Deck 10: Capital Budgeting Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/116

Play

Full screen (f)

Deck 10: Capital Budgeting Decisions

1

A follow-up evaluation of capital-budgeting decisions is called a postaudit.

True

2

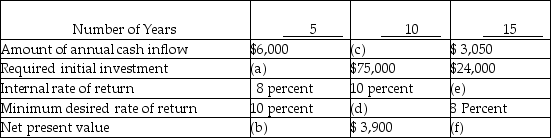

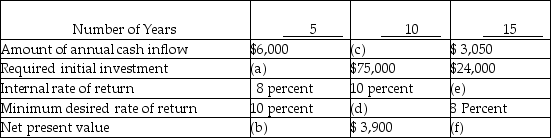

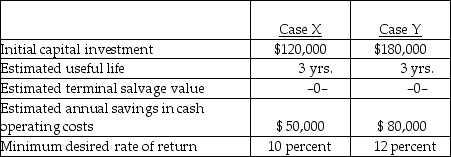

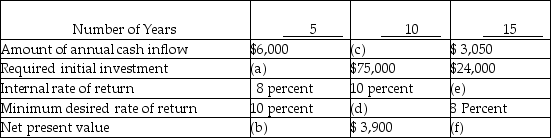

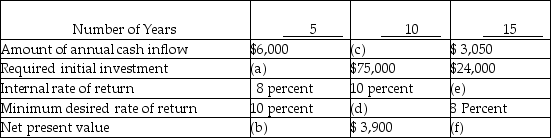

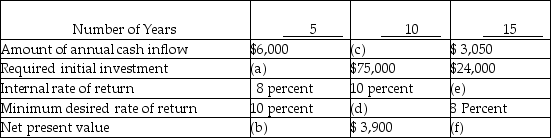

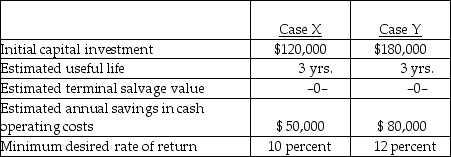

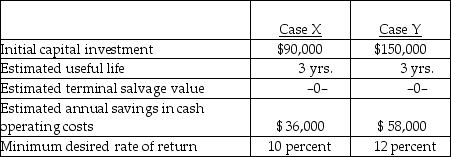

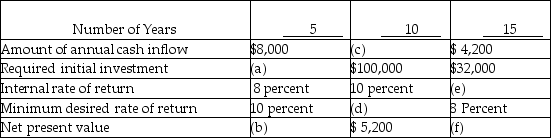

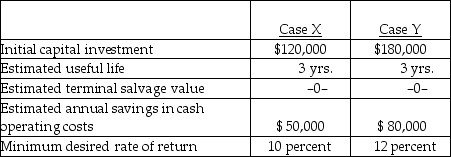

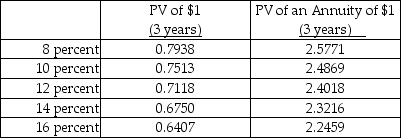

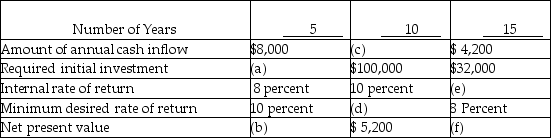

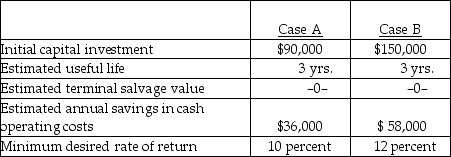

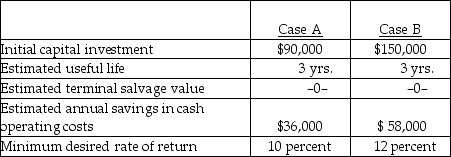

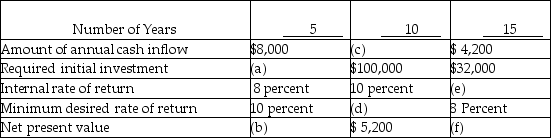

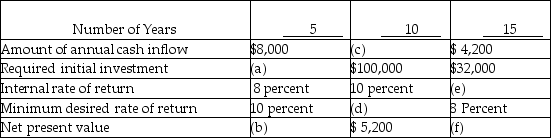

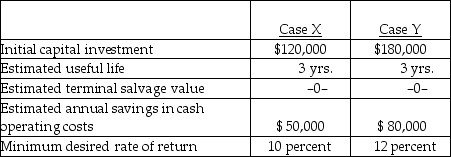

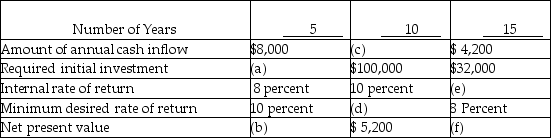

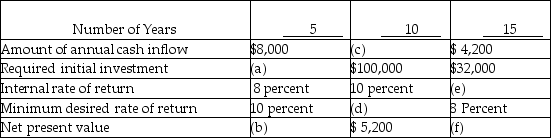

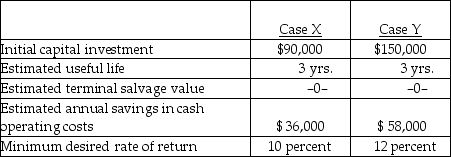

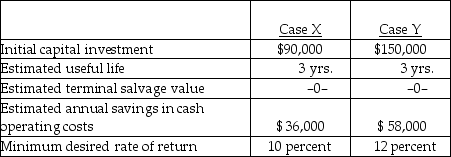

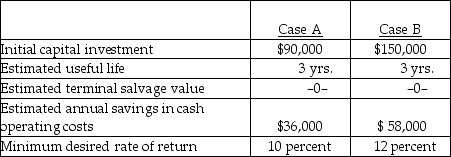

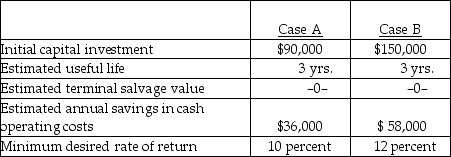

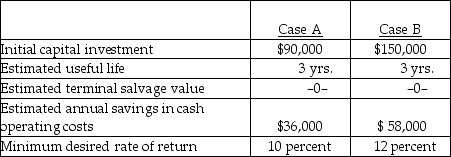

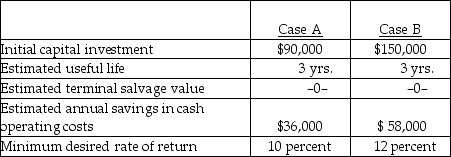

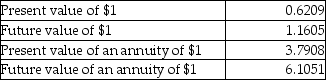

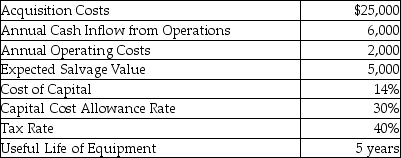

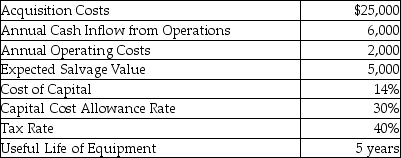

Alpha Company has the following information:

What is (a)?

A) $23,958

B) $22,746

C) $ 8,811

D) $ 9,662

What is (a)?

A) $23,958

B) $22,746

C) $ 8,811

D) $ 9,662

A

3

The cash outflow for the purchase of equipment is an example of an operating cash flow.

False

4

The cost of assets is recognized by the initial outlay, not by depreciation as computed under accrual accounting.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

5

Two common methods for comparing alternatives are (1) the total project approach and (2) the conversion approach.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

6

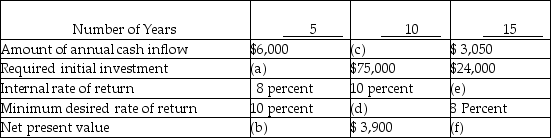

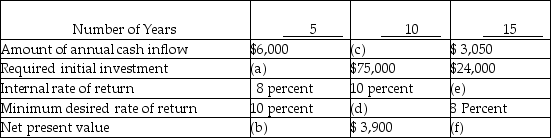

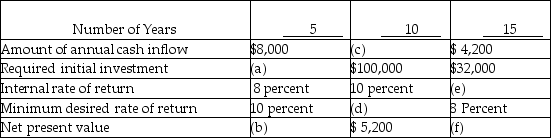

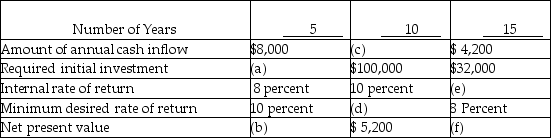

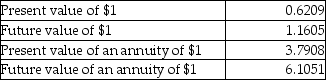

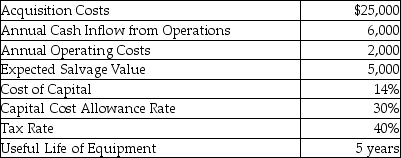

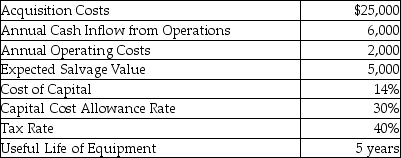

Alpha Company has the following information:

What is (f)?

A) $2,105

B) $26,105

C) $3,050

D) $(4,510)

What is (f)?

A) $2,105

B) $26,105

C) $3,050

D) $(4,510)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

7

The differential approach is limited to cases in which no more than four alternatives are being examined.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

8

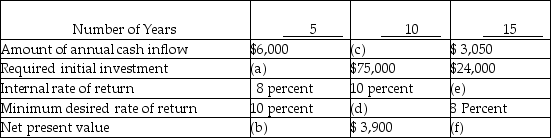

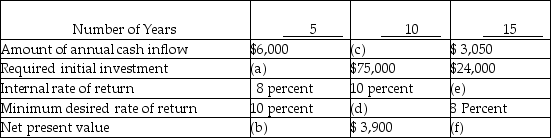

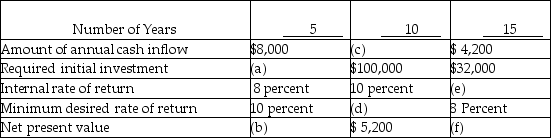

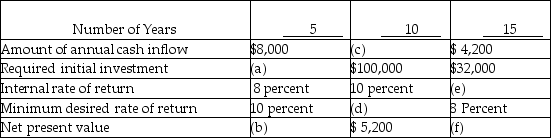

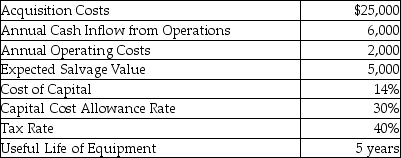

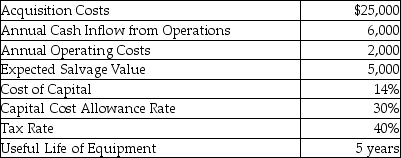

Alpha Company has the following information:

What is (e)?

A) Below 6 percent

B) Between 6 and 8 percent

C) Between 8 and 10 percent

D) Between 10 and 12 percent

What is (e)?

A) Below 6 percent

B) Between 6 and 8 percent

C) Between 8 and 10 percent

D) Between 10 and 12 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

9

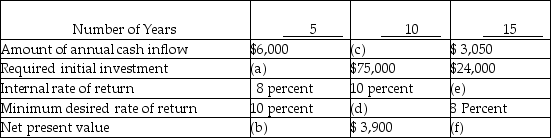

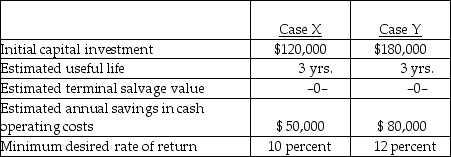

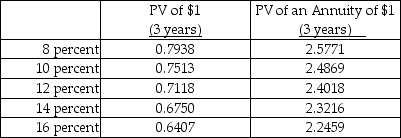

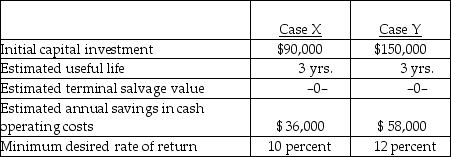

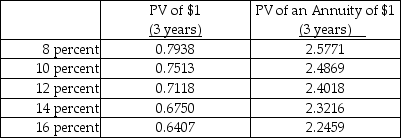

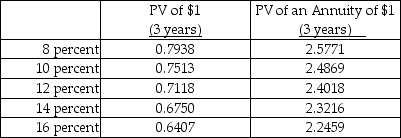

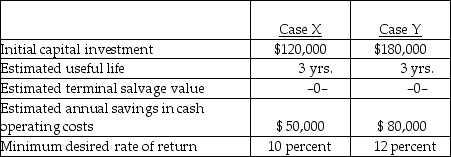

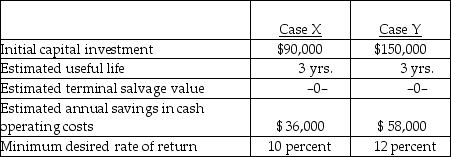

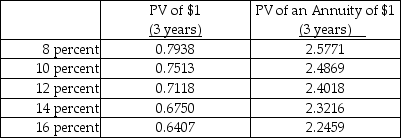

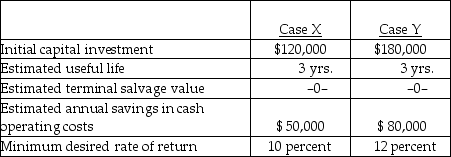

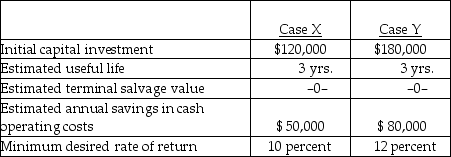

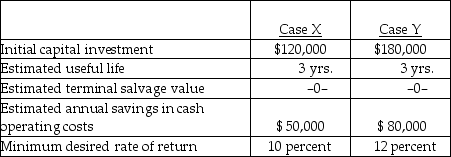

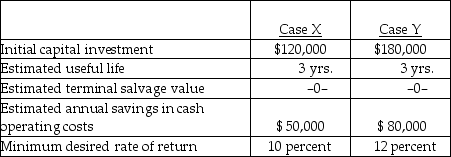

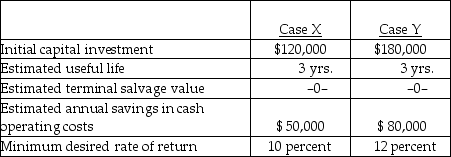

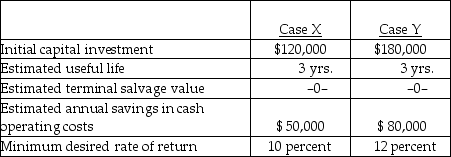

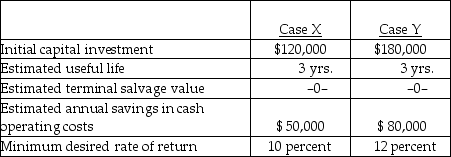

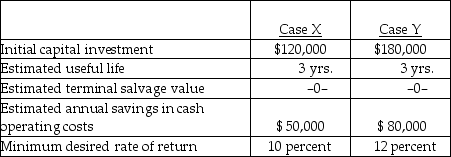

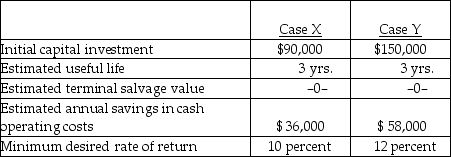

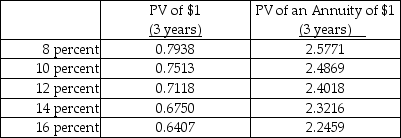

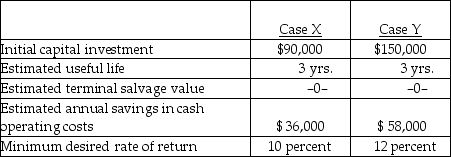

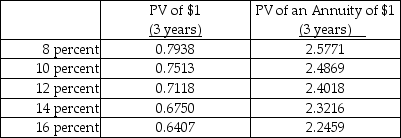

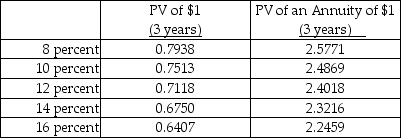

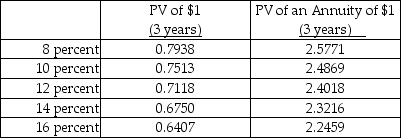

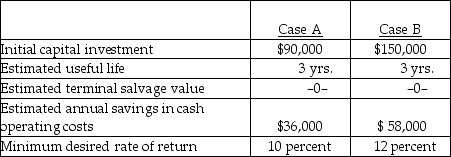

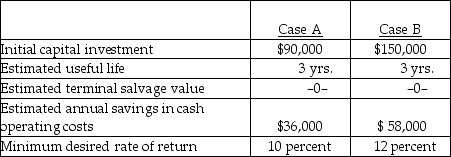

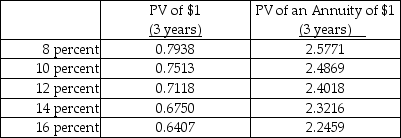

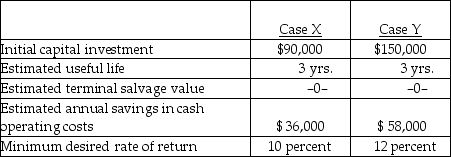

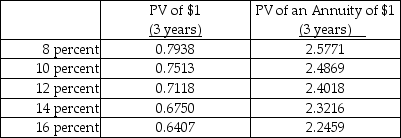

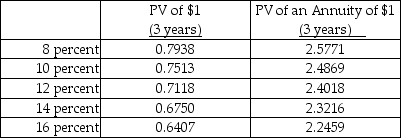

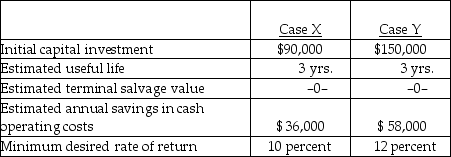

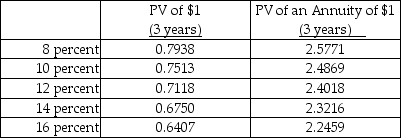

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes. The net present value in case X is

A) $4,345.

B) $82,435.

C) $50,000.

D) $90.

Assume straight-line amortization in all computations, and ignore income taxes. The net present value in case X is

A) $4,345.

B) $82,435.

C) $50,000.

D) $90.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

10

The payback model measures profitability as well as how quickly investment dollars may be recouped.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

11

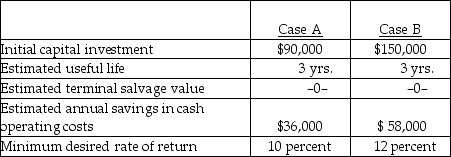

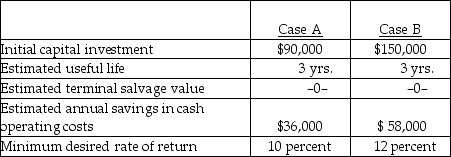

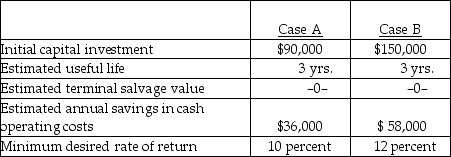

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes. The net present value in case B is

A) $8,000.

B) $(8,000).

C) $(10,696).

D) $(8,716).

Assume straight-line amortization in all computations, and ignore income taxes. The net present value in case B is

A) $8,000.

B) $(8,000).

C) $(10,696).

D) $(8,716).

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

12

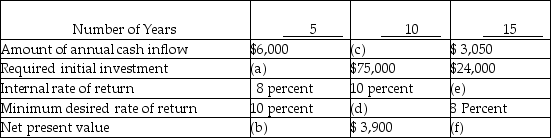

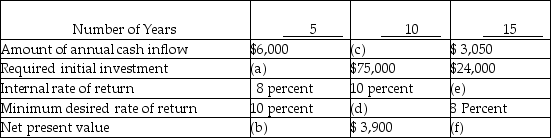

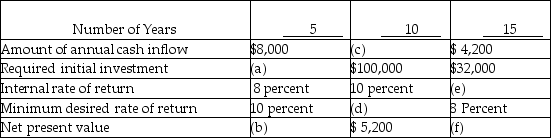

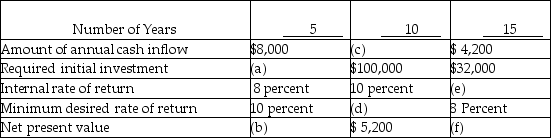

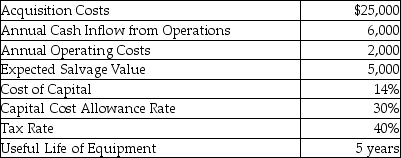

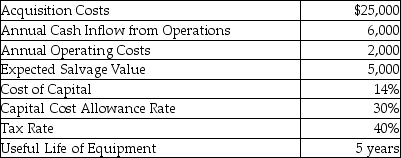

Alpha Company has the following information:

What is (b)?

A) $ -0-

B) $(1,212)

C) $16,359

D) $14,296

What is (b)?

A) $ -0-

B) $(1,212)

C) $16,359

D) $14,296

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

13

Alpha Company has the following information:

What is (d)?

A) Less than 6 percent

B) Between 6 and 8 percent

C) Between 8 and 10 percent

D) Between 10 and 12 percent

What is (d)?

A) Less than 6 percent

B) Between 6 and 8 percent

C) Between 8 and 10 percent

D) Between 10 and 12 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

14

Alpha Company has the following information:

What is (c)?

A) $28,950

B) $71,100

C) $12,205

D) $ 3,900

What is (c)?

A) $28,950

B) $71,100

C) $12,205

D) $ 3,900

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

15

Both the payback and the accounting rate-of-return models are attempts to approach capital budgeting systematically.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

16

When no revenue is involved, organizations try to choose projects with the least cost for any given set of objectives.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

17

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes. The net present value in case Y is

A) $80,000.

B) $12,144.

C) $(328).

D) $123,056.

Assume straight-line amortization in all computations, and ignore income taxes. The net present value in case Y is

A) $80,000.

B) $12,144.

C) $(328).

D) $123,056.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

18

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes. The net present value in case A is

A) $54,000.

B) $( 472).

C) $ 6,000.

D) $(6,000).

Assume straight-line amortization in all computations, and ignore income taxes. The net present value in case A is

A) $54,000.

B) $( 472).

C) $ 6,000.

D) $(6,000).

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

19

One purpose of a postaudit is to evaluate the continuation of the project.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

20

The net present value model expresses all amounts in today's monetary units at time zero.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

21

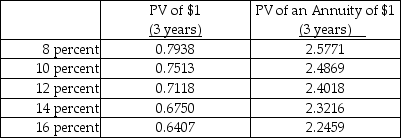

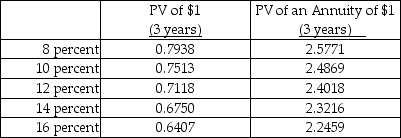

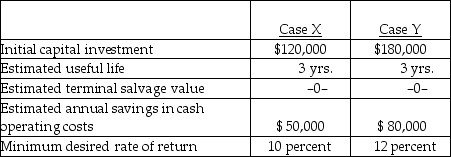

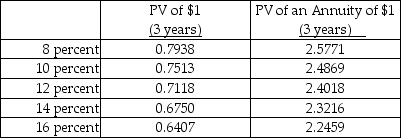

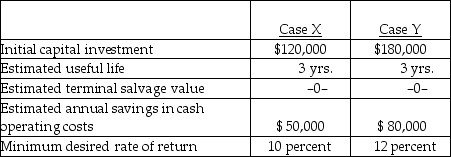

Beta Company has the following information:

What is (c)?

A) $38,599

B) $94,800

C) $16,273

D) $ 5,200

What is (c)?

A) $38,599

B) $94,800

C) $16,273

D) $ 5,200

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

22

Beta Company has the following information:

What is (a)?

A) $31,944

B) $30,328

C) $11,747

D) $12,882

What is (a)?

A) $31,944

B) $30,328

C) $11,747

D) $12,882

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

23

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes. The internal rate of return in case Y is approximately

A) 10 percent.

B) 12 percent.

C) 14 percent.

D) 16 percent.

Assume straight-line amortization in all computations, and ignore income taxes. The internal rate of return in case Y is approximately

A) 10 percent.

B) 12 percent.

C) 14 percent.

D) 16 percent.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

24

Beta Company has the following information:

What is (f)?

A) $ 3,948

B) $35,948

C) $ 4,200

D) $(6,013)

What is (f)?

A) $ 3,948

B) $35,948

C) $ 4,200

D) $(6,013)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

25

Beta Company has the following information:

What is (d)?

A) Less than 6 percent

B) Between 6 and 8 percent

C) Between 8 and 10 percent

D) Between 10 and 12 percent

What is (d)?

A) Less than 6 percent

B) Between 6 and 8 percent

C) Between 8 and 10 percent

D) Between 10 and 12 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

26

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

The accounting rate of return based on INITIAL investment in case X is

A) 41.67 percent.

B) 8.33 percent.

C) 16.67 percent.

D) 33.33 percent.

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.The accounting rate of return based on INITIAL investment in case X is

A) 41.67 percent.

B) 8.33 percent.

C) 16.67 percent.

D) 33.33 percent.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

27

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

In capital budgeting, the relevant tax rate to consider is the

A) prior year tax rate.

B) average rate expected for the company.

C) marginal rate expected for the company.

D) highest rate that applies to U.S. corporations.

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.In capital budgeting, the relevant tax rate to consider is the

A) prior year tax rate.

B) average rate expected for the company.

C) marginal rate expected for the company.

D) highest rate that applies to U.S. corporations.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

28

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

The accounting rate of return based on INITIAL investment in case A is

A) 6.67 percent.

B) 5.56 percent.

C) 2.49 percent.

D) 40.00 percent.

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.The accounting rate of return based on INITIAL investment in case A is

A) 6.67 percent.

B) 5.56 percent.

C) 2.49 percent.

D) 40.00 percent.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

29

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

The payback period in case X is

A) 3.0 years.

B) 0.4 years.

C) 2.5 years.

D) 2.4 years.

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.The payback period in case X is

A) 3.0 years.

B) 0.4 years.

C) 2.5 years.

D) 2.4 years.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

30

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

The payback period for case Y is

A) 0.44 years.

B) 3.00 years.

C) 2.25 years.

D) 2.40 years.

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.The payback period for case Y is

A) 0.44 years.

B) 3.00 years.

C) 2.25 years.

D) 2.40 years.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

31

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

The accounting rate of return based on INITIAL investment in case Y is

A) 11.11 percent.

B) 44.44 percent.

C) 33.33 percent.

D) 22.22 percent.

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.The accounting rate of return based on INITIAL investment in case Y is

A) 11.11 percent.

B) 44.44 percent.

C) 33.33 percent.

D) 22.22 percent.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

32

Beta Company has the following information:

What is (b)?

A) $-0-

B) $(1,616)

C) $20,197

D) $19,062

What is (b)?

A) $-0-

B) $(1,616)

C) $20,197

D) $19,062

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

33

Below are two potential investment alternatives:

There are two key aspects of capital budgeting: (1) investing decisions and (2)

A) accounting decisions.

B) financing decisions.

C) discount decisions.

D) payback decisions.

There are two key aspects of capital budgeting: (1) investing decisions and (2)

A) accounting decisions.

B) financing decisions.

C) discount decisions.

D) payback decisions.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

34

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

The accounting rate of return based on INITIAL investment in case B is

A) 38.67 percent.

B) 2.59 percent.

C) 5.33 percent.

D) 2.40 percent.

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.The accounting rate of return based on INITIAL investment in case B is

A) 38.67 percent.

B) 2.59 percent.

C) 5.33 percent.

D) 2.40 percent.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

35

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes. The internal rate of return in case X is approximately

A) 8 percent.

B) 10 percent.

C) 12 percent.

D) 14 percent.

Assume straight-line amortization in all computations, and ignore income taxes. The internal rate of return in case X is approximately

A) 8 percent.

B) 10 percent.

C) 12 percent.

D) 14 percent.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

36

Beta Company has the following information:

What is (e)?

A) Below 6 percent

B) Between 6 and 8 percent

C) Between 8 and 10 percent

D) Between 10 and 12 percent

What is (e)?

A) Below 6 percent

B) Between 6 and 8 percent

C) Between 8 and 10 percent

D) Between 10 and 12 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

37

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

The payback period in case A is

A) 0.4 years.

B) 2.5 years.

C) 3.3 years.

D) 3.0 years.

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.The payback period in case A is

A) 0.4 years.

B) 2.5 years.

C) 3.3 years.

D) 3.0 years.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

38

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes. The internal rate of return in case A is approximately

A) 8 percent.

B) 10 percent.

C) 12 percent.

D) 14 percent.

Assume straight-line amortization in all computations, and ignore income taxes. The internal rate of return in case A is approximately

A) 8 percent.

B) 10 percent.

C) 12 percent.

D) 14 percent.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

39

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes. The internal rate of return in case B is approximately

A) 14 percent.

B) 12 percent.

C) 10 percent.

D) 8 percent.

Assume straight-line amortization in all computations, and ignore income taxes. The internal rate of return in case B is approximately

A) 14 percent.

B) 12 percent.

C) 10 percent.

D) 8 percent.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

40

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

The payback period in case B is

A) 3.63 years.

B) 3.00 years.

C) 3.87 years.

D) 2.59 years.

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.The payback period in case B is

A) 3.63 years.

B) 3.00 years.

C) 3.87 years.

D) 2.59 years.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

41

Inflation is

A) not a factor in most capital-budgeting decisions because it tends to be very low in Canada.

B) equal to the amount of interest (or nominal rate) charged for most loans.

C) the increase in the general purchasing power of the monetary unit.

D) the decrease in the general purchasing power of the monetary unit.

A) not a factor in most capital-budgeting decisions because it tends to be very low in Canada.

B) equal to the amount of interest (or nominal rate) charged for most loans.

C) the increase in the general purchasing power of the monetary unit.

D) the decrease in the general purchasing power of the monetary unit.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

42

If a company pays taxes of 15 percent on their first $25,000 of pretax income, and 30 percent on any taxable income in excess of $25,000, what is the marginal tax rate if current pretax income is $40,000?

A) 15.00 percent

B) 20.63 percent

C) 30.00 percent

D) 22.50 percent

A) 15.00 percent

B) 20.63 percent

C) 30.00 percent

D) 22.50 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

43

If a company pays taxes of 20 percent on their first $20,000 of pretax income, and 30 percent on any taxable income in excess of $20,000, what is the marginal tax rate if current pretax income is $45,000?

A) 20 percent

B) 30 percent

C) 25 percent

D) 39 percent

A) 20 percent

B) 30 percent

C) 25 percent

D) 39 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

44

A company with pretax income of $45,000 is required to pay taxes of 20 percent on all income up to $15,000 and 32 percent on any income in excess of $15,000. The company's average tax rate is

A) 28 percent.

B) 32 percent.

C) 26 percent.

D) higher than its marginal rate.

A) 28 percent.

B) 32 percent.

C) 26 percent.

D) higher than its marginal rate.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

45

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

The marginal tax rate is

A) the average rate for the company.

B) the highest possible rate the company might be expected to pay.

C) the lowest tax rate applicable to the company.

D) the rate paid on additional amounts of pretax income.

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.The marginal tax rate is

A) the average rate for the company.

B) the highest possible rate the company might be expected to pay.

C) the lowest tax rate applicable to the company.

D) the rate paid on additional amounts of pretax income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is not true about CCA expense?

A) It is sometimes called a tax shield.

B) It usually causes an increase in taxes.

C) Businesses usually want the largest possible CCA deduction.

D) The expense deduction results from a cash expenditure.

A) It is sometimes called a tax shield.

B) It usually causes an increase in taxes.

C) Businesses usually want the largest possible CCA deduction.

D) The expense deduction results from a cash expenditure.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is NOT usually considered when a company establishes its minimum desired rate of return?

A) A risk-free element of interest

B) A business-risk element

C) An inflation element

D) A political-risk element

A) A risk-free element of interest

B) A business-risk element

C) An inflation element

D) A political-risk element

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

48

When making capital-budgeting decisions, the effects of inflation

A) should be ignored since it is impossible to know what future inflation rates will be.

B) are important, but it is impossible to estimate their effects on capital-budgeting decisions.

C) act to reduce the minimum desired rate of return on projects.

D) act to increase the minimum desired rate of return on projects.

A) should be ignored since it is impossible to know what future inflation rates will be.

B) are important, but it is impossible to estimate their effects on capital-budgeting decisions.

C) act to reduce the minimum desired rate of return on projects.

D) act to increase the minimum desired rate of return on projects.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

49

A company is considering the purchase of some equipment that in the second year of operation should cause an increase in sales of $200,000, an increase in cash expenses of $120,000, and a depreciation deduction of $60,000. If the appropriate tax rate is 40 percent, what will be the after-tax effect of this equipment on cash flows in year two?

A) No effect

B) Net after-tax cash inflows will be $72,000.

C) Net after-tax cash inflows will be $12,000.

D) Net after-tax cash inflows will be $20,000.

A) No effect

B) Net after-tax cash inflows will be $72,000.

C) Net after-tax cash inflows will be $12,000.

D) Net after-tax cash inflows will be $20,000.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

50

A company with pretax income of $60,000 is required to pay taxes of 20 percent on all income up to $20,000 and 32 percent on any income in excess of $20,000. The company's average tax rate is

A) 20 percent.

B) 28 percent.

C) 32 percent.

D) higher than its marginal rate.

A) 20 percent.

B) 28 percent.

C) 32 percent.

D) higher than its marginal rate.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

51

In making capital-budgeting decisions, it is relevant to consider

A) future data that will differ among competing alternatives.

B) the cash outflows caused by future depreciation deductions.

C) the book value of equipment.

D) the original cost of currently owned equipment.

A) future data that will differ among competing alternatives.

B) the cash outflows caused by future depreciation deductions.

C) the book value of equipment.

D) the original cost of currently owned equipment.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

52

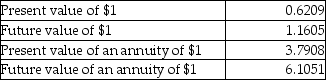

Fagen Grocery Store is considering the purchase of a new $45,000 delivery truck. The truck will have a useful life of 5 years, no terminal salvage value, and tax amortization will be calculated using the straight-line method.

If the truck is purchased, the company will be able to increase annual revenues by $90,000 per year for the life of the truck, but out-of-pocket expenses will also increase by $67,500 per year.

Assume a tax rate of 30 percent and a required after-tax rate of return equal to 10 percent.

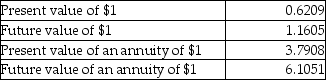

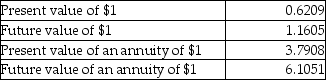

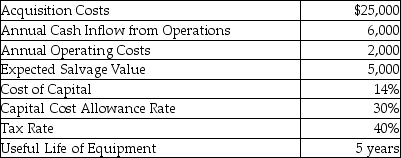

Time value factors are given below for 5 years and an interest rate of 10 percent.

What is the net present value of the tax savings from depreciation?

A) $3,912

B) $23,881

C) $10,235

D) $1,677

If the truck is purchased, the company will be able to increase annual revenues by $90,000 per year for the life of the truck, but out-of-pocket expenses will also increase by $67,500 per year.

Assume a tax rate of 30 percent and a required after-tax rate of return equal to 10 percent.

Time value factors are given below for 5 years and an interest rate of 10 percent.

What is the net present value of the tax savings from depreciation?

A) $3,912

B) $23,881

C) $10,235

D) $1,677

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

53

Fagen Grocery Store is considering the purchase of a new $45,000 delivery truck. The truck will have a useful life of 5 years, no terminal salvage value, and tax amortization will be calculated using the straight-line method.

If the truck is purchased, the company will be able to increase annual revenues by $90,000 per year for the life of the truck, but out-of-pocket expenses will also increase by $67,500 per year.

Assume a tax rate of 30 percent and a required after-tax rate of return equal to 10 percent.

Time value factors are given below for 5 years and an interest rate of 10 percent.

What is the total net present value of the investment?

A) $69,941

B) $24,941

C) $42,000

D) $(33,545)

If the truck is purchased, the company will be able to increase annual revenues by $90,000 per year for the life of the truck, but out-of-pocket expenses will also increase by $67,500 per year.

Assume a tax rate of 30 percent and a required after-tax rate of return equal to 10 percent.

Time value factors are given below for 5 years and an interest rate of 10 percent.

What is the total net present value of the investment?

A) $69,941

B) $24,941

C) $42,000

D) $(33,545)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

54

The cash inflow effect of a disposal at a loss is equal to the

A) amount of the loss plus the tax savings.

B) amount of the loss minus the tax savings.

C) selling price plus the tax savings.

D) selling price minus the tax savings.

A) amount of the loss plus the tax savings.

B) amount of the loss minus the tax savings.

C) selling price plus the tax savings.

D) selling price minus the tax savings.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

55

Another term for market interest rate is

A) risk-free interest rate.

B) real rate.

C) nominal rate.

D) marginal rate.

A) risk-free interest rate.

B) real rate.

C) nominal rate.

D) marginal rate.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

56

The "inflation element" refers to the

A) future increase in the general purchasing power of the monetary unit.

B) future deterioration of the general purchasing power of the monetary unit.

C) impact that future price increases will have on the original cost of a piece of equipment.

D) fact that the real purchasing power of a monetary unit usually increases over time.

A) future increase in the general purchasing power of the monetary unit.

B) future deterioration of the general purchasing power of the monetary unit.

C) impact that future price increases will have on the original cost of a piece of equipment.

D) fact that the real purchasing power of a monetary unit usually increases over time.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements about depreciation is TRUE?

A) The amortization method chosen does not affect cash inflows from operations.

B) The amortization method chosen for taxes will not affect cash outflows.

C) The total amount of amortization over the life of the assets differs with different amortization methods.

D) Since amortization does not involve a cash expenditure, it can be ignored in capital-budgeting decisions.

A) The amortization method chosen does not affect cash inflows from operations.

B) The amortization method chosen for taxes will not affect cash outflows.

C) The total amount of amortization over the life of the assets differs with different amortization methods.

D) Since amortization does not involve a cash expenditure, it can be ignored in capital-budgeting decisions.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

58

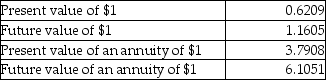

Fagen Grocery Store is considering the purchase of a new $45,000 delivery truck. The truck will have a useful life of 5 years, no terminal salvage value, and tax amortization will be calculated using the straight-line method.

If the truck is purchased, the company will be able to increase annual revenues by $90,000 per year for the life of the truck, but out-of-pocket expenses will also increase by $67,500 per year.

Assume a tax rate of 30 percent and a required after-tax rate of return equal to 10 percent.

Time value factors are given below for 5 years and an interest rate of 10 percent.

What is the present value of the after-tax cash flows from operations, exclusive of depreciation?

A) $85,293

B) $13,971

C) $ 9,778

D) $59,705

If the truck is purchased, the company will be able to increase annual revenues by $90,000 per year for the life of the truck, but out-of-pocket expenses will also increase by $67,500 per year.

Assume a tax rate of 30 percent and a required after-tax rate of return equal to 10 percent.

Time value factors are given below for 5 years and an interest rate of 10 percent.

What is the present value of the after-tax cash flows from operations, exclusive of depreciation?

A) $85,293

B) $13,971

C) $ 9,778

D) $59,705

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

59

If the appropriate tax rate is 35%, the after-tax effect of a single CCA deduction of $30,000 is

A) $19,500 net after-tax cash outflow.

B) $19,500 net after-tax cash inflow.

C) $10,500 net after-tax cash outflow.

D) $10,500 net after-tax cash inflow.

A) $19,500 net after-tax cash outflow.

B) $19,500 net after-tax cash inflow.

C) $10,500 net after-tax cash outflow.

D) $10,500 net after-tax cash inflow.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

60

If a company pays taxes of 15 percent on their first $25,000 of pretax income, and 30 percent on any taxable income in excess of $25,000, what is the average tax rate if current pretax income is $40,000?

A) 15.00 percent

B) 20.63 percent

C) 30.00 percent

D) 22.50 percent

A) 15.00 percent

B) 20.63 percent

C) 30.00 percent

D) 22.50 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

61

The present value of 5-year annuity of $10,000, earning an annual return of 8 percent is

A) $31,700.

B) $34,700.

C) $37,910.

D) $39,930.

A) $31,700.

B) $34,700.

C) $37,910.

D) $39,930.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements about the riskiness of an investment is true?

A) The lower the risk, the higher the discount rate.

B) The higher the risk, the higher the discount rate.

C) The higher the risk, the lower the cost of capital.

D) The higher the risk, the higher the minimum desired rate of return.

A) The lower the risk, the higher the discount rate.

B) The higher the risk, the higher the discount rate.

C) The higher the risk, the lower the cost of capital.

D) The higher the risk, the higher the minimum desired rate of return.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

63

Use the following information to answer the next question(s).

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

Payback for the project is

A) 6.11 years.

B) 6.25 years.

C) 7.96 years.

D) 8.33 years.

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

Payback for the project is

A) 6.11 years.

B) 6.25 years.

C) 7.96 years.

D) 8.33 years.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following methods determines the interest rate which equates the present value of the future cash flows with the investment outlay?

A) Payback

B) Accounting rate of return

C) Internal rate of return

D) Net present value

A) Payback

B) Accounting rate of return

C) Internal rate of return

D) Net present value

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

65

Use the following information to answer the next question(s).

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

If the depreciation is $25,000 per year, the accounting rate of return based on the initial investment is

A) 11%.

B) 12%.

C) 16%.

D) 17.2%.

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

If the depreciation is $25,000 per year, the accounting rate of return based on the initial investment is

A) 11%.

B) 12%.

C) 16%.

D) 17.2%.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

66

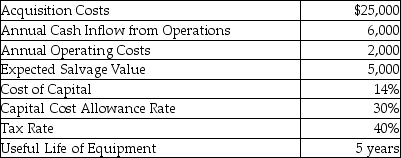

Use the following information regarding a production asset to answer the next question(s).

The annual after-tax operation costs would be

A) $1,000.

B) $1,200.

C) $1,500.

D) $2.000.

The annual after-tax operation costs would be

A) $1,000.

B) $1,200.

C) $1,500.

D) $2.000.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

67

Use the following information regarding a production asset to answer the next question(s).

The annual after-tax cash inflow from operations would be

A) $1,200.

B) $2,400.

C) $2,800.

D) $3,600.

The annual after-tax cash inflow from operations would be

A) $1,200.

B) $2,400.

C) $2,800.

D) $3,600.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

68

Use the following information regarding a production asset to answer the next question(s).

The capital cost allowance for the first year would be

A) $3,750.

B) $6,375.

C) $7,500.

D) $4,463.

The capital cost allowance for the first year would be

A) $3,750.

B) $6,375.

C) $7,500.

D) $4,463.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements about depreciation is TRUE?

A) The tax effects of depreciation are not adjusted for inflation.

B) The tax effects of depreciation must be adjusted for inflation.

C) Canadian tax laws allow for inflation adjustments to depreciation each year.

D) Capital investment is encouraged by not allowing depreciation to be adjusted for the effect of inflation.

A) The tax effects of depreciation are not adjusted for inflation.

B) The tax effects of depreciation must be adjusted for inflation.

C) Canadian tax laws allow for inflation adjustments to depreciation each year.

D) Capital investment is encouraged by not allowing depreciation to be adjusted for the effect of inflation.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

70

Use the following information to answer the next question(s).

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

Miller Manufacturing has acquired a new parcel van to transport packages from the airport to its sales offices for $20,000. The van is a class 10 item which has a capital cost allowance rate of 30%. The company plans to use the van for five years and then sell it for an expected salvage value of $4,000. The capital cost allowance for the first year would be

A) $3,000.

B) $6,000.

C) $5,100.

D) $3,500.

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

Miller Manufacturing has acquired a new parcel van to transport packages from the airport to its sales offices for $20,000. The van is a class 10 item which has a capital cost allowance rate of 30%. The company plans to use the van for five years and then sell it for an expected salvage value of $4,000. The capital cost allowance for the first year would be

A) $3,000.

B) $6,000.

C) $5,100.

D) $3,500.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

71

Use the following information to answer the next question(s).

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

The cost of capital for the firm is

A) 8%.

B) 6%.

C) 10%.

D) 12%.

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

The cost of capital for the firm is

A) 8%.

B) 6%.

C) 10%.

D) 12%.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following methods determines the interest rate which equates the present value of the future cash flows with the investment outlay?

A) Payback

B) Accounting rate of return

C) Internal rate of return

D) Net present value

A) Payback

B) Accounting rate of return

C) Internal rate of return

D) Net present value

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

73

The discount rate is

A) the rate used to compute payback.

B) the rate used to compute the accounting rate of return.

C) the rate used to compute the internal rate of return.

D) the rate used to compute NPV.

A) the rate used to compute payback.

B) the rate used to compute the accounting rate of return.

C) the rate used to compute the internal rate of return.

D) the rate used to compute NPV.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

74

Use the following information to answer the next question(s).

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

The amount of the capital cost allowance for the second year for Mike Manufacturing would be

A) $3,000.

B) $6,000.

C) $5,100.

D) $3,500.

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

The amount of the capital cost allowance for the second year for Mike Manufacturing would be

A) $3,000.

B) $6,000.

C) $5,100.

D) $3,500.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

75

The present value of $10,000 to be received 5 years from now and earning an annual return of 8 percent is

A) $6,210.

B) $6,810.

C) $4,000.

D) $4,693.

A) $6,210.

B) $6,810.

C) $4,000.

D) $4,693.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

76

Use the following information to answer the next question(s).

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

The approximate internal rate of return of the project is

A) 8%.

B) 12%.

C) 12.5%.

D) 14%.

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

The approximate internal rate of return of the project is

A) 8%.

B) 12%.

C) 12.5%.

D) 14%.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

77

Use the following information to answer the next question(s).

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

Using the cost capital as the discount rate, the net present value of the project is

A) $89,360.

B) $108,480.

C) $114,680.

D) $228,180.

Sunny Flowers is considering the purchase of a small business that costs $500,000. Sunny plans to sell stock valued at $250,000. The stock would pay dividends of $20,000 per year. Sunny would borrow the remaining $250,000 from a local bank at 12 percent interest.

The business is expected to generate annual cash inflows of $80,000. Duane plans to operate the business for 15 years and then turn it over to his son.

Using the cost capital as the discount rate, the net present value of the project is

A) $89,360.

B) $108,480.

C) $114,680.

D) $228,180.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

78

Discounting

A) is the process of determining value at a future time.

B) is the process of converting future cash flows to their present value.

C) is a process that doers not consider the time value of money.

D) is a process that can only be used for a single amount (not annuities).

A) is the process of determining value at a future time.

B) is the process of converting future cash flows to their present value.

C) is a process that doers not consider the time value of money.

D) is a process that can only be used for a single amount (not annuities).

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

79

Use the following information regarding a production asset to answer the next question(s).

The present value of equipment salvage value at the end of the five years would be

A) $4,000.

B) $5,000,

C) $2,076,

D) $2,595,

The present value of equipment salvage value at the end of the five years would be

A) $4,000.

B) $5,000,

C) $2,076,

D) $2,595,

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

80

Use the following information regarding a production asset to answer the next question(s).

The tax savings from the capital cost allowance in the second year would be

A) $1,500.

B) $2,550.

C) $3,000.

D) $2,000.

The tax savings from the capital cost allowance in the second year would be

A) $1,500.

B) $2,550.

C) $3,000.

D) $2,000.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck