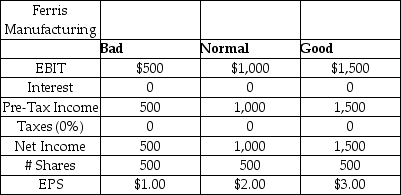

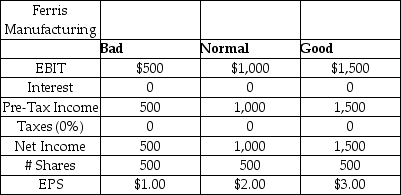

Ferris Manufacturing is all equity financed.Current financial data for Ferris is provided in the table below for three states of nature,which correspond with three levels of sales.The CFO of Ferris,Cameron Fry,is considering a change in capital structure.In particular,he is thinking about borrowing $5,000.He will borrow the money by issuing perpetual bonds with a face value of $5,000 and a coupon rate of 5%.The borrowed money will be used to repurchase shares at $28.57 per share.Repurchased shares will be cancelled.Taxes are 0%.What are Earnings per Share (EPS)in each state of nature if Ferris borrows the money?

A) Bad: $1.00; Normal: $2.00; Good: $3.00

B) Bad: $0.77; Normal: $2.31; Good: $3.85

C) Bad: $0.50; Normal: $1.50; Good: $2.50

D) Bad: $1.54; Normal: $3.08; Good: $4.62

E) Bad: $1.25; Normal: $2.25; Good: $4.15

A) Bad: $1.00; Normal: $2.00; Good: $3.00

B) Bad: $0.77; Normal: $2.31; Good: $3.85

C) Bad: $0.50; Normal: $1.50; Good: $2.50

D) Bad: $1.54; Normal: $3.08; Good: $4.62

E) Bad: $1.25; Normal: $2.25; Good: $4.15

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

29

A company posts a 25% increase in sales,a degree of financing leverage of 2.4,and a degree of total leverage of 3.2.Find the % change in the earnings per share.

A) 50%

B) 33.33%

C) 80%

D) 24%

E) 30%

A) 50%

B) 33.33%

C) 80%

D) 24%

E) 30%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

30

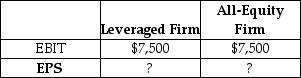

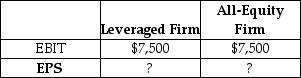

Consider two firms that are identical in every way except that one has $15,000 of debt and 500 shares of stock outstanding,while the other is all-equity and has 650 shares of stock outstanding.Assume that the debt is a perpetuity with annual coupons at the rate of 6%.What is each firms' earnings per share if EBIT is $7,500? Assume a tax rate of 40%.

A) EPSL = 7.92; EPSE = 7.92

B) EPSL = 6.92; EPSE = 7.92

C) EPSL = 6.92; EPSE = 6.92

D) EPSL = 7.92; EPSE = 6.92

E) EPSL = 8.92; EPSE = 6.92

A) EPSL = 7.92; EPSE = 7.92

B) EPSL = 6.92; EPSE = 7.92

C) EPSL = 6.92; EPSE = 6.92

D) EPSL = 7.92; EPSE = 6.92

E) EPSL = 8.92; EPSE = 6.92

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

31

A firm has an increase in EPS of 5%,increase in EBIT of 3%,and a degree of total leverage of 2.What is the firm's percentage change in sales?

A) 2.5%

B) 1.5%

C) 1.0%

D) 4.2%

E) Cannot be determined with the information provided.

A) 2.5%

B) 1.5%

C) 1.0%

D) 4.2%

E) Cannot be determined with the information provided.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

32

Jerry's Dog Food,Inc.is a dog food wholesaler located in Greenwich,Connecticut.Selected financial statement values for Jerry's are shown in the table below.What is the degree of total leverage for Jerry's given the change in revenues from Year 1 to Year 2?

A) 0.99

B) 1.24

C) 1.57

D) 1.91

E) 1.47

A) 0.99

B) 1.24

C) 1.57

D) 1.91

E) 1.47

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is true?

A) A graph of the relationship between EPS and EBIT is steeper when the firm is leveraged.

B) At the indifference point on an EPS-EBIT graph, two financing alternatives provide the same EBIT.

C) Firms are more likely to use greater levels of debt when predicted EBIT is low.

D) In EPS-EBIT analysis, EPS is considered a poor proxy for firm value.

E) None of the above.

A) A graph of the relationship between EPS and EBIT is steeper when the firm is leveraged.

B) At the indifference point on an EPS-EBIT graph, two financing alternatives provide the same EBIT.

C) Firms are more likely to use greater levels of debt when predicted EBIT is low.

D) In EPS-EBIT analysis, EPS is considered a poor proxy for firm value.

E) None of the above.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

34

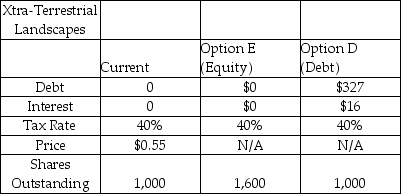

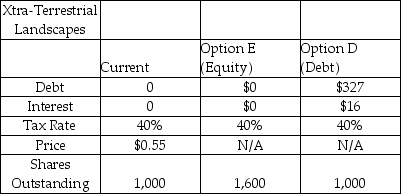

Xtra-Terrestrial Landscapes needs to raise capital to finance an expansion in their business.The company is trying to decide between borrowing or issuing more equity.Selected financial information is provided in the table below.The current capital structure is shown in the column labeled "Current." Under Option E,they will sell 600 new shares at the current price.Under Option D,they will borrow $327 at 5% and no new equity will be issued.There are currently 1,000 shares outstanding,and the firm is debt-free.The tax rate is 40%.To help Xtra-Terrestrial Landscapes with its decision,what is the EBIT-EPS indifference point? Round to the nearest dollar.

A) $43

B) $55

C) $88

D) $33

E) $47

A) $43

B) $55

C) $88

D) $33

E) $47

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

35

Compared with an all-equity financed firm,one that uses debt will have

A) a lower degree of financial leverage.

B) greater variation in EPS and ROE.

C) lower risk.

D) less risk of bankruptcy.

E) lower profits per share during an economic expansion.

A) a lower degree of financial leverage.

B) greater variation in EPS and ROE.

C) lower risk.

D) less risk of bankruptcy.

E) lower profits per share during an economic expansion.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

36

When calculating the EBIT-EPS breakeven point,the interest due under the equity option is:

A) The cost of equity X number of equity shares

B) Shares outstanding X cost of equity

C) Interest rate X number of equity shares

D) 0

A) The cost of equity X number of equity shares

B) Shares outstanding X cost of equity

C) Interest rate X number of equity shares

D) 0

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

37

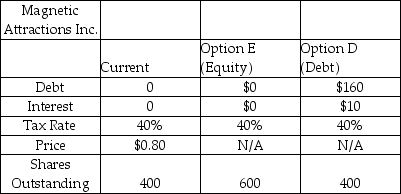

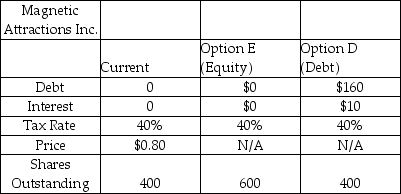

Magnetic Attractions Inc.a web-based dating company,needs to raise capital to finance an expansion in their business.The company is trying to decide between borrowing or issuing more equity.Selected financial information is provided in the table below.The current capital structure is shown in the column labeled "Current." Under Option E,they will sell 200 new shares at the current price.Under Option D,they will borrow $160 at 6.25% and no new equity will be issued.There are currently 400 shares outstanding,and the firm is debt-free.The tax rate is 40%.To help Magnetic Attractions with its decision,what is the EBIT-EPS indifference point?

A) $32

B) $48

C) $16

D) $30

E) $28

A) $32

B) $48

C) $16

D) $30

E) $28

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

38

If Ubu's Pear Farm expects EBIT to increase 10% next year after a 15% increase in sales,what is the expected percentage change in EPS if the degree of total leverage is 4?

A) 16%

B) 20%

C) 45%

D) 30%

E) 60%

A) 16%

B) 20%

C) 45%

D) 30%

E) 60%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

39

As firms become more leveraged,the risk of insolvency rises because

A) the use of debt results in interest payments that cannot be avoided during poor economic conditions.

B) bondholders trade lower risk for greater expected returns.

C) interest payments on most bonds vary with the level of market rates.

D) bondholders are less vigilant than shareholders.

E) debt-financed firms are less able to take advantage of a strong economy.

A) the use of debt results in interest payments that cannot be avoided during poor economic conditions.

B) bondholders trade lower risk for greater expected returns.

C) interest payments on most bonds vary with the level of market rates.

D) bondholders are less vigilant than shareholders.

E) debt-financed firms are less able to take advantage of a strong economy.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

40

A firm has a projected EBIT of $20,000 for a new project.The funds needed for the project are $40,000.The firm can finance the project completely with debt at a pre-tax interest cost of 10%.Alternatively,the firm could finance the project with equity by selling stock at $5 per share.If there are 500,000 shares outstanding and the firm's tax rate is 40%,what is the EBIT-EPS indifference point?

A) $254,000

B) $504,000

C) $40,000

D) $20,000

E) $500,000

A) $254,000

B) $504,000

C) $40,000

D) $20,000

E) $500,000

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

41

Bob's Farm Rental and Party Supply posted an EBIT of $45,000 and has no investments in working capital or assets.Shareholders are requiring a return of 22%.Calculate the value of the company.Assume a tax rate of 15%.

A) $204,545

B) $173,864

C) $300,000

D) $234,000

E) $217,865

A) $204,545

B) $173,864

C) $300,000

D) $234,000

E) $217,865

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

42

What is the optimal capital structure?

A) The capital structure that frees up the most cash flow

B) The capital structure that makes management the most money

C) The capital structure that produces the highest firm value

D) The capital structure that keeps the most control within the company

A) The capital structure that frees up the most cash flow

B) The capital structure that makes management the most money

C) The capital structure that produces the highest firm value

D) The capital structure that keeps the most control within the company

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

43

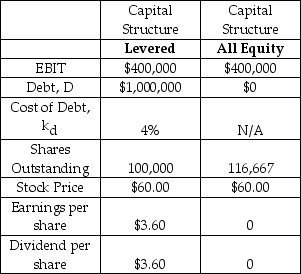

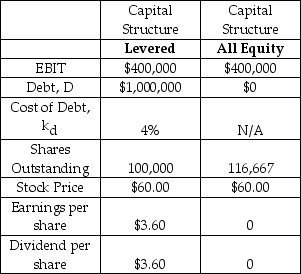

The Mohawk & Hudson Railway (M&H)currently has a levered capital structure,but it is considering a proposal to issue new equity (@$60/share)and use the proceeds to retire its debt.Selected financial information for M&H is provided in the table below.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with an annual coupon rate of 4% (and yield of 4%).Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Charlie Jones,an engineer for the railway,owns 100 shares of M&H.Charlie receives annual dividend income of $360 under the current capital structure.Charlie likes the lower risk and the return on investment that he could earn under the proposed all-equity capital structure,but Mohawk & Hudson has announced that it will not go forward with the change in capital structure.If Charlie sells 14.29 shares and lends the proceeds,then what are his annual investment cash flows?

A) $260

B) $294

C) $308

D) $343

E) $360

Charlie Jones,an engineer for the railway,owns 100 shares of M&H.Charlie receives annual dividend income of $360 under the current capital structure.Charlie likes the lower risk and the return on investment that he could earn under the proposed all-equity capital structure,but Mohawk & Hudson has announced that it will not go forward with the change in capital structure.If Charlie sells 14.29 shares and lends the proceeds,then what are his annual investment cash flows?

A) $260

B) $294

C) $308

D) $343

E) $360

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

44

Tarbox Tobacco Inc.is all equity financed and generates perpetual annual EBIT of $300.Assume that the EBIT,and all other cash flows,occur at year end and that we are currently at the beginning of a year.Assume that Tarbox has a 100% payout rate.Tarbox has 1,500 shares outstanding.The stock holders of Tarbox require a return of 5%.Assume that the tax rate is 0%.What is the price per share for Tarbox stock?

A) $6.67

B) $0.20

C) $4.00

D) $10.00

E) $7.49

A) $6.67

B) $0.20

C) $4.00

D) $10.00

E) $7.49

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

45

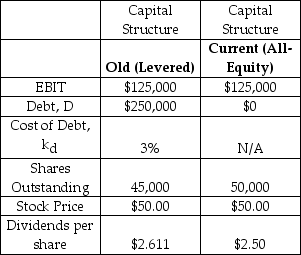

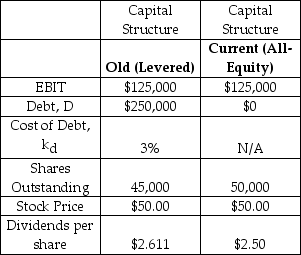

Jungle Cat Petting Zoo Inc.is currently all equity financed.It used to be leveraged,but it recently issued 5,000 new shares at $50 per share.The proceeds from the new issue were used to repay all of its debt.Financial details for the current and old capital structures are presented in the table below.

Assume that Jungle Cat generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons at 3%.Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Leo Delgato is a shareholder in Jungle Cat who owns 6,750 shares.After the new issue,Leo is unhappy with his dividends.How many shares does Leo have to buy (or sell)in order to return his annual cash flows to the level he enjoyed when the company was leveraged?

A) Buy 750 shares

B) Sell 750 shares

C) Buy 675 shares

D) Sell 675 shares

E) Do nothing. The investment cash flows are identical under each capital structure

Assume that Jungle Cat generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons at 3%.Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Leo Delgato is a shareholder in Jungle Cat who owns 6,750 shares.After the new issue,Leo is unhappy with his dividends.How many shares does Leo have to buy (or sell)in order to return his annual cash flows to the level he enjoyed when the company was leveraged?

A) Buy 750 shares

B) Sell 750 shares

C) Buy 675 shares

D) Sell 675 shares

E) Do nothing. The investment cash flows are identical under each capital structure

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

46

The Cripple Creek Railway is currently all equity financed,but it is considering a leveraged capital structure.Selected financial information for Cripple Creek is provided in the table below.Assume that Cripple Creek generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with an annual coupon rate of 4% (and yield of 4%).Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Under the proposed levered capital structure,Cripple Creek will use all of the new debt to repurchase (and cancel)shares.

Bill Strong,a brakeman for the railway,bought 100 shares of Cripple Creek at $60.Bill receives annual dividend income of $300.Bill likes the return on investment that he could earn under the proposed levered capital structure,but Cripple Creek has announced that it will not go forward with the change in capital structure.If Bill borrows $2,000 and buys shares,then what is his return on investment?

A) 5.00%

B) 5.15%

C) 5.33%

D) 5.50%

E) 5.67%

Under the proposed levered capital structure,Cripple Creek will use all of the new debt to repurchase (and cancel)shares.

Bill Strong,a brakeman for the railway,bought 100 shares of Cripple Creek at $60.Bill receives annual dividend income of $300.Bill likes the return on investment that he could earn under the proposed levered capital structure,but Cripple Creek has announced that it will not go forward with the change in capital structure.If Bill borrows $2,000 and buys shares,then what is his return on investment?

A) 5.00%

B) 5.15%

C) 5.33%

D) 5.50%

E) 5.67%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

47

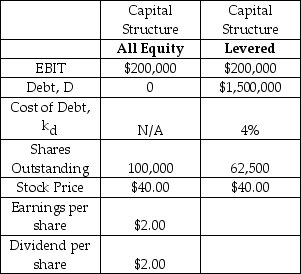

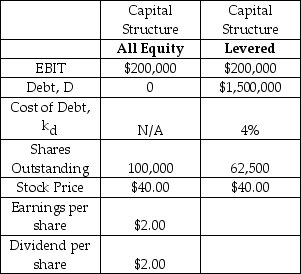

The Cramden Bus Company is currently all equity financed,but it is considering a leveraged capital structure,the details of which are presented in the table under the column labeled 'Proposed'.

Assume that the company generates perpetual annual EBIT.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons (and yield)of 4%.

If Cramden recapitalizes,it will use the borrowed funds to repurchase (and cancel)shares.Determine both the value of the company and the value of the company's equity if it recapitalizes.

A) Company value: $2,875,000; Equity value: $2,185,000

B) Company value: $2,875,000; Equity value: $2,875,000

C) Company value: $2,185,000; Equity value: $2,185,000

D) Company value: $2,300,000; Equity value: $1,610,000

E) Company value: $2,300,000; Equity value: $2,990,000

Assume that the company generates perpetual annual EBIT.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons (and yield)of 4%.

If Cramden recapitalizes,it will use the borrowed funds to repurchase (and cancel)shares.Determine both the value of the company and the value of the company's equity if it recapitalizes.

A) Company value: $2,875,000; Equity value: $2,185,000

B) Company value: $2,875,000; Equity value: $2,875,000

C) Company value: $2,185,000; Equity value: $2,185,000

D) Company value: $2,300,000; Equity value: $1,610,000

E) Company value: $2,300,000; Equity value: $2,990,000

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

48

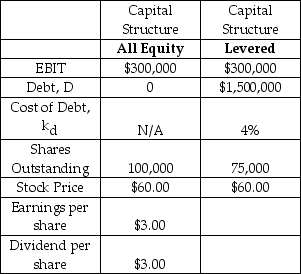

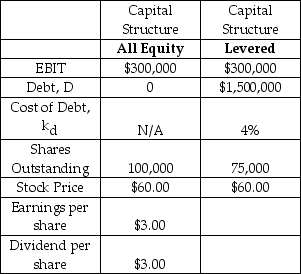

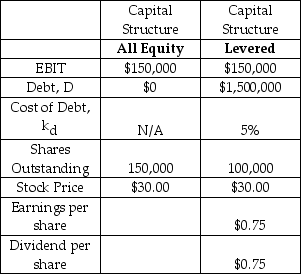

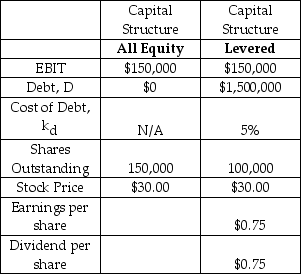

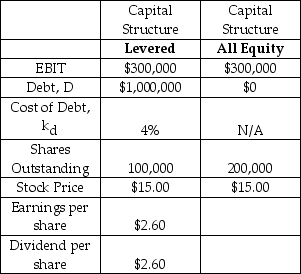

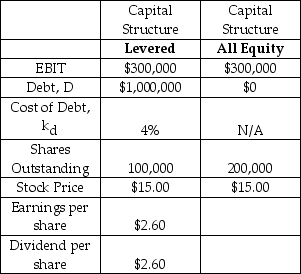

Austin-Healey Motors Inc.is currently levered.It used to be all-equity,but it recently borrowed and used the money to repurchase 50,000 shares.Financial details for the current and old capital structures are presented in the table below.

Assume that Austin-Healey generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons at 3%.Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Nigel Mansell is a shareholder in Austin-Healey who owns 5,000 shares.After the repurchase,Nigel is unhappy with his dividends.How many shares does Nigel have to buy (sell)in order to return his annual cash flows to what they were under the all-equity capital structure? (Assume that Nigel had the same number of shares under the old structure.)

A) Sell 3,572 shares

B) Sell 2,500 shares

C) Sell 2,143 shares

D) Buy 3,572 shares

E) Buy 2,764 shares

Assume that Austin-Healey generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons at 3%.Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Nigel Mansell is a shareholder in Austin-Healey who owns 5,000 shares.After the repurchase,Nigel is unhappy with his dividends.How many shares does Nigel have to buy (sell)in order to return his annual cash flows to what they were under the all-equity capital structure? (Assume that Nigel had the same number of shares under the old structure.)

A) Sell 3,572 shares

B) Sell 2,500 shares

C) Sell 2,143 shares

D) Buy 3,572 shares

E) Buy 2,764 shares

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

49

The Pennsylvania Railroad (PRR)currently has a levered capital structure,but it is considering a proposal to issue new equity (@$30/share)and use the proceeds to retire its debt.Selected financial information for PRR is provided in the table below.Assume that PRR generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with an annual coupon rate of 5% (and yield of 5%).Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Charlie Jones,an engineer for the railway,owns 100 shares of PRR.Charlie receives annual dividend income of $75 under the current capital structure.Charlie likes the lower risk and the return on investment that he could earn under the proposed all-equity capital structure.If PRR chooses not to change its capital structure,then what can Charlie do to achieve the investment cash flows (and return on investment)that he would have received under the all equity capital structure?

A) Sell $1,500 worth of shares and lend the proceeds.

B) Invest an additional $1,500 and buy more shares.

C) Sell 50 shares and loan the proceeds.

D) Invest an additional $1,000 and buy 33.33 more shares.

E) Sell 33.33 shares and lend the proceeds.

Charlie Jones,an engineer for the railway,owns 100 shares of PRR.Charlie receives annual dividend income of $75 under the current capital structure.Charlie likes the lower risk and the return on investment that he could earn under the proposed all-equity capital structure.If PRR chooses not to change its capital structure,then what can Charlie do to achieve the investment cash flows (and return on investment)that he would have received under the all equity capital structure?

A) Sell $1,500 worth of shares and lend the proceeds.

B) Invest an additional $1,500 and buy more shares.

C) Sell 50 shares and loan the proceeds.

D) Invest an additional $1,000 and buy 33.33 more shares.

E) Sell 33.33 shares and lend the proceeds.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is NOT a conclusion drawn from M&M's Propositions 1 and 2?

A) Firm value is determined by the left hand of the balance sheet, the firm's assets, and the cash flow generated by them.

B) A firm can change its market value by splitting its cash flows into different streams.

C) Shareholder's required return rises with leverage.

D) The WACC does not change as capital structure change.

E) The WACC is determined by the riskiness of the company's business (assets).

A) Firm value is determined by the left hand of the balance sheet, the firm's assets, and the cash flow generated by them.

B) A firm can change its market value by splitting its cash flows into different streams.

C) Shareholder's required return rises with leverage.

D) The WACC does not change as capital structure change.

E) The WACC is determined by the riskiness of the company's business (assets).

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

51

The Atchison,Topeka &Santa Fe Railway (ATSFR)is currently all equity financed,but it is considering a leveraged capital structure.Selected financial information for ATSFR is provided in the table below.Assume that ATSFR generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with an annual coupon rate of 3% (and yield of 3%).Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Under the proposed levered capital structure,ATSFR will use all of the new debt to repurchase (and cancel)shares.

Bill Strong,a brakeman for the railway,owns 100 shares of ATSFR.Bill receives annual dividend income of $150.Bill likes the return on investment that he could earn under the proposed levered capital structure.If ATSFR chooses not to change its capital structure,then what can Bill do to achieve the investment cash flows (and return on investment)that he would have received under the levered capital structure? (Assume that Bill would not sell shares during the repurchase.)

A) Borrow $1,500 and buy more shares.

B) Invest an additional $1,500 and buy more shares.

C) Borrow $3,000 and use it to buy more shares.

D) Invest an additional $3,000 and buy 100 more shares.

E) Sell 33.33 shares and lend the proceeds.

Under the proposed levered capital structure,ATSFR will use all of the new debt to repurchase (and cancel)shares.

Bill Strong,a brakeman for the railway,owns 100 shares of ATSFR.Bill receives annual dividend income of $150.Bill likes the return on investment that he could earn under the proposed levered capital structure.If ATSFR chooses not to change its capital structure,then what can Bill do to achieve the investment cash flows (and return on investment)that he would have received under the levered capital structure? (Assume that Bill would not sell shares during the repurchase.)

A) Borrow $1,500 and buy more shares.

B) Invest an additional $1,500 and buy more shares.

C) Borrow $3,000 and use it to buy more shares.

D) Invest an additional $3,000 and buy 100 more shares.

E) Sell 33.33 shares and lend the proceeds.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

52

The Naugatuck Railway is currently all equity financed,but it is considering a leveraged capital structure.Selected financial information for Naugatuck is provided in the table below.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with an annual coupon rate of 4% (and yield of 4%).Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Under the proposed levered capital structure,Naugatuck will use all of the new debt to repurchase (and cancel)shares.

Bill Strong,a brakeman for the railway,bought 100 shares of Naugatuck at $40.Bill receives annual dividend income of $200 under the current capital structure.Bill likes the return on investment that he could earn under the proposed levered capital structure,but Naugatuck has announced that it will not go forward with the change in capital structure.If Bill borrows $2,400 and buys shares,then what are his annual investment cash flows?

A) $200

B) $224

C) $245

D) $267

E) $320

Under the proposed levered capital structure,Naugatuck will use all of the new debt to repurchase (and cancel)shares.

Bill Strong,a brakeman for the railway,bought 100 shares of Naugatuck at $40.Bill receives annual dividend income of $200 under the current capital structure.Bill likes the return on investment that he could earn under the proposed levered capital structure,but Naugatuck has announced that it will not go forward with the change in capital structure.If Bill borrows $2,400 and buys shares,then what are his annual investment cash flows?

A) $200

B) $224

C) $245

D) $267

E) $320

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

53

Under the Static Tradeoff Theory,the optimal debt-to-equity ratio is higher than under Modigliani and Miller (with taxes).

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

54

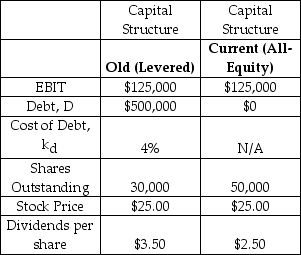

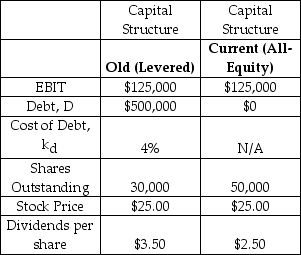

Parker's Barbecue Inc.operates a chain of restaurants in the south eastern United States.Parker's is currently levered.It used to be all-equity,but it recently borrowed and used the money to repurchase 30,000 shares.Financial details for the current and old capital structures are presented in the table below.

Assume that Parker's generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons at 6%.Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Duane Allman is a shareholder in Parker's who owns 30,000 shares.After the repurchase,Duane is unhappy with his dividends.How many shares does Duane have to buy (sell)in order to return his annual cash flows to what they were under the all-equity capital structure? (Assume that Duane had the same number of shares under the old structure.)

A) Buy 8,000 shares

B) Sell 8,000 shares

C) Sell 9,000 shares

D) Buy 9,000 shares

E) Buy 7,000 shares

Assume that Parker's generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons at 6%.Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Duane Allman is a shareholder in Parker's who owns 30,000 shares.After the repurchase,Duane is unhappy with his dividends.How many shares does Duane have to buy (sell)in order to return his annual cash flows to what they were under the all-equity capital structure? (Assume that Duane had the same number of shares under the old structure.)

A) Buy 8,000 shares

B) Sell 8,000 shares

C) Sell 9,000 shares

D) Buy 9,000 shares

E) Buy 7,000 shares

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

55

Treadless Tires Inc.is currently all equity financed.It used to be leveraged,but it recently issued 20,000 new shares at $25 per share.The proceeds from the new issue were used to repay all of its debt.Financial details for the current and old capital structures are presented in the table below.

Assume that Treadless generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons at 4%.Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Ron Platt is a shareholder in Treadless who owns 5,000 shares.After the new issue,Ron is unhappy with his dividends.How many shares does Ron have to buy (or sell)in order to return his annual cash flows to the level he enjoyed when the company was leveraged?

A) Buy 3,333 shares

B) Sell 3,333 shares

C) Buy 4,000 shares

D) Sell 4,000 shares

E) Do nothing. The investment cash flows are identical under each capital structure.

Assume that Treadless generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons at 4%.Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Ron Platt is a shareholder in Treadless who owns 5,000 shares.After the new issue,Ron is unhappy with his dividends.How many shares does Ron have to buy (or sell)in order to return his annual cash flows to the level he enjoyed when the company was leveraged?

A) Buy 3,333 shares

B) Sell 3,333 shares

C) Buy 4,000 shares

D) Sell 4,000 shares

E) Do nothing. The investment cash flows are identical under each capital structure.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

56

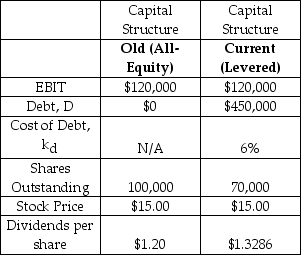

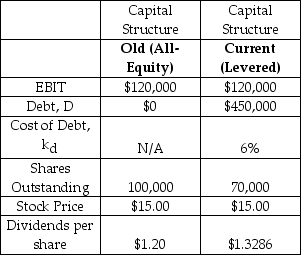

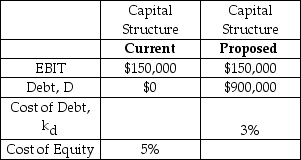

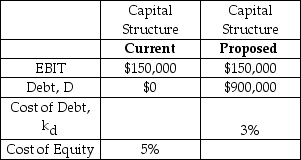

The Kansas City Southern Railroad (KCSR)currently has a levered capital structure,but it is considering a proposal to issue new equity (@$15/share)and use the proceeds to retire its debt.Selected financial information for KCSR is provided in the table below.Assume that KCSR generates perpetual annual EBIT at a constant level.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with an annual coupon rate of 4% (and yield of 4%).Assume that individual investors can borrow and lend at the same interest rate (and with the same terms)as corporations.

Charlie Jones,an engineer for the railway,owns 100 shares of KCSR.Charlie receives annual dividend income of $260 under the current capital structure.Charlie likes the lower risk and the return on investment that he could earn under the proposed all-equity capital structure,but Kansas City Southern has announced that it will not go forward with the change in capital structure.If Charlie sells 40 shares and lends the proceeds,then what is his return on investment?

A) 10.00%

B) 12.00%

C) 12.33%

D) 15.50%

E) 17.33%

Charlie Jones,an engineer for the railway,owns 100 shares of KCSR.Charlie receives annual dividend income of $260 under the current capital structure.Charlie likes the lower risk and the return on investment that he could earn under the proposed all-equity capital structure,but Kansas City Southern has announced that it will not go forward with the change in capital structure.If Charlie sells 40 shares and lends the proceeds,then what is his return on investment?

A) 10.00%

B) 12.00%

C) 12.33%

D) 15.50%

E) 17.33%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

57

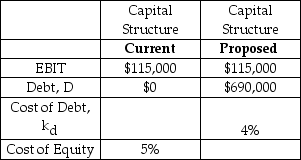

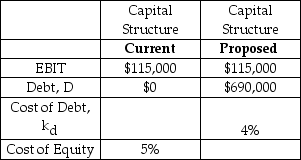

Selected financial information for N7 Tactical Solutions is provided in the table below.N7 is currently all equity financed,but it is considering a leveraged capital structure,details of which are presented in the column labeled "Proposed."

Assume that N7 generates perpetual annual EBIT.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons (and yield)of 3%.

If N7 recapitalizes,it will use the borrowed funds to repurchase (and cancel)shares.Determine both the value of the company and the value of the company's equity if it recapitalizes.

A) Company value: $3,000,000; Equity value: $2,100,000

B) Company value: $3,000,000; Equity value: $3,000,000

C) Company value: $2,100,000; Equity value: $2,100,000

D) Company value: $3,000,000; Equity value: $3,900,000

E) Company value: $5,000,000; Equity value: $4,100,000

Assume that N7 generates perpetual annual EBIT.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons (and yield)of 3%.

If N7 recapitalizes,it will use the borrowed funds to repurchase (and cancel)shares.Determine both the value of the company and the value of the company's equity if it recapitalizes.

A) Company value: $3,000,000; Equity value: $2,100,000

B) Company value: $3,000,000; Equity value: $3,000,000

C) Company value: $2,100,000; Equity value: $2,100,000

D) Company value: $3,000,000; Equity value: $3,900,000

E) Company value: $5,000,000; Equity value: $4,100,000

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

58

Climax Motors Inc.is currently all equity financed,but it is considering a leveraged capital structure,details of which are presented in the table below (under the column labeled 'Proposed').Under the proposed capital structure,Climax will use all of the new debt to repurchase (and cancel)shares.Assume that taxes are zero.Assume that all of net income is paid out as a dividend in one year's time.Assume that the debt is perpetual with an annual coupon rate of 6%.Wolfgang von Trips owns 25,000 shares.Under each capital structure,how much does Wolfgang receive in dividends at the end of each year? Assume that Wolfgang has the same number of shares under both structures.

A) Current: $30,000; Proposed: $30,000

B) Current: $30,000; Proposed: $23,250

C) Current: $30,000; Proposed: $42,857

D) Current: $30,000; Proposed: $33,214

E) Current: $30,000; Proposed: $27,684

A) Current: $30,000; Proposed: $30,000

B) Current: $30,000; Proposed: $23,250

C) Current: $30,000; Proposed: $42,857

D) Current: $30,000; Proposed: $33,214

E) Current: $30,000; Proposed: $27,684

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

59

The essence of Modigliani and Miller's irrelevance theory is that

A) increasing operating leverage will maximize EPS.

B) shareholders prefer to invest in firms with a high degree of financial leverage.

C) altering a firm's capital structure will increase its value.

D) utilizing more debt will increase a firm's value.

E) the value of the firm will not be changed by how assets are distributed between bondholders and stockholders.

A) increasing operating leverage will maximize EPS.

B) shareholders prefer to invest in firms with a high degree of financial leverage.

C) altering a firm's capital structure will increase its value.

D) utilizing more debt will increase a firm's value.

E) the value of the firm will not be changed by how assets are distributed between bondholders and stockholders.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

60

According to Modigliani and Miller,altering a firm's capital structure will not change a firm's value because

A) taxes have no effect on capital structure decisions.

B) the value of a firm is based on the earnings power of its assets.

C) markets are not efficient and shareholders can be fooled by capital structure changes.

D) bankruptcy costs rise when debt levels increase.

E) the cost of equity falls as more debt is issued.

A) taxes have no effect on capital structure decisions.

B) the value of a firm is based on the earnings power of its assets.

C) markets are not efficient and shareholders can be fooled by capital structure changes.

D) bankruptcy costs rise when debt levels increase.

E) the cost of equity falls as more debt is issued.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

61

Fawlty Brake Systems Inc.is all equity financed and generates perpetual annual EBIT of $600.Assume that the EBIT,and all other cash flows,occur at year end and that we are currently at the beginning of a year.Assume that Fawlty has a 100% payout rate,1,000 shares outstanding,and that shareholders require a return of 6%.Assume that the tax rate is 0%.

Fawlty is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $10.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds worth a total sum of $2,000 and a coupon rate (and yield)of 4%.Assume that the tax rate is 0%.

If Fawlty goes ahead with the repurchase,then what is its WACC after the repurchase is complete?

A) 4.0%

B) 4.5%

C) 5.0%

D) 5.5%

E) 6.0%

Fawlty is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $10.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds worth a total sum of $2,000 and a coupon rate (and yield)of 4%.Assume that the tax rate is 0%.

If Fawlty goes ahead with the repurchase,then what is its WACC after the repurchase is complete?

A) 4.0%

B) 4.5%

C) 5.0%

D) 5.5%

E) 6.0%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

62

Amish Electronics Inc.is all equity financed and generates perpetual annual EBIT of $600.Assume that the EBIT,and all other cash flows,occur at year end and that we are currently at the beginning of a year.Assume that Amish has a 100% payout rate,5,000 shares outstanding,and that shareholders require a return of 5%.Assume that the tax rate is 0%.

Amish is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $4.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds with a coupon rate (and yield)of 3%.Assume that the tax rate is 0%.

If Amish goes ahead with the repurchase,then what is the value of the company after the repurchase is complete?

A) $4,800

B) $6,000

C) $7,200

D) $10,000

E) $12,000

Amish is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $4.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds with a coupon rate (and yield)of 3%.Assume that the tax rate is 0%.

If Amish goes ahead with the repurchase,then what is the value of the company after the repurchase is complete?

A) $4,800

B) $6,000

C) $7,200

D) $10,000

E) $12,000

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

63

Café Americain Coffee Inc.is all equity financed and generates perpetual annual EBIT of $600.Assume that the EBIT,and all other cash flows,occur at year end and that we are currently at the beginning of a year.Assume that Café Americain has a 100% payout rate,1,000 shares outstanding,and that shareholders require a return of 6%.Assume that the tax rate is 0%.

Café Americain is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $10.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds worth a total sum of $2,000 and a coupon rate (and yield)of 4%.Assume that the tax rate is 0%.

If Café Americain goes ahead with the repurchase,then what is the required return of stock holders after the repurchase is complete?

A) 6.1%

B) 6.2%

C) 6.3%

D) 6.4%

E) 6.5%

Café Americain is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $10.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds worth a total sum of $2,000 and a coupon rate (and yield)of 4%.Assume that the tax rate is 0%.

If Café Americain goes ahead with the repurchase,then what is the required return of stock holders after the repurchase is complete?

A) 6.1%

B) 6.2%

C) 6.3%

D) 6.4%

E) 6.5%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

64

Halo Corp.is all equity financed and generates perpetual annual EBIT of $600.Assume that the EBIT,and all other cash flows,occur at year end and that we are currently at the beginning of a year.Assume that Halo has a 100% payout rate.Halo has 1,000 shares outstanding.The stock holders of Halo require a return of 6%.Assume that the tax rate is 0%.What is the price per share for Halo stock?

A) $15.00

B) $0.60

C) $30.00

D) $10.00

E) $4.20

A) $15.00

B) $0.60

C) $30.00

D) $10.00

E) $4.20

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

65

Slurp Cola Inc.is all equity financed and generates perpetual annual EBIT of $600.Assume that the EBIT,and all other cash flows,occur at year end and that we are currently at the beginning of a year.Assume that Slurp has a 100% payout rate,1,000 shares outstanding,and that shareholders require a return of 6%.Assume that the tax rate is 0%.

Slurp Cola Inc.is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $10.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds with a coupon rate (and yield)of 4%.Assume that the tax rate is 0%.

If Slurp goes ahead with the repurchase,then what is the stock price after the repurchase is complete?

A) $9.50

B) $10.00

C) $10.50

D) $11.00

E) $11.50

Slurp Cola Inc.is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $10.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds with a coupon rate (and yield)of 4%.Assume that the tax rate is 0%.

If Slurp goes ahead with the repurchase,then what is the stock price after the repurchase is complete?

A) $9.50

B) $10.00

C) $10.50

D) $11.00

E) $11.50

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

66

Pensacola Soda Inc.is all equity financed and generates perpetual annual EBIT of $300.Assume that the EBIT,and all other cash flows,occur at year end and that we are currently at the beginning of a year.Assume that Pensacola has a 100% payout rate,1,500 shares outstanding,and that shareholders require a return of 5%.Assume that the tax rate is 0%.

Pensacola is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $4.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds worth a total sum of $1,200 and a coupon rate (and yield)of 3%.Assume that the tax rate is 0%.

If Pensacola goes ahead with the repurchase,then what is its WACC after the repurchase is complete?

A) 3.0%

B) 3.5%

C) 4.5%

D) 5.0%

E) 5.5%

Pensacola is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $4.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds worth a total sum of $1,200 and a coupon rate (and yield)of 3%.Assume that the tax rate is 0%.

If Pensacola goes ahead with the repurchase,then what is its WACC after the repurchase is complete?

A) 3.0%

B) 3.5%

C) 4.5%

D) 5.0%

E) 5.5%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

67

The Oval Bearing Corp.manufactures ball bearings.Oval Bearing Corp.is all equity financed and its shareholders require a return of 8%.Elliptical Bearing Inc.is also a manufacturer of ball bearings.Elliptical has 30% debt in its capital structure (debt-to-equity is 0.4286),and its cost of debt is 4%.What is Elliptical's WACC? Assume that the tax rate is 0%.

A) 6.8%

B) 7.3%

C) 8.0%

D) 8.5%

E) 9.7%

A) 6.8%

B) 7.3%

C) 8.0%

D) 8.5%

E) 9.7%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

68

When Modigliani and Miller revised their original model to include taxes,they concluded that

A) firms should reduce their degree of financial leverage.

B) tax avoidance does not alter a firm's value.

C) tax increases lower a firm's value.

D) firms should use only debt in their capital structure.

E) taxes also have no bearing on the capital structure decision.

A) firms should reduce their degree of financial leverage.

B) tax avoidance does not alter a firm's value.

C) tax increases lower a firm's value.

D) firms should use only debt in their capital structure.

E) taxes also have no bearing on the capital structure decision.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

69

In the year just past (Year 1)Kaos Corp.had no debt.Today is January 1 of Year 2.Kaos is considering a plan to sell bonds worth $25B and use the proceeds to repurchase 2.5B shares (on the open market at $10/share).If Kaos maintains this new level of debt in perpetuity,then what is the present value of the resulting interest tax shields? Assume that the debt is sold immediately,that the bonds are a perpetuity,and that interest is paid at the end of each year.Assume that the coupon rate on the bonds is 6% and that the tax rate is 15%.

A) $0.23B

B) $3.75B

C) $6.0B

D) $21.25B

E) $25B

A) $0.23B

B) $3.75B

C) $6.0B

D) $21.25B

E) $25B

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

70

Fury Motor Corp.is all equity financed and generates perpetual annual EBIT of $300.Assume that the EBIT,and all other cash flows,occur at year end and that we are currently at the beginning of a year.Assume that Fury has a 100% payout rate,1,500 shares outstanding,and that shareholders require a return of 5%.Assume that the tax rate is 0%.

Fury Motor Corp.is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $4.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds with a coupon rate (and yield)of 3%.Assume that the tax rate is 0%.

If Fury Motor Corp.goes ahead with the repurchase,then what is the stock price after the repurchase is complete?

A) $3.00

B) $3.50

C) $4.00

D) $4.50

E) $5.00

Fury Motor Corp.is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $4.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds with a coupon rate (and yield)of 3%.Assume that the tax rate is 0%.

If Fury Motor Corp.goes ahead with the repurchase,then what is the stock price after the repurchase is complete?

A) $3.00

B) $3.50

C) $4.00

D) $4.50

E) $5.00

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

71

The Pollos Chicken Company farms chickens for sale to grocery retailers.Pollos is all equity financed and its shareholders require a return of 7%.Gus Poultry Inc.farms chickens for sale to fast food restaurants.Gus Poultry has 20% debt in its capital structure (debt-to-equity is 0.25),and its cost of debt is 4%.What is Gus's WACC? Assume that the tax rate is 0%.

A) 6.6%

B) 6.4%

C) 7.0%

D) 7.2%

E) 7.4%

A) 6.6%

B) 6.4%

C) 7.0%

D) 7.2%

E) 7.4%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

72

Codswallop Disposal Inc.is an all equity firm.At the end of the current year,the CFO expects EBIT to be $10M,and the same earnings are expected annually in perpetuity.The company is not growing,so CAPEX and investments in net working capital are zero.Codswallop's shareholders require a return of 8%.Codswallop has 20 million shares outstanding.The corporate tax rate is 30%.What is the market value of Codswallop's shares?

A) $0.44

B) $4.38

C) $6.25

D) $8.75

E) $3.84

A) $0.44

B) $4.38

C) $6.25

D) $8.75

E) $3.84

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

73

Fred's Frankfurters posted an EBIT of $67,256.He paid $5,360 in interest and $7,521 in taxes.Calculate the interest tax shield.

A) $621.13

B) $599.25

C) $534.99

D) $593.89

E) $575.35

A) $621.13

B) $599.25

C) $534.99

D) $593.89

E) $575.35

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

74

Lanley Monorails Inc.is all equity financed and generates perpetual annual EBIT of $300.Assume that the EBIT,and all other cash flows,occur at year end and that we are currently at the beginning of a year.Assume that Lanley has a 100% payout rate,1,500 shares outstanding,and that shareholders require a return of 5%.Assume that the tax rate is 0%.

Lanley Monorails is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $4.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds worth a total sum of $1,200 and a coupon rate (and yield)of 3%.Assume that the tax rate is 0%.

If Lanley goes ahead with the repurchase,then what is the required return of stock holders after the repurchase is complete?

A) 5.1%

B) 5.3%

C) 5.5%

D) 5.7%

E) 5.9%

Lanley Monorails is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $4.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds worth a total sum of $1,200 and a coupon rate (and yield)of 3%.Assume that the tax rate is 0%.

If Lanley goes ahead with the repurchase,then what is the required return of stock holders after the repurchase is complete?

A) 5.1%

B) 5.3%

C) 5.5%

D) 5.7%

E) 5.9%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

75

According to Modigliani and Miller's second paper,firms should use ________% debt to maximize the value of the firm.

A) 100

B) 20

C) 40

D) 80

E) 60

A) 100

B) 20

C) 40

D) 80

E) 60

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

76

What is the interest tax shield?

A) The tax increase to deter companies from using too much debt

B) The amount by which taxes are reduced due to interest tax deductibility

C) The tax benefit given to companies for buying bonds

D) The benefit from not reporting interest income

E) The decrease in taxes paid on interest earned by the firm on its cash reserves

A) The tax increase to deter companies from using too much debt

B) The amount by which taxes are reduced due to interest tax deductibility

C) The tax benefit given to companies for buying bonds

D) The benefit from not reporting interest income

E) The decrease in taxes paid on interest earned by the firm on its cash reserves

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

77

Cyberdyne Systems is a military/defense products company.Cyberdyne Systems is all equity financed.Cyberdyne has 200 million shares outstanding which trade for $20 per share.Cyberdyne's shareholders require a return of 10%.

Omni Defense Products Inc.is also a military/defense products company.It's shares are trading for $35 per share.Omni has 100 million shares outstanding.Omni has debt worth $3 billion.Omni's debt is priced to yield 6.5%.

What is the required return of Omni's shareholders? (Assume that the tax rate is 0%.)

A) 12.33%

B) 12.50%

C) 12.63%

D) 13.00%

E) 13.50%

Omni Defense Products Inc.is also a military/defense products company.It's shares are trading for $35 per share.Omni has 100 million shares outstanding.Omni has debt worth $3 billion.Omni's debt is priced to yield 6.5%.

What is the required return of Omni's shareholders? (Assume that the tax rate is 0%.)

A) 12.33%

B) 12.50%

C) 12.63%

D) 13.00%

E) 13.50%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

78

In the year just past (Year 1)Hane Heavy Industries had no debt.Today is January 1 of Year 2.Hane is considering a plan to sell bonds worth $30B and use the proceeds to repurchase 2B shares (on the open market at $15/share).If Hane maintains this new level of debt in perpetuity,then what is the present value of the resulting interest tax shields? Assume that the debt is sold immediately,that the bonds are a perpetuity,and that interest is paid at the end of each year.Assume that the coupon rate on the bonds is 3.5% and that the tax rate is 13%.

A) $3.9B

B) $7.8B

C) $13.7B

D) $26.1B

E) $30B

A) $3.9B

B) $7.8B

C) $13.7B

D) $26.1B

E) $30B

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

79

Leakey Valves Inc.is all equity financed and generates perpetual annual EBIT of $600.Assume that the EBIT,and all other cash flows,occur at year end and that we are currently at the beginning of a year.Assume that Leakey Valves has a 100% payout rate,1,000 shares outstanding,and that shareholders require a return of 6%.Assume that the tax rate is 0%.

Leakey Valves is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $10.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds with a coupon rate (and yield)of 4%.Assume that the tax rate is 0%.

If Leakey Valves goes ahead with the repurchase,then what is the value of the company after the repurchase is complete?

A) $8,000

B) $10,000

C) $12,000

D) $15,000

E) $9,000

Leakey Valves is considering an open market stock repurchase.It plans to buy 20% of its outstanding shares at the price of $10.00 per share.The repurchased shares will be cancelled.It will finance the repurchase by issuing perpetual bonds with a coupon rate (and yield)of 4%.Assume that the tax rate is 0%.

If Leakey Valves goes ahead with the repurchase,then what is the value of the company after the repurchase is complete?

A) $8,000

B) $10,000

C) $12,000

D) $15,000

E) $9,000

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

80