Deck 3: Accounting for Merchandising Businesses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/105

Play

Full screen (f)

Deck 3: Accounting for Merchandising Businesses

1

Which of the following would be considered as primarily a merchandising business?

A) West Consulting

B) Martin's Supermarket

C) Sandridge and Associates Law Offices

D) KPM Accounting and Tax Service

A) West Consulting

B) Martin's Supermarket

C) Sandridge and Associates Law Offices

D) KPM Accounting and Tax Service

B

Explanation: Merchandising companies, such as retailers, purchase goods and resell them without making significant changes to those goods.

Explanation: Merchandising companies, such as retailers, purchase goods and resell them without making significant changes to those goods.

2

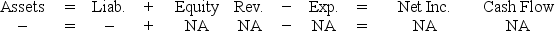

A company using the perpetual inventory method paid $250 cash to have goods delivered from one of its suppliers. The payment of $250 for transportation-in is considered a(n):

A) asset source transaction.

B) asset use transaction.

C) asset exchange transaction.

D) claims exchange transaction.

A) asset source transaction.

B) asset use transaction.

C) asset exchange transaction.

D) claims exchange transaction.

C

Explanation: Transportation-in is an asset exchange transaction that increases one asset (merchandise inventory) and decreases another asset (cash). It does not affect the income statement until the merchandise is sold, but it is reported as a cash outflow for operating activities.

Explanation: Transportation-in is an asset exchange transaction that increases one asset (merchandise inventory) and decreases another asset (cash). It does not affect the income statement until the merchandise is sold, but it is reported as a cash outflow for operating activities.

3

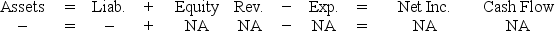

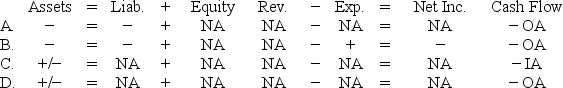

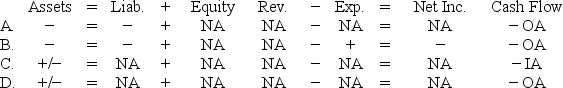

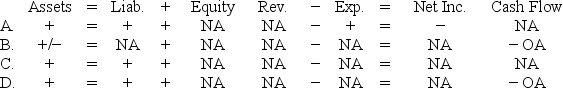

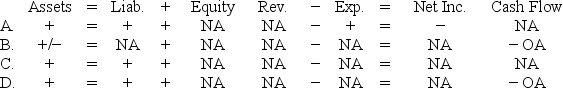

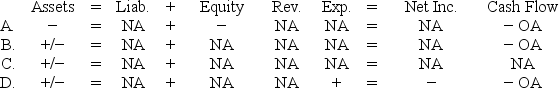

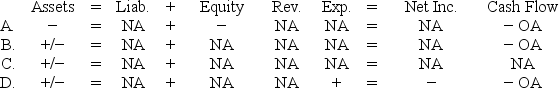

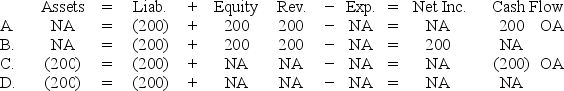

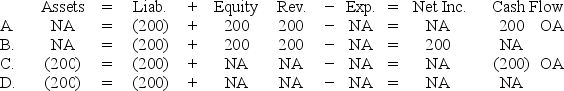

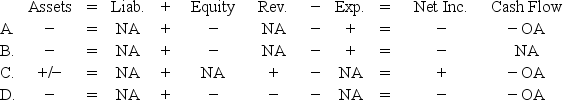

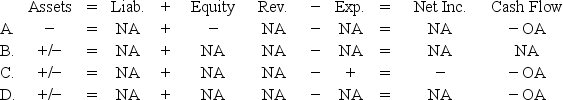

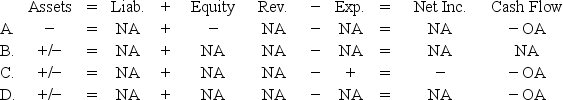

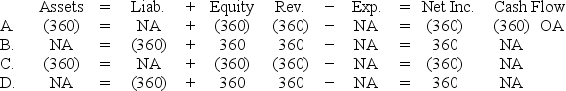

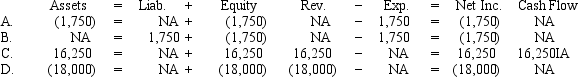

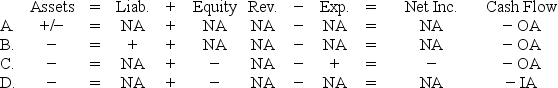

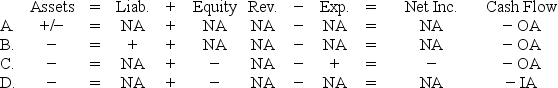

Kenyon Company experienced a transaction that had the following effect on the financial statements:  Which transaction would have this effect?

Which transaction would have this effect?

A) Paid for merchandise that had been purchased on account.

B) A loss on land that was sold for cash.

C) Return by a customer of a sale that was made on account.

D) Return to a supplier of merchandise purchased on account.

Which transaction would have this effect?

Which transaction would have this effect?A) Paid for merchandise that had been purchased on account.

B) A loss on land that was sold for cash.

C) Return by a customer of a sale that was made on account.

D) Return to a supplier of merchandise purchased on account.

D

Explanation: A purchase return would decrease assets (merchandise inventory) and decrease liabilities (accounts payable), but would not affect the income statement or the statement of cash flows.

Explanation: A purchase return would decrease assets (merchandise inventory) and decrease liabilities (accounts payable), but would not affect the income statement or the statement of cash flows.

4

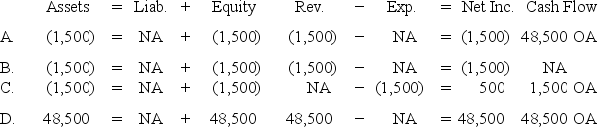

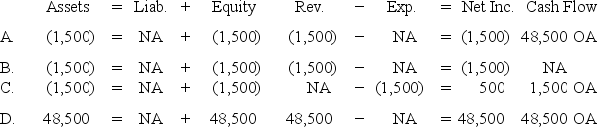

Assume the perpetual inventory method is used.

1) The company purchased $12,500 of merchandise on account under terms 2/10, n/30.

2) The company returned $1,200 of merchandise to the supplier before payment was made.

3) The liability was paid within the discount period.

"4) All of the merchandise purchased was sold for $18,800 cash.

The net cash flow from operating activities as a result of the four transactions is:"

A) $5,100.

B) $7,726.

C) $6,550.

D) $11,074.

1) The company purchased $12,500 of merchandise on account under terms 2/10, n/30.

2) The company returned $1,200 of merchandise to the supplier before payment was made.

3) The liability was paid within the discount period.

"4) All of the merchandise purchased was sold for $18,800 cash.

The net cash flow from operating activities as a result of the four transactions is:"

A) $5,100.

B) $7,726.

C) $6,550.

D) $11,074.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

5

Abbott Company purchased $6,500 of merchandise inventory on account. Advent uses the perpetual inventory method. How does this transaction affect the financial statements?

A) Decrease accounts payable and decrease purchases.

B) Increase inventory and increase accounts payable.

C) Increase cost of goods sold and increase accounts payable.

D) Decrease accounts payable and decrease inventory.

A) Decrease accounts payable and decrease purchases.

B) Increase inventory and increase accounts payable.

C) Increase cost of goods sold and increase accounts payable.

D) Decrease accounts payable and decrease inventory.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is considered a product cost?

A) Utility expense for the current month.

B) Salaries paid to employees of a retailer.

C) Transportation cost on goods received from suppliers.

D) Transportation cost on goods shipped to customers.

A) Utility expense for the current month.

B) Salaries paid to employees of a retailer.

C) Transportation cost on goods received from suppliers.

D) Transportation cost on goods shipped to customers.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is considered a period cost?

A) Transportation cost on goods received from suppliers.

B) Advertising expense for the current month.

C) Cost of merchandise purchased.

D) None of these answer choices are considered a period cost.

A) Transportation cost on goods received from suppliers.

B) Advertising expense for the current month.

C) Cost of merchandise purchased.

D) None of these answer choices are considered a period cost.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

8

The cost of goods sold account is classified as:

A) a liability.

B) an asset.

C) a contra asset.

D) an expense.

A) a liability.

B) an asset.

C) a contra asset.

D) an expense.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

9

Anchor Company sold merchandise with a cost of $560 to a customer for $890 on account. Due to an error, this sale was never recorded in the accounting records. What effects will the failure to make the necessary entries have on the company's accounting equation?

A) Total assets and total equity will be overstated.

B) Total assets will be overstated and total equity will be understated.

C) Total assets and total equity will be understated.

D) The accounting equation will not be affected.

A) Total assets and total equity will be overstated.

B) Total assets will be overstated and total equity will be understated.

C) Total assets and total equity will be understated.

D) The accounting equation will not be affected.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

10

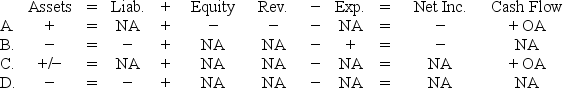

Llewelyn Company paid the amount due on a purchase of merchandise on account. Llewelyn uses the perpetual inventory system. Which of the following answers reflects the effect of the payment on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

11

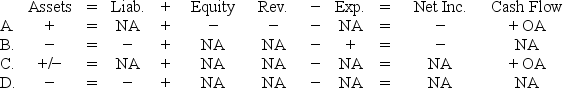

A company purchased inventory on account. If the perpetual inventory method is used, which of the following choices accurately reflects how the purchase affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

12

A business firm that primarily sells merchandise to other businesses is known as a:

A) Wholesale firm

B) Service firm

C) Retail firm

D) Consulting firm

A) Wholesale firm

B) Service firm

C) Retail firm

D) Consulting firm

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following items is not a product cost?

A) Transportation cost on goods delivered to customers.

B) Cost of merchandise purchased for resale.

C) Transportation cost on merchandise purchased from suppliers.

D) All of these answer choices are product costs.

A) Transportation cost on goods delivered to customers.

B) Cost of merchandise purchased for resale.

C) Transportation cost on merchandise purchased from suppliers.

D) All of these answer choices are product costs.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following would not be considered as primarily a merchandising business?

A) Abercrombie and Fitch

B) Sam's Clubs

C) Amazon

D) Regal Cinemas

A) Abercrombie and Fitch

B) Sam's Clubs

C) Amazon

D) Regal Cinemas

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

15

On April 1, Snell Company made a $50,000 sale giving the customer terms of 3/10/n30. The receivable was collected from the customer on April 8. Considering the collection of cash from the receivable, what effect will the transaction have on the company's statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

16

Galaxy Company sold merchandise costing $1,700 for $2,600 cash. The merchandise was later returned by the customer for a refund. If the perpetual inventory method is used, what effect will the sales return have on the accounting equation?

A) Total assets and total equity decrease by $900.

B) Total assets decrease by $2,600 and total equity is decreased by $1,700.

C) Total assets and total equity decrease by $2,600.

D) Total assets and total equity increase by $900.

A) Total assets and total equity decrease by $900.

B) Total assets decrease by $2,600 and total equity is decreased by $1,700.

C) Total assets and total equity decrease by $2,600.

D) Total assets and total equity increase by $900.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

17

Assume the perpetual inventory method is used.

1) The company purchased $12,500 of merchandise on account under terms 2/10, n/30.

2) The company returned $1,200 of merchandise to the supplier before payment was made.

3) The liability was paid within the discount period.

"4) All of the merchandise purchased was sold for $18,800 cash.

The amount of gross margin from the four transactions is:"

A) $5,100.

B) $7,726.

C) $6,550.

D) $11,074.

1) The company purchased $12,500 of merchandise on account under terms 2/10, n/30.

2) The company returned $1,200 of merchandise to the supplier before payment was made.

3) The liability was paid within the discount period.

"4) All of the merchandise purchased was sold for $18,800 cash.

The amount of gross margin from the four transactions is:"

A) $5,100.

B) $7,726.

C) $6,550.

D) $11,074.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

18

Assume the perpetual inventory method is used.

1) The company purchased $12,500 of merchandise on account under terms 2/10, n/30.

2) The company returned $1,200 of merchandise to the supplier before payment was made.

3) The liability was paid within the discount period.

"4) All of the merchandise purchased was sold for $18,800 cash.

What effect will the return of merchandise to the supplier have on the accounting equation?"

A) Assets and equity are reduced by $1,176.

B) Assets and liabilities are reduced by $1,176.

C) Assets and liabilities are reduced by $1,200.

D) None. It is an asset exchange transaction.

1) The company purchased $12,500 of merchandise on account under terms 2/10, n/30.

2) The company returned $1,200 of merchandise to the supplier before payment was made.

3) The liability was paid within the discount period.

"4) All of the merchandise purchased was sold for $18,800 cash.

What effect will the return of merchandise to the supplier have on the accounting equation?"

A) Assets and equity are reduced by $1,176.

B) Assets and liabilities are reduced by $1,176.

C) Assets and liabilities are reduced by $1,200.

D) None. It is an asset exchange transaction.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

19

Product costs are matched against sales revenue:

A) in the period immediately following the purchase.

B) in the period immediately following the sale.

C) when the merchandise is purchased.

D) when the merchandise is sold.

A) in the period immediately following the purchase.

B) in the period immediately following the sale.

C) when the merchandise is purchased.

D) when the merchandise is sold.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is true about period costs?

A) Most period costs are expensed in the period the costs are incurred.

B) Period costs are expensed when the products associated with these costs are sold.

C) Period costs are usually recorded as assets.

D) Period costs do not adhere to the matching principle.

A) Most period costs are expensed in the period the costs are incurred.

B) Period costs are expensed when the products associated with these costs are sold.

C) Period costs are usually recorded as assets.

D) Period costs do not adhere to the matching principle.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

21

The term "FOB Shipping Point" means:

A) The buyer pays the shipping cost.

B) The seller pays the shipping cost.

C) The buyer records transportation cost as an expense.

D) The seller records transportation-out cost.

A) The buyer pays the shipping cost.

B) The seller pays the shipping cost.

C) The buyer records transportation cost as an expense.

D) The seller records transportation-out cost.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

22

Sanchez Company engaged in the following transactions during Year 1:

1) Started the business by issuing $42,000 of common stock for cash.

2) The company paid cash to purchase $26,400 of inventory.

3) The company sold inventory that cost $16,000 for $30,600 cash.

"4) Operating expenses incurred and paid during the year, $14,000.

Sanchez Company engaged in the following transactions during Year 2:"

1) The company paid cash to purchase $35,200 of inventory.

2) The company sold inventory that cost $32,800 for $57,000 cash.

"3) Operating expenses incurred and paid during the year, $18,000.

Note: Sanchez uses the perpetual inventory system.

Sanchez's gross margin for the Year 2 is:"

A) $6,200.

B) $24,200.

C) $21,800.

D) $32,800.

1) Started the business by issuing $42,000 of common stock for cash.

2) The company paid cash to purchase $26,400 of inventory.

3) The company sold inventory that cost $16,000 for $30,600 cash.

"4) Operating expenses incurred and paid during the year, $14,000.

Sanchez Company engaged in the following transactions during Year 2:"

1) The company paid cash to purchase $35,200 of inventory.

2) The company sold inventory that cost $32,800 for $57,000 cash.

"3) Operating expenses incurred and paid during the year, $18,000.

Note: Sanchez uses the perpetual inventory system.

Sanchez's gross margin for the Year 2 is:"

A) $6,200.

B) $24,200.

C) $21,800.

D) $32,800.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

23

When using a perpetual inventory system, which of the following events is an asset use transaction?

A) Paid cash to purchase inventory.

B) Paid cash for transportation-out costs.

C) Purchased inventory on account.

D) Paid cash for transportation-in costs.

A) Paid cash to purchase inventory.

B) Paid cash for transportation-out costs.

C) Purchased inventory on account.

D) Paid cash for transportation-in costs.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

24

How does the purchase of inventory on account under the perpetual inventory method affect the financial statements?

A) Total assets increase

B) Total liabilities increase

C) Total assets are unaffected

D) Total assets and total liabilities both increase

A) Total assets increase

B) Total liabilities increase

C) Total assets are unaffected

D) Total assets and total liabilities both increase

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

25

Sanchez Company engaged in the following transactions during Year 1:

1) Started the business by issuing $42,000 of common stock for cash.

2) The company paid cash to purchase $26,400 of inventory.

3) The company sold inventory that cost $16,000 for $30,600 cash.

"4) Operating expenses incurred and paid during the year, $14,000.

Sanchez Company engaged in the following transactions during Year 2:"

1) The company paid cash to purchase $35,200 of inventory.

2) The company sold inventory that cost $32,800 for $57,000 cash.

"3) Operating expenses incurred and paid during the year, $18,000.

Note: Sanchez uses the perpetual inventory system.

The balance in the inventory account shown at December 31, Year 2 is:"

A) $2,400.

B) $12,800.

C) $61,600.

D) $28,800.

1) Started the business by issuing $42,000 of common stock for cash.

2) The company paid cash to purchase $26,400 of inventory.

3) The company sold inventory that cost $16,000 for $30,600 cash.

"4) Operating expenses incurred and paid during the year, $14,000.

Sanchez Company engaged in the following transactions during Year 2:"

1) The company paid cash to purchase $35,200 of inventory.

2) The company sold inventory that cost $32,800 for $57,000 cash.

"3) Operating expenses incurred and paid during the year, $18,000.

Note: Sanchez uses the perpetual inventory system.

The balance in the inventory account shown at December 31, Year 2 is:"

A) $2,400.

B) $12,800.

C) $61,600.

D) $28,800.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

26

Faust Company uses the perpetual inventory method. Faust sold goods that cost $2,300 for $3,600. If the sale was made on account, the net effect of the sale will:

A) increase total assets by $2,300.

B) increase total equity by $3,600.

C) increase total assets by $1,300.

D) increase total assets by $3,600.

A) increase total assets by $2,300.

B) increase total equity by $3,600.

C) increase total assets by $1,300.

D) increase total assets by $3,600.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

27

The term "FOB Destination" means:

A) The seller pays the shipping cost.

B) The seller records transportation-out expense.

C) The buyer pays the shipping cost.

D) The seller pays the shipping cost and records transportation-out expense.

A) The seller pays the shipping cost.

B) The seller records transportation-out expense.

C) The buyer pays the shipping cost.

D) The seller pays the shipping cost and records transportation-out expense.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

28

A company using the perpetual inventory method paid cash for freight costs to purchase merchandise. Which of the following answers reflects the effects of this event on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

29

Ramirez Company returns merchandise previously purchased on account. It had not yet been paid for. Ramirez uses the perpetual inventory system. Which of the following answers reflects the effects on the financial statements of only the purchase return?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

30

Middleton Company uses the perpetual inventory method. The company purchased an item of inventory for $130 and sold the item to a customer for $200. What effect will the sale have on the company's inventory account?

A) The account will decrease by $200

B) The account will decrease by $130

C) The account will decrease by $70

D) No effect

A) The account will decrease by $200

B) The account will decrease by $130

C) The account will decrease by $70

D) No effect

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

31

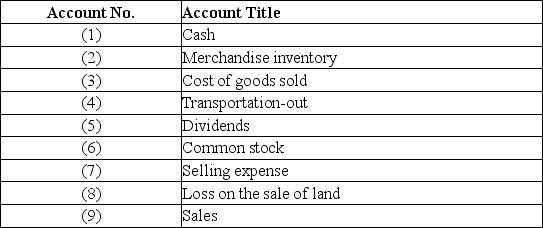

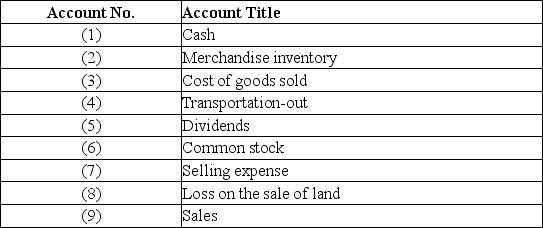

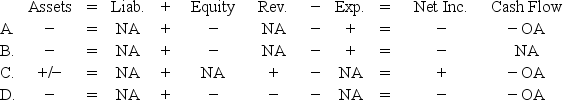

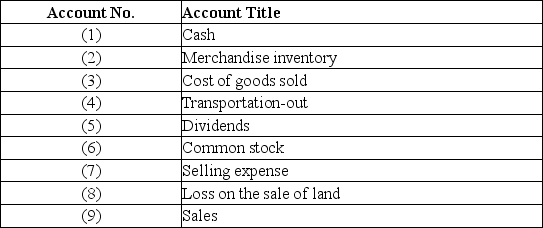

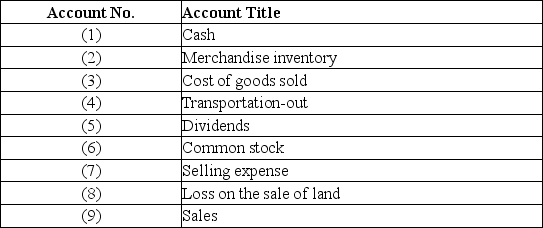

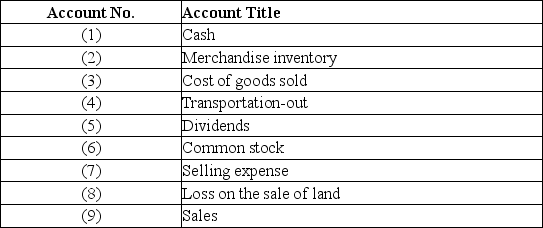

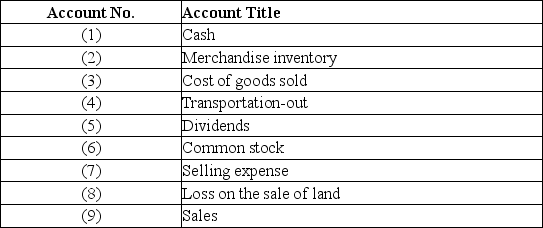

Use the following account numbers and corresponding account titles to answer the following question.  Which accounts would affect gross margin?

Which accounts would affect gross margin?

A) Account numbers 2 and 9.

B) Account numbers 3 and 9.

C) Account numbers 3, 4, 7, and 9.

D) Account numbers 3, 7, 8 and 9.

Which accounts would affect gross margin?

Which accounts would affect gross margin?A) Account numbers 2 and 9.

B) Account numbers 3 and 9.

C) Account numbers 3, 4, 7, and 9.

D) Account numbers 3, 7, 8 and 9.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

32

Foote Company recorded a purchase discount of $200 on merchandise the company had purchased on account a few days ago. Foote uses the perpetual inventory system. Which of the following answers reflects the effects of this event on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

33

Sanchez Company engaged in the following transactions during Year 1:

1) Started the business by issuing $42,000 of common stock for cash.

2) The company paid cash to purchase $26,400 of inventory.

3) The company sold inventory that cost $16,000 for $30,600 cash.

"4) Operating expenses incurred and paid during the year, $14,000.

Sanchez Company engaged in the following transactions during Year 2:"

1) The company paid cash to purchase $35,200 of inventory.

2) The company sold inventory that cost $32,800 for $57,000 cash.

"3) Operating expenses incurred and paid during the year, $18,000.

Note: Sanchez uses the perpetual inventory system.

The amount of retained earnings at December 31, Year 2 is:"

A) $6,200.

B) $26,000.

C) $6,800.

D) $38,800.

1) Started the business by issuing $42,000 of common stock for cash.

2) The company paid cash to purchase $26,400 of inventory.

3) The company sold inventory that cost $16,000 for $30,600 cash.

"4) Operating expenses incurred and paid during the year, $14,000.

Sanchez Company engaged in the following transactions during Year 2:"

1) The company paid cash to purchase $35,200 of inventory.

2) The company sold inventory that cost $32,800 for $57,000 cash.

"3) Operating expenses incurred and paid during the year, $18,000.

Note: Sanchez uses the perpetual inventory system.

The amount of retained earnings at December 31, Year 2 is:"

A) $6,200.

B) $26,000.

C) $6,800.

D) $38,800.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

34

Becker's Bookstore shipped merchandise FOB destination to a customer. If the transportation costs are paid in cash, which of the following choices reflects how this transaction will affect the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

35

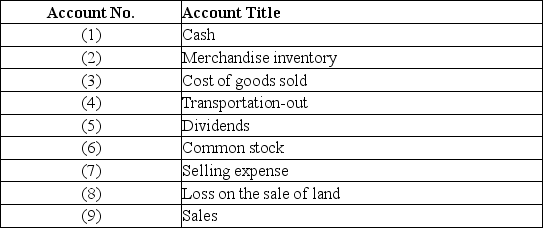

Use the following account numbers and corresponding account titles to answer the following question.  Which accounts would appear on the balance sheet?

Which accounts would appear on the balance sheet?

A) Account numbers 1, 2, 4, and 5.

B) Account numbers 1, 3, 7, and 8.

C) Account numbers 1, 2, and 6.

D) Account numbers 3, 4, 8, and 9.

Which accounts would appear on the balance sheet?

Which accounts would appear on the balance sheet?A) Account numbers 1, 2, 4, and 5.

B) Account numbers 1, 3, 7, and 8.

C) Account numbers 1, 2, and 6.

D) Account numbers 3, 4, 8, and 9.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

36

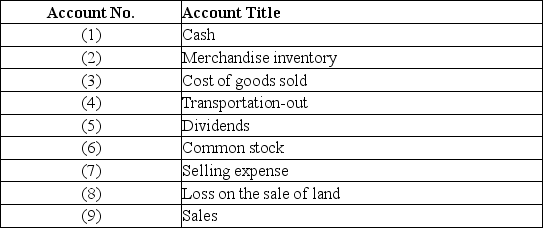

Use the following account numbers and corresponding account titles to answer the following question.  Which accounts would appear on the income statement?

Which accounts would appear on the income statement?

A) Account numbers 3, 4, 7, 8, and 9.

B) Account numbers 3, 4, 5, 7, and 9.

C) Account numbers 2, 3, 7, 8, and 9.

D) Account numbers 3, 5, 7, and 8.

Which accounts would appear on the income statement?

Which accounts would appear on the income statement?A) Account numbers 3, 4, 7, 8, and 9.

B) Account numbers 3, 4, 5, 7, and 9.

C) Account numbers 2, 3, 7, 8, and 9.

D) Account numbers 3, 5, 7, and 8.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

37

A company using the perpetual inventory method paid cash for a transportation-in cost. Which of the following choices reflects the effects of this event on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

38

The Wilson Company purchased $44,000 of merchandise from the Poole Wholesale Company. Wilson also paid $3,000 for freight costs to have the goods shipped to its location. Which of the following statements regarding the necessary entries for the transactions is true? Wilson uses the perpetual inventory system.

A) Total increases to the inventory account would be $47,000.

B) Total increases to the inventory account would be $44,000.

C) Transportation-in would be increased by $3,000.

D) Total increases to the inventory account would be $41,000.

A) Total increases to the inventory account would be $47,000.

B) Total increases to the inventory account would be $44,000.

C) Transportation-in would be increased by $3,000.

D) Total increases to the inventory account would be $41,000.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

39

Use the following account numbers and corresponding account titles to answer the following question.  Which accounts would affect operating income?

Which accounts would affect operating income?

A) Account numbers 2, 4, and 9.

B) Account numbers 3, 5, 7, and 9.

C) Account numbers 3, 4, 7, and 9.

D) Account numbers 3, 4, 7, 8 and 9.

Which accounts would affect operating income?

Which accounts would affect operating income?A) Account numbers 2, 4, and 9.

B) Account numbers 3, 5, 7, and 9.

C) Account numbers 3, 4, 7, and 9.

D) Account numbers 3, 4, 7, 8 and 9.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

40

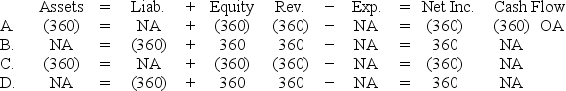

Yowell Company granted a sales discount of $360 to a customer when it collected the amount due on account. Yowell uses the perpetual inventory system. Which of the following answers reflects the effects on the financial statements of only the discount?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

41

A discount given to encourage prompt payment is called:

A) a cash discount.

B) a sales discount by the seller.

C) a purchase discount by the buyer.

D) all of these answer choices are correct.

A) a cash discount.

B) a sales discount by the seller.

C) a purchase discount by the buyer.

D) all of these answer choices are correct.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

42

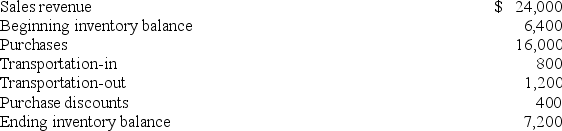

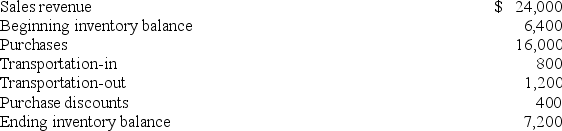

Sullivan Company uses the periodic inventory method. The following balances were drawn from the accounts of Sullivan Company prior to the closing process:  The amount of gross margin appearing on the income statement should be:

The amount of gross margin appearing on the income statement should be:

A) $8,400.

B) $7,200.

C) $15,600.

D) $18,400.

The amount of gross margin appearing on the income statement should be:

The amount of gross margin appearing on the income statement should be:A) $8,400.

B) $7,200.

C) $15,600.

D) $18,400.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

43

Vargas Company sold a piece of land for $39,000 that had originally cost $32,500. This event would:

A) increase cash flows from investing activities by $39,000.

B) not affect operating income.

C) increase net income by $6,500.

D) all of these answer choices are correct.

A) increase cash flows from investing activities by $39,000.

B) not affect operating income.

C) increase net income by $6,500.

D) all of these answer choices are correct.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

44

Net income percentage is equal to:

A) Net Sales divided by Net Income

B) Net Income divided by Net Sales

C) Total Equity divided by Net Sales

D) Net Income divided by Gross Margin

A) Net Sales divided by Net Income

B) Net Income divided by Net Sales

C) Total Equity divided by Net Sales

D) Net Income divided by Gross Margin

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

45

The credit terms, 2/15, n/30, indicate that a:

A) fifteen percent discount can be deducted if the invoice is paid within two days following the date of sale.

B) two percent discount can be deducted for a period up to thirty days following the date of sale.

C) two percent discount can be deducted if the invoice is paid before the fifteenth day following the date of the sale.

D) two percent discount can be deducted if the invoice is paid after the fifteenth day following the sale, but before the thirtieth day.

A) fifteen percent discount can be deducted if the invoice is paid within two days following the date of sale.

B) two percent discount can be deducted for a period up to thirty days following the date of sale.

C) two percent discount can be deducted if the invoice is paid before the fifteenth day following the date of the sale.

D) two percent discount can be deducted if the invoice is paid after the fifteenth day following the sale, but before the thirtieth day.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

46

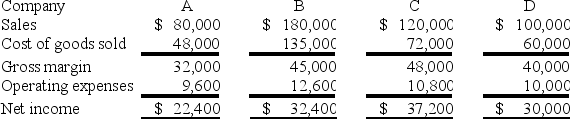

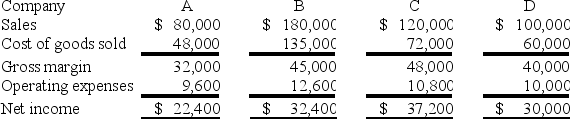

Consider the information:  Based on common-sized income statements, which of the companies spent, relative to sales, the least on operating expenses?

Based on common-sized income statements, which of the companies spent, relative to sales, the least on operating expenses?

A) Company A

B) Company B

C) Company C

D) Company D

Based on common-sized income statements, which of the companies spent, relative to sales, the least on operating expenses?

Based on common-sized income statements, which of the companies spent, relative to sales, the least on operating expenses?A) Company A

B) Company B

C) Company C

D) Company D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

47

The Garrett Company uses the perpetual inventory system. Although its inventory records indicated $18,000 in the inventory, a physical count showed only $16,250. Which of the following answers indicates the effect of the necessary adjusting entry?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

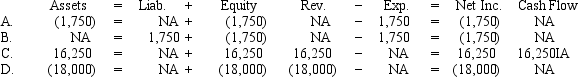

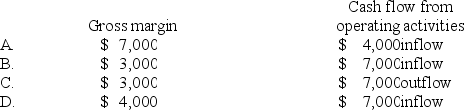

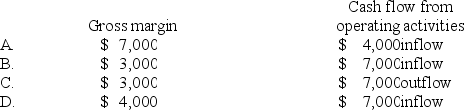

48

Flagler Company purchased $4,000 of merchandise on account. Flagler sold the merchandise to a customer for $7,000 cash. What is the increase in gross margin and the net change in cash flow from operating activities as a result of these transactions?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

49

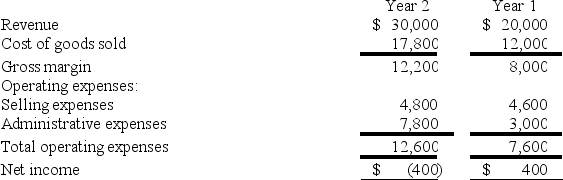

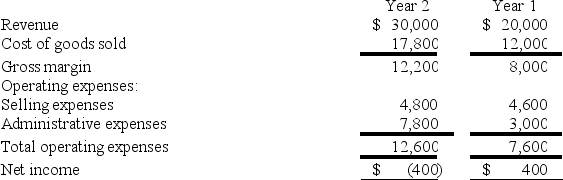

The following are the income statements of the Hancock Company for two consecutive years. Increases in which expenses contributed to the net loss in Year 2?

A) Cost of goods sold and selling expenses

B) Selling expenses and administrative expenses

C) Cost of goods sold and administrative expenses

D) Administrative expenses

A) Cost of goods sold and selling expenses

B) Selling expenses and administrative expenses

C) Cost of goods sold and administrative expenses

D) Administrative expenses

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

50

Gomez Co. had beginning inventory of $2,400 and ending inventory of $1,200. The cost of goods sold was $9,600. Based on this information, Gomez Co. must have purchased inventory amounting to:

A) $8,400.

B) $9,600.

C) $10,800.

D) $13,200.

A) $8,400.

B) $9,600.

C) $10,800.

D) $13,200.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

51

Assume the perpetual inventory method is used.

1) Green Company purchased merchandise inventory that cost $64,000 under terms of 2/10, n/30 and FOB shipping point.

2) The company paid freight cost of $2,400 to have the merchandise delivered.

3) Payment was made to the supplier within 10 days.

"4) All of the merchandise was sold to customers for $94,000 cash and delivered under terms FOB shipping point with freight cost amounting to $1,600.

The gross margin from these transactions of Green Company is:"

A) $31,280.

B) $27,280.

C) $28,880.

D) $29,680.

1) Green Company purchased merchandise inventory that cost $64,000 under terms of 2/10, n/30 and FOB shipping point.

2) The company paid freight cost of $2,400 to have the merchandise delivered.

3) Payment was made to the supplier within 10 days.

"4) All of the merchandise was sold to customers for $94,000 cash and delivered under terms FOB shipping point with freight cost amounting to $1,600.

The gross margin from these transactions of Green Company is:"

A) $31,280.

B) $27,280.

C) $28,880.

D) $29,680.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

52

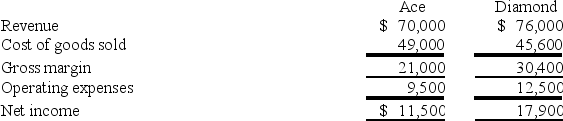

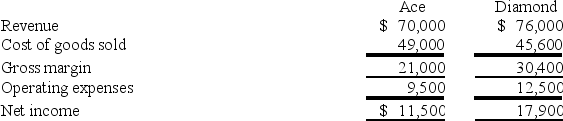

The following are the income statements for Ace and Diamond Companies.  What are the net income percentages for the above companies?

What are the net income percentages for the above companies?

A) 6.09%; 4.25%

B) 1.83%; 1.70%

C) 16.4%; 23.6%

D) 30%; 40%

What are the net income percentages for the above companies?

What are the net income percentages for the above companies?A) 6.09%; 4.25%

B) 1.83%; 1.70%

C) 16.4%; 23.6%

D) 30%; 40%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

53

On March 5, Gibbs Company purchases $5,000 of merchandise from a supplier for cash and records that transaction by increasing its inventory account. On March 30, the company records a $400 decrease in its inventory account. We can assume the company uses the:

A) perpetual inventory method and $400 may represent a purchase return.

B) perpetual inventory method and $400 may represent cost of goods sold.

C) perpetual inventory method and $400 may represent a purchase allowance.

D) All of these answer choices are correct.

A) perpetual inventory method and $400 may represent a purchase return.

B) perpetual inventory method and $400 may represent cost of goods sold.

C) perpetual inventory method and $400 may represent a purchase allowance.

D) All of these answer choices are correct.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

54

Ashton Company uses the perpetual method. The company's inventory account had a $6,600 balance as of December 31, Year 1. A physical count of inventory shows only $5,900 of merchandise in stock at December 31, Year 1. How does the related adjusting entry affect the financial statements?

A) Assets increase.

B) Expenses increase.

C) Cash flow from operating activities decreases.

D) All of these answer choices are correct.

A) Assets increase.

B) Expenses increase.

C) Cash flow from operating activities decreases.

D) All of these answer choices are correct.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

55

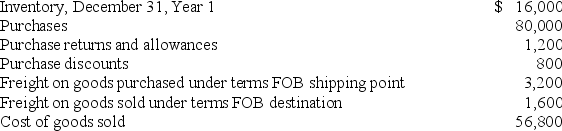

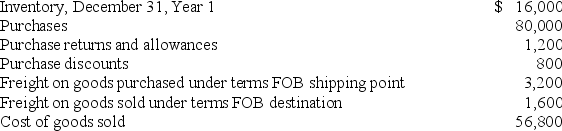

The following information for the year Year 1 is taken from the accounts of Tuttle Company. The company uses the periodic inventory method.  Based on this information, the inventory at December 31, Year 21 is:

Based on this information, the inventory at December 31, Year 21 is:

A) $55,200.

B) $24,400.

C) $38,800.

D) $40,400.

Based on this information, the inventory at December 31, Year 21 is:

Based on this information, the inventory at December 31, Year 21 is:A) $55,200.

B) $24,400.

C) $38,800.

D) $40,400.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

56

Ballard Company uses the perpetual inventory system. The company purchased $16,000 of merchandise from Andes Company under the terms 2/10, net/30. Ballard paid for the merchandise within 10 days and also paid $500 freight to obtain the goods under terms FOB shipping point. All of the merchandise purchased was sold for $30,000 cash. The amount of gross margin for this merchandise is:

A) $14,000.

B) $13,820.

C) $16,000.

D) $13,500.

A) $14,000.

B) $13,820.

C) $16,000.

D) $13,500.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

57

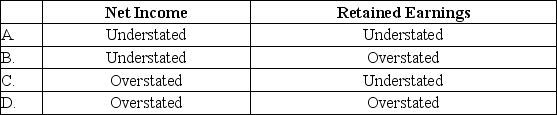

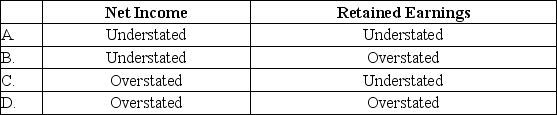

Aaron Company uses the periodic inventory cost flow method. If Aaron's ending inventory is understated due to an accounting error, what is the effect on net income and the ending balance of retained earnings?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

58

Assume the perpetual inventory method is used.

1) Green Company purchased merchandise inventory that cost $64,000 under terms of 2/10, n/30 and FOB shipping point.

2) The company paid freight cost of $2,400 to have the merchandise delivered.

3) Payment was made to the supplier within 10 days.

"4) All of the merchandise was sold to customers for $94,000 cash and delivered under terms FOB shipping point with freight cost amounting to $1,600 paid by Green company.

As a result of the above transactions of Green Company, the net cash flow from operating activities was:"

A) $94,000 inflow.

B) $27,280 inflow.

C) $66,720 outflow.

D) $31,280 inflow.

1) Green Company purchased merchandise inventory that cost $64,000 under terms of 2/10, n/30 and FOB shipping point.

2) The company paid freight cost of $2,400 to have the merchandise delivered.

3) Payment was made to the supplier within 10 days.

"4) All of the merchandise was sold to customers for $94,000 cash and delivered under terms FOB shipping point with freight cost amounting to $1,600 paid by Green company.

As a result of the above transactions of Green Company, the net cash flow from operating activities was:"

A) $94,000 inflow.

B) $27,280 inflow.

C) $66,720 outflow.

D) $31,280 inflow.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

59

Leonard Company paid freight costs to have goods shipped to one of its customers. What effect will these freight-out costs have on the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

60

The purpose of common size financial statements is to:

A) compare the amount of common stock to other types of stock.

B) make comparisons between firms of different sizes.

C) make comparisons between different time periods.

D) make comparisons between firms of different sizes and between different time periods.

A) compare the amount of common stock to other types of stock.

B) make comparisons between firms of different sizes.

C) make comparisons between different time periods.

D) make comparisons between firms of different sizes and between different time periods.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

61

Costs of selling inventory are product costs.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

62

Wholesale companies sell goods primarily to other businesses.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

63

Under a periodic inventory system, the buyer does not use which of the following accounts in recording purchases and related transactions?

A) Merchandise Inventory

B) Purchase Returns and Allowances

C) Purchase Discounts

D) Purchases

A) Merchandise Inventory

B) Purchase Returns and Allowances

C) Purchase Discounts

D) Purchases

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

64

The beginning merchandise inventory plus cost of goods sold equals the cost of goods available for sale during the period.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

65

Hill Company uses the periodic inventory system. It records a transaction that increases the balances in its purchases and accounts payable accounts. Which of the following is true about Hill Company?

A) When the related merchandise is sold, the purchases account will be decreased by the related cost of goods sold.

B) The manner in which this transaction was recorded indicates that Hill returned $6,000 of merchandise to a supplier.

C) The balance in the account will appear on the balance sheet at year end.

D) The manner in which this transaction was recorded indicates that Hill purchased inventory on account.

A) When the related merchandise is sold, the purchases account will be decreased by the related cost of goods sold.

B) The manner in which this transaction was recorded indicates that Hill returned $6,000 of merchandise to a supplier.

C) The balance in the account will appear on the balance sheet at year end.

D) The manner in which this transaction was recorded indicates that Hill purchased inventory on account.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

66

Indicate whether each of the following statements is true or false.

_____ a) A merchandising company generates revenue primarily by selling goods to customers.

_____ b) The supply of goods accumulated to deliver when sales are made is called Supplies.

_____ c) Retail companies are firms that sell goods to other businesses.

_____ d) Product costs include all costs associated with the sale of products.

_____ e) WalMart is an example of a wholesale company.

_____ a) A merchandising company generates revenue primarily by selling goods to customers.

_____ b) The supply of goods accumulated to deliver when sales are made is called Supplies.

_____ c) Retail companies are firms that sell goods to other businesses.

_____ d) Product costs include all costs associated with the sale of products.

_____ e) WalMart is an example of a wholesale company.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

67

Indicate whether each of the following statements is true or false.

_____ a) A multistep income statement separates product from period costs.

_____ b) A single-step income statement shows the computation of gross margin.

_____ c) Interest is normally shown as a separate item on the multistep income statement.

_____ d) The treatment of interest on the multistep income statement is consistent with the treatment of interest on the statement of cash flows.

_____ e) Gains and losses are included in operating income on a multistep income statement.

_____ a) A multistep income statement separates product from period costs.

_____ b) A single-step income statement shows the computation of gross margin.

_____ c) Interest is normally shown as a separate item on the multistep income statement.

_____ d) The treatment of interest on the multistep income statement is consistent with the treatment of interest on the statement of cash flows.

_____ e) Gains and losses are included in operating income on a multistep income statement.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

68

Merchandising businesses include retail companies and manufacturing companies.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

69

Indicate whether each of the following statements is true or false. (Assume a perpetual inventory system.)

_____ a) In a perpetual inventory system, an employee theft is discovered immediately.

_____ b) No adjusting entry is required for inventory losses under a perpetual inventory system.

_____ c) Inventory shrinkage is calculated as the difference between the beginning and ending balances in the merchandise inventory account.

_____ d) In a perpetual inventory system, adjustments for lost, damaged or stolen merchandise are recorded as expenses.

_____ e) The adjusting entry to record inventory losses due to employee theft or shoplifting has a negative effect on the statement of cash flows.

_____ a) In a perpetual inventory system, an employee theft is discovered immediately.

_____ b) No adjusting entry is required for inventory losses under a perpetual inventory system.

_____ c) Inventory shrinkage is calculated as the difference between the beginning and ending balances in the merchandise inventory account.

_____ d) In a perpetual inventory system, adjustments for lost, damaged or stolen merchandise are recorded as expenses.

_____ e) The adjusting entry to record inventory losses due to employee theft or shoplifting has a negative effect on the statement of cash flows.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

70

Indicate whether each of the following statements is true or false. (Assume a perpetual inventory system.)

_____ a) Transportation-out cost is a part of selling and administrative costs.

_____ b) When transportation-out cost is incurred, the balance in the inventory account increases.

_____ c) When transportation-in cost is incurred, the balance in the inventory account increases.

_____ d) When the transportation-out cost is incurred, the balance in the cost of goods sold account increases.

_____ e. Transportation-in cost is a part of selling and administrative costs.

_____ a) Transportation-out cost is a part of selling and administrative costs.

_____ b) When transportation-out cost is incurred, the balance in the inventory account increases.

_____ c) When transportation-in cost is incurred, the balance in the inventory account increases.

_____ d) When the transportation-out cost is incurred, the balance in the cost of goods sold account increases.

_____ e. Transportation-in cost is a part of selling and administrative costs.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

71

Indicate whether each of the following statements is true or false.

_____ a) A common size income statement facilitates comparison between two or more companies of different size and in the same industry.

_____ b) A common size income statement is prepared by dividing the various amounts reported on the income statement by the amount of total assets.

_____ c) A common size income statement is helpful in comparing the results of operations in different time periods.

_____ a) A common size income statement facilitates comparison between two or more companies of different size and in the same industry.

_____ b) A common size income statement is prepared by dividing the various amounts reported on the income statement by the amount of total assets.

_____ c) A common size income statement is helpful in comparing the results of operations in different time periods.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

72

Under a periodic system, the payment of shipping costs on goods received from the vendor will increase the:

A) merchandise inventory account.

B) cost of goods sold account.

C) transportation-out account.

D) transportation-in account.

A) merchandise inventory account.

B) cost of goods sold account.

C) transportation-out account.

D) transportation-in account.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

73

Which factor has removed most of the practical limitations associated with use of the perpetual inventory system?

A) A more honest work force.

B) Recent changes in GAAP.

C) Recent changes in federal and state laws.

D) Advancements in technology.

A) A more honest work force.

B) Recent changes in GAAP.

C) Recent changes in federal and state laws.

D) Advancements in technology.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

74

Indicate whether each of the following statements is true or false. (Assume a periodic inventory system)

_____ a) If the balance in ending inventory is overstated, net income will be understated.

_____ b) If the balance in ending inventory is understated, retained earnings will be understated.

_____ c) If the balance in ending inventory is overstated, selling and administrative expenses will not be affected.

_____ d) If the balance in ending inventory is overstated, cost of goods sold will be overstated.

_____ e) If the balance in ending inventory is overstated, assets will be overstated.

_____ a) If the balance in ending inventory is overstated, net income will be understated.

_____ b) If the balance in ending inventory is understated, retained earnings will be understated.

_____ c) If the balance in ending inventory is overstated, selling and administrative expenses will not be affected.

_____ d) If the balance in ending inventory is overstated, cost of goods sold will be overstated.

_____ e) If the balance in ending inventory is overstated, assets will be overstated.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

75

Indicate whether each of the following statements is true or false. (Assume a perpetual inventory system)

_____ a) The purchase of merchandise inventory is recorded as an expense.

_____ b) Merchandise inventory is expensed in the period it is sold.

_____ c) Merchandise Inventory is an account appearing on the balance sheet.

_____ d) Cost of goods available for sale is allotted between cost of goods sold and selling expenses.

_____ e) Cost of goods sold is a part of administrative and selling expenses.

_____ a) The purchase of merchandise inventory is recorded as an expense.

_____ b) Merchandise inventory is expensed in the period it is sold.

_____ c) Merchandise Inventory is an account appearing on the balance sheet.

_____ d) Cost of goods available for sale is allotted between cost of goods sold and selling expenses.

_____ e) Cost of goods sold is a part of administrative and selling expenses.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

76

Indicate whether each of the following statements is true or false. (Assume a perpetual inventory system.)

_____ a) The freight terms FOB shipping point increase the cost of inventory to the buyer.

_____ b) The term FOB means that goods are shipped free of charge to buyer and seller.

_____ c) FOB shipping point means that purchaser's responsibility ends at shipping point.

_____ d) FOB destination means that seller's responsibility ends at destination.

_____ e) When the seller of merchandise records freight under the terms FOB shipping point, the seller records an expense.

_____ a) The freight terms FOB shipping point increase the cost of inventory to the buyer.

_____ b) The term FOB means that goods are shipped free of charge to buyer and seller.

_____ c) FOB shipping point means that purchaser's responsibility ends at shipping point.

_____ d) FOB destination means that seller's responsibility ends at destination.

_____ e) When the seller of merchandise records freight under the terms FOB shipping point, the seller records an expense.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

77

The chief advantage of the periodic system is:

A) efficiency and ease of recording.

B) immediate feedback on the inventory on hand at any time during the period.

C) timely discovery of losses due to theft.

D) better control over inventory.

A) efficiency and ease of recording.

B) immediate feedback on the inventory on hand at any time during the period.

C) timely discovery of losses due to theft.

D) better control over inventory.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following account titles is normally used in a periodic inventory system?

A) Transportation-in

B) Purchases

C) Purchase Returns and Allowances

D) All of these answer choices are normally used.

A) Transportation-in

B) Purchases

C) Purchase Returns and Allowances

D) All of these answer choices are normally used.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

79

Indicate whether each of the following statements is true or false.

_____ a) The perpetual inventory method recognizes inventory transactions as they occur.

_____ b) The periodic inventory method recognizes sales revenue at the end of the accounting period.

_____ c) A physical count of inventory at the end of each accounting period is necessary for the periodic inventory system, as well as for the perpetual inventory system.

_____ d) A periodic inventory system requires more detailed record keeping than a perpetual inventory system.

_____ e) With a periodic inventory system, cost of goods sold is not determined until the end of the accounting period.

_____ a) The perpetual inventory method recognizes inventory transactions as they occur.

_____ b) The periodic inventory method recognizes sales revenue at the end of the accounting period.

_____ c) A physical count of inventory at the end of each accounting period is necessary for the periodic inventory system, as well as for the perpetual inventory system.

_____ d) A periodic inventory system requires more detailed record keeping than a perpetual inventory system.

_____ e) With a periodic inventory system, cost of goods sold is not determined until the end of the accounting period.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

80

Indicate whether each of the following statements is true or false.

_____ a) A cash discount is extended to reward the buyer for purchasing large quantities of goods.

_____ b) A purchase discount refers to a cash discount as seen from the seller's viewpoint.

_____ c) A sales discount refers to a cash discount as seen from the buyer's view.

_____ d) In a perpetual inventory system, a sales discount is recorded as a reduction of sales revenue.

_____ e) In a perpetual inventory system, a purchase discount is recorded as a reduction of merchandise inventory.

_____ a) A cash discount is extended to reward the buyer for purchasing large quantities of goods.

_____ b) A purchase discount refers to a cash discount as seen from the seller's viewpoint.

_____ c) A sales discount refers to a cash discount as seen from the buyer's view.

_____ d) In a perpetual inventory system, a sales discount is recorded as a reduction of sales revenue.

_____ e) In a perpetual inventory system, a purchase discount is recorded as a reduction of merchandise inventory.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck